| | | | | | | | | | | | | | |

PROPOSAL NO. 4 APPROVAL OF WAYFAIR INC. 2023 INCENTIVE AWARD PLAN |

Overview

We are asking our stockholders to approve the Wayfair Inc. 2023 Incentive Award Plan (the “2023 Plan”). The 2023 Plan was approved by the Board on March 2, 2023. A copy of the 2023 Plan is attached hereto as Annex A and is incorporated herein by reference subject to approval from our stockholders at the Annual Meeting. Subject to stockholder approval of this Proposal No. 4, the 2023 Plan will, among other things, allow the issuance of up to 15,000,000 shares of Class A common stock for compensation to our employees and directors. The 2023 Plan will replace our 2014 Incentive Award Plan, as amended (the “2014 Plan”). If the 2023 Plan is approved by our stockholders, the 2014 Plan will no longer be used for further awards. If the 2023 Plan is not approved by our stockholders, it will not become effective, the 2014 Plan will continue in effect, and we may continue to grant awards under the 2014 Plan, subject to its terms, conditions and limitations, using the shares available for issuance thereunder.

The Board adopted the 2014 Plan in 2014, and on October 13, 2022 the stockholders approved Amendment No. 1 to the 2014 Plan (the “Amendment”) to increase the number of shares of Class A common stock authorized for issuance under the 2014 Plan by 5,000,000 shares. In connection with the Amendment, we notified stockholders of our intent to reevaluate our compensation needs and projected share usage in the first half of 2023 to determine if at our 2023 Annual Meeting of Stockholders we would seek approval of a new equity incentive plan since the 2014 Plan is set to expire in 2024. In determining to approve the 2023 Plan, the Board considered the number of shares remaining under the 2014 Plan, the upcoming expiration of the 2014 Plan in 2024, and our need to continue to offer a competitive equity incentive program to current employees and new talent.

We believe approval of the 2023 Plan is necessary for us to continue to offer a competitive broad-based equity incentive program that enables us to recruit, motivate and retain talented and highly qualified employees and directors who are critical to our ability to successfully operate our business. If we were unable to continue to grant competitive equity awards, we may be required to offer additional cash-based incentives as a means of competing for talent. This could have a significant effect on our financial and operating results, and put us at a competitive disadvantage in the market for talent, and it could also reduce the alignment between the interests of our employees and those of our stockholders.

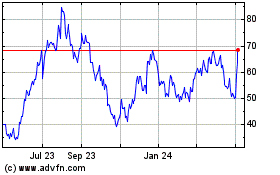

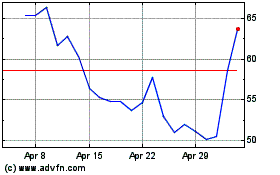

In designing the 2023 Plan, our Board and compensation committee worked with management to evaluate a number of factors, including our corporate strategy and compensation needs, our compensation philosophy of broad-based eligibility for equity incentive awards, our recent and projected share usage, share usage at peer companies and the total potential dilution of the proposed 2023 Plan. The Board and compensation committee believe that approving the 2023 Plan is appropriate and in the best interests of stockholders given the highly competitive environment in which we compete for talent, the recent volatility in the capital markets and its impact on our stock price, and our projected share usage.

Stockholder Approval

If this Proposal No. 4 is approved by our stockholders, the 2023 Plan will become effective as of the date of the Annual Meeting. In the event that our stockholders do not approve this Proposal No. 4, the 2023 Plan will not become effective.

Shares Available and Outstanding Awards

As of February 27, 2023, there were 4,581,685 shares of Class A common stock available for awards under the 2014 Plan. As of February 27, 2023, there were approximately 8,026,875 outstanding unvested full value awards with time-based vesting. Other than the foregoing, no awards were outstanding under our equity compensation plans as of February 27, 2023. The closing price of our Class A common stock as reported by the NYSE on February 27, 2023 was $39.18.

Benefits of the 2023 Plan

We believe that equity is a key element of our compensation package and that equity awards encourage employee loyalty and align employee interests directly with those of our stockholders. The 2023 Plan allows us to provide employees, consultants and directors with equity incentives that are competitive with the market.

The 2023 Plan reflects a broad range of compensation and governance best practices. These include:

•Stockholder approval is required for additional shares. The 2023 Plan does not contain an annual “evergreen” provision. The 2023 Plan authorizes a fixed number of shares, so that stockholder approval is required to issue any additional shares under the 2023 Plan.

• Limit on non-employee director compensation. The aggregate value of all cash and equity-based compensation paid or granted by the Company to any individual for service as a non-employee director with respect to any fiscal year will not exceed a total of $1,000,000, except the limit may be increased by $200,000 as the Board (excluding any director receiving such additional compensation) may deem necessary to compensate a non-employee director for service on a special purpose committee or for other special or extraordinary service. This limit may not be increased without the approval of our stockholders.

•Restrictions on Dividends and Dividend Equivalents. The 2023 Plan provides that no dividends or dividend equivalents may be paid with respect to any shares of our common stock subject to an award granted under the 2023 Plan before the date such award has vested.

•No Liberal Share Recycling on Options or Stock Appreciation Rights. The 2023 Plan provides that shares delivered or withheld by us in payment of the exercise price of an option and/or the tax withholding obligations relating to an award that is not a full-value award, shares subject to stock appreciation rights that are not issued on settlement of stock appreciation rights that are exercised, and shares purchased on the open market by us with the cash proceeds received from the exercise of options will not be added back to the number of shares remaining available for issuance under the 2023 Plan.

•“Claw back” of Awards for misconduct. As provided in the 2023 Plan and/or applicable award agreement, the administrator may cancel outstanding awards or, in some cases, “claw back” awards previously granted if an award recipient engages in an act of misconduct as described in the 2023 Plan, as well as where such “claw back” is required by applicable law.

•No “single-trigger” vesting. The 2023 Plan does not provide for any right to single-trigger vesting on a change in control.

•No reload awards. The 2023 Plan does not provide for “reload” grants of additional awards upon exercise of a stock option or stock appreciation right.

•No repricing. Without obtaining stockholder approval, we may not amend any stock option or stock appreciation right to reduce its exercise price, including by replacing such award with a stock option or stock appreciation right with a lower exercise price, or cancel any stock option or stock appreciation right in exchange for cash or another award when the exercise price of such stock option or stock appreciation right exceeds the fair market value of our common stock.

We Manage Our Equity Incentive Award Use Carefully

We believe that equity incentive awards are a vital part of our overall compensation program, and we grant awards to motivate and retain our employees. However, we recognize that this compensation philosophy dilutes existing stockholders, and, therefore, we must responsibly manage the growth of our equity compensation program. We are committed to monitoring our equity compensation share reserve carefully by granting the appropriate number of awards necessary to attract, retain and motivate our employees, directors and consultants, while focusing on maximizing stockholders’ value and balancing this against the current volatility in the markets.

The Size of Our Share Reserve Request Is Reasonable

If this Proposal No. 4 is approved by our stockholders, then subject to adjustment for certain changes in our capitalization, we will have 15,000,000 shares of Class A common stock available for grant under the 2023 Plan, plus the number of shares that are available for grant under the 2014 Plan when the 2023 Plan becomes effective, as well as certain shares subject to existing 2014 Plan awards (as described below), as such shares become available from time to time.

Summary of the 2023 Plan

The principal features of the 2023 Plan are summarized below. This summary is not a complete description of the 2023 Plan and is qualified in its entirety by reference to the 2023 Plan which is attached to this Proxy Statement as Annex A.

Administration. The 2023 Plan will be administered by the compensation committee. The compensation committee has full power to select, from among the individuals eligible for awards, the individuals to whom awards will be granted, to make any combination of awards to participants and to determine the specific terms and conditions of each award, subject to the provisions of the 2023 Plan. Subject to certain limitations and guidelines, as well as applicable laws, the Board or the compensation committee may delegate to a committee of one or more members of the Board or one or more officers of the company or to such other person or body as it deems appropriate the authority to grant or amend awards under the 2023 Plan or to take other administrative action for individuals who are not subject to Section 16 of the Exchange Act or such persons to whom authority to grant or amend awards has been delegated.

Plan Limits. The maximum number of shares of Class A common stock that may be issued under the 2023 Plan is the sum of: (i) 15,000,000 shares of Class A common stock, (ii) any shares of Class A common stock that are available for grant under the 2014 Plan as of the effective date of the 2023 Plan and (iii) any shares of Class A common stock which are subject to 2014 Plan awards and become available for issuance under the 2023 Plan after the effective date of the 2023 Plan. In this regard, if shares subject to an award under the 2023 Plan or the 2014 Plan are forfeited or expire or if an award under the 2023 Plan or the 2014 Plan is settled for cash or is converted to shares of an unrelated entity in connection with a corporate transaction, such shares may, to the extent of such forfeiture, expiration, cash settlement or conversion, be used again for new grants under the 2023 Plan. Additionally, any shares subject to a full value award granted under the 2023 Plan or the 2014 Plan that are retained by the Company to satisfy tax withholding obligations will be available for the grant of new awards under the 2023 Plan. However, any shares tendered or withheld to satisfy the exercise price or tax withholding obligation pursuant to an award other than a full value award, as well as shares subject to a stock appreciation right that are not issued in connection with the stock settlement of the SAR and any shares purchased on the open market with the cash proceeds from the exercise of options, may not be used for new grants. There are certain limits on the number of awards that may be granted under the 2023 Plan. For example, no more than 15,000,000 shares of Class A common stock may be granted in the form of incentive stock options.

Eligibility. All of our officers, employees, non-employee directors and consultants are eligible to participate in the 2023 Plan, subject to the discretion of the administrator. As of February 27, 2023, approximately 17,000 individuals were eligible to participate in the 2014 Plan, which includes six (6) executive officers, 16,987 employees who are not executive officers, seven (7) non-employee directors and zero (0) consultants.

Non-Employee Director Compensation Limit. The 2023 Plan provides that the aggregate grant date fair value of all awards payable in shares of Class A common stock and the maximum cash value of any other award granted under the 2023 Plan to any non-employee director as compensation for services as a non-employee director, together with cash compensation paid to such director in the form of Board and committee retainer, meeting or similar fees, during any calendar year may not exceed $1,000,000. This limit is increased by $200,000 as the Board may deem necessary to compensate a director for service on a special purpose committee or for other special or extraordinary service, as determined in the discretion of the Board excluding any director receiving such additional compensation.

Types of Awards. The 2023 Plan provides for the grant of the following types of awards:

•Stock Options. The 2023 Plan permits the granting of (1) options to purchase Class A common stock intended to qualify as incentive stock options under Section 422 of the Internal Revenue Code of 1986, as amended (the "Code"), and (2) options that do not so qualify. Options granted under the 2023 Plan

will be non-qualified options if they fail to qualify as incentive stock options or exceed the annual limit on incentive stock options. Incentive stock options may be granted only to employees of Wayfair and its subsidiaries. Non-qualified options may be granted to any persons eligible to receive incentive stock options and to non-employee directors and consultants. The exercise price of each option may not be less than 100% of the fair market value of the Class A common stock on the date of grant unless otherwise determined by the administrator. In the case of an incentive stock option that is granted to a greater than 10% owner, the exercise price of such incentive stock option shall be not less than 110% of the fair market value on the grant date. Fair market value for this purpose is determined by reference to the closing price of the shares of Class A common stock on the NYSE.

◦The term of each option is fixed by the administrator and generally may not exceed ten years from the date of grant (or five years from the date of grant in the case of an incentive stock option granted to a greater than 10% owner). The administrator will determine at what time or times each option may be exercised. Options may be made exercisable in installments and the exercisability of options may be accelerated by the administrator. In general, unless otherwise permitted by the administrator, no option granted under the 2023 Plan is transferable by the optionee other than by will or by the laws of descent and distribution or, subject to the consent of the administrator, pursuant to a domestic relations order, and options may be exercised during the optionee’s lifetime only by the optionee, unless the option has been disposed of pursuant to a domestic relations order.

◦Upon exercise of options, the option exercise price must be paid in full by the method or methods determined by the administrator, including: (i) cash, wire transfer of immediately available funds or check, (ii) shares of Class A common stock having a fair market value equal to the payment required and held for such period of time as may be established or required by the administrator, (iii) delivery of a written or electronic notice that the holder has placed a market sell order with a broker acceptable to Wayfair with respect to shares then issuable upon exercise or vesting of an award, and that the broker has been directed to pay a sufficient portion of the net proceeds of the sale to us in satisfaction of the aggregate payments required, (iv) any other form of legal consideration acceptable to the administrator in its discretion, or (v) any combination of the above permitted forms of payment.

◦To qualify as incentive stock options, options must meet additional federal tax requirements, including a $100,000 limit on the value of shares subject to incentive stock options that first become exercisable by a participant in any one calendar year.

•Restricted Stock Awards. The 2023 Plan permits the grant of restricted stock awards, subject to such conditions and restrictions as the administrator may determine. These conditions and restrictions may include the achievement of certain performance goals and/or continued employment or other service relationship with us through a specified restricted period. During the vesting period, restricted stock awards may be credited with dividends and other distributions paid or made with respect to shares of Class A common stock, but any dividends and distributions payable with respect to a restricted stock award shall be subject to the same restrictions as the underlying restricted stock award. For avoidance of doubt, dividends paid prior to vesting of shares of restricted stock shall be paid out to the participant only to the extent that the vesting conditions are subsequently satisfied and the shares of restricted stock vest.

•Restricted Stock Units. The 2023 Plan permits the grant of restricted stock units in such amounts and subject to such terms and conditions as determined by the administrator. These conditions and restrictions may include the achievement of certain performance goals and/or continued employment or other service relationship with us through a specified vesting period.

•Performance Awards. The 2023 Plan permits the grant of performance awards, including awards of performance stock units and other awards determined in the administrator’s discretion from time to time. The value of performance awards may be linked to the attainment of the performance goals or other specific criteria, whether or not objective, determined by the administrator, in each case on a specified date or dates or over any period or periods and in such amounts as may be determined by the administrator.

•Dividend Equivalents. The 2023 Plan permits the grant of dividend equivalent rights, either alone or in tandem with another award, which entitle the recipient to receive credits for dividends that would be

paid if the recipient had held specified shares of Class A common stock. Dividend equivalent rights may be converted to cash or additional shares of Class A common stock by such formula and at such time and subject to such restrictions and limitations as may be determined by the administrator; provided, however, that dividend equivalents with respect to an award that are based on dividends paid prior to the vesting of such award shall be paid out to the holder only to the extent that the vesting conditions are subsequently satisfied and the award vests, and in no event may any award provide for a holder’s receipt of any other dividends prior to the vesting of such award. No dividend equivalents may be payable with respect to options or stock appreciation rights.

•Stock Payments. The 2023 Plan permits the grant of stock payments. The number or value of shares of any stock payment shall be determined by the administrator and may be based upon one or more performance goals or any other specific criteria, including service to Wayfair or any of its subsidiaries. Shares of Class A common stock underlying a stock payment that is subject to a vesting schedule or other conditions or criteria set by the administrator shall not be issued until those conditions have been satisfied. Stock payments may, but are not required to, be made in lieu of base salary, bonus, fees or other cash compensation.

•Stock Appreciation Rights. The 2023 Plan permits the grant of stock appreciation rights, subject to such conditions and restrictions as the administrator may determine. Stock appreciation rights entitle the recipient to shares of Class A common stock, cash or a combination of both equal to the value of the appreciation in the stock price over the exercise price. Unless otherwise determined by the administrator, the exercise price of a stock appreciation right may not be less than the fair market value of the shares of Class A common stock on the date of grant. The term of a stock appreciation right generally may not exceed ten years.

•Substitute Awards. Substitute awards granted upon the assumption of, or in substitution for, outstanding equity awards previously granted by a company or other entity in connection with a corporate transaction may be granted on such terms as the administrator deems appropriate, notwithstanding limitations on awards in the 2023 Plan. Shares subject to substitute awards will not reduce the shares authorized for grant under the 2023 Plan and shares subject to such substitute awards may not be added to the 2023 Plan’s share reserve if such awards are forfeited or expire.

Change in Control Provisions. In the event of a dividend or other distribution, Change in Control (as defined in the 2023 Plan), reorganization, merger, amalgamation, consolidation, combination, repurchase, recapitalization, liquidation, dissolution, or sale, transfer, exchange or other disposition of all or substantially all of the assets of the Company, or sale or exchange of common stock or other securities of the Company, issuance of warrants or other rights to purchase common stock or other securities of the Company, or other similar corporate transaction, as determined by the administrator, each a Corporate Transaction, or any unusual or nonrecurring transactions or events affecting Wayfair or any of its subsidiaries, or the financial statements of Wayfair or any of its subsidiaries, or of changes in applicable law or accounting principles, the administrator, in its discretion, and on such terms and conditions as it deems appropriate, is authorized to take any one or more of the following actions whenever the administrator determines that such action is appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the 2023 Plan or with respect to any award under the 2023 Plan, to facilitate such transactions or events or to give effect to such changes in laws, regulations or principles: (i) provide for either (A) termination of any such award in exchange for an amount of cash, if any, equal to the amount that would have been attained upon the exercise of such award or realization of the holder’s rights or (B) the replacement of such award with other rights or property selected by the administrator, in its discretion, having an aggregate value not exceeding the amount that could have been attained upon the exercise of such award or the realization of the holder’s rights, had such award been currently exercisable or payable or fully vested; (ii) provide that such award be assumed by the successor or survivor corporation, or a parent or subsidiary thereof, or shall be substituted for by similar options, rights or awards covering the stock of the successor or survivor corporation, or a parent or subsidiary thereof, with appropriate adjustments as to the number and kind of shares and prices; (iii) make adjustments in the number and type of shares of stock (or other securities or property) subject to outstanding awards and/or in the terms and conditions of (including the grant or exercise price) outstanding awards and awards that may be granted in the future; (iv) provide that such award shall be exercisable or payable or fully vested with respect to all shares covered thereby; (v) to replace such award with other rights or property selected by the administrator; and/or (vi) provide that the award will terminate and cannot vest, be exercised or become payable after such event.

Equity Restructuring. In the event of a Corporate Transaction that affects the Class A common stock such that an adjustment is determined by the administrator to be appropriate in order to prevent dilution or enlargement of the benefits or potential benefits intended to be made available under the 2023 Plan or with respect to any award thereunder, the administrator may make equitable adjustments, if any, to reflect such change with respect to: (i) the aggregate number and kind of shares that may be issued under the 2023 Plan; (ii) the number and kind of shares (or other securities or property) subject to outstanding awards; (iii) the number and kind of shares (or other securities or property) for which automatic grants are subsequently to be made to new and continuing non-employee directors; (iv) the terms and conditions of any outstanding awards (including, without limitation, any applicable performance targets or criteria with respect thereto); and (v) the grant or exercise price per share for any outstanding awards under the 2023 Plan.

Tax Withholding. Participants in the 2023 Plan are responsible for the payment of any federal, state, local or foreign taxes that we are required by law to withhold upon the exercise of options or stock appreciation rights or vesting of other awards. The Company or any of its subsidiaries shall have the authority and right to deduct or withhold, or require the holder to remit to us, an amount sufficient to satisfy federal, state, local and foreign taxes required by law to be withheld with respect to any taxable event arising as a result of the 2023 Plan. The administrator, in its discretion, may withhold, or allow a holder to elect to have Wayfair withhold, shares otherwise issuable under an award, which, unless otherwise determined by the administrator, shall be limited to the number of shares with a fair market value on the date of withholding or repurchase no greater than the aggregate amount of such liabilities based on the maximum statutory withholding rates in such holder’s applicable jurisdictions for federal, state, local and foreign income tax and payroll tax purposes that are applicable to such supplemental taxable income (or such other rate as may be required to avoid adverse accounting consequences). Further, the administrator, in its sole discretion, may satisfy the foregoing requirement by any other manner of withholding set forth in the award agreement, including, without limitation, by entry into a broker-sell arrangement whereby a number of shares issued pursuant to an award is immediately sold and proceeds from such sale are remitted to the Company in an amount that would satisfy the withholding amount due.

Amendment, Suspension or Termination of the Plan. The Board or compensation committee may at any time wholly or partially amend or otherwise modify, suspend or terminate the 2023 Plan. However, no such action may impair any rights or obligation under any award without the holder’s consent unless the award otherwise expressly provides, or to the extent the forfeiture and claw-back provisions of the 2023 Plan apply to the holder, or to the extent the administrator determines amendments are necessary or appropriate for purposes of compliance with Section 409A of the Code. Certain amendments to the terms of the 2023 Plan, including the maximum number of shares that may be issued under the 2023 Plan, will require the approval of our stockholders.

Claw-Back Provisions. All awards are subject to the forfeiture and claw-back provisions in the 2023 Plan to the extent set forth in the 2023 Plan and/or in the applicable award agreement.

Effective Date of Plan. The 2023 Plan was approved by our Board on March 2, 2023, and will become effective if and when approved by our stockholders. The 2023 Plan will remain in effect until it is terminated by the Board or the compensation committee.

Fair Market Value of Shares. The fair market value of the shares of our common stock on any relevant date, as defined under the 2023 Plan, is generally the closing sales price for a share as quoted on the NYSE, as reported in The Wall Street Journal or such other source as the Administrator deems reliable. The fair market value of our Class A common shares as reported on the NYSE on February 27, 2023 was $39.18 per share.

New Plan Benefits. Because the 2023 Plan is discretionary, benefits to be received in the future by eligible individuals are not determinable. The 2023 Plan does not contain objective criteria for determining the compensation payable thereunder.

Tax Aspects Under the Code

The following is a summary of the principal U.S. federal income tax consequences of certain transactions under the 2023 Plan as of the date hereof. This discussion is intended for the information of shareholders considering how to vote at the Annual Meeting and not as tax guidance to participants in the 2023 Plan, as the tax consequences may vary with the types of awards made, the identity of the recipients, the method of payment or settlement of the award and other circumstances. It does not describe all U.S. federal tax consequences under the 2023 Plan, nor does it describe foreign, state or, local, or payroll tax consequences.

Incentive Stock Options. No taxable income is generally realized by the optionee upon the grant or exercise of an incentive stock option. However, the spread at exercise will be an “item of tax preference,” which may give rise to “alternative minimum tax” liability for the taxable year in which the exercise occurs. If shares of Class A common stock issued to an optionee pursuant to the exercise of an incentive stock option are sold or transferred after two years from the date of grant and after one year from the date of exercise, then (i) upon sale of such shares, any amount realized in excess of the exercise price (the amount paid for the shares) will be taxed to the optionee as a long-term capital gain, and any loss sustained will be a long-term capital loss, and (ii) we will not be entitled to any deduction for federal income tax purposes.

If shares of Class A common stock acquired upon the exercise of an incentive stock option are disposed of prior to the expiration of the two-year and one-year holding periods described above (a “disqualifying disposition”), generally (i) the optionee will realize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of the shares of Class A common stock at exercise (or, if less, the amount realized on a sale of such shares of Class A common stock) over the exercise price thereof, and (ii) we will generally be entitled to deduct such amount. Special rules will apply where all or a portion of the exercise price of the incentive stock option is paid by tendering shares of Class A common stock.

If an incentive stock option is exercised at a time when it no longer qualifies for the tax treatment described above, the option is treated as a nonqualified option. Generally, an incentive stock option will not be eligible for the tax treatment described above if it is exercised more than three months following termination of employment (or one year in the case of termination of employment by reason of disability). In the case of termination of employment by reason of death, the three-month rule does not apply.

Non-Qualified Options. No income is realized by the optionee at the time a non-qualified option is granted. Generally (i) at exercise, ordinary income is realized by the optionee in an amount equal to the difference between the exercise price and the fair market value of the shares of Class A common stock on the date of exercise, and we generally receive a tax deduction for the same amount, and (ii) at disposition, appreciation or depreciation after the date of exercise is treated as either short-term or long-term capital gain or loss depending on how long the shares of Class A common stock have been held. Special rules will apply where all or a portion of the exercise price of the non-qualified option is paid by tendering shares of Class A common stock. Upon exercise, the optionee will also be subject to Social Security taxes on the excess of the fair market value over the exercise price of the option.

Stock Appreciation Rights. No income will be realized by a participant upon grant or vesting of a stock appreciation right. Upon the exercise of a stock appreciation right, the participant will recognize ordinary compensation income in an amount equal to the fair market value of the number of shares (or the amount of cash) the participant receives in respect of the stock appreciation right. We will generally be able to deduct this amount.

Restricted Stock. A participant will not be subject to tax upon the grant of an award of restricted stock unless the participant otherwise elects to be taxed at the time of grant pursuant to Section 83(b) of the Code. On the date an award of restricted stock becomes transferable or is no longer subject to a substantial risk of forfeiture (i.e., the vesting date), the participant will have taxable compensation equal to the difference between the fair market value of the shares on that date and the amount the participant paid for such shares, if any, unless the participant made an election under Section 83(b) of the Code to be taxed at the time of grant. If the participant made an election under Section 83(b), the participant will have taxable compensation at the time of grant equal to the difference between the fair market value of the shares on the date of grant and the amount the participant paid for such shares, if any. If the election is made, the participant will not be allowed a deduction for amounts subsequently required to be returned to us. We will generally be able to deduct the amount of taxable compensation to the participant.

Restricted Stock Units. A participant will not be subject to tax upon the grant or vesting of a restricted stock unit award. Rather, upon the delivery of shares or cash pursuant to a restricted stock unit award, the participant will have taxable compensation equal to the fair market value of the number of shares (or the amount of cash) the participant receives with respect to the award. We will generally be able to deduct the amount of taxable compensation to the participant.

Dividend Equivalents. A participant does not realize taxable income at the time of the grant of dividend equivalents, and we are not entitled to a deduction at that time. When a dividend equivalent is paid, the participant recognizes ordinary income and we are generally entitled to a corresponding deduction.

Other Awards. We generally will be entitled to a tax deduction in connection with other awards under the 2023 Plan in an amount equal to the ordinary income realized by the participant at the time the participant recognizes such income. Depending on the form of the award, participants typically are subject to income tax and recognize such tax at the time that an award is exercised, vests or becomes non-forfeitable, unless the award provides for a further deferral.

Parachute Payments. To the extent that compensation provided under the 2023 Plan may be deemed to be contingent upon a change in control (including, e.g., the vesting of any portion of an award that is accelerated due to the occurrence of a change in control) a portion of such payments may be treated as “parachute payments” as defined in the Code. Any such parachute payments may be non-deductible to us, in whole or in part, under Section 280G of the Code, and may subject the recipient to a non-deductible 20% federal excise tax on all or a portion of such payment (in addition to other taxes ordinarily payable).

Limitation on Deductions. Under Section 162(m) of the Code, our deduction for awards under the 2023 Plan may be limited to the extent that any “covered employee” (as defined in Section 162(m) of the Code) receives compensation in excess of $1 million a year.

Section 409A. Certain types of awards under the 2023 Plan may constitute, or provide for, a deferral of compensation subject to Section 409A of the Code. Unless certain requirements set forth in Section 409A of the Code are complied with, holders of such awards may be taxed earlier than would otherwise be the case (e.g., at the time of vesting instead of the time of payment) and may be subject to an additional 20% penalty tax (and, potentially, certain interest penalties). To the extent applicable, the 2023 Plan and awards granted under the 2023 Plan are intended to be structured and interpreted in a manner intended to either comply with or be exempt from Section 409A of the Code and the Department of Treasury regulations and other interpretive guidance that may be issued under Section 409A of the Code. To the extent determined necessary or appropriate by the Administrator, the 2023 Plan and applicable award agreements may be amended to further comply with Section 409A of the Code or to exempt the applicable awards from Section 409A of the Code. We have no obligation to take any action to avoid the imposition of taxes, penalties or interest under Section 409A with respect to any award under the 2023 Plan and we make no representations or warranties as to the tax treatment of any award under the 2023 Plan under Section 409A or otherwise.

In order for Proposal No. 4 to be approved, holders of a majority of the votes properly cast at the Annual Meeting must vote “FOR” Proposal No. 4. Abstentions and broker non-votes are not votes cast and will not be counted either “FOR” or “AGAINST” the proposal. Therefore, abstentions and broker non-votes will have no effect on the proposal.

| | | | | | | | | | | | | | |

| BOARD RECOMMENDATION |

| ☑ | THE BOARD RECOMMENDS A VOTE FOR THIS PROPOSAL NO. 4. |

The following table sets forth our executive officers and their respective ages and positions with us as of the Record Date.

| | | | | | | | | | | | | | |

| Name | | Age | | Position(s) |

| Niraj Shah | | 48 | | | Co-Founder, Chief Executive Officer and President, Director (Co-Chairman) |

| Steven Conine | | 50 | | | Co-Founder, Director (Co-Chairman) |

| Kate Gulliver | | 41 | | | Chief Financial Officer and Chief Administrative Officer |

| Thomas Netzer | | 53 | | | Chief Operating Officer |

| Stephen Oblak | | 49 | | | Chief Commercial Officer |

| Fiona Tan | | 52 | | | Chief Technology Officer |

Each of our Co-Founders, Niraj Shah and Steven Conine, also serve on our Board and their biographical information can be found above under the heading “Proposal No. 1 - Election of Directors”. The biographical information for our other executive officers is set forth below.

| | | | | | | | | | | | | | |

| Kate Gulliver Chief Financial Officer and Chief Administrative Officer CFO Since: 2022 ‖ Age:41

Ms. Gulliver has served as Chief Financial Officer and Chief Administrative Officer since November 2022 and previously served as our Incoming Chief Financial Officer from May 2022 to November 2022. Prior to that, Ms. Gulliver served as Wayfair’s Chief People Officer, Head of Talent from May 2016 to May 2022 where she built up the Company’s talent organization. Prior to leading the talent function, Ms. Gulliver managed the company's Investor Relations team where she drove all communication and relationship development with outside investors. Previously, Ms. Gulliver worked as an investor for nearly five years at Bain Capital, the Boston-based private equity firm. She started her career in consulting at McKinsey & Company. Ms. Gulliver holds an M.B.A. from Harvard Business School, and a B.A. from Yale University. |

| |

| Thomas Netzer Chief Operating Officer COO Since: 2019 ‖ Age: 53

Mr. Netzer has served as our Chief Operating Officer since July 2019. Prior to that, Mr. Netzer served as our Vice President, COO - Europe from April 2018 to July 2019. Prior to joining Wayfair, Mr. Netzer worked at McKinsey & Company for more than 20 years in various positions, most recently as a Senior Partner, where he focused on the transportation and infrastructure industries and co-led McKinsey’s global logistics practice. Mr. Netzer received a B.A. and a Ph.D. from the University of Cologne. |

| |

| | | | | | | | | | | | | | |

| Stephen Oblak Chief Commercial Officer CCO Since: 2021 ‖ Age: 49

Mr. Oblak has served as our Chief Commercial Officer since March 2021 and previously served as our Chief Merchandising Officer from May 2017 to March 2021; our Senior Vice President, General Manager of Wayfair.com from March 2014 to May 2017; our Vice President, Category Management from July 2011 to March 2014; and as our Director, Category Management from October 2009 to July 2011. Prior to joining Wayfair, Mr. Oblak served as Vice President of River West Brands, a brand acquisition and enterprise development company focused on acquiring and re‑commercializing dormant consumer brands, from 2007 to 2009. He previously served as Senior Director of the Strategy Consulting Group of FutureBrand Worldwide from 2003 to 2007, as a consultant to Peppers & Rogers Group from 2002 to 2003 and as a Senior Manager of the International Financial Services practice of the Corporate Executive Board from 1995 to 1999. He received a B.A. from Hamilton College and an M.B.A. from Northwestern University’s Kellogg School of Management. |

| | | | |

| Fiona Tan Chief Technology Officer CTO Since: 2022 ‖ Age: 52

Ms. Tan has served as our Chief Technology Officer since March 2022 and previously served as our Global Head of Customer and Supplier Technology from September 2020 to March 2022. Prior to Wayfair, Ms. Tan served as Senior Vice President of U.S. Technology at Walmart where she was responsible for innovation and engineering execution spanning its site, mobile app and all associate and merchant-facing technology across its e-commerce and stores business in the U.S from April 2014 to August 2020. Prior to Walmart, Ms. Tan served in a number of leadership roles at Ariba from January 2012 to April 2014, where she led a global engineering organization responsible for the strategy, lifecycle, and delivery of the Ariba Commerce Network, as well as TIBCO Software. Ms. Tan received a B.S. from MIT and a master’s degree from Stanford University. |

| | | | | | | | | | | | | | |

| COMPENSATION DISCUSSION AND ANALYSIS |

Executive Summary

This Compensation Discussion and Analysis, or CD&A, provides an overview and analysis of the elements of our compensation program for our named executive officers, or NEOs, identified below, the material compensation decisions made under that program and reflected in the executive compensation tables that follow this CD&A and the material factors considered in making those decisions. As a company dedicated to a pay-for-performance culture, we aim to provide our NEOs with compensation that is significantly performance-based. Our executive compensation program is designed to align executive pay with measurable results intended to create value for stockholders, and utilize compensation as a tool to assist us in attracting and retaining the high-caliber executives that we believe are critical to our long-term success. We believe that the key to our success is the long-term stockholder value that is created by our employees. Our compensation philosophy is weighted towards providing equity awards, and we believe this helps to retain our executives and aligns their interests with those of our stockholders by allowing them to participate in the longer-term success of our company as reflected in stock price appreciation. For example, we provide many of our employees, including our NEOs, with an equity award upon hire, which we believe motivates the employee to think of themselves as an owner of the company.

Unless stated otherwise, amounts in this CD&A are presented in U.S. Dollars.

Compensation for our NEOs consists primarily of the elements, and their corresponding objectives, identified in the following table.

| | | | | | | | |

| Compensation Element | | Primary Objective |

| Base Salary | | To recognize performance of job responsibilities and to attract and retain individuals with superior talent. |

Annual Cash Bonus (1) | | To reward individual contributions to the achievement of the company’s performance objectives. |

| Equity Awards | | To emphasize our long-term performance objectives, encourage the maximization of stockholder value and retain key executives by providing an opportunity to participate in the ownership of our common stock. |

| Retirement Savings (401(k)) | | To provide an opportunity for tax-efficient savings and long-term financial security. |

(1) In the second quarter of 2022, we shifted our corporate approach to cash compensation to incorporate the annual cash bonus into regular base salaries, resulting in higher base salaries and the removal of annual cash bonuses for our NEOs.

The compensation committee has primary authority to determine and approve compensation decisions with respect to our NEOs; provided, however, that our Co-Founders make recommendations to the compensation committee regarding the compensation of the NEOs, excluding themselves. In alignment with the objectives set forth above, the compensation committee determines overall compensation and its allocation among the elements described above, in reliance upon the judgment and general industry knowledge of its members obtained through years of service with comparably-sized companies in our and similar industries.

Our Named Executive Officers

For the year ended December 31, 2022, our named executive officers or NEOs were:

| | | | | | | | |

| Name | | Title |

| Niraj Shah | | Co-Founder, Chief Executive Officer and President, Director (Co-Chairman) |

| Steven Conine | | Co-Founder, Director (Co-Chairman) |

| Kate Gulliver | (1) | Chief Financial Officer and Chief Administrative Officer |

| Michael Fleisher | (2) | Former Chief Financial Officer |

| Thomas Netzer | | Chief Operating Officer |

| Stephen Oblak | | Chief Commercial Officer |

| Fiona Tan | | Chief Technology Officer |

(1) Ms. Gulliver became our Chief Financial Officer and Chief Administrative Officer on November 1, 2022.

(2) Mr. Fleisher retired from his position as Chief Financial Officer as of November 1, 2022 and thereafter served as a non-executive employee until January 15, 2023 to support his transition.

Our compensation decisions for the NEOs in 2022 are discussed below in relation to each of the above-described elements of our compensation program. The discussion below is intended to be read in conjunction with the executive compensation tables and related disclosures that follow this CD&A.

Compensation Overview

Our overall compensation program is structured to attract, motivate and retain highly qualified executives by paying them competitively, consistent with our success and their contribution to that success. We believe compensation should be structured to ensure that a significant portion of an executive’s compensation opportunity will be related to factors that directly and indirectly influence stockholder value. Our pay practices are focused on providing our executives with a significant amount of their compensation in the form of upfront equity grants, which we believe attracts and retains the highest caliber employees and aligns our employees’ long-term interests with our stockholders’ interests. In addition, NEOs other than our Co-Founders have historically participated in our corporate bonus program, which provided for a moderate annual cash bonus based on personal performance. In the second quarter of 2022, however, we shifted the corporate bonus opportunity into NEO base salaries, resulting in higher base salaries and the removal of annual cash bonuses for our NEOs. Our Co-Founders do not receive cash bonuses and therefore their base salaries were not increased as a result of this change. NEO compensation may also include additional equity grants based on performance or promotions. Our NEOs, who are all employed on an at-will basis, also receive limited perquisites. We offer a qualified 401(k) retirement plan with employer matching, but do not offer nonqualified deferred compensation plans, supplemental executive retirement plan benefits or formal cash severance programs.

Determination of Compensation

The compensation committee has the primary authority to determine and approve compensation paid to our NEOs. The compensation committee is charged with, among other things, reviewing compensation policies and practices to ensure adherence to our compensation philosophies and that the total compensation paid to our NEOs is fair, reasonable and competitive, taking into account our position within our industry, including our comparative performance, and our NEOs’ level of expertise and experience in their respective positions. In furtherance of the considerations described above, the compensation committee is primarily responsible for determining NEO base salaries, assessing the performance of the Chief Executive Officer and other NEOs for each applicable performance period and approving the equity awards and any cash bonuses to be paid to our Chief Executive Officer and other NEOs for each year. To aid the compensation committee in making its determinations, the Co-Founders provide recommendations at least annually to the compensation committee regarding the compensation of all NEOs, excluding themselves. The performance of our NEOs is reviewed at least annually by the compensation committee, and the compensation committee approves each NEO’s compensation at least annually.

In determining compensation for our NEOs, the compensation committee considers each NEO’s particular position and responsibility and relies upon the judgment and industry experience of its members, including their knowledge of competitive compensation levels across companies and industries. We believe that compensation should be competitive with compensation for executive officers in similar positions and with similar responsibilities in

the market. Our compensation committee and management team reference national surveys and publicly available executive officer data from e-commerce, retail, and technology organizations as an input for compensation decisions. We did not use a compensation consultant in 2022 to assist us with our executive compensation program.

In 2020, we asked our stockholders, through an advisory vote, to approve the compensation of our NEOs. The 2020 advisory vote received the approval of 99.7% of the votes cast on the proposal. Although the results of the say-on-pay vote are advisory and not binding on the company, the Board or the compensation committee, we value the opinions of our stockholders and take the results of the say-on-pay vote into account when making decisions regarding the compensation of our NEOs. In 2022, our stockholders approved, on an advisory basis, a frequency of every three (3) years for casting advisory votes to approve executive compensation. Due to the vote of stockholders on the matter, as well as the long-term focus of our compensation philosophy, we adopted a three-year interval for the advisory vote on executive compensation. Accordingly, a stockholder advisory vote on executive compensation will occur at the Annual Meeting.

Elements of Our Executive Compensation Program

Base Salary

Base salary represents annual fixed compensation and is a standard element of compensation necessary to attract and retain talent. The compensation committee reviews base salaries of our NEOs in the first quarter of each year. Base salary is set at the compensation committee’s discretion after taking into account the recommendations of our Co-Founders regarding NEOs, excluding themselves, our company-wide target for base salary increases for all employees, the competitive landscape, inflation, changes in the scope of an executive officer’s job responsibilities, and other components of compensation and other relevant factors. In the second quarter of 2022, we shifted our corporate approach to cash compensation to incorporate the annual cash bonus into regular base salaries, thereby increasing the maximum NEO base salary to $250,000 while not increasing total cash compensation. The base salaries for our NEOs for 2022 were as follows:

| | | | | | | | |

| NEO | | Base Salary ($) |

| Niraj Shah | | 80,000 | |

| Steven Conine | | 80,000 | |

| Kate Gulliver | | 250,000 | |

| Michael Fleisher | | 250,000 | |

| Thomas Netzer | | 250,000 | |

| Stephen Oblak | | 250,000 | |

| Fiona Tan | | 250,000 | |

Annual Cash Bonuses

In the second quarter of 2022, we shifted our corporate approach to cash compensation to incorporate the annual cash bonus into base salaries, resulting in a higher maximum base salary and the removal of annual cash bonuses for our NEOs. Prior to this, all of our NEOs were eligible to participate in a discretionary annual cash bonus program which provided the opportunity to earn a cash bonus award that ranged from 0% to 25% of base salary. Under the program, the compensation committee determined prorated NEO bonuses based on the overall individual performance of the NEOs for the compensation period in 2022 prior to the termination of the corporate bonus program, and such prorated bonus amounts were paid in the third quarter of 2022. Each of Messrs. Fleisher, Netzer and Oblak and Mses. Gulliver and Tan received a prorated cash bonus award of 25% of their base salary for such prorated period. Messrs. Shah and Conine do not participate in the corporate bonus program.

Equity Awards

A large portion of our NEOs’ total compensation is stock-based compensation in furtherance of our focus on long-term performance, which we believe is tied to retention and increasing stockholder value. Our NEOs receive sizable equity awards at the time of hire and are eligible to receive additional awards at the time of a promotion or at other times at the discretion of our compensation committee. NEOs do not necessarily receive equity awards on an annual basis. Therefore, an NEO’s compensation, as reported in the Summary Compensation Table, may fluctuate materially from year to year depending on whether a grant was made in a particular year. To support our retention strategy and align the interests of our NEOs with those of our stockholders, we generally grant Restricted Stock Units, or RSUs, subject to vesting requirements and the NEO’s continued employment through each applicable vesting date. As our compensation philosophy has continued to evolve, our leadership team has grown and we have also experienced volatility in the market. As a result, we have also started to introduce RSUs with more unique, tailored vesting schedules to facilitate promotions, role changes and the evolution of our management team. NEO equity awards (including grant amounts and vesting schedules), whether for new hires or follow-on grants, are determined at the compensation committee’s discretion after taking into account other direct compensation elements, the recommendations of our Co-Founders regarding NEOs, excluding themselves, and the landscape in which we compete for executive talent.

In 2022, the compensation committee granted the following time-based RSU awards to our NEOs:

| | | | | | | | | | | |

| NEO | | | Shares of Class A Common Stock Subject to RSU Awards (#) (1) |

| Niraj Shah | | | — | |

| Steven Conine | | | — | |

| Kate Gulliver |

| | 32,360 | |

| Michael Fleisher | | | — | |

| Thomas Netzer |

| | 97,345 | |

| Stephen Oblak |

| | 134,139 | |

| Fiona Tan |

| | 77,647 | |

(1)See the “Grants of Plan-Based Awards in 2022” table below for more information related to each award.

Defined Contribution Plans

We maintain a defined contribution plan that is tax-qualified under Section 401(a) of the Internal Revenue Code of 1986, as amended, or the Code, which we refer to as the 401(k) Plan. The 401(k) Plan permits our eligible salaried employees to defer receipt of portions of their eligible salaries, subject to certain limitations imposed by the Code, by making contributions to the 401(k) Plan, including flexible compensation contributions, Roth contributions, catch-up contributions and after-tax contributions.

We provide matching contributions to the 401(k) Plan in an amount equal to 100% of each participant’s pre-tax contribution up to a maximum of 4% of the participant’s annual eligible cash compensation, subject to certain other limits. In 2022, we made a company contribution to the 401(k) Plan in an amount equal to approximately $43.3 million. Participants are 100% vested in all contributions, including company contributions. The 401(k) Plan is offered on a nondiscriminatory basis to all of our salaried employees, including NEOs.

The compensation committee believes that matching contributions assist us in attracting and retaining talented employees and executives. The 401(k) Plan provides an opportunity for participants to save money for retirement on a tax-deferred basis and to achieve financial security, thereby promoting retention.

Employment and Change in Control Arrangements

Employment Agreements

We have entered into employment letter agreements with certain of our NEOs, the material terms of which are described below.

Messrs. Shah and Conine: We entered into amended and restated employment letter agreements with Messrs. Shah and Conine on May 6, 2014, which entitle each of Messrs. Shah and Conine to receive an annual base salary, subject to periodic increases (but not decreases) at the discretion of the Board. The letter agreements also entitle them to participate in the employee benefit plans and programs that we offer to our other full-time

employees. Messrs. Shah’s and Conine’s employment letter agreements contain restrictive covenants which prohibit them from competing with us or soliciting our employees, consultants or suppliers for twenty-four (24) months following termination of employment. Pursuant to Messrs. Shah’s and Conine’s employment letter agreements, if we terminate their employment without cause (as defined in the employment letter agreements) or if they resign for good reason (as defined in the employment letter agreements) they will receive healthcare benefit continuation until the earlier of (i) the last day of the applicable COBRA period and (ii) twenty-four (24) months following termination.

Mr. Fleisher: We entered into an employment letter agreement with Mr. Fleisher on October 2, 2013, which was amended on May 5, 2014, and which entitled him to an initial annual base salary of $350,000, which he agreed to reduce to $200,000 commencing in January 2016. The employment letter agreement also provided Mr. Fleisher with an annual cash bonus opportunity between 0% and 20% of his annual salary, and the opportunity to participate in the employee benefit plans and programs that we offer to our other full-time employees. In 2015, we agreed to increase Mr. Fleisher’s annual bonus opportunity range to between 0% and 25% of his annual salary, commensurate with our other NEOs. As described elsewhere, in the second quarter of 2022, we shifted our corporate approach to cash compensation to incorporate the annual cash bonus into base salaries, resulting in a higher maximum base salary and the removal of annual cash bonuses for our NEOs. Mr. Fleisher is also subject to the company’s non-compete, non-solicitation, non-disclosure and invention agreement designed for all employees, which agreement generally provides that he will not disclose confidential information of the company nor solicit any employee, contractor, customer or supplier of the company for a period of 12 months following termination of his employment. Mr. Fleisher retired from his position as Chief Financial Officer as of November 1, 2022 and thereafter served as a non-executive employee until January 15, 2023 to support his transition.

We have not entered into employment agreements with Messrs. Netzer or Oblak, or Mses. Gulliver or Tan, however, each of Messrs. Netzer and Oblak and Mses. Gulliver and Tan is subject to the company’s non-compete, non-solicitation, non-disclosure and invention agreement designed for all employees, as described above.

Restricted Stock Unit Vesting

The award agreements governing the NEOs’ outstanding RSU awards provide that, in the event an NEO’s employment is terminated for any reason other than cause (excluding a resignation by the NEO or a termination as a result of the NEO’s death or disability) within twelve (12) months following a change in control (as each such term is defined in the applicable award agreement), 50% of the NEO’s unvested RSUs will vest; provided, however, for Mr. Fleisher only, 100% of his unvested RSUs will vest in the same double-trigger scenario. Mr. Fleisher’s service relationship with the Company terminated on January 15, 2023. As of January 15, 2023, the accelerated RSU vesting had not been triggered and following January 15, 2023, such provision is no longer in effect for Mr. Fleisher.

Other Elements of Compensation and Perquisites

We maintain broad-based benefits that are provided to all employees, including our NEOs. These benefits include a 401(k) retirement savings plan with matching contributions, a group health plan, group term life insurance and health and financial wellness programs. For more information about our 401(k) plan, see the discussion above under the heading “Defined Contribution Plans.” Currently, we do not view perquisites or other personal benefits as a significant component of our executive compensation program. However, we have provided certain perquisites to our NEOs in situations where we believe it is appropriate, principally to allow them to devote more time to our business and to promote their health and safety. The compensation committee reviews these perquisites to ensure they are consistent with our philosophy and appropriate in magnitude. Beginning in 2021, the compensation committee authorized a security program for Messrs. Shah and Conine to address safety concerns, including specific threats to their safety arising directly as a result of their positions with the company. We believe the costs of this overall security program are reasonable and appropriate and that the program benefits the company. Although we do not consider this program to be a perquisite for the benefit of the Co-Founders for the reasons described above, the costs related to personal security under this program are reported in the “All Other Compensation” column in the 2022 Summary Compensation Table below.

Summary Compensation Table

The following table sets forth information with respect to the compensation of our NEOs for fiscal years indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name and Principal Position | | Year | | Salary ($)(1) | | Bonus ($)(2) | | Stock Awards ($)(3) | | All Other Compensation ($)(4) | | Total

($) |

Niraj Shah, Co-Founder, Chief Executive Officer and President, Director (Co-Chairman) | | 2022 | | 80,000 | | | — | | | — | | | 671,221 | | | 751,221 | |

| 2021 | | 80,000 | | | — | | | — | | | 147,271 | | | 227,271 | |

| 2020 | | 80,000 | | | — | | | — | | | 3,274 | | | 83,274 | |

Steven Conine, Co-Founder, Director (Co-Chairman) | | 2022 | | 80,000 | | | — | | | — | | | 28,761 | | | 108,761 | |

| 2021 | | 80,000 | | | — | | | — | | | 73,363 | | | 153,363 | |

| 2020 | | 80,000 | | | — | | | — | | | 3,274 | | | 83,274 | |

Kate Gulliver, Chief Financial Officer and Chief Administrative Officer (5) | | 2022 | | 236,539 | | | 13,462 | | | 2,076,887 | | | 9,462 | | | 2,336,350 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Michael Fleisher, Former Chief Financial Officer (6) | | 2022 | | 236,539 | | | 13,462 | | | — | | | 9,462 | | | 259,463 | |

| 2021 | | 200,000 | | | 50,000 | | | — | | | 10,031 | | | 260,031 | |

| 2020 | | 200,000 | | | 50,000 | | | — | | | 10,185 | | | 260,185 | |

Thomas Netzer, Chief Operating Officer (7) | | 2022 | | 236,539 | | | 13,462 | | | 7,151,187 | | | — | | | 7,401,188 | |

| 2021 | | 200,000 | | | 50,000 | | | 6,584,845 | | | — | | | 6,834,845 | |

| 2020 | | 200,000 | | | 50,000 | | | 1,879,050 | | | — | | | 2,129,050 | |

Stephen Oblak, Chief Commercial Officer | | 2022 | | 236,539 | | | 13,462 | | | 10,960,533 | | | 6,385 | | | 11,216,919 | |

| 2021 | | 200,000 | | | 50,000 | | | 12,963,814 | | | 7,877 | | | 13,221,691 | |

| 2020 | | 200,000 | | | 50,000 | | | — | | | 8,031 | | | 258,031 | |

Fiona Tan, Chief Technology Officer (8) | | 2022 | | 236,539 | | | 13,462 | | | 5,251,708 | | | 9,462 | | | 5,511,171 | |

| 2021 | | 200,000 | | | 50,000 | | | — | | | 7,108 | | | 257,108 | |

(1)Salary amounts in 2022 reflect our cash compensation change in the second quarter of 2022 to incorporate the annual cash bonus into regular base salaries. For additional information, see “Elements of Our Executive Compensation Program” above.

(2)Represents the discretionary cash bonuses paid to our NEOs under our annual cash bonus program for such year. Bonus amounts in 2022 reflect prorated NEO bonuses based on the overall individual performance of the NEOs for the compensation period in 2022 prior to the termination of the corporate bonus program. For additional information, see “Elements of Our Executive Compensation Program” above.

(3)Represents the aggregate fair value on the grant date of RSUs granted to our NEOs calculated in accordance with Financial Accounting Standards Board, or FASB, Accounting Standards Codification, or ASC, Topic 718, related to service-based vesting. See Note 10 of the “Notes to Consolidated Financial Statements - Equity-Based Compensation” in our Annual Report on Form 10-K for the year ended December 31, 2022.

(4)For Messrs. Fleisher and Oblak and Mses. Gulliver and Tan, amounts reported for 2022 represent employer contributions under our 401(k) Plan. For Messrs. Shah and Conine, amounts reported in 2022 represent employer contributions under our 401(k) Plan and also include approximately $668,021 and $25,561, respectively, for costs related to personal security under the Co-Founders’ overall security program.

(5)Ms. Gulliver became our Chief Financial Officer and Chief Administrative Officer on November 1, 2022.

(6)Mr. Fleisher retired from his position as Chief Financial Officer as of November 1, 2022 and thereafter served as a non-executive employee until January 15, 2023.

(7)Amounts paid to Mr. Netzer that were denominated in Euros have been converted to U.S. dollars. For 2022, the average daily exchange rate was 1€ to $1.05.

(8)Ms. Tan became our Chief Technology Officer on March 1, 2022.

Grants of Plan-Based Awards in 2022

The following table sets forth information regarding the grant of plan-based awards made during 2022 to our NEOs under our 2014 Plan:

| | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Grant Date | | All Other

Stock Awards:

Number of

Shares of Stock or Units

(#) | | Grant Date Fair Value of Stock and Option Awards ($) (1) | |

| Niraj Shah | | — | | | — | | | — | | |

| Steven Conine | | — | | | — | | | — | | |

| Kate Gulliver | (2) | 4/18/2022 | | 14,814 | | | 1,511,028 | | |

(3) | 10/17/2022 | | 17,546 | | | 565,859 | | |

| Michael Fleisher | | — | | | — | | | — | | |

| Thomas Netzer | (4) | 4/18/2022 | | 57,517 | | | 5,866,734 | | |

(5) | 10/17/2022 | | 39,828 | | | 1,284,453 | | |

| Stephen Oblak | (6) | 4/18/2022 | | 95,119 | | | 9,702,138 | | |

(7) | 10/17/2022 | | 39,020 | | | 1,258,395 | | |

| Fiona Tan | (8) | 4/18/2022 | | 39,392 | | | 4,017,984 | | |

(9) | 10/17/2022 | | 38,255 | | | 1,233,724 | | |

(1)Represents the aggregate fair value on the grant date of RSUs granted to our NEOs calculated in accordance with FASB ASC Topic 718. See Note 10 of the “Notes to Consolidated Financial Statements - Equity-Based Compensation” in our Annual Report on Form 10-K for the year ended December 31, 2022 for a discussion of assumptions made in determining the value of our stock awards.

(2)Ms. Gulliver was granted RSUs which vest upon the satisfaction of a service condition and the service condition was partially satisfied on July 1, 2022 and October 1, 2022 with respect to a total of 3,622 shares. Varying amounts of additional shares will vest for every three (3) months of continuous service thereafter over a period of five (5) years.

(3)Ms. Gulliver was granted RSUs which vest upon the satisfaction of a service condition and the service condition was partially satisfied on November 1, 2022 and December 1, 2022 with respect to a total of 5,848 shares. Varying amounts of additional shares will vest for every month of continuous service thereafter over a period of six (6) months.

(4)Mr. Netzer was granted RSUs which vest upon the satisfaction of a service condition and the service condition was partially satisfied on July 1, 2022 and October 1, 2022 with respect to a total of 10,103 shares. Varying amounts of additional shares will vest for every three (3) months of continuous service thereafter over a period of five (5) years.

(5)Mr. Netzer was granted RSUs which vest upon the satisfaction of a service condition and the service condition was partially satisfied on November 1, 2022 and December 1, 2022 with respect to a total of 13,276 shares. Varying amounts of additional shares will vest for every month of continuous service thereafter over a period of six (6) months.

(6)Mr. Oblak was granted RSUs which vest upon the satisfaction of a service condition and the service condition was partially satisfied on July 1, 2022 and October 1, 2022 with respect to a total of 8,892 shares. Varying amounts of additional shares will vest for every three (3) months of continuous service thereafter over a period of five (5) years.

(7)Mr. Oblak was granted RSUs which vest upon the satisfaction of a service condition and the service condition was partially satisfied on November 1, 2022 and December 1, 2022 with respect to a total of 13,006 shares. Varying amounts of additional shares will vest for every month of continuous service thereafter over a period of six (6) months.

(8)Ms. Tan was granted RSUs which vest upon the satisfaction of a service condition and the service condition was partially satisfied on July 1, 2022 and October 1, 2022 with respect to a total of 7,644 shares. Varying amounts of additional shares will vest for every three (3) months of continuous service thereafter over a period of five (5) years

(9)Ms. Tan was granted RSUs which vest upon the satisfaction of a service condition and the service condition was partially satisfied on November 1, 2022 and December 1, 2022 with respect to a total of 12,751 shares. Varying amounts of additional shares will vest for every month of continuous service thereafter over a period of six (6) months.

Outstanding Equity Awards at December 31, 2022

The following table provides information regarding the outstanding equity awards held by our NEOs as of December 31, 2022:

| | | | | | | | | | | | | | | | | | | | |

| | | | | Stock Awards |

| Name | | Grant Date | | Number of Shares

or Units of Stock

that have not

Vested

(#) | | Market Value of Shares or Units of Stock that have not Vested ($) (1) |

| Niraj Shah | | — | | | — | | | |

| Steven Conine | | — | | | — | | | |

| Kate Gulliver | (2) | 11/5/2019 | | 5,520 | | | 181,553 | |

(3) | 11/12/2020 | | 3,350 | | | 110,182 | |

(4) | 11/11/2021 | | 8,508 | | | 279,828 | |

(5) | 4/18/2022 | | 11,192 | | | 368,105 | |

(6) | 10/17/2022 | | 11,698 | | | 384,747 | |

| Michael Fleisher | (7) | 3/12/2018 | | 13,750 | | | 452,238 | |

| Thomas Netzer | (8) | 5/16/2018 | | 12,000 | | | 394,680 | |

(9) | 2/11/2021 | | 17,645 | | | 580,344 | |

(10) | 4/18/2022 | | 47,414 | | | 1,559,446 | |

(11) | 10/17/2022 | | 26,552 | | | 873,295 | |

| Stephen Oblak | (12) | 3/12/2018 | | 3,000 | | | 98,670 | |

(13) | 2/11/2021 | | 26,645 | | | 876,354 | |

(14) | 4/18/2022 | | 50,000 | | | 1,644,500 | |

(15) | 4/18/2022 | | 36,227 | | | 1,191,506 | |

(16) | 10/17/2022 | | 26,014 | | | 855,600 | |

| Fiona Tan | (17) | 11/12/2020 | | 32,000 | | | 1,052,480 | |

(18) | 4/18/2022 | | 31,748 | | | 1,044,192 | |

(19) | 10/17/2022 | | 25,504 | | | 838,827 | |

(1)Amount shown is based on our closing stock price as reported on the NYSE on December 30, 2022, the last trading day of our Class A common stock in 2022, of $32.89.

(2)These RSUs were granted in multiple awards on November 5, 2019, which vest upon the satisfaction of a service condition and have no expiration date. With respect to the number of shares that have not vested, subject to continued service on each applicable vesting date, 2,998 shares will vest in substantially equal quarterly amounts commencing January 1, 2023, and 2,522 shares will vest in substantially equal quarterly amounts commencing January 1, 2024.

(3)These RSUs were granted in multiple awards on November 12, 2020, which vest upon the satisfaction of a service condition and have no expiration date. With respect to the number of shares that have not vested, subject to continued service on each applicable vesting date, 2,010 shares will vest in substantially equal quarterly amounts commencing January 1, 2023, and 1,340 shares will vest in substantially equal quarterly amounts commencing January 1, 2025.

(4)These RSUs were granted in multiple awards on November 11, 2021, which vest upon the satisfaction of a service condition and have no expiration date. With respect to the number of shares that have not vested, subject to continued service on each applicable vesting date, 2,842 shares will vest in substantially equal quarterly amounts commencing January 1, 2023, 3,376 shares will vest in substantially equal quarterly amounts commencing January 1, 2024, 723 shares will vest in substantially equal quarterly amounts commencing January 1, 2025, and 1,567 shares will vest in substantially equal quarterly amounts commencing on January 1, 2026.

(5)These RSUs were granted in multiple awards on April 18, 2022, which vest upon the satisfaction of a service condition and have no expiration date. With respect to the number of shares that have not vested, subject to continued service on each applicable vesting date, 3,622 shares will vest in two (2) substantially equal quarterly amounts commencing January 1, 2023, 3,481 shares will vest in substantially equal quarterly amounts commencing July 1, 2023, 2,346 shares will vest in substantially equal quarterly amounts commencing July 1, 2024, 868 shares will vest in substantially equal quarterly amounts commencing July 1, 2025, and 875 shares will vest in substantially equal quarterly amounts commencing July 1, 2026.

(6)These RSUs were granted on October 17, 2022, and vest upon the satisfaction of a service condition and have no expiration date. With respect to the number of shares that have not vested, subject to continued service on each applicable vesting date, 11,698 shares will vest in four (4) substantially equal monthly amounts commencing on January 1, 2023.

(7)These RSUs were granted on March 12, 2018, and vest upon the satisfaction of a service condition and have no expiration date. The service condition was satisfied and the remaining 13,750 unvested shares vested in full on January 15, 2023.

(8)These RSUs were granted on May 16, 2018, and vest upon the satisfaction of a service condition and have no expiration date. With respect to the number of shares that have not vested, subject to continued service on each applicable vesting date, 12,000 shares will vest in two (2) substantially equal quarterly amounts commencing on February 1, 2023.

(9)These RSUs were granted in multiple awards on February 11, 2021, which vest upon the satisfaction of a service condition and have no expiration date. With respect to the number of shares that have not vested, subject to continued service on each applicable vesting date, 17,645 shares will vest in ten (10) varying quarterly amounts commencing on September 15, 2023.

(10)These RSUs were granted in multiple awards on April 18, 2022, which vest upon the satisfaction of a service condition and have no expiration date. With respect to the number of shares that have not vested, subject to continued service on each applicable vesting date, 10,104 shares will vest in two (2) substantially equal quarterly amounts commencing January 1, 2023, 17,639 shares will vest in substantially equal quarterly amounts commencing July 1, 2023, 11,555 shares will vest in substantially equal quarterly amounts commencing July 1, 2024, 3,321 shares will vest in substantially equal quarterly amounts commencing July 1, 2025, and 4,795 shares will vest in substantially equal quarterly amounts commencing July 1, 2026.

(11)These RSUs were granted on October 17, 2022, which vest upon the satisfaction of a service condition and have no expiration date. With respect to the number of shares that have not vested, subject to continued service on each applicable vesting date, 26,552 shares will vest in four (4) substantially equal monthly amounts commencing on January 1, 2023.

(12)These RSUs were granted on March 12, 2018 and vest upon the satisfaction of a service condition and have no expiration date. The service condition was satisfied and the remaining 3,000 unvested shares vested in full on January 15, 2023.

(13)These RSUs were granted on February 11, 2021, which vest upon the satisfaction of a service condition and have no expiration date. With respect to the number of shares that have not vested, subject to continued service on each applicable vesting date, 26,645 shares will vest in twelve (12) varying quarterly amounts commencing on March 15, 2023.

(14)These RSUs vest upon the satisfaction of a service condition and have no expiration date. The service condition will be fully satisfied and the grant will vest in full on May 31, 2023.

(15)These RSUs were granted in multiple awards on April 18, 2022, which vest upon the satisfaction of a service condition and have no expiration date. With respect to the number of shares that have not vested, subject to continued service on each applicable vesting date, 8,892 shares will vest in two (2) substantially equal quarterly amounts commencing January 1, 2023, 15,197 shares will vest in substantially equal quarterly amounts commencing July 1, 2023, 7,141 shares will vest in substantially equal quarterly amounts commencing July 1, 2024, 202 shares will vest in substantially equal quarterly amounts commencing July 1, 2025, and 4,795 shares will vest in substantially equal quarterly amounts commencing July 1, 2026.