US Foods Announces Pricing of Private Offering of $500 Million of Senior Unsecured Notes

September 27 2024 - 4:05PM

Business Wire

US Foods Holding Corp. (NYSE: USFD) today announced that its

wholly-owned subsidiary, US Foods, Inc. (“US Foods”), has priced

the previously announced notes offering and has agreed to issue and

sell $500 million aggregate principal amount of 5.75% senior

unsecured notes due 2033 (the “Notes”).

US Foods intends to use the net proceeds of the Notes offering

to repay a portion of the amounts outstanding under its term loan

facility. The Notes will be the senior unsecured obligations of US

Foods and will be guaranteed by all of US Foods’ existing and

future wholly-owned domestic subsidiaries that guarantee US Foods’

obligations under its existing term loan credit facility. The

closing of the sale of the Notes is scheduled for October 3, 2024,

subject to customary closing conditions.

The Notes and the related guarantees thereof will be offered in

a private offering exempt from the registration requirements of the

Securities Act of 1933, as amended (the “Securities Act”) in the

United States to persons reasonably believed to be qualified

institutional buyers pursuant to Rule 144A under the Securities

Act, and outside the United States pursuant to Regulation S under

the Securities Act. The Notes and the related guarantees have not

been registered under the Securities Act or any state securities

laws and unless so registered, may not be offered or sold in the

United States absent registration or an applicable exemption from

the registration requirements of the Securities Act and applicable

state securities laws.

This press release is for informational purposes only and does

not constitute an offer to sell the Notes, nor a solicitation for

an offer to purchase the Notes or any other securities, nor shall

there be any sales of Notes or other securities, in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction. No assurance can

be made that the Offering will be consummated on its proposed terms

or at all.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240927990835/en/

INVESTOR CONTACT: Mike Neese (847) 232-5894

Michael.Neese@usfoods.com

MEDIA CONTACT: Sara Matheu (773) 580-3775

Sara.Matheu@usfoods.com

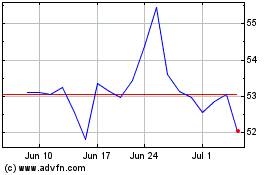

US Foods (NYSE:USFD)

Historical Stock Chart

From Jan 2025 to Feb 2025

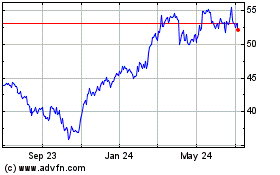

US Foods (NYSE:USFD)

Historical Stock Chart

From Feb 2024 to Feb 2025