Vitesse Energy, Inc. (NYSE: VTS) (“we,” “our,” “Vitesse,” or the

“Company”) today announced the Company’s first quarter 2023

financial and operating results.

HIGHLIGHTS

- Completed spin-off from Jefferies Financial Group Inc. (the

“Spin-Off”) and closed the acquisition of Vitesse Oil, LLC on

January 13, 2023

- First quarter net loss of $47.8 million reflecting $77.4

million of charges associated with the Spin-Off, including (i) a

one-time non-cash income tax expense of $44.1 million related to a

change in corporate tax status, (ii) an acceleration of $26.8

million of non-cash equity-based compensation expense, and (iii)

non-recurring transaction costs of $6.5 million

- First quarter Adjusted Net Income(1) of $15.6 million

- Adjusted EBITDA(1) of $40.1 million, up 6% sequentially from

the prior quarter and from the first quarter of 2022

- As previously announced, declared our second quarterly cash

dividend of $0.50 per common share to be paid on June 30, 2023

- Total debt of $45.0 million as of March 31, 2023, a decrease

from $53.0 million at the time of the Spin-Off on January 13,

2023

- Production of 11,524 barrels of oil equivalent (“Boe”) per day

(67% oil), up 6% sequentially from the prior quarter and 20% from

the first quarter of 2022

(1) Non-GAAP financial measure; see

reconciliation schedules at the end of this release

MANAGEMENT COMMENTS

Bob Gerrity, Vitesse’s Chairman and Chief Executive Officer,

commented, “In our first quarter as a fully integrated, publicly

traded company, we returned capital to our stockholders. During the

quarter, we paid our fixed dividend and modestly increased

production through organic capex and planned near term development

opportunities, while reducing debt. Our financial and operating

results reflect the significant cash flow our business generates as

we apply our returns-based capital allocation strategy.”

STOCKHOLDER RETURNS

On February 13, 2023, Vitesse’s Board of Directors declared a

regular quarterly cash dividend for Vitesse’s common stock of $0.50

per share for stockholders of record as of March 15, 2023, which

was paid on March 31, 2023. Additionally, Vitesse’s Board of

Directors approved a stock repurchase program authorizing the

repurchase of up to $60 million of the Company’s common stock. As

the Company continues to focus on its goal of maximizing total

stockholder return, we believe that a share repurchase program is

complementary to the dividend and is a tax efficient means to

further improve stockholder return.

In the first quarter of 2023, Vitesse repurchased $0.2 million

of common stock at an average share price of $16.98.

In May 2023, Vitesse’s Board of Directors declared its second

quarterly cash dividend for Vitesse’s common stock of $0.50 per

share for stockholders of record as of June 15, 2023, which will be

paid on June 30, 2023. Subject to Board approval, contractual

restrictions and applicable law, Vitesse currently intends to pay

quarterly dividends of $0.50 per share for the foreseeable

future.

FINANCIAL AND OPERATING RESULTS

First quarter net loss of $47.8 million reflecting $77.4 million

of charges associated with the Spin-Off, including (i) a one-time

non-cash income tax expense of $44.1 million related to a change in

corporate tax status, (ii) an acceleration of $26.8 million of

non-cash equity-based compensation expense, and (iii) non-recurring

transaction costs of $6.5 million.

First quarter Adjusted Net Income was $15.6 million. Adjusted

EBITDA was $40.1 million, an increase of 6% over the first quarter

of 2022. See “Non-GAAP Financial Measures” below.

Oil and gas production for the first quarter of 2023 averaged

11,524 Boe per day, an increase of 20% from the first quarter of

2022. Oil represented 67% of production and 87% of total revenue in

the first quarter of 2023. Total revenue, including the effects of

our realized hedges, for the first quarter of 2023 was $58.7

million compared to $52.1 million for the first quarter of 2022,

despite a 20% drop in WTI oil price and a 42% drop in Henry Hub

natural gas price.

Vitesse’s realized oil and natural gas prices before hedging

were $72.95 per Bbl and $3.61 per Mcf, respectively, during the

first quarter of 2023. Vitesse hedges a portion of its oil

production to reduce the impact of price volatility on its

financial results. In the first quarter, the Company’s realized oil

price with hedging was $74.02 per Bbl.

Lease operating expenses in the first quarter of 2023 were $9.1

million, or $8.75 per Boe, an increase of 17% on a per unit basis

compared to the first quarter of 2022. The higher lease operating

expense was primarily related to increased workover activity and

inflationary pressure on service costs.

General and administrative (“G&A”) expenses for the first

quarter of 2023 totaled $10.9 million, which included $6.5 million

of costs related to the Spin-Off. Excluding these costs, G&A

would have been $4.16 per Boe, an increase of 26% on a per unit

basis compared to the first quarter of 2022. The increase in

G&A expense per Boe, excluding the Spin-Off costs, was

primarily due to higher costs associated with being a public

company.

LIQUIDITY AND CAPITAL EXPENDITURES

As of March 31, 2023, Vitesse had $3.4 million in cash and $45.0

million of borrowings outstanding on its revolving credit facility.

Vitesse had total liquidity of $128.4 million as of March 31, 2023,

consisting of cash and committed borrowing availability under its

revolving credit facility. On May 2, 2023 Vitesse amended its

revolving credit facility in conjunction with the regular

semi-annual borrowing base redetermination that reduced the

borrowing base from $265 million to $245 million, primarily related

to lower commodity prices, and reaffirmed elected commitments at

$170 million, among other items.

During the quarter, Vitesse spent $21.6 million on development

capital expenditures and $1.1 million on acquisitions of oil and

gas properties.

OPERATIONS UPDATE

As of March 31, 2023, there were 43 drilling rigs operating in

the Williston Basin of which 18 were drilling on acreage in which

Vitesse owns an interest. The Company owned an interest in 276

gross (7.2 net) wells that were either drilling or in the

completion phase, and another 408 gross (10.1 net) locations that

had been permitted for development at the end of the quarter.

2023 ANNUAL GUIDANCE

Vitesse reaffirms its previously issued 2023 annual guidance,

which is set forth below.

2023 Guidance

Annual Production (Boe per day)

10,800 - 11,800

Oil as a Percentage of Annual

Production

66% - 70%

Total Capital Expenditures ($ in

millions)

$60 -$80

FIRST QUARTER 2023 RESULTS

The following table sets forth selected financial and operating

data for the periods indicated.

($ in thousands, except production and

per unit data)

QUARTER ENDED MARCH

31,

INCREASE

(DECREASE)

2023

2022

AMOUNT

PERCENT

Financial and Operating

Results:

Revenue

Oil

$

50,486

$

52,481

$

(1,995

)

(4

%)

Natural gas

7,475

12,498

(5,023

)

(40

%)

Total revenue

$

57,961

$

64,979

$

(7,018

)

(11

%)

Operating Expenses

Lease operating expense

$

9,080

$

6,498

$

2,582

40

%

Production taxes

5,255

5,110

145

3

%

General and administrative

10,862

2,874

7,988

278

%

Depletion, depreciation, amortization, and

accretion

18,472

14,183

4,289

30

%

Equity-based compensation

27,972

5,948

22,024

370

%

Interest Expense

$

1,181

$

709

$

472

67

%

Commodity Derivative Gain

(Loss)

$

7,419

$

(36,818

)

$

44,237

(120

%)

Income Tax Expense

$

40,371

$

—

$

40,371

100

%

Production Data:

Oil (MBbls)

692

587

105

18

%

Natural gas (MMcf)

2,071

1,683

388

23

%

Combined volumes (MBoe)

1,037

867

170

20

%

Daily combined volumes (Boe/d)

11,524

9,635

1,889

20

%

Average Realized Prices before

Hedging:

Oil (per Bbl)

$

72.95

$

89.45

$

(16.50

)

(18

%)

Natural gas (per Mcf)

3.61

7.43

(3.82

)

(51

%)

Combined (per Boe)

55.88

74.93

(19.05

)

(25

%)

Average Realized Prices with

Hedging:

Oil (per Bbl)

$

74.02

$

68.51

$

5.51

8

%

Natural gas (per Mcf)

3.61

7.08

(3.47

)

(49

%)

Combined (per Boe)

56.60

60.09

(3.49

)

(6

%)

Average Costs (per Boe):

Lease operating

$

8.75

$

7.49

$

1.26

17

%

Production taxes

5.07

5.89

(0.82

)

(14

%)

General and administrative

10.47

3.31

7.16

216

%

Depletion, depreciation, amortization, and

accretion

17.81

16.36

1.45

9

%

COMMODITY HEDGING

Vitesse hedges a portion of its expected annual oil production

volumes to increase the predictability and certainty of its cash

flow and to help maintain a strong financial position. Vitesse does

not currently have hedges in place on its expected natural gas

production volumes. The following table summarizes Vitesse’s open

oil commodity derivative swap contracts scheduled to settle after

March 31, 2023.

SETTLEMENT

PERIOD

OIL (barrels)

WEIGHTED

AVERAGE

PRICE $

Swaps-Crude Oil

2023:

Q2

345,000

$

78.28

Q3

345,000

$

78.28

Q4

305,000

$

77.66

2024:

Q1

180,000

$

75.97

Q2

180,000

$

75.97

Q3

180,000

$

75.97

Q4

120,000

$

75.97

The following table presents Vitesse’s settlements on commodity

derivative instruments and unsettled gains and losses on open

commodity derivative instruments for the periods presented:

QUARTER ENDED MARCH

31,

(in thousands)

2023

2022

Realized gain (loss) on commodity

derivatives

$

742

$

(12,867

)

Unrealized gain (loss) on commodity

derivatives

6,677

(23,951

)

Total commodity derivative gain (loss)

$

7,419

$

(36,818

)

Q1 2023 EARNINGS RELEASE CONFERENCE CALL

In conjunction with Vitesse’s release of its financial and

operating results, investors, analysts and other interested parties

are invited to listen to a conference call with management on

Tuesday, May 9, 2023 at 9:00 a.m. Eastern Time.

An updated corporate slide presentation that may be referenced

on the conference call will be posted prior to the conference call

on Vitesse’s website, www.vitesse-vts.com, in the “Investor

Relations” section of the site, under “News & Events,” sub-tab

“Presentations.”

Those wishing to listen to the conference call may do so via the

Company’s website or by phone as follows:

Website:

https://event.choruscall.com/mediaframe/webcast.html?webcastid=Hh2OlEjx

Dial-In Number: 877-407-0778

(US/Canada) and 201-689-8565 (International)

Conference ID: 13738310 - Vitesse

Energy First Quarter 2023 Earnings Call

Replay Dial-In Number: 877-660-6853

(US/Canada) 201-612-7415 (International)

Replay Access Code: 13738310 -

Replay will be available through May 16, 2023

ABOUT VITESSE ENERGY, INC.

Vitesse Energy, Inc. is focused on returning capital to

stockholders through owning financial interests as a non-operator

in oil and gas wells drilled by leading US operators.

More information about Vitesse can be found at

www.vitesse-vts.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements regarding

future events and future results that are subject to the safe

harbors created under the Securities Act of 1933 and the Securities

Exchange Act of 1934. All statements other than statements of

historical facts included in this release regarding Vitesse’s

financial position, operating and financial performance,

development pace and drilling inventory, business strategy,

dividend plans and practices, guidance, Vitesse’s share repurchase

program, plans and objectives of management for future operations,

and industry conditions are forward-looking statements. When used

in this release, forward-looking statements are generally

accompanied by terms or phrases such as “estimate,” “project,”

“predict,” “believe,” “expect,” “continue,” “anticipate,” “target,”

“could,” “plan,” “intend,” “seek,” “goal,” “will,” “should,” “may”

or other words and similar expressions that convey the uncertainty

of future events or outcomes. Items contemplating or making

assumptions about actual or potential future production and sales,

market size, collaborations, and trends or operating results also

constitute such forward-looking statements.

Forward-looking statements involve inherent risks and

uncertainties, and important factors (many of which are beyond

Vitesse’s control) that could cause actual results to differ

materially from those set forth in the forward-looking statements,

including the following: changes in oil and natural gas prices; the

pace of drilling and completions activity on Vitesse’s properties;

Vitesse’s ability to acquire additional development opportunities;

potential acquisition transactions; integration and benefits of

property acquisitions, or the effects of such acquisitions on

Vitesse’s cash position and levels of indebtedness; changes in

Vitesse’s reserves estimates or the value thereof; disruptions to

Vitesse’s business due to acquisitions and other significant

transactions; infrastructure constraints and related factors

affecting Vitesse’s properties; cost inflation or supply chain

disruption; ongoing legal disputes over and potential shutdown of

the Dakota Access Pipeline; the COVID-19 pandemic and its related

economic repercussions and effect on the oil and natural gas

industry; the impact of general economic or industry conditions,

nationally and/or in the communities in which Vitesse conducts

business, including central bank policy actions, bank failures and

associated liquidity risks; changes in the interest rate

environment, legislation or regulatory requirements; conditions of

the securities markets; Vitesse’s ability to raise or access

capital; cyber-related risks; changes in accounting principles,

policies or guidelines; and financial or political instability,

health-related epidemics, acts of war (including the armed conflict

in Ukraine) or terrorism, and other economic, competitive,

governmental, regulatory and technical factors affecting Vitesse’s

operations, products and prices. Additional information concerning

potential factors that could affect future results is included in

the section entitled “Item 1A. Risk Factors” and other sections of

Vitesse’s Annual Report on Form 10-K and subsequent Quarterly

Reports on Form 10-Q, as updated from time to time in amendments

and subsequent reports filed with the SEC, which describe factors

that could cause Vitesse’s actual results to differ from those set

forth in the forward-looking statements.

Vitesse has based these forward-looking statements on its

current expectations and assumptions about future events. While

management considers these expectations and assumptions to be

reasonable, they are inherently subject to significant business,

economic, competitive, regulatory and other risks, contingencies

and uncertainties, most of which are difficult to predict and many

of which are beyond Vitesse’s control. Vitesse does not undertake

any duty to update or revise any forward-looking statements, except

as may be required by the federal securities laws.

FINANCIAL INFORMATION

Vitesse Energy, LLC is the “predecessor” of Vitesse for

financial reporting purposes. As a result, unless otherwise

indicated, the 2022 financial and operating data presented in this

release are those of Vitesse Energy, LLC.

VITESSE ENERGY, INC.

Condensed Consolidated

Statements of Operations (Unaudited)

FOR THE THREE MONTHS

ENDED

MARCH 31,

(In thousands, except share and unit

data)

2023

2022

Revenue

Oil

$

50,486

$

52,481

Natural gas

7,475

12,498

Total revenue

57,961

64,979

Operating Expenses

Lease operating expense

9,080

6,498

Production taxes

5,255

5,110

General and administrative

10,862

2,874

Depletion, depreciation, amortization, and

accretion

18,472

14,183

Equity-based compensation

27,972

5,948

Total operating expenses

71,641

34,613

Operating Income (Loss)

(13,680

)

30,366

Other (Expense) Income

Commodity derivative gain (loss), net

7,419

(36,818

)

Interest expense

(1,181

)

(709

)

Other (expense) income

(2

)

4

Total other (expense) income

6,236

(37,523

)

Income (Loss) Before Income

Taxes

$

(7,444

)

$

(7,157

)

(Provision for) Benefit from Income

Taxes

(40,371

)

—

Net Loss

(47,815

)

(7,157

)

Net income (loss) attributable to

Predecessor common unit holders

1,832

(7,157

)

Net Loss Attributable to Vitesse

Energy, Inc.

$

(49,647

)

$

—

Weighted average common shares /

Predecessor common unit outstanding–basic and diluted

29,663,644

438,625,000

Net loss per common share / Predecessor

common unit–basic and diluted

$

(1.67

)

$

(0.02

)

Net loss per Predecessor non-founder MIUs

classified as temporary equity–basic and diluted

$

—

VITESSE ENERGY, INC.

Condensed Consolidated Balance

Sheets (Unaudited)

MARCH 31,

DECEMBER 31,

(in thousands, except shares and

units)

2023

2022

Assets

Current Assets

Cash

$

3,375

$

10,007

Revenue receivable

30,396

41,393

Commodity derivatives

5,041

2,112

Prepaid expenses and other current

assets

4,056

841

Total current assets

42,868

54,353

Oil and Gas Properties-Using the

successful efforts method of accounting

Proved oil and gas properties

1,043,419

985,751

Less accumulated DD&A and

impairment

(401,281

)

(382,974

)

Total oil and gas properties

642,138

602,777

Other Property and Equipment—Net

97

114

Other Assets

Commodity derivatives

2,558

1,155

Other noncurrent assets

2,272

2,085

Total other assets

4,830

3,240

Total assets

$

689,933

$

660,484

Liabilities, Redeemable Units and

Equity

Current Liabilities

Accounts payable

$

9,627

$

7,207

Accrued liabilities

17,368

25,849

Commodity derivatives

1,094

3,439

Other current liabilities

116

184

Total current liabilities

28,205

36,679

Long-term Liabilities

Revolving credit facility

45,000

48,000

Deferred tax liability

44,854

—

Asset retirement obligations

7,354

6,823

Other noncurrent liabilities

1,406

—

Total liabilities

$

126,819

$

91,502

Commitments and Contingencies

Predecessor Redeemable Management

Incentive Units

—

4,559

Equity

Preferred stock, $0.01 par value,

5,000,000 shares authorized; 0 shares issued at March 31, 2023

—

—

Common stock, $0.01 par value, 95,000,000

shares authorized; 32,796,234 shares issued at March 31, 2023

328

—

Additional paid-in capital

612,433

—

Accumulated deficit

(49,647

)

—

Predecessor members' equity-common

units-450,000,000 units outstanding

—

564,423

Total equity

563,114

564,423

Total liabilities, redeemable units and

equity

$

689,933

$

660,484

NON-GAAP FINANCIAL MEASURES

Vitesse defines Adjusted Net Income (Loss) as net income (loss)

before (i) non-cash gains and losses on unsettled derivative

instruments, (ii) non-cash unit-based compensation, and (iii)

certain items we consider non-routine in nature, including non-cash

oil and natural gas property impairments and material general and

administrative costs related to the Spin-Off; reduced by the

estimated impact of income tax expense.

Adjusted EBITDA is defined as net income (loss) before expenses

for interest, income taxes, depletion, depreciation, amortization

and accretion, and excludes non-cash unit-based compensation and

non-cash gains and losses on unsettled derivative instruments in

addition to certain items we consider non-routine in nature,

including non-cash oil and natural gas property impairments and

material general and administrative costs related to the

Spin-Off.

Management believes the use of these non-GAAP financial measures

provides useful information to investors to gain an overall

understanding of financial performance. Specifically, management

believes the non-GAAP financial measures included herein provide

useful information to both management and investors by excluding

certain items that management believes are not indicative of

Vitesse’s core operating results. In addition, these non-GAAP

financial measures are used by management for budgeting and

forecasting as well as subsequently measuring Vitesse’s

performance, and management believes it is providing investors with

financial measures that most closely align to its internal

measurement processes.

RECONCILIATION OF ADJUSTED NET

INCOME

FOR THE THREE MONTHS

ENDED MARCH 31,

2023

(in thousands)

Loss Before Income Taxes

$

(7,444

)

Add:

Impact of Selected Items:

Unrealized loss (gain) on derivative

instruments

(6,677

)

Equity-based compensation

27,972

Adjusted for non-routine items(1)

6,548

Adjusted Income Before Adjusted Income Tax

Expense

20,399

Adjusted Income Tax Expense(2)

(4,773

)

Adjusted Net Income (non-GAAP)

$

15,626

(1) Our Adjusted Net Income calculations

exclude certain items we consider non-routine and non-recurring.

During the quarter ended March 31, 2023, adjustments for

non-routine items consisted of $6.5 million of costs related to the

Spin-Off.

(2) The Company determined the income tax

impact on the “Adjusted Income Before Adjusted Income Tax Expense,”

using the relevant statutory tax rate of 23.4%.

RECONCILIATION OF ADJUSTED

EBITDA

FOR THE THREE MONTHS

ENDED MARCH 31,

(in thousands)

2023

2022

Net loss

$

(47,815

)

$

(7,157

)

Add:

Interest expense

1,181

709

Income taxes

40,371

—

Depletion, depreciation, amortization, and

accretion

18,472

14,183

Equity-based compensation

27,972

5,948

Unrealized loss (gain) on derivatives

(6,677

)

23,951

Adjusted for non-routine items(1)

6,548

48

Adjusted EBITDA

$

40,052

$

37,682

(1) Our Adjusted EBITDA calculations

exclude certain items we consider non-routine and non-recurring.

During the quarter ended March 31, 2023, adjustments for

non-routine items consisted of $6.5 million of costs related to the

Spin-Off.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230508005574/en/

INVESTOR AND MEDIA CONTACT Ben Messier, CFA Director –

Investor Relations (720) 532-8232 benmessier@vitesse-vts.com

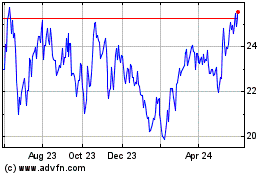

Vitesse Energy (NYSE:VTS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vitesse Energy (NYSE:VTS)

Historical Stock Chart

From Nov 2023 to Nov 2024