UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission

File Number: 001-41169

Vertical Aerospace Ltd.

(Exact Name of Registrant as Specified in Its

Charter)

Unit 1 Camwal Court, Chapel Street

Bristol BS2 0UW

United Kingdom

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

On May 24, 2024, the Vertical Aerospace Ltd. (the “Company”)

issued a press release announcing its financial results for the first quarter ended March 31, 2024, a copy of which is furnished

as 99.1 hereto.

INCORPORATION BY REFERENCE

The information included in this

Report on Form 6-K (including Exhibit 99.1, but excluding the quotation by the Company’s Chief Executive Officer) is hereby

incorporated by reference into the Company’s Registration Statements on Form F-3 (File No. 333-270756 and File

No. 333-275430) (including any prospectuses forming a part of such registration statements) and to be a part thereof from the date

on which this Report on Form 6-K is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Vertical Aerospace Ltd. |

| |

|

|

| Date: May 24, 2024 |

By: |

/s/ Stuart Simpson |

| |

|

Stuart Simpson |

| |

|

Chief Executive Officer |

Exhibit 99.1

Vertical Aerospace

Releases First Quarter 2024 Financial Results

London, UK; New York, USA – May 24, 2024

Vertical Aerospace Ltd. (“Vertical”

or the “Company”) (NYSE: EVTL; EVTLW), a global aerospace and technology company that is pioneering zero emission aviation,

today announces its financial results for the first quarter ended March 31, 2024. The first quarter 2024 financial results filing can

be found on the investor relations website.

Stuart Simpson, CEO at Vertical, said “I

am delighted to lead this incredibly innovative company and I’m immensely proud of the progress the team has made so far this year.

We are within touching distance of kicking off the robust piloted flight test programme for our significantly more sophisticated second

full-scale VX4 aircraft, as we prepare to demonstrate its full potential to the world. This aircraft represents a huge leap forward along

our path to certification.”

First Quarter 2024 and Recent Operational Highlights

Business

| · | A

new £8 million ($10 million) grant in February from the Aerospace Technology Institute

to develop Vertical’s next-generation propellers for use on its VX4 aircraft brought

total grant funding to £37 million ($47 million), signalling a further vote of confidence

in Vertical from the UK Government. |

| · | The

UK’s Aviation and Technology Minister, Anthony Browne MP, visited Vertical’s

HQ in Bristol in March to mark the launch of the Government’s Future of Flight Action

Plan. The joint initiative between the UK Government and industry outlines plans for flying

taxis to become a reality in the UK within the next few years. |

| · | Vertical’s

partner, Skyports, announced its plans to develop the UK’s first vertiport testbed

at Bicester Motion, Oxfordshire, at which Vertical intends to fly later this year. |

| · | At

the latest Vertical Pioneer’s Event in April, the team updated customers on the VX4

programme, with topics including certification and operating economics, and hearing from

partners CAE and Skyports Infrastructure. Our customers also visited the Vertical Flight

Test Centre to see the aircraft and hear directly from our chief pilot on our upcoming crewed

flight test programme. |

| · | Founder

Stephen Fitzpatrick committed additional capital to the Company, with Vertical receiving

£19.5 million ($25 million) on March 13, 2024. |

| · | Vertical

and Rolls-Royce have mutually agreed to exit Rolls-Royce's contract to design an Electric

Propulsion Unit (EPU). Under the agreement, Vertical will receive a cash amount from Rolls-Royce

which is expected to cover the anticipated costs of an alternative EPU design contract as

well as provide an extension to Vertical's cash runway. Vertical is already working with

other EPU suppliers and there is no expected impact on the completion of Vertical’s

prototypes or certification timelines - further detail below. |

Vertical Team

| · | On

May 1, 2024, Vertical made a series of leadership appointments, including appointing Stuart

Simpson, Vertical’s CFO and seasoned FTSE100 executive, to CEO as the Company moves

to the pivotal phase of certifying and commercialising its VX4 aircraft. |

| · | Founder

and majority shareholder, Stephen Fitzpatrick, remains on the Vertical Board as a non-executive

director, focused on business strategy and delivering on the Company’s vision. |

| · | Ben

Story, who brings 30 years of fundraising, business strategy and leadership experience from

roles at Rolls-Royce, Citi and Transport for London, was appointed to Vertical’s Board

as an independent non-executive director. |

| · | Charlotte

Cowley will join in June 2024 as Director of Strategic Finance, responsible for executing

Vertical’s fundraising strategy. Charlotte brings over 20 years of experience in banking

and investor relations, having led Investor Relations for FTSE100 Burberry Group plc, and

FTSE250 Aston Martin Lagonda plc, where she supported successful capital raises. |

VX4 Progress

| · | Final

assembly of the next generation full-scale VX4 prototype nears completion and the aircraft

remains on track to begin its test programme ahead of intended public demonstrations later

this year. |

| · | This

prototype, which features more advanced propellers, will for the first time use Vertical’s

next generation proprietary battery technology built at the Vertical Energy Centre. This

next prototype incorporates the majority of the Company’s leading aerospace partners’

technology and will align closely with the aircraft Vertical intends to take into certification. |

| · | Vertical

is on track to receive its Permit to Fly from the UK Civil Aviation Authority (CAA) to begin

its robust piloted flight test campaign in the coming weeks. |

Agreement with Rolls-Royce

| · | On

and with effect from May 22, 2024, Vertical and Rolls-Royce mutually agreed to exit Rolls-Royce's

contract to design an Electric Propulsion Unit (EPU). Under the agreement, Vertical will

receive a cash amount from Rolls-Royce by June 30, 2024 which is expected to cover the anticipated

costs of an alternative EPU design contract and provide an extension to Vertical’s

cash runway. This follows Rolls-Royce's announcement in November 2023 of its intention to

seek a partner or buyer for its advanced air mobility activities. |

| · | Vertical

is already working with other EPU suppliers for its new prototype, and the exit of this contract

has no impact on the completion of this prototype or its identical twin. Vertical is now

in active engagement with a shortlist of potential EPU partners for the certification and

production aircraft following the launch of a formal tender process. Vertical continues to

target type certification by the end of 2026. |

| · | The

agreement also includes the return to Vertical of Rolls-Royce's EVTL shares, which it initially

acquired as a private investment in public equity (PIPE) investor in 2021. |

First Quarter 2024 Financial Highlights

| · | Vertical

reported a net operating loss of £20 million for the three months ended March 31, 2024,

compared to a net operating loss of £23 million for the three months ended March 31,

2023, emphasising the Company’s continued financial discipline. |

| · | Spending

reflects investments in the near completion of the second, more advanced full-scale VX4 prototype. |

| · | As

of March 31, 2024, Vertical had cash and cash equivalents totalling £49 million, including

the investment of £19.5 million ($25 million) received from Stephen Fitzpatrick, which

will be invested in the creation and development of an identical twin VX4 prototype; testing

and certification activities; as well as in the people, systems and processes that support

the Company. |

| · | Vertical

is planning a Capital Markets Event which it expects to host in the second half of 2024. |

Consolidated Financial Summary

| | |

Three months ending March 31*, | |

| | |

2024 £'000 | | |

2023 £'000 | |

| Research and development expenses | |

| (13,984 | ) | |

| (12,612 | ) |

| Administrative expenses | |

| (9,467 | ) | |

| (11,741 | ) |

| Related party administrative expenses | |

| (21 | ) | |

| (21 | ) |

| Other operating income | |

| 3,234 | | |

| 1,824 | |

| Operating loss | |

| (20,238 | ) | |

| (22,550 | ) |

*Unaudited

Financial Outlook

| · | Net

cash outflows incurred in the second quarter of the year will be in relation to the testing

of prototype aircraft and the support of the certification process – Vertical’s

capital plan remains on track for 2024. Following receipt of the cash contribution from Rolls-Royce

under its settlement agreement, Vertical’s cash runway will be extended into H2 2025. |

| · | As

previously announced, to support Vertical’s ongoing capital requirements, fund its

future operations and remain as a going concern, Vertical intends to undertake further fundraising

in 2024 to raise additional capital. |

| · | As

previously announced, in November 2023, Vertical received notice from the New York Stock

Exchange (NYSE) indicating that the Company was not in compliance with the NYSE continued

listing standard requiring a minimum average closing price for its ordinary shares of $1.00

over the preceding 30 consecutive trading days. As set forth in NYSE’s continued listing

standards, if Vertical determines that, to regain compliance, an action requiring shareholder

approval is necessary to cure the share price non-compliance, such as via a reverse share

split, that approval may be sought at the next annual general meeting of shareholders (AGM).

The Company intends to convene its AGM in September 2024 (further details regarding the AGM

to be announced at a later date). If the Company remains non-compliant with the minimum share

price requirement at that time, it will ask shareholders at its AGM to approve a reverse

share split to cure the non-compliance. |

| · | The

above forward-looking statements reflect the Company’s expectations for the three months

ending June 30, 2024, as of May 24, 2024, and are subject to substantial uncertainty. The results are based

on assumptions that the Company believes to be reasonable as of this date, but may be materially affected by many factors, as discussed

below in “Forward-Looking Statements.” |

About Vertical Aerospace

Vertical Aerospace is a global aerospace and

technology company pioneering electric aviation.

Vertical is creating a safer, cleaner and quieter

way to travel. Vertical's VX4 is a piloted, four passenger, Electric Vertical Take-Off and Landing (eVTOL) aircraft, with zero operating

emissions. Vertical combines partnering with leading aerospace companies, including Honeywell and Leonardo, with developing its own proprietary

battery and propeller technology to develop the world’s most advanced and safest eVTOL.

Vertical has 1,500 pre-orders of the VX4 worth

$6bn, with customers across four continents, including Virgin Atlantic, American Airlines, Japan Airlines, GOL and Bristow. Headquartered

in Bristol, the epicentre of the UK’s aerospace industry, Vertical was founded in 2016 by Stephen Fitzpatrick, founder of the OVO

Group, Europe’s largest independent energy retailer.

Vertical's experienced leadership team comes

from top tier automotive and aerospace companies such as Rolls-Royce, Airbus, Heathrow, GM and Leonardo. Together they have previously

certified and supported over 30 different civil and military aircraft and propulsion systems.

For more information:

Justin Bates, Head of Communications

Justin.bates@vertical-aerospace.com

+44 7878357463

Samuel Emden, Head of Investor Affairs

Samuel.emden@vertical-aerospace.com

+447816 459 904

Vertical Media Kit

Available here.

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 that relate to our current expectations

and views of future events. We intend such forward-looking statements to be covered by the safe harbor provisions for

forward-looking statements as contained in Section 27A of the Securities Act and Section 21E of the Exchange Act. Any express or

implied statements contained in this press release that are not statements of historical fact may be deemed to be forward-looking

statements, including, without limitation, statements regarding the design and manufacture of the VX4, our future results of

operations and financial position and expected financial performance and operational performance, liquidity, growth and

profitability strategies, business strategy and plans and objectives of management for future operations, including the building and

testing of our prototype aircrafts on timelines projected, selection of suppliers, certification and the commercialization of the

VX4 and our ability to achieve regulatory certification of our aircraft product on any particular timeline or at all, our ability

and plans to raise additional capital to fund our operations, including as a result of any ongoing or future discussions with

potential investors, statements regarding completion of the committed funding from Company’s founder and majority owner, our

plans to mitigate the risk that we are unable to continue as a going concern, our plans for capital expenditures, the expectations

surrounding pre-orders and commitments, the features and capabilities of the VX4, the transition towards a net-zero emissions

economy, as well as statements that include the words “expect,” “intend,” “plan,”

“believe,” “project,” “forecast,” “estimate,” “may,”

“should,” “anticipate,” “will,” “aim,” “potential,”

“continue,” “are likely to” and similar statements of a future or forward-looking nature. Forward-looking

statements are neither promises nor guarantees, but involve known and unknown risks and uncertainties that could cause actual

results to differ materially from those projected, including, without limitation: our limited operating history without manufactured

non-prototype aircraft or completed eVTOL aircraft customer order; our ability to raise additional funds when we need or want them,

or at all, to fund our operations; our limited cash and cash equivalents and recurring losses from our operations raise significant

doubt (or raise substantial doubt as contemplated by PCAOB standards) regarding our ability to continue as a going concern; our

potential inability to produce or launch aircraft in the volumes or timelines projected; the potential inability to obtain the

necessary certifications for production and operation within any projected timeline, or at all; the inability for our aircraft to

perform at the level we expect and may have potential defects; our history of losses and the expectation to incur significant

expenses and continuing losses for the foreseeable future; the market for eVTOL aircraft being in a relatively early stage; any

accidents or incidents involving eVTOL aircraft could harm our business; our dependence on partners and suppliers for the components

in our aircraft and for operational needs; the potential that certain strategic partnerships may not materialize into long-term

partnership arrangements; all of the pre-orders received are conditional and may be terminated at any time and any pre-delivery

payments may be fully refundable upon certain specified dates; any circumstances; any potential failure to effectively manage our

growth; our inability to recruit and retain senior management and other highly skilled personnel; we have previously identified

material weaknesses in our internal controls over financial reporting which if we fail to properly remediate, could adversely affect

our results of operations, investor confidence in us and the market price of our ordinary shares; as a foreign private issuer we

follow certain home country corporate governance rules, are not subject to U.S. proxy rules and are subject to Exchange Act

reporting obligations that, to some extent, are more lenient and less frequent than those of a U.S. domestic public company; and the

other important factors discussed under the caption “Risk Factors” in our Annual Report on Form 20-F filed with the U.S.

Securities and Exchange Commission (“SEC”) on March 14, 2024, as such factors may be updated from time to time in our

other filings with the SEC. Any forward-looking statements contained in this press release speak only as of the date hereof and

accordingly undue reliance should not be placed on such statements. We disclaim any obligation or undertaking to update or revise

any forward-looking statements contained in this press release, whether as a result of new information, future events or otherwise,

other than to the extent required by applicable law.

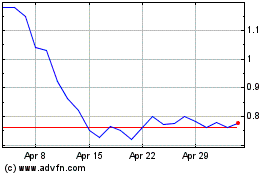

Vertical Aerospace (NYSE:EVTL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vertical Aerospace (NYSE:EVTL)

Historical Stock Chart

From Dec 2023 to Dec 2024