UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

TENDER OFFER STATEMENT UNDER

SECTION 14(D)(1) OR 13(E)(1) OF

THE SECURITIES EXCHANGE ACT OF 1934

VECTOR GROUP LTD.

(Name of Subject Company — Issuer)

VAPOR MERGER SUB INC.

a wholly owned subsidiary of

JTI (US) HOLDING

INC.

an indirect wholly owned subsidiary

of

JT INTERNATIONAL

HOLDING B.V.

(Names of Filing Persons — Offerors)

Common Stock, par value $0.10 per

share

(Title of Class of Securities)

92240M108

(CUSIP Number of Class of Securities)

Christopher Hill

c/o JTI (US) Holding Inc.

501 Brickell Key Dr., Suite 402

Miami, Florida 33131

United States

Telephone: +1 201 871 1210

(Name, Address and Telephone Number

of Person Authorized to Receive Notices and Communications on Behalf of Filing Persons)

With copies to:

Sebastian L. Fain, Esq.

Paul K. Humphreys, Esq.

Freshfields Bruckhaus Deringer US LLP

3 World Trade Center

175 Greenwich Street

New York, NY 10007

CALCULATION OF FILING FEE

| Transaction Valuation* |

Amount of Filing Fee* |

| Not applicable* |

Not applicable* |

* A filing fee is not

required in connection with this filing as it relates solely to preliminary communications made before the commencement of a tender offer.

| ¨ |

Check the box if any part of the fee is offset as provided by Rule 0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| Amount Previously Paid: |

Not applicable. |

| Form of Registration No.: |

Not applicable. |

| Filing Party: |

Not applicable. |

| Date Filed: |

Not applicable. |

| x |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

Check the appropriate boxes to designate any transactions to which

this statement relates:

| x |

third party tender offer subject to Rule 14d-l |

| ¨ |

issuer tender offer subject to Rule 13e-4 |

| ¨ |

going-private transaction subject to Rule 13e-3 |

| ¨ |

amendment to Schedule 13D under Rule 13d-2 |

Check the following box if the filing is a final amendment reporting

the results of the tender offer. ¨

If applicable, check the appropriate box(es) below to designate the

appropriate rule provision(s) relied upon:

| ¨ |

Rule 13e-4(i) (Cross-Border Issuer Tender Offer) |

| ¨ |

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer) |

This filing relates solely to preliminary communications

made before the commencement of a tender offer for the outstanding common stock of Vector Group Ltd. (“Vector”) by Vapor

Merger Sub Inc. (“Purchaser”), a wholly owned subsidiary of JTI (US) Holding Inc. (“Parent”), to be commenced

pursuant to the Agreement and Plan of Merger, dated as of August 21, 2024, by and among Vector, Purchaser and Parent.

Important Information About the Tender Offer

The tender offer for the outstanding common stock

of Vector has not yet commenced. This communication does not constitute a recommendation, an offer to purchase or a solicitation of an

offer to sell Vector’s securities. An offer to purchase shares of Vector’s common stock will only be made pursuant to an Offer

to Purchase and related tender offer materials. At the time the tender offer is commenced, Parent and Purchaser will file a Tender Offer

Statement on Schedule TO with the Securities and Exchange Commission (the “SEC”) and thereafter Vector will file a Solicitation/Recommendation

Statement on Schedule 14D-9 with the SEC with respect to the tender offer. The tender offer materials (including the Offer to Purchase,

a related Letter of Transmittal and other tender offer documents) and the Solicitation/Recommendation Statement on Schedule 14D-9 will

contain important information.

VECTOR’S STOCKHOLDERS ARE URGED TO READ

THESE DOCUMENTS (INCLUDING THE OFFER TO PURCHASE AND RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER DOCUMENTS), AND THE SOLICITATION/RECOMMENDATION

STATEMENT, AS MAY BE AMENDED FROM TIME TO TIME, CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT

THEY SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES OF COMMON STOCK.

The tender offer materials and the Solicitation/Recommendation

Statement will be made available for free at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC

by Vector may be obtained at no charge under the “Investor Relations” section of Vector’s internet website at https://vectorgroupltd.com.

Forward-Looking Statements

This announcement may include statements that

are not statements of historical fact, or “forward-looking statements,” including with respect to the JT Group’s proposed

acquisition of Vector. Such forward-looking statements include, but are not limited to, the ability of the JT Group and Vector to complete

the transactions contemplated by the merger agreement, including the parties’ ability to satisfy the conditions to the consummation

of the offer contemplated thereby and the other conditions set forth in the merger agreement, statements about the expected timetable

for completing the transaction, the JT Group’s and Vector’s beliefs and expectations and statements about the benefits sought

to be achieved in the JT Group’s proposed acquisition of Vector, the potential effects of the acquisition on both the JT Group and

Vector, the possibility of any termination of the merger agreement, as well as the expected benefits and success of any combination product.

These statements are based upon the current beliefs and expectations of the JT Group’s and Vector’s management and are subject

to significant risks and uncertainties. There can be no guarantees that the conditions to the closing of the proposed transaction will

be satisfied on the expected timetable or at all. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual

results may differ materially from those set forth in the forward-looking statements.

Risks and uncertainties include, but are not limited

to, uncertainties as to the timing of the offer and the subsequent merger; uncertainties as to how many of Vector’s stockholders

will tender their shares in the offer; the possibility that various conditions to the consummation of the offer and the merger contemplated

by the merger agreement may not be satisfied or waived; the ability to obtain necessary regulatory approvals or to obtain them on acceptable

terms or within expected timing; the effects of disruption from the transactions contemplated by the merger agreement and the impact of

the announcement and pendency of the transactions on Vector’s business; the risk that stockholder litigation in connection with

the offer or the merger may result in significant costs of defense, indemnification and liability; general industry conditions and competition;

general economic factors, including interest rate and currency exchange rate fluctuations; the impact of COVID-19; the impact of tobacco

industry regulation and tobacco legislation in the United States and internationally; competition from other products; and challenges

inherent in new product development, including obtaining regulatory approval.

Neither the JT Group nor Vector undertakes any

obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except

to the extent required by law. Additional factors that could cause results to differ materially from those described in the forward-looking

statements can be found in Japan Tobacco Inc.’s integrated report for the year ended December 31, 2023, Vector’s Annual Report

on Form 10-K for the year ended December 31, 2023 and Vector’s Quarterly Reports on Form 10-Q for the three months ended March 31, 2024

and June 30, 2024, in each case as amended by any subsequent filings made with the SEC. These and other filings made by Vector with the

SEC are available at www.sec.gov.

Exhibit Index

Exhibit 99.1

FOR IMMEDIATE RELEASE

Tokyo, August 21, 2024

JT Group to Acquire Vector Group Ltd.

Japan Tobacco Inc. (JT) (the “Company”) (TSE: 2914) announces

today that the JT Group has reached an agreement with Vector Group Ltd. (“VGR”), the fourth largest tobacco company in the

United States, to acquire VGR.

Based on the agreement, the JT Group will conduct a tender offer for

all outstanding shares of VGR, through Vapor Merger Sub Inc., an entity the JT Group established for the purpose of this acquisition.

Through the tender offer and a subsequent statutory merger, the JT Group intends to acquire 100% of VGR’s outstanding fully diluted

share capital for a per share price of $15.00, representing a total equity value transaction estimated at around USD 2.4 billion (approximately

378 billion yen). The transaction, which is unanimously supported by the board of directors of VGR, is expected to be completed by the

end of JT Group’s current fiscal year, ending December 31, 2024, subject to receipt of antitrust approvals and satisfaction

of customary closing conditions.

Following closing, VGR will be a wholly

owned consolidated subsidiary of JT and be delisted from the New York Stock Exchange.

Strategic rationale

In line with the JT Group’s tobacco business strategy, outlined

in Business Plan 2024, this acquisition will add a growing and historically profitable business, which is expected to improve the Company’s

Return-On-Investment (ROI) in combustibles. The transaction will significantly expand JT Group’s presence in the US, the second

largest tobacco market in net sales and one of the most profitable globally. Furthermore, it is expected to strengthen the Group’s

financial position through mid to long term hard currency profits and cash flows, which will support the Company’s investment strategy

in Reduced-Risk Products, notably in heated tobacco sticks.

Executive comments

“We are excited by this acquisition which, in line with our tobacco

business strategy, will contribute to the acceleration of the ROI in our combustible business and expand JT Group’s global footprint.

By adding this sizeable and historically profitable business to our Company, we are confident the transaction will contribute to sustainable

growth and increase JT Group’s corporate value,” said Masamichi Terabatake, JT Group CEO and President of the Tobacco Business.

“This transaction will significantly

increase our US presence, boosting our market share from 2.3% to approximately 8.0% and giving us full ownership of two of the top-10

US cigarette brands. The transaction will enable us to also strengthen our distribution network, and create mid to long term strategic

opportunities to boost our competitiveness in this major tobacco market,” said Eddy Pirard, President and CEO of JT International.

| 1. | Overview of newly acquired company |

| (1) Name |

Vector Group Ltd. |

| (2) Address |

Miami, FL 33137 USA |

| (3) Representative |

Howard M. Lorber (President and CEO) |

| (4) Business description |

Manufacturing and sales of cigarettes, etc. |

| (5) Capitalization |

USD 15,598 Thousand (As of December 31, 2023) |

| (6) Year of foundation |

1873 |

| (7) Major shareholder and holding ratio (As of June 27, 2024) |

BlackRock, Inc. (13.61%) The Vanguard Group, Inc. (11.35%) Dr. Phillip Frost (9.38%) |

| (8) Relationship

with JT |

Capital |

None |

| Personnel |

None |

| Business |

None |

| (9) Financial results audited (Note1) |

| Accounting period (Dollars in Thousands) |

Fiscal year

ended

December

31,

2021 |

Fiscal year

ended

December

31,

2022 |

Fiscal year

ended

December

31,

2023 |

| Net assets |

(841,553) |

(807,877) |

(741,814) |

| Total assets |

871,087 |

908,591 |

934,095 |

| Net assets per share (Dollar) (Note2) |

(5.47) |

(5.22) |

(4.76) |

| Net sales |

1,220,700 |

1,441,009 |

1,424,268 |

| Operating profit |

320,439 |

339,010 |

328,035 |

| Net income |

219,463 |

158,701 |

183,526 |

| Net income per share (Dollar) (Note3) |

1.16 |

1.01 |

1.40 |

| Dividend per share (Dollar) |

0.80 |

0.80 |

0.80 |

Note1:

The results of operations and financial condition of the company are taken from the Form 10-K filed by VGR with the U.S. Securities

and Exchange Commission (SEC).

Note2:

Net assets per share is calculated by dividing net assets by the number of common shares outstanding at the end of each period.

Note3:

Diluted EPS is shown.

| 2. | Overview of Tender Offer |

| (1) Tender offeror |

Vapor Merger Sub Inc. |

| (2) Target

Company |

Vector

Group Ltd. |

| (3) Class of shares to be acquired |

Common stock (on a fully diluted basis) |

| (4) Tender offer price |

US$ 15.00 per share |

| (5) Period of tender offer (planned) |

From late August or early September 2024 to October 2024

*The offer period under the tender offer will commence within

the next 10 business days and is expected to expire 20 business days after commencement thereof, subject to receipt of antitrust approvals

and satisfaction of customary closing conditions. If a situation arises whereby the conditions to the tender offer are not satisfied,

the period of the tender offer may be extended, in accordance with the terms of the definitive agreement. |

| (6) Conditions of tender offer |

The tender offer is subject to

approval under U.S. and Serbian antitrust laws, the tender of more than 50% of VGR’s outstanding common stock, and

satisfaction of other customary closing conditions. Any remaining shares of common stock of VGR that were not tendered - in the

tender offer - will be, upon the completion of the transaction, cancelled and converted into the right to receive the same

consideration payable in the tender offer. |

Note

1: VGR is a listed company on the New York Stock Exchange, and the Tender Offer does not constitute a tender offer as defined in Article 27-2-1

of the Financial Instruments and Exchange Law of Japan. Further information regarding the Tender Offer will be posted on the U.S. Securities

and Exchange Commission’s (SEC) website at http://www.sec.gov.

Note

2: J.P. Morgan Securities LLC and J.P. Morgan Securities plc are serving as exclusive financial advisor to the JT Group, Ernst &

Young Tax Co. is acting as its financial and tax advisor and Freshfields Bruckhaus Deringer US LLP is acting as its legal counsel. Jefferies

LLC is acting as exclusive financial advisor to VGR and Sullivan & Cromwell LLP is acting as its legal counsel.

| 3. | Status of the number of shares and consideration for acquisition |

| (1) |

Number of shares held by JT Group (before acquisition) |

None |

| (2) |

Number of shares to be acquired |

157,486,267 shares |

| (3) |

Acquisition price (estimated) |

The outstanding shares: USD 2.4billion (approximately 378 billion yen) |

| (4) |

Number of shares to be held by JT Group (after acquisition) |

157,486,267 shares (Ratio of voting rights: 100%) |

Note 1: The above figures are based on the assumption that all of

VGR’s shares are acquired through the

Tender Offer and a subsequent statutory merger.

Note 2: The acquisition price is

converted at the rate of 158.229 yen per U.S. dollar (TTM rate mean in July,2024).

| (1) Agreement date |

August 21, 2024 |

|

(2) Period of Tender Offer (planned) |

From late August or early September 2024 to October 2024. If a situation arises whereby the conditions to the tender offer are not satisfied, the period of the tender offer may be extended, in accordance with the terms of the definitive agreement. |

|

(3) Stock transfer date (planned) |

By the end of the fiscal year ending December 31, 2024. |

| 5. | Impact on Financial Performance |

The transaction is not expected to have any material

impact on the Group’s consolidated performance for the fiscal year ending December 31, 2024.

Important Information About the Tender Offer

The tender offer for the outstanding common stock

of VGR has not yet commenced. This communication does not constitute a recommendation, an offer to purchase or a solicitation of an offer

to sell VGR’s securities. An offer to purchase shares of VGR’s common stock will only be made pursuant to an Offer to Purchase

and related tender offer materials. At the time the tender offer is commenced, JTI (US) Holding Inc. and Vapor Merger Sub Inc. will file

a Tender Offer Statement on Schedule TO with the Securities and Exchange Commission (the “SEC”) and thereafter VGR will file

a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer. The tender offer materials (including

the Offer to Purchase, a related Letter of Transmittal and other tender offer documents) and the Solicitation/Recommendation Statement

on Schedule 14D-9 will contain important information.

VGR’S STOCKHOLDERS ARE URGED TO READ THESE

DOCUMENTS (INCLUDING THE OFFER TO PURCHASE AND RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER DOCUMENTS), AND THE SOLICITATION/RECOMMENDATION

STATEMENT, AS MAY BE AMENDED FROM TIME TO TIME, CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

THAT THEY SHOULD CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES OF COMMON STOCK.

The tender offer materials and the Solicitation/Recommendation

Statement will be made available for free at the SEC’s website at www.sec.gov. Copies of the documents filed with the SEC by VGR

may be

obtained at no charge under the “Investors”

section of VGR’s internet website at https://vectorgroupltd.com.

Forward-Looking Statements

This announcement may include statements that

are not statements of historical fact, or “forward-looking statements,” including with respect to the JT Group’s proposed

acquisition of VGR. Such forward-looking statements include, but are not limited to, the ability of the JT Group and VGR to complete the

transactions contemplated by the merger agreement, including the parties’ ability to satisfy the conditions to the consummation

of the offer contemplated thereby and the other conditions set forth in the merger agreement, statements about the expected timetable

for completing the transaction, the JT Group’s and VGR’s beliefs and expectations and statements about the benefits sought

to be achieved in the JT Group’s proposed acquisition of VGR, the potential effects of the acquisition on both the JT Group and

VGR, the possibility of any termination of the merger agreement, as well as the expected benefits and success of any combination product.

These statements are based upon the current beliefs and expectations of the JT Group’s and VGR’s management and are subject

to significant risks and uncertainties. There can be no guarantees that the conditions to the closing of the proposed transaction will

be satisfied on the expected timetable or at all. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual

results may differ materially from those set forth in the forward-looking statements.

Risks and uncertainties include, but are not limited

to, uncertainties as to the timing of the offer and the

subsequent merger; uncertainties as to how many

of VGR’s stockholders will tender their shares in the offer; the possibility that various conditions to the consummation of the

offer and the merger contemplated by the merger agreement may not be satisfied or waived; the ability to obtain necessary regulatory approvals

or to obtain them on acceptable terms or within expected timing; the effects of disruption from the transactions contemplated by the merger

agreement and the impact of the announcement and pendency of the transactions on VGR’s business; the risk that stockholder litigation

in connection with the offer or the merger may result in significant costs of defense, indemnification and liability; general industry

conditions and competition; general economic factors, including interest rate and currency exchange rate fluctuations; the impact of COVID-19;

the impact of tobacco industry regulation and tobacco legislation in the United States and internationally; competition from other products;

and challenges inherent in new product development, including obtaining regulatory approval.

Neither the JT Group nor VGR undertakes any obligation

to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise, except to the extent

required by law. Additional factors that could cause results to differ materially from those described in the forward-looking statements

can be found in Japan Tobacco Inc.’s integrated report for the year ended December 31, 2023, VGR’s Annual Report on Form 10-K

for the year ended December 31, 2023 and VGR’s Quarterly Reports on Form 10-Q for the three months ended March 31,

2024 and June 30, 2024, in each case as amended by any subsequent filings made with the SEC. These and other filings made by VGR

with the SEC are available at www.sec.gov.

###

Japan Tobacco Inc. (JT) is a global company headquartered in Tokyo,

Japan. It is listed on the primary section of the Tokyo Stock Exchange (ticker: 2914.T). JT Group has approximately 53,000 employees and

62 factories worldwide, operating in three business segments: tobacco, pharmaceutical, and processed food. Within the tobacco business,

the largest segment, products are sold in over 130 markets and its flagship brands include Winston, Camel, MEVIUS, and LD. The Group is

committed to investing in Reduced-Risk Products and markets its heated tobacco products under its Ploom brand.

Consumers, shareholders, employees, and society are the four stakeholder

groups (4S) at the heart of all of JT Group's activities. Inspired by its “Fulfilling Moment, Enriching Life” purpose, the

Group aims to ensure sustainable and valuable contributions to its stakeholders over the long term. In addition to our three business

segments, this goal is also supported by D-LAB, the JT Group’s corporate R&D initiative, set up to search and create added-value

business opportunities. For more information, visit https://www.jt.com/.

| Contact: | Investor and Media Relations Division Japan Tobacco Inc. |

| |

For Investors |

Jerome Jaffeux, Head of IR: jt.ir@jt.com |

| |

For Media |

Yunosuke Miyata, Director: jt.media.relations@jt.com |

Exhibit 99.2

Exhibit 99.3

Eddy Pirard

President and Chief Executive Officer

|

|

August 21, 2024

To all Vector Group Ltd. employees,

Hello everyone. My name is Eddy Pirard and I am the President

and C.E.O. of JT International, JT Group’s tobacco business. While I would have preferred to be with you in person today, I wanted

to share my enthusiasm and excitement following the announcement made today.

I am truly delighted by this great opportunity to bring

Vector Group into the fold of JT International’s group of companies. Until the completion of the transaction, which is expected

by the end of 2024, we will continue to operate as independent entities, focusing on our respective day-to-day responsibilities and as

always, focused on serving our customers and our consumers as best we can.

I am looking forward to the day when,

after completion, we will join forces to drive further growth and deliver even more value to our consumers in the US. In the meantime,

I would like to share with you a few details about JT International, or JTI as we like to call ourselves.

Headquartered in Geneva, Switzerland, JTI is a member of

the JT Group, a global company headquartered in Tokyo, Japan. The JT Group operates in tobacco, pharmaceutical and processed food. At

JTI, our 46,000 dedicated employees have been the cornerstone of twenty-five years of growth, selling our global flagship brands Winston,

Camel, MEVIUS and LD – as well as many other regional or local brands – in more than 130 markets globally, while operating

36 factories and 8 research & development centers worldwide. We are also increasingly present in the Reduced-Risk Products category,

notably with our heated tobacco brand, Ploom, vaping brand, Logic, and Nordic Spirit nicotine pouches. We are committed to making our

business not only the fastest growing of its kind, but also the most consumer centric and sustainably run company in the industry. To

this end, we are guided by our purpose of “Creating fulfilling moments. Creating a better future”.

In the United States, more specifically, we have been growing

steadily over the years. With Vector Group Ltd. soon to become a member of the JTI family, we aim to accelerate our growth, fully leveraging

the assets of both businesses as well as the vast quality and experience of both teams. We have great ambitions for the US market, and

look forward to developing strategies together that will achieve this.

I very much look forward to meeting with you in person in the

near future to formally welcome you to JTI!

Sincerely,

Eddy Pirard

Important Information About the Tender Offer

The tender offer for the outstanding common stock of Vector

Group Ltd. (“VGR”) has not yet commenced. This communication does not constitute a recommendation, an offer to purchase or

a solicitation of an offer to sell VGR’s securities. An offer to purchase shares of VGR’s common stock will only be made pursuant

to an Offer to Purchase and related tender offer materials. At the time the tender offer is commenced, JTI (US) Holding Inc. and Vapor

Merger Sub Inc. will file a Tender Offer Statement on Schedule TO with the Securities and Exchange Commission (the “SEC”)

and thereafter VGR will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC with respect to the tender offer.

The tender offer materials (including the Offer to Purchase, a related Letter of Transmittal and other tender offer documents) and the

Solicitation/Recommendation Statement on Schedule 14D-9 will contain important information.

VGR’S STOCKHOLDERS ARE URGED TO READ THESE DOCUMENTS

(INCLUDING THE OFFER TO PURCHASE AND RELATED LETTER OF TRANSMITTAL AND CERTAIN OTHER DOCUMENTS), AND THE SOLICITATION/RECOMMENDATION STATEMENT,

AS MAY BE AMENDED FROM TIME TO TIME, CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION THAT THEY SHOULD

CONSIDER BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR SHARES OF COMMON STOCK.

The tender offer materials

and the Solicitation/Recommendation Statement will be made available for free at the SEC’s website at www.sec.gov.

Copies of the documents filed with the SEC by VGR may be obtained at no charge under the “Investors” section of VGR’s

internet website at https://vectorgroupltd.com.

Forward-Looking Statements

This announcement may include statements that are not

statements of historical fact, or “forward- looking statements,” including with respect to the JT Group’s proposed acquisition

of VGR. Such forward-looking statements include, but are not limited to, the ability of the JT Group and VGR to complete the transactions

contemplated by the merger agreement, including the parties’ ability to satisfy the conditions to the consummation of the offer

contemplated thereby and the other conditions set forth in the merger agreement, statements about the expected timetable for completing

the transaction, the JT Group’s and VGR’s beliefs and expectations and statements about the benefits sought to be achieved

in the JT Group’s proposed acquisition of VGR, the potential effects of the acquisition on both the JT Group and VGR, the possibility

of any termination of the merger agreement, as well as the expected benefits and success of any combination product. These statements

are based upon the current beliefs and expectations of the JT Group’s and VGR’s management and are subject to significant

risks and uncertainties. There can be no guarantees that the conditions to the closing of the proposed transaction will be satisfied on

the expected timetable or at all. If underlying assumptions prove inaccurate or risks or uncertainties materialize, actual results may

differ materially from those set forth in the forward-looking statements.

Risks and uncertainties include, but are not limited to,

uncertainties as to the timing of the offer and the subsequent merger; uncertainties as to how many of VGR’s stockholders will tender

their shares in the offer; the possibility that various conditions to the consummation of the offer and the merger contemplated by the

merger agreement may not be satisfied or waived; the ability to obtain necessary regulatory approvals or to obtain them on acceptable

terms or within expected timing; the effects of disruption from the transactions contemplated by the merger agreement and the impact of

the announcement and pendency of the transactions on VGR’s business; the risk that stockholder litigation in connection with the

offer or the merger may result in significant costs of defense, indemnification and liability; general industry conditions and competition;

general economic factors, including interest rate and currency exchange rate fluctuations; the impact of COVID-19; the impact of tobacco

industry regulation and tobacco legislation in the United States and internationally; competition from other products; and challenges

inherent in new product development, including obtaining regulatory approval.

Neither the JT Group nor

VGR undertakes any obligation to publicly update any forward-looking statement, whether as a result of new information, future events

or otherwise, except to the extent required by law. Additional factors that could cause results to differ materially from those described

in the forward-looking statements can be found in Japan Tobacco Inc.’s integrated report for the year ended December 31, 2023,

VGR’s Annual Report on Form 10-K for the year ended December 31, 2023 and VGR’s Quarterly Reports on Form 10-Q for the three

months ended March 31, 2024 and June 30, 2024, in each case as amended by any subsequent filings made with the SEC. These and other filings

made by VGR with the SEC are available at www.sec.gov.

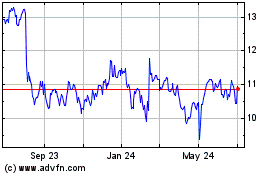

Vector (NYSE:VGR)

Historical Stock Chart

From Nov 2024 to Dec 2024

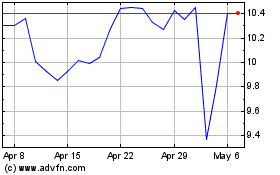

Vector (NYSE:VGR)

Historical Stock Chart

From Dec 2023 to Dec 2024