Additional Proxy Soliciting Materials (definitive) (defa14a)

August 21 2020 - 4:55PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material Pursuant to Section 240.14a-12

|

WORTHINGTON INDUSTRIES, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(l) and 0-11.

|

|

|

1)

|

Title of each class of securities to which transaction applies:

|

|

|

2)

|

Aggregate number of securities to which transaction applies:

|

|

|

3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (Set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

4)

|

Proposed maximum aggregate value of transaction:

|

|

☐

|

Fee paid previously with preliminary materials .

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-l l(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

1)

|

Amount Previously Paid:

|

|

|

2)

|

Form, Schedule or Registration Statement No.:

|

Worthington Industries, Inc.

Supplemental Proxy Materials

August 21, 2020

Due to a clerical error, the Fiscal 2020 Summary Compensation Table included in the Proxy Statement for the 2020 Annual Meeting of Shareholders of Worthington Industries, Inc. (the “Company”), dated August 12, 2020 and filed with the Securities and Exchange Commission on that same date (the “2020 Proxy Statement”) incorrectly disclosed the “Total” compensation for each of John P. McConnell and Geoffrey G. Gilmore for fiscal 2019 and fiscal 2018, and for Virgil L. Winland for fiscal 2019. Although the amounts of various components of compensation are correctly disclosed, they are not appropriately added together for purposes of the disclosure in the “Total” column. Accordingly, “Total” compensation for Mr. McConnell, Mr. Gilmore and Mr. Winland for the fiscal years noted above should have been shown as follows:

|

|

(a)

|

For Mr. McConnell, Chairman of the Board and Chief Executive Officer, “Total” compensation for fiscal 2019 should have been shown as $3,738,833, instead of $3,254,633, and for fiscal 2018 should have been shown as $4,428,242, instead of $3,493,242.

|

|

|

(b)

|

For Mr. Gilmore, Executive Vice President and Chief Operating Officer, “Total” compensation for fiscal 2019 should have been shown as $5,395,082, instead of $5,233,382, and for fiscal 2018 should have been shown as $3,004,962, instead of $2,855,361.

|

|

|

(c)

|

For Mr. Winland, Senior Vice President, Manufacturing, “Total” compensation for fiscal 2019 should have been shown as $1,256,709, instead of $1,145,389.

|

The “Total” compensation amounts had been correctly discussed in the Company’s 2019 Proxy Statement and the Company’s 2018 Proxy Statement, as relevant.

The amounts initially disclosed for Mr. McConnell, Mr. Gilmore and Mr. Winland in the 2020 Proxy Statement for fiscal 2020 are correct.

The following table shows the corrected information for Mr. McConnell, Mr. Gilmore and Mr. Winland in the Fiscal 2020 Summary Compensation Table, amending the tabular portion of the Fiscal 2020 Summary Compensation Table included in the 2020 Proxy Statement. The footnotes to the Fiscal 2020 Summary Compensation Table are accurate and not amended hereby.

Fiscal 2020 Summary Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Equity Incentive Plan

Compensation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Short-Term / Long-Term

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name and Principal

Positions During

Fiscal 2020

|

Fiscal Year

|

|

Salary

($) (1)

|

|

Discretionary

Bonuses ($) (1)

|

|

Stock

Awards

($) (2)

|

|

Option

Awards

($) (3)

|

|

Annual

Incentive

Bonus

Award

($) (1)

|

|

3-year Cash

Performance

Award ($) (4)

|

|

All Other

Compensation

($) (5)

|

|

Total ($)

|

|

John P. McConnell,

|

|

2020

|

|

|

|

|

698,715

|

|

|

|

|

0

|

|

|

|

|

1,459,125

|

|

|

|

|

|

276,480

|

|

|

|

|

|

727,890

|

|

|

|

|

|

|

|

|

|

|

|

58,142

|

|

|

|

|

|

3,220,352

|

|

|

|

Chairman of the Board

|

|

2019

|

|

|

|

|

667,780

|

|

|

|

|

0

|

|

|

|

|

1,373,120

|

|

|

|

|

|

276,100

|

|

|

|

|

|

877,722

|

|

|

|

|

|

484,000

|

|

|

|

|

|

60,111

|

|

|

|

|

|

3,738,833

|

|

|

|

and Chief Executive Officer

|

|

2018

|

|

|

|

|

661,008

|

|

|

|

|

0

|

|

|

|

|

1,471,080

|

|

|

|

|

|

329,780

|

|

|

|

|

|

970,766

|

|

|

|

|

|

935,000

|

|

|

|

|

|

60,608

|

|

|

|

|

|

4,428,242

|

|

|

|

Joseph B. Hayek,

|

|

2020

|

|

|

|

|

322,269

|

|

|

|

|

0

|

|

|

|

|

2,847,190

|

|

|

|

|

|

69,632

|

|

|

|

|

|

298,206

|

|

|

|

|

|

18,364

|

|

|

|

|

|

54,377

|

|

|

|

|

|

3,610,038

|

|

|

|

Vice President and

|

|

2019

|

|

|

|

|

298,727

|

|

|

|

|

0

|

|

|

|

|

329,838

|

|

|

|

|

|

67,224

|

|

|

|

|

|

291,288

|

|

|

|

|

|

55,909

|

|

(6)

|

|

|

|

38,822

|

|

|

|

|

|

1,081,878

|

|

|

|

Chief Financial Officer (7)

|

|

2018

|

|

|

|

N/A

|

|

|

|

|

0

|

|

|

|

N/A

|

|

|

|

|

N/A

|

|

|

|

|

N/A

|

|

|

|

|

N/A

|

|

|

|

|

N/A

|

|

|

|

|

|

0

|

|

|

|

B. Andrew Rose,

|

|

2020

|

|

|

|

|

562,692

|

|

|

|

|

0

|

|

|

|

|

758,745

|

|

|

|

|

|

143,360

|

|

|

|

|

|

580,920

|

|

|

|

|

|

|

|

|

|

|

|

88,716

|

|

|

|

|

|

2,134,433

|

|

|

|

President and Former

|

|

2019

|

|

|

|

|

527,103

|

|

|

|

|

0

|

|

|

|

|

4,799,515

|

|

|

|

|

|

144,325

|

|

|

|

|

|

657,547

|

|

|

|

|

|

290,400

|

|

|

|

|

|

80,533

|

|

|

|

|

|

6,499,423

|

|

|

|

Chief Financial Officer (8)

|

|

2018

|

|

|

|

|

502,212

|

|

|

|

|

0

|

|

|

|

|

757,035

|

|

|

|

|

|

172,385

|

|

|

|

|

|

632,236

|

|

|

|

|

|

561,000

|

|

|

|

|

|

73,608

|

|

|

|

|

|

2,698,476

|

|

|

|

Geoffrey G. Gilmore,

|

|

2020

|

|

|

|

|

552,462

|

|

|

|

|

0

|

|

|

|

|

552,522

|

|

|

|

|

|

102,400

|

|

|

|

|

|

511,210

|

|

|

|

|

|

71,294

|

|

|

|

|

|

68,179

|

|

|

|

|

|

1,858,067

|

|

|

|

Executive Vice President

|

|

2019

|

|

|

|

|

520,837

|

|

|

|

|

0

|

|

|

|

|

4,022,219

|

|

|

|

|

|

80,320

|

|

|

|

|

|

557,266

|

|

|

|

|

|

161,700

|

|

(6)

|

|

|

|

52,740

|

|

|

|

|

|

5,395,082

|

|

|

|

and Chief Operating Officer (9)

|

|

2018

|

|

|

|

|

500,215

|

|

|

|

|

0

|

|

|

|

|

1,693,596

|

|

|

|

|

|

95,936

|

|

|

|

|

|

525,672

|

|

|

|

|

|

149,600

|

|

|

|

|

|

39,942

|

|

|

|

|

|

3,004,961

|

|

|

|

Virgil L. Winland,

|

|

2020

|

|

|

|

|

396,133

|

|

|

|

|

0

|

|

|

|

|

241,242

|

|

|

|

|

|

44,032

|

|

|

|

|

|

369,778

|

|

|

|

|

|

|

|

|

|

|

|

46,240

|

|

|

|

|

|

1,097,425

|

|

|

|

Senior Vice President,

|

|

2019

|

|

|

|

|

378,595

|

|

|

|

|

0

|

|

|

|

|

236,005

|

|

|

|

|

|

37,650

|

|

|

|

|

|

445,896

|

|

|

|

|

|

111,320

|

|

|

|

|

|

47,243

|

|

|

|

|

|

1,256,709

|

|

|

|

Manufacturing

|

|

2018

|

|

|

|

|

374,755

|

|

|

|

|

0

|

|

|

|

|

252,186

|

|

|

|

|

|

44,970

|

|

|

|

|

|

493,164

|

|

|

|

|

|

215,050

|

|

|

|

|

|

37,166

|

|

|

|

|

|

1,417,291

|

|

|

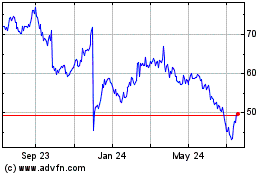

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Worthington Enterprises (NYSE:WOR)

Historical Stock Chart

From Jul 2023 to Jul 2024