AT&T Selling Yellow Pages - Analyst Blog

April 10 2012 - 9:30AM

Zacks

AT&T Inc. (T), the second-largest U.S.

mobile service provider, will sell 53% stake in its Yellow Pages

business to Cerberus Capital Management LP, a private equity firm.

The deal would be worth $950 million, including debt. AT&T will

receive $750 million in cash and Cerebus will assume $200 million

in debt.

The Yellow Pages business is the part of AT&T’s Advertising

Solutions segment, which fell 16.3% last year and represented about

3% of the company’s revenue. Profitability at the Yellow Pages

business had been declining for the past several years as the

telephone directories have become obsolete due to changing customer

habits. The operations were highly impacted by the online service

provides like Google Inc. (GOOG), Yelp

Inc. (YELP) and Groupon Inc. (GRPN) that

have replaced the concept of printed phonebooks. AT&T recorded

$2.9 billion or 48 cents in asset impairments of its directories

business in the fourth quarter of last year.

AT&T’s decision to sell off Yellow Pages was an outcome of

its plan to shed some of its slower-growing assets or restructuring

underperforming or non-strategic assets such as the directory

business and rural access lines. Now, AT&T will focus on its

core wireless, IP, cloud and application-based services.

The deal, pending regulatory approval, is expected to close in

middle of the year. The transaction would have minimal effect on

its earnings this year. The Yellow Pages includes AT&T’s

Advertising Solutions and Interactive assets. It excludes the

recently formed AT&T AdWorks, a New York-based operation that

sells advertising offerings across 3-screen platforms (online,

mobile and TV).

AT&T is following similar trends as that of its major rival

Verizon Communication Inc. (VZ). Verizon, the

largest U.S. mobile service provider, had exited its directories

business in 2006.

Cerberus Capital, managed by the billionaire investor Stephen A.

Feinberg, is hopeful of generating substantial cash flow from the

Yellow Pages. It also believes that any growth potential in the

business is likely to stem from its online and mobile

initiatives.

We are maintaining our long-term Neutral recommendation on

AT&T. The company retains the Zacks # 3 (Hold) Rank for the

short term (1–3 months).

GOOGLE INC-CL A (GOOG): Free Stock Analysis Report

GROUPON INC (GRPN): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

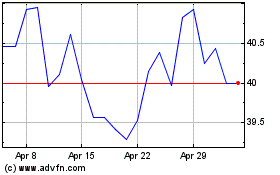

Yelp (NYSE:YELP)

Historical Stock Chart

From Jun 2024 to Jul 2024

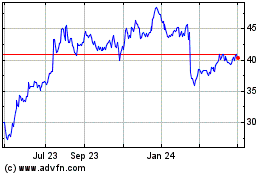

Yelp (NYSE:YELP)

Historical Stock Chart

From Jul 2023 to Jul 2024