WeWork Inc. (NYSE: WE) ("WeWork"), the leading global flexible

space provider, disclosed financial results today for the three and

six months ended June 30, 2023. Second quarter highlights

include:

- Consolidated revenue for the second quarter 2023 was $844

million, an increase of 4% year-over-year and up 7% for the first

half 2023 year-over-year.

- Net loss was $(397) million, a $238 million improvement

year-over-year, and an improvement of $443 million for the first

half 2023 year-over-year.

- Adjusted EBITDA was $(36) million, a $98 million improvement

year-over-year and a $281 million improvement for the first half

2023 year-over-year.

- Consolidated physical occupancy was 72% at the end of the

second quarter 2023, an increase from 70% at the end of the second

quarter 2022.

(Amounts in millions)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Consolidated Revenue

$

844

$

815

$

1,693

$

1,580

Net loss

(397

)

(635

)

(696

)

(1,139

)

Adjusted EBITDA(1)

(36

)

(134

)

(65

)

(346

)

(1) Adjusted EBITDA is a non-GAAP measure.

See Appendix for reconciliation and other information.

“In a difficult operating environment, we have delivered solid

year-over-year revenue growth and dramatic profitability

improvements,” David Tolley, Interim Chief Executive Officer,

commented. “Excess supply in commercial real estate, increasing

competition in flexible space and macroeconomic volatility drove

higher member churn and softer demand than we anticipated,

resulting in a slight decline in memberships.”

“We are confident in our ability to meet the evolving workplace

needs of businesses of all sizes across sectors and geographies,

and our long term company vision remains unchanged,” continued

Tolley. “Although we have more work to do, the talent and energy of

the WeWork team is extraordinary and we are resolutely focused on

delivering for our members for the long term. The company’s

transformation continues at pace, with a laser focus on member

retention and growth, doubling down on our real estate portfolio

optimization efforts, and maintaining a disciplined approach to

reducing operating costs.”

Space-as-a-Service:

- As of June 30, 2023, WeWork's systemwide real estate portfolio

consisted of 777 locations across 39 countries, supporting

approximately 906,000 workstations and 653,000 physical

memberships, equating to physical occupancy of 72%, and a decrease

in physical memberships of 1% year-over-year.

- As of June 30, 2023, WeWork’s consolidated real estate

portfolio consisted of 610 locations across 33 countries, which

supported approximately 715,000 workstations and 512,000 physical

memberships, equating to physical occupancy of 72%, and a decrease

in physical memberships of 3% year-over-year.

- Average revenue per physical member was $502 in the second

quarter of 2023, an increase of 4% from the second quarter

2022.

WeWork Access: All Access consolidated memberships were

approximately 75,000 in the second quarter of 2023, an increase of

21% year-over-year.

Liquidity On May 5, 2023, the Company closed on its

previously announced debt exchange and restructuring transactions.

As of June 30, 2023, the Company had $680 million of liquidity,

consisting of $205 million of cash and $475 million of capacity

under its delayed draw, first lien notes, of which $175 million

were drawn in July 2023.

In addition, as disclosed in WeWork’s Quarterly Report for the

three and six months ended June 30, 2023 (the “Second Quarter

10-Q”), as a result of the Company’s losses and projected cash

needs, combined with increased member churn and current liquidity

levels, substantial doubt exists about the Company’s ability to

continue as a going concern. The Company’s ability to continue as a

going concern is contingent upon successful execution of

management’s plan to improve liquidity and profitability over the

next 12 months, which includes, without limitation:

- Reducing rent and tenancy costs via restructuring actions and

negotiation of more favorable lease terms;

- Increasing revenue by reducing member churn and increasing new

sales;

- Controlling expenses and limiting capital expenditures;

and

- Seeking additional capital via issuance of debt or equity

securities or asset sales.

Earnings Conference Call: WeWork management will host an

earnings conference call at 8:00 a.m. EDT on August 9, 2023.

Earnings call details will be available on WeWork’s Investor

Relations website at investors.wework.com. Questions must be

submitted in advance to investor@wework.com. Please visit the

Investors section of the Company’s website at investors.wework.com

for event information.

Source: We Work Category: Investor Relations, Earnings

About WeWork WeWork Inc.

(NYSE: WE) was founded in 2010 with the vision to create

environments where people and companies come together and do their

best work. Since then, we’ve become the leading global flexible

space provider committed to delivering technology-driven turnkey

solutions, flexible spaces, and community experiences. For more

information about WeWork, please visit us at wework.com.

Forward-Looking Statements

Certain statements made in this press release may be deemed

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, as amended. These forward

looking statements generally are identified by the words “believe,”

“project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “pipeline,” “may,”

“should,” “will,” “would,” “will be,” “will continue,” “will likely

result,” and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events

that are based on current expectations and assumptions and, as a

result, are subject to risks and uncertainties. Although WeWork

believes the expectations reflected in any forward-looking

statement are based on reasonable assumptions, it can give no

assurance that its expectations will be attained, and it is

possible that actual results may differ materially from those

indicated by these forward-looking statements due to a variety of

risks, uncertainties and other factors. Such factors include, but

are not limited to, WeWork’s ability to implement its business

plan; WeWork’s ability to refinance, extend, restructure or repay

outstanding debt; its outstanding indebtedness; its liquidity needs

to operate its business and execute its strategy, and related use

of cash; its ability to raise capital through equity issuances,

asset sales or the incurrence of debt; WeWork’s ability to fully

execute actions and steps that would be probable of mitigating the

existence of substantial doubt regarding its ability to continue as

a going concern; retail and credit market conditions; higher cost

of capital and borrowing costs; impairments; its current and

projected liquidity needs; changes in general economic conditions,

including as a result of inflation, the COVID-19 pandemic and the

conflict in Ukraine; WeWork’s expectations regarding its exits of

underperforming locations, including the timing of any such exits

and its ability to retain its members; delays in customers and

prospective customers returning to the office and taking occupancy,

or changes in the preferences of customers and prospective

customers with respect to remote or hybrid working, as a result of

the COVID-19 pandemic leading to a parallel delay, or potentially

permanent change, in receiving the corresponding revenue; the

health of the commercial real estate market; and the impact of

foreign exchange rates on WeWork’s financial performance.

Forward-looking statements speak only as of the date they are made.

WeWork discusses these and other risks and uncertainties in its

annual and quarterly periodic reports and other documents filed

with the U.S. Securities and Exchange Commission (the “SEC”).

WeWork undertakes no duty or obligation to update or revise these

forward-looking statements, whether as a result of new information,

future developments, or otherwise, except as required by law.

Use of Non-GAAP Financial Measures and

Other Performance Indicators This press release includes

certain financial measures not presented in accordance with

generally accepted accounting principles in the United States

(“GAAP”): Adjusted EBITDA and Free Cash Flow. These financial

measures are not measures of financial performance in accordance

with GAAP and may exclude items that are significant in

understanding and assessing our financial results. Therefore, these

measures should not be considered in isolation or as an alternative

to net loss or other measures of profitability, liquidity or

performance under GAAP. You should be aware that WeWork’s

presentation of these measures may not be comparable to similarly

titled measures used by other companies, which may be defined and

calculated differently. WeWork believes that these non-GAAP

measures of financial results (including on a forward-looking

basis) provide useful supplemental information to investors about

WeWork. WeWork’s management uses forward-looking non-GAAP measures

to evaluate WeWork’s projected financials and operating

performance.

Non-GAAP Financial

Definitions Adjusted Earnings Before Interest

Expense, Income Tax, Depreciation, and Amortization (“Adjusted

EBITDA”) We supplement our GAAP results by evaluating Adjusted

EBITDA, a non-GAAP measure. We define "Adjusted EBITDA" as net loss

before income tax (benefit) provision, interest and other (income)

expense, net depreciation and amortization, stock-based

compensation expense, expense related to stock-based payments for

services rendered by consultants, income or expense relating to the

changes in fair value of assets and liabilities remeasured to fair

value on a recurring basis, expense related to costs associated

with mergers, acquisitions, divestitures and capital raising

activities, legal, tax and regulatory reserves or settlements,

significant legal costs incurred by WeWork in connection with

regulatory investigations and litigation regarding WeWork's 2019

withdrawn initial public offering and the related execution of the

SoftBank Transactions, as defined in Note 1 of the Notes to the

Consolidated Financial Statements included in our Second Quarter

10-Q, filed with the SEC on August 8, 2023, net of any insurance or

other recoveries, significant non-ordinary course asset impairment

charges and restructuring and other related (gains)/costs.

Free Cash Flow We also supplement our GAAP results by

evaluating Free Cash Flow, a non-GAAP measure. Free Cash Flow is

defined as net cash provided by (used in) operating activities less

purchases of property, equipment and capitalized software, each as

presented in the Company's consolidated statements of cash flows

and calculated in accordance with GAAP. Free Cash Flow is both a

performance measure and a liquidity measure that we believe

provides useful information to management and investors about the

amount of cash generated by or used in the business. Free Cash Flow

is also a key metric used internally by our management to develop

internal budgets, forecasts, and performance targets.

(Other key performance indicators (in

thousands, except for revenue in millions and

percentages)):

June 30, 2023

March 31, 2023

December 31,

2022

September 30,

2022

June 30, 2022

Other key performance

indicators:

Consolidated

Locations(1)

Membership and service revenues

$

835

$

838

$

834

$

809

$

796

Other revenue

4

5

10

2

14

Consolidated total revenue, excluding

Unconsolidated Locations Management fees

$

839

$

843

$

844

$

811

$

810

Workstation Capacity

715

720

731

756

749

Physical Memberships

512

527

547

536

528

All Access and Other Legacy

Memberships

75

75

70

67

62

Memberships

587

602

617

603

589

Physical Occupancy Rate

72

%

73

%

75

%

71

%

70

%

Enterprise Physical Membership

Percentage

41

%

45

%

46

%

47

%

45

%

Unconsolidated

Locations(1)

Membership and service revenues(2)

$

135

$

133

$

129

$

132

$

134

Workstation Capacity

191

184

175

173

172

Physical Memberships

141

137

135

135

133

All Access and Other Virtual

Memberships

2

2

1

1

—

Memberships

143

139

136

136

134

Physical Occupancy Rate

74

%

75

%

77

%

78

%

77

%

Systemwide

Locations

Membership and service revenues(3)

$

970

$

971

$

963

$

941

$

930

Consolidated other revenue

4

5

10

2

14

Systemwide revenue(3)

$

974

$

976

$

973

$

943

$

944

Workstation Capacity

906

904

906

928

922

Physical Memberships

653

664

682

671

661

All Access and Other Legacy

Memberships

77

77

71

68

62

Memberships

730

741

754

739

723

Physical Occupancy Rate

72

%

73

%

75

%

72

%

72

%

(1)

For certain key performance indicators the

amounts we present are based on whether the indicator relates to a

location for which the revenues and expenses of the location are

consolidated within our results of operations ("Consolidated

Locations") or whether the indicator relates to a location for

which the revenues and expenses are not consolidated within our

results of operations, but for which we are entitled to a

management fee for our advisory services ("Unconsolidated

Locations"). As of June 30, 2023, our India, China, Israel, South

Africa and certain Common Desk locations are our only

Unconsolidated Locations.

(2)

Unconsolidated membership and service

revenues represents the results of Unconsolidated Locations that

typically generate ongoing management fees for the Company at rates

ranging from 2.75% to 7.00% of applicable revenue.

(3)

Systemwide Location membership and service

revenues represents the results of all locations regardless of

ownership.

WEWORK INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS (UNAUDITED)

June 30,

December 31,

(Amounts in millions, except share and

per share amounts)

2023

2022

Assets

Current assets:

Cash and cash equivalents

$

205

$

287

Accounts receivable and accrued revenue,

net of allowance of $8 as of June 30, 2023 and $13 as of December

31, 2022

118

109

Prepaid expenses

135

138

Other current assets

286

155

Total current assets

744

689

Property and equipment, net

3,860

4,391

Lease right-of-use assets, net

9,275

11,243

Equity method and other investments

49

63

Goodwill and intangible assets, net

735

737

Other assets (including related party

amounts of $75 as of June 30, 2023 and $384 as of December 31,

2022)

400

740

Total assets

$

15,063

$

17,863

Liabilities

Current liabilities:

Accounts payable and accrued expenses

$

455

$

526

Members’ service retainers

434

445

Deferred revenue

112

151

Current lease obligations

883

936

Other current liabilities

305

172

Total current liabilities

2,189

2,230

Long-term lease obligations

13,280

15,598

Long-term debt, net (including amounts due

to related parties of $458 as of June 30, 2023 and $1,650 as of

December 31, 2022)

2,910

3,208

Other liabilities

277

282

Total liabilities

18,656

21,318

Commitments and contingencies

Redeemable noncontrolling interests

(33

)

(20

)

Equity

WeWork Inc. shareholders' equity

(deficit):

Preferred stock; par value $0.0001;

100,000,000 shares authorized, zero issued and outstanding as of

June 30, 2023 and December 31, 2022

—

—

Common stock Class A; par value $0.0001;

4,874,958,334 shares authorized, 2,112,965,359 shares issued and

2,110,021,147 shares outstanding as of June 30, 2023, and

1,500,000,000 shares authorized, 711,106,961 shares issued and

708,162,749 shares outstanding as of December 31, 2022

—

—

Common stock Class C; par value $0.0001;

25,041,666 shares authorized, 19,938,089 shares issued and

outstanding as of June 30, 2023 and December 31, 2022

—

—

Treasury stock, at cost; 2,944,212 shares

held as of June 30, 2023 and December 31, 2022

(29

)

(29

)

Additional paid-in capital

13,004

12,387

Accumulated other comprehensive income

(loss)

97

149

Accumulated deficit

(16,790

)

(16,177

)

Total WeWork Inc. shareholders'

deficit

(3,718

)

(3,670

)

Noncontrolling interests

158

235

Total equity

(3,560

)

(3,435

)

Total liabilities and equity

$

15,063

$

17,863

WEWORK INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (UNAUDITED)

(Amounts in millions, except share and

per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Revenue

$

844

$

815

$

1,693

$

1,580

Expenses:

Location operating expenses—cost of

revenue (exclusive of depreciation and amortization of $149 and

$150 for the three months ended and $290 and $308 for the six

months ended June 30, 2023 and 2022, respectively, shown separately

below)

725

736

1,449

1,472

Pre-opening location expenses

8

38

15

85

Selling, general and administrative

expenses

150

189

305

397

Restructuring and other related (gains)

costs

(107

)

(26

)

(165

)

(156

)

Impairment expense/(gain on sale)

263

36

340

127

Depreciation and amortization

156

158

304

329

Total expenses

1,195

1,131

2,248

2,254

Loss from operations

(351

)

(316

)

(555

)

(674

)

Interest and other income (expenses),

net:

Interest expense (including related party

expenses of $44 and $132 for the three months ended and $124 and

$222 for the six months ended June 30, 2023 and 2022,

respectively)

(102

)

(159

)

(223

)

(272

)

Foreign currency gain (loss)

20

(157

)

51

(201

)

Other income (expense), net

41

—

33

10

Total interest and other income

(expenses), net

(41

)

(316

)

(139

)

(463

)

Pre-tax loss

(392

)

(632

)

(694

)

(1,137

)

Income tax benefit (provision)

(5

)

(3

)

(2

)

(2

)

Net loss

(397

)

(635

)

(696

)

(1,139

)

Net loss attributable to noncontrolling

interests:

Redeemable noncontrolling interests —

mezzanine

10

15

16

36

Noncontrolling interest — equity

38

43

67

91

Net loss attributable to WeWork Inc.

$

(349

)

$

(577

)

$

(613

)

$

(1,012

)

Net loss per share attributable to Class A

common stockholders:

Basic

$

(0.21

)

$

(0.76

)

$

(0.51

)

$

(1.33

)

Diluted

$

(0.21

)

$

(0.76

)

$

(0.51

)

$

(1.33

)

Weighted-average shares used to compute

net loss per share attributable to Class A common stockholders,

basic and diluted

1,626,430,041

761,552,438

1,199,105,476

760,620,470

WEWORK INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (UNAUDITED)

Six Months Ended June

30,

(Amounts in millions)

2023

2022

Cash Flows from Operating

Activities:

Net loss

$

(696

)

$

(1,139

)

Adjustments to reconcile net loss to net

cash from operating activities:

Depreciation and amortization

304

329

Impairment expense/(gain on sale)

340

127

Stock-based compensation expense

6

26

Non-cash interest expense

57

149

Non-cash debt extinguishment

(35

)

—

Foreign currency (gain) loss

(51

)

201

Other non-cash operating expenses

15

42

Changes in operating assets and

liabilities:

Operating lease right-of-use assets

1,895

610

Current and long-term lease

obligations

(2,320

)

(798

)

Accounts receivable and accrued

revenue

1

14

Other assets

4

(22

)

Accounts payable and accrued expenses

(42

)

(90

)

Deferred revenue

(40

)

2

Other liabilities

32

14

Net cash provided by (used in) operating

activities

(530

)

(535

)

Cash Flows from Investing

Activities:

Purchases of property, equipment and

capitalized software

(116

)

(175

)

Other investing

(5

)

2

Net cash provided by (used in) investing

activities

(121

)

(173

)

Cash Flows from Financing

Activities:

Proceeds from issuance of debt

1,277

350

Proceeds from issuance of stock

34

—

Repayments of debt

(652

)

(4

)

Debt and equity issuance costs

(48

)

(17

)

Additions to members’ service

retainers

178

213

Refunds of members’ service retainers

(191

)

(169

)

Other financing

(4

)

35

Net cash provided by (used in) financing

activities

594

408

Effects of exchange rate changes on cash,

cash equivalents and restricted cash

(3

)

(3

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(60

)

(303

)

Cash, cash equivalents and restricted

cash—Beginning of period

299

935

Cash, cash equivalents and restricted

cash—End of period

$

239

$

632

June 30,

(Amounts in millions)

2023

2022

Cash and cash equivalents

$

205

$

625

Restricted cash - current

29

—

Cash and cash equivalents held for

sale

5

—

Restricted cash

—

7

Cash, cash equivalents and restricted

cash, including cash held for sale

$

239

$

632

A reconciliation of net loss, the most comparable GAAP measure,

to Adjusted EBITDA is set forth below:

Three Months Ended June

30,

Six Months Ended June

30,

(Amounts in millions)

2023

2022

2023

2022

Net loss(1)

$

(397

)

$

(635

)

$

(696

)

$

(1,139

)

Income tax (benefit) provision(1)

5

3

2

2

Interest and other (income) expenses,

net(1)

41

316

139

463

Depreciation and amortization(1)

156

158

304

329

Restructuring and other related (gains)

costs(1)

(107

)

(26

)

(165

)

(156

)

Impairment expense/(gain on sale)(1)

263

36

340

127

Stock-based compensation expense(2)

3

13

6

26

Other, net(3)

—

1

5

2

Adjusted EBITDA

$

(36

)

$

(134

)

$

(65

)

$

(346

)

(1)

As presented on our Condensed Consolidated Statements of

Operations.

(2)

Represents the non-cash expense of our equity compensation

arrangements for employees, directors, and consultants.

(3)

Other, net includes stock-based payments for services rendered

by consultants, change in fair value of contingent consideration

liabilities, legal, tax and regulatory reserves or settlements, net

of any insurance or other recoveries, and expense related to

mergers, acquisitions, divestitures and capital raising activities,

all as included in selling, general and administrative expenses on

the Consolidated Statements of Operations.

A reconciliation of net cash provided by (used in) operating

activities, the most comparable GAAP measure, to Free Cash Flow is

set forth below:

Six Months Ended June

30,

(Amounts in millions)

2023

2022

Net cash provided by (used in) operating

activities (1)

$

(530

)

$

(535

)

Less: Purchases of property, equipment and

capitalized software (1)

(116

)

(175

)

Free Cash Flow

$

(646

)

$

(710

)

(1)

As presented on our Condensed Consolidated

Statements of Cash Flows.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230808215543/en/

Investors Kevin Berry investor@wework.com

kevin.berry2@wework.com Media press@wework.com

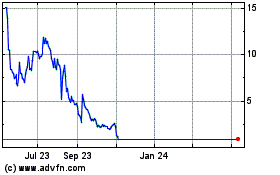

WeWorks (NYSE:WE)

Historical Stock Chart

From Dec 2024 to Jan 2025

WeWorks (NYSE:WE)

Historical Stock Chart

From Jan 2024 to Jan 2025