- Anticipating strong operating cash flow of approximately

$175 million year-to-date through Q3 2024 and new record operating

cash flow in the range of $425 million to $575 million for

full-year 2024

- Planning to utilize anticipated strong 2024 cash collections

to prepay $100 million to $150 million of Term Loan B debt by

December 31, 2024, with further prepayments of $50 million to $75

million expected in Q1 2025

- Expecting record backlog of approximately $14 billion as of

September 30, 2024, up 35% compared to the backlog at June 30,

2024, driven by certain significant new project awards, two of

which have not yet been announced

- Awaiting owners’ decisions and potential awards for other

significant new projects in Q4 2024; backlog at year-end 2024 could

be substantially higher than at the end of Q3 2024

- While the Company made considerable progress in resolving

seven of its largest disputed matters, which is expected to

contribute to the strong future operating cash flow, the result is

anticipated to be a net charge to earnings and a net loss for Q3

2024

- Management expects return to profitability in 2025

Tutor Perini Corporation (NYSE: TPC) (the “Company”), a leading

civil, building and specialty construction company, provided an

update today regarding several recent developments, including the

settlement of various project-related disputes, which had both

favorable and adverse implications for the Company. Because of

anticipated cash collections resulting from these settlements and

from other unrelated project activities, some of which are driven

by new awards, the Company expects that its operating cash flow for

2024 will be in the range of $425 million to $575 million,

meaningfully surpassing the Company’s previous record for full-year

operating cash generation in 2023 and significantly greater than

previous estimates. The Company expects to use this anticipated

cash, in part, to prepay its Term Loan B debt by $100 million to

$150 million by the end of 2024, with further prepayments of $50

million to $75 million in the first quarter of 2025.

Significant new award activity is expected to result in a new

record ending backlog of approximately $14 billion as of September

30, 2024, up 35% compared to the backlog reported as of June 30,

2024. The Company continues to expect strong new award bookings in

the near term, as it has recently submitted proposals and is

awaiting owners’ decisions and potential awards for several other

large projects. Accordingly, ending backlog for the fourth quarter

of 2024 could see further significant growth compared to the result

to be reported for the third quarter of 2024.

As a result of the net charges discussed below, the Company

expects that it will report a loss from construction operations and

negative earnings per share for the third quarter of 2024.

Therefore, the Company is withdrawing its EPS guidance for 2024.

The Company does not expect these net charges to affect compliance

with its debt covenants. Excluding the impact of these net charges,

the Company believes that the third-quarter results would have been

profitable, and it would have been in a position to achieve its

previously provided EPS guidance range.

The Company expects to return to profitability in 2025 and will

provide guidance for 2025 in February, when it reports its

full-year 2024 results.

Settlements of Disputed Matters

During the third quarter of 2024 and through the date of this

release, several matters in various stages of litigation or dispute

resolution proceedings with project owners, subcontractors and/or

insurance companies were adjudicated or otherwise settled. The

Company reached resolution or otherwise made significant progress

towards the resolution of various matters, including seven of its

largest outstanding disputed balances, with four of the seven

having favorable outcomes for the Company.

For one matter, the Company expects to record a non-cash,

pre-tax charge to income (loss) from construction operations of

approximately $102 million in the third quarter of 2024 as a result

of an unexpected adverse arbitration decision issued in October

2024 involving a Civil segment bridge project in California. The

Company strongly disagrees with the decision and intends to appeal.

While the arbitration panel agreed with prior non-binding rulings

of an independent dispute resolution board comprised of industry

experts, the most important of which was that the Company was not

provided accurate construction documents for the project, including

geotechnical information, the arbitration panel failed to award the

Company its complete damages and applied offsets that the Company

strongly disputes.

For the resolution of other matters, including the other six

large disputed balances, the Company expects to record a net

pre-tax charge to income (loss) from construction operations of

approximately $43 million in the third quarter of 2024, with an

associated expected net cash inflow to the Company resulting from

these resolutions of approximately $180 million, which is expected

to be received in the fourth quarter of 2024.

Additionally, during the third quarter of 2024, the Company

received a favorable ruling from an independent dispute review

board that issued a non-binding decision as to the quantum of

damages the Company is entitled to recover associated with a claim

on a mass-transportation project in the Northeast. The favorable

dispute review board decision could serve as a meaningful catalyst

in the resolution of this matter.

For some of the matters adjudicated unsuccessfully during the

period, the Company continues to strongly believe that it is

legally entitled to collect all or substantially all of the amounts

previously recorded. However, in light of the rulings and despite

the fact that certain matters will be appealed, the Company expects

to record these charges in the third quarter of 2024, consistent

with applicable accounting standards. These charges primarily

reflect write-downs related to Costs and Estimated Earnings in

Excess of Billings and Accounts Receivable that the Company

previously recorded based on its expected recovery. The outcome of

appeals could result in additional cash collections or payments,

and charges or earnings, which could offset some or all of the

charges mentioned above.

As previously disclosed in the Company’s Annual Report on Form

10-K for the year ended December 31, 2023, and its subsequent

Quarterly Reports on Form 10-Q, the Company is involved in various

lawsuits or dispute resolution proceedings which may involve making

estimates of recovery for additional costs exceeding the contract

price or for amounts not included in the original contract price.

From time to time, the Company may invest significant working

capital on projects while legal and other dispute resolution

proceedings are pending. Adverse outcomes of these litigation or

dispute resolution matters sometimes require the Company to record

an expense or reduce revenue that was previously recorded based on

estimates made and reduce the cash collections previously expected

to be received. Conversely, favorable outcomes of these litigation

or dispute resolution matters can result in gains and increase the

amount of expected cash collections.

Management Remarks

Gary Smalley, President, commented, “We have made and continue

to make tremendous strides in resolving many of our larger,

long-standing disputes and collecting substantial amounts of

associated cash. We are pleased that we expect to deliver a third

consecutive year of record operating cash flow, with this year’s

result well above last year's. We plan to utilize a substantial

portion of this cash to pay down much of our Term Loan B debt by

the end of this year, with further deleveraging planned in the

first quarter of 2025. This continued debt reduction from improved

cash collections is another step along the path of optimizing our

capital structure, which will enable us to reduce our interest

costs considerably.”

Ronald Tutor, Chairman and Chief Executive Officer, remarked,

“Unfortunately, we received a couple of unexpected and rather

inexplicable legal decisions that will negatively impact earnings

for the third quarter of 2024. We strongly disagree with both

rulings and are appealing them. We hope to reverse the negative

impact of these decisions in the future. With many of our larger

disputes now behind us, we anticipate that we will experience less

earnings volatility in 2025 and beyond. Finally, we are enjoying a

remarkably successful year in terms of major new awards that are

driving our backlog to new record levels, setting a solid

foundation for revenue growth and strong profitability and cash

flow in the years ahead. Our backlog could continue to grow

substantially in the near term due to certain bids outstanding and

other projects that will be bidding soon.”

Cash and Debt

For the nine months ended September 30, 2024, the Company

expects to report operating cash flow of approximately $175

million. Operating cash flow for the fourth quarter of 2024 is

expected to be in the range of $250 million to $400 million, such

that operating cash generation for the full year of 2024 is

estimated to be in the range of $425 million to $575 million. Even

the low end of this anticipated range would significantly surpass

the Company’s previous all-time record operating cash flow of $308

million in 2023. The strong operating cash flow anticipated for the

fourth quarter is expected to be driven by collections related to

the resolution of the aforementioned disputed matters, as well as

cash generation related to project execution activities for new and

existing projects. The wide range in the estimated generation of

operating cash in the fourth quarter of 2024 is due to the

uncertainty as to the precise timing of when certain large payments

will be collected, though any amounts in this range that are not

collected in the fourth quarter of 2024 are expected to be

collected in the first quarter of 2025.

With the significant operating cash flow expected in the fourth

quarter of 2024, the Company anticipates prepaying $100 million to

$150 million of its outstanding Term Loan B debt prior to December

31, 2024. The Company also estimates that it will prepay an

additional $50 million to $75 million of the Term Loan B debt in

the first quarter of 2025 with cash generated from operations.

Backlog

As a result of the recently announced award of the $1.66 billion

City Center Guideway and Stations project in Honolulu, Hawaii, as

well as certain other significant new awards that were booked in

the third quarter of 2024, which will be announced soon, ending

backlog for the third quarter of 2024 is expected to be

approximately $14 billion, a 35% increase over backlog as of June

30, 2024, and far exceeding the Company’s previous record backlog

of $11.6 billion that was reported for the first quarter of 2019.

In addition, the Company has submitted or will submit proposals and

expects owners’ decisions in November on the multi-billion-dollar

Manhattan Jail project, the $1.8 billion Amtrak Sawtooth Bridges

project, the $1.5 billion Newark AirTrain project, and the $550

million Raritan River Bridge Replacement project. Accordingly,

ending backlog for the fourth quarter of 2024 could reflect further

significant growth.

Preliminary Estimates and Results

The preliminary estimates of the Company’s results presented

above are based upon currently available information, and are

subject to revision as a result of, among other things, the

completion of the Company’s financial closing procedures, the

completion of its financial statements for such period and the

completion of other operational procedures (all of which have not

yet been completed), including the possibility of changes as a

result of resolutions on open litigation, arbitration or other

settlement negotiations that could occur through the filing of the

Company’s Quarterly Report on Form 10-Q for the fiscal quarter

ended September 30, 2024. Additional items that may require

adjustments to the preliminary estimates may be identified. The

Company’s actual results may be materially different from its

preliminary estimates, which should not be regarded as a

representation by the Company or its management as to the Company’s

actual results for the fiscal quarter ended, and as of, September

30, 2024. You should not place undue reliance on this preliminary

information. In addition, the preliminary data is not necessarily

indicative of the Company’s results for any future period. During

the course of the preparation of the Company’s financial statements

and related notes as of and for the three months ended September

30, 2024, the Company may identify items that would require

material adjustments to these preliminary estimates. As a result,

you should exercise caution in relying on this information and

should not draw any inferences from this information. These

preliminary estimates have been prepared by and are the

responsibility of the Company’s management. Deloitte & Touche

LLP, the Company’s independent registered public accounting firm,

has not audited, reviewed, compiled or performed any procedures

with respect to these preliminary estimates, and accordingly,

Deloitte & Touche LLP does not express an opinion or any other

form of assurance with respect thereto.

Note Regarding Forward-Looking Statements

The statements contained in this release that are not purely

historical are forward‐looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, including

without limitation, statements regarding the Company’s

expectations, hopes, beliefs, intentions or strategies regarding

the future and statements regarding future guidance or estimates

and non‐historical performance. These forward‐looking statements

are based on the Company’s current expectations and beliefs

concerning future developments and their potential impacts on the

Company. While the Company’s expectations, beliefs and projections

are expressed in good faith and the Company believes there is a

reasonable basis for them, there can be no assurance that future

developments affecting the Company will be those that we have

anticipated. These forward‐looking statements involve a number of

risks, uncertainties (some of which are beyond the control of the

Company) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by such forward‐looking statements. These risks and

uncertainties include, but are not limited to: unfavorable outcomes

of existing or future litigation or dispute resolution proceedings

against us or customers (project owners, developers, general

contractors, etc.), subcontractors or suppliers, as well as failure

to promptly recover significant working capital invested in

projects subject to such matters; revisions of estimates of

contract risks, revenue or costs, economic factors such as

inflation, the timing of new awards, or the pace of project

execution, which has resulted and may continue to result in losses

or lower than anticipated profit; contract requirements to perform

extra work beyond the initial project scope, which has and in the

future could result in disputes or claims and adversely affect our

working capital, profits and cash flows; risks and other

uncertainties associated with estimates and assumptions used to

prepare our financial statements; failure to meet contractual

schedule requirements, which could result in higher costs and

reduced profits or, in some cases, exposure to financial liability

for liquidated damages and/or damages to customers, as well as

damage to our reputation; inability to attract and retain our key

officers, and to adequately plan for their succession, and hire and

retain personnel required to execute and perform on our contracts;

possible systems and information technology interruptions and

breaches in data security and/or privacy; an inability to obtain

bonding, which could have a negative impact on our operations and

results; the impact of inclement weather conditions and other

events outside of our control on projects; risks related to our

international operations, such as uncertainty of U.S. government

funding, as well as economic, political, regulatory and other

risks, including risks of loss due to acts of war, labor

conditions, and other unforeseeable events in countries where we do

business, which could adversely affect our revenue and earnings;

increased competition and failure to secure new contracts; a

significant slowdown or decline in economic conditions, such as

those presented during a recession; decreases in the level of

government spending for infrastructure and other public projects;

client cancellations of, or reductions in scope under, contracts

reported in our backlog; risks related to government contracts and

related procurement regulations; failure of our joint venture

partners to perform their venture obligations, which could impose

additional financial and performance obligations on us, resulting

in reduced profits or losses and/or reputational harm; significant

fluctuations in the market price of our common stock, which could

result in substantial losses for stockholders and potentially

subject us to securities litigation; failure to meet our

obligations under our debt agreements (especially in a high

interest rate environment); downgrades in our credit ratings;

violations of the U.S. Foreign Corrupt Practices Act and similar

worldwide anti‐bribery laws; public health crises, such as

COVID‐19, which have adversely impacted, and could in the future

adversely impact, our business, financial condition and results of

operations by, among other things, delaying the timing of project

bids and/or awards and the timing of dispute resolutions and

associated collections; physical and regulatory risks related to

climate change; impairment of our goodwill or other

indefinite‐lived intangible assets; the exertion of influence over

the Company by our chairman and chief executive officer due to his

position and significant ownership interest; and other risks and

uncertainties discussed under the heading “Risk Factors” in our

Annual Report on Form 10‐K for the year ended December 31, 2023

filed on February 28, 2024 and in other reports that we file with

the Securities and Exchange Commission from time to time. The

Company undertakes no obligation to publicly update or revise any

forward‐looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws.

About Tutor Perini Corporation

Tutor Perini Corporation is a leading civil, building and

specialty construction company offering diversified general

contracting and design-build services to private customers and

public agencies throughout the world. We have provided construction

services since 1894 and have established a strong reputation within

our markets by executing large, complex projects on time and within

budget, while adhering to strict quality control measures. We offer

general contracting, pre-construction planning and comprehensive

project management services, including planning and scheduling of

manpower, equipment, materials and subcontractors required for a

project. We also offer self-performed construction services

including site work, concrete forming and placement, steel

erection, electrical, mechanical, plumbing and heating, ventilation

and air conditioning (HVAC).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241021252515/en/

Tutor Perini Corporation Jorge Casado, 818-362-8391 Vice

President, Investor Relations and Corporate Communications

www.tutorperini.com

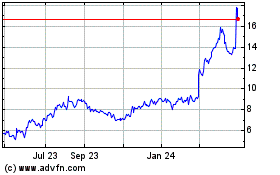

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Nov 2024 to Dec 2024

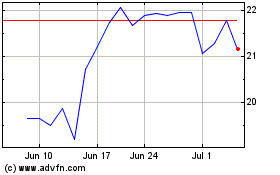

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Dec 2023 to Dec 2024