Tyson Foods, Inc. Announces Pricing of Senior Notes Offerings

February 28 2024 - 10:21PM

Tyson Foods, Inc. (the “Company”) (NYSE: TSN) announced today that

it has agreed to sell $600 million aggregate principal amount of

its 5.400% Senior Notes due 2029 (the “2029 notes”) and $900

million aggregate principal amount of its 5.700% Senior Notes due

2034 (the “2034 notes”) in underwritten public offerings under its

effective shelf registration statement. The offerings are expected

to close on March 8, 2024, subject to the satisfaction of customary

closing conditions.

The company intends to use the net proceeds from

the offerings for general corporate purposes, which is expected to

include the retirement of the outstanding 3.95% Notes due August

2024 (the ‘‘2024 Notes’’). Pending application of the proceeds, the

Company intends to use the proceeds to pay down other outstanding

debt, which may include amounts under its revolving credit facility

or its commercial paper program, and/or invest the proceeds in bank

deposit accounts, certificates of deposit, U.S. government

securities or other interest bearing securities.

BofA Securities, Inc., Morgan Stanley & Co.

LLC, Rabo Securities USA, Inc., RBC Capital Markets, LLC and J.P.

Morgan Securities LLC are acting as joint book-running managers for

the offerings. Barclays Capital Inc. and Goldman Sachs & Co.

LLC are acting as senior co-managers for the offerings. The

co-managers for the offerings are Credit Agricole Securities (USA)

Inc., Mizuho Securities USA LLC, MUFG Securities Americas Inc.,

U.S. Bancorp Investments, Inc., Wells Fargo Securities, LLC,

Regions Securities LLC, Comerica Securities, Inc. and Siebert

Williams Shank & Co., LLC.

The offerings may be made only by means of a

prospectus supplement and the accompanying prospectus. Copies of

the preliminary prospectus supplement and accompanying prospectus

relating to these offerings may be obtained from BofA Securities,

Inc. by calling BofA Securities, Inc. toll free at 1-800-294-1322

or from Morgan Stanley & Co. LLC by calling Morgan Stanley

& Co. LLC toll-free at 1-866-718-1649. You may also get these

documents for free by visiting EDGAR on the website of the

Securities and Exchange Commission (the “SEC”) at www.sec.gov.

This press release shall not constitute an offer

to sell or the solicitation of an offer to buy any securities, nor

shall there be any sale of these securities, in any state or

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such state or jurisdiction. A registration

statement relating to the notes became effective on June 9, 2023,

and this offering is being made by means of a prospectus

supplement.

Forward-Looking Statements

Certain information in this release constitutes

forward-looking statements as contemplated by the Private

Securities Litigation Reform Act of 1995. Such forward-looking

statements include, but are not limited to, current views and

estimates of our outlook for fiscal 2024, other future economic

circumstances, industry conditions in domestic and international

markets, our performance and financial results (e.g., debt levels,

return on invested capital, value-added product growth, capital

expenditures, tax rates, access to foreign markets and dividend

policy). These forward-looking statements are subject to a number

of factors and uncertainties that could cause our actual results

and experiences to differ materially from anticipated results and

expectations expressed in such forward-looking statements. The

Company cautions readers not to place undue reliance on any

forward-looking statements, which are expressly qualified in their

entirety by this cautionary statement and speak only as of the date

made. Other important factors are discussed in detail in the

company’s filings with the Securities and Exchange Commission,

including in Part I, Item 1A. “Risk Factors” included in our most

recent Annual Report on Form 10-K and Quarterly Reports on Form

10-Q. The Company undertakes no obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

About Tyson Foods, Inc. Tyson

Foods, Inc. (NYSE: TSN) is one of the world’s largest food

companies and a recognized leader in protein. Founded in 1935 by

John W. Tyson and grown under four generations of family

leadership, the Company has a broad portfolio of products and

brands like Tyson®, Jimmy Dean®, Hillshire Farm®, Ball Park®,

Wright®, Aidells®, ibp® and State Fair®. Tyson Foods innovates

continually to make protein more sustainable and affordable to meet

customers’ needs worldwide and raise the world’s expectations for

how much good food can do. Headquartered in Springdale, Arkansas,

the Company had approximately 139,000 team members on September 30,

2023. Through its Core Values, Tyson Foods strives to operate with

integrity, create value for its shareholders, customers,

communities and team members and serve as a steward of the animals,

land and environment entrusted to it. Visit www.tysonfoods.com.

Media Contact: Angelena Abate |

Angelena.Abate@ketchum.com | 646-234-8060

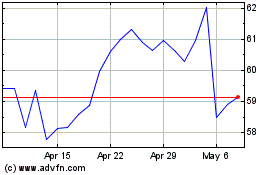

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Nov 2024 to Dec 2024

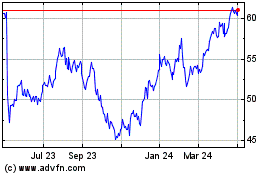

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Dec 2023 to Dec 2024