Vishay Precision Group, Inc. (NYSE: VPG), a leading producer of

precision sensors and systems, today announced its results for its

fiscal 2018 first quarter ended March 31, 2018.

First Quarter Highlights:

- Growth in revenues to $73.1 million, up

22.3% year-over-year

- Earnings increased to $0.37 per diluted

share, compared to $0.15 reported last year

- Adjusted diluted EPS* increased 95% to

$0.37 compared to prior year $0.19

- Operating margin for the quarter was

11.2% as compared to 6.6% for the prior year period

- Book-to-bill remained strong at 1.05,

reflecting healthy, stable end-markets

Ziv Shoshani, Chief Executive Officer of VPG, commented, “Our

operating performance in the first quarter of 2018 demonstrates our

ability to capture opportunity across all of our end markets in the

improved business environment, delivering solid operating margins.

We continue to execute well against our business strategy and

deliver value to our stockholders.”

The Company grew first fiscal quarter 2018 net earnings

attributable to VPG stockholders to $5.0 million, or $0.37 per

diluted share, compared to $2.0 million, or $0.15 per diluted

share, in the first fiscal quarter of 2017.

The first fiscal quarter 2018 adjusted net earnings attributable

to VPG stockholders approximately doubled to $5.0 million, or $0.37

per diluted share, compared to adjusted net earnings attributable

to VPG stockholders of $2.5 million, or $0.19 per diluted share,

for the comparable prior year period. This growth was achieved

despite a foreign currency exchange rate headwind that reduced net

income for the first fiscal quarter of 2018 by $0.2 million, or

$0.02 per diluted share relative to the first fiscal quarter of

2017.

Segments

Foil Technology Products segment revenues grew 23.0% to $34.2

million in the first fiscal quarter of 2018, up from $27.8 million

in the first fiscal quarter of 2017; sequential revenue increased

14.3% compared to $29.9 million in the fourth quarter of 2017. The

year-over-year and sequential increases in revenues were

attributable to precision resistors growth in all regions,

primarily for the test and measurement market, in addition to an

increase mainly in the advanced sensors products across all

regions.

Gross profit margin for the segment was 42.8% for the first

fiscal quarter of 2018, an increase compared to 41.4% in the first

fiscal quarter of 2017 and 39.3% in the fourth fiscal quarter of

2017. The year-over-year and sequential increase in gross margin

was directly due to the volume increase experienced in the first

fiscal quarter of 2018.

Force Sensors segment revenues grew 24.3% to $19.2 million in

the first fiscal quarter of 2018, up from $15.5 million in the

first fiscal quarter of 2017; sequential revenue increased 8.5% up

from $17.7 million in the fourth quarter of 2017. The

year-over-year increase in revenues was mainly attributable to OEM

customers in the force measurement and precision weighing markets

across all regions. The increase in sequential revenue was

primarily attributable to OEM customers in the force measurement

market in Europe.

Gross profit margin for Force Sensors was 27.3% for the first

fiscal quarter of 2018, an increase compared to 23.9% in the first

fiscal quarter of 2017 and a decrease compared to 29.5% in the

fourth fiscal quarter of 2017. Gross margins were up compared to

the prior year period due to the volume increase experienced in the

first fiscal quarter of 2018. The sequential decline in gross

margins is primarily related to higher freight costs and wage

increases.

Weighing and Control Systems segment revenues grew by 19.0% to

$19.7 million in the first fiscal quarter of 2018, up from $16.6

million in the first fiscal quarter of 2017; sequential revenue

decreased 9.7% from $21.8 million in the fourth fiscal quarter of

2017. The increased year-over-year revenues were primarily

attributable to the on-board weighing and process weighing product

lines in Europe and the Americas. The comparative decrease in

sequential revenue was attributable to the significant revenues in

the steel business, primarily in Asia, that occurred in the fourth

fiscal quarter of 2017.

The first fiscal quarter 2018 gross profit margin for the

segment was 43.9%, a decrease compared to 44.3% from the first

fiscal quarter of 2017 and 44.8% from the fourth fiscal quarter of

2017. The year-over-year decline in gross margin was primarily due

to product mix. The sequential decline in gross margin was

primarily due to a reduction in volume.

Near-Term Outlook

“In light of a continued strong business environment, at

constant first fiscal quarter 2018 exchange rates, we expect net

revenues in the range of $71 million to $77 million for the second

fiscal quarter of 2018,” concluded Mr. Shoshani.

*Use of Non-GAAP Financial Information

We define “adjusted net earnings” as net earnings attributable

to VPG stockholders before restructuring costs and associated tax

effects. The reconciliation table within this release reconciles

the Company's non-GAAP measures, which are provided for comparison

with other results, to the most directly comparable U.S. GAAP

measures. Management believes that these measures are meaningful

because they provide insight with respect to intrinsic operating

results.

Conference Call and Webcast

A conference call will be held today (May 8) at 10:00 a.m. ET

(9:00 a.m. CT). To access the conference call, interested parties

may call 1-888-317-6003 or internationally 1-412-317-6061 and use

passcode 5447133, or log on to the investor relations page of the

VPG website at www.vpgsensors.com.

A replay will be available approximately one hour after the

completion of the call by calling toll-free 1-877-344-7529 or

internationally 1-412-317-0088 and by using the passcode 10119570.

The replay will also be available on the investor relations page of

the VPG website at www.vpgsensors.com for a limited time.

About VPG

Vishay Precision Group, Inc. (VPG) is an internationally

recognized designer, manufacturer and marketer of: components based

on its resistive foil technology; sensors; and sensor-based

measurement systems specializing in the growing markets of stress,

force, weight, pressure, and current measurements. VPG is a market

leader of foil technology products, providing ongoing technology

innovations in precision foil resistors and foil strain gages,

which are the foundation of the company's force sensors products

and its weighing and control systems. The product portfolio

consists of a variety of well-established brand names recognized

for precision and quality in the marketplace. To learn more, visit

VPG at www.vpgsensors.com.

Forward-Looking Statements

From time to time, information provided by us, including but not

limited to statements in this report, or other statements made by

or on our behalf, may contain "forward-looking" information within

the meaning of the Private Securities Litigation Reform Act of

1995. Such statements involve a number of risks, uncertainties, and

contingencies, many of which are beyond our control, which may

cause actual results, performance, or achievements to differ

materially from those anticipated.

Such statements are based on current expectations only, and are

subject to certain risks, uncertainties, and assumptions. Should

one or more of these risks or uncertainties materialize, or should

underlying assumptions prove incorrect, actual results may vary

materially from those anticipated, expected, estimated, or

projected. Among the factors that could cause actual results to

materially differ include: general business and economic

conditions; difficulties or delays in completing acquisitions and

integrating acquired companies; the inability to realize

anticipated synergies and expansion possibilities; difficulties in

new product development; changes in competition and technology in

the markets that we serve and the mix of our products required to

address these changes; changes in foreign currency exchange rates;

difficulties in implementing our cost reduction strategies, such as

underutilization of production facilities, labor unrest or legal

challenges to our lay-off or termination plans, operation of

redundant facilities due to difficulties in transferring production

to achieve efficiencies; and other factors affecting our

operations, markets, products, services, and prices that are set

forth in our Annual Report on Form 10-K for the fiscal year ended

December 31, 2017. We undertake no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events, or otherwise.

VISHAY PRECISION GROUP, INC. Consolidated Condensed

Statements of Operations (Unaudited - In thousands, except per

share amounts)

Fiscal quarter ended March

31, 2018 April 1, 2017 Net revenues

$

73,091 $ 59,787 Costs of products sold

44,586

37,270 Gross profit

28,505 22,517 Gross

profit margin

39.0 % 37.7 % Selling, general,

and administrative expenses

20,319 18,018 Restructuring

costs

— 554 Operating income

8,186 3,945 Operating margin

11.2 % 6.6 %

Other income (expense): Interest expense

(442

) (452 ) Other

(649 ) (529 )

Other income (expense) - net

(1,091 )

(981 ) Income before taxes

7,095 2,964 Income

tax expense

2,137 961 Net

earnings

4,958 2,003 Less: net earnings attributable to

noncontrolling interests

(30 ) 8

Net earnings attributable to VPG stockholders

$ 4,988

$ 1,995 Basic earnings per share attributable

to VPG stockholders

$ 0.37 $ 0.15 Diluted earnings

per share attributable to VPG stockholders

$ 0.37 $

0.15 Weighted average shares outstanding - basic

13,342 13,210 Weighted average shares outstanding - diluted

13,497 13,438

VISHAY PRECISION GROUP,

INC. Consolidated Condensed Balance Sheets (In thousands)

March 31, 2018 December 31, 2017

(Unaudited) Assets Current assets: Cash and cash

equivalents

$ 73,734 $ 74,292 Accounts receivable,

net

53,141 46,789 Inventories: Raw materials

18,247

16,601 Work in process

23,387 23,160 Finished goods

19,963 20,174 Inventories, net

61,597 59,935 Prepaid expenses and other current assets

12,668 10,299 Total current

assets

201,140 191,315 Property and equipment, at

cost: Land

3,484 3,434 Buildings and improvements

50,816 50,276 Machinery and equipment

97,199 95,158

Software

8,068 7,955 Construction in progress

2,501

2,252 Accumulated depreciation

(106,324 )

(103,401 ) Property and equipment, net

55,744 55,674

Goodwill

18,995 19,181 Intangible assets, net

19,748 20,475 Other assets

19,775

19,906 Total assets

$ 315,402

$ 306,551

Liabilities and equity

Current liabilities: Trade accounts payable

$ 12,953

$ 13,678 Payroll and related expenses

17,201 15,892 Other

accrued expenses

16,408 15,952 Income taxes

2,103

2,515 Current portion of long-term debt

3,926

3,878 Total current liabilities

52,591 51,915

Long-term debt, less current portion

27,717 28,477

Deferred income taxes

2,300 2,300 Other liabilities

13,968 14,131 Accrued pension and other postretirement costs

16,952 16,424 Total liabilities

113,528 113,247

Commitments and contingencies

Equity:

Common stock

1,304 1,288 Class B convertible common stock

103 103 Treasury stock

(8,765 ) (8,765 )

Capital in excess of par value

195,259 192,904 Retained

earnings

47,911 43,076 Accumulated other comprehensive loss

(33,939 ) (35,450 ) Total Vishay

Precision Group, Inc. stockholders' equity

201,873 193,156

Noncontrolling interests

1 148

Total equity

201,874 193,304

Total liabilities and equity

$ 315,402 $

306,551

VISHAY PRECISION GROUP, INC.

Consolidated Condensed Statements of Cash Flows (Unaudited - In

thousands)

Three fiscal months ended March

31, 2018 April 1, 2017 Operating

activities Net earnings

$ 4,958 $ 2,003

Adjustments to reconcile net earnings to net cash provided by

operating activities: Depreciation and amortization

2,684

2,681 Gain on disposal of property and equipment

(53

) (109 ) Share-based compensation expense

373 243

Inventory write-offs for obsolescence

613 297 Deferred

income taxes

268 (97 ) Other

(723 ) (359 ) Net

changes in operating assets and liabilities: Accounts receivable,

net

(5,519 ) (3,362 ) Inventories, net

(1,910

) 284 Prepaid expenses and other current assets

(2,517 ) (2,154 ) Trade accounts payable

1,687

1,422 Other current liabilities

1,943

2,032 Net cash provided by operating activities

1,804 2,881

Investing

activities Capital expenditures

(4,296 ) (1,962 )

Proceeds from sale of property and equipment

53

148 Net cash used in investing activities

(4,243 ) (1,814 )

Financing activities Principal payments on long-term debt

and capital leases

(2,970 ) (657 ) Proceeds from

revolving facility

8,000 7,000 Payments on revolving

facility

(3,000 ) (7,000 ) Distributions to

noncontrolling interests

(117 ) (2 ) Payments of

employee taxes on certain share-based arrangements

(785 ) (303 ) Net cash provided by (used in)

financing activities

1,128 (962 ) Effect of exchange rate

changes on cash and cash equivalents

753

694 (Decrease) increase in cash and cash equivalents

(558 ) 799 Cash and cash equivalents at

beginning of period

74,292 58,452

Cash and cash equivalents at end of period

$

73,734 $ 59,251

Supplemental

disclosure of non-cash investing transactions: Capital

expenditures purchased

$ (1,773 ) $ (1,962 )

Supplemental disclosure of non-cash financing transactions:

Conversion of exchangeable notes to common stock

$

(2,794 ) $ —

VISHAY PRECISION GROUP,

INC. Reconciliation of Consolidated Adjusted Gross Profit

Margin (Unaudited - In thousands)

Fiscal quarter ended

March 31, 2018 April 1, 2017

Gross profit

$ 28,505 $ 22,517 Gross profit margin

39.0

% 37.7 % Adjusted gross profit

$

28,505 $ 22,517 Adjusted gross profit margin

39.0 % 37.7 %

VISHAY PRECISION

GROUP, INC. Reconciliation of Consolidated Adjusted Operating

Margin (Unaudited - In thousands)

Fiscal quarter

ended March 31, 2018 April 1, 2017

Operating income

$ 8,186 $ 3,945 Operating margin

11.2 %

6.6 %

Reconciling items

affecting operating margin

Restructuring costs

— 554 Adjusted operating

income

$ 8,186 $ 4,499 Adjusted

operating margin

11.2 % 7.5 %

VISHAY

PRECISION GROUP, INC. Reconciliation of Adjusted Earnings Per

Share (Unaudited - In thousands, except per share data)

Fiscal

quarter ended March 31, 2018 April 1, 2017 Net

earnings attributable to VPG stockholders

$ 4,988 $

1,995

Reconciling items

affecting operating margin

Restructuring costs

— 554

Less reconciling

items affecting income tax expense

Tax effect of reconciling items

— 42

Adjusted net earnings attributable to VPG stockholders

$ 4,988 $ 2,507 Adjusted net

earnings per diluted share

$ 0.37 $ 0.19

Weighted average shares outstanding - diluted

13,497 13,438

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180508005433/en/

VPGFor InvestorsICR, Inc.James Palczynski,

203-682-8229jp@icrinc.comorFor MediaICR, Inc.Phil Denning,

646-277-1258phil.denning@icrinc.com

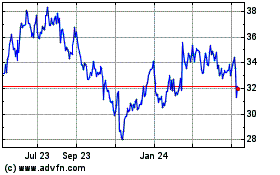

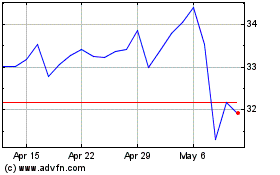

Vishay Precision (NYSE:VPG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Vishay Precision (NYSE:VPG)

Historical Stock Chart

From Jul 2023 to Jul 2024