VMware Announces Per Share Dividend Amount and Payment Date for Previously Announced One-Time Special Dividend

December 28 2018 - 7:40AM

Payment date for previously announced $11bn

one-time special dividend is December 28, 2018

VMware Inc. (NYSE:VMW) (“VMware”), a leading innovator in

enterprise software, today announced that the payment date for

VMware’s $11 billion, conditional one-time special dividend payable

pro-rata to all VMware stockholders (the “Special Dividend”),

previously announced on July 2, 2018, is December 28, 2018 (the

“Payment Date”). The Special Dividend is payable to all VMware

stockholders of record as of the close of business on December 27,

2018 (the “Record Date”).

Shares of VMware Class A common stock will trade with due bills

following the Record Date through and including the Payment Date.

The ex-dividend date will be the first trading day following the

Payment Date – December 31, 2018.

US Federal Tax Treatment of the Special

DividendVMware currently estimates that, for U.S. federal

tax purposes, 60.39% of the Special Dividend (or $16.19 per share)

will be treated as a taxable dividend, with the other 39.61% of the

Special Dividend (or $10.62 per share) being first treated as a

return on capital to stockholders to the extent of their basis in

VMware common stock, and then as capital gain.

The tax treatment of the Special Dividend will be based on

VMware’s current and accumulated earnings and profits for VMware’s

2019 fiscal year ending February 1, 2019 (“FY19”). The process of

determining current and accumulated earnings and profits requires a

final determination of VMware’s financial results for FY19 and a

review of certain other factors. The determination will be based in

part on factors that are outside of the control of VMware and which

cannot be ascertained at this time. VMware does not expect the

calculation of the portion that will be treated as a taxable

dividend for federal tax purposes to be finalized until after the

completion of FY19. Accordingly, the portion of the Special

Dividend estimated to be a taxable dividend provided in this

release is based upon currently available information and is

subject to change. VMware currently expects to update information

on taxation of the Special Dividend later in calendar year

2019.

The taxable dividend may be eligible for treatment as a

qualified dividend for federal tax purposes depending on the

holding period of the underlying stock and other personal tax

matters. The precise tax impact of the dividend to specific

stockholders depends upon the stockholder’s individual tax

situation. Stockholders are advised to consult with their personal

tax advisors.

The return of capital percentage on common stock dividends as

reported on Form 8937 can be found on VMware’s website at

ir.vmware.com. The Form 8937 will be updated as necessary following

the determination of VMware’s financial results for FY19 and a

review of certain other factors.

About VMwareVMware software powers the world’s

complex digital infrastructure. The company’s compute, cloud,

mobility, networking and security offerings provide a dynamic and

efficient digital foundation to over 500,000 customers globally,

aided by an ecosystem of 75,000 partners. Headquartered in Palo

Alto, California, this year VMware celebrates twenty years of

breakthrough innovation benefiting business and society. For more

information please visit https://www.vmware.com/company.html.

Forward-Looking StatementsThis press release

contains forward-looking statements that are based on VMware’s

current expectations, including, among other things, statements

regarding VMware’s Special Dividend, including its payment date,

the tax treatment of the Special Dividend and the specific portion

of the Special Dividend that will be treated as a return on

capital, the expected completion of the Dell exchange transaction,

satisfaction of conditions to payment of the Special Dividend, the

elimination of Dell Class V common stock and creation of a new

public equity class for Dell. These forward-looking statements are

subject to the safe harbor provisions created by the Private

Securities Litigation Reform Act of 1995. Actual results could

differ materially from those projected in the forward-looking

statements as a result of certain risk factors, including but not

limited to: (i) VMware’s relationship with Dell and Dell’s

ability to control matters requiring stockholder approval,

including the election of VMware’s board members and matters

relating to Dell’s investment in VMware; (ii) tabulation of

VMware’s financial results for FY19; (iii) other factors

relating to the final calculation of the portion of the Special

Dividend taxable as a dividend or as a return of capital or capital

gain including calculations of the impact on VMware as a member of

a consolidated tax group with Dell; and (iv) logistics involved in

setting the ex-dividend date. These forward-looking

statements are made as of the date of this press release, are based

on current expectations and are subject to uncertainties and

changes in condition, significance, value and effect as well as

other risks detailed in documents filed with the Securities and

Exchange Commission, including VMware’s most recent reports on Form

10-K and Form 10-Q and Current Reports on Form 8-K that we have

filed and may file from time to time, which could cause actual

results to vary from expectations. VMware assumes no obligation to,

and does not currently intend to, update any such forward-looking

statements after the date of this press release.

ContactPaul ZiotsVMware Investor

Relationspziots@vmware.com 650-427-3267

Michael ThackerVMware Global

PRmthacker@vmware.com 650-427-4454

Vmware (NYSE:VMW)

Historical Stock Chart

From Feb 2025 to Mar 2025

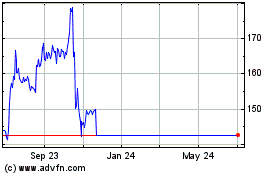

Vmware (NYSE:VMW)

Historical Stock Chart

From Mar 2024 to Mar 2025