Supplemental Financial & Operating Data Third Quarter Ended September 30, 2023 Exhibit 99.2

2Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA Forward Looking Statements Certain statements in this presentation are forward-looking statements within the meaning of the federal securities laws. Forward-looking statements are based on VICI Properties Inc.’s (“VICI” or the “Company”) current plans, expectations and projections about future events and are not guarantees of future performance. These statements can be identified by the fact that they do not relate strictly to historical facts and by the use of words such as “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “guidance,” “intends,” “plans,” “projects,” and similar expressions that do not relate to historical matters. All statements other than statements of historical fact are forward-looking statements. You should exercise caution in interpreting and relying on forward-looking statements because they involve known and unknown risks, uncertainties, and other factors which are, in some cases, beyond the Company’s control and could materially affect actual results, performance or achievements. Among those risks, uncertainties and other factors are: the impact of changes in general economic conditions and market developments, including inflation, interest rate changes, foreign currency exchange rate fluctuations, supply chain disruptions, consumer confidence levels, changes in consumer spending, unemployment levels and depressed real estate prices resulting from the severity and duration of any downturn in the U.S. or global economy; the impact of the recent and potential future interest rate increases, including our ability to successfully pursue investments in, and acquisitions of, additional properties and to obtain debt financing for such investments at attractive interest rates, or at all; risks associated with our pending and recently closed transactions, including our ability or failure to realize the anticipated benefits thereof; our dependence on our tenants at our properties, including their financial condition, results of operations, cash flows and performance, and their affiliates that serve as guarantors of the lease payments, and the negative consequences any material adverse effect on their respective businesses could have on us; our ability to obtain the financing necessary to complete any acquisitions on the terms we expect in a timely manner, or at all; the anticipated benefits of certain arrangements with certain tenants relating to our funding of "same store" capital improvements in exchange for increased rent pursuant to the terms of our agreements with such tenants, which we refer to as the VICI Partner Property Growth Fund; our borrowers’ ability to repay their outstanding loan obligations to us; our dependence on the gaming industry; the impact of extensive regulation from gaming and other regulatory authorities; the ability of our tenants to obtain and maintain regulatory approvals in connection with the operation of our properties, or the imposition of conditions to such regulatory approvals; the possibility that our tenants may choose not to renew their lease agreements with us following the initial or subsequent terms of the leases; restrictions on our ability to sell our properties subject to our lease agreements; our tenants and any guarantors’ historical results may not be a reliable indicator of their future results; our substantial amount of indebtedness, and ability to service, refinance and otherwise fulfill our obligations under such indebtedness; our historical financial information may not be reliable indicators of our future results of operations, financial condition and cash flows; our inability to successfully pursue investments in, and acquisitions of, additional properties; the possibility that we identify significant environmental, tax, legal or other issues that materially and adversely impact the value of assets acquired or secured as collateral (or other benefits we expect to receive) in any of our pending or completed transactions; the possibility of adverse tax consequences as a result of our pending or recently completed transactions, including tax protection agreements to which we are a party; increased volatility in our stock price, including as a result of our pending or recently completed transactions; our inability to maintain our qualification for taxation as a REIT; our reliance on distributions received from our subsidiaries, including VICI OP, to make distributions to our stockholders; our ability to continue to make distributions to holders of our common stock or maintain anticipated levels of distributions over time; and competition for transaction opportunities, including from other REITs, investment companies, private equity firms and hedge funds, sovereign funds, lenders, gaming companies and other investors that may have greater resources and access to capital and a lower cost of capital or different investment parameters than us. Although the Company believes that in making such forward-looking statements its expectations are based upon reasonable assumptions, such statements may be influenced by factors that could cause actual outcomes and results to be materially different from those projected. The Company cannot assure you that the assumptions upon which these statements are based will prove to have been correct. Additional important factors that may affect the Company’s business, results of operations and financial position are described from time to time in the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, Quarterly Reports on Form 10-Q and the Company’s other filings with the Securities and Exchange Commission. The Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as may be required by applicable law. Tenant, Borrower and Other Company Information The Company makes no representation as to the accuracy or completeness of the information regarding its tenants, including Bowlero Corp. (“Bowlero”), Caesars Entertainment, Inc. (“Caesars”), Century Casinos, Inc. (“Century Casinos”), Cherokee Nation Entertainment, L.L.C. (“CNE”), the Eastern Band of Cherokee Indians (“EBCI”), Foundation Gaming and Entertainment LLC (“Foundation Gaming”), Seminole Hard Rock Entertainment, Inc. (“Hard Rock”), JACK Ohio LLC (“JACK Entertainment”), MGM Resorts International (“MGM”), PENN Entertainment, Inc. (“PENN Entertainment”), PURE Canadian Gaming Corp. (“PURE Canadian”), and an affiliate of certain funds managed by affiliates of Apollo Global Management, Inc. (“Venetian Las Vegas Tenant”), borrowers and other companies included in this presentation. The historical audited and unaudited financial s tatements of Caesars, as the parent and guarantor of CEOC, LLC and MGM, as the parent and guarantor of MGM Lessee, LLC, the Company's significant lessees, have been filed with the Securities and Exchange Commission (“SEC”). Certain financia l and other information for our tenants, guarantors, borrowers and other companies included in this presentation have been derived from their respective filings, if and as applicable, and other publicly available presentations and press releases. W hile we believe this information to be reliable, we have not independently investigated or verified such data. Market and Industry Data and Trademark Information This presentation contains estimates and information concerning the Company's industry, including market position, rent growth, corporate governance, and other analyses of the Company's peers, that are based on industry publications, reports and peer company public filings. This information involves a number of assumptions and limitations, and you are cautioned not to rely on or give undue weight to this information. The Company has not independently verified the accuracy or completeness of the data contained in these industry publications, reports or filings. The industry in which the Company operates is subject to a high degree of uncertainty and risk due to a variety of factors, including those described in the "Risk Factors" section of the Company's public filings with the SEC. The brands operated at our properties are trademarks of their respective owners. None of these owners nor any of their respective officers, directors, agents or employees have approved any disclosure contained in this presentation or are responsible or liable for the content of this presentation. Non‐GAAP Financial Measures This presentation includes reference to Funds From Operations (“FFO”), FFO per share, Adjusted Funds From Operations (“AFFO”) , AFFO per share, and Adjusted EBITDA, which are not required by, or presented in accordance with, generally accepted accounting principles in the United States (“GAAP”). These are non-GAAP financial measures and should not be construed as alternatives to net income or as an indicator of operating performance (as determined in accordance with GAAP). We believe FFO, FFO per share, AFFO, AFFO per share and Adjusted EBITDA provide a meaningful perspective of the underlying operating performance of our business. For additional information regarding these non-GAAP financial measures see “Definitions of Non-GAAP Financial Measures” included in the Appendix at the end of this presentation. Financial Data Financial information provided herein is as of September 30, 2023 unless otherwise indicated. DISCLAIMERS

3Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA TABLE OF CONTENTS Corporate Overview………………………………………………………………………….. 4 Portfolio & Financial Highlights……………………………………………………………... 5 Consolidated Balance Sheets………………………………………………………………. 6-7 Consolidated Statement of Operations……………………………….…………………… 8-9 Non-GAAP Financial Measures…………………………………………………………….. 10-11 Revenue Detail……………………………………………………………………………….. 12-13 Annualized Contractual Rent and Income from Loans………………………………....... 14 2023 Guidance……………………………………………………………………………….. 15 Capitalization & Key Credit Metrics………………………………………………………… 16 Debt Detail……………………………………………………………………………………. 17 Geographic Diversification…………………………………………………………………. 18 Summary of Current Lease Terms…………………………………………………………. 19-22 Investment Activity…………………………………………………………………………… 23 Capital Markets Activity……………………………………………………………………… 24 Gaming Embedded Growth Pipeline………………………………………………………. 25 Non-Gaming Embedded Growth Pipeline…………………………………………………. 26 Analyst Coverage…………………………………………………………………………….. 27 Definitions of Non-GAAP Financial Measures…………………………….…………….... 28

4Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA CORPORATE OVERVIEW VICI Properties Inc. is an S&P 500® experiential real estate investment trust that owns one of the largest portfolios of market-leading gaming, hospitality and entertainment destinations, including Caesars Palace Las Vegas, MGM Grand and the Venetian Resort Las Vegas, three of the most iconic entertainment facilities on the Las Vegas Strip. VICI Properties owns 92 experiential assets across a geographically diverse portfolio consisting of 54 gaming properties and 38 non-gaming experiential properties across the United States and Canada. The portfolio is comprised of approximately 125 million square feet and features approximately 60,300 hotel rooms and approximately 500 restaurants, bars, nightclubs and sportsbooks. Its properties are occupied by industry-leading gaming, leisure and hospitality operators under long- term, triple-net lease agreements. VICI Properties has a growing array of real estate and financing partnerships with leading non-gaming experiential operators, including Bowlero, Great Wolf Resorts, Cabot, Canyon Ranch and Chelsea Piers. VICI Properties also owns four championship golf courses and 33 acres of undeveloped and underdeveloped land adjacent to the Las Vegas Strip. VICI Properties’ goal is to create the highest quality and most productive experiential real estate portfolio through a strategy of partnering with the highest quality experiential place makers and operators. For additional information, please visit www.viciproperties.com. Senior Management Board of Directors Contact Information Edward Pitoniak Chief Executive Officer & Director John Payne President & Chief Operating Officer David Kieske Executive Vice President, Chief Financial Officer Samantha Gallagher Executive Vice President, General Counsel & Secretary Gabriel Wasserman Senior Vice President, Chief Accounting Officer Kellan Florio Senior Vice President, Chief Investment Officer Moira McCloskey Senior Vice President, Capital Markets James Abrahamson* Director, Chairman of the Board Diana Cantor* Director, Audit Committee Chair Monica Douglas* Director Elizabeth Holland* Director, Nominating & Governance Committee Chair Craig Macnab* Director, Compensation Committee Chair Edward Pitoniak Director, Chief Executive Officer Michael Rumbolz* Director Note: * Denotes independent director Corporate Headquarters – VICI Properties Inc. 535 Madison Avenue, 20th Floor New York, New York 10022 (646) 949-4631 Public Markets Detail Ticker: VICI Exchange: NYSE Transfer Agent – Computershare 7530 Lucerne Drive, Suite 305 Cleveland, OH 44130 (800) 962‐4284 www.computershare.com Website www.viciproperties.com Investor Relations investors@viciproperties.com Public Relations pr@viciproperties.com

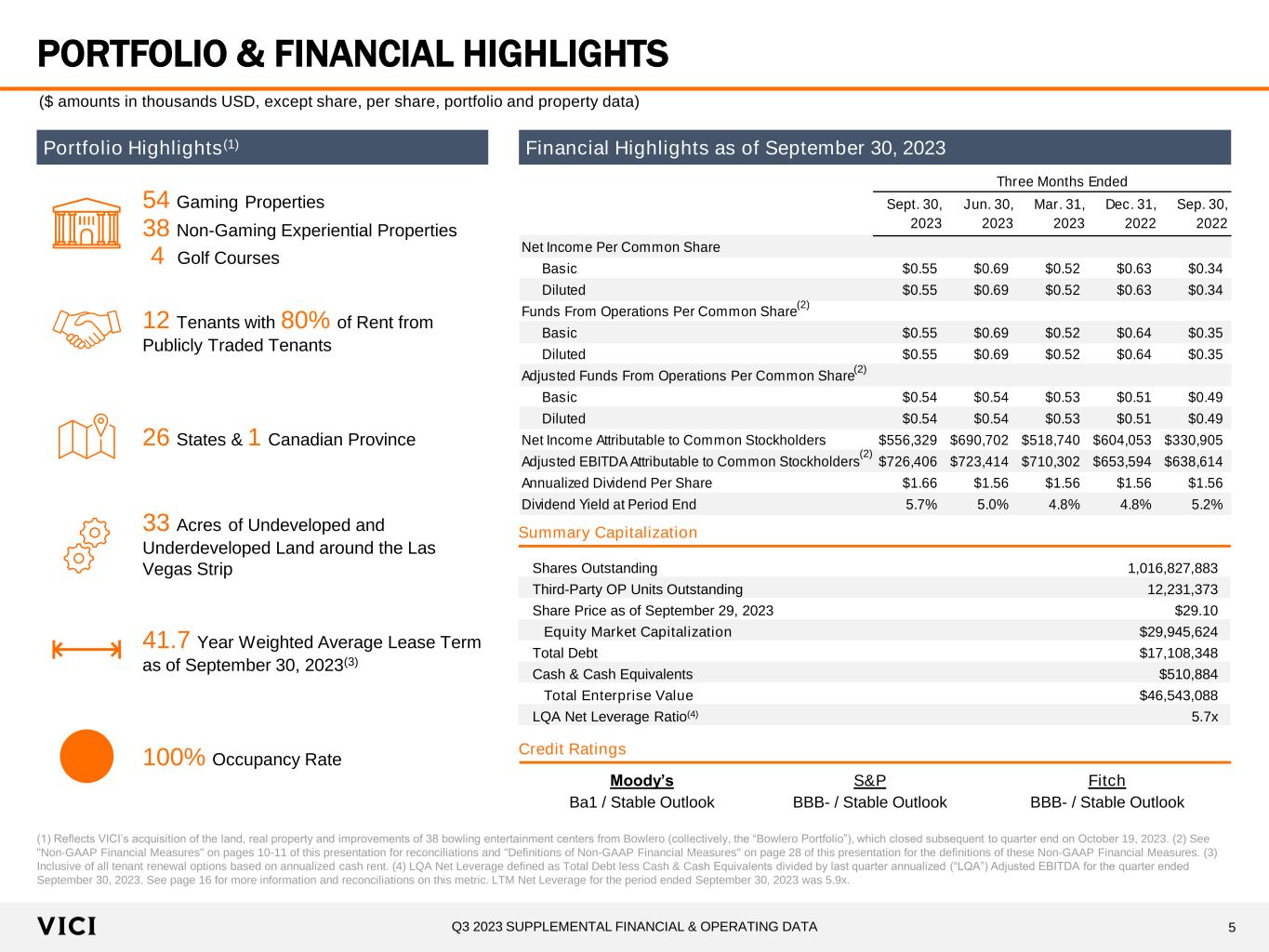

5Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA Three Months Ended Sept. 30, 2023 Jun. 30, 2023 Mar. 31, 2023 Dec. 31, 2022 Sep. 30, 2022 Net Income Per Common Share Basic $0.55 $0.69 $0.52 $0.63 $0.34 Diluted $0.55 $0.69 $0.52 $0.63 $0.34 Funds From Operations Per Common Share Basic $0.55 $0.69 $0.52 $0.64 $0.35 Diluted $0.55 $0.69 $0.52 $0.64 $0.35 Adjusted Funds From Operations Per Common Share Basic $0.54 $0.54 $0.53 $0.51 $0.49 Diluted $0.54 $0.54 $0.53 $0.51 $0.49 Net Income Attributable to Common Stockholders $556,329 $690,702 $518,740 $604,053 $330,905 Adjusted EBITDA Attributable to Common Stockholders $726,406 $723,414 $710,302 $653,594 $638,614 Annualized Dividend Per Share $1.66 $1.56 $1.56 $1.56 $1.56 Dividend Yield at Period End 5.7% 5.0% 4.8% 4.8% 5.2% PORTFOLIO & FINANCIAL HIGHLIGHTS (1) Reflects VICI’s acquisition of the land, real property and improvements of 38 bowling entertainment centers from Bowlero (collectively, the “Bowlero Portfolio”), which closed subsequent to quarter end on October 19, 2023. (2) See "Non‐GAAP Financial Measures" on pages 10-11 of this presentation for reconciliations and "Definitions of Non-GAAP Financial Measures" on page 28 of this presentation for the definitions of these Non‐GAAP Financial Measures. (3) Inclusive of all tenant renewal options based on annualized cash rent. (4) LQA Net Leverage defined as Total Debt less Cash & Cash Equivalents divided by last quarter annualized (“LQA”) Adjusted EBITDA for the quarter ended September 30, 2023. See page 16 for more information and reconciliations on this metric. LTM Net Leverage for the period ended September 30, 2023 was 5.9x. ($ amounts in thousands USD, except share, per share, portfolio and property data) Financial Highlights as of September 30, 2023 Shares Outstanding 1,016,827,883 Third-Party OP Units Outstanding 12,231,373 Share Price as of September 29, 2023 $29.10 Equity Market Capitalization $29,945,624 Total Debt $17,108,348 Cash & Cash Equivalents $510,884 Total Enterprise Value $46,543,088 LQA Net Leverage Ratio(4) 5.7x Summary Capitalization Portfolio Highlights(1) 54 Gaming Properties 33 Acres of Undeveloped and Underdeveloped Land around the Las Vegas Strip 26 States & 1 Canadian Province 41.7 Year Weighted Average Lease Term as of September 30, 2023(3) 100% Occupancy Rate 12 Tenants with 80% of Rent from Publicly Traded Tenants Moody’s S&P Fitch Ba1 / Stable Outlook BBB- / Stable Outlook BBB- / Stable Outlook Credit Ratings (2) (2) (2) 38 Non-Gaming Experiential Properties 4 Golf Courses

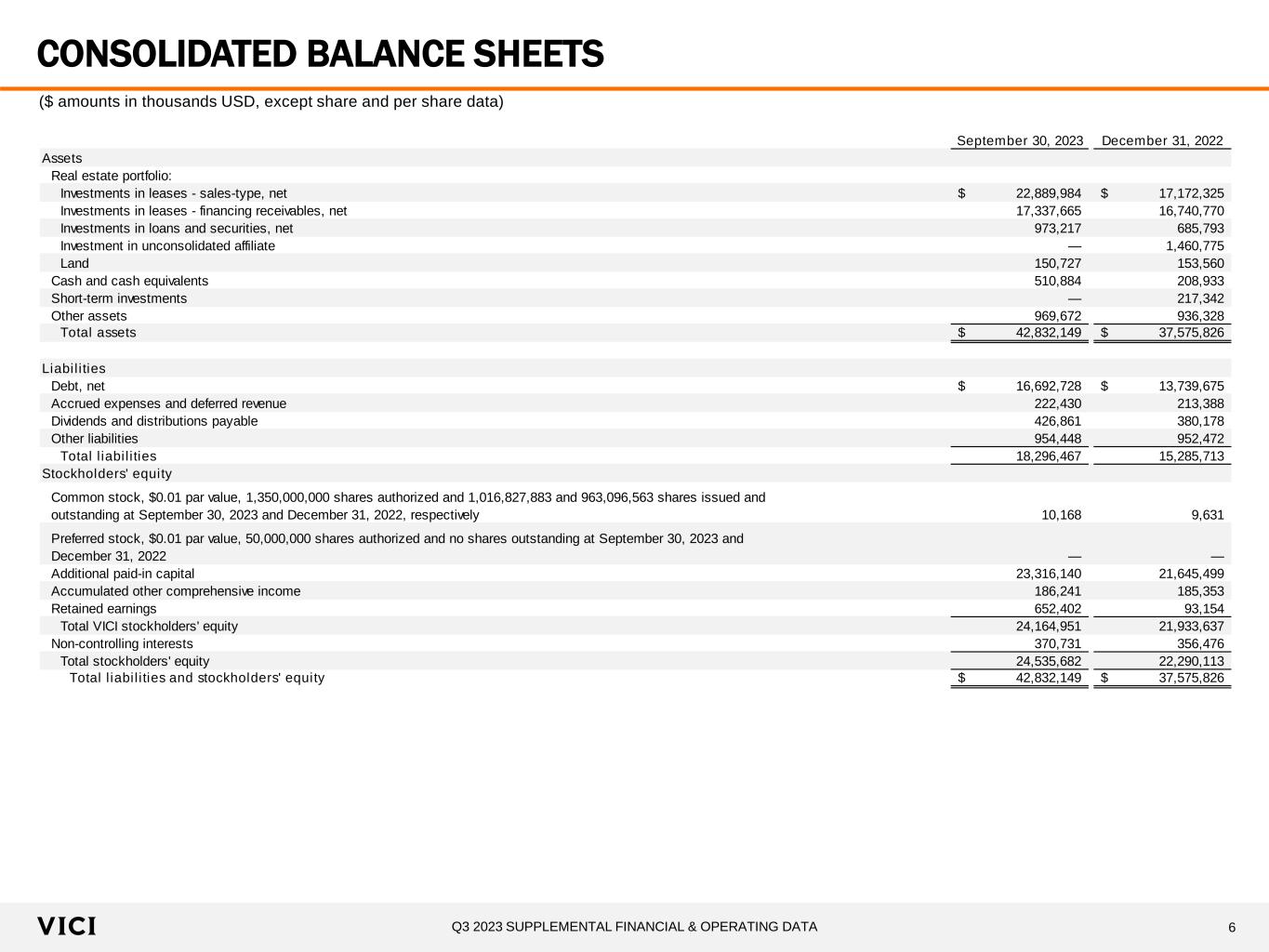

6Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA CONSOLIDATED BALANCE SHEETS ($ amounts in thousands USD, except share and per share data) September 30, 2023 December 31, 2022 Assets Real estate portfolio: Investments in leases - sales-type, net 22,889,984$ 17,172,325$ Investments in leases - financing receivables, net 17,337,665 16,740,770 Investments in loans and securities, net 973,217 685,793 Investment in unconsolidated affiliate — 1,460,775 Land 150,727 153,560 Cash and cash equivalents 510,884 208,933 Short-term investments — 217,342 Other assets 969,672 936,328 Total assets 42,832,149$ 37,575,826$ Liabilities Debt, net 16,692,728$ 13,739,675$ Accrued expenses and deferred revenue 222,430 213,388 Dividends and distributions payable 426,861 380,178 Other liabilities 954,448 952,472 Total liabilities 18,296,467 15,285,713 Stockholders' equity 10,168 9,631 — — Additional paid-in capital 23,316,140 21,645,499 Accumulated other comprehensive income 186,241 185,353 Retained earnings 652,402 93,154 Total VICI stockholders' equity 24,164,951 21,933,637 Non-controlling interests 370,731 356,476 Total stockholders' equity 24,535,682 22,290,113 Total liabilities and stockholders' equity 42,832,149$ 37,575,826$ Common stock, $0.01 par value, 1,350,000,000 shares authorized and 1,016,827,883 and 963,096,563 shares issued and outstanding at September 30, 2023 and December 31, 2022, respectively Preferred stock, $0.01 par value, 50,000,000 shares authorized and no shares outstanding at September 30, 2023 and December 31, 2022

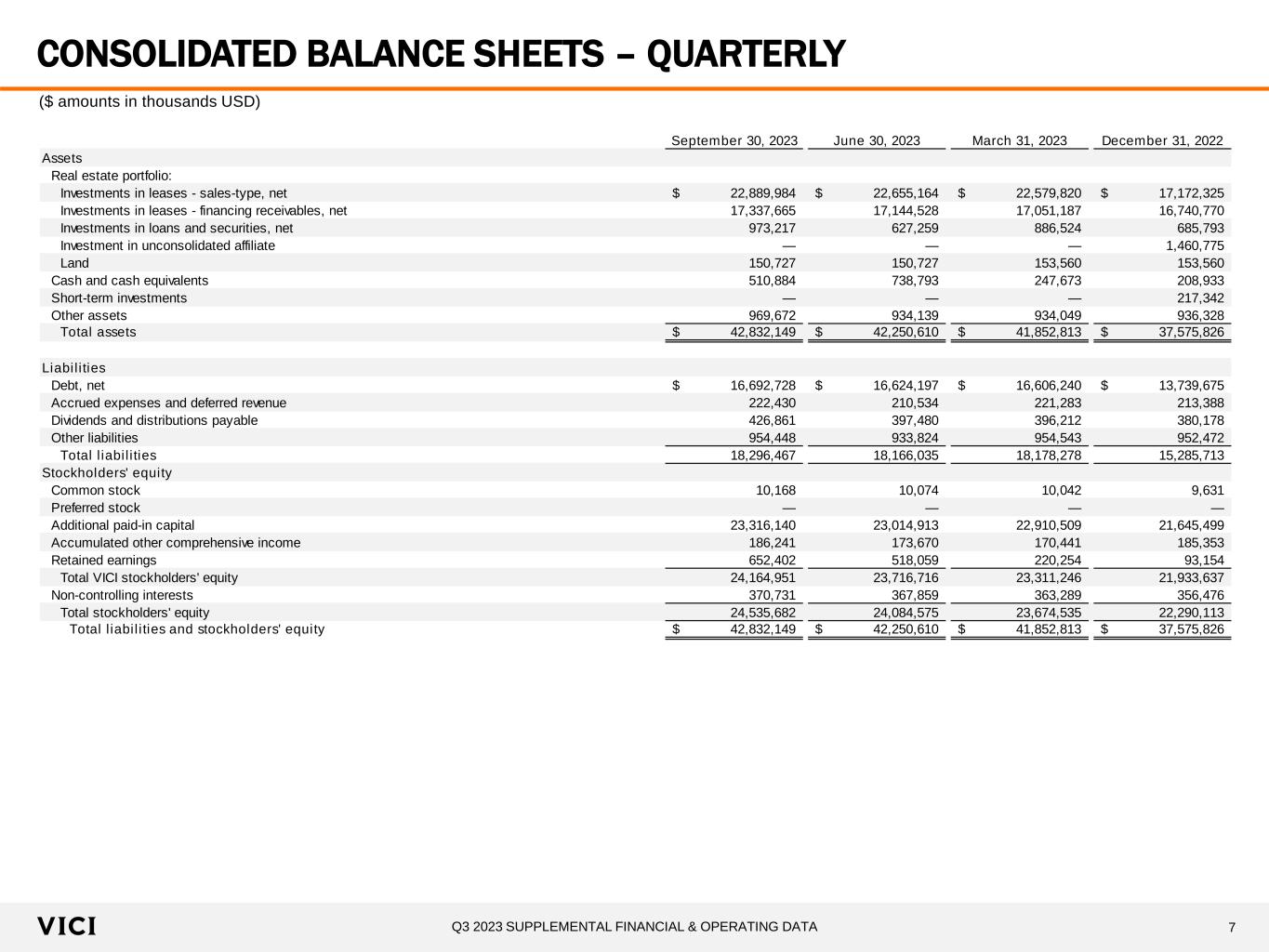

7Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA CONSOLIDATED BALANCE SHEETS – QUARTERLY ($ amounts in thousands USD) September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 Assets Real estate portfolio: Investments in leases - sales-type, net 22,889,984$ 22,655,164$ 22,579,820$ 17,172,325$ Investments in leases - financing receivables, net 17,337,665 17,144,528 17,051,187 16,740,770 Investments in loans and securities, net 973,217 627,259 886,524 685,793 Investment in unconsolidated affiliate — — — 1,460,775 Land 150,727 150,727 153,560 153,560 Cash and cash equivalents 510,884 738,793 247,673 208,933 Short-term investments — — — 217,342 Other assets 969,672 934,139 934,049 936,328 Total assets 42,832,149$ 42,250,610$ 41,852,813$ 37,575,826$ Liabilities Debt, net 16,692,728$ 16,624,197$ 16,606,240$ 13,739,675$ Accrued expenses and deferred revenue 222,430 210,534 221,283 213,388 Dividends and distributions payable 426,861 397,480 396,212 380,178 Other liabilities 954,448 933,824 954,543 952,472 Total liabilities 18,296,467 18,166,035 18,178,278 15,285,713 Stockholders' equity Common stock 10,168 10,074 10,042 9,631 Preferred stock — — — — Additional paid-in capital 23,316,140 23,014,913 22,910,509 21,645,499 Accumulated other comprehensive income 186,241 173,670 170,441 185,353 Retained earnings 652,402 518,059 220,254 93,154 Total VICI stockholders' equity 24,164,951 23,716,716 23,311,246 21,933,637 Non-controlling interests 370,731 367,859 363,289 356,476 Total stockholders' equity 24,535,682 24,084,575 23,674,535 22,290,113 Total liabilities and stockholders' equity 42,832,149$ 42,250,610$ 41,852,813$ 37,575,826$

8Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Revenues Income from sales-type leases 500,212$ 376,048$ 1,473,961$ 1,077,952$ Income from lease financing receivables, loans and securities 378,502 350,945 1,122,703 685,544 Other income 18,179 17,862 55,043 41,811 Golf revenues 7,425 6,688 28,416 25,484 Total revenues 904,318 751,543 2,680,123 1,830,791 Operating expenses General and administrative 14,422 12,063 44,347 33,311 Depreciation 1,011 816 2,712 2,371 Other expenses 18,179 17,862 55,043 41,811 Golf expenses 6,332 5,186 18,874 16,330 Change in allowance for credit losses 95,997 232,763 166,119 865,459 Transaction and acquisition expenses 3,566 1,947 3,385 19,366 Total operating expenses 139,507 270,637 290,480 978,648 Income from unconsolidated affiliate — 22,719 1,280 37,853 Interest expense (204,927) (169,354) (612,881) (370,624) Interest income 7,341 3,024 16,194 3,897 Other (losses) gains (1,122) — 4,295 — Income before income taxes 566,103 337,295 1,798,531 523,269 Income tax expense (644) (417) (3,630) (1,844) Net income 565,459 336,878 1,794,901 521,425 Less: Net income attributable to non-controlling interests (9,130) (5,973) (29,130) (7,843) Net income attributable to common stockholders 556,329$ 330,905$ 1,765,771$ 513,582$ Net income per common share Basic 0.55$ 0.34$ 1.75$ 0.61$ Diluted 0.55$ 0.34$ 1.75$ 0.60$ Weighted average number of shares of common stock outstanding Basic 1,012,986,784 962,573,646 1,007,110,068 848,839,357 Diluted 1,013,589,640 964,134,340 1,008,437,452 850,823,037 Impact to net income related to non-cash change in allowance for credit losses - CECL (95,997)$ (232,763)$ (166,119)$ (865,459)$ Per share impact related to non-cash change in allowance for credit losses - CECL Basic (0.09)$ (0.24)$ (0.16)$ (1.02)$ Diluted (0.09)$ (0.24)$ (0.16)$ (1.02)$ CONSOLIDATED STATEMENT OF OPERATIONS ($ amounts in thousands USD, except share and per share data) (1) (1) (1) Refer to Note 5 – Allowance for Credit Losses within our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023.

9Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA Three Months Ended September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 Revenues Income from sales-type leases 500,212$ 495,355$ 478,394$ 386,293$ Income from lease financing receivables, loans and securities 378,502 373,132 371,069 355,685 Other income 18,179 18,525 18,339 17,818 Golf revenues 7,425 11,146 9,845 10,110 Total revenues 904,318 898,158 877,647 769,906 Operating expenses General and administrative 14,422 14,920 15,005 15,029 Depreciation 1,011 887 814 811 Other expenses 18,179 18,525 18,339 17,818 Golf expenses 6,332 6,590 5,952 6,272 Change in allowance for credit losses 95,997 (41,355) 111,477 (30,965) Transaction and acquisition expenses 3,566 777 (958) 3,287 Total operating expenses 139,507 344 150,629 12,252 Income from unconsolidated affiliate — — 1,280 21,916 Interest expense (204,927) (203,594) (204,360) (169,329) Interest income 7,341 5,806 3,047 5,633 Other (losses) gains (1,122) 3,454 1,963 — Income before income taxes 566,103 703,480 528,948 615,874 Income tax expense (644) (1,899) (1,087) (1,032) Net income 565,459 701,581 527,861 614,842 Less: Net income attributable to non-controlling interests (9,130) (10,879) (9,121) (10,789) Net income attributable to common stockholders 556,329$ 690,702$ 518,740$ 604,053$ Net income per common share Basic 0.55$ 0.69$ 0.52$ 0.63$ Diluted 0.55$ 0.69$ 0.52$ 0.63$ Weighted average number of shares of common stock outstanding Basic 1,012,986,784 1,006,893,810 1,001,526,645 962,580,619 Diluted 1,013,589,640 1,007,968,422 1,003,831,325 965,299,406 Impact to net income related to non-cash change in allowance for credit losses - CECL (95,997)$ 41,355$ (111,477)$ 30,965$ Per share impact related to non-cash change in allowance for credit losses - CECL Basic (0.09)$ 0.04$ (0.11)$ 0.03$ Diluted (0.09)$ 0.04$ (0.11)$ 0.03$ CONSOLIDATED STATEMENT OF OPERATIONS – QUARTERLY (1) Refer to Note 5 – Allowance for Credit Losses within our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. ($ amounts in thousands USD, except share and per share data) (1) (1)

10Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Net income attributable to common stockholders 556,329$ 330,905$ 1,765,771$ 513,582$ Real estate depreciation — — — — Joint venture depreciation and non-controlling interest adjustments — 9,743 1,426 17,053 Funds From Operations (FFO) attributable to common stockholders(1) 556,329 340,648 1,767,197 530,635 Non-cash leasing and financing adjustments (131,344) (108,553) (383,688) (230,522) Non-cash change in allowance for credit losses 95,997 232,763 166,119 865,459 Non-cash stock-based compensation 4,019 3,493 11,517 9,359 Transaction and acquisition expenses 3,566 1,947 3,385 19,366 Amortization of debt issuance costs and original issue discount 17,283 10,326 53,645 38,294 Other depreciation 833 785 2,442 2,280 Capital expenditures (444) (437) (1,762) (1,093) Gain on extinguishment of debt and interest rate swap settlements — — — (5,405) Other losses (gains)(2) 1,122 — (4,295) — Joint venture non-cash adjustments and non-controlling interest adjustments 253 (10,315) 2,066 (22,171) Adjusted Funds From Operations (AFFO) attributable to common stockholders(1) 547,614 470,657 1,616,626 1,206,202 Interest expense, net 180,303 156,004 543,042 333,838 Income tax expense 644 417 3,630 1,844 Joint venture adjustments and non-controlling interest adjustments (2,155) 11,536 (3,176) 19,187 Adjusted EBITDA attributable to common stockholders(1) 726,406$ 638,614$ 2,160,122$ 1,561,071$ Net income per common share Basic 0.55$ 0.34$ 1.75$ 0.61$ Diluted 0.55$ 0.34$ 1.75$ 0.60$ FFO per common share Basic 0.55$ 0.35$ 1.75$ 0.63$ Diluted 0.55$ 0.35$ 1.75$ 0.62$ AFFO per common share Basic 0.54$ 0.49$ 1.61$ 1.42$ Diluted 0.54$ 0.49$ 1.60$ 1.42$ Weighted average number of shares of common stock outstanding Basic 1,012,986,784 962,573,646 1,007,110,068 848,839,357 Diluted 1,013,589,640 964,134,340 1,008,437,452 850,823,037 NON-GAAP FINANCIAL MEASURES ($ amounts in thousands USD, except share and per share data) (1) See definitions of Non-GAAP Financial Measures on page 28 of this presentation. (2) Represents non-cash foreign currency remeasurement adjustments and gain on sale of land.

11Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA Three Months Ended September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 Net income attributable to common stockholders 556,329$ 690,702$ 518,740$ 604,053$ Real estate depreciation — — — — Joint venture depreciation and non-controlling interest adjustments — — 1,426 10,093 Funds From Operations (FFO) attributable to common stockholders(1) 556,329 690,702 520,166 614,146 Non-cash leasing and financing adjustments (131,344) (129,510) (122,834) (107,109) Non-cash change in allowance for credit losses 95,997 (41,355) 111,477 (30,965) Non-cash stock-based compensation 4,019 4,031 3,467 3,627 Transaction and acquisition expenses 3,566 777 (958) 3,287 Amortization of debt issuance costs and original issue discount 17,283 16,680 19,682 10,301 Other depreciation 833 826 783 780 Capital expenditures (444) (330) (988) (709) Other losses (gains)(2) 1,122 (3,454) (1,963) — Joint venture non-cash adjustments and non-controlling interest adjustments 253 2,040 (227) (5,759) Adjusted Funds From Operations (AFFO) attributable to common stockholders(1) 547,614 540,407 528,605 487,599 Interest expense, net 180,303 181,108 181,631 153,395 Income tax expense 644 1,899 1,087 1,032 Joint venture adjustments and non-controlling interest adjustments (2,155) — (1,021) 11,568 Adjusted EBITDA attributable to common stockholders(1) 726,406$ 723,414$ 710,302$ 653,594$ Net income per common share Basic 0.55$ 0.69$ 0.52$ 0.63$ Diluted 0.55$ 0.69$ 0.52$ 0.63$ FFO per common share Basic 0.55$ 0.69$ 0.52$ 0.64$ Diluted 0.55$ 0.69$ 0.52$ 0.64$ AFFO per common share Basic 0.54$ 0.54$ 0.53$ 0.51$ Diluted 0.54$ 0.54$ 0.53$ 0.51$ Weighted average number of shares of common stock outstanding Basic 1,012,986,784 1,006,893,810 1,001,526,645 962,580,619 Diluted 1,013,589,640 1,007,968,422 1,003,831,325 965,299,406 NON-GAAP FINANCIAL MEASURES – QUARTERLY (1) See definitions of Non-GAAP Financial Measures on page 28 of this presentation. (2) Represents non-cash foreign currency remeasurement adjustments and gain on sale of land. ($ amounts in thousands USD, except share and per share data)

12Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Contractual revenue from sales-type leases Caesars Regional Master Lease (excluding Harrah's NOLA, AC, and Laughlin) & Joliet Lease 132,952$ 122,729$ 398,856$ 368,187$ Caesars Las Vegas Master Lease 113,619 105,556 340,857 316,668 MGM Grand/Mandalay Bay Lease 77,468 — 224,858 — The Venetian Resort Las Vegas Lease 64,375 62,500 191,875 150,298 Greektown Lease 13,214 12,830 39,001 38,490 Hard Rock Cincinnati Lease 11,176 11,010 33,528 33,030 Southern Indiana Lease 8,288 8,166 24,782 24,416 Century Master Lease (excluding Century Canadian Portfolio) 9,740 6,376 23,470 19,128 Margaritaville Lease 6,615 5,953 19,624 17,831 Income from sales-type leases non-cash adjustment 62,765 40,928 177,110 109,904 Income from sales-type leases 500,212 376,048 1,473,961 1,077,952 Contractual revenue from lease financing receivables MGM Master Lease 186,150 215,000 558,583 363,112 Harrah's NOLA, AC, and Laughlin 42,966 39,663 128,898 118,989 JACK Entertainment Master Lease 17,511 17,250 52,445 51,191 Mirage Lease 22,500 — 67,500 — Gold Strike Lease 10,000 — 25,000 — Foundation Master Lease 6,063 — 18,189 — PURE Master Lease 4,054 — 11,913 — Century Canadian Portfolio 887 — 887 — Income from lease financing receivables non-cash adjustment 68,586 67,629 206,625 120,614 Income from lease financing receivables 358,717 339,542 1,070,040 653,906 Contractual interest income Senior secured notes 2,344 — 4,847 — Senior secured loans 4,565 9,508 20,395 27,723 Mezzanine loans & preferred equity 12,883 1,898 27,468 3,910 Income from loans non-cash adjustment (7) (3) (47) 5 Income from loans and securities 19,785 11,403 52,663 31,638 Income from lease financing receivables, loans and securities 378,502 350,945 1,122,703 685,544 Other income 18,179 17,862 55,043 41,811 Golf revenues 7,425 6,688 28,416 25,484 Total revenues 904,318$ 751,543$ 2,680,123$ 1,830,791$ REVENUE DETAIL (1) Amounts represent non-cash adjustments to recognize revenue on an effective interest basis in accordance with GAAP. (2) Assets are part of the Caesars Regional Master Lease. (3) Assets are part of the Century Master Lease. ($ amounts in thousands USD) (1) (1) (1) (2) (3)

13Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA Three Months Ended September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 Contractual revenue from sales-type leases Caesars Regional Master Lease (excluding Harrah's NOLA, AC, and Laughlin) & Joliet Lease 132,952$ 132,952$ 132,952$ 129,544$ Caesars Las Vegas Master Lease 113,619 113,619 113,619 110,932 MGM Grand/Mandalay Bay Lease 77,468 77,468 69,922 — The Venetian Resort Las Vegas Lease 64,375 64,375 63,125 62,500 Greektown Lease 13,214 12,957 12,830 12,830 Hard Rock Cincinnati Lease 11,176 11,176 11,176 11,176 Southern Indiana Lease 8,288 8,247 8,247 8,247 Century Master Lease (excluding Century Canadian Portfolio) 9,740 6,865 6,865 6,376 Margaritaville Lease 6,615 6,615 6,394 5,953 Income from sales-type leases non-cash adjustment 62,765 61,081 53,264 38,735 Income from sales-type leases 500,212 495,355 478,394 386,293 Contractual revenue from lease financing receivables MGM Master Lease 186,150 184,933 187,500 211,855 Harrah's NOLA, AC, and Laughlin 42,966 42,966 42,966 41,866 JACK Entertainment Master Lease 17,511 17,511 17,423 17,251 Mirage Lease 22,500 22,500 22,500 3,145 Gold Strike Lease 10,000 10,000 5,000 — Foundation Master Lease 6,063 6,063 6,063 652 PURE Master Lease 4,054 4,050 3,809 — Century Canadian Portfolio 887 — — — Income from lease financing receivables non-cash adjustment 68,586 68,462 69,577 68,379 Income from lease financing receivables 358,717 356,485 354,838 343,148 Contractual interest income Senior secured notes 2,344 2,395 108 — Senior secured loans 4,565 5,566 10,264 9,801 Mezzanine loans & preferred equity 12,883 8,719 5,866 2,741 Income from loans non-cash adjustment (7) (33) (7) (5) Income from loans and securities 19,785 16,647 16,231 12,537 Income from lease financing receivables, loans and securities 378,502 373,132 371,069 355,685 Other income 18,179 18,525 18,339 17,818 Golf revenues 7,425 11,146 9,845 10,110 Total revenues 904,318$ 898,158$ 877,647$ 769,906$ REVENUE DETAIL – QUARTERLY (1) Amounts represent non-cash adjustments to recognize revenue on an effective interest basis in accordance with GAAP. (2) Assets are part of the Caesars Regional Master Lease. (3) Assets are part of the Century Master Lease. ($ amounts in thousands USD) (1) (1) (1) (2) (3)

14Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA ANNUALIZED CONTRACTUAL RENT AND INCOME FROM LOANS (1) Includes rent or a portion of rent collected in CAD, assuming an exchange rate of C$1:00:US$0.74 as of September 30, 2023. (2) Reflects VICI’s acquisition of the Bowlero Portfolio, which closed subsequent to quarter end on October 19, 2023. ($ amounts in millions USD) Caesars 39% MGM 36% Venetian 9% Hard Rock 4% PENN 3% JACK 2% Century Casinos(1) 2% Cherokee Nation 1% EBCI 1% Bowlero 1% Foundation 1% PURE Canadian(1) 1% Partnerships with 12 Tenants Total Commitments Principal Balance as of September 30, 2023 Blended Interest Rate Annualized Income from Loans Annualized Contractual Income from Loans and Securities Senior Secured Notes $85.0 $85.0 11.0% $9.4 Senior Secured Loans 916.0 333.8 7.1% 13.9 Mezzanine Loans & Preferred Equity 765.5 579.5 9.5% 55.3 Totals $1,766.5 $998.3 8.8% $78.5 Total Annualized Contractual Rent and Income from Loans and Securities $3,035.2 Assets Per Lease Tenant Annualized Rent as of October 2023 Annualized Contractual Rent MGM Master Lease 11 MGM Resorts International $744.6 Caesars Regional Master Lease & Joliet Lease 16 Caesars Entertainment 703.7 Caesars Las Vegas Master Lease 2 Caesars Entertainment 454.5 MGM Grand/Mandalay Bay Master Lease 2 MGM Resorts International 309.9 The Venetian Resort Las Vegas Lease 1 Venetian Las Vegas Tenant 257.5 Mirage Lease 1 Hard Rock Entertainment 90.0 JACK Entertainment Master Lease 2 JACK Entertainment 70.0 Century Master Lease(1) 8 Century Casinos 55.8 Greektown Lease 1 PENN Entertainment 52.9 Hard Rock Cincinnati Lease 1 Hard Rock Entertainment 46.2 Gold Strike Lease 1 Cherokee Nation Entertainment 40.0 Southern Indiana Lease 1 Eastern Band of Cherokee Indians 33.5 Bowlero Master Lease(2) 38 Bowlero 31.6 Margaritaville Lease 1 PENN Entertainment 26.5 Foundation Gaming Master Lease 2 Foundation Gaming 24.3 PURE Canadian Master Lease(1) 4 PURE Canadian Gaming 16.1 Totals 92 $2,956.8

15Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA 2023 GUIDANCE ($ amounts in millions USD, except per share data) The Company is increasing AFFO guidance for the full year 2023. In determining AFFO, the Company adjusts for certain items that are otherwise included in determining net income attributable to common stockholders, the most comparable GAAP financial measure. In reliance on the exemption provided by applicable rules, the Company does not provide guidance for GAAP net income, the most comparable GAAP financial measure, or a reconciliation of 2023 AFFO to GAAP net income because we are unable to predict with reasonable certainty the amount of the change in non-cash allowance for credit losses under ASU No. 2016-13 - Financial Instruments—Credit Losses (Topic 326) (“ASC 326”) for a future period. The non-cash change in allowance for credit losses under ASC 326 with respect to a future period is dependent upon future events that are entirely outside of the Company’s control and may not be reliably predicted, including its tenants’ respective financial performance, fluctuations in the trading price of their common stock, credit ratings and outlook (each to the extent applicable), as well as broader macroeconomic performance. Based on past results and as disclosed in the Company’s historical financial results, the impact of these adjustments could be material, individually or in the aggregate, to the Company’s reported GAAP results. For more information, see “Non-GAAP Financial Measures” on page 28 of this presentation. The Company estimates AFFO for the year ending December 31, 2023 will be between $2,170.0 million and $2,180.0 million, or between $2.14 and $2.15 per diluted common share. Guidance does not include the impact on operating results from any possible or pending future acquisitions or dispositions, capital markets activity, or other non-recurring transactions. The following is a summary of the Company’s full-year 2023 guidance: The above per share estimates reflect the dilutive effect of the 8,170,658 shares pending under the Q2 and Q3 2023 ATM Forward Sale Agreements as calculated under the treasury stock method. VICI OP Units held by a third party are reflected as non-controlling interests and the income allocable to them is deducted from net income to arrive at net income attributable to common stockholders and AFFO; accordingly, guidance represents AFFO per share attributable to common stockholders based solely on outstanding shares of VICI common stock. The estimates set forth above reflect management’s view of current and future market conditions, including assumptions with respect to the earnings impact of the events referenced in this presentation. The estimates set forth above may be subject to fluctuations as a result of several factors and there can be no assurance that the Company’s actual results will not differ materially from the estimates set forth above. Updated Guidance Prior Guidance For the Year Ending December 31, 2023: Low High Low High Estimated Adjusted Funds From Operations (AFFO) $2,170.0 $2,180.0 $2,130.0 $2,160.0 Estimated Adjusted Funds From Operations (AFFO) per common diluted share $2.14 $2.15 $2.11 $2.14 Estimated Weighted Average Common Share Count at Year End (in millions) 1,014.4 1,014.4 1,011.7 1,011.7 2023 Guidance

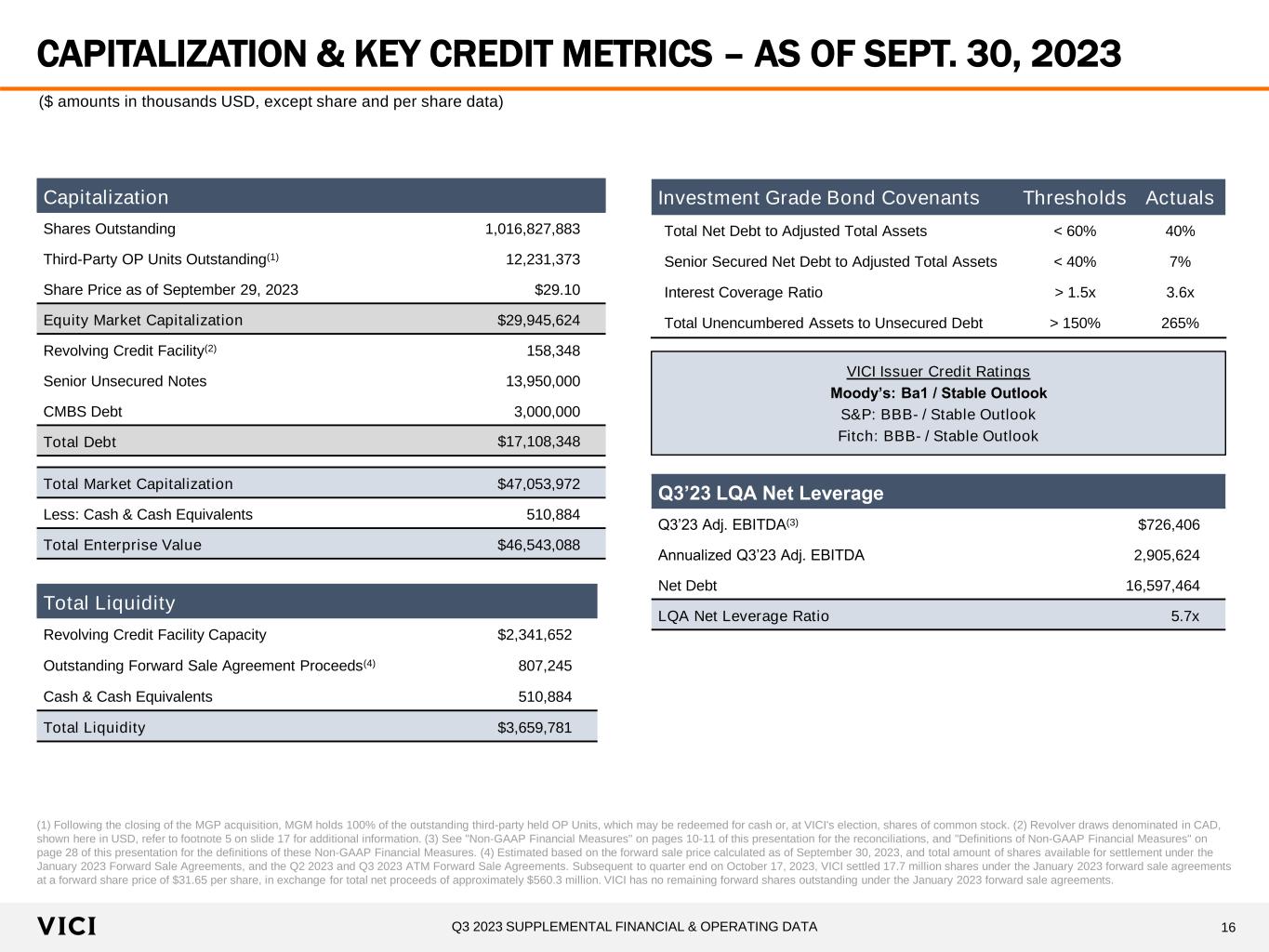

16Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA CAPITALIZATION & KEY CREDIT METRICS – AS OF SEPT. 30, 2023 (1) Following the closing of the MGP acquisition, MGM holds 100% of the outstanding third-party held OP Units, which may be redeemed for cash or, at VICI's election, shares of common stock. (2) Revolver draws denominated in CAD, shown here in USD, refer to footnote 5 on slide 17 for additional information. (3) See "Non‐GAAP Financial Measures" on pages 10-11 of this presentation for the reconciliations, and "Definitions of Non-GAAP Financial Measures" on page 28 of this presentation for the definitions of these Non‐GAAP Financial Measures. (4) Estimated based on the forward sale price calculated as of September 30, 2023, and total amount of shares available for settlement under the January 2023 Forward Sale Agreements, and the Q2 2023 and Q3 2023 ATM Forward Sale Agreements. Subsequent to quarter end on October 17, 2023, VICI settled 17.7 million shares under the January 2023 forward sale agreements at a forward share price of $31.65 per share, in exchange for total net proceeds of approximately $560.3 million. VICI has no remaining forward shares outstanding under the January 2023 forward sale agreements. ($ amounts in thousands USD, except share and per share data) Capitalization Shares Outstanding 1,016,827,883 Third-Party OP Units Outstanding(1) 12,231,373 Share Price as of September 29, 2023 $29.10 Equity Market Capitalization $29,945,624 Revolving Credit Facility(2) 158,348 Senior Unsecured Notes 13,950,000 CMBS Debt 3,000,000 Total Debt $17,108,348 Total Market Capitalization $47,053,972 Less: Cash & Cash Equivalents 510,884 Total Enterprise Value $46,543,088 Q3’23 LQA Net Leverage Q3’23 Adj. EBITDA(3) $726,406 Annualized Q3’23 Adj. EBITDA 2,905,624 Net Debt 16,597,464 LQA Net Leverage Ratio 5.7x VICI Issuer Credit Ratings Moody’s: Ba1 / Stable Outlook S&P: BBB- / Stable Outlook Fitch: BBB- / Stable Outlook Investment Grade Bond Covenants Thresholds Actuals Total Net Debt to Adjusted Total Assets < 60% 40% Senior Secured Net Debt to Adjusted Total Assets < 40% 7% Interest Coverage Ratio > 1.5x 3.6x Total Unencumbered Assets to Unsecured Debt > 150% 265% Total Liquidity Revolving Credit Facility Capacity $2,341,652 Outstanding Forward Sale Agreement Proceeds(4) 807,245 Cash & Cash Equivalents 510,884 Total Liquidity $3,659,781

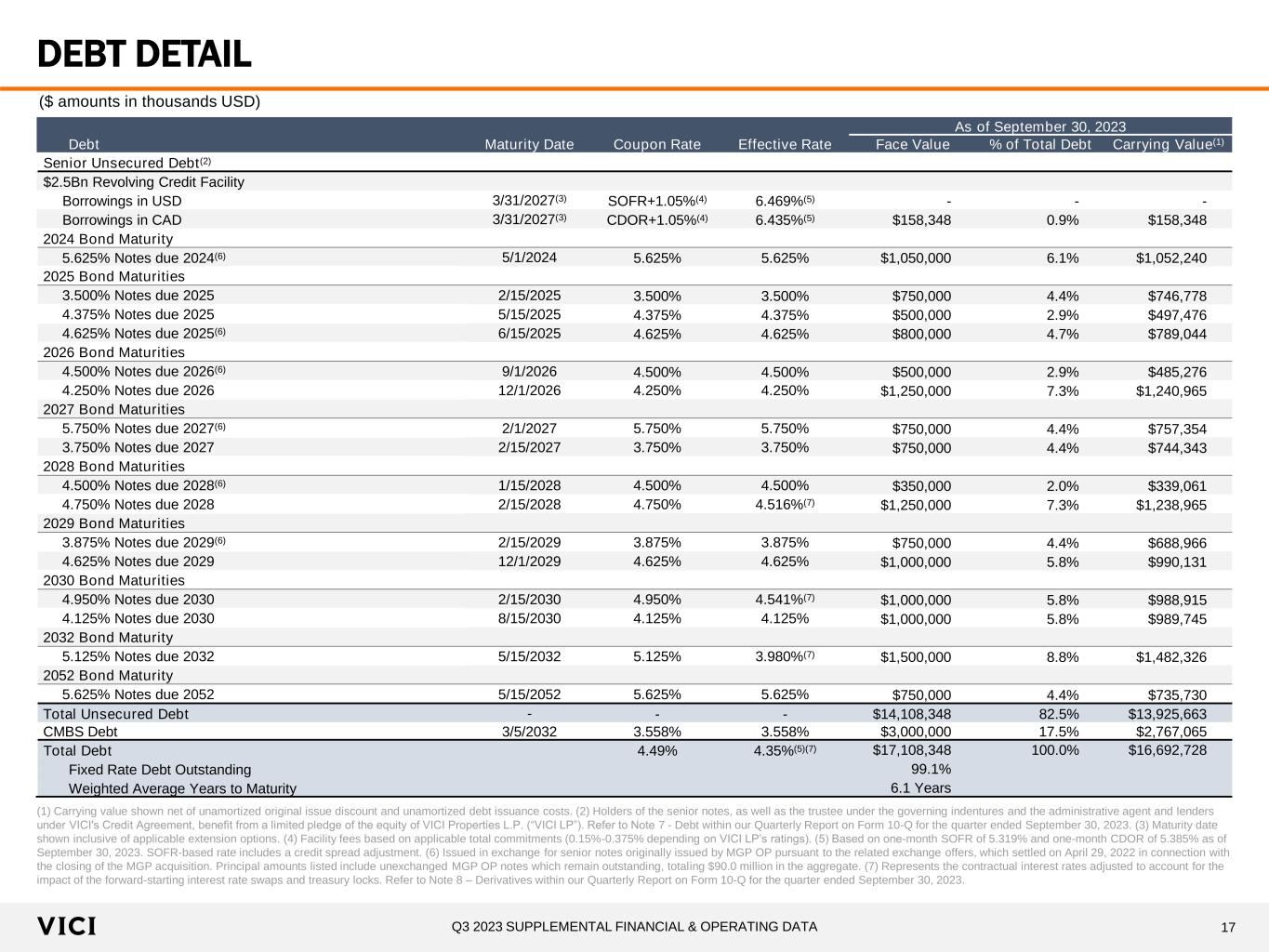

17Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA DEBT DETAIL (1) Carrying value shown net of unamortized original issue discount and unamortized debt issuance costs. (2) Holders of the senior notes, as well as the trustee under the governing indentures and the administrative agent and lenders under VICI's Credit Agreement, benefit from a limited pledge of the equity of VICI Properties L.P. (“VICI LP”). Refer to Note 7 - Debt within our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. (3) Maturity date shown inclusive of applicable extension options. (4) Facility fees based on applicable total commitments (0.15%-0.375% depending on VICI LP’s ratings). (5) Based on one-month SOFR of 5.319% and one-month CDOR of 5.385% as of September 30, 2023. SOFR-based rate includes a credit spread adjustment. (6) Issued in exchange for senior notes originally issued by MGP OP pursuant to the related exchange offers, which settled on April 29, 2022 in connection with the closing of the MGP acquisition. Principal amounts listed include unexchanged MGP OP notes which remain outstanding, totaling $90.0 million in the aggregate. (7) Represents the contractual interest rates adjusted to account for the impact of the forward-starting interest rate swaps and treasury locks. Refer to Note 8 – Derivatives within our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023. ($ amounts in thousands USD) As of September 30, 2023 Debt Maturity Date Coupon Rate Effective Rate Face Value % of Total Debt Carrying Value(1) Senior Unsecured Debt(2) $2.5Bn Revolving Credit Facility Borrowings in USD 3/31/2027(3) SOFR+1.05%(4) 6.469%(5) - - - Borrowings in CAD 3/31/2027(3) CDOR+1.05%(4) 6.435%(5) $158,348 0.9% $158,348 2024 Bond Maturity 5.625% Notes due 2024(6) 5/1/2024 5.625% 5.625% $1,050,000 6.1% $1,052,240 2025 Bond Maturities 3.500% Notes due 2025 2/15/2025 3.500% 3.500% $750,000 4.4% $746,778 4.375% Notes due 2025 5/15/2025 4.375% 4.375% $500,000 2.9% $497,476 4.625% Notes due 2025(6) 6/15/2025 4.625% 4.625% $800,000 4.7% $789,044 2026 Bond Maturities 4.500% Notes due 2026(6) 9/1/2026 4.500% 4.500% $500,000 2.9% $485,276 4.250% Notes due 2026 12/1/2026 4.250% 4.250% $1,250,000 7.3% $1,240,965 2027 Bond Maturities 5.750% Notes due 2027(6) 2/1/2027 5.750% 5.750% $750,000 4.4% $757,354 3.750% Notes due 2027 2/15/2027 3.750% 3.750% $750,000 4.4% $744,343 2028 Bond Maturities 4.500% Notes due 2028(6) 1/15/2028 4.500% 4.500% $350,000 2.0% $339,061 4.750% Notes due 2028 2/15/2028 4.750% 4.516%(7) $1,250,000 7.3% $1,238,965 2029 Bond Maturities 3.875% Notes due 2029(6) 2/15/2029 3.875% 3.875% $750,000 4.4% $688,966 4.625% Notes due 2029 12/1/2029 4.625% 4.625% $1,000,000 5.8% $990,131 2030 Bond Maturities 4.950% Notes due 2030 2/15/2030 4.950% 4.541%(7) $1,000,000 5.8% $988,915 4.125% Notes due 2030 8/15/2030 4.125% 4.125% $1,000,000 5.8% $989,745 2032 Bond Maturity 5.125% Notes due 2032 5/15/2032 5.125% 3.980%(7) $1,500,000 8.8% $1,482,326 2052 Bond Maturity 5.625% Notes due 2052 5/15/2052 5.625% 5.625% $750,000 4.4% $735,730 Total Unsecured Debt - - - $14,108,348 82.5% $13,925,663 CMBS Debt 3/5/2032 3.558% 3.558% $3,000,000 17.5% $2,767,065 Total Debt 4.49% 4.35%(5)(7) $17,108,348 100.0% $16,692,728 Fixed Rate Debt Outstanding 99.1% Weighted Average Years to Maturity 6.1 Years

18Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA GEOGRAPHIC DIVERSIFICATION (1) Based on annualized contractual rent as of October 2023. Diversified Portfolio: 26 States and 1 Canadian Province Gaming: 15 States (52% Regional, 47% Las Vegas, 1% International)(1) Non-Gaming Experiential: 11 States Alberta, Canada Gaming Non-Gaming Experiential

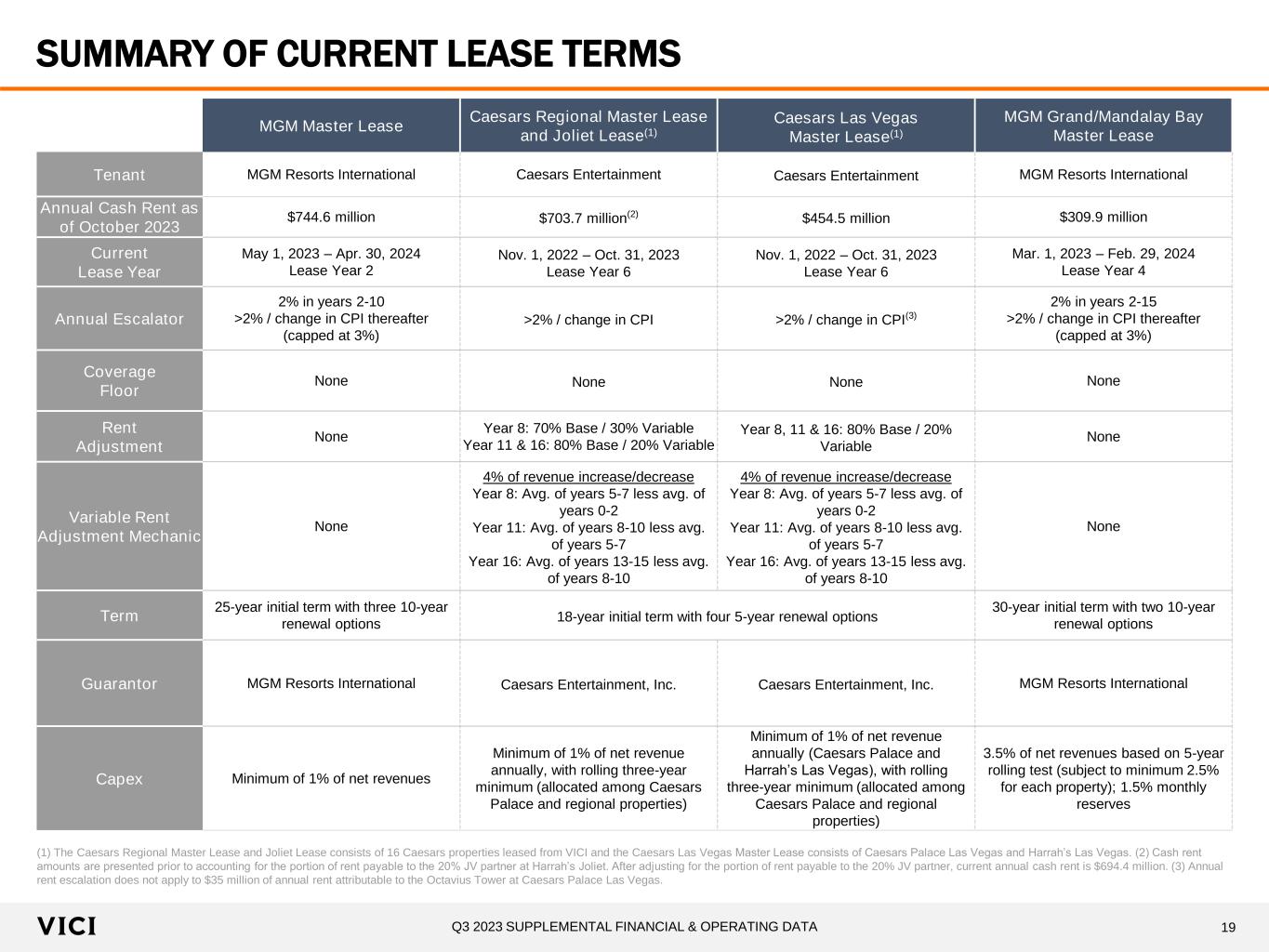

19Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA MGM Master Lease Caesars Regional Master Lease and Joliet Lease(1) Caesars Las Vegas Master Lease(1) MGM Grand/Mandalay Bay Master Lease Tenant MGM Resorts International Caesars Entertainment Caesars Entertainment MGM Resorts International Annual Cash Rent as of October 2023 $744.6 million $703.7 million(2) $454.5 million $309.9 million Current Lease Year May 1, 2023 – Apr. 30, 2024 Lease Year 2 Nov. 1, 2022 – Oct. 31, 2023 Lease Year 6 Nov. 1, 2022 – Oct. 31, 2023 Lease Year 6 Mar. 1, 2023 – Feb. 29, 2024 Lease Year 4 Annual Escalator 2% in years 2-10 >2% / change in CPI thereafter (capped at 3%) >2% / change in CPI >2% / change in CPI(3) 2% in years 2-15 >2% / change in CPI thereafter (capped at 3%) Coverage Floor None None None None Rent Adjustment None Year 8: 70% Base / 30% Variable Year 11 & 16: 80% Base / 20% Variable Year 8, 11 & 16: 80% Base / 20% Variable None Variable Rent Adjustment Mechanic None 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 0-2 Year 11: Avg. of years 8-10 less avg. of years 5-7 Year 16: Avg. of years 13-15 less avg. of years 8-10 4% of revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 0-2 Year 11: Avg. of years 8-10 less avg. of years 5-7 Year 16: Avg. of years 13-15 less avg. of years 8-10 None Term 25-year initial term with three 10-year renewal options 18-year initial term with four 5-year renewal options 30-year initial term with two 10-year renewal options Guarantor MGM Resorts International Caesars Entertainment, Inc. Caesars Entertainment, Inc. MGM Resorts International Capex Minimum of 1% of net revenues Minimum of 1% of net revenue annually, with rolling three-year minimum (allocated among Caesars Palace and regional properties) Minimum of 1% of net revenue annually (Caesars Palace and Harrah’s Las Vegas), with rolling three-year minimum (allocated among Caesars Palace and regional properties) 3.5% of net revenues based on 5-year rolling test (subject to minimum 2.5% for each property); 1.5% monthly reserves SUMMARY OF CURRENT LEASE TERMS (1) The Caesars Regional Master Lease and Joliet Lease consists of 16 Caesars properties leased from VICI and the Caesars Las Vegas Master Lease consists of Caesars Palace Las Vegas and Harrah’s Las Vegas. (2) Cash rent amounts are presented prior to accounting for the portion of rent payable to the 20% JV partner at Harrah’s Joliet. After adjusting for the portion of rent payable to the 20% JV partner, current annual cash rent is $694.4 million. (3) Annual rent escalation does not apply to $35 million of annual rent attributable to the Octavius Tower at Caesars Palace Las Vegas.

20Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA SUMMARY OF CURRENT LEASE TERMS (CONTINUED) The Venetian Resort Las Vegas Lease Mirage Lease JACK Entertainment Master Lease Century Master Lease Tenant Affiliate of funds managed by affiliates of Apollo Global Management, Inc. Hard Rock Entertainment JACK Entertainment Century Casinos Annual Cash Rent as of October 2023 $257.5 million $90.0 million $70.0 million $55.8 million(1) Current Lease Year Mar. 1, 2023 – Feb. 29, 2024 Lease Year 2 Dec. 19, 2022 – Dec. 31, 2023 Lease Year 1 Feb. 1, 2023 – Jan. 31, 2024 Lease Year 4 Jan. 1, 2023 – Dec. 31, 2023 Lease Year 4 Annual Escalator >2% / change in CPI (capped at 3%) 2% in years 2-10 >2% / change in CPI thereafter (capped at 3%) 1.5% in years 4-6 >1.5% / change in CPI thereafter (capped at 2.5%) >1.25% / change in CPI (Century Canadian Portfolio escalation based on Canadian CPI and capped at 2.5%) Coverage Floor None None None None Rent Adjustment None None None None Variable Rent Adjustment Mechanic None None None None Term 30-year initial term with two 10-year renewal options 25-year initial term with three 10-year renewal options 20-year initial term with three 5-year renewal options 24-year term with three 5-year renewal options Guarantor Affiliate of funds managed by affiliates of Apollo Global Management, Inc. Seminole Hard Rock Entertainment, Inc. and Seminole Hard Rock International, LLC Rock Ohio Ventures LLC and JACK Investments Co., LLC Century Casinos, Inc. Capex Minimum of 2% of net revenues annually (exclusive of gaming equipment) on a rolling three-year basis with ramp up Minimum of 1% of net revenues Minimum of 1% of net revenues beginning in lease year 4, based on a rolling three-year basis Minimum 1% of net revenues on a rolling three-year basis for each individual facility; 1% of Net Revenues per fiscal year for the facilities collectively (1) Assumes an exchange rate of C$1:00:US$0.74 as of September 30, 2023.

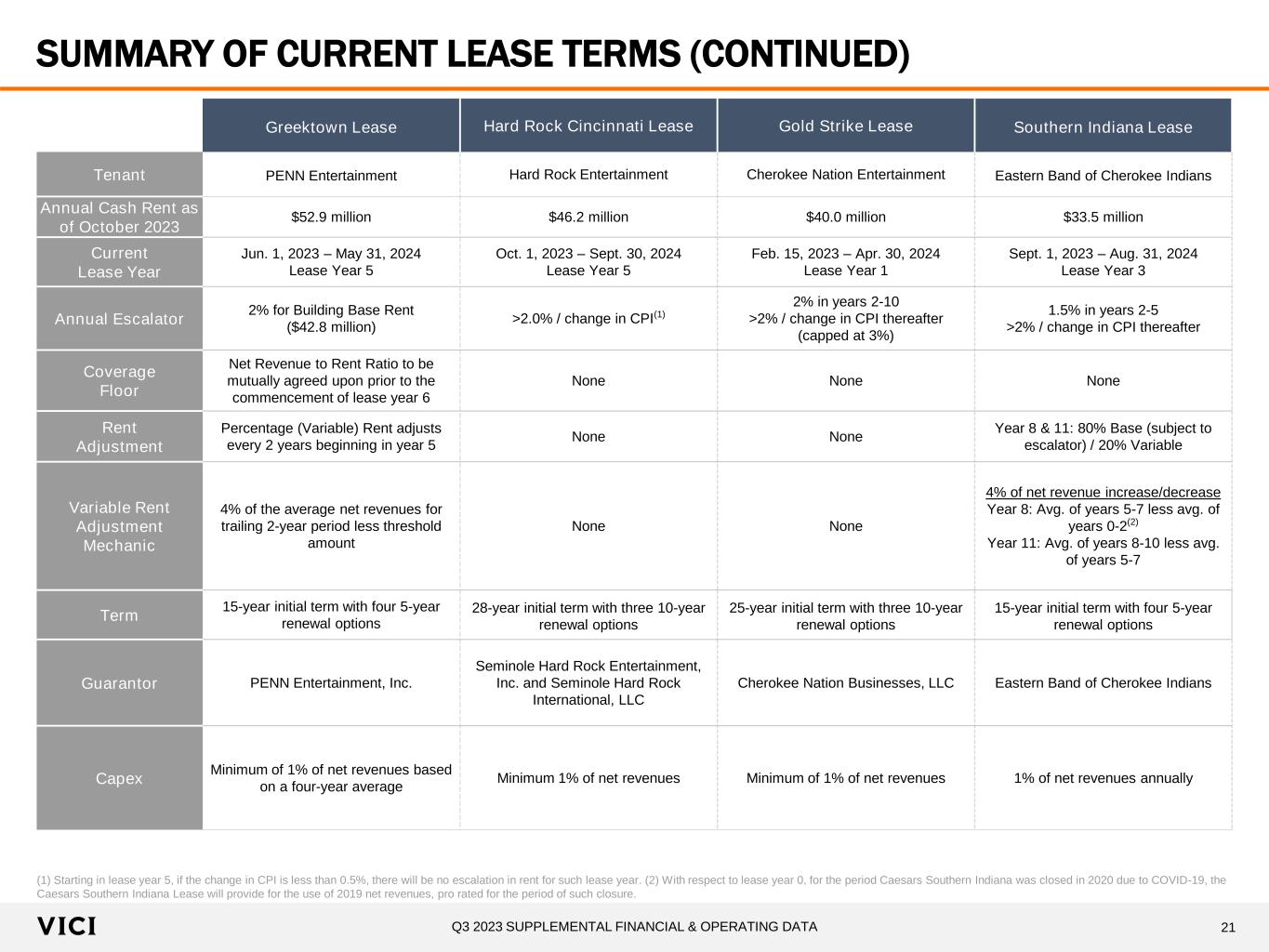

21Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA SUMMARY OF CURRENT LEASE TERMS (CONTINUED) (1) Starting in lease year 5, if the change in CPI is less than 0.5%, there will be no escalation in rent for such lease year. (2) With respect to lease year 0, for the period Caesars Southern Indiana was closed in 2020 due to COVID-19, the Caesars Southern Indiana Lease will provide for the use of 2019 net revenues, pro rated for the period of such closure. Greektown Lease Hard Rock Cincinnati Lease Gold Strike Lease Southern Indiana Lease Tenant PENN Entertainment Hard Rock Entertainment Cherokee Nation Entertainment Eastern Band of Cherokee Indians Annual Cash Rent as of October 2023 $52.9 million $46.2 million $40.0 million $33.5 million Current Lease Year Jun. 1, 2023 – May 31, 2024 Lease Year 5 Oct. 1, 2023 – Sept. 30, 2024 Lease Year 5 Feb. 15, 2023 – Apr. 30, 2024 Lease Year 1 Sept. 1, 2023 – Aug. 31, 2024 Lease Year 3 Annual Escalator 2% for Building Base Rent ($42.8 million) >2.0% / change in CPI(1) 2% in years 2-10 >2% / change in CPI thereafter (capped at 3%) 1.5% in years 2-5 >2% / change in CPI thereafter Coverage Floor Net Revenue to Rent Ratio to be mutually agreed upon prior to the commencement of lease year 6 None None None Rent Adjustment Percentage (Variable) Rent adjusts every 2 years beginning in year 5 None None Year 8 & 11: 80% Base (subject to escalator) / 20% Variable Variable Rent Adjustment Mechanic 4% of the average net revenues for trailing 2-year period less threshold amount None None 4% of net revenue increase/decrease Year 8: Avg. of years 5-7 less avg. of years 0-2(2) Year 11: Avg. of years 8-10 less avg. of years 5-7 Term 15-year initial term with four 5-year renewal options 28-year initial term with three 10-year renewal options 25-year initial term with three 10-year renewal options 15-year initial term with four 5-year renewal options Guarantor PENN Entertainment, Inc. Seminole Hard Rock Entertainment, Inc. and Seminole Hard Rock International, LLC Cherokee Nation Businesses, LLC Eastern Band of Cherokee Indians Capex Minimum of 1% of net revenues based on a four-year average Minimum 1% of net revenues Minimum of 1% of net revenues 1% of net revenues annually

22Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA SUMMARY OF CURRENT LEASE TERMS (CONTINUED) Bowlero Master Lease Margaritaville Lease Foundation Gaming Master Lease PURE Canadian Master Lease Tenant Bowlero PENN Entertainment Foundation Gaming PURE Canadian Gaming Annual Cash Rent as of October 2023 $31.6 million $26.5 million $24.3 million C$21.8 / US$16.1 million(1) Current Lease Year Oct. 19, 2023 – Oct. 31, 2024 Lease Year 1 Feb. 1, 2023 – Jan. 31, 2024 Lease Year 5 Dec. 22, 2022 – Dec. 31, 2023 Lease Year 1 Jan. 6, 2023 – Jan. 31, 2024 Lease Year 1 Annual Escalator >2% / change in CPI (capped at 2.5%) 2% for Building Base Rent ($17.2 million) 1.0% in years 2-3 >1.5% / change in CPI thereafter (capped at 3%) 1.25% in years 2-3 >1.5% / change in Canadian CPI thereafter (capped at 2.5%) Coverage Floor None Net Revenue to Rent Ratio: 6.1x None None Rent Adjustment None Percentage (Variable) Rent adjusts every 2 years beginning in year 3 None None Variable Rent Adjustment Mechanic None 4% of the average net revenues for trailing 2-year period less threshold amount None None Term 25-year initial term with six 5-year renewal options 15-year initial term with four 5-year renewal options 15-year initial term with four 5-year renewal options 25-year initial term with four 5-year renewal options Guarantor Bowlero Corp. PENN Entertainment, Inc. Foundation Gaming and Entertainment, LLC Parent entity of PURE Canadian Gaming Corp. Capex None Minimum 1% of net revenues based on a four-year average 1% of net revenue (excluding gaming equipment, IT etc.) annually on a rolling 3-year basis and a per-facility triennial capex requirement of 1% of three-year rolling net revenue 1% of net revenue (excluding gaming equipment, IT etc.) annually (1) Assumes an exchange rate of C$1:00:US$0.74 as of September 30, 2023.

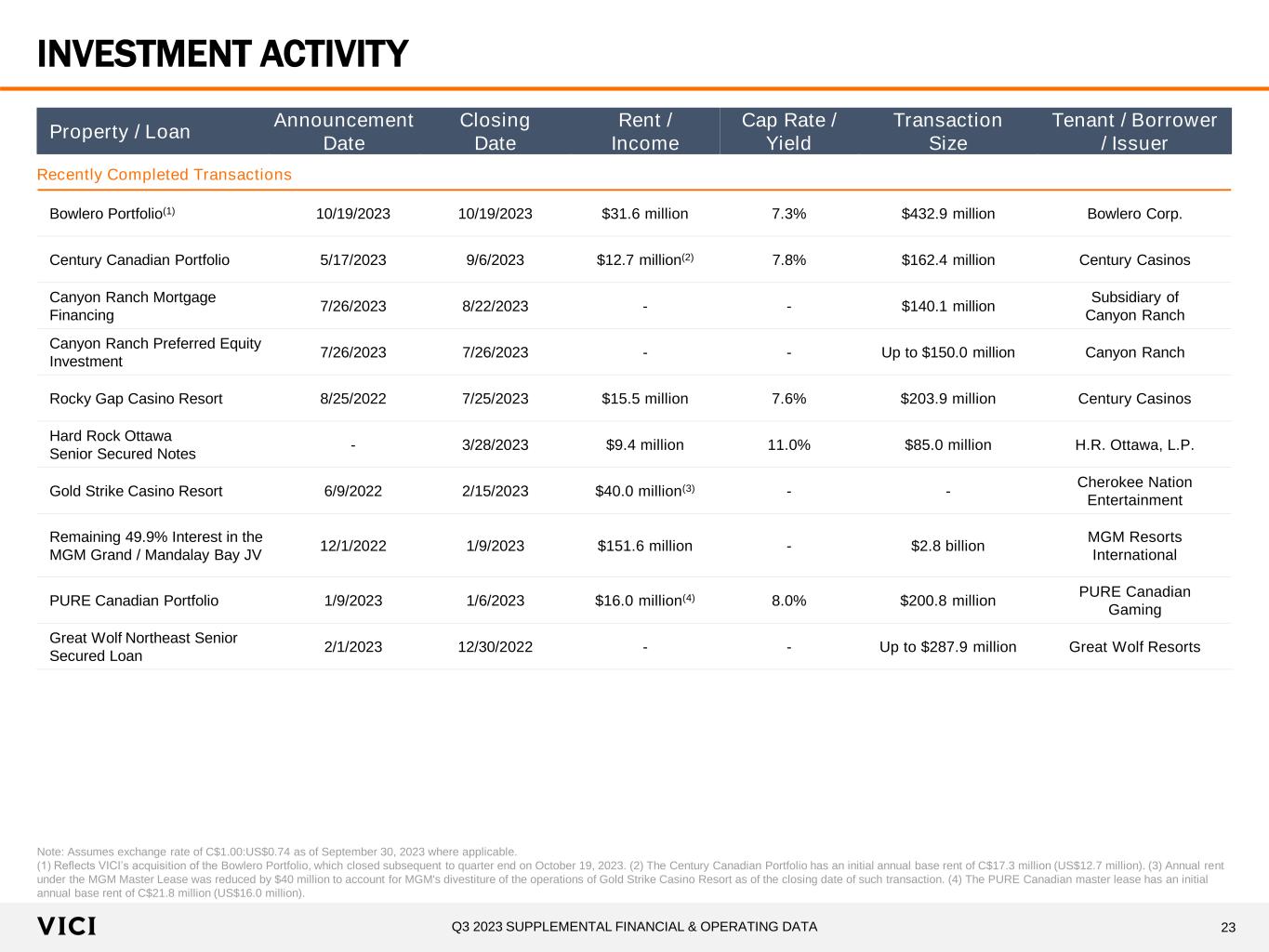

23Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA INVESTMENT ACTIVITY Note: Assumes exchange rate of C$1.00:US$0.74 as of September 30, 2023 where applicable. (1) Reflects VICI’s acquisition of the Bowlero Portfolio, which closed subsequent to quarter end on October 19, 2023. (2) The Century Canadian Portfolio has an initial annual base rent of C$17.3 million (US$12.7 million). (3) Annual rent under the MGM Master Lease was reduced by $40 million to account for MGM's divestiture of the operations of Gold Strike Casino Resort as of the closing date of such transaction. (4) The PURE Canadian master lease has an initial annual base rent of C$21.8 million (US$16.0 million). Property / Loan Announcement Date Closing Date Rent / Income Cap Rate / Yield Transaction Size Tenant / Borrower / Issuer Recently Completed Transactions Bowlero Portfolio(1) 10/19/2023 10/19/2023 $31.6 million 7.3% $432.9 million Bowlero Corp. Century Canadian Portfolio 5/17/2023 9/6/2023 $12.7 million(2) 7.8% $162.4 million Century Casinos Canyon Ranch Mortgage Financing 7/26/2023 8/22/2023 - - $140.1 million Subsidiary of Canyon Ranch Canyon Ranch Preferred Equity Investment 7/26/2023 7/26/2023 - - Up to $150.0 million Canyon Ranch Rocky Gap Casino Resort 8/25/2022 7/25/2023 $15.5 million 7.6% $203.9 million Century Casinos Hard Rock Ottawa Senior Secured Notes - 3/28/2023 $9.4 million 11.0% $85.0 million H.R. Ottawa, L.P. Gold Strike Casino Resort 6/9/2022 2/15/2023 $40.0 million(3) - - Cherokee Nation Entertainment Remaining 49.9% Interest in the MGM Grand / Mandalay Bay JV 12/1/2022 1/9/2023 $151.6 million - $2.8 billion MGM Resorts International PURE Canadian Portfolio 1/9/2023 1/6/2023 $16.0 million(4) 8.0% $200.8 million PURE Canadian Gaming Great Wolf Northeast Senior Secured Loan 2/1/2023 12/30/2022 - - Up to $287.9 million Great Wolf Resorts

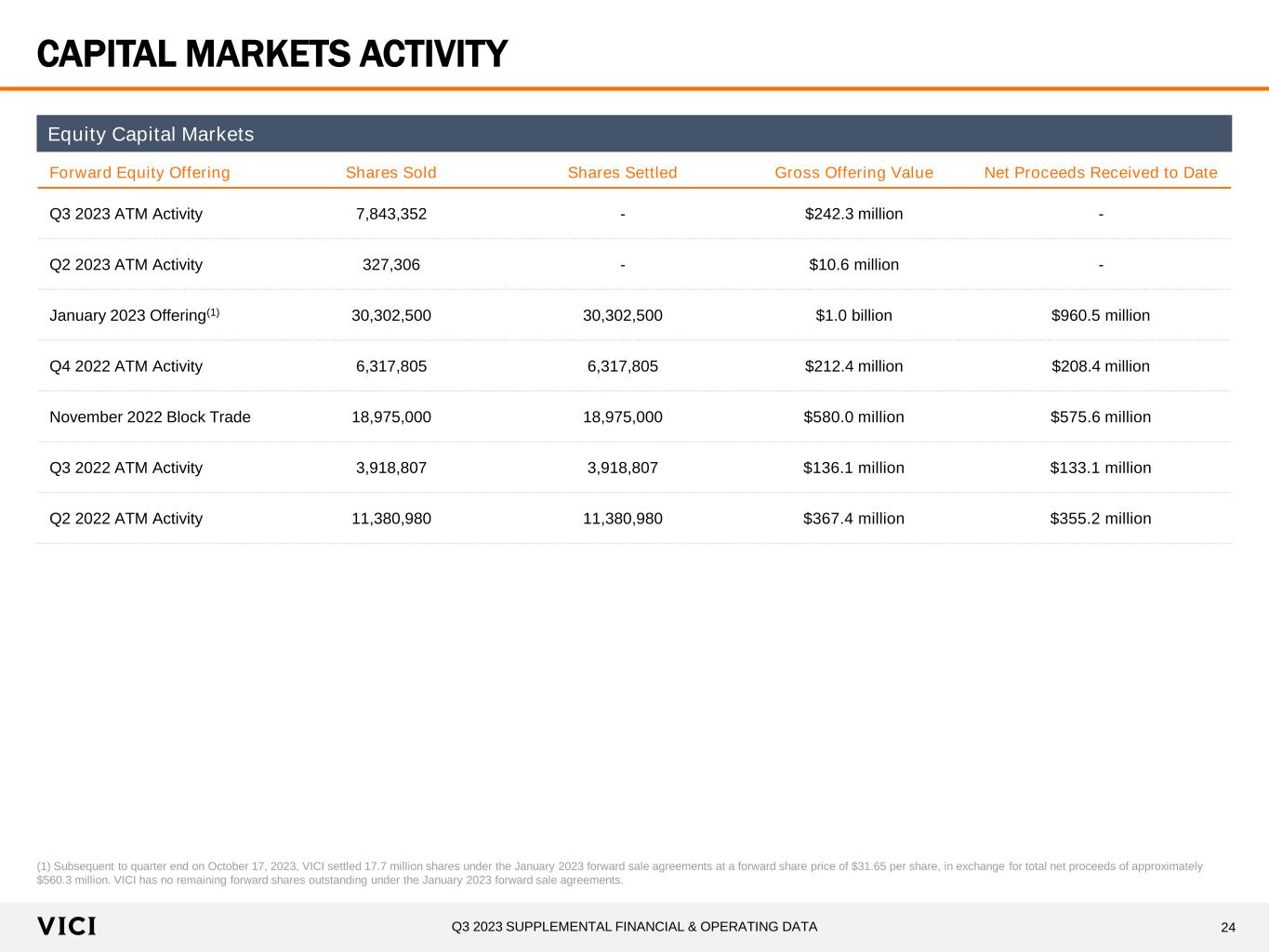

24Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA CAPITAL MARKETS ACTIVITY (1) Subsequent to quarter end on October 17, 2023, VICI settled 17.7 million shares under the January 2023 forward sale agreements at a forward share price of $31.65 per share, in exchange for total net proceeds of approximately $560.3 million. VICI has no remaining forward shares outstanding under the January 2023 forward sale agreements. Forward Equity Offering Shares Sold Shares Settled Gross Offering Value Net Proceeds Received to Date Q3 2023 ATM Activity 7,843,352 - $242.3 million - Q2 2023 ATM Activity 327,306 - $10.6 million - January 2023 Offering(1) 30,302,500 30,302,500 $1.0 billion $960.5 million Q4 2022 ATM Activity 6,317,805 6,317,805 $212.4 million $208.4 million November 2022 Block Trade 18,975,000 18,975,000 $580.0 million $575.6 million Q3 2022 ATM Activity 3,918,807 3,918,807 $136.1 million $133.1 million Q2 2022 ATM Activity 11,380,980 11,380,980 $367.4 million $355.2 million Equity Capital Markets

25Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA GAMING EMBEDDED GROWTH PIPELINE The descriptions of the Put/Call Agreements and ROFR Agreements herein are presented as a summary of such agreements, which are or may be subject to additional terms and conditions as described in the applicable agreements. Put / Call Agreements Harrah’s Hoosier Park and Horseshoe Indianapolis: VICI has the right to call Harrah’s Hoosier Park and Horseshoe Indianapolis from Caesars at a 13.0x multiple (7.7% cap rate) of the initial annual rent of each facility in a sale leaseback transaction. Caesars has the right to put Harrah’s Hoosier Park and Horseshoe Indianapolis to VICI at a 12.5x multiple (8.0% cap rate) of the initial annual rent of each facility in a sale leaseback transaction. The put/call agreement can be exercised until December 31, 2024. Right of First Refusal (“ROFR”) Agreements Las Vegas Strip Assets(1): VICI has a ROFR to acquire the land and real estate assets of each of the first two of certain specified Las Vegas Strip assets should the properties be sold by Caesars, whether pursuant to an OpCo/PropCo or a WholeCo sale. The first property subject to the ROFR will be one of: Flamingo Las Vegas, Horseshoe Las Vegas, Paris Las Vegas and Planet Hollywood Resort & Casino. The second property subject to the ROFR will be selected from one of the aforementioned four properties plus The LINQ Hotel & Casino. (1) Caesars does not have a contractual obligation to sell the properties subject to the ROFR Agreements and will make an independent financial decision regarding whether to trigger the ROFR agreements and VICI will make an independent financial decision whether to purchase the properties. (2) Subject to any consent required from Caesars’ applicable joint venture partners. Caesars Forum Convention Center: VICI has the right to call the Caesars Forum Convention Center from Caesars at a 13.0x multiple (7.7% cap rate) of the initial annual rent in a sale leaseback transaction between September 18, 2025 and December 31, 2028. Caesars has the right to put the Caesars Forum Convention Center to VICI at a 13.0x multiple (7.7% cap rate) of the initial annual rent in a sale leaseback transaction between January 1, 2024 and December 31, 2024. Horseshoe Casino Baltimore(1)(2): VICI has a ROFR to enter into a sale leaseback transaction with respect to the land and real estate assets of Horseshoe Baltimore should the property be sold by Caesars. Caesars Virginia Development(1)(2): VICI has a ROFR to enter into a sale leaseback transaction with respect to the land and real estate assets associated with the development of a new casino resort in Danville, Virginia by Caesars and EBCI.

26Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA NON-GAMING EMBEDDED GROWTH PIPELINE The descriptions of the Put/Call Agreements, Purchase Right Agreements, and Right of First Offer Agreements herein are presented as a summary of such agreements, which are or may be subject to additional terms and conditions as described in the applicable agreements. Canyon Ranch Lenox & Canyon Ranch Tucson: VICI has the right to call the real estate assets of each of Canyon Ranch Tucson in Tucson, Arizona and Canyon Ranch Lenox in Lenox, Massachusetts, at pre-negotiated terms in a sale-leaseback transaction following stabilization, subject to certain conditions. If the call right(s) are exercised, Canyon Ranch would continue to operate the applicable wellness resort(s) subject to a long-term triple-net master lease with VICI. Chelsea Piers New York: VICI entered into an agreement with Chelsea Piers for the life of the existing mortgage loan, subject to a minimum of 5 years, that could lead to a longer-term financing partnership in the future. Call Right Agreements Longer Term Financing Partnerships Canyon Ranch Austin: In connection with VICI’s $200 million delayed draw term loan to Canyon Ranch, VICI has the right to call the real estate assets of Canyon Ranch Austin at pre-negotiated terms in a sale-leaseback transaction for up to 24 months following stabilization, subject to certain conditions. If the call right is exercised, Canyon Ranch would continue to operate Canyon Ranch Austin subject to a long-term triple-net master lease with VICI. Cabot Citrus Farms: In connection with VICI’s $120 million delayed draw term loan to Cabot, VICI also entered into a purchase and sale agreement, pursuant to which VICI will convert a portion of the Cabot Citrus Farms loan into the ownership of certain Cabot Citrus Farms real estate assets and simultaneously enter into a triple-net lease with Cabot that has an initial term of 25 years, with five 5-year tenant renewal options. Canyon Ranch: VICI entered into a right of first offer agreement on future financing opportunities with Canyon Ranch for funding of certain facilities until the earlier of five years from the commencement of the Canyon Ranch Austin lease or the date VICI is no longer landlord. On July 26, 2023, VICI further solidified its partnership with Canyon Ranch and entered into a right of first financing agreement pursuant to which VICI will have the first right, but not the obligation, to serve as the real estate capital financing partner for Canyon Ranch with respect to the acquisition, build-out and/or redevelopment of future greenfield and build-to-suit wellness resorts. Bowlero: In connection with VICI’s acquisition of the Bowlero Portfolio, the Bowlero master lease includes a right of first offer provision under which VICI has the right to acquire the real estate assets of any current or future Bowlero asset should Bowlero elect to enter into a sale-leaseback transaction in the first 8 years of the lease term.

27Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA ANALYST COVERAGE Firm Analyst Phone Email BNP Paribas Nate Crossett (646) 725-3716 Nate.crossett@us.bnpparibas.com BofA Securities Shaun Kelley (646) 855-1005 Shaun.kelley@bofa.com Capital One Securities Dan Guglielmo (202) 213-6408 Daniel.guglielmo@capitalone.com CBRE John DeCree (702) 691-3213 John.decree@cbre.com Citi Smedes Rose (212) 816-6243 Smedes.rose@citi.com Deutsche Bank Carlo Santarelli (212) 250‐5815 Carlo.santarelli@db.com Evercore ISI Steve Sakwa (212) 446-9462 Steve.sakwa@evercoreisi.com Green Street Advisors Chris Darling (949) 640-8780 Cdarling@greenstreet.com Jefferies David Katz (212) 323-3355 Dkatz@jefferies.com JMP Securities Mitch Germain (212) 906-3537 Mgermain@jmpsecurities.com J.P. Morgan Anthony Paolone (212) 622-6682 Anthony.paolone@jpmorgan.com Keybanc Todd Thomas (917) 368-2286 Tthomas@key.com Macquarie Capital Chad Beynon (212) 231-2634 Chad.beynon@macquarie.com Mizuho Securities Haendel St. Juste (212) 205-7860 Haendel.st.juste@mizuhogroup.com Morgan Stanley Ronald Kamdem (212) 296-8319 Ronald.kamdem@morganstanley.com Raymond James RJ Milligan (727) 567-2585 Rjmilligan@raymondjames.com Robert W. Baird Wesley Golladay (216) 737-7510 Wgolladay@rwbaird.com Scotiabank Greg McGinniss (212) 225-6906 Greg.mcginniss@scotiabank.com Stifel Nicolaus Simon Yarmak (443) 224‐1345 Yarmaks@stifel.com Truist Securities Barry Jonas (212) 590-0998 Barry.jonas@truist.com Wedbush Rich Anderson (212) 938-9949 Richard.anderson@wedbush.com Wells Fargo Connor Siversky (212) 214-8069 Connor.siversky@wellsfargo.com Wolfe Research Andrew Rosivach (646) 582-9250 Arosivach@wolferesearch.com Firm Analyst Phone Email BofA Securities James Kayler (646) 855-9223 James.f.kayler@bofa.com Deutsche Bank Luis Chinchilla (212) 250-9980 Luis.chinchilla@db.com J.P. Morgan Mark Streeter (212) 834-5086 Mark.streeter@jpmorgan.com Covering Fixed Income Analysts Covering Equity Analysts

28Q3 2023 SUPPLEMENTAL FINANCIAL & OPERATING DATA DEFINITIONS OF NON-GAAP FINANCIAL MEASURES FFO is a non-GAAP financial measure that is considered a supplemental measure for the real estate industry and a supplement to GAAP measures. Consistent with the definition used by the National Association of Real Estate Investment Trusts (NAREIT), we define FFO as net income (or loss) attributable to common stockholders (computed in accordance with GAAP) excluding (i) gains (or losses) from sales of certain real estate assets, (ii) depreciation and amortization related to real estate, (iii) gains and losses from change in control, (iv) impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity and (v) our proportionate share of such adjustments from our investment in unconsolidated affiliate. AFFO is a non-GAAP financial measure that we use as a supplemental operating measure to evaluate our performance. We calculate our AFFO by adding or subtracting from FFO non-cash leasing and financing adjustments, non-cash change in allowance for credit losses, non-cash stock-based compensation expense, transaction costs incurred in connection with the acquisition of real estate investments, amortization of debt issuance costs and original issue discount, other non-cash interest expense, non-real estate depreciation (which is comprised of the depreciation related to our golf course operations), capital expenditures (which are comprised of additions to property, plant and equipment related to our golf course operations), impairment charges related to non-depreciable real estate, gains (or losses) on debt extinguishment and interest rate swap settlements, other gains (losses), other non-recurring non-cash transactions, our proportionate share of non-cash adjustments from our investment in unconsolidated affiliate (including the amortization of any basis differences) with respect to certain of the foregoing and non-cash adjustments attributable to non- controlling interest with respect to certain of the foregoing. We calculate Adjusted EBITDA by adding or subtracting from AFFO contractual interest expense (including the impact of the forward-starting interest rate swaps and treasury locks) and interest income (collectively, interest expense, net), income tax expense and our proportionate share of such adjustments from our investment in unconsolidated affiliate. These non-GAAP financial measures: (i) do not represent cash flow from operations as defined by GAAP; (ii) should not be considered as an alternative to net income as a measure of operating performance or to cash flows from operating, investing and financing activities; and (iii) are not alternatives to cash flow as a measure of liquidity. In addition, these measures should not be viewed as measures of liquidity, nor do they measure our ability to fund all of our cash needs, including our ability to make cash distributions to our stockholders, to fund capital improvements, or to make interest payments on our indebtedness. Investors are also cautioned that FFO, FFO per share, AFFO, AFFO per share and Adjusted EBITDA, as presented, may not be comparable to similarly titled measures reported by other real estate companies, including REITs, due to the fact that not all real estate companies use the same definitions. Our presentation of these measures does not replace the presentation of our financial results in accordance with GAAP.