UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 8, 2015

|

Health Care REIT, Inc.

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Delaware

|

1-8923

|

34-1096634

|

|

(State or other jurisdiction

|

(Commission

|

(IRS Employer

|

|

of incorporation)

|

File Number)

|

Identification No.)

|

|

4500 Dorr Street, Toledo,

Ohio

|

43615

|

|

(Address of principal executive offices)

|

(Zip Code)

|

|

Registrant’s telephone

number, including area code: (419) 247-2800

|

|

Not Applicable

|

|

(Former name or former address, if changed since last report.)

|

| |

|

|

|

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing

obligation of the registrant under any of the following provisions (see General

Instruction A.2. below):

[ ] Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange

Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c))

Item 2.02 Results

of Operations and Financial Condition.

On May 8, 2015, Health Care REIT, Inc. (the “Company”)

issued a press release that announced operating results for its first quarter ended

March 31, 2015. The press release refers to a supplemental information package

that is available on the Company's website (www.hcreit.com), free of charge.

Copies of the press release and supplemental information package have been

furnished as Exhibits 99.1 and 99.2, respectively, to this Current Report, and

are incorporated herein by reference.

The information included in this Current Report shall

not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the “Exchange Act”), and shall not be incorporated by

reference into any filing of the Company under the Securities Act of 1933, as

amended, or the Exchange Act, regardless of any general incorporation language

in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

99.1

Press

release of Health Care REIT, Inc. dated May 8, 2015.

99.2

Health

Care REIT, Inc. Supplemental Information Package for the quarter ended March

31, 2015.

SIGNATURE

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly

caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

HEALTH CARE REIT, INC.

By: /s/ THOMAS J. DEROSA

Name: Thomas J. DeRosa

Title:

Chief Executive Officer

Dated: May 8, 2015

FOR IMMEDIATE RELEASE

May 8, 2015

For more information contact:

Scott Estes (419) 247-2800

HCN

Reports First Quarter

Normalized

FFO of $1.04 Per Diluted Share

Maintains

Normalized FFO and FAD Per Share Guidance of 3%-5% and 5%-7% Growth for 2015

Completes

$2.2 Billion of First Quarter Investments

Generates

Same Store NOI Growth of 3.1%

Toledo, Ohio, May 8, 2015…..Health

Care REIT, Inc. (NYSE:HCN) today announced operating results for the

company’s first quarter ended March 31,

2015.

“This quarter demonstrates the

unparalleled strength of our platform and operating model,” said Tom DeRosa,

CEO of HCN. “Despite an unprecedented winter in the Mid-Atlantic and New

England impacting operating expenses and a severe flu season affecting

occupancy rates across the seniors housing industry, we are able to maintain

our full-year earnings and total portfolio same store NOI growth

expectations. We completed $2.2 billion of high-quality investments,

received an upgrade from Fitch to BBB+, and continued to strengthen our balance

sheet through a successful $1.5 billion overnight equity offering, the largest

in HCN’s history. This performance demonstrates the consistency and

resiliency of our portfolio and is a testament to the benefits of our portfolio

diversification, state-of-the-art asset management capabilities, the quality

and locations of our real estate, and our best-in-class operating partners. HCN’s

business model remains uniquely positioned to drive consistent returns and

long-term value for our shareholders.”

Dividend Growth As

previously announced, the Board of Directors declared a cash dividend for the

quarter ended March 31, 2015 of $0.825 per share, as compared to $0.795 per

share for the same period in 2014, representing a 4% increase. On May 20,

2015, we will pay our 176th consecutive quarterly cash dividend.

The declaration and payment of quarterly dividends remains subject to review by

and approval of the Board of Directors.

Earnings Results For the quarter, we generated normalized FFO and FAD per share

of $1.04 and $0.92, respectively. First quarter results were impacted by the

February equity raise, decreasing our leverage to 37.3% net debt to

undepreciated book capitalization, completing $2.2 billion of high-quality

investments and total same store NOI growth of 3.1%. Same store NOI for

seniors housing operating was 3.0% for the quarter and was negatively impacted

by the unusually harsh winter and flu season.

Outlook for

2015 We are affirming our 2015 earnings

guidance and expect to report normalized FFO in a range of $4.25 to $4.35 per

diluted share, representing a 3%-5% increase, and normalized FAD in a range of

$3.83 to $3.93 per diluted share, representing a 5%-7% increase. Our guidance

includes the impact of the February equity raise and reduced leverage for

2015. Additionally, in preparing our guidance, we have updated the following

assumptions:

·

Same Store Cash NOI: We continue to expect blended same store cash NOI

growth of approximately 3.0%-3.5% in 2015.

·

Acquisitions: 2015 earnings guidance does not include any

acquisitions beyond what has been announced, including those completed in the

first quarter and investments associated with the Mainstreet partnership.

·

Development: We anticipate funding additional development of $230

million in 2015 relating to projects underway on March 31, 2015. We expect

development conversions of approximately $190 million in the remainder of 2015.

These investments are currently expected to generate initial yields of

approximately 8.3% upon conversion.

·

Dispositions: As announced on May 4, 2015, we expect to sell our

unconsolidated life science investment in the second half of 2015. Primarily

as a result of this, we are increasing our 2015 dispositions guidance to approximately

$1 billion of pro rata proceeds at an average yield on proceeds of 7% from the

previous $400 million of book value at an average yield of 10% on book value.

Net income

attributable to common stockholders guidance has been increased to a range of

$2.62 to $2.72 per diluted share from the previous range of $1.70 to $1.80 per

diluted share primarily due to the items noted above and estimated net

gains/losses/impairments offset by normalizing items.

1Q15

Earnings Release May

8, 2015

Our guidance does

not include any additional 2015 investments or dispositions beyond what we have

announced, nor any transaction costs, capital transactions, impairments,

unanticipated additions to the loan loss reserve or other additional normalizing

items. Please see the exhibits for a reconciliation of the outlook for net

income available to common stockholders to normalized FFO and FAD. We will

provide additional detail regarding our 2015 outlook and assumptions on the

first quarter 2015 conference call.

First Quarter Investment Activity We completed over $2.2 billion of pro rata gross investments for

the quarter including $1.6 billion in acquisitions/JVs, $101 million in

development funding and $484 million in loans. Approximately 81% of these

investments were done with existing relationships. The $1.6 billion

acquisitions/JVs have a blended yield of 6.4% and are consistent with our

strategic focus on high-quality properties. The $101 million in development

funding is expected to yield 7.8% upon completion and the $484 million of loans

were made at a blended rate of 8.4%. In addition to the new investment activity

during the quarter, we placed into service four development property expansions

totaling $36 million with a blended yield of 8.0%.

Notable Investments with Existing

Operating Partners

Benchmark Senior Living Benchmark is the largest seniors housing

operator in New England, and is one of our Top 10 operating partners. We

partnered with Benchmark on two separate acquisitions last quarter with a

total of ten private pay seniors housing properties with 771 units. The aggregate

purchase price based on a 100% ownership interest was $391 million, which

represents a projected year one cap rate in the high 5’s. Nine of the

properties are located in the Boston MSA and the tenth property is located in

Fairfield County, CT. The median housing value in the local markets is

nearly two times the national median. HCN owns 95% of the joint venture and

Benchmark owns the remaining 5% interest. Benchmark previously operated

all ten properties on behalf of institutional capital partners, and will manage

the properties going forward under an incentive-based management

contract. Our existing portfolio of 39 properties with Benchmark is

concentrated in the Boston MSA, so these properties add to our significant

presence in this desirable market. The investments are consistent with our

strategy of growing alongside our partners through the acquisition of

high quality private pay properties in densely populated, affluent

markets. Since closing our initial $845.5

million RIDEA investment in 2011, we've completed $501 million of follow-on pro

rata investments with Benchmark.

Revera We expanded our partnership

with Revera last quarter through the acquisition of 23 private pay seniors

housing properties in Canada. Revera is the second largest seniors housing

operator in Canada, and is one of our Top 10 operating partners. The

portfolio includes approximately 2,900 units, which are predominately

independent living. Revera previously owned a 100% interest in the properties.

The purchase price based on a 100% ownership interest was CAD$634 million,

which represents a projected year one cap rate in the mid 6’s. HCN owns 75% of

the joint venture. Revera owns the remaining 25% and will operate the

properties under an incentive-based management contract. The properties are

concentrated in Canada's largest metro markets, as two-thirds of the NOI in the

portfolio comes from properties in Toronto, Vancouver, and Ottawa. The

acquisition adds to our sizable existing footprint in these desirable metro

markets. Revera is required to fund the first CAD$23 million of capital

expenditures into the portfolio after closing. The investment is consistent

with our strategy of growing with our partners by acquiring high quality

private pay properties in densely populated, affluent markets. Since

closing our initial $1.0 billion RIDEA investment in 2013, we've completed $443

million of follow-on pro rata investments with Revera.

Belmont Village We partnered

with Belmont Village, one of our Top 10 operating partners, to acquire two

private pay seniors housing properties with 351 units. The purchase price based

on a 100% ownership interest was $200 million. We are precluded from

disclosing the cap rate on this investment due to a confidentiality agreement

with the seller, but we anticipate returns consistent with our other high-quality

seniors housing investments. The properties were built by Belmont Village in

2013 and 2014 and are located in affluent infill locations, including the

Turtle Creek submarket of Dallas, and the West Lake Hills submarket of Austin,

TX. The median housing value in the local markets is nearly two times

higher than the national median. HCN owns 95% of the joint venture.

Belmont Village owns the remaining 5% and will operate the properties

under an incentive-based management contract. The investment is consistent

with HCN’s strategy of growing alongside its best in class operating

partners through the acquisition of high quality private pay properties in

densely populated, affluent markets. Since closing our initial $176

million RIDEA investment in 2012, we've completed $897 million of follow-on pro

rata investments with Belmont Village.

Avery Healthcare We acquired a

total of ten seniors housing properties that will be leased to

Avery, a highly-regarded developer and operator of private pay seniors

housing properties in the U.K. and one of our Top 10 operating partners.

1Q15

Earnings Release May

8, 2015

The properties contain 863 units and are concentrated

in Birmingham, the U.K.'s third largest market. The average age of the

properties is less than 5 years. The £130 million investment was added to the

existing Avery master lease at an initial lease yield of 7.6%. Rent will

increase annually by 2.5% in the first two years and by 3.0% each year

thereafter. The acquired properties are projected to have 1.4x payment coverage

after management fee upon stabilization of the newly constructed properties

that are still in lease up. The master lease is guaranteed by the Avery

parent company. The investments are consistent with our strategy of

growing alongside our partners through the acquisition of modern, high quality

properties in major metropolitan areas. Since closing our initial $204

million sale/leaseback in 2013, we've completed $465 million of follow-on pro

rata investments with Avery.

Genesis Healthcare We provided

Genesis with a $360 million loan to help facilitate the merger between Genesis

and Skilled Healthcare Group. Genesis is an existing partner and one of our Top

10 operators. The loan is secured by a first mortgage against 67 skilled

nursing and seniors housing facilities and represents a loan-to-value of

approximately 75%. The properties are concentrated in California, Texas and

Kansas. The term is two years. The initial rate is 7.25% and increases by 50

basis points beginning 150 days after closing and by 100 basis points every 90

days thereafter. We also received a 1% commitment fee and a 1.5% funding fee.

The loan is cross-defaulted with the HCN/Genesis master lease and is guaranteed

by the Genesis parent company. Genesis expects to pay off the loan in tranches

with proceeds from new HUD loans over the course of 2015 and 2016. The HUD

refinance will further improve Genesis’ fixed charge coverage and ownership of

real estate will further strengthen its financial flexibility. The loan is

consistent with our approach of helping our operating partners achieve their

strategic objectives with investments that are mutually beneficial. Since

closing our initial $2.4 billion sale/leaseback in 2011, we've completed $677

million of follow-on pro rata investments with Genesis.

Merrill Gardens We acquired

a 26-unit seniors housing property in a joint venture with Merrill

Gardens. The property is located in the Seattle MSA and shares a campus

with a highly occupied property already owned by the joint venture. The

purchase price based on a 100% ownership interest was $8 million,

which represents a projected year one cap rate in the mid 7’s. We own 80% of

the joint venture and Merrill Gardens owns the remainder. Merrill Gardens

is a leading developer and operator of high quality seniors housing properties

primarily on the West Coast, and is a long time operating partner of HCN.

Merrill Gardens developed the expansion and will operate the campus under a

long-term management contract. The investment is consistent with our

strategy of growing alongside our operating partners through

the acquisition of modern properties in affluent, high barrier to entry

markets. Our relationship with Merrill Gardens began in 1999 and they

currently manage 11 seniors housing operating properties for the joint venture

with a pro rata investment amount of $369 million.

Continuum Healthcare We acquired a

newly constructed seniors housing property in Alberta, Canada in a

sale/leaseback transaction with Continuum, who developed the property. The

transaction was the 53rd and final property in the previously

disclosed HealthLease acquisition. The purchase price was CAD$19 million, which

represents an initial lease yield of 7.5%. Rent will increase by 2.25% each

year. Continuum now operates eight properties for HCN, all of which were

acquired through the HealthLease REIT acquisition. The eight leases are cross

defaulted and secured by a CAD$5 million security deposit and a parent company

guarantee. The investment is consistent with our strategy of acquiring modern,

high quality real estate.

Texas Health Resources We acquired an

outpatient medical building on a THR hospital campus in Flower Mound, TX for

$10 million, which represents a projected year one mid 6’s cap rate. The

property, which was built in 2014, is 100% leased. The property is anchored by

THR, one of the leading health systems in Dallas. We own 12 outpatient

medical properties with more than 800,000 square feet in the Dallas MSA

that are anchored by THR, an Aa3 rated health system. The investment is

consistent with our strategy of acquiring modern, heath system affiliated

outpatient medical properties that are located in attractive, growing markets.

Signature Senior Lifestyle We extended our relationship with

Signature Senior Lifestyle by providing a £65 million loan that was used by

Signature’s management team to help buy out a private equity owner for £79

million. Signature develops and operates premium seniors housing

communities in Greater London. The loan is guaranteed by Signature’s

parent company and is fully secured by Signature’s joint venture equity

interests in properties co-owned and managed by Signature. We have fixed price

purchase options on several of the properties, and Signature’s proceeds from

any such purchases will be used to repay the loan. Signature’s leasehold

interests, management fees, and development fees provide additional security

for the loan. The interest rate is 10% and the term

is eight years. We also received the exclusive right to own

Signature’s substantial pipeline of development projects in Greater London. Our

existing portfolio with Signature includes six properties: three properties are

leased to Signature under a master lease and three properties secure

construction loans from HCN for which we have fixed price purchase options upon

stabilization. Signature has four projects scheduled to commence

construction during

1Q15

Earnings Release May

8, 2015

2015, and more

than fifteen others in various stages of development. Since closing our initial $37 million sale/leaseback in

2012, we've completed $210 million of follow-on pro rata investments with

Signature.

Cascade Living Group We acquired a 192-unit seniors housing

community north of Seattle in an acquisition/leaseback transaction

with Cascade. The purchase price was $35 million, and the property was added to

the existing master lease with Cascade at an initial lease yield of 6.0%

with 4% annual escalators. The investment is consistent with our strategy

of growing with our partners in their core markets, as Cascade

operates eight private pay communities in the Pacific Northwest, all

of which are leased from HCN. Since closing our

initial $5 million sale/leaseback in 2006, we've completed $193 million of

follow-on pro rata investments with Cascade.

Trilogy/Mainstreet We extended our relationship with

Mainstreet through the acquisition of a 100-bed post-acute facility for $18

million. This is the third property that we’ve acquired pursuant to the

17-facility pipeline announced in August 2014. The property is leased to

Trilogy under a 10-year lease. The initial lease yield is 7.5% with 2.5%

annual escalators. The property was developed and owned by Mainstreet and

is a NextGen® building prototype. Construction was completed in early 2015. Our

relationship with Trilogy began fifteen years ago, and Trilogy currently leases

15 properties from HCN. The investment is consistent with our strategy of

partnering with high quality development and operating partners to own modern,

high quality real estate.

Notable Investments with New Operating

Partners

Aspen Healthcare We acquired

four private pay hospitals in Greater London for £226 million. The

hospitals were leased back to Aspen, a leading private pay hospital

operator in the U.K., under a 25-year master lease at an initial lease

yield of 6.32%. Rent escalates each year based upon RPI (Retail Prices Index),

with a ceiling of 4.5% per year, and a floor of 1.5% in year two,

2.25% in year three, and 2.5% each year thereafter. The Aspen parent company

guarantees the master lease. The hospitals focus on outpatient care and

elective day/short-stay surgeries. The properties have an average effective age

of four years, having undergone significant renovation and expansion to

accommodate market demand. Stabilized payment coverage is projected to be over

2.0x before management fee. The hospitals are located in densely populated,

wealthy areas of Greater London. The median housing value in the local markets

is over two times higher than the national median. The two facilities (a

hospital and a cancer center) in Wimbledon are located a few hundred

yards from the world famous All England Lawn Tennis and Croquet Club. The

hospitals benefit from strong demand from consumers who are willing to pay

privately for faster service, better accommodations, and better

outcomes. The investment provides a platform for creating connectivity

across the continuum of care given our extensive footprint of seniors housing

properties in Greater London. The investment extends our strategy of

owning private pay properties operated by best-in-class providers in high

barrier to entry markets in the U.K. Subsequent to our acquisition, and

consistent with our expectations, Aspen signed a definitive agreement to be

acquired by Tenet Healthcare (NYSE:THC) for approximately $215 million. Under

the terms of the agreement, Tenet will acquire Aspen, including the leasehold

interests. The transaction with Tenet is expected to close by the third quarter

of 2015. Tenet is a long-time relationship of ours as they are the anchor

tenant on 19 of our outpatient medical properties with more than 1 million

square feet in the U.S. A presentation describing the investment is available

on our website.

Oakmont Senior Living We acquired

two newly constructed private pay seniors housing properties with 145 units

built by Oakmont and opened in 2014. The purchase price was $80 million, which

represents a projected year one cap rate in the high 5’s. The properties are

located in the Sacramento and Riverside MSAs. The median housing value in

the local markets is more than two times higher than the national

median. Oakmont is a leading developer/operator of high end seniors

housing properties in California, and will operate the properties under an

incentive-based management contract. The investment is consistent with our

strategy of partnering with leading developers/operators to own high quality seniors

housing properties in affluent, high barrier to entry markets.

Notable Development Conversions

Kelsey-Seybold We completed a

51,000 square foot expansion of an HCN-owned outpatient medical building that

is sponsored by Kelsey-Seybold and located in Houston. Kelsey-Seybold is a

leading multi-specialty physician practice with more than 380 physicians and

was one of the country’s first accountable care organizations. The

investment amount was $17 million and the initial yield on the expansion is

7.5%. The entire 294,000 square foot building is 100% occupied. The building is

Kelsey-Seybold’s flagship location and acts as the hub in their hub-and-spoke

model. We own 11 outpatient medical properties with over 1 million square feet

that are anchored by Kelsey-Seybold. Since closing our initial $35 million

acquisition in 2012, we've completed $220 million of follow-on pro rata

investments with Kelsey-Seybold.

1Q15

Earnings Release May

8, 2015

Brandywine Senior Living We completed

construction of 28 new units, modernized a 14-unit wing, removed six units from

service and redesigned several amenity areas in a highly occupied seniors

housing facility leased to Brandywine in Rehoboth Beach, DE. The investment

amount was $8 million and the initial lease yield on the expansion is 8.0%. Since

closing our initial $599 million sale/leaseback in 2010, we've completed $287

million of follow-on pro rata investments with Brandywine.

StoryPoint Senior Living We completed a

44-unit memory care expansion to a highly occupied seniors housing facility

leased to StoryPoint Senior Living in Avon Lake, OH. The investment amount was

$6 million and the initial lease yield on the expansion is 9.0%. Since closing

our initial $87 million sale/leaseback in 2010, we've completed $58 million of

follow-on pro rata investments with StoryPoint.

New Perspective Senior Living We completed a

36-unit expansion to a highly occupied seniors housing facility leased to New

Perspective in Superior, WI. The investment amount was $6 million and the

initial lease yield on the expansion is 8.25%. Since closing our initial $17

million sale/leaseback in 2009, we've completed $83 million of follow-on pro

rata investments with New Perspective.

Notable Dispositions

We sold nine long-term care

facilities with 1,151 beds for $143 million and a yield on sale of 8.6%. We

realized a gain on sale of $52 million and an unlevered IRR of 12.4%

during our 12-year holding period. The facilities are located in Texas with a

concentration in Houston. In addition, we received $10.6 million in loan payoff

proceeds on an $8.5 million loan and a $2.1 million early payoff fee. The

disposition is consistent with our strategy of minimizing our investments in

Medicaid-oriented long-term care facilities.

We sold our 78.5% interest in

a 56,742 square foot outpatient medical building in Stafford, VA for $11

million and a yield on sale of 7.3%. We realized a gain on sale of $3

million and an unlevered IRR of 9.7% during our 6 year holding period. We

did not expect future growth with the sponsoring health system, making it a

non-core asset.

First Quarter Capital Activity At March 31, 2015, we had $202 million of cash and cash

equivalents and $2.1 billion of available borrowing capacity under our primary

unsecured credit facility. In February 2015, we completed a public offering of

19,550,000 common shares at a price of $75.50 per share for total gross

proceeds of approximately $1.5 billion. This was the largest overnight common stock

offering and the highest offering price in our history. In March 2015, Fitch

Ratings raised our credit rating to BBB+ with a stable outlook from BBB with a

stable outlook. This upgrade created immediate value for the company and its

shareholders through its positive impact on the pricing of our credit facility.

Conference Call Information We

have scheduled a conference call on Friday, May 8, 2015 at 10:00 a.m. Eastern Time

to discuss our first quarter 2015 results, industry trends, portfolio performance

and outlook for 2015. Telephone access will be available by dialing

888-346-2469 or 706-758-4923 (international). For those unable to listen to

the call live, a taped rebroadcast will be available beginning two hours after

completion of the call through May 22, 2015. To access the rebroadcast, dial

855-859-2056 or 404-537-3406 (international). The conference ID number is

29557802. To participate in the webcast, log on to www.hcreit.com 15 minutes before the call to download

the necessary software. Replays will be available for 90 days.

Supplemental Reporting

Measures We believe that net income attributable to common stockholders

(NICS), as defined by U.S. generally accepted accounting principles (U.S.

GAAP), is the most appropriate earnings measurement. However, we consider funds

from operations (FFO) and funds available for distribution (FAD) to be useful

supplemental measures of our operating performance. Historical cost accounting

for real estate assets in accordance with U.S. GAAP implicitly assumes that the

value of real estate assets diminishes predictably over time as evidenced by

the provision for depreciation. However, since real estate values have

historically risen or fallen with market conditions, many industry investors

and analysts have considered presentations of operating results for real estate

companies that use historical cost accounting to be insufficient. In response,

the National Association of Real Estate Investment Trusts (NAREIT) created FFO

as a supplemental measure of operating performance for REITs that excludes

historical cost depreciation from net income. FFO, as defined by NAREIT, means

net income attributable to common stockholders, computed in accordance with

U.S. GAAP, excluding gains (or losses) from sales of real estate and

impairments of depreciable assets, plus real estate depreciation and

amortization, and after adjustments for unconsolidated entities and

noncontrolling interests. Normalized FFO represents FFO adjusted for certain

items detailed in Exhibit 1. FAD represents FFO excluding net straight-line

rental adjustments, amortization related to above/below market leases and

amortization of non-cash interest expenses and less cash used to fund capital

expenditures,

1Q15

Earnings Release May

8, 2015

tenant improvements and lease

commissions. Normalized FAD represents FAD excluding prepaid/straight-line

rent cash receipts and adjusted for certain items detailed in Exhibit 1. We believe

that normalized FFO and normalized FAD are useful supplemental measures of

operating performance because investors and equity analysts may use these

measures to compare the operating performance of the company between periods or

as compared to other REITs or other companies on a consistent basis without

having to account for differences caused by unanticipated and/or incalculable

items. Our supplemental reporting measures and similarly entitled financial

measures are widely used by investors and equity analysts in the valuation,

comparison and investment recommendations of companies. Our management uses

these financial measures to facilitate internal and external comparisons to

historical operating results and in making operating decisions. Additionally,

they are utilized by the Board of Directors to evaluate management. The

supplemental reporting measures do not represent net income or cash flow

provided from operating activities as determined in accordance with U.S. GAAP

and should not be considered as alternative measures of profitability or

liquidity. Finally, the supplemental reporting measures, as defined by us, may

not be comparable to similarly entitled items reported by other real estate

investment trusts or other companies. Please see the exhibits for

reconciliations of supplemental reporting measures and the supplemental

information package for the quarter ended March 31, 2015, which is available on

the company’s website (www.hcreit.com), for information and reconciliations of

additional supplemental reporting measures.

About Health Care REIT, Inc. HCN,

an S&P 500 company with headquarters in Toledo, Ohio, is a real estate

investment trust that invests across the full spectrum of seniors housing and

health care real estate. We also provide an extensive array of property

management and development services. As of March 31, 2015, our broadly

diversified portfolio consisted of 1,384 properties in 46 states, the United

Kingdom, and Canada. More information is available on the company’s website at

www.hcreit.com.

Forward-Looking Statements

and Risk Factors This document contains “forward-looking statements” as defined

in the Private Securities Litigation Reform Act of 1995. When the company uses

words such as “may,” “will,” “intend,” “should,” “believe,” “expect,”

“anticipate,” “project,” “estimate” or similar expressions that do not relate

solely to historical matters, it is making forward-looking statements. In

particular, these forward-looking statements include, but are not limited to,

those relating to the company’s opportunities to acquire, develop or sell

properties; the company’s ability to close its anticipated acquisitions,

investments or dispositions on currently anticipated terms, or within currently

anticipated timeframes; the expected performance of the company’s

operators/tenants and properties; the company’s expected occupancy rates; the

company’s ability to declare and to make distributions to shareholders; the

company’s investment and financing opportunities and plans; the company’s

continued qualification as a real estate investment trust (“REIT”); the

company’s ability to access capital markets or other sources of funds; and the

company’s ability to meet its earnings guidance. Forward-looking statements are

not guarantees of future performance and involve risks and uncertainties that

may cause the company’s actual results to differ materially from the company’s

expectations discussed in the forward-looking statements. This may be a result

of various factors, including, but not limited to: the status of the economy;

the status of capital markets, including availability and cost of capital;

issues facing the health care industry, including compliance with, and changes

to, regulations and payment policies, responding to government investigations

and punitive settlements and operators’/tenants’ difficulty in cost-effectively

obtaining and maintaining adequate liability and other insurance; changes in

financing terms; competition within the health care, seniors housing and life

science industries; negative developments in the operating results or financial

condition of operators/tenants, including, but not limited to, their ability to

pay rent and repay loans; the company’s ability to transition or sell properties

with profitable results; the failure to make new investments or acquisitions as

and when anticipated; natural disasters and other acts of God affecting the

company’s properties; the company’s ability to re-lease space at similar rates

as vacancies occur; the company’s ability to timely reinvest sale proceeds at

similar rates to assets sold; operator/tenant or joint venture partner

bankruptcies or insolvencies; the cooperation of joint venture partners;

government regulations affecting Medicare and Medicaid reimbursement rates and

operational requirements; liability or contract claims by or against

operators/tenants; unanticipated difficulties and/or expenditures relating to

future investments or acquisitions; environmental laws affecting the company’s

properties; changes in rules or practices governing the company’s financial

reporting; the movement of U.S. and foreign currency exchange rates; the

company’s ability to maintain its qualification as a REIT; key management

personnel recruitment and retention; and other risks described in the company’s

reports filed from time to time with the Securities and Exchange Commission.

Finally, the company undertakes no obligation to update or revise publicly any

forward-looking statements, whether because of new information, future events

or otherwise, or to update the reasons why actual results could differ from

those projected in any forward-looking statements.

1Q15

Earnings Release May

8, 2015

HEALTH CARE REIT, INC.

Financial Exhibits

|

Consolidated Balance Sheets (unaudited)

|

|

|

(in thousands)

|

|

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

|

Assets

|

|

|

|

|

|

|

|

|

Real estate investments:

|

|

|

|

|

|

|

|

|

|

|

Land and land improvements

|

|

$

|

2,160,886

|

|

$

|

1,883,866

|

|

|

|

|

Buildings and improvements

|

|

|

23,192,154

|

|

|

20,769,414

|

|

|

|

|

Acquired lease intangibles

|

|

|

1,187,094

|

|

|

1,066,626

|

|

|

|

|

Real property held for sale, net of accumulated depreciation

|

|

|

234,829

|

|

|

18,502

|

|

|

|

|

Construction in progress

|

|

|

211,941

|

|

|

144,516

|

|

|

|

|

|

|

|

26,986,904

|

|

|

23,882,924

|

|

|

|

|

Less accumulated depreciation and intangible amortization

|

|

|

(3,186,424)

|

|

|

(2,617,026)

|

|

|

|

|

|

Net real property owned

|

|

|

23,800,480

|

|

|

21,265,898

|

|

|

|

|

Real estate loans receivable(1)

|

|

|

745,267

|

|

|

351,401

|

|

|

|

|

Net real estate investments

|

|

|

24,545,747

|

|

|

21,617,299

|

|

|

Other assets:

|

|

|

|

|

|

|

|

|

|

|

Investments in unconsolidated entities

|

|

|

715,468

|

|

|

668,171

|

|

|

|

|

Goodwill

|

|

|

68,321

|

|

|

68,321

|

|

|

|

|

Deferred loan expenses

|

|

|

63,378

|

|

|

68,842

|

|

|

|

|

Cash and cash equivalents

|

|

|

202,273

|

|

|

185,928

|

|

|

|

|

Restricted cash

|

|

|

85,177

|

|

|

67,797

|

|

|

|

|

Straight-line rent receivable

|

|

|

307,050

|

|

|

215,759

|

|

|

|

|

Receivables and other assets

|

|

|

641,981

|

|

|

318,925

|

|

|

|

|

|

|

|

2,083,648

|

|

|

1,593,743

|

|

|

Total assets

|

|

$

|

26,629,395

|

|

$

|

23,211,042

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and equity

|

|

|

|

|

|

|

|

|

Liabilities:

|

|

|

|

|

|

|

|

|

|

|

Borrowings under primary unsecured credit facility

|

|

$

|

410,000

|

|

$

|

562,000

|

|

|

|

|

Senior unsecured notes

|

|

|

7,518,196

|

|

|

7,377,789

|

|

|

|

|

Secured debt

|

|

|

3,010,971

|

|

|

2,917,314

|

|

|

|

|

Capital lease obligations

|

|

|

75,622

|

|

|

84,371

|

|

|

|

|

Accrued expenses and other liabilities

|

|

|

604,149

|

|

|

612,671

|

|

|

Total liabilities

|

|

|

11,618,938

|

|

|

11,554,145

|

|

|

Redeemable noncontrolling interests

|

|

|

92,508

|

|

|

34,171

|

|

|

Equity:

|

|

|

|

|

|

|

|

|

|

|

Preferred stock

|

|

|

1,006,250

|

|

|

1,006,250

|

|

|

|

|

Common stock

|

|

|

350,434

|

|

|

291,091

|

|

|

|

|

Capital in excess of par value

|

|

|

16,218,794

|

|

|

12,494,410

|

|

|

|

|

Treasury stock

|

|

|

(41,373)

|

|

|

(26,454)

|

|

|

|

|

Cumulative net income

|

|

|

3,049,173

|

|

|

2,396,244

|

|

|

|

|

Cumulative dividends

|

|

|

(5,924,844)

|

|

|

(4,848,008)

|

|

|

|

|

Accumulated other comprehensive income

|

|

|

(107,496)

|

|

|

(25,419)

|

|

|

|

|

Other equity

|

|

|

4,449

|

|

|

6,241

|

|

|

|

|

|

Total Health Care REIT, Inc. stockholders’ equity

|

|

|

14,555,387

|

|

|

11,294,355

|

|

|

|

|

Noncontrolling interests

|

|

|

362,562

|

|

|

328,371

|

|

|

Total equity

|

|

|

14,917,949

|

|

|

11,622,726

|

|

|

Total liabilities and equity

|

|

$

|

26,629,395

|

|

$

|

23,211,042

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes non-accrual loan balances of $21,000,000 and $0 at

March 31, 2015 and 2014, respectively.

|

1Q15

Earnings Release May

8, 2015

|

Consolidated

Statements of Income (unaudited)

|

|

(in thousands, except per share data)

|

|

|

|

|

|

|

Three Months Ended

|

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

|

2015

|

|

2014

|

|

Revenues:

|

|

|

|

|

|

|

|

|

|

Rental income

|

|

$

|

379,587

|

|

$

|

336,455

|

|

|

|

Resident fees and service

|

|

|

492,510

|

|

|

456,265

|

|

|

|

Interest income

|

|

|

16,994

|

|

|

8,594

|

|

|

|

Other income

|

|

|

5,086

|

|

|

493

|

|

Gross revenues

|

|

|

894,177

|

|

|

801,807

|

|

|

|

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

121,080

|

|

|

120,833

|

|

|

|

Property operating expenses

|

|

|

376,461

|

|

|

341,431

|

|

|

|

Depreciation and amortization

|

|

|

188,829

|

|

|

233,318

|

|

|

|

General and administrative expenses

|

|

|

35,138

|

|

|

32,865

|

|

|

|

Transaction costs

|

|

|

48,554

|

|

|

952

|

|

|

|

Loss (gain) on derivatives, net

|

|

|

(58,427)

|

|

|

-

|

|

|

|

Loss (gain) on extinguishment of debt, net

|

|

|

15,401

|

|

|

(148)

|

|

|

|

Impairment of assets

|

|

|

2,220

|

|

|

-

|

|

|

Total expenses

|

|

|

729,256

|

|

|

729,251

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from continuing operations before income taxes

|

|

|

|

|

|

|

|

|

and income from unconsolidated entities

|

|

|

164,921

|

|

|

72,556

|

|

Income tax (expense) benefit

|

|

|

304

|

|

|

(2,260)

|

|

Income (loss) from unconsolidated entities

|

|

|

(12,648)

|

|

|

(5,556)

|

|

Income (loss) from continuing operations

|

|

|

152,577

|

|

|

64,740

|

|

Discontinued operations, net

|

|

|

-

|

|

|

460

|

|

Gain (loss) on real estate dispositions, net

|

|

|

56,845

|

|

|

-

|

|

Net income (loss)

|

|

|

209,422

|

|

|

65,200

|

|

Less:

|

Preferred dividends

|

|

|

16,352

|

|

|

16,353

|

|

|

|

|

Net income (loss) attributable to noncontrolling interests

|

|

|

2,271

|

|

|

(1,175)

|

|

Net income (loss) attributable to common stockholders

|

|

$

|

190,799

|

|

$

|

50,022

|

|

|

|

|

|

|

|

|

|

|

|

|

Average number of common shares outstanding:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

336,754

|

|

|

289,606

|

|

|

|

Diluted

|

|

|

337,812

|

|

|

290,917

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to common stockholders per share:

|

|

|

|

|

|

|

|

|

|

Basic

|

|

$

|

0.57

|

|

$

|

0.17

|

|

|

|

Diluted

|

|

$

|

0.56

|

|

$

|

0.17

|

|

|

|

|

|

|

|

|

|

|

|

|

Common dividends per share

|

|

$

|

0.825

|

|

$

|

0.795

|

1Q15

Earnings Release May

8, 2015

|

|

Normalizing Items

|

|

|

|

|

Exhibit 1

|

|

|

|

(in thousands, except per share data)

|

Three Months Ended

|

|

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

|

|

Transaction costs

|

$

|

48,554 (1)

|

|

$

|

952

|

|

|

|

Loss (gain) on derivatives, net

|

|

(58,427)(2)

|

|

|

-

|

|

|

|

Loss (gain) on extinguishment of debt, net

|

|

15,401 (3)

|

|

|

(148)

|

|

|

|

Other expenses

|

|

695 (4)

|

|

|

-

|

|

|

|

Additional other income

|

|

(2,144)(5)

|

|

|

-

|

|

|

|

Normalizing items attributable to noncontrolling interests and

unconsolidated entities, net

|

|

1,334 (6)

|

|

|

105

|

|

|

|

Total

|

$

|

5,413

|

|

$

|

909

|

|

|

|

|

|

|

|

|

|

|

|

|

Average diluted common shares outstanding

|

|

337,812

|

|

|

290,917

|

|

|

|

Net amount per diluted share

|

$

|

0.02

|

|

$

|

-

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

|

(1) Primarily costs incurred with seniors housing transactions.

|

|

|

|

|

|

(2) Represents gain on derivative prior to Genesis Healthcare

option exercise.

|

|

|

|

|

|

(3) Primarily related to seniors housing secured debt extinguishments

and redemption of convertible senior unsecured notes.

|

|

|

|

|

|

(4) Due to accelerated vesting of stock-based compensation for a

retiring officer.

|

|

|

|

|

|

(5) Early termination fee on loan payoff.

|

|

|

|

|

|

(6) Primarily related to debt extinguishments and transaction

costs incurred with unconsolidated seniors housing investments.

|

|

|

Funds Available for Distribution Reconciliation

|

|

|

|

|

Exhibit 2

|

|

|

|

(in thousands, except per share data)

|

Three Months Ended

|

|

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

|

|

Net income (loss) attributable to common stockholders

|

$

|

190,799

|

|

$

|

50,022

|

|

|

|

Depreciation and amortization

|

|

188,829

|

|

|

233,318

|

|

|

|

Losses/impairments (gains) on properties, net

|

|

(54,625)

|

|

|

-

|

|

|

|

Noncontrolling interests(1)

|

|

(6,338)

|

|

|

(9,522)

|

|

|

|

Unconsolidated entities(2)

|

|

25,837

|

|

|

14,399

|

|

|

|

Gross straight-line rental income

|

|

(28,537)

|

|

|

(16,589)

|

|

|

|

Amortization related to above (below) market leases, net

|

|

113

|

|

|

85

|

|

|

|

Non-cash interest expense

|

|

119

|

|

|

330

|

|

|

|

Cap-ex, tenant improvements, lease commissions

|

|

(10,485)

|

|

|

(12,392)

|

|

|

|

Funds available for distribution

|

|

305,712

|

|

|

259,651

|

|

|

|

Normalizing items, net(3)

|

|

5,413

|

|

|

909

|

|

|

|

Funds available for distribution - normalized

|

$

|

311,125

|

|

$

|

260,560

|

|

|

|

|

|

|

|

|

|

|

|

|

Average diluted common shares outstanding

|

|

337,812

|

|

|

290,917

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share data:

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to common stockholders

|

$

|

0.56

|

|

$

|

0.17

|

|

|

|

|

Funds available for distribution

|

$

|

0.90

|

|

$

|

0.89

|

|

|

|

|

Funds available for distribution - normalized

|

$

|

0.92

|

|

$

|

0.90

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized FAD Payout Ratio:

|

|

|

|

|

|

|

|

|

|

Dividends per common share

|

$

|

0.825

|

|

$

|

0.795

|

|

|

|

|

FAD per diluted share - normalized

|

$

|

0.92

|

|

$

|

0.90

|

|

|

|

|

|

Normalized FAD payout ratio

|

|

90%

|

|

|

88%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

|

(1) Represents noncontrolling interests' share of net FAD

adjustments.

|

|

|

|

|

|

|

(2) Represents HCN's share of net FAD adjustments from

unconsolidated entities.

|

|

|

|

|

|

|

(3) See Exhibit 1.

|

|

1Q15

Earnings Release May

8, 2015

|

|

Funds From Operations Reconciliation

|

|

|

|

|

Exhibit 3

|

|

|

|

(in thousands, except per share data)

|

Three Months Ended

|

|

|

|

|

|

|

|

March 31,

|

|

|

|

|

|

|

|

2015

|

|

2014

|

|

|

|

Net income (loss) attributable to common stockholders

|

$

|

190,799

|

|

$

|

50,022

|

|

|

|

Depreciation and amortization

|

|

188,829

|

|

|

233,318

|

|

|

|

Losses/impairments (gains) on properties, net

|

|

(54,625)

|

|

|

0

|

|

|

|

Noncontrolling interests(1)

|

|

(7,249)

|

|

|

(10,520)

|

|

|

|

Unconsolidated entities(2)

|

|

26,496

|

|

|

15,983

|

|

|

|

Funds from operations - NAREIT

|

|

344,250

|

|

|

288,803

|

|

|

|

Normalizing items, net(3)

|

|

5,413

|

|

|

909

|

|

|

|

Funds from operations - normalized

|

$

|

349,663

|

|

$

|

289,712

|

|

|

|

|

|

|

|

|

|

|

|

|

Average diluted common shares outstanding

|

|

337,812

|

|

|

290,917

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share data:

|

|

|

|

|

|

|

|

|

|

Net income (loss) attributable to common stockholders

|

$

|

0.56

|

|

$

|

0.17

|

|

|

|

|

Funds from operations - NAREIT

|

$

|

1.02

|

|

$

|

0.99

|

|

|

|

|

Funds from operations - normalized

|

$

|

1.04

|

|

$

|

1.00

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Normalized FFO Payout Ratio:

|

|

|

|

|

|

|

|

|

|

Dividends per common share

|

$

|

0.825

|

|

$

|

0.795

|

|

|

|

|

FFO per diluted share - normalized

|

$

|

1.04

|

|

$

|

1.00

|

|

|

|

|

|

Normalized FFO payout ratio

|

|

79%

|

|

|

80%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

|

(1) Represents noncontrolling interests' share of net FFO

adjustments.

|

|

|

|

|

|

(2) Represents HCN's share of net FFO adjustments from

unconsolidated entities.

|

|

|

|

|

|

(3) See Exhibit 1.

|

|

|

Outlook Reconciliations: Year Ended December 31, 2015

|

|

|

|

|

|

|

|

Exhibit 4

|

|

|

|

(dollars per fully diluted share)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Prior Outlook

|

|

Current Outlook

|

|

|

|

|

|

|

|

Low

|

|

High

|

|

Low

|

|

High

|

|

|

|

FFO Reconciliation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to common stockholders

|

$

|

1.70

|

|

$

|

1.80

|

|

$

|

2.62

|

|

$

|

2.72

|

|

|

|

Losses/impairments (gains) on sales, net(1,2)

|

|

-

|

|

|

-

|

|

|

(0.78)

|

|

|

(0.78)

|

|

|

|

Depreciation and amortization(1)

|

|

2.55

|

|

|

2.55

|

|

|

2.39

|

|

|

2.39

|

|

|

|

Funds from operations - NAREIT

|

$

|

4.25

|

|

$

|

4.35

|

|

$

|

4.23

|

|

$

|

4.33

|

|

|

|

Normalizing items, net(3)

|

|

-

|

|

|

-

|

|

|

0.02

|

|

|

0.02

|

|

|

|

Funds from operations - normalized

|

$

|

4.25

|

|

$

|

4.35

|

|

$

|

4.25

|

|

$

|

4.35

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FAD Reconciliation:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income attributable to common stockholders

|

$

|

1.70

|

|

$

|

1.80

|

|

$

|

2.62

|

|

$

|

2.72

|

|

|

|

Losses/impairments (gains) on sales, net(1,2)

|

|

-

|

|

|

-

|

|

|

(0.78)

|

|

|

(0.78)

|

|

|

|

Depreciation and amortization(1)

|

|

2.55

|

|

|

2.55

|

|

|

2.39

|

|

|

2.39

|

|

|

|

FAD-only adjustments(1,4)

|

|

(0.42)

|

|

|

(0.42)

|

|

|

(0.42)

|

|

|

(0.42)

|

|

|

|

Funds available for distribution

|

$

|

3.83

|

|

$

|

3.93

|

|

$

|

3.81

|

|

$

|

3.91

|

|

|

|

Normalizing items, net(3)

|

|

-

|

|

|

-

|

|

|

0.02

|

|

|

0.02

|

|

|

|

Funds available for distribution - normalized

|

$

|

3.83

|

|

$

|

3.93

|

|

$

|

3.83

|

|

$

|

3.93

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes:

|

(1) Amounts presented net of noncontrolling interests' share and

HCN's share of unconsolidated entities.

|

|

|

|

|

|

|

(2) Includes estimated gains on expected dispositions.

|

|

|

|

|

|

|

(3) See Exhibit 1.

|

|

|

|

|

|

|

(4) Includes straight-line rent, above/below amortization,

non-cash interest and cap-ex, tenant improvements and lease commissions.

|

|

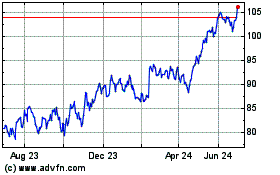

Welltower OP (NYSE:WELL)

Historical Stock Chart

From Jan 2025 to Feb 2025

Welltower OP (NYSE:WELL)

Historical Stock Chart

From Feb 2024 to Feb 2025