Current Report Filing (8-k)

January 25 2023 - 5:17PM

Edgar (US Regulatory)

0001166003

false

0001166003

2023-01-23

2023-01-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): January 23, 2023

XPO, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-32172 |

|

03-0450326 |

(State or other jurisdiction of

incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

Five American Lane,

Greenwich, Connecticut |

06831 |

(Address

of principal

executive offices) |

(Zip Code) |

(855)

976-6951

Registrant’s telephone number, including

area code

(Former Name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.001 per share |

|

XPO |

|

New

York Stock Exchange |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or

Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| |

| Emerging growth company ¨ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨ |

| Item 5.02. | Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Senior Advisor - Finance and former Chief Financial Officer

On January 23, 2023, XPO, Inc. (the “Company”)

and Ravi Tulsyan, the Company’s Senior Advisor – Finance and former Chief Financial Officer, entered into a Separation Agreement

and General Release (the “Separation Agreement”), setting forth the terms of Mr. Tulsyan’s separation from employment

with the Company, effective as of January 6, 2023 (the “Separation Date”). For purposes of the Separation Agreement,

the Change in Control and Severance Agreement (“Severance Agreement”), dated September 14, 2021, and the Transition Agreement

(“Transition Agreement”), dated October 10, 2022, each entered into by and between Mr. Tulsyan and the Company,

Mr. Tulsyan will receive the payments, benefits, and accelerated vesting due upon a termination of employment without cause.

Pursuant to the Separation Agreement, the Severance Agreement, and

the Transition Agreement, Mr. Tulsyan will receive the following payments and benefits from the Company in exchange for agreeing

to a general release of claims in favor of the Company and other promises by Mr. Tulsyan in the Separation Agreement: (i) cash

severance payments equal to twelve months of Mr. Tulsyan’s base salary in effect on the Separation Date, totaling a gross amount

of $500,000 (the “Severance Payments”), less applicable taxes and withholdings, payable in equal installments over a twelve-month

period on the Company's normal payroll dates with the first installment to be paid within 65 days after the Separation Date, (ii) an

additional payment of $8,200 (the “Additional Payment”), less applicable taxes and withholdings, equal to the estimated prorated

target bonus for the 2023 performance year, (iii) a lump sum, less applicable taxes and withholdings, equivalent to any unused carryover

paid time off for 2022 that Mr. Tulsyan would otherwise forfeit upon separation (the “Carryover PTO Payment”), (iv) an

enhanced payment equivalent to what Mr. Tulsyan would have received as the funded bonus amount for the Company's 2022 annual incentive

plan year if Mr. Tulsyan had remained employed through the payout date, calculated based on Mr. Tulsyan's base salary as of

the Separation Date multiplied by his bonus target percentage multiplied by the bonus funding percentage for his incentive plan, (v) nine

(9) months of outplacement services, and (vi) provided Mr. Tulsyan timely elects coverage under the Consolidated Omnibus

Budget Reconciliation Act (“COBRA”), the Company will pay Mr. Tulsyan's COBRA premiums for medical and dental coverage

for up to six (6) months from the Separation Date. Additionally, pursuant to the Separation Agreement, certain of Mr. Tulsyan’s

outstanding time-based restricted stock unit awards will be subject to accelerated vesting and Mr. Tulsyan will be eligible for accelerated

vesting in certain of Mr. Tulsyan’s outstanding performance-based restricted stock unit awards, subject to the achievement

of applicable performance goals in accordance with the terms and conditions of the applicable award agreements.

The foregoing summary does not purport to be complete and is qualified

in its entirety by reference to the full text of the Separation Agreement and General Release, a copy of which is filed herewith as Exhibit 10.1.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

| Date: January 25,

2023 |

XPO, INC. |

| |

|

| |

By: |

/s/ Christopher J. Signorello |

| |

|

Christopher J. Signorello |

| |

|

Chief Compliance Officer and Deputy General Counsel |

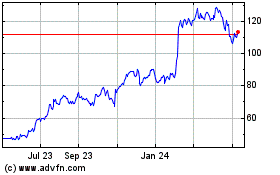

XPO (NYSE:XPO)

Historical Stock Chart

From Jun 2024 to Jul 2024

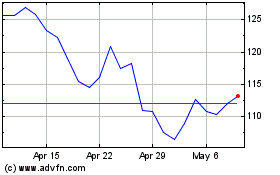

XPO (NYSE:XPO)

Historical Stock Chart

From Jul 2023 to Jul 2024