Voya Financial recognizes 10 years of innovation in retirement income support

July 11 2024 - 9:00AM

Business Wire

myOrangeMoney® retirement calculator reaches milestone market

anniversary in providing users a solution to help save more for

retirement

It’s been 10 years since Voya Financial, Inc. (NYSE: VOYA)

launched its innovative myOrangeMoney® retirement calculator, an

online experience designed to educate and help individuals by

translating their accumulated retirement savings into estimated

monthly retirement income. Today, the company is recognizing the

milestone anniversary as the retirement-income savings needs of

individuals continue to grow. According to new Voya research, a

majority (90%) of Americans believe having a guaranteed source of

income in retirement — so they don’t outlive their retirement

savings — to be extremely important or important.1

“Over the past decade, the retirement plan industry has

introduced new ways for individuals to accumulate assets and become

more comfortable managing their long-term retirement savings. But

as individuals get closer to retirement, the need to transition

their assets into income remains paramount,” said Amy Vaillancourt,

senior vice president, Workplace Product Development and

Architecture at Voya Financial. “The demand for retirement income

solutions has been building for some time, and myOrangeMoney has

played a critical role in helping employees shift their mindset

around how they think about and prepare for retirement.”

Since its launch, myOrangeMoney has transformed how Voya’s

customers manage, engage and interact with their retirement

accounts through a combination of education and guidance to take

action with confidence. Specifically, Voya’s participant data shows

that approximately one-third (32%) of individuals who use

myOrangeMoney have modeled changes that could impact their future

retirement income, including actions such as changing their savings

rate or adjusting their desired retirement age.2 As a result,

participants who have used myOrangeMoney are shown to save nearly

one-quarter (24%) more for their future retirement compared to

non-users of the solution.3

Voya has continued to enhance the myOrangeMoney solution to

support workers at every stage and income level. As Voya continues

to advance its Behavioral Finance Institute for Innovation,

myOrangeMoney has evolved to leverage behavioral research insights

to build actionable “nudges” for users to gauge retirement

sentiment and help them remain engaged in making progress toward

their personal savings goals. Additional enhancements throughout

the years have included providing participants with tools to help

optimize their company match and benchmark themselves to peers.

Features have also been added to allow customers to calculate how

Social Security and healthcare costs factor into their retirement

planning decisions.

“When it comes to retirement income, individuals need to

consider more than just their retirement income, and they are often

focused on things like investing strategies, managing Social

Security and covering healthcare expenses,” added Vaillancourt. “At

Voya, we know there is no ‘one-size-fits-all’ solution that can

meet every individual’s needs. For employers, offering an array of

solutions that are easy to understand and implement can ultimately

provide a greater feeling of financial confidence and deliver a

positive retirement outlook for individuals.”

In addition to products and solutions, Voya’s retirement income

strategy covers a broad spectrum of support, including education

and guidance, tools and experiences such as myOrangeMoney and

myVoyage — the personalized financial-guidance and connected

workplace-benefits digital platform. Voya was also one of the first

recordkeepers to lead the industry in offering two in-plan

retirement income options: Voya Lifetime Income Protection,

designed for small and government market employers; and the

AllianceBernstein Lifetime Income Strategy to address the needs of

larger employers. Most recently, Voya also revealed it would make

the BlackRock LifePath Paycheck™ solution available on its

recordkeeping platform.

As an industry leader focused on the delivery of benefits,

savings and investment solutions to and through the workplace, Voya

is committed to delivering on its mission to make a secure

financial future possible for all — one person, one family, one

institution at a time.

1. Voya Consumer Insights & Research conducted May 15-16,

2024, on the Ipsos eNation omnibus online platform among 1,005

adults aged 18+ in the U.S. 2 & 3. Voya Financial internal data

as of March 31, 2024.

About Voya Financial® Voya Financial, Inc. (NYSE: VOYA),

is a leading health, wealth and investment company with

approximately 9,000 employees who are focused on achieving Voya’s

aspirational vision: “Clearing your path to financial confidence

and a more fulfilling life.” Through products, solutions and

technologies, Voya helps its 15.2 million individual, workplace and

institutional clients become well planned, well invested and well

protected. Benefitfocus, a Voya company and a leading benefits

administration provider, extends the reach of Voya’s workplace

benefits and savings offerings by engaging directly with over 12

million employees in the U.S. Certified as a “Great Place to Work”

by the Great Place to Work® Institute, Voya is purpose-driven and

committed to conducting business in a way that is economically,

ethically, socially and environmentally responsible. Voya has

earned recognition as: one of the World’s Most Ethical Companies®

by Ethisphere; a member of the Bloomberg Gender-Equality Index; and

a “Best Place to Work for Disability Inclusion” on the Disability

Equality Index. For more information, visit voya.com. Follow Voya

Financial on Facebook, LinkedIn and Instagram.

VOYA-RET

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240711581546/en/

Media Contact: Laura Maulucci Voya Financial (508)

353-6913 Laura.Maulucci@voya.com

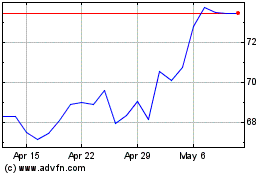

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Oct 2024 to Nov 2024

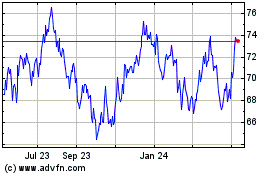

Voya Financial (NYSE:VOYA)

Historical Stock Chart

From Nov 2023 to Nov 2024