0000783325false00007833252023-10-312023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

October 31, 2023

____________________

| | | | | | | | | | | | | | |

Commission

File Number | | Registrant; State of Incorporation;

Address; and Telephone Number | | IRS Employer

Identification No. |

| | | | |

| 001-09057 | | WEC ENERGY GROUP, INC. | | 39-1391525 |

(A Wisconsin Corporation)

231 West Michigan Street

P.O. Box 1331

Milwaukee, WI 53201

(414) 221-2345

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $.01 Par Value | | WEC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On Tuesday, October 31, 2023, WEC Energy Group, Inc. issued a press release announcing its financial results for the quarter and nine months ended September 30, 2023. A copy of the press release is being furnished to the Securities and Exchange Commission as Exhibit 99.1 attached hereto and incorporated herein by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

| | | | | |

| SIGNATURES |

| |

| |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| |

| |

| |

| WEC ENERGY GROUP, INC. |

| (Registrant) |

| |

| /s/ WILLIAM J. GUC |

| October 31, 2023 | William J. Guc, Vice President and Controller |

From: Brendan Conway (news media)

414-221-4444

brendan.conway@wecenergygroup.com

Beth Straka (investment community)

414-221-4639

beth.straka@wecenergygroup.com

October 31, 2023

WEC Energy Group reports third-quarter results

MILWAUKEE – WEC Energy Group (NYSE: WEC) today reported net income of $316.0 million, or $1.00 per share, for the third quarter of 2023 – up from $302.0 million, or 96 cents per share, in last year's third quarter.

For the first nine months of 2023, the company recorded net income of $1.11 billion, or $3.52 per share – down from $1.16 billion, or $3.65 per share, in the corresponding period a year ago.

Consolidated revenues totaled $6.7 billion for the first nine months of 2023, down $363.5 million from revenues for the first nine months of 2022.

“We delivered another solid quarter, and we're on track for a strong 2023,” said Gale Klappa, executive chairman. “Our focus remains on the fundamentals of our business – reliability, customer satisfaction, environmental progress and financial discipline – creating value for our customers and stockholders.”

Retail deliveries of electricity – excluding the iron ore mine in Michigan’s Upper Peninsula – were down by 1.3 percent in the third quarter of 2023, compared to the third quarter last year.

Electricity consumption by small commercial and industrial customers was flat. Electricity use by large commercial and industrial customers – excluding the iron ore mine – declined by 4.1 percent.

Residential electricity use rose by 0.1 percent.

On a weather-normal basis, retail deliveries of electricity during the third quarter of this year – excluding the iron ore mine – decreased by 0.8 percent.

The company is reaffirming its 2023 annual earnings guidance of $4.58 to $4.62 per share, with an expectation of completing the year in the upper half of the range. This assumes normal weather for the remainder of the year.

Earnings per share listed in this news release are on a fully diluted basis.

Conference call

A conference call is scheduled for 1 p.m. Central time, Tuesday, Oct. 31. The call will review 2023 third-quarter earnings and the company’s outlook for the future.

All interested parties, including stockholders, news media and the general public, are invited to listen. Access the call at 888-330-2443 up to 15 minutes before it begins. The number for international callers is 240-789-2728. The conference ID is 3088105.

Conference call access also is available at wecenergygroup.com. Under 'Webcasts,' select 'Q3 Earnings.' In conjunction with this earnings announcement, WEC Energy Group will post on its website a package of detailed financial information on its third-quarter performance. The materials will be available at 6:30 a.m. Central time, Tuesday, Oct. 31.

Replay

A replay will be available on the website and by phone. Access to the webcast replay will be available on the website about two hours after the call. Access to a phone replay also will be available approximately two hours after the call and remain accessible through Nov. 14, 2023. Domestic callers should dial 800-770-2030. International callers should dial 647-362-9199. The replay conference ID is 3088105.

WEC Energy Group (NYSE: WEC), based in Milwaukee, is one of the nation’s premier energy companies, serving nearly 4.7 million customers in Wisconsin, Illinois, Michigan and Minnesota.

The company’s principal utilities are We Energies, Wisconsin Public Service, Peoples Gas, North Shore Gas, Michigan Gas Utilities, Minnesota Energy Resources and Upper Michigan Energy Resources. Another major subsidiary, We Power, designs, builds and owns electric generating plants. In addition, WEC Infrastructure LLC owns a growing fleet of renewable generation facilities in states ranging from South Dakota to Texas.

WEC Energy Group (wecenergygroup.com) is a Fortune 500 company and a component of the S&P 500. The company has approximately 36,000 stockholders of record, 7,000 employees and more than $43 billion of assets.

Forward-looking statements

Certain statements contained in this press release are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements are based upon management’s current expectations and are subject to risks and uncertainties that could cause our actual results to differ materially from those contemplated in the statements. Readers are cautioned not to place undue reliance on these statements. Forward-looking statements include, among other things, statements concerning management’s expectations and projections regarding earnings and future

results. In some cases, forward-looking statements may be identified by reference to a future period or periods or by the use of forward-looking terminology such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “guidance,” “intends,” “may,” “objectives,” “plans,” “possible,” “potential,” “projects,” “should,” “targets,” “will” or similar terms or variations of these terms.

Factors that could cause actual results to differ materially from those contemplated in any forward-looking statements include, but are not limited to: general economic conditions, including business and competitive conditions in the company’s service territories; timing, resolution and impact of rate cases and other regulatory decisions; the company’s ability to continue to successfully integrate the operations of its subsidiaries; availability of the company’s generating facilities and/or distribution systems; unanticipated changes in fuel and purchased power costs; key personnel changes; unusual, varying or severe weather conditions; continued industry restructuring and consolidation; continued advances in, and adoption of, new technologies that produce power or reduce power consumption; energy and environmental conservation efforts; electrification initiatives, mandates and other efforts to reduce the use of natural gas; the company’s ability to successfully acquire and/or dispose of assets and projects and to execute on its capital plan; terrorist, physical or cyber-security threats or attacks and data security breaches; construction risks; labor disruptions; equity and bond market fluctuations; changes in the company’s and its subsidiaries’ ability to access the capital markets; changes in tax legislation or our ability to use certain tax benefits and carryforwards; federal, state, and local legislative and regulatory changes, including changes in rate setting policies or procedures and to environmental standards, the enforcement of these laws and regulations or permit conditions, and changes in the interpretation of regulations by regulatory agencies; supply chain disruptions; inflation; political or geopolitical developments, including impacts on the global economy, supply chain and fuel prices, generally, from ongoing global conflicts; the impact from any health crises, including epidemics and pandemics; current and future litigation and regulatory investigations, proceedings or inquiries; changes in accounting standards; the financial performance of American Transmission Company as well as projects in which the company’s energy infrastructure business invests; the ability of the company to obtain additional generating capacity at competitive prices; goodwill and its possible impairment; and other factors described under the heading “Factors Affecting Results, Liquidity and Capital Resources” in Management’s Discussion and Analysis of Financial Condition and Results of Operations and under the headings “Cautionary Statement Regarding Forward-Looking Information” and “Risk Factors” contained in the company’s Form 10-K for the year ended December 31, 2022, and in subsequent reports filed with the Securities and Exchange Commission. Except as may be required by law, the company expressly disclaims any obligation to publicly update or revise any forward-looking information.

Tables follow

WEC ENERGY GROUP, INC.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED INCOME STATEMENTS (Unaudited) | | Three Months Ended | | Nine Months Ended | | |

| September 30 | | September 30 | | |

| (in millions, except per share amounts) | | 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Operating revenues | | $ | 1,957.4 | | | $ | 2,003.0 | | | $ | 6,675.5 | | | $ | 7,039.0 | | | | | |

| | | | | | | | | | | | |

| Operating expenses | | | | | | | | | | | | |

| Cost of sales | | 587.4 | | | 805.1 | | | 2,430.1 | | | 3,123.5 | | | | | |

| Other operation and maintenance | | 516.6 | | | 454.3 | | | 1,546.6 | | | 1,357.7 | | | | | |

| Depreciation and amortization | | 320.3 | | | 280.3 | | | 939.7 | | | 838.0 | | | | | |

| Property and revenue taxes | | 61.1 | | | 59.1 | | | 192.5 | | | 176.0 | | | | | |

| Total operating expenses | | 1,485.4 | | | 1,598.8 | | | 5,108.9 | | | 5,495.2 | | | | | |

| | | | | | | | | | | | |

| Operating income | | 472.0 | | | 404.2 | | | 1,566.6 | | | 1,543.8 | | | | | |

| | | | | | | | | | | | |

| Equity in earnings of transmission affiliates | | 44.7 | | | 63.7 | | | 132.1 | | | 148.4 | | | | | |

| Other income, net | | 41.8 | | | 34.7 | | | 130.9 | | | 94.1 | | | | | |

| Interest expense | | 182.5 | | | 127.5 | | | 533.4 | | | 364.9 | | | | | |

| Other expense | | (96.0) | | | (29.1) | | | (270.4) | | | (122.4) | | | | | |

| | | | | | | | | | | | |

| Income before income taxes | | 376.0 | | | 375.1 | | | 1,296.2 | | | 1,421.4 | | | | | |

| Income tax expense | | 60.4 | | | 73.4 | | | 183.0 | | | 263.9 | | | | | |

| Net income | | 315.6 | | | 301.7 | | | 1,113.2 | | | 1,157.5 | | | | | |

| | | | | | | | | | | | |

| Preferred stock dividends of subsidiary | | 0.3 | | | 0.3 | | | 0.9 | | | 0.9 | | | | | |

| Net loss (income) attributed to noncontrolling interests | | 0.7 | | | 0.6 | | | 0.9 | | | (1.2) | | | | | |

| Net income attributed to common shareholders | | $ | 316.0 | | | $ | 302.0 | | | $ | 1,113.2 | | | $ | 1,155.4 | | | | | |

| | | | | | | | | | | | |

| Earnings per share | | | | | | | | | | | | |

| Basic | | $ | 1.00 | | | $ | 0.96 | | | $ | 3.53 | | | $ | 3.66 | | | | | |

| Diluted | | $ | 1.00 | | | $ | 0.96 | | | $ | 3.52 | | | $ | 3.65 | | | | | |

| | | | | | | | | | | | |

| Weighted average common shares outstanding | | | | | | | | | | | | |

| Basic | | 315.4 | | 315.4 | | 315.4 | | 315.4 | | | | |

| Diluted | | 315.8 | | 316.2 | | 315.9 | | 316.2 | | | | |

| | | | | | | | | | | | |

| Dividends per share of common stock | | $ | 0.7800 | | | $ | 0.7275 | | | $ | 2.3400 | | | $ | 2.1825 | | | | | |

WEC ENERGY GROUP, INC.

| | | | | | | | | | | | | | |

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) (in millions, except share and per share amounts) | | September 30, 2023 | | December 31, 2022 |

| Assets | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 45.9 | | | $ | 28.9 | |

| Accounts receivable and unbilled revenues, net of reserves of $176.8 and $199.3, respectively | | 1,243.2 | | | 1,818.4 | |

| Materials, supplies, and inventories | | 749.9 | | | 807.1 | |

| | | | |

| Prepaid taxes | | 157.8 | | | 201.8 | |

| Other prepayments | | 40.6 | | | 69.8 | |

| Collateral on deposit | | 118.4 | | | 122.4 | |

| Other | | 87.8 | | | 139.3 | |

| Current assets | | 2,443.6 | | | 3,187.7 | |

| | | | |

| Long-term assets | | | | |

| Property, plant, and equipment, net of accumulated depreciation and amortization of $10,914.6 and $10,383.8, respectively | | 31,467.5 | | | 29,113.8 | |

| Regulatory assets (September 30, 2023 and December 31, 2022 include $87.5 and $92.4, respectively, related to WEPCo Environmental Trust Finance I, LLC) | | 3,197.1 | | | 3,264.6 | |

| Equity investment in transmission affiliates | | 1,983.8 | | | 1,909.2 | |

| Goodwill | | 3,052.8 | | | 3,052.8 | |

| Pension and OPEB assets | | 918.7 | | | 916.7 | |

| Other | | 378.2 | | | 427.3 | |

| Long-term assets | | 40,998.1 | | | 38,684.4 | |

| Total assets | | $ | 43,441.7 | | | $ | 41,872.1 | |

| | | | |

| Liabilities and Equity | | | | |

| Current liabilities | | | | |

| Short-term debt | | $ | 1,549.3 | | | $ | 1,647.1 | |

| Current portion of long-term debt (September 30, 2023 and December 31, 2022 include $9.0 and $8.9, respectively, related to WEPCo Environmental Trust Finance I, LLC) | | 712.9 | | | 881.2 | |

| Accounts payable | | 867.7 | | | 1,198.1 | |

| | | | |

| Other | | 943.8 | | | 884.6 | |

| Current liabilities | | 4,073.7 | | | 4,611.0 | |

| | | | |

| Long-term liabilities | | | | |

| Long-term debt (September 30, 2023 and December 31, 2022 include $89.8 and $94.1, respectively, related to WEPCo Environmental Trust Finance I, LLC) | | 15,956.5 | | | 14,766.2 | |

| Deferred income taxes | | 4,832.2 | | | 4,625.6 | |

| Deferred revenue, net | | 360.4 | | | 370.7 | |

| Regulatory liabilities | | 3,720.0 | | | 3,735.5 | |

| Intangible liabilities | | 608.2 | | | 335.4 | |

| Asset retirement obligations | | 505.5 | | | 479.3 | |

| Environmental remediation liabilities | | 456.6 | | | 499.6 | |

| Other | | 828.3 | | | 832.2 | |

| Long-term liabilities | | 27,267.7 | | | 25,644.5 | |

| | | | |

| Commitments and contingencies | | | | |

| | | | |

| Common shareholders' equity | | | | |

| Common stock – $0.01 par value; 325,000,000 shares authorized; 315,434,531 shares outstanding | | 3.2 | | | 3.2 | |

| Additional paid in capital | | 4,116.4 | | | 4,115.2 | |

| Retained earnings | | 7,640.4 | | | 7,265.3 | |

| Accumulated other comprehensive loss | | (7.0) | | | (6.8) | |

| Common shareholders' equity | | 11,753.0 | | | 11,376.9 | |

| | | | |

| Preferred stock of subsidiary | | 30.4 | | | 30.4 | |

| Noncontrolling interests | | 316.9 | | | 209.3 | |

| Total liabilities and equity | | $ | 43,441.7 | | | $ | 41,872.1 | |

WEC ENERGY GROUP, INC.

| | | | | | | | | | | | | | |

| CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) | | Nine Months Ended |

| | September 30 |

| (in millions) | | 2023 | | 2022 |

| Operating activities | | | | |

| Net income | | $ | 1,113.2 | | | $ | 1,157.5 | |

| Reconciliation to cash provided by operating activities | | | | |

| Depreciation and amortization | | 939.7 | | | 838.0 | |

| Deferred income taxes and ITCs, net | | 155.9 | | | 187.8 | |

| Contributions and payments related to pension and OPEB plans | | (13.0) | | | (11.6) | |

| Equity income in transmission affiliates, net of distributions | | (23.1) | | | (47.1) | |

| Change in – | | | | |

| Accounts receivable and unbilled revenues, net | | 600.7 | | | 150.9 | |

| Materials, supplies, and inventories | | 67.2 | | | (288.8) | |

| Prepaid taxes | | 43.6 | | | 57.8 | |

| Other current assets | | 64.7 | | | 45.4 | |

| Accounts payable | | (350.6) | | | 82.2 | |

| Other current liabilities | | 52.3 | | | 68.5 | |

| Other, net | | (112.2) | | | (181.1) | |

| Net cash provided by operating activities | | 2,538.4 | | | 2,059.5 | |

| | | | |

| Investing activities | | | | |

| Capital expenditures | | (1,729.5) | | | (1,700.7) | |

Acquisition of Whitewater Cogeneration Facility | | (76.0) | | | — | |

| Acquisition of Sapphire Sky Wind Energy LLC, net of cash acquired of $0.3 | | (442.6) | | | — | |

| Acquisition of Samson I Solar Energy Center LLC, net of cash acquired of $5.2 | | (249.4) | | | — | |

| Acquisition of Red Barn Wind Park | | (143.8) | | | — | |

| Acquisition of West Riverside Energy Center | | (95.3) | | | — | |

| Acquisition of Thunderhead Wind Energy LLC, net of cash acquired of $0.5 | | — | | | (362.9) | |

| Capital contributions to transmission affiliates | | (51.5) | | | (39.4) | |

| Proceeds from the sale of assets | | 30.4 | | | 69.0 | |

| Proceeds from the sale of investments held in rabbi trust | | 10.4 | | | 15.4 | |

| Payments for American Transmission Company LLC's construction costs that will be reimbursed | | (19.5) | | | (20.6) | |

| Insurance proceeds received for property damage | | 0.5 | | | 41.6 | |

| Other, net | | (5.4) | | | 11.7 | |

| Net cash used in investing activities | | (2,771.7) | | | (1,985.9) | |

| | | | |

| Financing activities | | | | |

| Exercise of stock options | | 3.0 | | | 33.1 | |

| Purchase of common stock | | (10.7) | | | (68.3) | |

| Dividends paid on common stock | | (738.1) | | | (688.5) | |

| Issuance of long-term debt | | 2,050.0 | | | 1,400.0 | |

| Retirement of long-term debt | | (996.0) | | | (64.9) | |

| Change in commercial paper | | (98.2) | | | (640.2) | |

| Payments for debt issuance costs | | (13.0) | | | (9.1) | |

| Other, net | | (4.5) | | | (7.2) | |

| Net cash provided by (used in) financing activities | | 192.5 | | | (45.1) | |

| | | | |

| Net change in cash, cash equivalents, and restricted cash | | (40.8) | | | 28.5 | |

| Cash, cash equivalents, and restricted cash at beginning of period | | 182.2 | | | 87.5 | |

| Cash, cash equivalents, and restricted cash at end of period | | $ | 141.4 | | | $ | 116.0 | |

v3.23.3

Cover Page

|

Oct. 31, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Oct. 31, 2023

|

| Entity File Number |

001-09057

|

| Entity Registrant Name |

WEC ENERGY GROUP, INC.

|

| Entity Tax Identification Number |

39-1391525

|

| Entity Incorporation, State or Country Code |

WI

|

| Entity Address, Address Line One |

231 West Michigan Street

|

| Entity Address, Address Line Two |

P.O. Box 1331

|

| Entity Address, City or Town |

Milwaukee

|

| Entity Address, State or Province |

WI

|

| Entity Address, Postal Zip Code |

53201

|

| City Area Code |

414

|

| Local Phone Number |

221-2345

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $.01 Par Value

|

| Trading Symbol |

WEC

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000783325

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

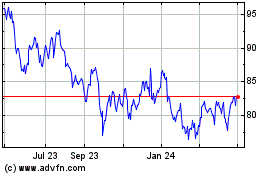

WEC Energy (NYSE:WEC)

Historical Stock Chart

From Jun 2024 to Jul 2024

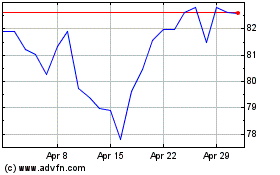

WEC Energy (NYSE:WEC)

Historical Stock Chart

From Jul 2023 to Jul 2024