Company Issues Shareholder Letter

Vertical Aerospace Ltd. (“Vertical” or the "Company") (NYSE:

EVTL; EVTLW), a global aerospace and technology company that is

pioneering zero emission aviation, announces its financial results

for the six months ended June 30, 2022. The Company has also issued

a shareholder letter discussing its operating results and

management commentary, which is posted to its investor relations

website at investor.vertical-aerospace.com.

Stephen Fitzpatrick, Vertical Founder and CEO, said: “I

am delighted to share that we have reached a critical engineering

milestone by completing the build of our full-scale VX4 prototype,

and we have now begun putting it through its paces for an

intensive, multi-month flight test programme. I am grateful for the

efforts of our amazing team, and for our outstanding partners that

have got us to this point as we continue to leverage their deep

sector expertise to build, fly and industrialise our aircraft to

revolutionise the way we travel.

In the last quarter, we have expanded our pre-order book to more

than 1,400 and announced new VX4 applications in emergency medical

services, cargo and business aviation, with Babcock and

FLYINGGROUP. We have also secured an industry first with American

Airlines' commitment to place a pre-delivery payment for the

delivery slots of their first 50 VX4s, out of a possible 350. The

outlook for eVTOLs and Vertical has never looked better, and we

look forward to providing our shareholders with more news on our

piloted flight."

First Half-Year 2022 and Recent Operational

Highlights

- Completed the build of the full-scale VX4 Prototype. The VX4

Prototype, as part of its intensive flight test programme, has

conducted a series of ground tests and is expected to begin flying

over the summer.

- Enhanced Vertical’s collaborative industrial partnership

ecosystem by entering into a strategic partnership with Molicel, a

leading manufacturer of lithium-Ion cells, for the supply of

high-power, low-impedance, cylindrical battery cells for the VX4

battery pack.

- Strengthened Vertical’s leadership team by welcoming Mike

Flewitt, former Chief Executive Officer of McLaren Automotive Ltd

and VP Manufacturing of Ford Europe, to the Board of Directors as

an independent non-executive director.

- Secured 50 new pre-orders for the VX4 from business aviation

operator FLYINGGROUP; announced a new partnership with Babcock for

emergency medical services and logistics application of the VX4,

and received a commitment from American Airlines to make a

pre-delivery payment to secure delivery slots for the first 50 VX4s

of their conditional pre-order of up to 250 aircraft, with an

option to purchase an additional 100 aircraft.

- Secured concurrent validation of the VX4 between European Union

Aviation Safety Agency (“EASA”) and the UK’s Civil Aviation

Authority ("CAA") on the same SC-VTOL certification basis, which we

believe will enable rapid deployment of the VX4 across multiple

markets.

First Half-Year 2022 and Recent Financial Highlights

- During the first half of 2022 Vertical invested in the build of

the VX4 Prototype, the development of its test and certification

activities and in the people, systems and processes to support the

company.

- Vertical reported a net operating loss of £39m for the six

months ended June 30, 2022, compared to a net loss of £22m for the

six months ended June 30, 2021.

- As of June 30, 2022, Vertical had cash and cash equivalents of

£158m. Vertical expects that its existing cash and cash equivalents

will enable Vertical to fund its operating expenses and capital

expenditure requirements for at least the next 12 months.

- In August 2022, to support ongoing capital requirements,

Vertical established an equity subscription line with Nomura, which

will allow Vertical to issue up to $100 million in new ordinary

shares. This facility is intended to provide flexibility around the

timing of issuing new stock to minimise dilution.

Financial Outlook

- The 2022 capital plan continues to remain on track, with net

cash outflows to be used in operating activities in the second half

of the year expected to be between £40m and £50m.

The above forward-looking statements reflect our expectations

for the six months ending December 31, 2022 as of August 8, 2022,

and are subject to substantial uncertainty. Our results are based

on assumptions that we believe to be reasonable as of this date,

but may be materially affected by many factors, as discussed below

in “Forward-Looking Statements.”

About Vertical Aerospace

Vertical Aerospace is pioneering electric aviation. The company

was founded in 2016 by Stephen Fitzpatrick, an established

entrepreneur best known as the founder of the Ovo Group, a leading

energy and technology group and Europe’s largest independent energy

retailer. Over the past six years, Vertical has focused on building

the most experienced and senior team in the eVTOL industry, who

have over 1,700 combined years of engineering experience, and have

certified and supported over 30 different civil and military

aircraft and propulsion systems.

Vertical’s top-tier partner ecosystem is expected to de-risk

operational execution and its pathway to certification allows for a

lean cost structure and enables production at scale. Vertical has a

market-leading pre-order book by value for more than 1,400 aircraft

from global customers creating multiple potential near term and

actionable routes to market. Customers include American Airlines,

Virgin Atlantic, Avolon, Bristow, Marubeni, Iberojet and

FLYINGGROUP, as well as (through Avolon’s VX4 placements) Japan

Airlines (JAL), Gol, G�zen Holding and AirAsia. Vertical’s ordinary

shares listed on the NYSE in December 2021 under the ticker “EVTL”.

Find out more: vertical-aerospace.com

About the VX4 eVTOL Aircraft

The piloted zero operating emissions four-passenger VX4, is

projected to be capable of travelling distances over 100 miles,

achieving top speeds of over 200mph, while producing minimal noise

and has a low cost per passenger mile. The VX4 is expected to open

up advanced air mobility to a whole new range of passengers and

transform how we travel. Find out more: vertical-aerospace.com

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Any express or implied statements contained in this press

release that are not statements of historical fact may be deemed to

be forward-looking statements, including, without limitation,

statements regarding the certification and the commercialization of

the VX4 and related timelines, expectations surrounding pre-orders

and commitments, Vertical’s differential strategy compared to its

peer group, the features and capabilities of the VX4, the

transition towards a net-zero emissions economy, the sufficiency of

Vertical’s cash and cash equivalents to fund operations, expected

financial performance and operational performance for the fiscal

year ending December 31, 2022, as well as statements that include

the words “expect,” “intend,” “plan,” “believe,” “project,”

“forecast,” “estimate,” “may,” “should,” “anticipate,” “will,”

“aim,” “potential,” “continue,” “are likely to” and similar

statements of a future or forward-looking nature. Forward-looking

statements are neither promises nor guarantees, but involve known

and unknown risks and uncertainties that could cause actual results

to differ materially from those projected, including, without

limitation: Vertical’s limited operating history without

manufactured non-prototype aircraft or completed eVTOL aircraft

customer order; Vertical’s history of losses and the expectation to

incur significant expenses and continuing losses for the

foreseeable future; the market for eVTOL aircraft being in a

relatively early stage; the potential inability of Vertical to

produce or launch aircraft in the volumes and on timelines

projected; the potential inability of Vertical to obtain the

necessary certifications on the timelines projected; any accidents

or incidents involving eVTOL aircraft could harm Vertical's

business; Vertical's dependence on partners and suppliers for the

components in its aircraft and for operational needs; the potential

that certain of Vertical’s strategic partnerships may not

materialize into long-term partnership arrangements; all of the

pre-orders Vertical has received for its aircraft are not legally

binding, conditional and may be terminated without penalty at any

time by either party, and if these orders are cancelled, modified,

delayed or not placed in accordance with the terms agreed with each

party, Vertical’s business, results of operations, liquidity and

cash flow will be materially adversely affected; any potential

failure by Vertical to effectively manage its growth; the impact of

COVID-19 on Vertical’s business; Vertical has identified material

weaknesses in its internal controls over financial reporting and

may be unable to remediate the material weaknesses; Vertical's

dependence on our senior management team and other highly skilled

personnel; as a foreign private issuer Vertical follows certain

home country corporate governance rules, is not subject to U.S.

proxy rules and is subject to Exchange Act reporting obligations

that, to some extent, are more lenient and less frequent than those

of a U.S. domestic public company; and the other important factors

discussed under the caption “Risk Factors” in our Annual Report on

Form 20-F filed with the U.S. Securities and Exchange Commission

(“SEC”) on April 29, 2022, as such factors may be updated from time

to time in Vertical’s other filings with the SEC. Any

forward-looking statements contained in this press release speak

only as of the date hereof and accordingly undue reliance should

not be placed on such statements. Vertical disclaims any obligation

or undertaking to update or revise any forward-looking statements

contained in this press release, whether as a result of new

information, future events or otherwise, other than to the extent

required by applicable law.

Unaudited Condensed Consolidated Interim Statement of

Comprehensive Income

H1’2022

£ 000

H1’2021

£ 000

Revenue

-

66

Cost of sales

-

(25)

Gross profit

-

41

Research and development expenses

(19,396)

(7,747)

Administrative expenses

(23,466)

(23,890)

Related party administrative expenses

-

(127)

Other operating income

3,407

9,686

Operating loss

(39,455)

(22,037)

Finance income

42,497

-

Finance costs

(20,063)

(37)

Related party finance costs

-

(483)

Net finance income/(costs)

22,434

(520)

Loss before tax

(17,021)

(22,557)

Income tax expense

-

-

Net loss for the period

(17,021)

(22,557)

Foreign exchange translation

differences

9,482

-

Total comprehensive loss for the

period

(7,539)

(22,557)

Unaudited Condensed Consolidated Interim Statement of

Cashflows

H1’2022

£ 000

H1’2021

£ 000

Cash flows from operating

activities

Net loss for the period

(17,021)

(22,557)

Adjustments to cash flows from non-cash

items:

Depreciation and amortization

832

330

Depreciation on right of use assets

189

70

Finance (income)/costs

(22,434)

37

Related party finance costs

-

483

Share based payment transactions

7,294

16,815

Net exchange differences

4,694

-

Income tax expense

-

(4)

(26,446)

(4,826)

Working capital adjustments:

(Increase) in trade and other

receivables

(1,499)

(7,654)

(Decrease)/increase in trade and other

payables

(30,442)

2,160

Net cash flows used in operating

activities

(58,387)

(10,320)

Cash flows from investing

activities

Acquisitions of property plant and

equipment

(167)

(147)

Acquisition of intangible assets

(393)

(349)

Net cash flows used in investing

activities

(560)

(496)

Cash flows from financing

activities

Proceeds from convertible loan notes

-

25,000

Proceeds from related party borrowings

-

2,208

Payments to lease creditors

(235)

(87)

Net cash flows (used)/generated from

financing activities

(235)

27,121

Net (decrease)/increase in cash at

bank

(59,182)

16,305

Cash at bank as at January 1

212,660

839

Effect of foreign exchange rate

changes

4,074

-

Cash at bank as at June 30

157,552

17,144

Unaudited Condensed Consolidated Interim Statement of

Financial Position

30 June

2022

£ 000

31 December

2021

£ 000

Assets

Non-current assets

Property, plant and equipment

1,738

1,834

Right of use assets

2,112

1,969

Intangible assets

4,028

4,208

7,878

8,011

Current assets

Trade and other receivables

14,157

12,658

Cash at bank

157,552

212,660

171,709

225,318

Total assets

179,587

233,329

Equity

Share capital

16

16

Other reserve

80,271

63,314

Share premium

249,103

248,354

Accumulated deficit

(267,064)

(250,123)

Total equity

62,326

61,561

Non-current liabilities

Lease liabilities

1,683

1,580

Provisions

98

95

Derivative financial liabilities

92,450

112,799

Trade and other payables

6,632

5,975

100,863

120,449

Current liabilities

Lease liabilities

426

362

Warrant liabilities

6,187

10,730

Trade and other payables

9,785

40,227

16,398

51,319

Total liabilities

117,261

171,768

Total equity and liabilities

179,587

233,329

- ENDS -

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220808005081/en/

For more information: Vertical Media Samuel Emden

nepeanverticalteam@nepean.co.uk +44 7816 459 904 Vertical Investors

Eduardo Royes investors@vertical-aerospace.com +1 (646)

200-8871

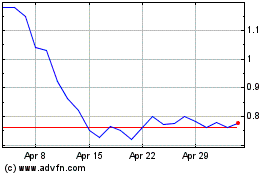

Vertical Aerospace (NYSE:EVTL)

Historical Stock Chart

From Nov 2024 to Dec 2024

Vertical Aerospace (NYSE:EVTL)

Historical Stock Chart

From Dec 2023 to Dec 2024