Agreement provides Ohio community banks a commercial and

industrial loan-acquisition and risk-management program

Voya Investment Management, the asset management business of

Voya Financial, Inc. (NYSE: VOYA), and OBL BankServices, Inc.

(OBLBS), a subsidiary of the Ohio Bankers League, announced today

they have entered into a commercial and industrial (C&I) loan

growth partnership program known as the Voya Senior Loan Bank

Advisory Program.

While community and small regional banks have historically

excelled at small business underwriting and relationship

management, Voya’s C&I program recognizes the syndicated loan

market demands a broader industry knowledge and timely action.

Participating commercial banks benefit from Voya’s unique market

leadership, experience, relationships, credit risk management,

training and sourcing capabilities while effectively keeping

independent research and decision-making within their walls, thus

satisfying regulatory requirements.

“Our goal is to provide banks with a turnkey solution--combining

education, preparation and implementation to enable them to enter

the $1.4 trillion senior loan market,” said Randy Cameron, co-head

of the Voya Bank Advisory Group. “This asset class benefits banks

looking for a combination of loan diversification, asset growth,

interest and fee income, and floating rate assets.”

Under the Voya program, community and regional bank commercial

credit professionals build portfolios of senior secured commercial

and industrial loans. Banks may work individually to build

portfolios, one loan at a time, or cooperatively to share in a

portfolio of select loans These portfolios benefit from Voya’s

access to the new loan and secondary markets as well as strong and

ongoing loan underwriting and monitoring processes, which are

compliant with regulatory guidelines and prudent standards. Through

education and mentoring, banks learn about the implementation and

monitoring of compliant portfolios that offer diversification,

value recognition and loss avoidance as their core objectives.

“We’re excited about this newly founded endorsed business

partnership with Voya Investment Management as it is going to

provide our member banks access to unparalleled resources,

empowering them to navigate today’s complex financial landscape

with confidence and drive sustainable growth,” said Michelle Crume,

executive director of OBL BankServices. “Together we will be

bringing two new solutions to our Bank Members that will expand

their commercial and industrial loan offerings at a time when this

may be a much-needed resource.”

“The goal of OBL BankServices is to provide member banks with a

turnkey solution that combines education, preparation and

implementation to enable them to enter the $1.4 trillion senior

loan market,” said Crume. “This asset class benefits banks looking

for a combination of loan diversification, asset growth, interest

and fee income, and floating rate assets.”

OBL Bank Services, Inc. (“OBLBS”) has entered into a

Solicitation Agreement (the “Agreement”) with Voya Investment

Management Co. LLC (“Voya”) under which OBLBS solicits clients for

the Voya Senior Loan Advisory Program and/or the Voya Senior Loan

Shared Portfolio Program (each, a Program, and together, the

“Programs”).

As part of OBLBS’ services under the Agreement, OBLBS and its

personnel may make favorable statements regarding Voya and its

products and services, including a Program. Such statements

constitute “endorsements” for purposes of Rule 206(4)-1 under the

Investment Advisers Act of 1940.

Under the Agreement, in exchange for its services (including

making such endorsements), OBLBS will receive cash compensation

from Voya, consisting of up to 5.0 basis points (.05%) computed

based on the Target Portfolio Commitments to the Programs that are

agreed upon by clients solicited by OBLBS. In addition, Voya has

agreed to pay and maintain Affiliate Members status with OBLBS and

support OBLBS through various event sponsorships. Other than the

incentive such compensation gives OBLBS to endorse Voya, there are

no material conflicts of interest resulting from OBLBS’

relationship with Voya.

No costs or charges will be incurred by any client by reason of

having been referred to Voya by OBLBS However, the presence of

these arrangements may affect Voya’s willingness to negotiate below

its standard advisory fee, and therefore may affect the overall

fees paid by referred clients.

OBLBS is not a Voya client and OBLBS and Voya are not

affiliated. Also, OBLBS is not authorized to provide investment or

other advice on behalf of Voya or to act for or bind Voya. No asset

advisory agreement with Voya will become effective until accepted

by Voya.

About OBL Bank Services, Inc.

OBL BankServices, Inc. (OBLBS) is the for-profit division of

Ohio Bankers League (OBL) Each preferred vendor is carefully

researched and approved by the OBLBS Board of Directors — selected

by bankers for bankers — to ensure quality, consistent product and

service delivery. OBLBS offers a full line of products and services

to meet your bank’s needs. Visit ohiobankersleague.com to learn

more.

About Ohio Bankers League

Ohio Bankers League is the trade association for the Ohio

banking industry — and is Ohio’s only organization focused on

meeting the needs of all banks and thrifts in the Buckeye State.

For more than 125 years, the OBL has been the voice of the Ohio

banking industry fostering a cooperation that has made it one of

the strongest and most reputable financial trade associations in

the country. By linking banks, bankers, and industry experts — and

by pooling their intellectual and capital resources — the OBL

serves as a powerful creator of knowledge and collective resources.

The non-profit association is comprised of 174 FDIC-insured

financial institutions including commercial banks, savings banks,

and savings and loan associations ranging in size from just over

$13 million in assets to more than $1.5 trillion.

About Voya Investment Management

Voya Investment Management (IM) manages approximately $331

billion as of March 31, 2024, in assets across public and private

fixed income, equities, multi-asset solutions and alternative

strategies for institutions, financial intermediaries and

individual investors, drawing on a 50-year legacy of active

investing and the expertise of 300+ investment professionals. Voya

IM has cultivated a culture grounded in a commitment to

understanding and anticipating clients’ needs, producing strong

investment performance, and embedding diversity, equity and

inclusion in its business.

VOYA-IM

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725225708/en/

Media: Voya Financial Kristopher Kagel (212) 309-6568

Kristopher.Kagel@voya.com

Ohio Bankers League Audra Johnson Director of Communications

(614) 340-7621 ajohnson@ohiobankersleague.com

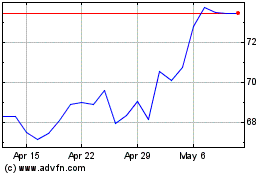

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Dec 2024 to Jan 2025

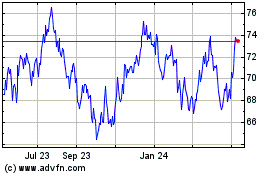

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Jan 2024 to Jan 2025