- Strong operating cash flow of $53.1 million in Q2 2024 and

$151.4 million in the first six months of 2024

- Revenue of $1.1 billion in Q2 2024, up 10% compared to Q2

2023

- Backlog of $10.4 billion at the end of Q2 2024, up modestly

compared to the end of Q1 2024; anticipating continued strong

backlog growth in 2024 and 2025

- Affirming 2024 EPS guidance in range of $0.85 to

$1.10

Tutor Perini Corporation (the "Company") (NYSE: TPC), a leading

civil, building and specialty construction company, reported

results today for the second quarter of 2024. The Company generated

$53.1 million of cash from operating activities in the second

quarter of 2024 compared to $56.3 million for the same period of

2023. For the first six months of 2024, the Company generated

$151.4 million of cash from operating activities, an increase

compared to $77.7 million for the first six months of 2023. The

operating cash flow for the first six months of 2024 was the

Company's second-highest result for the first six months of any

year since the merger between Tutor-Saliba Corporation and Perini

Corporation in 2008. The Company continues to anticipate strong

operating cash generation over the remainder of 2024 and in

2025.

Revenue for the second quarter of 2024 was $1.1 billion, up 10%

compared to $1.0 billion for the second quarter of 2023. The growth

was primarily driven by increased project execution activities on

various Building and Civil segment projects in California and New

York, as well as certain Civil segment projects in the Northern

Mariana Islands and British Columbia.

Income from construction operations for the second quarter of

2024 was $40.5 million, an increase of $38.1 million compared to

$2.4 million for the same period in 2023. The increase was

principally due to contributions related to the increased project

execution activities in the current-year quarter discussed above

and the absence of certain significant prior-year unfavorable

adjustments. The Company's income from construction operations for

the second quarter of 2024 was negatively impacted by a $14.3

million ($0.19 per diluted share) increase in share-based

compensation expense compared to the second quarter of 2023,

primarily due to a substantial increase in the Company’s stock

price during the second quarter of 2024, which affected the fair

value of liability-classified awards, as well as by an unfavorable

adjustment of $12.4 million ($0.17 per diluted share) due to the

impact of a settlement of two completed Civil segment highway

projects in the Northeast. Net income attributable to the Company

for the second quarter of 2024 was $0.8 million, or $0.02 diluted

earnings per share ("EPS"), compared to net loss attributable to

the Company of $37.5 million, or a $0.72 diluted loss per share,

for the second quarter of 2023.

Backlog grew to $10.4 billion as of June 30, 2024 compared to

$10.0 billion as of March 31, 2024. The Civil and Building segments

were the primary contributors to the new awards activity in the

second quarter of 2024. The most significant new awards and

contract adjustments in the second quarter of 2024 included the

Company's proportionate share of its contract value for a $1.3

billion bridge replacement project in Connecticut; a $216 million

airport terminal connectors project at Fort Lauderdale-Hollywood

International Airport in Florida; $144 million of additional

funding for certain mass-transit projects in California; a $136

million highway and bridge project in the Midwest; a $127 million

electrical project in New York; a $74 million military facilities

project in Guam; and $71 million of additional funding for various

healthcare projects in California.

Outlook and Guidance

“We generated strong operating cash flow in the second quarter,

and our operating cash flow for the first half of 2024 was our

second-highest result for the first six months of any year,”

remarked Ronald Tutor, Chairman and Chief Executive Officer. “In

addition, we delivered solid year-over-year revenue growth and

significantly improved earnings despite the impact of higher

share-based compensation expense that resulted from a substantial

increase in our stock price during the second quarter, as well as

an unfavorable adjustment due to a project settlement, which will

have a significant positive impact on our third-quarter operating

cash flow. Our backlog is anticipated to grow significantly during

the second half of this year and in 2025, as we pursue and expect

to capture our share of various large project opportunities, some

of which we have already bid and others that we expect to bid

soon.”

Based on the Company's year-to-date results in 2024 and the

current outlook for the remainder of the year, the Company is

affirming its 2024 EPS guidance and still expects EPS to be in the

range of $0.85 to $1.10.

Second Quarter 2024 Conference Call

The Company will host a conference call at 2:00 PM Pacific Time

on Thursday, August 1, 2024, to discuss the second quarter 2024

results. To participate in the conference call, please dial

877-407-8293 five to ten minutes prior to the scheduled time.

International callers should dial 1-201-689-8349.

The conference call will be webcast live over the Internet and

can be accessed by all interested parties on Tutor Perini's website

at www.tutorperini.com. For those unable to participate during the

live call, the webcast will be available for replay on the website

shortly after the call.

About Tutor Perini Corporation

Tutor Perini Corporation is a leading civil, building and

specialty construction company offering diversified general

contracting and design-build services to private customers and

public agencies throughout the world. We have provided construction

services since 1894 and have established a strong reputation within

our markets by executing large, complex projects on time and within

budget, while adhering to strict quality control measures. We offer

general contracting, pre-construction planning and comprehensive

project management services, including planning and scheduling of

manpower, equipment, materials and subcontractors required for a

project. We also offer self-performed construction services

including site work, concrete forming and placement, steel

erection, electrical, mechanical, plumbing and heating, ventilation

and air conditioning (HVAC).

Forward-Looking Statements

The statements contained in this release, including those set

forth in the section “Outlook and Guidance,” that are not purely

historical are forward-looking statements within the meaning of

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, including

without limitation, statements regarding the Company’s

expectations, hopes, beliefs, intentions or strategies regarding

the future and statements regarding future guidance or estimates

and non-historical performance. These forward-looking statements

are based on the Company’s current expectations and beliefs

concerning future developments and their potential impacts on the

Company. While the Company’s expectations, beliefs and projections

are expressed in good faith and the Company believes there is a

reasonable basis for them, there can be no assurance that future

developments affecting the Company will be those that we have

anticipated. These forward-looking statements involve a number of

risks, uncertainties (some of which are beyond the control of the

Company) or other assumptions that may cause actual results or

performance to be materially different from those expressed or

implied by such forward-looking statements. These risks and

uncertainties include, but are not limited to: unfavorable outcomes

of existing or future litigation or dispute resolution proceedings

against us or customers (project owners, developers, general

contractors, etc.), subcontractors or suppliers, as well as failure

to promptly recover significant working capital invested in

projects subject to such matters; revisions of estimates of

contract risks, revenue or costs, economic factors such as

inflation, the timing of new awards, or the pace of project

execution, which has resulted and may continue to result in losses

or lower than anticipated profit; contract requirements to perform

extra work beyond the initial project scope, which has and in the

future could result in disputes or claims and adversely affect our

working capital, profits and cash flows; risks and other

uncertainties associated with estimates and assumptions used to

prepare our financial statements; failure to meet contractual

schedule requirements, which could result in higher costs and

reduced profits or, in some cases, exposure to financial liability

for liquidated damages and/or damages to customers, as well as

damage to our reputation; inability to attract and retain our key

officers, and to adequately plan for their succession, and hire and

retain personnel required to execute and perform on our contracts;

possible systems and information technology interruptions and

breaches in data security and/or privacy; an inability to obtain

bonding, which could have a negative impact on our operations and

results; the impact of inclement weather conditions and other

events outside of our control on projects; risks related to our

international operations, such as uncertainty of U.S. government

funding, as well as economic, political, regulatory and other

risks, including risks of loss due to acts of war, labor

conditions, and other unforeseeable events in countries where we do

business, which could adversely affect our revenue and earnings;

increased competition and failure to secure new contracts; a

significant slowdown or decline in economic conditions, such as

those presented during a recession; decreases in the level of

government spending for infrastructure and other public projects;

client cancellations of, or reductions in scope under, contracts

reported in our backlog; risks related to government contracts and

related procurement regulations; failure of our joint venture

partners to perform their venture obligations, which could impose

additional financial and performance obligations on us, resulting

in reduced profits or losses and/or reputational harm; significant

fluctuations in the market price of our common stock, which could

result in substantial losses for stockholders and potentially

subject us to securities litigation; failure to meet our

obligations under our debt agreements (especially in a high

interest rate environment); downgrades in our credit ratings;

violations of the U.S. Foreign Corrupt Practices Act and similar

worldwide anti-bribery laws; public health crises, such as

COVID-19, which have adversely impacted, and could in the future

adversely impact, our business, financial condition and results of

operations by, among other things, delaying the timing of project

bids and/or awards and the timing of dispute resolutions and

associated collections; physical and regulatory risks related to

climate change; impairment of our goodwill or other

indefinite-lived intangible assets; the exertion of influence over

the Company by our chairman and chief executive officer due to his

position and significant ownership interest; and other risks and

uncertainties discussed under the heading “Risk Factors” in our

Annual Report on Form 10-K for the year ended December 31, 2023

filed on February 28, 2024 and in other reports that we file with

the Securities and Exchange Commission from time to time. The

Company undertakes no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required under

applicable securities laws.

Tutor Perini

Corporation

Condensed Consolidated

Statements of Operations

Unaudited

Three Months Ended

June 30,

Six Months Ended

June 30,

(in thousands, except per common share

amounts)

2024

2023

2024

2023

REVENUE

$

1,127,470

$

1,021,751

$

2,176,457

$

1,798,051

COST OF OPERATIONS

(1,010,392

)

(956,790

)

(1,944,129

)

(1,757,259

)

GROSS PROFIT

117,078

64,961

232,328

40,792

General and administrative expenses

(76,585

)

(62,573

)

(143,029

)

(120,349

)

INCOME (LOSS) FROM CONSTRUCTION

OPERATIONS

40,493

2,388

89,299

(79,557

)

Other income, net

5,838

3,058

11,149

9,475

Interest expense

(23,084

)

(22,016

)

(42,391

)

(43,529

)

INCOME (LOSS) BEFORE INCOME

TAXES

23,247

(16,570

)

58,057

(113,611

)

Income tax (expense) benefit

(7,278

)

(194

)

(14,586

)

47,918

NET INCOME (LOSS)

15,969

(16,764

)

43,471

(65,693

)

LESS: NET INCOME ATTRIBUTABLE TO

NONCONTROLLING INTERESTS

15,157

20,770

26,899

21,037

NET INCOME (LOSS) ATTRIBUTABLE TO TUTOR

PERINI CORPORATION

$

812

$

(37,534

)

$

16,572

$

(86,730

)

BASIC EARNINGS (LOSS) PER COMMON

SHARE

$

0.02

$

(0.72

)

$

0.32

$

(1.68

)

DILUTED EARNINGS (LOSS) PER COMMON

SHARE

$

0.02

$

(0.72

)

$

0.31

$

(1.68

)

WEIGHTED-AVERAGE COMMON SHARES

OUTSTANDING:

BASIC

52,327

51,803

52,210

51,678

DILUTED

52,848

51,803

52,682

51,678

Tutor Perini

Corporation

Segment Information

Unaudited

Reportable Segments

(in thousands)

Civil

Building

Specialty

Contractors

Total

Corporate

Consolidated

Total

Three Months Ended June 30,

2024

Total revenue

$

577,519

$

433,797

$

163,066

$

1,174,382

$

—

$

1,174,382

Elimination of intersegment revenue

(31,031

)

(15,931

)

50

(46,912

)

—

(46,912

)

Revenue from external customers

$

546,488

$

417,866

$

163,116

$

1,127,470

$

—

$

1,127,470

Income (loss) from construction

operations

$

75,587

$

5,047

$

(7,846

)

$

72,788

(a)

$

(32,295

)(b)

$

40,493

Capital expenditures

$

9,479

$

68

$

(30

)

$

9,517

$

1,401

$

10,918

Depreciation and amortization(c)

$

10,727

$

585

$

574

$

11,886

$

2,120

$

14,006

Three Months Ended June 30,

2023

Total revenue

$

555,553

$

321,933

$

136,323

$

1,013,809

$

—

$

1,013,809

Elimination of intersegment revenue

(1,430

)

9,409

(37

)

7,942

—

7,942

Revenue from external customers

$

554,123

$

331,342

$

136,286

$

1,021,751

$

—

$

1,021,751

Income (loss) from construction

operations

$

105,407

$

(13,831

)

$

(69,832

)

$

21,744

(d)

$

(19,356

)(b)

$

2,388

Capital expenditures

$

9,643

$

1,458

$

256

$

11,357

$

1,470

$

12,827

Depreciation and amortization(c)

$

7,074

$

455

$

622

$

8,151

$

2,195

$

10,346

______________________________

(a)

During the three months ended June 30,

2024, the Company’s income (loss) from construction operations was

impacted by an unfavorable adjustment of $12.4 million ($9.1

million, or $0.17 per diluted share, after tax) due to the impact

of a settlement on two completed Civil segment highway projects in

the Northeast.

(b)

Consists primarily of corporate general

and administrative expenses. Corporate general and administrative

expenses for the three months ended June 30, 2024 and 2023 included

share-based compensation expense of $16.9 million ($12.4 million,

or $0.23 per diluted share, after tax) and $2.6 million ($1.9

million, or $0.04 per diluted share, after tax), respectively. The

increase in share-based compensation expense in the second quarter

of 2024 was primarily due to a substantial increase in the

Company’s stock price during the period, which impacted the fair

value of liability-classified awards. These awards are remeasured

at fair value at the end of each reporting period with the change

in fair value recognized in earnings.

(c)

Depreciation and amortization is included

in income (loss) from construction operations.

(d)

During the three months ended June 30,

2023, the Company’s income (loss) from construction operations was

impacted by favorable adjustments totaling $58.1 million ($46.1

million, or $0.89 per diluted share, after tax) resulting from

changes in estimates due to improved performance on a Civil segment

mass-transit project in California; $35.8 million ($26.0 million,

or $0.50 per diluted share, after tax) of unfavorable non-cash

adjustments due to changes in estimates on the Specialty

Contractors segment’s electrical and mechanical scope of a

transportation project in the Northeast associated with a change in

the expected recovery on certain unapproved change orders; a

non-cash charge of $24.7 million ($18.0 million, or $0.35 per

diluted share, after tax) that resulted from an adverse legal

ruling on a Specialty Contractors segment educational facilities

project in New York; and a $13.1 million ($10.2 million, or $0.20

per diluted share, after tax) unfavorable adjustment on a

transportation project in the Northeast, split evenly between the

Civil and Building segments, due to the settlement of certain

change orders during project closeout.

Tutor Perini

Corporation

Segment Information

Unaudited

Reportable Segments

(in thousands)

Civil

Building

Specialty

Contractors

Total

Corporate

Consolidated

Total

Six Months Ended June 30, 2024

Total revenue

$

1,080,341

$

855,973

$

327,946

$

2,264,260

$

—

$

2,264,260

Elimination of intersegment revenue

(61,688

)

(26,165

)

50

(87,803

)

—

(87,803

)

Revenue from external customers

$

1,018,653

$

829,808

$

327,996

$

2,176,457

$

—

$

2,176,457

Income (loss) from construction

operations

$

146,330

$

21,167

$

(26,158

)

$

141,339

(a)

$

(52,040

)(b)

$

89,299

Capital expenditures

$

17,610

$

285

$

273

$

18,168

$

3,184

$

21,352

Depreciation and amortization(c)

$

20,981

$

1,170

$

1,172

$

23,323

$

4,265

$

27,588

Six Months Ended June 30, 2023

Total revenue

$

933,777

$

551,224

$

333,071

$

1,818,072

$

—

$

1,818,072

Elimination of intersegment revenue

(29,784

)

9,771

(8

)

(20,021

)

—

(20,021

)

Revenue from external customers

$

903,993

$

560,995

$

333,063

$

1,798,051

$

—

$

1,798,051

Income (loss) from construction

operations

$

123,419

$

(84,040

)

$

(82,280

)

$

(42,901

)(d)

$

(36,656

)(b)

$

(79,557

)

Capital expenditures

$

24,708

$

3,475

$

700

$

28,883

$

1,740

$

30,623

Depreciation and amortization(c)

$

14,055

$

912

$

1,241

$

16,208

$

4,546

$

20,754

______________________________

(a)

During the six months ended June 30, 2024,

the Company’s income (loss) from construction operations was

impacted by unfavorable adjustments of $12.4 million ($9.1 million,

or $0.17 per diluted share, after tax) due to the impact of a

settlement on two completed Civil segment highway projects in the

Northeast and $12.0 million ($8.8 million, or $0.17 per diluted

share, after tax) due to an arbitration ruling that only provided a

partial award to the Company pertaining to a completed Specialty

Contractors segment electrical project in New York. The period was

also impacted by a favorable adjustment of $10.2 million ($7.5

million, or $0.14 per diluted share, after tax) on a Civil segment

mass-transit project in California related to a dispute resolution

and associated expected cost savings.

(b)

Consists primarily of corporate general

and administrative expenses. Corporate general and administrative

expenses for the six months ended June 30, 2024 and 2023 included

share-based compensation expense of $22.4 million ($16.5 million,

or $0.31 per diluted share, after tax) and $5.6 million ($4.1

million, or $0.08 per diluted share, after tax), respectively. The

increase in share-based compensation expense in the current-year

period was primarily due to a substantial increase in the Company’s

stock price during the period, which impacted the fair value of

liability-classified awards. These awards are remeasured at fair

value at the end of each reporting period with the change in fair

value recognized in earnings.

(c)

Depreciation and amortization is included

in income (loss) from construction operations.

(d)

During the six months ended June 30, 2023,

the Company’s income (loss) from construction operations was

impacted by an adverse legal ruling on a completed mixed-use

project in New York, which resulted in a non-cash, pre-tax charge

of $83.6 million ($60.1 million, or $1.16 per diluted share, after

tax), of which $72.2 million impacted the Building segment and

$11.4 million impacted the Specialty Contractors segment; $35.8

million ($26.0 million, or $0.50 per diluted share, after tax) of

unfavorable non-cash adjustments due to changes in estimates on the

Specialty Contractors segment’s electrical and mechanical scope of

a transportation project in the Northeast associated with a change

in the expected recovery on certain unapproved change orders; net

favorable adjustments of $30.1 million ($23.9 million, or $0.46 per

diluted share, after tax) for a Civil segment mass-transit project

in California that resulted from changes in estimates due to

improved performance; a non-cash charge of $24.7 million ($18.0

million, or $0.35 per diluted share, after tax) that resulted from

an adverse legal ruling on a Specialty Contractors segment

educational facilities project in New York; and a $13.1 million

($10.2 million, or $0.20 per diluted share, after tax) unfavorable

adjustment on a transportation project in the Northeast, split

evenly between the Civil and Building segments, due to the

settlement of certain change orders during project closeout.

Tutor Perini

Corporation

Condensed Consolidated Balance

Sheets

Unaudited

(in thousands, except share and per share

amounts)

As of June 30,

2024

As of December 31,

2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents ($156,912 and

$173,118 related to variable interest entities (“VIEs”))

$

267,072

$

380,564

Restricted cash

12,417

14,116

Restricted investments

134,182

130,287

Accounts receivable ($60,049 and $84,014

related to VIEs)

1,087,369

1,054,014

Retention receivable ($157,536 and

$161,187 related to VIEs)

546,668

580,926

Costs and estimated earnings in excess of

billings ($87,833 and $58,089 related to VIEs)

1,160,710

1,143,846

Other current assets ($18,918 and $26,725

related to VIEs)

187,822

217,601

Total current assets

3,396,240

3,521,354

PROPERTY AND EQUIPMENT ("P&E"),

net of accumulated depreciation of $548,937 and $534,171 (net

P&E of $29,449 and $35,135 related to VIEs)

434,371

441,291

GOODWILL

205,143

205,143

INTANGIBLE ASSETS, NET

67,187

68,305

DEFERRED INCOME TAXES

67,284

74,083

OTHER ASSETS

123,523

119,680

TOTAL ASSETS

$

4,293,748

$

4,429,856

LIABILITIES AND EQUITY

CURRENT LIABILITIES:

Current maturities of long-term debt

$

18,602

$

117,431

Accounts payable ($28,980 and $24,160

related to VIEs)

622,776

466,545

Retention payable ($18,444 and $22,841

related to VIEs)

223,962

223,138

Billings in excess of costs and estimated

earnings ($394,866 and $439,759 related to VIEs)

987,447

1,103,530

Accrued expenses and other current

liabilities ($10,620 and $18,206 related to VIEs)

207,877

214,309

Total current liabilities

2,060,664

2,124,953

LONG-TERM DEBT, less current

maturities, net of unamortized discount and debt issuance costs

totaling $31,387 and $11,000

657,835

782,314

OTHER LONG-TERM LIABILITIES

259,132

238,678

TOTAL LIABILITIES

2,977,631

3,145,945

COMMITMENTS AND CONTINGENCIES

EQUITY

Stockholders' equity:

Preferred stock - authorized 1,000,000

shares ($1 par value), none issued

—

—

Common stock - authorized 112,500,000

shares ($1 par value), issued and outstanding 52,389,430 and

52,025,497 shares

52,389

52,025

Additional paid-in capital

1,148,074

1,146,204

Retained earnings

149,718

133,146

Accumulated other comprehensive loss

(40,226

)

(39,787

)

Total stockholders' equity

1,309,955

1,291,588

Noncontrolling interests

6,162

(7,677

)

TOTAL EQUITY

1,316,117

1,283,911

TOTAL LIABILITIES AND EQUITY

$

4,293,748

$

4,429,856

Tutor Perini

Corporation

Condensed Consolidated

Statements of Cash Flows

Unaudited

Six Months Ended June

30,

(in thousands)

2024

2023

Cash Flows from Operating

Activities:

Net income (loss)

$

43,471

$

(65,693

)

Adjustments to reconcile net income (loss)

to net cash provided by operating activities:

Depreciation

26,470

19,636

Amortization of intangible assets

1,118

1,118

Share-based compensation expense

22,437

5,637

Change in debt discounts and deferred debt

issuance costs

4,366

2,005

Deferred income taxes

5,969

(68,256

)

(Gain) loss on sale of property and

equipment

595

(5,038

)

Changes in other components of working

capital

49,150

188,761

Other long-term liabilities

1,188

(2,152

)

Other, net

(3,351

)

1,632

NET CASH PROVIDED BY OPERATING

ACTIVITIES

151,413

77,650

Cash Flows from Investing

Activities:

Acquisition of property and equipment

(21,352

)

(30,623

)

Proceeds from sale of property and

equipment

1,434

6,758

Investments in securities

(22,073

)

(14,521

)

Proceeds from maturities and sales of

investments in securities

17,979

9,227

NET CASH USED IN INVESTING

ACTIVITIES

(24,012

)

(29,159

)

Cash Flows from Financing

Activities:

Proceeds from debt

597,900

537,500

Repayment of debt

(800,819

)

(571,332

)

Cash payments related to share-based

compensation

(2,194

)

(284

)

Distributions paid to noncontrolling

interests

(12,400

)

(15,250

)

Contributions from noncontrolling

interests

—

2,000

Debt issuance, extinguishment and

modification costs

(25,079

)

(497

)

NET CASH USED IN FINANCING

ACTIVITIES

(242,592

)

(47,863

)

Net increase (decrease) in cash, cash

equivalents and restricted cash

(115,191

)

628

Cash, cash equivalents and restricted

cash at beginning of period

394,680

273,831

Cash, cash equivalents and restricted

cash at end of period

$

279,489

$

274,459

Tutor Perini

Corporation

Backlog Information

Unaudited

(in millions)

Backlog at

March 31, 2024

New Awards in the

Three Months

Ended

June 30,

2024(a)

Revenue Recognized in

the

Three Months

Ended

June 30, 2024

Backlog at

June 30, 2024

Civil

$

4,096.6

$

814.5

$

(546.5

)

$

4,364.6

Building

4,169.9

436.7

(417.9

)

4,188.7

Specialty Contractors

1,715.7

313.0

(163.1

)

1,865.6

Total

$

9,982.2

$

1,564.2

$

(1,127.5

)

$

10,418.9

(in millions)

Backlog at

December 31,

2023

New Awards in the

Six Months

Ended

June 30,

2024(a)

Revenue Recognized in

the

Six Months

Ended

June 30, 2024

Backlog at

June 30, 2024

Civil

$

4,240.6

$

1,142.7

$

(1,018.7

)

$

4,364.6

Building

4,177.5

841.0

(829.8

)

4,188.7

Specialty Contractors

1,740.3

453.3

(328.0

)

1,865.6

Total

$

10,158.4

$

2,437.0

$

(2,176.5

)

$

10,418.9

______________________________

(a)

New awards consist of the original

contract price of projects added to backlog plus or minus

subsequent changes to the estimated total contract price of

existing contracts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240801443540/en/

Tutor Perini Corporation Jorge Casado, 818-362-8391 Vice

President, Investor Relations & Corporate Communications

www.tutorperini.com

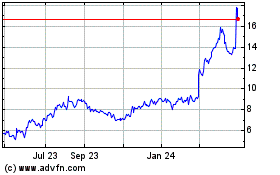

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Nov 2024 to Dec 2024

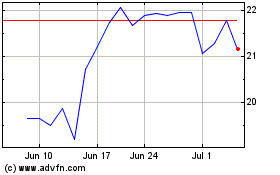

Tutor Perini (NYSE:TPC)

Historical Stock Chart

From Dec 2023 to Dec 2024