Controladora Vuela Compañía de Aviación, S.A.B. de C.V. (NYSE: VLRS

and BMV: VOLAR) (“Volaris” or “the Company”), the ultra-low-cost

carrier (ULCC) serving Mexico, the United States, Central, and

South America, today announces its financial results for the first

quarter 20241.

First Quarter 2024

Highlights(All figures are reported in U.S. dollars and

compared to 1Q 2023 unless otherwise noted)

- Net

income of $33 million. Earnings per ADS of $0.29

cents.

- Total

operating revenues of $768 million, a 5.1% increase.

- Total

revenue per available seat mile (TRASM) increased 21% to

$9.34 cents.

- Available

seat miles (ASMs) decreased by 13% to 8.2 billion.

- Total

operating expenses of $664 million, representing 86% of

total operating revenue.

- Total

operating expenses per available seat mile (CASM) remained

relatively flat at $8.08 cents.

- Average

economic fuel cost decreased 13% to $3.01 per gallon.

- CASM

ex-fuel increased 11% to $5.16 cents.

-

EBITDAR of $235 million, a 91% increase.

- EBITDAR

margin was 30.6%, an increase of 14 percentage

points.

- Total cash,

cash equivalents, restricted cash, and short-term

investments totaled $768 million, representing 23% of the

last twelve months’ total operating revenue.

- Net

debt-to-LTM EBITDAR2 ratio decreased to

3.1x, compared to 3.8x in 2023.

Enrique Beltranena, President &

Chief Executive Officer, said: “We are pleased with our

business performance as our Volaris team delivered strong first

quarter 2024 results. Over the last six months, our primary focus

has been directing operations to enhance our customer service and

continuing our emphasis on obsessive cost control.

Despite the ongoing industry challenges, we

continue to execute well and remain focused on delivering

shareholder value. The company produced strong results that

exceeded expectations. We generated a remarkable increase in TRASM

and ancillaries while costs remained controlled. Moreover, Volaris

achieved net profitability in the first quarter, posting a net

income of $33 million dollars. This marks a significant

achievement, as historically, due to seasonality, our first

quarters have resulted in net losses; the last time we recorded a

net profit in the first quarter was in 2019.

Looking forward, booking curves remain solid. As

we execute our strategy, we prioritize profitability when

allocating capacity and are cautiously optimistic about achieving

results in line with our updated guidance.”

1 The financial information, unless otherwise

indicated, is presented in accordance with the International

Financial Reporting Standards (IFRS).2 Includes short-term

investments.

| First

Quarter 2024 Consolidated Financial and Operating Highlights(All

figures are reported in U.S. dollars and compared to 1Q 2023 unless

otherwise noted) |

|

|

First Quarter |

|

Consolidated Financial Highlights |

2024 |

|

2023 |

|

Var. |

| Total operating

revenue (millions) |

768 |

|

731 |

|

5.1 |

% |

| TRASM (cents) |

9.34 |

|

7.71 |

|

21.3 |

% |

| ASMs (millions, scheduled

& charter) |

8,217 |

|

9,488 |

|

(13.4 |

%) |

| Load Factor (scheduled,

RPMs/ASMs) |

87.0 |

% |

85.0 |

% |

1.9 pp |

| Passengers (thousands,

scheduled & charter) |

6,924 |

|

8,186 |

|

(15.4 |

%) |

| Fleet

(at the end of the period) |

134 |

|

120 |

|

14 |

|

| Total operating

expenses (millions) |

664 |

|

762 |

|

(12.9 |

%) |

| CASM (cents) |

8.08 |

|

8.03 |

|

0.6 |

% |

| CASM ex fuel (cents) |

5.16 |

|

4.65 |

|

11.0 |

% |

|

Adjusted CASM ex fuel (cents)3 |

5.32 |

|

4.28 |

|

24.3 |

% |

| Operating income

(loss) (EBIT) (millions) |

104 |

|

(31 |

) |

N/A |

| % EBIT

Margin |

13.5 |

% |

(4.3 |

%) |

17.8 pp |

| Net income (loss)

(millions) |

33 |

|

(71 |

) |

N/A |

| % Net

income (loss) margin |

4.3 |

% |

(9.7 |

%) |

14.0 pp |

| EBITDAR

(millions) |

235 |

|

123 |

|

91.1 |

% |

| %

EBITDAR Margin |

30.6 |

% |

16.8 |

% |

13.7 pp |

| Net debt-to-LTM

EBITDAR4 |

3.1x |

3.8x |

-0.7x |

| Reconciliation of CASM

to Adjusted CASM ex-fuel: |

|

|

|

First Quarter |

|

Reconciliation of CASM |

2024 |

|

2023 |

|

Var. |

| CASM

(cents) |

8.08 |

|

8.03 |

|

0.6 |

% |

| Fuel

expense |

(2.92 |

) |

(3.38 |

) |

(13.6 |

%) |

| CASM ex

fuel |

5.16 |

|

4.65 |

|

11.0 |

% |

| Aircraft and engine variable

lease expenses5 |

0.04 |

|

(0.37 |

) |

N/A |

| Sale

and lease back gains |

0.12 |

|

0.00 |

|

N/A |

| Adjusted CASM ex

fuel |

5.32 |

|

4.28 |

|

24.3 |

% |

| Note: Figures are rounded for

convenience purposes. Further detail found in financial and

operating indicators. |

| 3 Excludes fuel expense,

aircraft and engine variable lease expenses and sale and lease-back

gains. |

| 4 Includes short-term

investments. |

| 5 Aircraft redeliveries. |

First Quarter 2024(All figures

are reported in U.S. dollars and compared to 1Q 2023 unless

otherwise noted)

Total operating revenue in the

quarter was $768 million, a 5.1% increase driven by solid demand

and an improvement in total revenue per passenger.

Booked passengers amounted to 6.9 million, a

decrease of 15%. Mexican domestic booked passengers decreased 23%,

while international booked passengers increased 11%.

Total capacity, in terms of available seat miles

(ASMs) decreased 13% to 8.2 billion due to the accelerated

Pratt & Whitney engine inspections and the resulting aircraft

groundings.

The load factor for the quarter

reached 87.0%, representing an increase of 1.9 percentage

points.

TRASM increased 21% to $9.34

cents, and total operating revenue per passenger stood at $111,

representing a 24% increase.

The average base fare was $54, a 15% increase.

The total ancillary revenue per passenger was $57, a 35% increase.

Ancillary revenue represented 51% of total operating revenue, an

increase of 4.1 percentage points.

Total operating expenses were

$664 million, representing 86% of total operating revenue.

CASM totaled $8.08 cents and

remained relatively flat year over year.

The average economic fuel cost

decreased 13% to $3.01 per gallon.

CASM ex-fuel increased 11% to

$5.16 cents. This increase was mainly caused by the

aircraft-on-ground (AOG) due to Pratt and Whitney's engine

preventive accelerated inspections and the effect of a larger

proportion of international capacity with higher landing and

navigation fees. This pressure was partially offset by the

remeasurement of previously booked redelivery accruals, which

reflect the lease extensions from 2024 to 2026.

Comprehensive financing result

represented an expense of $57 million, compared to $65 million in

the same period of 2023. For the period, the average exchange rate

was Ps.17.00 per U.S. dollar, a 9.1% appreciation. At the end of

the first quarter, the exchange rate stood at Ps.16.68 per U.S.

dollar.

Income tax expense for the

quarter was $14 million, compared to an income tax benefit of $25

million registered in the same period of 2023.

Net income in the quarter was

$33 million, with an earnings per ADS of $0.29 cents.

EBITDAR for the quarter was

$235 million, an increase of 91%, primarily attributable to higher

unit revenues and lower fuel prices, while EBITDAR

margin stood at 30.6%, an increase of 14 percentage

points.

Balance Sheet, Liquidity and Capital

Allocation

As of March 31, 2024, cash, cash equivalents,

restricted cash and short-term investments were $768 million,

representing 23% of the last twelve months total operating

revenue.

Net cash flow provided by operating activities

was $245 million. Net cash flow used in investing and financing

activities was $97 million and $171 million, respectively.

The financial debt amounted to $642 million,

while total lease liabilities stood at $3,021 million, resulting in

a net debt of $2,8956 million.

Net debt-to-LTM

EBITDAR6 ratio stood at 3.1x, compared to

3.3x in the previous quarter and 3.8x in the same period of

2023.

2024 Guidance

For the second quarter of 2024, the Company

expects:

|

|

2Q’24 |

2Q’23 (1) |

|

2Q’24 Guidance |

|

|

|

ASM growth (YoY) |

~ -18% |

+18.1% |

| TRASM |

$9.1 to $9.2 cents |

$7.92 cents |

| CASM ex fuel |

$5.5 to $5.6 cents |

$4.82 cents |

| EBITDAR

margin |

31% to 33% |

27.1% |

|

Average USD/MXN rate |

Ps.17.30 to 17.50 |

Ps.17.72 |

| Average U.S. Gulf Coast jet

fuel price |

$2.60 to $2.70 |

2.29 |

| (1) For convenience purposes,

actual reported figures for 2Q'23 are included. |

|

|

For the full year 2024, the Company expects:

|

|

Updated Guidance |

Prior Guidance |

|

Full Year 2024 Guidance |

|

|

|

ASM growth (YoY) |

-16% to -18% |

-16% to -18% |

| EBITDAR margin |

32% to 34% |

31% to 33% |

| CAPEX (2) |

$400 million |

~$300 million |

|

Average USD/MXN rate |

Ps.17.30 to 17.50 |

Ps.17.70 to Ps.17.90 |

| Average U.S. Gulf Coast jet

fuel price |

$2.60 to $2.70 |

$2.50 to $2.60 |

| (2) CAPEX net of financed

fleet predelivery payments. |

|

|

The second quarter and full year 2024 outlook

presented above includes the compensation that Volaris expects to

receive for the projected grounded aircraft resulting from the GTF

engine removals, in accordance with the Company’s agreement with

Pratt & Whitney that was previously announced on December 5,

2023.

The Company's outlook is subject to unforeseen

disruptions, macroeconomic factors, or other negative impacts that

may affect its business, and is based on several assumptions,

including the foregoing, which are subject to change and may be

outside the control of the Company and its management. The

Company's expectations may change if actual results vary from these

assumptions. There can be no assurances that Volaris will achieve

these results.

Fleet

During the first quarter, Volaris added two

A320ceo and three A321neo aircraft to its fleet, bringing the total

number of aircraft to 134. At the end of the quarter, Volaris’

fleet had an average age of 5.9 years and an average seating

capacity of 197 passengers per aircraft. Of the total fleet, 59% of

the aircraft are New Engine Option (NEO) models.

|

|

First Quarter |

Fourth Quarter |

|

Total Fleet |

2024 |

2023 |

Var. |

2023 |

Var. |

|

CEO |

|

|

|

|

|

| A319 |

3 |

3 |

- |

3 |

- |

| A320 |

42 |

40 |

2 |

40 |

2 |

|

A321 |

10 |

10 |

- |

10 |

- |

|

NEO |

|

|

|

|

|

| A320 |

51 |

50 |

1 |

51 |

- |

|

A321 |

28 |

17 |

11 |

25 |

3 |

| Total aircraft at the

end of the period |

134 |

120 |

14 |

129 |

5 |

Investors are urged to carefully read the

Company’s periodic reports filed with or provided to the Securities

and Exchange Commission, for additional information regarding the

Company.

Investor Relations ContactRicardo Martínez /

ir@volaris.com

Media ContactIsrael Álvarez /

ialvarez@gcya.net

Conference Call Details

| Date: |

Tuesday, April 23,

2024 |

| Time: |

9:00 am Mexico City /

11:00 am New York (USA) (ET) |

| Webcast

link: |

Volaris Webcast

(View the live webcast) |

| Dial-in & Live

Q&A link: |

Volaris Dial-in and Live

Q&A

- Click on the call link and complete

the online registration form.

- Upon registering you will receive

the dial-in info and a unique PIN to join the call, as well as an

email confirmation with the details.

- Select a method for joining the

call:

- Dial-In: A dial-in number and

unique PIN are displayed to connect directly from your phone.

- Call Me: Enter your phone number

and click “Call Me” for an immediate callback from the system.

|

About Volaris

*Controladora Vuela Compañía de Aviación, S.A.B.

de C.V. (“Volaris” or “the Company”) (NYSE: VLRS and BMV: VOLAR) is

an ultra-low-cost carrier, with point-to-point operations, serving

Mexico, the United States, Central, and South America. Volaris

offers low base fares to build its market, providing quality

service and extensive customer choice. Since the beginning of

operations in March 2006, Volaris has increased its routes from 5

to more than 198 and its fleet from 4 to 134 aircraft. Volaris

offers more than 450 daily flight segments on routes that connect

44 cities in Mexico and 29 cities in the United States, Central,

and South America, with one of the youngest fleets in Mexico.

Volaris targets passengers who are visiting friends and relatives,

cost-conscious business and leisure travelers in Mexico, the United

States, Central, and South America. Volaris has received the ESR

Award for Social Corporate Responsibility for fourteen consecutive

years. For more information, please visit ir.volaris.com. Volaris

routinely posts information that may be important to investors on

its investor relations website. The Company encourages investors

and potential investors to consult the Volaris website regularly

for important information about Volaris.

Forward-Looking Statements

Statements in this release contain various

forward-looking statements within the meaning of Section 27A of the

US Securities Act of 1933, as amended, and Section 21E of the US

Securities Exchange Act of 1934, as amended, which represent the

Company's expectations, beliefs, or projections concerning future

events and financial trends affecting the financial condition of

our business. When used in this release, the words "expects,"

“intends,” "estimates," “predicts,” "plans," "anticipates,"

"indicates," "believes," "forecast," "guidance," “potential,”

"outlook," "may," “continue,” "will," "should," "seeks," "targets"

and similar expressions are intended to identify forward-looking

statements. Similarly, statements describing the Company's

objectives, plans or goals, or actions the Company may take in the

future are forward-looking. Forward-looking statements include,

without limitation, statements regarding the Company's outlook, the

expectation of receiving certain compensation in connection with

the GTF engine removals, and the anticipated execution of its

business plan and focus on its priorities. Forward-looking

statements should not be read as a guarantee or assurance of future

performance or results. They will not necessarily be accurate

indications of the times at or by which such performance or results

will be achieved. Forward-looking statements are based on

information available at the time those statements are made and/or

management’s good faith belief as of that time concerning future

events and are subject to risks and uncertainties that could cause

actual performance or results to differ materially from those

expressed in or suggested by the forward-looking statements.

Forward-looking statements are subject to several factors that

could cause the Company's actual results to differ materially from

the Company's expectations, including the competitive environment

in the airline industry, the Company's ability to keep costs low;

changes in fuel costs, the impact of worldwide economic conditions

on customer travel behavior; the Company's ability to generate

non-ticket revenue; and government regulation. The Company's US

Securities and Exchange Commission filings contain additional

information concerning these and other factors. All forward-looking

statements attributable to us or persons acting on our behalf are

expressly qualified in their entirety by the cautionary statements

set forth above. Forward-looking statements speak only as of the

date of this release. You should not put undue reliance on any

forward-looking statements. We assume no obligation to update

forward-looking statements to reflect actual results, changes in

assumptions, or changes in other factors affecting forward-looking

information except to the extent required by applicable law. If we

update one or more forward-looking statements, no inference should

be drawn that we will make additional updates with respect to those

or other forward-looking statements.

Supplemental Information on Non-IFRS

Measures

We evaluate our financial performance by using

various financial measures that are not performance measures under

International Financial Reporting Standards (“non-IFRS measures”).

These non-IFRS measures include CASM, CASM ex-fuel, Adjusted CASM

ex-fuel, EBITDAR, Net debt-to-LTM EBITDAR, Total cash, cash

equivalents, restricted cash, and short-term investments. We define

CASM as total operating expenses by available seat mile. We define

CASM ex-fuel as total operating expenses by available seat mile,

excluding fuel expense. We define Adjusted CASM ex fuel as total

operating expenses by available seat mile, excluding fuel expense,

aircraft and engine variable lease expenses and sale and lease back

gains. We define EBITDAR as earnings before interest, income tax,

depreciation and amortization, depreciation of right of use assets

and aircraft and engine variable lease expenses. We define Net

debt-to-LTM EBITDAR as Net debt divided by LTM EBITDAR. We define

Total cash, cash equivalents, restricted cash, and short-term

investments as the sum of cash, cash equivalents, restricted cash,

and short-term investments.

These non-IFRS measures are provided as

supplemental information to the financial information presented in

this release that is calculated and presented in accordance with

International Financial Reporting Standards (“IFRS”) because we

believe that they, in conjunction with the IFRS financial

information, provide useful information to management’s, analysts

and investors overall understanding of our operating

performance.

Because non-IFRS measures are not calculated in

accordance with IFRS, they should not be considered superior to and

are not intended to be considered in isolation or as a substitute

for the related IFRS measures presented in this release and may not

be the same as or comparable to similarly titled measures presented

by other companies due to possible differences in the method of

calculation and the items being adjusted.

We encourage investors to review our financial

statements and other filings with the Securities and Exchange

Commission in their entirety for additional information regarding

the Company and not to rely on any single financial measure.

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

SubsidiariesFinancial and Operating Indicators |

|

Unaudited(In millions U.S. dollars, except

otherwise indicated) |

Three months ended March 31, 2024 |

Three months ended March 31, 2023 |

Variance |

|

Total operating revenues (millions) |

768 |

|

731 |

|

5.1 |

% |

| Total

operating expenses (millions) |

664 |

|

762 |

|

(12.9 |

%) |

| EBIT

(millions) |

104 |

|

(31 |

) |

N/A |

| EBIT

margin |

13.5 |

% |

(4.3 |

%) |

17.8 pp |

|

Depreciation and amortization (millions) |

134 |

|

119 |

|

12.6 |

% |

| Aircraft

and engine variable lease expenses (millions) |

(3 |

) |

35 |

|

N/A |

| Net

income (loss) (millions) |

33 |

|

(71 |

) |

N/A |

| Net

income (loss) margin |

4.3 |

% |

(9.7 |

%) |

14.0 pp |

|

Earnings (loss) per share

(1): |

|

|

|

|

Basic |

0.03 |

|

(0.06 |

) |

N/A |

|

Diluted |

0.03 |

|

(0.06 |

) |

N/A |

|

Earnings (loss) per ADS*: |

|

|

|

|

Basic |

0.29 |

|

(0.62 |

) |

N/A |

|

Diluted |

0.29 |

|

(0.61 |

) |

N/A |

|

Weighted average shares outstanding: |

|

|

|

|

Basic |

1,151,450,983 |

|

1,152,524,284 |

|

(0.1 |

%) |

|

Diluted |

1,165,976,677 |

|

1,165,048,915 |

|

0.1 |

% |

|

Financial Indicators |

|

|

|

| Total

operating revenue per ASM (TRASM) (cents) (2) |

9.34 |

|

7.71 |

|

21.3 |

% |

| Average

base fare per passenger |

54 |

|

47 |

|

14.7 |

% |

| Total

ancillary revenue per passenger (3) |

57 |

|

42 |

|

34.9 |

% |

| Total

operating revenue per passenger |

111 |

|

89 |

|

24.2 |

% |

| Operating

expenses per ASM (CASM) (cents) (2) |

8.08 |

|

8.03 |

|

0.6 |

% |

| CASM ex

fuel (cents) (2) |

5.16 |

|

4.65 |

|

11.0 |

% |

|

Adjusted CASM ex fuel (cents) (2) (4) |

5.32 |

|

4.28 |

|

24.3 |

% |

|

Operating Indicators |

|

|

|

|

Available seat miles (ASMs) (millions) (2) |

8,217 |

|

9,488 |

|

(13.4 |

%) |

|

Domestic |

4,768 |

|

6,537 |

|

(27.1 |

%) |

|

International |

3,449 |

|

2,951 |

|

16.9 |

% |

| Revenue

passenger miles (RPMs) (millions) (2) |

7,146 |

|

8,067 |

|

(11.4 |

%) |

|

Domestic |

4,329 |

|

5,546 |

|

(21.9 |

%) |

|

International |

2,817 |

|

2,521 |

|

11.8 |

% |

| Load

factor (5) |

87.0 |

% |

85.0 |

% |

1.9 pp |

|

Domestic |

90.8 |

% |

84.8 |

% |

5.9 pp |

|

International |

81.7 |

% |

85.4 |

% |

(3.7 pp) |

| Booked

passengers (thousands) (2) |

6,924 |

|

8,186 |

|

(15.4 |

%) |

|

Domestic |

4,985 |

|

6,440 |

|

(22.6 |

%) |

|

International |

1,939 |

|

1,746 |

|

11.0 |

% |

|

Departures (2) |

40,428 |

|

50,191 |

|

(19.5 |

%) |

| Block

hours (2) |

109,363 |

|

130,549 |

|

(16.2 |

%) |

| Aircraft

at end of period |

134 |

|

120 |

|

14 |

|

| Average

aircraft utilization (block hours) |

12.73 |

|

13.52 |

|

(5.8 |

%) |

| Fuel

gallons accrued (millions) |

79.2 |

|

92.2 |

|

(14.1 |

%) |

| Average

economic fuel cost per gallon (6) |

3.01 |

|

3.46 |

|

(12.9 |

%) |

| Average

exchange rate |

17.00 |

|

18.70 |

|

(9.1 |

%) |

|

Exchange rate at the end of the period |

16.68 |

|

18.11 |

|

(7.9 |

%) |

| *Each ADS

represents ten CPOs and each CPO represents a financial interest in

one Series A share |

| (1) The basic and diluted loss or

earnings per share are calculated in accordance with IAS 33. Basic

loss or earnings per share is calculated by dividing net loss or

earnings by the average number of shares outstanding (excluding

treasury shares). Diluted loss or earnings per share is calculated

by dividing net loss or earnings by the average number of shares

outstanding adjusted for dilutive effects. |

(2) Includes schedule

and charter.(3) Includes “Other passenger revenues” and

“Non-passenger revenues”.(4) Excludes fuel expense, aircraft and

engine variable lease expenses and saleand lease-back gains. (5)

Includes schedule.(6) Excludes Non-creditable VAT. |

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

SubsidiariesConsolidated Statement of Operations |

|

Unaudited(In millions of U.S.

dollars) |

Three months ended March 31, 2024 |

Three months ended March 31, 2023 |

Variance |

|

Operating revenues: |

|

|

|

|

Passenger revenues |

732 |

|

701 |

|

4.4 |

% |

|

Fare revenues |

375 |

|

387 |

|

(3.1 |

%) |

|

Other passenger revenues |

357 |

|

314 |

|

13.7 |

% |

|

|

|

|

|

|

Non-passenger revenues |

36 |

|

30 |

|

20.0 |

% |

|

Cargo |

5 |

|

4 |

|

25.0 |

% |

|

Other non-passenger revenues |

31 |

|

26 |

|

19.2 |

% |

|

|

|

|

|

|

Total operating revenues |

768 |

|

731 |

|

5.1 |

% |

|

|

|

|

|

| Other

operating income |

(45 |

) |

- |

|

N/A |

| Fuel

expense |

240 |

|

321 |

|

(25.2 |

%) |

| Aircraft

and engine variable lease expenses |

(3 |

) |

35 |

|

N/A |

| Salaries

and benefits |

102 |

|

91 |

|

12.1 |

% |

| Landing,

take-off and navigation expenses |

127 |

|

110 |

|

15.5 |

% |

| Sales,

marketing and distribution expenses |

45 |

|

35 |

|

28.6 |

% |

|

Maintenance expenses |

37 |

|

26 |

|

42.3 |

% |

|

Depreciation and amortization |

35 |

|

31 |

|

12.9 |

% |

|

Depreciation of right of use assets |

99 |

|

88 |

|

12.5 |

% |

| Other

operating expenses |

27 |

|

25 |

|

8.0 |

% |

|

Operating expenses |

664 |

|

762 |

|

(12.9 |

%) |

|

|

|

|

|

|

Operating income (loss) |

104 |

|

(31 |

) |

N/A |

|

|

|

|

|

| Finance

income |

12 |

|

7 |

|

71.4 |

% |

| Finance

cost |

(62 |

) |

(58 |

) |

6.9 |

% |

| Exchange

loss, net |

(7 |

) |

(14 |

) |

(50.0 |

%) |

|

Comprehensive financing result |

(57 |

) |

(65 |

) |

(12.3 |

%) |

|

|

|

|

|

|

Income (loss) before income tax |

47 |

|

(96 |

) |

N/A |

| Income

tax (expense) benefit |

(14 |

) |

25 |

|

N/A |

|

Net income (loss) |

33 |

|

(71 |

) |

N/A |

|

|

|

|

|

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

SubsidiariesReconciliation of Total Ancillary Revenue per

PassengerThe following table shows quarterly additional detail

about the components of total ancillary revenue: |

|

Unaudited(In millions of U.S.

dollars) |

Three months ended March 31, 2024 |

Three months ended March 31, 2023 |

Variance |

|

|

|

|

|

| Other

passenger revenues |

357 |

314 |

13.7 |

% |

|

Non-passenger revenues |

36 |

30 |

20.0 |

% |

|

Total ancillary revenues |

393 |

344 |

14.2 |

% |

|

|

|

|

|

| Booked

passengers (thousands) (1) |

6,924 |

8,186 |

(15.4 |

%) |

|

|

|

|

|

|

Total ancillary revenue per passenger |

57 |

42 |

34.9 |

% |

|

|

|

|

|

| (1)

Includes schedule and charter. |

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

SubsidiariesConsolidated Statement of Financial

Position |

|

(In millions of U.S. dollars) |

As of March 31, 2024 Unaudited |

As of December 31,

2023Audited |

|

Assets |

|

|

| Cash,

cash equivalents and restricted cash |

752 |

|

774 |

|

|

Short-term investments |

16 |

|

15 |

|

|

Total cash, cash equivalents, restricted cash, and

short-term investments (1) |

768 |

|

- |

|

| Accounts

receivable, net |

295 |

|

251 |

|

|

Inventories |

16 |

|

16 |

|

| Guarantee

deposits |

150 |

|

148 |

|

| Prepaid

expenses and other current assets |

48 |

|

44 |

|

|

Total current assets |

1,277 |

|

1,248 |

|

| Right of

use assets |

2,463 |

|

2,338 |

|

| Rotable

spare parts, furniture and equipment, net |

865 |

|

805 |

|

|

Intangible assets, net |

18 |

|

16 |

|

|

Derivatives financial instruments |

1 |

|

2 |

|

| Deferred

income taxes |

231 |

|

236 |

|

| Guarantee

deposits |

483 |

|

462 |

|

| Other

long-term assets |

43 |

|

39 |

|

|

Total non-current assets |

4,104 |

|

3,898 |

|

|

Total assets |

5,381 |

|

5,146 |

|

|

Liabilities and equity |

|

|

| Unearned

transportation revenue |

394 |

|

343 |

|

| Accounts

payable |

179 |

|

250 |

|

| Accrued

liabilities |

205 |

|

163 |

|

| Other

taxes and fees payable |

304 |

|

262 |

|

| Income

taxes payable |

14 |

|

8 |

|

| Financial

debt |

260 |

|

220 |

|

| Lease

liabilities |

375 |

|

373 |

|

| Other

liabilities |

13 |

|

2 |

|

|

Total short-term liabilities |

1,744 |

|

1,621 |

|

| Financial

debt |

382 |

|

433 |

|

| Accrued

liabilities |

12 |

|

14 |

|

| Employee

benefits |

15 |

|

15 |

|

| Deferred

income taxes |

16 |

|

16 |

|

| Lease

liabilities |

2,646 |

|

2,518 |

|

| Other

liabilities |

289 |

|

286 |

|

|

Total long-term liabilities |

3,360 |

|

3,282 |

|

|

Total liabilities |

5,104 |

|

4,903 |

|

|

Equity |

|

|

| Capital

stock |

248 |

|

248 |

|

| Treasury

shares |

(12 |

) |

(12 |

) |

|

Contributions for future capital increases |

- |

|

- |

|

| Legal

reserve |

17 |

|

17 |

|

|

Additional paid-in capital |

283 |

|

282 |

|

|

Accumulated deficit |

(115 |

) |

(148 |

) |

|

Accumulated other comprehensive loss |

(144 |

) |

(144 |

) |

|

Total equity |

277 |

|

243 |

|

|

Total liabilities and equity |

5,381 |

|

5,146 |

|

| (1)

Non-GAAP measure. |

|

Controladora Vuela Compañía de Aviación, S.A.B. de C.V. and

SubsidiariesConsolidated Statement of Cash Flows – Cash

Flow Data Summary |

|

Unaudited(In millions of U.S.

dollars) |

Three months ended March 31, 2024 |

Three months ended March 31, 2023 |

|

|

|

|

| Net cash

flow provided by operating activities |

245 |

|

208 |

|

| Net cash

flow used in investing activities |

(97 |

) |

(109 |

) |

| Net cash

flow used in financing activities* |

(171 |

) |

(110 |

) |

|

Decrease in cash, cash equivalents and restricted

cash |

(23 |

) |

(11 |

) |

| Net

foreign exchange differences |

1 |

|

3 |

|

| Cash,

cash equivalents and restricted cash at beginning of period |

774 |

|

712 |

|

|

Cash, cash equivalents and restricted cash at end of

period |

752 |

|

704 |

|

| *Includes

aircraft rental payments of $141 million and $127 million for the

three months ended March 31, 2024, and 2023, respectively. |

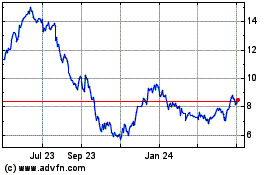

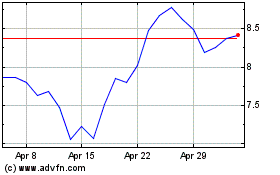

Volaris Aviation (NYSE:VLRS)

Historical Stock Chart

From Jun 2024 to Jul 2024

Volaris Aviation (NYSE:VLRS)

Historical Stock Chart

From Jul 2023 to Jul 2024