RICHMOND, Va., May 6 /PRNewswire-FirstCall/ -- Tredegar Corporation

(NYSE: TG) reported a first-quarter net loss from continuing

operations of $28.8 million (85 cents per share) compared with net

income from continuing operations of $3.8 million (11 cents per

share) in the first quarter of 2008. Results in the first quarter

of 2009 include a non-cash, goodwill impairment charge of $30.6

million (90 cents per share) related to its aluminum extrusions

business. Earnings from continuing manufacturing operations in the

first quarter were $4.6 million (14 cents per share) versus $6.0

million (17 cents per share) last year. First-quarter sales from

continuing operations decreased to $153.1 million from $228.5

million in 2008. A summary of results for continuing operations for

the three months ended March 31, 2009 and 2008 is shown below:

Three Months (In Millions, Except Per-Share Data) Ended March 31

-------- 2009 2008 ---- ---- Sales $153.1 $228.5 Income (loss) from

continuing operations as reported under generally accepted

accounting principles (GAAP) $(28.8) $3.8 After-tax effects of:

Goodwill impairment relating to aluminum extrusions business 30.6 -

Loss associated with plant shutdowns, asset impairments and

restructurings 1.1 2.7 (Gains) losses from sale of assets and other

items 1.7 (.5) --- --- Income from continuing manufacturing

operations* $4.6 $6.0 ---- ---- Diluted earnings (loss) per share

from continuing operations as reported under GAAP $(.85) $.11

After-tax effects per diluted share of: Goodwill impairment

relating to aluminum extrusions business .90 - Loss associated with

plant shutdowns, asset impairments and restructurings .03 .08

(Gains) losses from sale of assets and other items .06 (.02) ---

---- Diluted earnings per share from continuing manufacturing

operations* $.14 $.17 ---- ---- * The after-tax effects of unusual

items, plant shutdowns, asset impairments and restructurings, and

gains or losses from sale of assets and other items have been

presented separately and removed from net income and earnings per

share from continuing operations as reported under GAAP to

determine Tredegar's presentation of income and earnings per share

from continuing manufacturing operations. Income and earnings per

share from continuing manufacturing operations are key financial

and analytical measures used by Tredegar to gauge the operating

performance of its continuing manufacturing businesses. They are

not intended to represent the stand-alone results for Tredegar's

continuing manufacturing businesses under GAAP and should not be

considered as an alternative to net income or earnings per share as

defined by GAAP. They exclude items that we believe do not relate

to Tredegar's ongoing manufacturing operations. John D. Gottwald,

Tredegar's president and chief executive officer, said: "Obviously,

the global economy is the dominant force affecting Tredegar's first

quarter performance. The aluminum extrusion industry is in its

third year of recession. Order rates deteriorated this winter with

shipments down 37% versus the first quarter of 2008. We continue to

look for signs of a bottom as we actively reduce costs.

Unfortunately, we generated our first quarterly operating loss in

the aluminum business since 1991." "Similarly, our films business

experienced a volume decline of 15% in the first quarter. This

weakness was broad as demand weakened and inventories were adjusted

in all segments. Operating profits before restructuring charges in

films increased by $2.2 million in the first quarter of 2009

compared with the first quarter of 2008 primarily due to the

benefit of the lag in the pass-through of lower average resin

costs. Excluding resin lag, ongoing operating profit declined in

films by $1.9 million due to lower sales volume and the unfavorable

impact of currency rate changes, partially offset by cost reduction

efforts. We continue to be very focused on reducing costs." Mr.

Gottwald concluded: "Despite the challenging business environment,

our financial condition remains strong with cash in excess of debt

of $43.7 million at March 31, 2009, an improvement from $23.3

million at December 31, 2008." MANUFACTURING OPERATIONS Film

Products First quarter net sales (sales less freight) in Film

Products were $104.8 million, down 20.8% from $132.3 million in the

first quarter of 2008, while operating profit from ongoing

operations increased to $13.0 million in the first quarter of 2009

from $10.8 million in the prior year. Volume for the quarter was

49.3 million pounds, down 14.9% from 57.9 million pounds in the

first quarter of 2008. Net sales in the first quarter of 2009

declined due to lower volume across all market segments, most

notably surface protection and personal care materials, and the

unfavorable impact of changes in the U.S. dollar value of

currencies for operations outside of the U.S. Volume declines are

believed to be primarily driven by the economic downturn and

customer inventory adjustments. Operating profit from ongoing

operations increased in the first quarter of 2009 compared with the

first quarter of 2008 due primarily to the benefit of the lag in

the pass-through of lower resin costs. Excluding resin lag, ongoing

operating profit declined by $1.9 million due to lower sales volume

and the unfavorable impact of currency rate changes, partially

offset by cost reduction efforts. The company estimates that the

impact of the lag in pass-through of average resin costs on

operating profits from ongoing operations was a positive $2.9

million in the first quarter of 2009 and a negative $1.2 million in

the first quarter of 2008. The company estimates that changes in

the U.S. dollar value of currencies for operations outside of the

U.S. had an unfavorable impact on operating profit of $650,000 in

the first quarter of 2009 compared with the first quarter of 2008.

Capital expenditures in Film Products were $4.1 million in the

first quarter of 2009 compared with $3.2 million in the first

quarter of last year, and are projected to be approximately $20

million in 2009. Depreciation expense was $7.9 million in the first

quarter of 2009 compared with $8.8 million in the first quarter of

last year, and is projected to be approximately $32 million in

2009. Aluminum Extrusions First-quarter net sales from ongoing U.S.

operations in Aluminum Extrusions were $45.1 million, down 50.5%

from $91.1 million in the first quarter of 2008. Operating losses

from ongoing U.S. operations for the quarter were $1.8 million, a

$3.3 million decline from operating profit of $1.5 million reported

in the first quarter of 2008. Volume decreased to 23.5 million

pounds in the first quarter of 2009, down 36.8% from 37.1 million

pounds in the first quarter of 2008. The decrease in net sales and

the reported operating loss from ongoing U.S. operations were

primarily driven by lower volume in the first quarter of 2009

compared with the first quarter of last year. Net sales also

declined from lower average selling prices driven by lower average

aluminum costs. Extremely challenging market conditions led to

shipment declines in all markets. Shipments for non-residential

construction, which comprised approximately 72% of total volume in

2008, declined by approximately 32.6% during the first quarter of

2009 compared with the first quarter of 2008. Costs have been

reduced as volume has declined. Total full-time employees in

Aluminum Extrusions were 1,128 at December 31, 2007, 972 at

December 31, 2008 and 861 at March 31, 2009. The Company also

recognized a charge in the first quarter of 2009 of $30.6 million

($30.6 million after tax) for the write-off of goodwill associated

with Aluminum Extrusions. This non-cash charge, as computed under

U.S. generally accepted accounting principles, resulted from the

estimated adverse impact on the business unit's fair value of

possible future losses and the uncertainty of the amount and timing

of an economic recovery. Capital expenditures for continuing

operations in Aluminum Extrusions were $5.2 million in the first

quarter of 2009 compared with $810,000 in the first quarter of last

year. Capital expenditures are projected to be approximately $21

million in 2009, of which $16 million relates to the 18-month

project to expand capacity in the plant in Carthage, Tennessee

announced in January 2008. This new capacity will be dedicated to

serving customers in the non-residential construction sector.

Depreciation expense was $1.9 million in the first quarter of 2009

compared with $2.0 million in the first quarter of 2008, and is

projected to be approximately $8.1 million in 2009. OTHER ITEMS Net

pension income from continuing operations was $757,000 in the first

quarter of 2009, an unfavorable change of $802,000 (one cent per

share after taxes) from amounts recognized in the first quarter of

2008. The company contributed approximately $122,000 to its pension

plans for continuing operations in 2008 and expects to contribute

$4.4 million in 2009. During 2008, the fair value of the assets of

our pension plans declined by approximately $89.6 million to $194.5

million at December 31, 2008, due mainly to the drop in global

stock prices and benefit payments to retirees of $10.2 million.

Interest expense was $204,000 in the first quarter of 2009, a

decrease from $881,000 in the first quarter of last year due to

lower average debt levels and lower average interest rates. The

effective tax rate used to compute income taxes from continuing

manufacturing operations was 39.7% in the first quarter of 2009

compared with 38.8% in the first quarter of 2008. Overall results

for continuing operations for the quarter include special items.

After-tax charges for continuing operations for plant shutdowns,

asset impairments and restructurings and gains and losses from the

sale of assets and other items were 9 cents and 6 cents per share

in the first quarters of 2009 and 2008, respectively. In addition,

a non-cash goodwill impairment charge of $30.6 million (after-tax),

or 90 cents per share, was recorded for Aluminum Extrusions in the

first quarter of 2009. Further details regarding these items are

provided in the financial tables included with this press release.

Tredegar's investment in Harbinger Capital Partners Special

Situations Fund, L.P. had a reported capital account value of $10.0

million at March 31, 2009, compared with $10.1 million at December

31, 2008. This investment has a carrying value in Tredegar's

balance sheet of $10.0 million, which represents the amount

invested on April 2, 2007. CAPITAL STRUCTURE AND ADJUSTED EBITDA

Net cash (cash and cash equivalents in excess of debt) was $43.7

million at March 31, 2009, compared with net cash of $23.3 million

at December 31, 2008. Adjusted EBITDA from continuing manufacturing

operations, a key valuation and borrowing capacity measure, was

$93.8 million in the twelve months ended March 31, 2009, down from

$100.3 million for the preceding twelve month period. See notes to

financial statements and tables for reconciliations to comparable

GAAP measures. FORWARD-LOOKING AND CAUTIONARY STATEMENTS Some of

the information contained in this press release may constitute

"forward-looking statements" within the meaning of the "safe

harbor" provisions of the Private Securities Litigation Reform Act

of 1995. When we use the words "believe," "estimate," "anticipate,"

"expect," "project," "likely," "may" and similar expressions, we do

so to identify forward-looking statements. Such statements are

based on our then current expectations and are subject to a number

of risks and uncertainties that could cause actual results to

differ materially from those addressed in the forward-looking

statements. It is possible that our actual results and financial

condition may differ, possibly materially, from the anticipated

results and financial condition indicated in these forward-looking

statements. Factors that could cause actual results to differ from

expectations include, without limitation: Film Products is highly

dependent on sales to one customer -- The Procter & Gamble

Company; growth of Film Products depends on its ability to develop

and deliver new products at competitive prices; sales volume and

profitability of continuing operations in Aluminum Extrusions is

cyclical and highly dependent on economic conditions of end-use

markets in the U.S., particularly in the construction, distribution

and transportation industries and are also subject to seasonal

slowdowns; our substantial international operations subject us to

risks of doing business in foreign countries, which could adversely

affect our business, financial condition and results of operations;

our future performance is influenced by costs incurred by our

operating companies including, for example, the cost of energy and

raw materials; and the other factors discussed in the reports

Tredegar files with or furnishes to the Securities and Exchange

Commission (the "SEC") from time-to-time, including the risks and

important factors set forth in additional detail in "Risk Factors"

in Part I, Item 1A of Tredegar's 2008 Annual Report on Form 10-K

filed with the SEC. Readers are urged to review and consider

carefully the disclosures Tredegar makes in its filings with the

SEC. Tredegar does not undertake to update any forward-looking

statement made in this press release to reflect any change in

management's expectations or any change in conditions, assumptions

or circumstances on which such statements are based. To the extent

that the financial information portion of this release contains

non-GAAP financial measures, it also presents both the most

directly comparable financial measures calculated and presented in

accordance with GAAP and a quantitative reconciliation of the

difference between any such non-GAAP measures and such comparable

GAAP financial measures. Accompanying the reconciliation is

management's statement concerning the reasons why management

believes that presentation of non-GAAP measures provides useful

information to investors concerning Tredegar's financial condition

and results of operations. Based in Richmond, Va., Tredegar

Corporation is a global manufacturer of plastic films and aluminum

extrusions. Tredegar Corporation Condensed Consolidated Statements

of Income (In Thousands, Except Per-Share Data) (Unaudited) Three

Months Ended March 31 -------- 2009 2008 ---- ---- Sales $153,066

$228,480 Other income (expense), net (a) (d) 869 557 --- ---

153,935 229,037 ------- ------- Cost of goods sold (a) 125,258

194,239 Freight 3,229 5,101 Selling, R&D and general expenses

17,284 18,969 Amortization of intangibles 30 32 Interest expense

204 881 Asset impairments and costs associated with exit and

disposal activities (a) 1,631 3,940 Goodwill impairment charge (b)

30,559 - ------ --- 178,195 223,162 ------- ------- Income (loss)

from continuing operations before income taxes (24,260) 5,875

Income taxes (e) 4,557 2,090 ----- ----- Income (loss) from

continuing operations (28,817) 3,785 Loss from discontinued

operations (f) - (723) --- ---- Net income (loss) (a) (c) $(28,817)

$3,062 -------- ------ Earnings (loss) per share: Basic: Continuing

operations $(.85) $.11 Discontinued operations - (.02) --- ---- Net

income (loss) $(.85) $.09 ----- ---- Diluted: Continuing operations

$(.85) $.11 Discontinued operations - (.02) --- ---- Net income

(loss) $(.85) $.09 ----- ---- Shares used to compute earnings

(loss) per share: Basic 33,866 34,467 Diluted 33,866 34,682

Tredegar Corporation Net Sales and Operating Profit by Segment (In

Thousands) (Unaudited) Three Months Ended March 31 -------- 2009

2008 ---- ---- Net Sales Film Products $104,783 $132,314 Aluminum

Extrusions 45,054 91,065 ------ ------ Total net sales 149,837

223,379 Add back freight 3,229 5,101 ----- ----- Sales as shown in

the Consolidated Statements of Income $153,066 $228,480 --------

-------- Operating Profit (Loss) Film Products: Ongoing operations

$13,014 $10,786 Plant shutdowns, asset impairments, restructurings

and other (a) (809) (3,705) Aluminum Extrusions (f): Ongoing

operations (1,797) 1,542 Goodwill impairment charge (b) (30,559) -

Plant shutdowns, asset impairments, restructurings and other (a)

(978) (235) AFBS: Gain on sale investments in Theken Spine and

Therics, LLC (d) 150 - --- --- Total (20,979) 8,388 Interest income

259 258 Interest expense 204 881 Gain on the sale of corporate

assets (e) 404 - Stock option-based compensation costs 262 60

Corporate expenses, net (a) 3,478 1,830 ----- ----- Income (loss)

before income taxes (24,260) 5,875 Income taxes (e) 4,557 2,090

----- ----- Income (loss) from continuing operations (28,817) 3,785

Loss from discontinued operations (f) - (723) --- ---- Net income

(loss) (a) (c) $(28,817) $3,062 -------- ------ Tredegar

Corporation Condensed Consolidated Balance Sheets (In Thousands)

(Unaudited) March 31, December 31, 2009 2008 ---- ---- Assets Cash

& cash equivalents $53,281 $45,975 Accounts & notes

receivable, net 79,914 91,400 Income taxes recoverable 10,943

12,549 Inventories 27,170 36,809 Deferred income taxes 5,681 7,654

Prepaid expenses & other 3,236 5,374 ----- ----- Total current

assets 180,225 199,761 Property, plant & equipment, net 231,788

236,870 Other assets 38,277 38,926 Goodwill & other intangibles

103,945 135,075 ------- ------- Total assets $554,235 $610,632

-------- -------- Liabilities and Shareholders' Equity Accounts

payable $44,084 $54,990 Accrued expenses 40,696 38,349 Current

portion of long-term debt 604 529 --- --- Total current liabilities

85,384 93,868 Long-term debt 8,963 22,173 Deferred income taxes

44,602 45,152 Other noncurrent liabilities 27,675 29,023

Shareholders' equity 387,611 420,416 -------- -------- Total

liabilities and shareholders' equity $554,235 $610,632 --------

-------- Tredegar Corporation Condensed Consolidated Statement of

Cash Flows (In Thousands) (Unaudited) Three Months Ended March 31

-------- 2009 2008 ---- ---- Cash flows from operating activities:

Net income (loss) $(28,817) $3,062 Adjustments for noncash items:

Depreciation 9,830 11,336 Amortization of intangibles 30 32

Goodwill impairment charge 30,559 - Deferred income taxes 2,866

8,289 Accrued pension income and postretirement benefits (633)

(1,413) Loss on asset impairments and divestitures - 2,327 Gain on

sale of assets (829) - Changes in assets and liabilities, net of

effects of acquisitions and divestitures: Accounts and notes

receivables 9,573 (22,066) Inventories 9,105 10,013 Income taxes

recoverable 1,607 (13,841) Prepaid expenses and other 2,046 421

Accounts payable and accrued expenses (3,640) 5,357 Other, net

1,651 2,661 ----- ----- Net cash provided by operating activities

33,348 6,178 ------ ----- Cash flows from investing activities:

Capital expenditures (including settlement of related accounts

payable of $1,709 in 2009) (11,014) (4,052) Proceeds from the sale

of the aluminum extrusions business in Canada (net of cash included

in sale and transaction costs) - 23,616 Proceeds from the sale of

assets and property disposals 918 248 Investments in real estate

(509) - ---- --- Net cash provided by (used in) investing

activities (10,605) 19,812 ------- ------ Cash flows from financing

activities: Dividends paid (1,358) (1,378) Debt principal payments

(13,135) (38,158) Borrowings - 13,000 Repurchases of Tredegar

common stock - (7,283) Proceeds from exercise of stock options 112

- --- --- Net cash used in financing activities (14,381) (33,819)

------- ------- Effect of exchange rate changes on cash (1,056)

1,055 ------ ----- Increase (decrease) in cash and cash equivalents

7,306 (6,774) Cash and cash equivalents at beginning of period

45,975 48,217 ------ ------ Cash and cash equivalents at end of

period $53,281 $41,443 ------- ------- Selected Financial Measures

(In Millions) (Unaudited) For the Twelve Months Ended March 31,

2009 ---------------------- Film Aluminum Products Extrusions Total

---------- ------------ ------- Operating profit from continuing

ongoing operations $56.1 $6.8 $62.9 Allocation of corporate

overhead (9.0) (1.7) (10.7) Add back depreciation and amortization

from continuing operations 33.7 7.9 41.6 ---- --- ---- Adjusted

EBITDA from continuing operations (g) $80.8 $13.0 $93.8 ----- -----

----- Selected balance sheet and other data as of March 31, 2009:

Net debt (cash) (h) $(43.7) Shares outstanding 33.9 Notes to the

Financial Tables (a) Plant shutdowns, asset impairments,

restructurings and other in the first quarter of 2009 include: -

Pretax charges of $1.6 million for severance and other

employee-related costs in connection with restructurings in Film

Products ($1.1 million), Aluminum Extrusions ($369,000) and

corporate headquarters ($178,000, included in "Corporate expenses,

net" in the net sales and operating profit by segment table); -

Pretax losses of $609,000 associated with Aluminum Extrusions for

timing differences between the recognition of realized losses on

aluminum futures contracts and related revenues from the delayed

fulfillment by customers of fixed-price forward purchase

commitments (included in "Cost of goods sold" in the condensed

consolidated statements of income); and - Pretax gain of $275,000

on the sale of equipment (included in "Other income (expense) net

in the condensed consolidated statements of income) from a

previously shutdown films manufacturing facility in LaGrange,

Georgia. Plant shutdowns, asset impairments, restructurings and

other in the first quarter of 2008 include: - Pretax charges of

$2.3 million for severance and other employee-related costs in

connection with restructurings in Film Products ($2.1 million) and

Aluminum Extrusions ($235,000); and - Pretax charges of $1.6

million for asset impairments in Film Products. (b) Goodwill

impairment charge of $30.6 million ($30.6 million after taxes) was

recognized in Aluminum Extrusions in the first quarter of 2009 upon

completion of an impairment analysis performed as of March 31,

2009. This non-cash charge, as computed under U.S. generally

accepted accounting principles, resulted from the estimated adverse

impact on the business unit's fair value of possible future losses

and the uncertainty of the amount and timing of an economic

recovery. (c) Comprehensive income (loss), defined as net income

and other comprehensive income (loss), was a loss of $31.8 million

in the first quarter of 2009 and income of $1.1 million for the

first quarter 2008. Other comprehensive income (loss) includes

changes in foreign currency translation adjustments, unrealized

gains and losses on derivative financial instruments and prior

service cost and net gains or losses from pension and other

postretirement benefit plans arising during the period and the

related amortization of these prior service cost and net gains or

losses recorded net of deferred taxes directly in shareholders'

equity. (d) Gain on the sale of investments in Theken Spine and

Therics, LLC includes a post-closing contractual adjustment of

$150,000 (included in "Other income (expense), net" in the

condensed consolidated statements of income). Closing on sale of

these investments occurred in 2008. AFBS (formerly Therics, Inc.)

received these investments in 2005, when substantially all of the

assets of AFBS, Inc., a wholly- owned subsidiary of Tredegar, were

sold or assigned to a newly-created limited liability company,

Therics, LLC, controlled and managed by an individual not

affiliated with Tredegar. (e) Gain on sale of corporate assets in

the first quarter of 2009 includes a realized gain on the sale of

corporate real estate ($404,000). This gain is included in "Other

income (expense), net" in the condensed consolidated statement of

income. Income taxes for the first quarter of 2009 include the

recognition of a valuation allowance of $1.9 million related to

expected limitations on the utilization of assumed capital losses

on certain investments. (f) On February 12, 2008, Tredegar sold its

aluminum extrusions business in Canada for a purchase price of

approximately $25 million to an affiliate of H.I.G. Capital. The

purchase price was subject to adjustment based upon the actual

working capital of the business at the time of sale. All historical

results for this business have been reflected as discontinued

operations in the accompanying financial tables. The components of

income (loss) from discontinued operations are presented below:

Three Months Ended (In thousands) March 31 ------------------ 2009

2008 ------- -------- Income (loss) from operations before income

taxes $- $(391) Income tax cost (benefit) on operations - (98)

------- -------- - (293) ------- -------- Loss associated with

asset impairments and disposal activities - (1,130) Income tax cost

(benefit) on asset impairments and costs associated disposal

activities - (700) ------- -------- - (430) ------- -------- Income

(loss) from discontinued operations $- $(723) ------- -------- (g)

Adjusted EBITDA for the twelve months ended March 31, 2009,

represents income from continuing operations before interest,

taxes, depreciation, amortization, unusual items and losses

associated with plant shutdowns, asset impairments and

restructurings, gains from the sale of assets, investment

write-downs and write-ups, charges related to stock option awards

accounted for under the fair value-based method and other items.

Adjusted EBITDA is not intended to represent cash flow from

operations as defined by GAAP and should not be considered as

either an alternative to net income (as an indicator of operating

performance) or to cash flow (as a measure of liquidity). Tredegar

uses Adjusted EBITDA as a measure of unlevered (debt-free)

operating cash flow. We also use it when comparing relative

enterprise values of manufacturing companies and when measuring

debt capacity. When comparing the valuations of a peer group of

manufacturing companies, we express enterprise value as a multiple

of Adjusted EBITDA. We believe Adjusted EBITDA is preferable to

operating profit and other GAAP measures when applying a comparable

multiple approach to enterprise valuation because it excludes the

items noted above, measures of which may vary among peer companies.

(h) Net debt is calculated as follows (in millions): Debt $9.6

Less: Cash and cash equivalents (53.3) Net debt (cash) $(43.7) Net

debt or cash is not intended to represent debt or cash as defined

by GAAP. Net debt or cash is utilized by management in evaluating

the company's financial leverage and equity valuation, and the

company believes that investors also may find net debt or cash to

be helpful for the same purposes. DATASOURCE: Tredegar Corporation

CONTACT: D. Andrew Edwards, +1-804-330-1041, Fax: +1-804-330-1777,

Web Site: http://www.tredegar.com/

Copyright

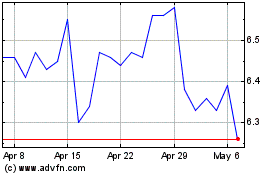

Tredegar (NYSE:TG)

Historical Stock Chart

From Dec 2024 to Jan 2025

Tredegar (NYSE:TG)

Historical Stock Chart

From Jan 2024 to Jan 2025