UBS Names Michael Baldinger as First Chief Sustainability Officer

May 05 2021 - 1:21PM

Dow Jones News

By Dieter Holger

UBS Group AG on Wednesday named Michael Baldinger as the Swiss

bank's first chief sustainability officer, effective June 1, a role

that will steer its goal to reach net-zero greenhouse-gas emissions

by 2050 as big financiers re-align their portfolios to combat

climate change.

Mr. Baldinger joined the bank in 2016 as head of sustainable and

impact investing for UBS Asset Management and was previously the

chief executive of sustainable-investment pioneer and research firm

RobecoSAM. In his new role, reporting to UBS Asset Management

President Suni Harford, he will have more power to oversee a number

of challenges to boost sustainable investments and activities.

"We aim to extend the group's leadership in sustainability and

take another step toward meeting our net-zero ambitions," Ms.

Harford said.

Mr. Baldinger's promotion comes at a time when UBS and the

financial sector is placing greater importance on sustainability

and environmental, social and governance-based investing

strategies, as governments, investors and the public call on banks

to mobilize their finances to meet the Paris climate accords. The

international agreement made in 2015 aims to keep global warming

well-below 2 degrees Celsius and achieve a climate-neutral world by

the mid-century.

Big U.S. banks Wells Fargo & Co., Bank of America Corp. and

Citigroup Inc. pledged earlier this year to reach net-zero

greenhouse-gas emissions across their finances by 2050. BlackRock

Inc., the world's largest fund manager, has also said its

investments would reach net-zero by 2050, which involves pressuring

companies to change course.

UBS, which has more than $4 trillion in invested assets, is

already one of the world's top managers of sustainability funds and

publishers of ESG research, but it plans to move even more

aggressively into the space. In September, UBS said it would

recommend sustainable investments over traditional options to its

clients around the world, including for retirement plans. More

wealth managers could follow its lead, analysts say.

Later this year, Mr. Baldinger will likely be involved in

unveiling the bank's climate action plan, which will set

science-based emissions targets and intermediate goals on the road

to net-zero. The most difficult area to cut emissions for UBS are

its scope 3 emissions, which are contained in the products

companies sell. For banks like UBS, that includes their

financing.

Sustainable investments can also bring profit to fund managers.

For instance, exchange-traded funds with sustainability mandates

around environmental and social issues carry higher fees on average

than standard ETFs, according to data from FactSet.

UBS's most recent first-quarter earnings topped Wall Street's

expectations across all its divisions but were overshadowed by a

surprise $774 million hit from the collapse of Archegos Capital

Management. Operating profit from its asset-management business

rose to $227 million from $157 million a year ago, buoyed by

inflows.

Write to Dieter Holger at dieter.holger@wsj.com;

@dieterholger

(END) Dow Jones Newswires

May 05, 2021 13:06 ET (17:06 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

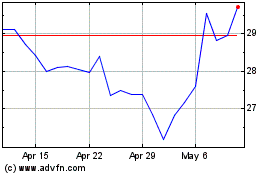

UBS (NYSE:UBS)

Historical Stock Chart

From Apr 2024 to May 2024

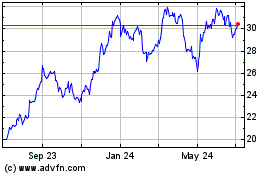

UBS (NYSE:UBS)

Historical Stock Chart

From May 2023 to May 2024