As filed with the Securities and Exchange Commission on June 12, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-8

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

UNIVERSAL HEALTH REALTY INCOME TRUST

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

Maryland |

|

23-6858580 |

(State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification Number) |

|

|

|

|

|

|

Universal Corporate Center 367 South Gulph Road PO Box 61558 King of Prussia, Pennsylvania |

|

19406 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

UNIVERSAL HEALTH REALTY INCOME TRUST

AMENDED AND RESTATED 2007 RESTRICTED STOCK PLAN, AS AMENDED

(Full title of the plan)

Alan B. Miller

Chairman of the Board, Chief Executive Officer and President

Universal Health Realty Income Trust

Universal Corporate Center

367 South Gulph Road

PO Box 61558

King of Prussia, Pennsylvania 19406

(Name and address of agent for service)

(610) 265-0688

(Telephone number, including area code, of agent for service)

Copies of all communications, including all communications sent to the agent for service, should be sent to:

Warren J. Nimetz, Esq.

Norton Rose Fulbright US LLP

1301 Avenue of the Americas

New York, New York 10019

(212) 318-3000

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

Large accelerated filer |

☒ |

Accelerated filer |

☐ |

Non accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

EXPLANATORY NOTE

Universal Health Realty Income Trust (the “Trust” or the “Registrant”) is filing this registration statement (this “Registration Statement”) on Form S-8 under the Securities Act of 1933, as amended (the “Securities Act”), to register additional 100,000 shares of beneficial interest, $.01 par value per share (“Common Shares”), of the Registrant authorized for future issuance under the Universal Health Realty Income Trust Amended and Restated 2007 Restricted Stock Plan, as amended (the “Plan”). These additional Common Shares have become reserved for issuance as a result of the amendment of the Plan, effective as of June 5, 2024.

In accordance with General Instruction E to Form S-8, the contents of the previous Registration Statements on Form S-8 related to the Plan (File Nos. 333-143944, filed on June 21, 2007, 333-211903, filed on June 6, 2016, and 333-246042, filed on August 14, 2020 with the Commission) are incorporated herein by reference and made part of this Registration Statement, except as amended hereby.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Trust with the Commission under the Securities Act or the Securities Exchange Act of 1934, as amended (the “Securities Exchange Act”) are incorporated by reference in this Registration Statement:

i.The Trust’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Commission on February 27, 2024 (File No. 001-09321);

ii.The Trust’s Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024, filed with the Commission on May 8, 2024 (File No. 001-09321);

iii.The Trust’s Current Report on Form 8-K filed with the Commission on June 6, 2024 (File No. 001-09321); and

iv.The description of the Trust’s shares of beneficial interest contained in Exhibit 4.1 to the Trust’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019, filed with the Commission on February 26, 2020 (File No. 001-09321), and as amended by any subsequent amendment or report filed for the purpose of updating such description.

All documents subsequently filed by the Trust pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act (other than documents or any information therein deemed to have been furnished and not filed in accordance with rules of the Commission), prior to the filing of a post-effective amendment to this Registration Statement indicating that all of the securities offered hereunder have been sold or deregistering all securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be part hereof from the date of filing of such documents.

Any statement contained in a document incorporated or deemed to be incorporated by reference in this Registration Statement shall be deemed to be modified or superseded for purposes of this Registration Statement to the extent that a statement contained herein, or in any subsequently filed document that is also incorporated or deemed to be incorporated by reference herein, modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement.

Item 8. Exhibits.

The following exhibits are filed herewith or incorporated by reference as part of this Registration Statement.

|

|

|

Exhibit No. |

|

Description |

|

|

4.1 |

|

Universal Health Realty Income Trust Declaration of Trust, dated as of August, 1986 (incorporated herein by reference to Exhibit 4.1 to the Trust’s Registration Statement on Form S-3, as filed with the Securities and Exchange Commission on May 10, 2001 (File No. 333-60638)). (P) |

|

|

|

4.2 |

|

Amendment to Declaration of Trust, dated as of June 15, 1993 (incorporated herein by reference to Exhibit 4.2 to the Trust’s Registration Statement on Form S-3, as filed with the Securities and Exchange Commission on May 10, 2001 (File No. 333-60638)). (P) |

|

|

|

4.3 |

|

Universal Health Realty Income Trust Amended and Restated Bylaws (incorporated herein by reference to Exhibit 3.1 to the Trust’s Current Report on Form 8-K, as filed with the Securities and Exchange Commission on October 3, 2016). |

|

|

|

4.4 |

|

Universal Health Realty Income Trust Amended and Restated 2007 Restricted Stock Plan, as amended by the First Amendment and the Second Amendment thereto (incorporated herein by reference to Annex A to the Trust’s Proxy Statement, as filed with the Securities and Exchange Commission on April 23, 2024). |

|

|

|

4.5* |

|

Form of Restricted Share Agreement. |

|

|

|

5.1* |

|

Opinion of Norton Rose Fulbright US LLP. |

|

|

23.1* |

|

Consent of KPMG LLP. |

|

|

23.2* |

|

Consent of Norton Rose Fulbright US LLP (included in Exhibit 5.1). |

|

|

24.1* |

|

Power of Attorney (included in the signature page). |

|

|

|

107* |

|

Filing Fee Table. |

_____________________________________________________________________________________________

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of King of Prussia, State of Pennsylvania, on the 12th day of June, 2024.

|

|

|

|

|

|

UNIVERSAL HEALTH REALTY INCOME TRUST |

|

|

By: |

|

/S/ ALAN B. MILLER |

|

|

Alan B. Miller |

|

|

Chairman of the Board, Chief Executive Officer and President |

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints Alan B. Miller and Charles F. Boyle, or either of them, as his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection therewith, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact and agents, or either of them, or their or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

Signature |

|

Title |

|

Date |

|

|

|

/S/ ALAN B. MILLER |

|

Chairman of the Board, Chief Executive Officer and President (Principal Executive Officer) |

|

June 12, 2024 |

Alan B. Miller |

|

|

|

|

|

/S/ CHARLES F. BOYLE |

|

Senior Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) |

|

June 12, 2024 |

Charles F. Boyle |

|

|

|

|

|

/S/Gayle L. Capozzalo |

|

Trustee |

|

June 12, 2024 |

Gayle L. Capozzalo |

|

|

|

|

|

|

|

/S/Michael Allan Domb |

|

Trustee |

|

June 12, 2024 |

Michael Allan Domb |

|

|

|

|

|

|

|

/S/ Rebecca A. Guzman |

|

Trustee |

|

June 12, 2024 |

Rebecca A. Guzman |

|

|

|

|

|

|

|

/S/Robert F. McCadden |

|

Trustee |

|

June 12, 2024 |

Robert F. McCadden |

|

|

|

|

|

|

|

/S/Marc D. Miller |

|

Trustee |

|

June 12, 2024 |

Marc D. Miller |

|

|

|

|

|

|

|

|

|

/S/James P. Morey |

|

Trustee |

|

June 12, 2024 |

James P. Morey |

|

|

|

|

Exhibit 4.5

Granted To: ###PARTICIPANT_NAME###

Address: ###HOME_ADDRESS###

Grant Date: ###GRANT_DATE###

Granted Amount: ###TOTAL_AWARDS###

Grant Type: ###DICTIONARY_AWARD_NAME###

Plan: Universal Health Realty Income Trust Amended and Restated 2007 Restricted Stock Plan

UNIVERSAL HEALTH REALTY INCOME TRUST RESTRICTED SHARE AGREEMENT

AGREEMENT made as of the date specified above, between Universal Health Realty Income Trust (the "Trust") and ###PARTICIPANT_NAME### (the "Recipient"), pursuant to the Universal Health Realty Income Trust Amended and Restated 2007 Restricted Stock Plan (the "Plan").

1. Restricted Share Award. In accordance with the Plan, the Trust hereby awards to the Recipient shares of beneficial interest in the Trust as indicated above (the "Restricted Shares"), subject to the vesting conditions, transfer restrictions and other terms and conditions of this Agreement.

2. Vesting Conditions.

(a) General. Except as otherwise specified, the Restricted Shares will become vested as follows, provided the Recipient remains in the continuous full-time employ or service of the Trust on each applicable vesting date.

###VEST_SCHEDULE_TABLE###

(b) Accelerated Vesting. If, before the applicable vesting date described in (a) above, the Recipient’s employment or service with the Trust terminates due to the Recipient’s death or "disability" (as defined below), the Restricted Shares will thereupon become fully vested. If a "change in control" (within the meaning of the Plan) occurs, the board of trustees of the Trust (the "Board"), acting in its discretion, may cause the Restricted Shares to (1) become fully vested immediately prior to the change in control, or (2) be converted into restricted equity securities of the acquiring or successor entity which are equal in value to the Restricted Shares being converted, in which case any performance vesting conditions shall be waived. The term "disability" means the inability of Recipient to perform the principal duties of the Recipient’s employment by reason of a physical or mental illness or injury that is expected to last indefinitely or result in death, as determined by a duly licensed physician selected by the Trust.

3. Employment or Service. Upon the termination of the Recipient's full-time employment or other service with the Trust (for any reason other than death or disability), or unless otherwise stipulated in writing and signed by an authorized representative of the Trust, the Recipient will forfeit any Restricted Shares covered by this Agreement that have not previously vested (as well as any unvested dividends attributable to those Restricted Shares), and such forfeited Restricted Shares will be canceled on the date of the Recipient's termination of full-time employment or other service. Per diem or other similar type of employment relationship does not constitute "full-time employment" with the Trust.

4. Restrictions on Transfer. The Restricted Shares covered by this Agreement may not be sold, assigned, transferred, alienated, commuted, anticipated, or otherwise disposed of (except by will or the laws of descent and distribution), or pledged or hypothecated as collateral for a loan or as security for the performance of any obligation, or be otherwise encumbered, and may not become subject to attachment, garnishment, execution or other legal or equitable process, and any attempt to do so shall be null and void. If the Recipient attempts to dispose of or encumber any Restricted Shares covered by this Agreement before such Restricted Shares are vested, then the Recipient’s rights with respect to such Restricted Shares shall terminate and such Restricted Shares shall be canceled as of the date of such attempted transfer.

5. Dividends and Voting Rights. The Recipient will have the right to receive dividends distributable on and exercise voting rights with respect to the Restricted Shares while they are covered by this Agreement. Dividends on unvested stock will be deferred and accumulated prior to the vesting of the shares and paid, in either cash and/or stock, in the aggregate on the vesting date on the shares that ultimately vest.

6. Issuance of Restricted Shares. The Recipient is the record owner of the Restricted Shares on the Trust’s books, subject to the restrictions and conditions set forth in this Agreement. By executing this Agreement, the Recipient expressly authorizes the Trust to cancel, reacquire, retire or retain, at its election, any unvested Restricted Shares if and when they are forfeited in accordance with this Agreement. The Recipient will execute and deliver such other documents and take such other actions, if any, as the Trust may reasonably request in order to evidence such action with respect to any unvested Restricted Shares that are forfeited. If and when the Restricted Shares become vested, the vested Restricted Shares will no longer be subject to the transfer restrictions contained in this Agreement and the Company’s books will be updated accordingly.

7. Tax Withholding. The Trust may require as a condition of the removal of restrictions on the Restricted Shares under this Agreement that the Recipient remit to the Trust an amount sufficient in the opinion of the Trust to satisfy any federal, state and other governmental tax withholding requirements attributable to the transfer or vesting of the Restricted Shares. In addition, or in the alternative, the Trust may satisfy such tax withholding obligation in whole or in part by withholding Restricted Shares that would otherwise be delivered to the Recipient (or the Recipient’s representative or beneficiary) based upon the fair market value of the Restricted Shares on the applicable vesting date.

8. No Service Rights. Nothing contained in the Plan or this Agreement shall confer upon the Recipient any right with respect to the continuation of the Recipient’s employment or other service with the Trust or interfere in any way with the right of the Trust at any time to terminate such relationship.

9. Governing Law. This Agreement shall be governed by and construed in accordance with the laws of the State of Maryland, without regard to its principles of conflict of laws.

10. Miscellaneous. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which shall constitute one and the same instrument. This Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective successors and permitted assigns. This Agreement constitutes the entire agreement between the parties with respect to the subject matter hereof and may not be modified other than by written instrument executed by the parties.

IN WITNESS WHEREOF, this Agreement has been executed as of the date first above written.

|

|

|

|

|

UNIVERSAL HEALTH REALTY INCOME TRUST |

PARTICIPANT |

|

|

By: |

/s/ Charles F. Boyle |

|

By: _ ________________________________ |

|

|

|

|

|

Print Name: Charles F. Boyle |

|

Print Name: |

###PARTICIPANT_NAME### |

|

|

|

|

|

Title: Senior Vice President and CFO |

|

|

|

Exhibit 5.1

Norton Rose Fulbright US LLP

1301 Avenue of the Americas

New York, New York 10019-6022

United States

Tel +1 212 318 3000

Fax +1 212 318 3400

nortonrosefulbright.com

June 12, 2024

Universal Health Realty Income Trust

Universal Corporate Center

367 South Gulph Road

King of Prussia, PA 19406

Re: Registration Statement on Form S-8

Ladies and Gentlemen:

We refer to the Registration Statement on Form S-8 (the “Registration Statement”), to be filed with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the “Act”), by Universal Health Realty Income Trust (the “Trust”), for the registration of 100,000 shares of beneficial interest, $.01 par value per share, of the Trust (the “Shares”), which may be issued pursuant to the Universal Health Realty Income Trust Amended and Restated 2007 Restricted Stock Plan, as amended (the “Plan”).

As counsel for the Trust, we have examined the Plan and such Trust records, other documents, and such questions of law as we have considered necessary or appropriate for the purposes of this opinion and, upon the basis of such examination, advise you that in our opinion all necessary proceedings by the Trust have been duly taken to authorize the issuance of the Shares pursuant to the Plan and that the Shares being registered pursuant to the Registration Statement, when issued under the Plan in accordance with its terms, will be duly authorized, validly issued, fully paid and nonassessable.

We hereby consent to the use of this opinion as a part of the Registration Statement. This consent is not to be construed as an admission that we are a person whose consent is required to be filed with the Registration Statement under the provisions of the Act.

Very truly yours,

/s/ Norton Rose Fulbright US LLP

Norton Rose Fulbright US LLP

Exhibit 23.1

Consent of Independent Registered Public Accounting Firm

We consent to the use of our reports dated February 27, 2024, with respect to the consolidated financial statements and financial statement schedule III of Universal Health Realty Income Trust and subsidiaries, and the effectiveness of internal control over financial reporting, incorporated herein by reference.

/s/ KPMG LLP

Philadelphia, Pennsylvania

June 12, 2024

Exhibit 107

Calculation of Filing Fee Tables

FORM S-8

(Form Type)

UNIVERSAL HEALTH REALTY INCOME TRUST

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

|

|

|

|

|

|

|

Security Type |

Security Class Title |

Fee Calculation Rule |

Amount Registered (1) |

Proposed Maximum Offering Price Per Unit |

Maximum Aggregate Offering Price |

Fee Rate |

Amount of Registration Fee |

Equity |

Common Shares of Beneficial Interest, $0.01 par value, pursuant to Universal Health Realty Income Trust Amended and Restated 2007 Restricted Stock Plan, as amended |

Rule 457(c) and Rule 457(h) |

100,000 |

$38.90(2) |

$3,890,000 |

0.00014760 |

$574.16 |

Total Offering Amounts |

|

$3,890,000 |

|

$574.16 |

Total Fee Offsets (3) |

|

|

|

- |

Net Fee Due |

|

|

|

$574.16 |

(1) This Registration Statement on Form S-8 (this “Registration Statement”) covers 100,000 Common Shares of Beneficial Interest, $0.01 par value (“Common Shares”) of Universal Health Realty Income Trust (the “Registrant”) that may be awarded pursuant to Universal Health Realty Income Trust Amended and Restated 2007 Restricted Stock Plan, as amended (the “Plan”). In addition, pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement also covers an additional indeterminable number of shares as may be necessary to adjust the number of Common Shares being offered or issued pursuant to the Plan as a result of any stock split, stock dividend, recapitalization or similar transaction affecting such shares.

(2) Estimated solely for the purpose of determining the registration fee in accordance with Rule 457(c) and (h) of the Securities Act. The offering price per share and the aggregate offering price are based upon the average of the high and low sales prices of the Common Shares, as reported on the New York Stock Exchange on June 10, 2024.

(3) There are no fee offsets.

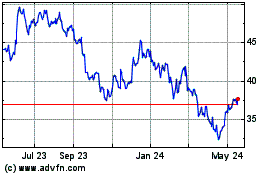

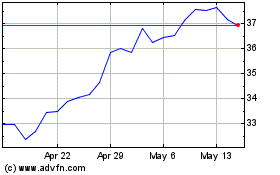

Universal Health Realty ... (NYSE:UHT)

Historical Stock Chart

From Feb 2025 to Mar 2025

Universal Health Realty ... (NYSE:UHT)

Historical Stock Chart

From Mar 2024 to Mar 2025