ISE Announces That Aggregate Assets under Management for ETFs Based on ISE Proprietary Indexes Now Exceeds $1 Billion

December 20 2010 - 11:00AM

Business Wire

The International Securities Exchange (ISE) announced today that

aggregate assets under management for the portfolios of exchange

traded funds (ETFs) based on ISE’s proprietary indexes now exceeds

$1 billion. First Trust Advisors has a portfolio of eight ETFs

based on ISE’s family of emerging market and sector indexes that

track public companies in high growth markets. Sectors covered

include natural gas, global wind energy, water, global engineering

and construction services, copper mining, and platinum group metals

mining. In addition, First Trust Advisors has developed ETFs that

track ISE’s ChIndia index that represents the emerging markets of

China and India, as well as ISE’s BICK Index that covers Brazil,

India, China and South Korea. Direxion has also created two

leveraged ETFs based on ISE’s natural gas index.

“Reaching $1 billion assets under management for ETFs tied to

ISE’s indexes is a very exciting milestone. We look forward to

continuing to work with our existing partners and to developing new

relationships to grow the Index and ETF segment of our business

even further,” said Kris Monaco, Director of New Product

Development at ISE. “At ISE, we remain focused on developing

innovative, actionable indexes for the creation of investment

vehicles that provide investors with targeted exposure to the most

liquid exchange-listed companies in rapidly growing markets.”

“It’s exciting for First Trust that our group of ISE index-based

ETFs continues to grow and give investors exposure to these

high-growth sectors,” said Robert F. Carey, CFA, and Chief

Investment Officer of First Trust. “As the ETF market has grown,

it’s clear to us that many investors are focusing on efficient ways

to access specialized segments of the market. This milestone proves

that.”

“We congratulate ISE on passing the $1 billion milestone. We

value our relationship with them, and are consistently impressed by

their robust index construction in focused industries such as

natural gas and clean energy,” said Mark Carroll, Director of

Research at Direxion.

First Trust Advisors offers eight ETFs based on ISE’s

proprietary indexes: the First Trust ISE-Revere Natural Gas Index

Fund (FCG), the First Trust ISE Global Wind Energy Index Fund

(FAN), the First Trust ISE ChIndia Index Fund (FNI), the First

Trust ISE Water Index Fund (FIW), the First Trust ISE Global

Engineering and Construction Index Fund (FLM), the First Trust BICK

Index Fund (BICK), the First Trust ISE Global Copper Index Fund

(CU) and the First Trust Global Platinum Index Fund (PLTM).

Direxion offers two ETFs based on the ISE-Revere Natural Gas

Index: The Direxion Daily Natural Gas Related Bull 2x Shares (FCGL)

and the Direxion Daily Natural Gas Related Bear 2x Shares

(FCGS).

ISE also offers options on certain index and ETF products within

the First Trust and Direxion portfolios, as outlined in the table

below.

For more information about First Trust Advisors’ ETFs, please

visit www.ftportfolios.com. For more information about the Direxion

leveraged indexes, visit www.direxionfunds.com. For information

about ISE’s proprietary indexes, please visit

www.ise.com/index.

Index

ETF Index Name

Symbol Options

Symbol Options ISE

BICKTM Index BIQ

BICK ISE Engineering

& ConstructionTM Index CVL

FLM

ISE-Revere Natural GasTM Index FUM

Yes FCG

FCGL

FCGS

Yes

Yes

Yes

ISE Global Wind EnergyTM Index GWE

FAN Yes ISE

WaterTM Index HHO Yes

FIW Yes

ISE ChIndiaTM Index

ICK

FNI Yes ISE Global CopperTM Index

ISC

CU Yes ISE Global PlatinumTM Index

ORE PLTM

Yes

About ISE

The International Securities Exchange (ISE) operates a leading

U.S. options exchange and offers options trading on over 2,000

underlying equity, ETF, index, and FX products. As the first

all-electronic options exchange in the U.S., ISE transformed the

options industry by creating efficient markets through innovative

market structure and technology. Regulated by the Securities and

Exchange Commission (SEC) and a member-owner of The Options

Clearing Corporation (OCC), ISE provides investors with a

transparent marketplace for price and liquidity discovery on

centrally cleared options products. ISE continues to expand its

marketplace through the ongoing development of enhanced trading

functionality, new products, and market data services. As a

complement to its options business, ISE has expanded its reach into

multiple asset classes through strategic investments in financial

marketplaces and services that foster technology innovation and

market efficiency. Through minority investments, ISE participates

in the securities lending and equities markets. ISE also licenses

its proprietary Longitude technology for trading in event-driven

derivatives markets.

ISE is a wholly owned subsidiary of Eurex, a leading global

derivatives exchange. Eurex itself is jointly operated by Deutsche

B�rse AG (Ticker: DB1) and SIX Swiss Exchange AG. Together, Eurex

and ISE are the global market leader in individual equity and

equity index derivatives. For more information, visit

www.ise.com.

About First Trust

Based in Wheaton, Illinois, First Trust Advisors L.P., and its

affiliate First Trust Portfolios L.P., are privately-held companies

which provide a variety of investment services, including asset

management, financial advisory services, and municipal and

corporate investment banking. The firms have collective assets

under management or supervision of over $39 billion (as of November

30, 2010) through exchange-traded funds, closed-end funds, unit

investment trusts, collective trusts, mutual funds, and separately

managed accounts.

For more information, please visit www.ftportfolios.com.

About Direxion

Direxion Funds/Direxion Shares, managed by Rafferty Asset

Management, LLC, is a major provider of leveraged index funds and

ETFs and alternative-class fund products for investment advisors

and sophisticated investors who seek to effectively manage risk and

return in both bull and bear markets. Founded in 1997, the company

has approximately $7.5 billion in assets under management. The

company’s business model is built on continuous product innovation,

exceptional customer service and a commitment to building strategic

relationships with distribution partners.

For more information, please visit www.direxionfunds.com or

www.direxionshares.com.

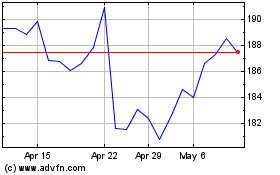

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Oct 2024 to Nov 2024

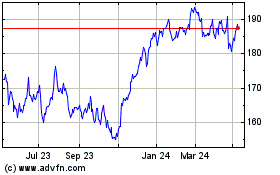

Deutsche Boerse (TG:DB1)

Historical Stock Chart

From Nov 2023 to Nov 2024