UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER SECURITIES EXCHANGE ACT OF 1934

For the month of September 2023

Commission File No. 001-39000

Vista Energy, S.A.B. de C.V.

(Exact Name of the Registrant as Specified in the Charter)

N.A.

(Translation of

Registrant’s Name into English)

Pedregal 24, Floor 4,

Colonia Molino del Rey, Alcaldía Miguel Hidalgo

Mexico City, 11040

Mexico

(Address of

Principal Executive Office)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

Indicate by check mark whether the registrant by furnishing the information contained

in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934:

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule

12g3-2(b): Not applicable.

Contents of this Form 6-K

This Form 6-K for Vista Energy, S.A.B. de C.V. (“Vista” or the “Company”) contains the following

exhibit:

Exhibit 1: Investor Day Presentation.

Forward-Looking Statements

Any statements contained

herein or in the attachments hereto regarding Vista that are not historical or current facts are forward-looking statements. These forward-looking statements convey Vista’s current expectations or forecasts of future events. Forward-looking

statements regarding Vista involve known and unknown risks, uncertainties and other factors that may cause Vista’s actual results, performance or achievements to be materially different from any future results, performances or achievements

expressed or implied by the forward-looking statements. Certain of these risks and uncertainties are described in the “Risk Factors,” “Forward-Looking Statements” and other applicable sections of Vista’s annual report filed

with the United States Securities and Exchange Commission (“SEC”) and other applicable filings with the SEC and the Mexican National Banking and Securities Commission (Comisión Nacional Bancaria y de Valores).

Enquiries:

Investor Relations:

ir@vistaenergy.com

Argentina: +54 11 3754 8500

Mexico: +52 55 8647 0128

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

Date: September 26, 2023

|

|

|

| VISTA ENERGY, S.A.B. DE C.V. |

|

|

| By: |

|

/s/ Alejandro Cherñacov |

| Name: |

|

Alejandro Cherñacov |

| Title: |

|

Strategic Planning and Investor Relations Officer |

Exhibit 1 STRATEGIC PLAN INVESTOR DAY SEPTEMBER 26, 2023

ABOUT PROJECTIONS AND FORWARD-LOOKING STATEMENTS ADDITIONAL INFORMATION

ABOUT VISTA ENERGY, S.A.B. DE C.V., A SOCIEDAD ANÓNIMA BURSÁTIL DE CAPITAL VARIABLE ORGANIZED UNDER THE LAWS OF MEXICO (THE “COMPANY” OR “VISTA”) CAN BE FOUND IN THE “INVESTORS” SECTION ON THE WEBSITE AT

WWW.VISTAENERGY.COM. THIS PRESENTATION DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF ANY OFFER TO BUY ANY SECURITIES OF THE COMPANY, IN ANY JURISDICTION. SECURITIES MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES OR MEXICO ABSENT

REGISTRATION WITH THE U.S. SECURITIES EXCHANGE COMMISSION (“SEC”), THE MEXICAN NATIONAL SECURITIES REGISTRY HELD BY THE MEXICAN NATIONAL BANKING AND SECURITIES COMMISSION (“CNBV”) OR AN EXEMPTION FROM SUCH REGISTRATIONS, AS

APPLICABLE. THIS PRESENTATION DOES NOT CONTAIN ALL THE COMPANY’S FINANCIAL INFORMATION. AS A RESULT, INVESTORS SHOULD READ THIS PRESENTATION IN CONJUNCTION WITH THE COMPANY’S CONSOLIDATED FINANCIAL STATEMENTS AND OTHER FINANCIAL

INFORMATION AVAILABLE ON THE COMPANY’S WEBSITE. THIS PRESENTATION CONTAINS AMOUNTS THAT ARE UNAUDITED. THIS PRESENTATION CONTAINS CERTAIN METRICS THAT DO NOT HAVE STANDARDIZED MEANINGS OR STANDARD METHODS OF CALCULATION AND THEREFORE SUCH

MEASURES MAY NOT BE COMPARABLE TO SIMILAR MEASURES USED BY OTHER COMPANIES. SUCH METRICS HAVE BEEN INCLUDED HEREIN TO PROVIDE READERS WITH ADDITIONAL MEASURES TO EVALUATE THE COMPANY’S PERFORMANCE; HOWEVER, SUCH MEASURES ARE NOT RELIABLE

INDICATORS OF THE FUTURE PERFORMANCE OF THE COMPANY AND FUTURE PERFORMANCE MAY NOT COMPARE TO THE PERFORMANCE IN PREVIOUS PERIODS. NO RELIANCE MAY BE PLACED FOR ANY PURPOSE WHATSOEVER ON THE INFORMATION CONTAINED IN THIS DOCUMENT OR ON ITS

COMPLETENESS. CERTAIN INFORMATION CONTAINED IN THIS PRESENTATION HAS BEEN OBTAINED FROM PUBLIC SOURCES, WHICH MAY NOT HAVE BEEN INDEPENDENTLY VERIFIED OR AUDITED. NO REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, IS GIVEN OR WILL BE GIVEN BY OR ON

BEHALF OF THE COMPANY, OR ANY OF ITS AFFILIATES (WITHIN THE MEANING OF RULE 405 UNDER THE ACT, “AFFILIATES”), MEMBERS, DIRECTORS, OFFICERS OR EMPLOYEES OR ANY OTHER PERSON (THE “RELATED PARTIES”) AS TO THE ACCURACY,

COMPLETENESS OR FAIRNESS OF THE INFORMATION OR OPINIONS CONTAINED IN THIS PRESENTATION OR ANY OTHER MATERIAL DISCUSSED VERBALLY, AND ANY RELIANCE YOU PLACE ON THEM WILL BE AT YOUR SOLE RISK. ANY OPINIONS PRESENTED HEREIN ARE BASED ON GENERAL

INFORMATION GATHERED AT THE TIME OF WRITING AND ARE SUBJECT TO CHANGE WITHOUT NOTICE. IN ADDITION, NO RESPONSIBILITY, OBLIGATION OR LIABILITY (WHETHER DIRECT OR INDIRECT, IN CONTRACT, TORT OR OTHERWISE) IS OR WILL BE ACCEPTED BY THE COMPANY OR ANY

OF ITS RELATED PARTIES IN RELATION TO SUCH INFORMATION OR OPINIONS OR ANY OTHER MATTER IN CONNECTION WITH THIS PRESENTATION OR ITS CONTENTS OR OTHERWISE ARISING IN CONNECTION THEREWITH. THIS PRESENTATION ALSO INCLUDES CERTAIN NON-IFRS (INTERNATIONAL

FINANCIAL REPORTING STANDARDS) FINANCIAL MEASURES WHICH HAVE NOT BEEN SUBJECT TO A FINANCIAL AUDIT FOR ANY PERIOD; THEY SHOULD NOT BE CONSIDERED IN ISOLATION OR AS A SUBSTITUTE FOR OTHER FINANCIAL METRICS THAT HAVE BEEN DISCLOSED IN ACCORDANCE WITH

IFRS. THE INFORMATION AND OPINIONS CONTAINED IN THIS PRESENTATION ARE PROVIDED AS AT THE DATE OF THIS PRESENTATION AND ARE SUBJECT TO VERIFICATION, COMPLETION AND CHANGE WITHOUT NOTICE. FOR A RECONCILIATION OF ADJUSTED EBITDA FOR THE FISCAL YEAR

ENDED DECEMBER 31, 2018 AND DECEMBER 31, 2019 TO THE CLOSEST IFRS MEASURE, PLEASE SEE OUR FORM 20-F FILED WITH THE SEC ON APRIL 28, 2021. FOR A RECONCILIATION OF ADJUSTED EBITDA FOR THE FISCAL YEARS ENDED DECEMBER 31, 2020, DECEMBER 31, 2021 AND

DECEMBER 31, 2022 TO THE CLOSEST IFRS MEASURE, PLEASE SEE OUR FORM 20-F FILED WITH THE SEC ON APRIL 24, 2023. FOR A RECONCILIATION OF ADJUSTED EBITDA FOR THE FIRST AND SECOND QUARTERS OF 2023 TO THE CLOSEST IFRS MEASURE, PLEASE SEE OUR FORM 6-K

FURNISHED ON APRIL 25 AND JULY 13, 2023. WE CANNOT PROVIDE A RECONCILIATION OF FORWARD-LOOKING NON-IFRS FINANCIAL MEASURES CONTAINED IN THIS PRESENTATION WITHOUT UNREASONABLE EFFORT, GIVEN THAT WE ARE UNABLE TO ESTIMATE THE AMOUNTS OF CERTAIN

COMPONENTS OF THE IFRS NET (LOSS) PROFIT FOR THE FORWARD-LOOKING PERIODS, INCLUDING INTEREST EXPENSE AND FOREIGN EXCHANGE GAINS (WHICH AFFECT THE IFRS MEASURE FINANCIAL RESULTS, NET) AND OUR DEFERRED INCOME TAX (WHICH AFFECTS THE IFRS MEASURE INCOME

TAX EXPENSE). DUE TO THE NATURE OF CERTAIN RECONCILING ITEMS, IT IS NOT POSSIBLE TO PREDICT WITH ANY RELIABILITY WHAT FUTURE OUTCOMES MAY BE WITH REGARD TO THE EXPENSE OR INCOME THAT MAY ULTIMATELY BE RECOGNIZED IN THE FIVE-YEAR PERIOD ENDED

DECEMBER 31, 2026. THIS PRESENTATION INCLUDES “FORWARD-LOOKING STATEMENTS” CONCERNING THE FUTURE. THE WORDS SUCH AS “PROPOSES,” “AIMS,” “ASPIRES,” “BELIEVES,” THINKS,”

“FORECASTS,” “EXPECTS,” “ANTICIPATES,” “INTENDS,” “SHOULD,” “SEEKS,” “ESTIMATES,” “FUTURE” OR SIMILAR EXPRESSIONS ARE INCLUDED WITH THE INTENTION OF

IDENTIFYING STATEMENTS ABOUT THE FUTURE. FOR THE AVOIDANCE OF DOUBT, ANY PROJECTION, GUIDANCE OR SIMILAR ESTIMATION ABOUT THE FUTURE OR FUTURE RESULTS, PERFORMANCE OR ACHIEVEMENTS IS A FORWARD- LOOKING STATEMENT. ALTHOUGH THE ASSUMPTIONS AND

ESTIMATES ON WHICH FORWARD-LOOKING STATEMENTS ARE BASED ARE BELIEVED BY OUR MANAGEMENT TO BE REASONABLE AND BASED ON THE BEST CURRENTLY AVAILABLE INFORMATION, SUCH FORWARD-LOOKING STATEMENTS ARE BASED ON ASSUMPTIONS THAT ARE INHERENTLY SUBJECT TO

SIGNIFICANT UNCERTAINTIES AND CONTINGENCIES, MANY OF WHICH ARE BEYOND OUR CONTROL. THERE WILL BE DIFFERENCES BETWEEN ACTUAL AND PROJECTED RESULTS, AND ACTUAL RESULTS MAY BE MATERIALLY GREATER OR LOWER THAN THOSE CONTAINED IN THE PROJECTIONS.

PROJECTIONS RELATED TO PRODUCTION RESULTS AS WELL AS COSTS ESTIMATIONS – INCLUDING VISTA’S ANTICIPATED PERFORMANCE AND GUIDANCE INCLUDED IN THIS PRESENTATION – ARE BASED ON INFORMATION AS OF THE DATE OF THIS PRESENTATION AND

REFLECT NUMEROUS ASSUMPTIONS INCLUDING ASSUMPTIONS WITH RESPECT TO TYPE CURVES FOR NEW WELL DESIGNS AND CERTAIN FRAC SPACING EXPECTATIONS, ALL OF WHICH ARE DIFFICULT TO PREDICT AND MANY OF WHICH ARE BEYOND OUR CONTROL AND REMAIN SUBJECT TO SEVERAL

RISKS AND UNCERTAINTIES. THE INCLUSION OF THE PROJECTED FINANCIAL INFORMATION IN THIS DOCUMENT SHOULD NOT BE REGARDED AS AN INDICATION THAT WE OR OUR MANAGEMENT CONSIDERED OR CONSIDER THE PROJECTIONS TO BE A RELIABLE PREDICTION OF FUTURE EVENTS. WE

MAY OR MAY NOT REFER BACK TO THESE PROJECTIONS IN OUR FUTURE PERIODIC REPORTS FILED OR FURNISHED UNDER THE EXCHANGE ACT OR OTHERWISE. THESE EXPECTATIONS AND PROJECTIONS ARE SUBJECT TO SIGNIFICANT KNOWN AND UNKNOWN RISKS AND UNCERTAINTIES WHICH MAY

CAUSE OUR ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS, OR INDUSTRY RESULTS, TO BE MATERIALLY DIFFERENT FROM ANY EXPECTED OR PROJECTED RESULTS, PERFORMANCE OR ACHIEVEMENTS EXPRESSED OR IMPLIED BY SUCH FORWARD-LOOKING STATEMENTS. MANY IMPORTANT

FACTORS COULD CAUSE OUR ACTUAL RESULTS, PERFORMANCE OR ACHIEVEMENTS TO DIFFER MATERIALLY FROM THOSE EXPRESSED OR IMPLIED IN OUR FORWARD-LOOKING STATEMENTS, INCLUDING, AMONG OTHER THINGS: UNCERTAINTIES RELATING TO OUR ABILITY TO BECOME NET ZERO IN

2026; FUTURE GOVERNMENT CONCESSIONS AND EXPLORATION PERMITS; ADVERSE OUTCOMES IN LITIGATION THAT MAY ARISE IN THE FUTURE; GENERAL POLITICAL, ECONOMIC, SOCIAL, DEMOGRAPHIC AND BUSINESS CONDITIONS IN ARGENTINA, MEXICO AND IN OTHER COUNTRIES IN WHICH

WE OPERATE; THE IMPACT OF POLITICAL DEVELOPMENTS AND UNCERTAINTIES RELATING TO POLITICAL AND ECONOMIC CONDITIONS IN ARGENTINA, INCLUDING THE POLICIES OF THE GOVERNMENT IN ARGENTINA; SIGNIFICANT ECONOMIC OR POLITICAL DEVELOPMENTS IN MEXICO AND THE

UNITED STATES; UNCERTAINTIES RELATING TO FUTURE ELECTION RESULTS IN ARGENTINA AND MEXICO; CHANGES IN LAW, RULES, REGULATIONS AND INTERPRETATIONS AND ENFORCEMENTS THERETO APPLICABLE TO THE ARGENTINE AND MEXICAN ENERGY SECTORS, INCLUDING CHANGES TO

THE REGULATORY ENVIRONMENT IN WHICH WE OPERATE AND CHANGES TO PROGRAMS ESTABLISHED TO PROMOTE INVESTMENTS IN THE ENERGY INDUSTRY; ANY UNEXPECTED INCREASES IN FINANCING COSTS OR AN INABILITY TO OBTAIN FINANCING AND/OR ADDITIONAL CAPITAL PURSUANT TO

ATTRACTIVE TERMS; ANY CHANGES IN THE CAPITAL MARKETS IN GENERAL THAT MAY AFFECT THE POLICIES OR ATTITUDE IN ARGENTINA AND/OR MEXICO, AND/OR ARGENTINE AND MEXICAN COMPANIES WITH RESPECT TO FINANCINGS EXTENDED TO OR INVESTMENTS MADE IN ARGENTINA AND

MEXICO OR ARGENTINE AND MEXICAN COMPANIES; FINES OR OTHER PENALTIES AND CLAIMS BY THE AUTHORITIES AND/OR CUSTOMERS; ANY FUTURE RESTRICTIONS ON THE ABILITY TO EXCHANGE MEXICAN OR ARGENTINE PESOS INTO FOREIGN CURRENCIES OR TO TRANSFER FUNDS ABROAD;

THE REVOCATION OR AMENDMENT OF OUR RESPECTIVE CONCESSION AGREEMENTS BY THE GRANTING AUTHORITY; OUR ABILITY TO IMPLEMENT OUR CAPITAL EXPENDITURES PLANS OR BUSINESS STRATEGY, INCLUDING OUR ABILITY TO OBTAIN FINANCING WHEN NECESSARY AND ON REASONABLE

TERMS; GOVERNMENT INTERVENTION, INCLUDING MEASURES THAT RESULT IN CHANGES TO THE ARGENTINE AND MEXICAN, LABOR MARKETS, EXCHANGE MARKETS OR TAX SYSTEMS; CONTINUED AND/OR HIGHER RATES OF INFLATION AND FLUCTUATIONS IN EXCHANGE RATES, INCLUDING THE

DEVALUATION OF THE MEXICAN PESO OR ARGENTINE PESO; ANY FORCE MAJEURE EVENTS, OR FLUCTUATIONS OR REDUCTIONS IN THE VALUE OF ARGENTINE PUBLIC DEBT; CHANGES TO THE DEMAND FOR ENERGY; UNCERTAINTIES RELATING TO THE EFFECTS OF THE COVID-19 OUTBREAK AND

ITS DIFFERENT VARIANTS; THE EFFECTS OF A PANDEMIC OR EPIDEMIC AND ANY SUBSEQUENT MANDATORY REGULATORY RESTRICTIONS OR CONTAINMENT MEASURES; ENVIRONMENTAL, HEALTH AND SAFETY REGULATIONS AND INDUSTRY STANDARDS THAT ARE BECOMING MORE STRINGENT; ENERGY

MARKETS, INCLUDING THE TIMING AND EXTENT OF CHANGES AND VOLATILITY IN COMMODITY PRICES, AND THE IMPACT OF ANY PROTRACTED OR MATERIAL REDUCTION IN OIL PRICES FROM HISTORICAL AVERAGES; CHANGES IN THE REGULATION OF THE ENERGY AND OIL AND GAS SECTOR IN

ARGENTINA AND MEXICO, AND THROUGHOUT LATIN AMERICA; OUR RELATIONSHIP WITH OUR EMPLOYEES AND OUR ABILITY TO RETAIN KEY MEMBERS OF OUR SENIOR MANAGEMENT AND KEY TECHNICAL EMPLOYEES; THE ABILITY OF OUR DIRECTORS AND OFFICERS TO IDENTIFY AN ADEQUATE

NUMBER OF POTENTIAL ACQUISITION OPPORTUNITIES; OUR EXPECTATIONS WITH RESPECT TO THE PERFORMANCE OF OUR RECENTLY ACQUIRED BUSINESSES; OUR EXPECTATIONS FOR FUTURE PRODUCTION, COSTS AND CRUDE OIL PRICES USED IN OUR PROJECTIONS; UNCERTAINTIES INHERENT

IN MAKING ESTIMATES OF OUR OIL AND GAS RESERVES, INCLUDING RECENTLY DISCOVERED OIL AND GAS RESERVES; INCREASED MARKET COMPETITION IN THE ENERGY SECTORS IN ARGENTINA AND MEXICO; AND POTENTIAL CHANGES IN REGULATION AND FREE TRADE AGREEMENTS AS A

RESULT OF U.S., MEXICAN OR OTHER LATIN AMERICAN POLITICAL CONDITIONS. FURTHER INFORMATION CONCERNING RISKS AND UNCERTAINTIES ASSOCIATED WITH THESE FORWARD-LOOKING STATEMENTS AND VISTA’S BUSINESS CAN BE FOUND IN VISTA’S PUBLIC DISCLOSURES

FILED ON EDGAR (WWW.SEC.GOV) OR AT THE WEB PAGE OF THE MEXICAN STOCK EXCHANGE (WWW.BMV.COM.MX). FORWARD-LOOKING STATEMENTS SPEAK ONLY AS OF THE DATE ON WHICH THEY WERE MADE, AND WE UNDERTAKE NO OBLIGATION TO RELEASE PUBLICLY ANY UPDATES OR REVISIONS

TO ANY FORWARD-LOOKING STATEMENTS CONTAINED HEREIN BECAUSE OF NEW INFORMATION, FUTURE EVENTS OR OTHER FACTORS. IN LIGHT OF THESE LIMITATIONS, UNDUE RELIANCE SHOULD NOT BE PLACED ON FORWARD-LOOKING STATEMENTS CONTAINED IN THIS PRESENTATION. YOU

SHOULD NOT TAKE ANY STATEMENT REGARDING PAST TRENDS OR ACTIVITIES AS A REPRESENTATION THAT THE TRENDS OR ACTIVITIES WILL CONTINUE IN THE FUTURE. ACCORDINGLY, YOU SHOULD NOT PUT UNDUE RELIANCE ON THESE STATEMENTS. THIS PRESENTATION IS NOT INTENDED TO

CONSTITUTE AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE. OTHER INFORMATION VISTA ROUTINELY POSTS IMPORTANT INFORMATION FOR INVESTORS IN THE INVESTOR RELATIONS SUPPORT SECTION ON ITS WEBSITE, WWW.VISTAENERGY.COM. FROM TIME TO TIME, VISTA MAY USE

ITS WEBSITE AS A CHANNEL OF DISTRIBUTION OF MATERIAL INFORMATION. ACCORDINGLY, INVESTORS SHOULD MONITOR VISTA’S INVESTOR RELATIONS WEBSITE, IN ADDITION TO FOLLOWING VISTA’S PRESS RELEASES, SEC FILINGS, PUBLIC CONFERENCE CALLS AND

WEBCASTS. 02

AGENDA Welcome ▪ Alejandro Cherñacov – Co-founder and

Strategic Planning & Investor Relations Officer Accelerating value creation with a larger, more efficient and sustainable company ▪ Miguel Galuccio – Founder, Chairman of the Board and Chief Executive Officer Reinforcing our 2026 net

zero ambition for scope 1 & 2 emissions ▪ Gabriela Prete – Sustainability & QHSE Manager Operational excellence expected to drive further growth, efficiency and value ▪ Juan Garoby – Co-founder and Chief Operating

Officer ▪ Matías Weissel – Operations Manager Our path to continue delivering superior total shareholder return ▪ Pablo Vera Pinto – Co-founder and Chief Financial Officer ▪ Alejandro Cherñacov Q&A

03

ACCELERATING VALUE CREATION WITH A LARGER, MORE EFFICIENT AND SUSTAINABLE

COMPANY MIGUEL GALUCCIO FOUNDER, CHAIRMAN AND CHIEF EXECUTIVE OFFICER 04

DELIVERING ON OUR ORIGINAL 5-YEAR VISION (1) 2018 2023Δ Production

24.5 +2x ~65.0 Mboe/d Exit rate Dec-23F ~900 (2) Adj. EBITDA 195 +4x Q4-23F annualized $MM run rate Adj. EBITDA margin 45% +22 p.p. 67% % LTM De-risked Vaca Muerta Acreage 54 ~4x 200+ M acres current (3) P1 Reserve Valuation 0.6 ~5x 3.2 $ Bn YE 2022

Our vision as presented during the initial (1) Includes Q1 2018 pro forma results aggregating production and costs from assets acquired conventional assets + Impairment (recovery) of long-lived assets + other adjustments (4) on April 4, 2018 (3)

Based con Company reserves reports as filed with the SEC. YE-18 reserves valued at 65.0 business combination (2) Adj. EBITDA = Net (loss) / profit for the period + Income tax (expense) / benefit + Financial $/bbl and YE-22 reserves valued at 72.3

$/bbl results, net + Depreciation, depletion and amortization + Transaction costs related to (4) Data from our Investor Presentation dated February 19, 2018 business combinations + Restructuring and reorganization expenses + Gain related to the

transfer of conventional assets + Other non-cash costs related to the transfer of 05

STRONG STRATEGIC FOUNDATIONS ALIGNED WITH THE GLOBAL ENERGY LANDSCAPE

Global energy demand growth calls Strong foundations support our for supply that is: strategic plan: Deep, Peer-leading ready-to-drill, Reliable operating short-cycle performance well inventory Affordable Robust Sustainability- balance focused

Sustainable sheet culture 06

VACA MUERTA ’S RISING STAR (1) Best quartile in upstream oil &

gas GHG Growing oil production in Argentina (3) emission intensity Mbbl/d kgCO /boe Medanito (light crude) exports 2 800 0% 4% 5% 12% 13% (as % of total production) Kuwait 8.0 Norway 600 8.1 Saudi Arabia 14.0 Other UAE 15.5 400 Argentina VM 15.8

China 16.8 200 Vaca Azerbaijan 17.3 Muerta Egypt 17.6 0 US 19.9 Russia 20.7 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023F Iraq 20.8 Iran 21.6 Brazil (2) 21.8 Best-in-class average well productivity Angola 23.0 UK First 365 days cumulative

production, Mbbl per 1,000 feet of lateral 24.2 Kazakhastan 24.5 30 Malaysia 27.0 Algeria 21 28.2 20 19 15 Oman 30.1 11 Indonesia 31.9 Nigeria 33.4 Qatar 36.2 Canada 36.6 Vaca Permian Bakken Eagle Permian DJ Basin Australia 41.1 Muerta Delaware Ford

Midland Libya 41.8 Mexico 42.3 (1) Source: Argentine Secretary of Energy, Company analysis (2) Includes only horizontal oil wells put on production in 2021-2022. Source: Rystad Energy ShaleWellCube (3) Top 26 oil and gas producing countries (>1

MMboe per day). Source: McKinsey, “Vaca Muerta: An opportunity to respond to the global energy crisis”, published in October 2022 07

SIGNIFICANT SCALABILITY AND OPTIONALITY IN OUR ASSET PORTFOLIO Initial

business combination Today April 2018 September 2023 Shale acres Shale acres 206k 54k Well inventory Well inventory 1,150 400 Successful de-risking and business development activity significantly expanded our value creation potential Note: the maps

exclude Mexico assets and Acambuco concession 08

WELL POSITIONED TO ACCELERATE VALUE GENERATION ▪ Delivering above

target on all operational goals ▪ Strengthened balance sheet Key milestones ▪ All production and development contracts in place, achieved with the right partners and the right incentives ▪ Secured capacity in treatment and

evacuation infrastructure ▪ Consolidated export-oriented strategy 09

SHIFTING GEARS TO PROPEL SUSTAINABLE VALUE CREATION RAISING 2026 TARGETS

(2) (3) (1) CASH AVAILABLE GHGE INTENSITY PRODUCTION Adj. EBITDA $Bn, cumulative 2022-2026 kgCO2e/boe Mboe/d $Bn + acreage + D&C capex + infrastructure -22% +25% +55% 9 1.0 80 1.1 100 1.7 1.0 7 Previous New Previous New Previous New Previous New

Maintaining cash available, Reinforcing our even after funding additional ambition to become acreage, higher capex and (3) Net Zero by 2026 infrastructure upfront payments (1) Adj. EBITDA = Net (loss) / profit for the period + Income tax (expense) /

benefit + Financial results, net + Depreciation, depletion and amortization + Transaction costs related to business combinations + Restructuring and reorganization expenses + Gain related to the transfer of conventional assets + Other non-cash costs

related to the transfer of conventional assets + Impairment (recovery) of long-lived assets + other adjustments (2) Cash available = Opening cash balance + cash flow from operating activities – capital expenditures – cash in/(from)

acquisitions & divestitures – minimum cash (3) Scope 1 and 2 GHG emissions 10

Our 2030 vision Vista in 2026 Annual cash (1) Production forecast

generation forecast ~500 ~150 150 100 Inventory forecast ~50 237 913 1H-23A 2026F 2030F (1) Cash generation = cash flow from operating activities – capital expenditures – cash in/(from) acquisitions & divestitures 11

REINFORCING OUR 2026 NET ZERO AMBITION FOR SCOPE 1 & 2 EMISSIONS

GABRIELA PRETE SUSTAINABILITY & QHSE MANAGER 12

ROBUST PROGRESS IN DECARBONIZING OUR OPERATIONS (1) GHG emission intensity

kgCO e/boe 2 Lowered 2026 GHG -64% (1) emission intensity target 39 24 18 22% to 7 kgCO2e/boe 14 2020A 2021A 2022A Q4-22A Planned operational decarbonization projects: Ongoing operational decarbonization projects ✓ Full roll-out of compressed

air instrumentation ✓ Vapor recovery units ✓ Compression units electrification ✓ Blanketing gas ✓ Drilling rigs electrification ✓ Glycol dehydration process ✓ Renewable energy ✓ Compressed air

instrumentation (1) Scope 1 & 2 GHG emissions 13

NBS PROJECTS: FROM AMBITION TO REALITY Path to net zero ambition MTonCO e

2 500 Our Nature Based Solutions (NBS) venture 250 designs, manages and executes carbon capture projects, staffed with leading local experts, to Scope 1 & 2 emissions offset our remaining carbon emissions 0 (1) Offsets Executing NBS projects for

Vista in Argentina: -250 • Spanning over 19,000 hectares • in 7 different locations 2022A 2023E 2024F 2025F 2026F • across 4 provinces Net carbon emissions (1) Includes carbon removal & avoided emissions 14

Rolón Cué project • Afforestation project initiated in

September 2022, extending Corrientes, Argentina across 3,300 ha Managed by Aike • Successfully planted 2.2 million trees of 15 native and exotic species in degraded grasslands, achieving high growth rates and a survival rate of +90% •

Once the project is finalized, 42% of the hectares will be left standing in perpetuity with native species, and the remaining 58% with exotics • Currently undergoing Verified Carbon Standard and Climate, Community and Biodiversity

certification processes under the Verra standard 15

OPERATIONAL EXCELLENCE EXPECTED TO DRIVE FURTHER GROWTH, EFFICIENCY AND

VALUE JUAN GAROBY CO-FOUNDER AND CHIEF OPERATING OFFICER MATÍAS WEISSEL OPERATIONS MANAGER 16

DOUBLED PRODUCTION AND QUADRUPLED RESERVES WITH STRONG SAFETY PERFORMANCE

(2) Production Proved Reserves TRIR Mboe/d MMboe +2x +4x 3.39 252 48.6 Consistently 182 38.8 below 1 128 29.1 26.6 24.5 102 1.30 0.86 58 0.38 0.39 (1) 2018 2019 2020 2021 2022 YE-18 YE-19 YE-20 YE-21 YE-22 2018 2019 2020 2021 2022 Outperformed

previous target of 46 Mboe/d by 6% (1) Includes Q1 2018 pro forma results aggregating production and costs from assets acquired on April 4, 2018 (2) TRIR (Total Recordable Injury Rate): Recordable work-related injury rate per 1,000,000 hours worked

17

REDUCED COSTS WITH FASTER WELL DELIVERY (1) (1) OPERATIONAL ACCELERATION

COST REDUCTION 2019 2022 2019 2022 Drilling Speed 602 1,056 75% Drilling 775 630 19% ft/day $/lateral ft Completion Speed 6.3 7.9 25% Completion 210 147 30% stages/day $M/stage Pad Construction 130 88 D&C 16.6 12.7 32% 23% (2) (2) Cycle days/pad

$MM per well (1) Vintage: 2019 includes pads BPO-1 and BPO-2 , 2022 includes pads BPO-11 to BPO-15 (2) Normalized to a standard well design of 2,800 meters lateral length and 47 completion stages well 18

HALVED OPERATING UNIT COSTS THROUGH SCALE AND EFFICIENCY Total operating

unit cost $/boe -50% 32.1 (1) Lifting cost 13.9 16.0 65% savings 4.8 (2) Development cost 16.9 40% savings 9.9 (3) Midstream cost 1.3 1.3 2018 Q2-23 (1) Lifting cost includes production, in-field transportation, treatment and field support services;

excludes crude stock (2) Development cost is calculated as: (i) D&C cost per well plus 10% (to account for well tie-in costs); divided by (ii) EUR fluctuations, depreciation, royalties, direct taxes, commercial, exploration, G&A costs and

other non-cash costs related (3) Trunk pipeline transportation only to the transfer of conventional assets. Includes Q1 2018 pro forma results aggregating production and costs from assets acquired on April 4, 2018 19

CONSISTENT PRODUCTIVITY IMPROVEMENT DELIVERING PRODUCTION GROWTH

Development hub productivity (4) Development hub production (1) above type curve Mboe/d Mboe 50 Bajada del Palo Oeste (2) BPO Type Curve Bajada del Palo Este +8% 40 (3) Vista Average Well Aguada Federal 584 543 +1% 30 369 +2% 365 20 +4% 229 224 125

10 120 0 Sep-20 Jan-21 May-21 Aug-21 Dec-21 Apr-22 Aug-22 Dec-22 Apr-23 Aug-23 90 days 180 days 360 days 720 days (1) Includes all wells in Bajada del Palo Oeste, Bajada del Palo Este and Aguada Federal normalized to a standard well (3) Normalized

average cumulative production of wells in Bajada del Palo Oeste, Bajada del Palo Este and Aguada Federal design of 2,800 meters lateral length and 47 completion stages well that have been on production for at least 90, 180, 360 and 720 days. The

number of wells included in each timeframe is (2) EUR: 1.52 Mmboe 74, 69, 52 and 32 wells, respectively (4) Production prior to shale oil wells shut-in during Q2-20 not shown 20

TRIPLED WELL INVENTORY WHILE CONSOLIDATING OUR CORE DEVELOPMENT HUB

Neuquén Río Negro Evolution of well inventory Number of wells Águila Mora (AM) 100 21.1k net acres De-risking wells Acquisitions Aguada Federal (AF) Bandurria Norte (BN) 24.1k acres 26.4k acres Bajada del Palo Este (BPE) 150 48.9k

acres wells 150 wells 150 550 wells wells 50 wells Bajada del Palo Oeste (BPO) BPO BPO AF BN BPE BPE AM CAN Vista concessions Total 62.6k acres # Well inventory Coirón Amargo Norte (CAN) 2019 2021 2022 2022 2022 2023 2023 2023 22.5k net acres

Vista development hub Vista oil treatment plant 21

Drilling and completion Extended contracts with One Team partners •

2 drilling rigs • 1 spudder rig WE HAVE SECURED • 1 completion set Treatment THE CAPACITY Modular facility expansions to gather and treat incremental production TO DELIVER • 70 Mbbl/d by end of Q3-23 ON OUR NEW • 85 Mbbl/d by

end of Q2-24 • 90 Mbbl/d by YE-24 GROWTH TARGETS • 100 Mbbl/d by YE-26 (1) Evacuation Signed contracts with Oldelval, OTE, VMN pipeline and OTASA/OTC/ENAP • 68 Mbbl/d by YE-23 • 80 Mbbl/d by YE-24 • 100 Mbbl/d by YE-25

(1) Based on contracts signed by Vista and data provided by project operators. Actual delivery dates might change subject to execution. Capacities include firm pipeline capacity in Oldelval of 35 Mbbl/d and additional capacity using

friction-reducing agents of 9 Mbbl/d 22

ACCELERATING ACTIVITY TO DRIVE FURTHER GROWTH Shale wells tied-in +48%

Number of wells Previous targets 46 46 46 +33% 2024-26 31 40 34 30 2023E 2024F 2025F 2026F Capex in $MM 725 900 800 800 Investment in: ~500 ~720 ~720 ~720 New wells (1) ~225 ~180 ~80 ~80 Facilities, technology & NBS (1) Facilities capex includes

investment in gathering and transportation, gas separation, treatment and compression, oil and water treatment, power grids, and other. Includes 20 $MM of payments to Vaca Muerta Norte project during 2023. Does not include upfront payments in

Oldelval and OTE expansion projects (for details on such payments please refer to slide 33) 23

TARGET TO DOUBLE PRODUCTION WITH FURTHER EFFICIENCY GAINS (1) Production

Lifting cost Mboe/d $/boe +82% -27% 6.0 5.5 100 -33% +25% 85 4.5 4.2 4.0 70 80 55 62 2023E 2024F 2025F 2026F 2023E 2024F 2025F 2026F Previous targets (1) Lifting cost includes production, transportation, treatment and field support services;

excludes crude stock fluctuations, depreciation, royalties, direct taxes, commercial, exploration, G&A costs and other non-cash costs related to the transfer of conventional assets 24

SIGNIFICANT INVENTORY EXPECTED TO SUPPORT GROWTH BEYOND 2026 Projected

evolution of well inventory Number of wells 1,150 Planned wells on 237 production by 2026 Aguila Mora and Bandurria Norte 27% upside Planned wells to be 913 drilled after 2026 73% Core development hub Total inventory 25

SUPERIOR TOTAL SHAREHOLDER RETURN PABLO VERA PINTO CO-FOUNDER AND CHIEF

FINANCIAL OFFICER ALEJANDRO CHERÑACOV CO-FOUNDER AND STRATEGIC PLANNING & INVESTOR RELATIONS OFFICER 26

ND BUILT 2 LARGEST VACA MUERTA OIL PRODUCER (1) AND TOP EXPORTER IN 5

YEARS (2) Shale oil production by operator Vista oil export volumes MMbbl VISTA ~3x 14% Operator 1 9.2 58% 6.6 Operator 2 10% 3.1 2.8 Operator 3 7% 55% 44% 44% Operator 4 28% 4% 2019A 2020A 2021A 2022A 2023E Operator 5 Operator 6 3% Others 3% % of

total oil sales volume 3% (1) Production data by operator from Capítulo IV, export data from dataset “Refinación y Comercialización de petróleo, gas y derivados”. Source: Argentine Secretary of Energy (2) 1H-23 oil

production. Source: Capítulo IV, Argentine Secretary of Energy 27

INDUSTRY-LEADING FINANCIAL METRICS OUTPERFORMING PREVIOUS TARGETS (1) (4)

+8 p.p. Adj. EBITDA ROACE (3) v. peers $MM % +29 p.p. 40% ~4x +15 765 p.p. +39% 25% 17% 380 550 11% 195 171 96 2% (2) 2018 2019 2020 2021 2022 +9 p.p. -5% (3) v. peers Adj. EBITDA (2) 45% 41% 35% 58% 67% margin (%) 2018 2019 2020 2021 2022 Previous

targets (1) Adj. EBITDA = Net (loss) / profit for the period + Income tax (expense) / benefit + Financial results, net + Depreciation, (2) Includes Q1 2018 pro forma results aggregating production and costs from assets acquired on April 4, 2018.

depletion and amortization + Transaction costs related to business combinations + Restructuring and reorganization (3) 2022 average of the following peers: 3R, Canacol, Devon, Diamondback, EOG, Frontera, Geopark, Gran Tierra, Matador, expenses +

Gain related to the transfer of conventional assets + Other non-cash costs related to the transfer of Pampa, Parex, Petroreconcavo, Petrorio, Pioneer, RRC and YPF conventional assets + Impairment (recovery) of long-lived assets + other adjustments

(4) ROACE = Operating profit (loss) / (Average total debt + Average total equity) 28

SOLID BALANCE SHEET SUPPORTS FURTHER GROWTH (2) Debt composition Net

Leverage Ratio $MM x Adj. EBITDA 651 611 549 540 451 Domestic 305 A+ AAA credit (1) Local rating 56% 54% 32% Cross border 50% 27% 22% 3.5x 2018 2019 2020 2021 2022 Q2-23 (3) Average interest rate 8.9% 8.3% 7.8% 7.6% 1.1x 1.1x 5.3% 51 48 0.8x 0.7x

3.0% 34 0.4x Interest expense 29 (4) p.a. ($MM) 22 16 2018 2019 2020 2021 2022 Q2-23 2018 2019 2020 2021 2022 Q2-23 (1) 2019 rating corresponds to Vista Oil and Gas Argentina S.A.: A+(arg) rating from FixScr (affiliate of Fitch (2) Local debt

includes debt to be settled in ARS pesos. Cross border includes debt to be settled in US dollars Ratings). Current rating corresponds to Vista Energy Argentina S.A.U. for the Argentine market: AAA(arg) (3) Includes dollar denominated and dollar

linked debt only rating from FixScr and AAA.ar rating from Moody’s Local (4) Q2-23 interest expense corresponds to 2023 estimate 29

REINFORCING OUR TOTAL SHAREHOLDER RETURN STRATEGY Milestones met since

2021 Investor Day Capital allocation priorities ✓ Overdelivered on operational and financial targets High-return and short-cycle projects MORE Growth to generate profitable growth driven ✓ Contracted trunk pipeline and export terminal

Growth by the export market evacuation capacity (1) ✓ Reduced operational GHG emission intensity Operational decarbonization and MORE by 64% Decarbonization NBS projects to pursue our net zero Decarbonization ambition ✓ Launched NBS

venture ✓ Extended maturity profile and reduced cost MORE of debt Deleveraging Gross leverage ratio reduction Deleveraging ✓ Significantly reduced cross-border debt Efficiently use net cash generation Strategic ✓ Acquired Aguada

Federal and Bandurria Norte MAINTAIN according to changing market Flexibility ✓ Executed 29 $MM of share buybacks flexibility dynamics (1) Scope 1 and 2 GHG emissions 30

ACCELERATING EXPORT-DRIVEN REVENUE GROWTH (1) Total revenues $MM 2,350

2,000 +42% +60% oil export volumes in 2026 1,550 1,650 1,200 Vista crude oil export volumes are projected to increase as Vaca Muerta production is 1,225 expected to continue outpacing the growth of domestic demand 2023E 2024F 2025F 2026F Previous

targets (1) Assumes a realized oil price of 65 $/bbl flat in real terms of Jan-24 31

DOUBLING ADJ. EBITDA WITH INDUSTRY-LEADING RETURNS (1) (2) Adj. EBITDA

ROACE $MM % ~2x +40% 1,700 36% 1,400 +55% 1,100 850 1,100 800 2023E 2026F 2023E 2024F 2025F 2026F Adj. EBITDA 70% 71% 71% 72% margin (%) We target to maintain gross +5p.p. Previous 65% 67% (3) targets leverage ratio at 0.4x for 2026 Previous

Previous ta tar rg gets ets (1) Adj. EBITDA = Net (loss) / profit for the period + Income tax (expense) / benefit + Financial results, net + Depreciation, depletion and (2) ROACE = Operating profit (loss) / (Average total debt + Average total

equity) amortization + Transaction costs related to business combinations + Restructuring and reorganization expenses + Gain related to the (3) Gross leverage ratio = Total financial debt / Adj. EBITDA transfer of conventional assets + Other

non-cash costs related to the transfer of conventional assets + Impairment (recovery) of long- lived assets + other adjustments 32

ROBUST CASH GENERATION EXPECTED TO DELIVER SUPERIOR TOTAL SHAREHOLDER

RETURNS Uses of cash flow from operating activities 500 400 (4) 100 Cash generation $Bn, cumulative 2022-26 $MM 2024F 2025F 2026F Sources Uses Sensitivity to crude oil realized price $Bn, cumulative cash generation 2024-26 1.6 3.8 Capex Cash flow

from 5.0 1.0 operating (1) activities 0.4 (2) 0.1 2022-23 A&D 0.1 Minimum cash (3) 1.0 Cash available 55 $/bbl 65 $/bbl 75 $/bbl Downside Plan Upside (1) Cash flow from operating activities = Adjusted EBITDA – income tax, VAT and interest

payments + changes in working (2) Acquisition of Aguada Federal & Bandurria Norte, transfer of conventional assets capital (includes midstream prepaid expenses of 148 $MM in Oldelval and OTE expansion projects) and other adjustments. (3) Cash

available = opening cash balance + cumulative cash generation – minimum cash Note: 5.0 $Bn shown above include 0.3 $Bn of opening cash balance (4) Cash generation = cash flow from operating activities – capital expenditures – cash

in/from acquisitions & divestitures 33

THANK YOU! Q&A

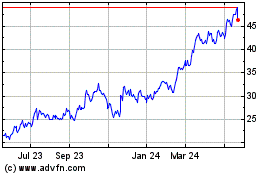

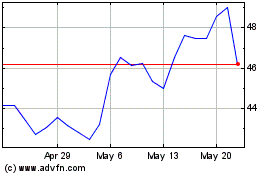

Vista Energy SAB de CV (NYSE:VIST)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vista Energy SAB de CV (NYSE:VIST)

Historical Stock Chart

From Jul 2023 to Jul 2024