0001617553FALSE00016175532024-08-072024-08-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 7, 2024

ZipRecruiter, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-40406 | | 27-2976158 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 604 Arizona Avenue, | Santa Monica, | California | | 90401 |

| (Address of principal Executive offices) | | (Zip Code) |

(877) 252-1062

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, $0.00001 par value per share | ZIP | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 7, 2024, ZipRecruiter, Inc. (“ZipRecruiter” or the "Company") held a conference call regarding its financial results for the quarter ended June 30, 2024 and financial outlook (the “Earnings Call”). ZipRecruiter also issued a press release announcing its financial results for the quarter ended June 30, 2024 and financial outlook (the “Press Release”) and a letter to shareholders announcing its financial results for the quarter ended June 30, 2024 and financial outlook (the “Shareholder Letter”). Copies of the Press Release and the Shareholder Letter are furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report on Form 8-K.

The information furnished with this Item 2.02, including Exhibits 99.1 and 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

ZipRecruiter is making reference to non-GAAP financial information in both the Shareholder Letter and the Earnings Call. A reconciliation of GAAP to non-GAAP results is provided in the Shareholder Letter, which is attached as Exhibit 99.2 to this Current Report on Form 8-K.

Item 7.01 Regulation FD Disclosure.

ZipRecruiter announces material information to its investors using filings with the Securities and Exchange Commission, the Company’s Investor Relations page on its website at www.ziprecruiter.com, press releases, public conference calls, public webcasts, its X (formerly known as Twitter) feed (@ZipRecruiter), its Facebook page, and its LinkedIn page. Therefore, ZipRecruiter encourages investors, the media and others interested in the Company to review the information it makes public in these channels, as such information could be deemed to be material information.

Also on August 7, 2024, the Company issued a press release announcing the acquisition of Poplar Technologies Limited (d/b/a Breakroom). A copy of the press release is attached as Exhibit 99.3 to this Current Report on Form 8-K.

The information furnished with this Item 7.01, including Exhibit 99.3, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the registrant under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit | | Description |

| |

| 99.1 | | |

| 99.2 | | |

| 99.3 | | |

| 104 | | The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| ZIPRECRUITER, INC. |

| | |

| | |

| Date: August 7, 2024 | By: | /s/ Timothy Yarbrough |

| | Timothy Yarbrough |

| | Executive Vice President, Chief Financial Officer |

ZipRecruiter Announces Second Quarter 2024 Results

Quarterly revenue of $123.7 million

Quarterly net income of $7.0 million, or net income margin of 6%

Quarterly Adjusted EBITDA of $27.8 million, or Adjusted EBITDA margin of 23%

SANTA MONICA, Calif. (August 7, 2024) – ZipRecruiter® (NYSE: ZIP) a leading online employment marketplace, today announced financial results for the quarter ended June 30, 2024. ZipRecruiter’s complete second quarter results, financial guidance, and management commentary can be found by accessing ZipRecruiter’s shareholder letter on the quarterly results page of the Investor Relations website at investors.ziprecruiter.com.

“ZipRecruiter’s flexible financial model has allowed us to maintain a robust balance sheet during this prolonged labor market downturn. We're continuing to invest in product and technology initiatives, which we believe will bear significant fruit in years to come,” said Ian Siegel, CEO of ZipRecruiter. “The current business is incredibly exciting, as we continue to win job seeker traffic and are energized by our product innovations. We have strong conviction that ZipRecruiter will further disrupt the recruitment industry in the coming years, fundamentally changing how employers and job seekers interact.”

Conference Call Details

ZipRecruiter will host a conference call today, August 7, at 2:00 p.m. Pacific Time to discuss its financial results. A live webcast of the call can be accessed from ZipRecruiter’s Investor Relations website at investors.ziprecruiter.com. An archived version will be available on the website two hours after the completion of the call. Investors and analysts can participate in the conference call by dialing +1 (888) 440-4199, or +1 (646) 960-0818 for callers outside the United States and use the Conference ID 9351892. To listen to the telephonic replay, available until Wednesday, August 14, 2024, please dial +1 (800) 770-2030 or +1 (647) 362-9199 for callers outside the United States and use the Conference ID 9351892.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding returns on investment and disrupting the recruitment industry, and other statements that reflect ZipRecruiter’s current expectations and projections with respect to, among other things, its financial condition, results of operations, plans, objectives, future performance, and business. These statements may be preceded by, followed by or include the words "aim," "anticipate," "believe," "estimate," "expect," "forecast," "intend," "likely," "outlook," "plan," "potential," "project," "projection," "seek," "can," "could," "may," "should," "would," "will," the negatives thereof and other words and terms of similar meaning. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements, including our ability to attract and retain employers and job seekers; our ability to compete with well-established competitors and new entrants; our ability to achieve and/or maintain profitability; our ability to maintain, protect and enhance our brand and intellectual property; our dependence on macroeconomic factors; our ability to maintain and improve the quality of our platform; our dependence on the interoperability of our platform with mobile operating systems that we do not control; our ability to successfully implement our business plan during a global economic downturn that may impact the demand for our services or have a material adverse impact on our and our business partners’ financial condition and results of operations; our ability and the ability of third parties to protect our users’ personal or other data from a security breach and to comply with laws and regulations relating to consumer data privacy and data protection; our ability to detect errors, defects or disruptions in our platform; our ability to comply with the terms of underlying licenses of open source software components on our platform; our ability to expand into markets outside the United States; our ability to achieve desired operating margins; our compliance with a wide variety of U.S. and international laws and regulations; our reliance on Amazon Web Services; our ability to mitigate payment and fraud risks; our dependence on our senior management and our ability to attract and retain new talent; and the other important factors discussed under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the three months ended June 30, 2024 that we will file with the U.S. Securities and Exchange Commission. There is no assurance that any

forward-looking statements will materialize. You are cautioned not to place undue reliance on forward-looking statements, which reflect expectations only as of this date. ZipRecruiter does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise.

Non-GAAP Financial Measures

This release includes certain non-GAAP financial measures, including Adjusted EBITDA and Adjusted EBITDA margin.

We define Adjusted EBITDA as our net income (loss) before interest expense, other income (expense), net, income tax expense (benefit) and depreciation and amortization, adjusted to eliminate stock-based compensation expense. Adjusted EBITDA margin represents Adjusted EBITDA as a percentage of revenue for the same period.

Management and our board of directors use these non-GAAP financial measures as supplemental measures of our performance because they assist us in comparing our operating performance on a consistent basis, as they remove the impact of some items not directly resulting from our core operations. We also use these non-GAAP financial measures for planning purposes, including the preparation of our internal annual operating budget and financial projections, to evaluate the performance and effectiveness of our strategic initiatives and to evaluate our capacity for capital expenditures to expand our business.

Adjusted EBITDA and Adjusted EBITDA margin should not be considered in isolation, as an alternative to, or superior to net income (loss), revenue, cash flows or other measures derived in accordance with GAAP. These non-GAAP measures are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. Management believes that the presentation of non-GAAP financial measures is an appropriate measure of operating performance because they eliminate the impact of some expenses that do not relate directly to the performance of our underlying business.

These non-GAAP financial measures should not be construed as an inference that our future results will be unaffected by unusual or other items. Additionally, Adjusted EBITDA and Adjusted EBITDA margin are not intended to be a measure of free cash

flow for management’s discretionary use, as they do not reflect our tax payments and certain other cash costs that may recur in the future, including, among other things, cash requirements for costs to replace assets being depreciated and amortized. Management compensates for these limitations by relying on our GAAP results in addition to using Adjusted EBITDA and Adjusted EBITDA margin as supplemental measures of our performance. Our measures of Adjusted EBITDA and Adjusted EBITDA margin used herein are not necessarily comparable to similarly titled captions of other companies due to different methods of calculation.

RECONCILIATION OF GAAP NET INCOME TO ADJUSTED EBITDA (UNAUDITED)

(in thousands, except Adjusted EBITDA margin data)

| | | | | |

| Quarter Ended June 30, |

| 2024 |

| GAAP net income | $ 7,014 |

| Stock-based compensation | 15,589 |

| Depreciation and amortization | 2,837 |

| Interest expense | 7,361 |

| Other (income) expense, net | (5,599) |

| Income tax expense | 647 |

| Adjusted EBITDA | $ 27,849 |

| Adjusted EBITDA margin | 23% |

About ZipRecruiter

ZipRecruiter® (NYSE:ZIP) is a leading online employment marketplace that actively connects people to their next great opportunity. ZipRecruiter’s powerful matching technology improves the job search experience for job seekers and helps businesses of all sizes find and hire the right candidates quickly. ZipRecruiter has been the #1 rated job search app on iOS & Android for the past seven years1 and is rated the #1 employment job site by G2.2 For more information, visit www.ziprecruiter.com.

Contacts

Investors:

Drew Haroldson

The Blueshirt Group, for ZipRecruiter

ir@ziprecruiter.com

Corporate Communications:

Claire Walsh

Press Relations

press@ziprecruiter.com

1 Based on job seeker app ratings, during the period of January 2017 to January 2024 from AppFollow for ZipRecruiter, CareerBuilder, Glassdoor, Indeed, LinkedIn, and Monster.

2 Based on G2 satisfaction ratings as of December 18, 2023.

Exhibit 99.2

Q2 2024 Shareholder Letter 1

Q2 2024 Shareholder Letter 2

ToOur Shareholders ZipRecruiter’s mission is simple: to actively connect people to their next great opportunity. Since day one, we have been focused on eliminating friction in the job search process. While we are proud of the substantial progress we have made, many pain points still exist for both sides of the marketplace. We believe ZipRecruiter’s brand, proprietary data, and technology uniquely position us to further disrupt the industry over the long term and accelerate the shift from o�ine to online recruitment. Despite the short-term challenges of navigating the post-COVID macroeconomic cycle, we believe that the advancements we are making toward transforming how the job search process works position us to thrive through many macroeconomic cycles to come. In Q2’24, revenue of $123.7 million was down 27% year-over-year. Net income in Q2’24 was $7.0 million while Adjusted EBITDA was $27.8 million, equating to a net incomemargin of 6% and an Adjusted EBITDAmargin of 23%. Both revenue and Adjusted EBITDA in Q2’24 came in above the high end of guidance. As we look toward the second half of 2024, we continue to navigate challenging labor market conditions. Per the Bureau of Labor Statistics: ● Seasonally adjusted hires have declined every month on a year-over-year basis since August 20221. ● The quits rate has fallen over 9% below the average rate in 20192. Despite the decline in hiring demand, our disciplined investment strategy allows us to build on our product momentum and technology leadership. In Q2’24, these investments contributed to another quarter of job seeker growth. Per SimilarWeb, total ZipRecruiter web tra�c in the U.S. grew by 22%year-over-year, which is at least 12 percentage pointsmore than any of our largest competitors.3Ongoing investments in product brand awareness paired with a number of product improvements contributed to a 30% year-over-year increase in organic job seeker tra�c. Over time, we believe growing job seeker tra�c will lead to meaningful revenue dollar shifts from both o�ine and online competitors. 3 Similarweb Market Intelligence Platform. Fastest growing online employment marketplace defined by number of total US visits. Results shown are from April 2024 - June 2024 compared to April 2023 - June 2023 for individual domains of ZipRecruiter.com, Glassdoor.com, CareerBuilder.com, Linkedin.com, and Indeed.com and not for parent companies, subsidiary sites, partner sites or subchannels. 2 U.S. Bureau of Labor Statistics, Total nonfarm quits, as of June 2024 and 2019 1 U.S. Bureau of Labor Statistics, Total nonfarm hires, as of June 2024 Q2 2024 Shareholder Letter 3

In Q2 we began the rollout of ZipIntro. ZipIntro enables the acceleration of face-to-face connections, delivering exceptional results so far,with over 90%of job seekers saying they are likely to use ZipIntro again4 and employers receiving over 3xmore quality applications per job5 utilizing ZipIntro. You should anticipate continued product launches that accelerate interaction and deepen engagement between employers and job seekers. In July we acquired Breakroom, a UK-based employer review site focused on frontline workers. In the coming months, we anticipate launching Breakroom in the U.S. where approximately 70% of the workforce is concentrated in frontline roles6. Breakroom collects data from frontline workers to provide community-powered ratings for companies, which helps job seekers apply for the right jobs for their individual needs. The underlying momentum in the long-term indicators of our business – attracting more job seekers to our marketplace faster than any of our major competitors and increasing the level of engagement from those job seekers – gives us deep conviction in our ability to capitalize on the immense hiring market opportunity in the U.S. Our innovation is enabled by our flexible financial model and robust balance sheet, which give us the ability to continue to build our brand and enhance our user experience throughout economic cycles. As we continue to navigate this current post-COVID macroeconomic cycle, we are confident that our disciplined investment strategy will put us in a strong position to take advantage of the inevitable recovery in the labor market to come. _________________________ _______________________________ Ian Siegel David Travers Chief Executive O�cer President _______________________________ TimYarbrough Chief Financial O�cer 6McKinsey analysis based on Bureau of Labor Statistics, 2019 data https://www.mckinsey.com/featured-insights/diversity-and-inclusion/race-in-the-workplace-the-frontline-experience 5 ZipRecruiter Internal data, Aug 1, 2023 - March 15, 2024 4 ZipRecruiter internal data, Sept 1, 2023 - June 30, 2024 Q2 2024 Shareholder Letter 4

Second Quarter 2024 Key Results Q2’24 Revenue �123.7million (27)% y/y Quarterly Paid Employers7 70.5K (31)% y/y Revenue per Paid Employer7 �1,755 5% y/y GrossMargin 90% Net Income �7.0million Net IncomeMargin 6% Adjusted EBITDA7 �27.8million Adjusted EBITDAMargin7 23% Financial Outlook Q3’24 Revenue �109 - �115million Adjusted EBITDA7 Adjusted EBITDAmargin �7 - �13million 6% - 11% 7 See “Key Operating Metrics and Non-GAAP Financial Measures” below for additional information regarding key operating metrics and non-GAAPmeasures used in this shareholder letter and a reconciliation of GAAP net income (loss) to Adjusted EBITDA. Q2 2024 Shareholder Letter 5

Growth Strategies and Recent Progress We believe we are still in the early stages of using smart matching technology to transform how employers and job seekers come together. We are leaning into product and technology investments to capture this massive opportunity, and are making continued progress improving outcomes for employers and job seekers. Growth Strategy #1: Increase the number of employers and the Revenue per Paid Employer in ourmarketplace We had 70.5k Quarterly Paid Employers in Q2’24, a decrease of 31% year-over-year and decrease of 2% sequentially. The year-over-year decrease in Quarterly Paid Employers is primarily reflective of reduced demand from SMBs. The slight decline quarter-over-quarter reflects the continued uncertainty and volatility of the labor market. Revenue per Paid Employer was $1,755 in Q2’24, an increase of 5% year-over-year and an increase of 3% quarter-over-quarter. The Revenue per Paid Employer increases year-over-year and quarter-over-quarter are primarily due to a slight mix shift from smaller customers – that tend to prefer flat-rate pricing – to larger customers - who tend to prefer buying job applicants on a performance basis. Performance-based revenue represented 22% of revenue in Q2’24, compared to 20% in Q2’23, and 21% of revenue in Q1’24. As shared earlier in the letter, we believe that ZipRecruiter is at the forefront of a shift in online recruitment, characterized by a focus on interactive candidate experiences, increased communication, and reduced time-to-hire. Our initial rollout of ZipIntro is an early example of a product that epitomizes this shift. ZipIntro enables job seekers to connect with employers face-to-face by inviting top candidates to RSVP for a video interview with employers at a specific time. After the employer reviews candidate RSVPs, they are connected for a video interview. Employers are having a great experience with ZipIntro, as employers that use ZipIntro for a job receive over 3xmore quality applications for that job. Job seekers are loving ZipIntro, too, as over 90%of job seekerswho connect with an employer say they are likely to use ZipIntro again. Our goal is to invest in product initiatives like ZipIntro to facilitate more one-on-one interactions between employers and job seekers earlier in Q2 2024 Shareholder Letter 6

the job search process, creating more value for both sides of our marketplace. Similar to when we previously released innovations like Invite to Apply & Phil to our marketplace, we are confident ongoing innovations like ZipIntro will continue to increase employers’ willingness to pay for our services. Growth Strategy #2: Increase the number of job seekers in ourmarketplace We are intently focused on creating a superior job seeker product experience in order to grow job seeker tra�c. We firmly believe that over time, market share shifts in job seeker activity will be followed by market share shifts in employer revenue dollars. In Q2’24, our momentum with both total and organic job seeker tra�c continued. According to SimilarWeb, total ZipRecruiter web tra�c in the U.S. grew by 22%year-over-year fromQ2’23 toQ2’24, which is at least 12 percentage pointsmore than any of our largest competitors8. This was driven by year-over-year organic job seeker tra�c growth of 30%. We believe this success is a testament to not only our enduring brand awareness, but also the strength of our o�ering and continued product improvements. Subsequent to quarter-end, ZipRecruiter closed on an acquisition of Breakroom, a UK-based employer review site focused on frontline workers in industries like retail and hospitality. Breakroom collects data from workers on pay, hours, flexibility, work conditions, culture, and more to provide community-powered ratings for companies. These ratings give an authentic and transparent view of what it’s like to work for di�erent employers, which, in turn, helps job seekers apply for the right jobs for their individual needs. In line with our mission to actively connect job seekers with their next great opportunity, we plan to launch Breakroom in the United States to empower workers with the job insights they need to apply with confidence. In Q2’24, we made several improvements to the job search experience. For example, we improved our job navigation experience on the home page of our iOS and Android apps by adding job group buttons. These buttons allow job seekers to immediately browse jobs by categories such as remote jobs, jobs recommended based on their most recent application, jobs requiring no prior experience, and others. This resulted in a 8 Similarweb Market Intelligence Platform. Fastest growing online employment marketplace defined by number of total US visits. Results shown are from Apr 2024 - June 2024 compared to Apr 2023 - June 2023 for individual domains of ZipRecruiter.com, Glassdoor.com, CareerBuilder.com, Linkedin.com, and Indeed.com and not for parent companies, subsidiary sites, partner sites or subchannels. Q2 2024 Shareholder Letter 7

10% increase in home screen engagement. Additionally, we revamped our search experience, allowing job seekers to more easily see both key job highlights and the full job description directly from the search results page, making it easier than ever to see the most important information about a job opening without clicking out to a new page. This enhancement increased job seeker engagement with job postings by over 30%while simultaneously improving the quality of applications by giving job seekers more information – and therefore more certainty – about jobs before they apply. Growth Strategy #3:Make ourmatching technology smarter over time We bring job seekers and employers together using machine learning and AI, leveraging observed behavior across billions of interactions to power and train our proprietary matching algorithms. This technology gets demonstrably smarter over time, improving outcomes for both employers and job seekers. In Q2’24, we made several improvements to our matching algorithms. For example, our redesigned Matching Job Index enables ZipRecruiter to more e�ciently serve recommendations to job seekers, improving their engagement with ZipRecruiter’s marketplace. Our team also made improvements to how wemake recommendations to job seekers with relatively light activity, increasing engagement by up to 6% and a�ording us the opportunity to better understand what the job seeker is interested in and qualified for. We believe that continued investments in creating the best matching technology for employers and job seekers compound over time, and will enable us to achieve our mission of actively connecting people to their next great opportunity. Q2 2024 Shareholder Letter 8

Investing in our People We recently made a key promotion within our executive team. Monika Shah was promoted from SVP, Marketing and Partnerships to EVP, Chief Marketing O�cer. Monika joined ZipRecruiter in September 2017 and has played a central role in building all aspects of ZipRecruiter’s marketing function. Monika has helped us achieve 80% aided brand awareness9 among both job seekers and employers and has developed and fine-tuned the ROI-driven, flexible marketing engine that has contributed to ZipRecruiter’s success. We are excited to welcomeMonika into her new role on the executive team, and to continue building a team and culture to help achieve our goal of actively connecting people to their next great opportunity. ZipRecruiter has once again beenCertified™byGreat Place ToWork®. This recognition is based entirely on what employees report about their workplace experience and exemplifies the supportive and collaborative environment at ZipRecruiter. We are honored to once again earn this recognition demonstrating our continued commitment to our employees. 9 Based on our ZipRecruiter Brand Awareness Survey, 2024, an internal company-designed survey of 625 participants, which included (1) certain persons who had been involved in hiring processes and had used, or intend to use, online job posting websites within the preceding two years in connection with such hiring processes, (2) decision makers at hiring sites or systems, or influencers in the process of hiring candidates and (3) business owners, human resource managers, and non-human resources managers for U.S. based companies with up to 500 employees. The survey responses were used to measure brand health dimensions for us within the U.S. employer market and to explore how we benchmark against our competition. We designed the Brand Awareness Survey in accordance with what we believe are best practices for conducting a survey. Nevertheless, while we believe this survey is reliable, it involves a number of assumptions and limitations, and no independent sources have verified such survey. Q2 2024 Shareholder Letter 9

Q2’24 Financial Discussion Revenue Revenue for Q2’24 was $123.7 million, down 27% year-over-year and up 1% quarter-over-quarter. While the decrease year-over-year is primarily due to continued softness in hiring demand, revenue increased sequentially with higher performance-based revenue quarter-over-quarter. Quarterly Paid Employers We had 70,458 Quarterly Paid Employers in Q2’24, down 31% year-over-year and down 2% sequentially. The decrease year-over-year is primarily due to reduced demand from SMBs. The slight decline quarter-over-quarter is reflective of continued uncertainty in the hiring market. Revenue per Paid Employer Revenue per Paid Employer for Q2’24 was $1,755, up 5% year-over-year and up 3% sequentially. The increases year-over-year and quarter-over-quarter are primarily due to the slight mix shift from subscription revenue to performance revenue, where performance-based revenue represented 22% of revenue in Q2’24, compared to 20% in Q2’23, and 21% of revenue in Q1’24. Gross Profit andMargin Gross profit for Q2’24 was $110.7 million, down 28% year-over-year and up 2% sequentially. The decrease year-over-year continues to be driven by revenue declines, while the increase quarter-over-quarter was driven by the increase in revenue sequentially. Gross margin for Q2’24 increased to 90% versus the prior quarter. Q2 2024 Shareholder Letter 10

Operating Expenses Total operating expenses for Q2’24 were $101.3 million, compared to $132.2 million in Q2’23 and $109.8 million in Q1’24. The decrease in total operating expenses year-over-year was primarily driven by lower personnel-related expenses, as well as lower sales and marketing expenses, as we continue to moderate our marketing investments in response to employer demand. Total operating expenses were down quarter-over-quarter primarily due to lower personnel-related expenses, as well as lower stock-based compensation. Sales andMarketing (S&M) expenses were $51.5 million in Q2’24, or 42% of revenue, compared to $72.2 million, or 42% of revenue, in Q2’23, and $54.7 million, or 45% of revenue, in Q1’24. The decreases in S&M expenses year-over-year and quarter-over-quarter were primarily due to lower personnel-related expenses. Research andDevelopment (R&D) expenses were $33.3 million in Q2’24, or 27% of revenue, compared to $38.6 million, or 23% of revenue, in Q2’23, and $36.1 million, or 30% of revenue, in Q1’24. R&D spend decreased year-over-year and quarter-over-quarter, primarily due to lower personnel-related expenses. General and Administrative (G&A) expenses were $16.5 million in Q2’24, or 13% of revenue, compared to $21.4 million, or 13% of revenue, in Q2’23, and $19.1 million, or 16% of revenue, in Q1’24. The decreases in general and administrative expenses year-over-year and quarter-over-quarter were driven by lower personnel-related expenses and lower stock-based compensation in the current quarter. Q2 2024 Shareholder Letter 11

Net Income (Loss) andAdjusted EBITDA Net income in Q2’24 was $7.0 million, compared to net income of $14.4 million in Q2’23 and net loss of ($6.5) million in Q1’24. Adjusted EBITDA was $27.8 million, equating to an Adjusted EBITDAmargin of 23%, in Q2’24, compared to $43.3 million, with a margin of 25%, in Q2’23, and $20.8 million, with a margin of 17%, in Q1’24. Net income and Adjusted EBITDA decreases year-over-year were driven by revenue declines, while the sequential increases were driven by higher revenue and lower operating expenses. Fully Diluted Shares As of June 30, 2024, ZipRecruiter had a fully diluted capitalization of 111 million shares of Class A common stock and Class B common stock. This fully diluted capitalization share count includes (a) the shares of Class A common stock and Class B common stock outstanding and (b) all shares of Class A common stock and Class B common stock reserved for issuance to settle outstanding stock options and restricted stock units, but does not include shares of Class A common stock and Class B common stock reserved for future issuance of award grants under ZipRecruiter’s equity compensation plans. As of June 30, 2024, the remaining amount available to repurchase under our $550 million share repurchase program was $48.4 million. Cash, Cash Equivalents andMarketable Securities Cash, cash equivalents and marketable securities totaled $523.3 million as of June 30, 2024, compared to $497.2 million as of June 30, 2023, and $513.0 million as of March 31, 2024. The increases in cash, cash equivalents and marketable securities year-over-year and quarter-over-quarter were primarily due to cash flow from operations, partially o�set by repurchases of Class A common stock under our share repurchase program over the respective periods. In Q2’24, we purchased 0.9 million shares totaling $8.6 million. Q2 2024 Shareholder Letter 12

Financial Outlook Quarterly Guidance We saw signs that we were potentially approaching a trough for much of Q2, but trends in the last few weeks of June through July make us more cautious in our expectations for Q3. This is reflected in our Q3’24 revenue guidance of $112 million at the midpoint, which represents a 28% decline year-over-year, and a 9% decline quarter-over-quarter. Our Adjusted EBITDA guidance for Q3’24 is $10 million at the midpoint, or a 9% Adjusted EBITDAmargin. On a sequential basis, this implies an increase to operating expenses as we continue to bring on top talent, as well as invest marketing dollars that drive a strong long-term ROI. We believe it remains prudent to continue long-term product, technology and marketing investments in our marketplace. Our operating plans continue to call for low-to-mid teens Adjusted EBITDAmargins in 2024. We are constantly assessing the state of the labor market, letting data lead our decision making. We are poised to increase investment as opportunities arise, and alternatively are always prepared to show further cost discipline if conditions deteriorate. Q2 2024 Shareholder Letter 13

Forward-Looking Statements This shareholder letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this shareholder letter that do not relate to matters of historical fact should be considered forward-looking statements, including, without limitation, statements regarding our market opportunity, market share and expected hiring activity; statements under the section titled “Financial Outlook”; statements regarding our expected financial performance and operational performance for the third quarter of 2024; statements regarding our expected future revenue growth, Adjusted EBITDA profitability, return on investment, capital allocation strategy and key strategies; statements regarding our anticipated continued product launches; statements regarding our beliefs regarding our position to disrupt the industry and the early stages of transforming how employers and job seekers come together; statements regarding our plan to launch Breakroom in the United States, as well as statements that include the words “expect,” “intend,” “plan,” “believe,” “project,” “forecast,” “estimate,” “may,” “should,” “anticipate” and similar statements of a future or forward-looking nature. These forward-looking statements are based on management's current expectations. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements to be materially di�erent from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to: our ability to attract and retain employers and job seekers; our ability to compete with well-established competitors and new entrants; our ability to achieve and/or maintain profitability; our ability to maintain, protect and enhance our brand and intellectual property; our dependence on macroeconomic factors; our ability to maintain and improve the quality of our platform; our dependence on the interoperability of our platform with mobile operating systems that we do not control; our ability to successfully implement our business plan during a global economic downturn that may impact the demand for our services or have a material adverse impact on our and our business partners’ financial condition and results of operations; our ability and the ability of third parties to protect our users’ personal or other data from a security breach and to comply with laws and regulations relating to consumer data privacy and data protection; our ability to detect errors, defects or disruptions in our platform; our ability to comply with the terms of underlying licenses of open source software components on our platform; our ability to expand into markets outside the United States; our ability to achieve desired operating margins; our compliance with a wide variety of U.S. and international laws and regulations; our reliance on AmazonWeb Services; our ability to mitigate payment and fraud risks; our dependence on our senior management and our ability to attract and retain new talent; and the other important risk factors more fully discussed and described in documents we have filed with the Securities and Exchange Commission (“SEC”), including our Quarterly Report on Form 10-Q for the three months ended March 31, 2024 that we filed with the SEC and our Quarterly Report on Form 10-Q for the three months ended June 30, 2024 that we will file with the SEC. In addition, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to di�er materially from those contained in any forward-looking statements that we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this release are inherently uncertain and may not occur, and actual results could di�er materially and adversely from those anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. In addition, the forward-looking statements made in this shareholder letter relate only to events or information as of the date on which the statements are made in this letter. Except as required by law, we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Q2 2024 Shareholder Letter 14

Conference Call Details Wewill host a conference call to discuss our financial results onWednesday, August 7, 2024, at 2:00 p.m. Pacific Time. A live webcast of the call can be accessed from ZipRecruiter’s Investor Relations website. An archived version will be available on the website two hours after the call. Investors and analysts can participate in the conference call by dialing +1 (888) 440-4199, or +1 (646) 960-0818 for callers outside the United States, and using the conference ID 9351892. A telephonic replay of the conference call will be available until Wednesday, August 14, 2024. To listen to the replay please dial +1 (800) 770-2030 or +1 (647) 362-9199 for callers outside the United States and use the Conference ID 9351892. Q2 2024 Shareholder Letter 15

CONDENSEDCONSOLIDATEDBALANCESHEETS (UNAUDITED) (in thousands) Q2 2024 Shareholder Letter 16

CONDENSEDCONSOLIDATEDSTATEMENTSOFOPERATIONS (UNAUDITED) (in thousands, except per share amounts) Q2 2024 Shareholder Letter 17

CONDENSEDCONSOLIDATEDSTATEMENTSOFCASHFLOWS (UNAUDITED) (in thousands) Q2 2024 Shareholder Letter 18

RECONCILIATIONOFGAAPNET INCOMETOADJUSTEDEBITDA (UNAUDITED) (in thousands, except Adjusted EBITDAmargin data) RECONCILIATIONOFGAAPTONON-GAAPCOSTOFREVENUE (UNAUDITED) (in thousands) RECONCILIATIONOFGAAPTONON-GAAPOPERATINGEXPENSES (UNAUDITED) (in thousands) Q2 2024 Shareholder Letter 19

FULLYDILUTEDSHARES (UNAUDITED) (in thousands) Q2 2024 Shareholder Letter 20

Key Operating Metrics and Non-GAAP Financial Measures This shareholder letter includes certain key operating metrics, including Quarterly Paid Employers and Revenue per Paid Employer, and non-GAAP financial measures, including Non-GAAP cost of revenue, Non-GAAP operating expenses, Adjusted EBITDA and Adjusted EBITDAmargin. We define Paid Employers as any employer(s) (or entities acting on behalf of an employer) on a paying subscription plan or performance marketing campaign for at least one day. Paid Employer(s) excludes employers from our Job Distribution Partners or other indirect channels, employers who are not actively searching for candidates, but otherwise have access to previously posted jobs, and employers on free trial. Job Distribution Partners are defined as third-party sites who have a relationship with us and advertise jobs from our marketplace. Quarterly Paid Employers means, with respect to any fiscal quarter, the count of Paid Employers during such fiscal quarter. Revenue per Paid Employer is the total company revenue in a particular period divided by the count of Quarterly Paid Employers in the same period. We define Non-GAAP cost of revenue as our cost of revenue before stock-based compensation expense, and depreciation and amortization. We define Non-GAAP operating expenses as our operating expenses before stock-based compensation expense, and depreciation and amortization. We define Adjusted EBITDA as our net income (loss) before interest expense, other (income) expense, net, income tax expense (benefit) and depreciation and amortization, adjusted to eliminate stock-based compensation expense. Adjusted EBITDAmargin represents Adjusted EBITDA as a percentage of revenue for the same period. Management and our board of directors use these key operating metrics and non-GAAP financial measures as supplemental measures of our performance because they assist us in comparing our operating performance on a consistent basis, as they remove the impact of some items not directly resulting from our core operations. We also use these key operating metrics and non-GAAP financial measures for planning purposes, including the preparation of our internal annual operating budget and financial projections, to evaluate the performance and e�ectiveness of our strategic initiatives and to evaluate our capacity for capital expenditures to expand our business. Non-GAAP cost of revenue, Non-GAAP operating expenses, Adjusted EBITDA and Adjusted EBITDAmargin should not be considered in isolation, as an alternative to, or superior to net income (loss), revenue, cash flows or other measures derived in accordance with GAAP. These non-GAAPmeasures are frequently used by analysts, investors and other interested parties to evaluate companies in our industry. Management believes that the presentation of non-GAAP financial measures is an appropriate measure of operating performance because they eliminate the impact of some expenses that do not relate directly to the performance of our underlying business. These non-GAAP financial measures should not be construed as an inference that our future results will be una�ected by unusual or other items. Additionally, Adjusted EBITDA and Adjusted EBITDAmargin are not intended to be a measure of free cash flow for management’s discretionary use, as they do not reflect our tax payments and certain other cash costs that may recur in the future, including, among other things, cash requirements for costs to replace assets being depreciated and amortized including our capitalized internal use software. Management compensates for these limitations by relying on our GAAP results in addition to using Adjusted EBITDA and Adjusted EBITDAmargin as supplemental measures of our performance. Our measures of Adjusted EBITDA and Adjusted EBITDAmargin used herein are not necessarily comparable to similarly titled captions of other companies due to di�erent methods of calculation. We are not able to provide a reconciliation of Adjusted EBITDA and Adjusted EBITDAmargin for Q3’24 to net income (loss) and net income (loss) margin, the comparable GAAPmeasures, respectively, because certain items that are excluded from non-GAAP financial measures cannot be reasonably predicted or are not in our control. In particular, we are unable to forecast the timing or magnitude of stock-based compensation or amortization of internal-use software, as applicable, without unreasonable e�orts, and these items could significantly impact, either individually or in the aggregate, GAAPmeasures in the future. See the tables above regarding reconciliations of these non-GAAP financial measures to the most directly comparable GAAPmeasures. Q2 2024 Shareholder Letter 21

ZipRecruiter Acquires People-Powered Job Comparison Site Breakroom

ZipRecruiter to bring the innovative employer review platform to the United States, empowering job seekers with authentic and comparable insights

SANTA MONICA, Calif. (August 7, 2024) – ZipRecruiter®, a leading online employment marketplace, today announced that it has acquired Breakroom, a UK-based employer review platform focused on frontline industries such as retail and hospitality. In line with its mission to actively connect job seekers with their next great opportunity, ZipRecruiter plans to launch Breakroom in the United States to empower workers with the job insights they need to apply with confidence. Breakroom will continue to operate as an independent brand.

Breakroom collects data from frontline workers on pay, hours, flexibility, work conditions, culture, and more to provide community-powered ratings for jobs. These ratings give an authentic and transparent view of what it’s like to work for different employers, which, in turn, helps job seekers apply for the right jobs for their individual needs.

“While traditional employer review sites have predominantly become places where workers go to voice their job dissatisfaction, Breakroom collects insights about what the day-to-day is like working for different companies,” said Ian Siegel, Founder & CEO of ZipRecruiter. “Breakroom’s ratings give job seekers a clear picture of what it’s really like to work for an employer, setting better expectations than a traditional job description. We know that when job seekers better understand the roles they’re applying for, it leads to better outcomes for both sides of our marketplace.”

Since its launch in 2020, Breakroom has built a platform that resonates with the rising digitally native workforce in an authentic way and features hundreds of thousands of reviews. These reviews also allow Breakroom to provide employers with highly actionable insights, including recommendations for how to improve their ratings, jobs, and ultimately, retention. Breakroom also supports employers in their efforts to create good jobs by providing employer branding and insights, recruitment marketing tools, and quality candidate sourcing.

“ZipRecruiter and Breakroom share a common mission to connect the right job seekers to the right employers. We believe everyone deserves a good job, and that all jobs have the potential to be good ones when both job seekers and employers are armed with objective and actionable information. We’re looking forward to teaming with ZipRecruiter to scale our platform so we can bring this powerful tool—and ultimately great employment matches—to even more job seekers and employers,” said Anna Maybank, Founder & CEO, Breakroom.

For more information, visit www.breakroom.cc.

Forward-Looking Statements

This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking statements, including statements regarding Breakroom’s independent operation and ZipRecruiter’s plans to launch it in the United States. These statements may be preceded by, followed by or include the words "aim," "anticipate," "believe," "estimate," "expect," "forecast," "intend," "likely," "outlook," "plan," "potential," "project," "projection," "seek," "can," "could," "may," "should," "would," "will," the negatives thereof and other words and terms of similar meaning. Such forward-looking statements are subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in these statements, including our ability to attract and retain employers and job seekers; our ability to compete with well-established competitors and new entrants; our ability to achieve and/or maintain profitability; our ability to maintain, protect and enhance our brand and intellectual property; our dependence on macroeconomic factors; our ability to maintain and improve the quality of our platform; our dependence on the interoperability of our platform with mobile operating systems that we do not control; our ability to successfully implement our business plan during a global economic downturn that may impact the demand for our services or have a material adverse impact on our and our business partners’ financial condition and results of operations; our ability and the ability of third parties to protect our users’ personal or other data from a security breach and to comply with laws and regulations relating to consumer data privacy and data protection; our ability to detect errors, defects or disruptions in our platform; our ability to comply with the terms of underlying licenses of open source software components on our platform; our ability to expand into markets outside the United States; our ability to achieve desired operating margins; our compliance with a wide variety of U.S. and international laws and regulations; our reliance on Amazon Web Services; our ability to mitigate payment and fraud risks; our dependence on our senior management and our ability to attract and retain new talent; and the other important factors discussed under the caption “Risk Factors” in our Quarterly Report on Form 10-Q for the three months ended June 30, 2024 that we will file with the U.S. Securities and Exchange Commission. There is no assurance that any forward-looking statements will materialize. You are cautioned not to place undue reliance on forward-looking statements, which reflect expectations only as of this date. ZipRecruiter does not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments, or otherwise.

About ZipRecruiter

ZipRecruiter® (NYSE:ZIP) is a leading online employment marketplace that actively connects people to their next great opportunity. ZipRecruiter’s powerful matching technology improves the job search experience for job seekers and helps businesses of all sizes find and hire the right candidates quickly. ZipRecruiter has been the #1 rated job search app on iOS & Android for the past seven years1 and is rated the #1 employment job site by G2.2 For more information, visit

www.ziprecruiter.com.

1 Based on job seeker app ratings, during the period of January 2017 to January 2024 from AppFollow for ZipRecruiter, CareerBuilder, Glassdoor, Indeed, LinkedIn, and Monster.

2 Based on G2 satisfaction ratings as of December 18, 2023.

About Breakroom

Breakroom is an employer review and job marketplace platform. Featuring reviews for thousands of UK employers, Breakroom’s proprietary data on pay, hours, flexibility and culture are sourced straight from job seekers to help candidates learn about and apply to the right roles and employers. With a focus on frontline workers, employers can use their enhanced profiles to showcase what it’s really like to work for the company and attract more engaged candidates. For more information, visit www.breakroom.cc.

Contact

ZipRecruiter

Claire Walsh, Press Relations

press@ziprecruiter.com

v3.24.2.u1

Cover

|

Aug. 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 07, 2024

|

| Entity Registrant Name |

ZipRecruiter, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40406

|

| Entity Tax Identification Number |

27-2976158

|

| Entity Address, Address Line One |

604 Arizona Avenue,

|

| Entity Address, City or Town |

Santa Monica,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

90401

|

| City Area Code |

877

|

| Local Phone Number |

252-1062

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, $0.00001 par value per share

|

| Trading Symbol |

ZIP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001617553

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

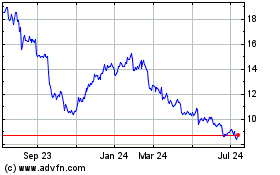

ZipRecruiter (NYSE:ZIP)

Historical Stock Chart

From Nov 2024 to Dec 2024

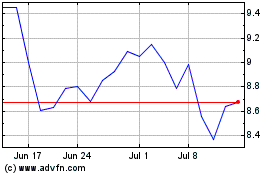

ZipRecruiter (NYSE:ZIP)

Historical Stock Chart

From Dec 2023 to Dec 2024