0001499832false00014998322023-11-092023-11-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

| | |

CURRENT REPORT |

PURSUANT TO SECTION 13 OR 15(d) |

OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of report (Date of earliest event reported): November 9, 2023

Townsquare Media, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | |

Delaware | 001-36558 | 27-1996555 |

(State or other jurisdiction of incorporation or organization) | (Commission file number) | (I.R.S. Employer Identification No.) |

| | | | | | |

| | One Manhattanville Road, | Suite 202 | | |

|

| Purchase, | New York | 10577 | | |

| (Address of Principal Executive Offices, including Zip Code) |

(203) 861-0900

(Registrant's telephone number, including area code)

Not applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a - 12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.01 par value per share | TSQ | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition.

On November 9, 2023, Townsquare Media Inc. (the “Company”) issued a press release announcing operating results for the quarter ended September 30, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. In accordance with General Instruction B.2 of Form 8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

The Company uses the “Equity Investors” section of its website as a means of disclosing material non-public information and for complying with its disclosure obligations under Regulation FD. Investors are urged to monitor the Company’s website for announcements of material information relating to the Company.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | Press release, dated November 9, 2023 |

| 104 | | Cover Page Interactive Data File (cover page XBRL tags are embedded within the Inline XBRL document). |

| | |

| | |

| | |

| | |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Date: November 9, 2023 | TOWNSQUARE MEDIA, INC.

|

| | | |

| | By: | /s/ Stuart Rosenstein |

| | Name: | Stuart Rosenstein |

| | Title: | Executive Vice President and Chief Financial Officer |

IMMEDIATE RELEASE

TOWNSQUARE ANNOUNCES THIRD QUARTER RESULTS

September YTD Net Revenue Excluding Political Flat Year-Over-Year

Digital Represents 52% of September YTD 2023 Total Net Revenue and

57% of September YTD 2023 Total Adjusted Operating Income

Purchase, NY – November 9, 2023 - Townsquare Media, Inc. (NYSE: TSQ) (“Townsquare”, the "Company," "we," "us," or "our") announced today its financial results for the third quarter ended September 30, 2023.

“I am pleased to share that Townsquare’s third quarter results met our previously issued guidance. In the third quarter, net revenue excluding political revenue declined -4% year-over-year (and decreased -5% year-over-year in total), and Adjusted EBITDA decreased -12% year-over-year. Our Digital Advertising segment delivered revenue and profit growth once again in the third quarter, as September year-to-date revenue and Adjusted Operating Income increased +10% and +19%, respectively, each as compared to the prior year. In total, Digital now represents 52% of Townsquare’s total September year-to-date net revenue and 57% of our total September year-to-date Adjusted Operating Income,” commented Bill Wilson, Chief Executive Officer of Townsquare Media, Inc. “Our performance this year, and particularly the growth of our Digital Advertising segment, has reinforced our confidence in our Digital First Local Media Strategy, our deliberate focus on markets outside of the Top 50, and the long-term, profitable growth potential of our digital platform.”

Mr. Wilson continued, “The strong cash generation characteristics of our assets allowed us to produce $39 million of cash flow from operations in the first nine months of 2023, an increase of $7 million as compared to the prior year. We could not be more pleased to share that given our strong cash position, we were able to repurchase and retire approximately $14 million of our Unsecured Senior Notes at a discount during the third quarter, bringing our year-to-date total bond repurchases to $27 million. In addition, we repurchased approximately 94,000 Class A shares in the third quarter (in total, we’ve repurchased 1.7 million shares in 2023), and continue to pay a high-yielding dividend while also investing in our business. We also ended the quarter with a strong cash balance of $38 million and net leverage of 4.49x, retaining financial flexibility moving forward.”

The Company announced today that its Board of Directors approved a quarterly cash dividend of $0.1875 per share. The dividend will be payable on February 1, 2024 to shareholders of record as of the close of business on January 2, 2024.

Segment Reporting

We have three reportable operating segments, Subscription Digital Marketing Solutions, Digital Advertising and Broadcast Advertising. The Subscription Digital Marketing Solutions segment includes our subscription digital marketing solutions business, Townsquare Interactive. The Digital Advertising segment, marketed externally as Townsquare Ignite, includes digital advertising on our owned and operated digital properties, our first party data digital management platform and our digital programmatic advertising platform. The Broadcast Advertising segment includes our local, regional, and national advertising products and solutions delivered via terrestrial radio broadcast, and other miscellaneous revenue that is associated with our broadcast advertising platform. The remainder of our business is reported in the Other category, which includes our live events business.

Third Quarter Highlights*

•As compared to the third quarter of 2022:

•Net revenue decreased 4.6%, and 3.8% excluding political

•Net income decreased $39.3 million

•Adjusted EBITDA decreased 12.1%

•Total Digital net revenue decreased 1.5%

•Subscription Digital Marketing Solutions (“Townsquare Interactive”) net revenue decreased 12.6%

•Digital Advertising net revenue increased 5.5%

•Total Digital Adjusted Operating Income increased 0.1%

•Subscription Digital Marketing Solutions Adjusted Operating Income decreased 10.6%

•Digital Advertising Adjusted Operating Income increased 6.3%

•Broadcast Advertising net revenue decreased 8.6%, and 7.2% excluding political

•Diluted loss per share was $2.27, and Adjusted Net Income per diluted share was $0.46

•Repurchased $14.2 million of our 2026 Secured Senior Notes below par

•Repurchased 0.1 million shares of the Company’s common stock

Year-to-Date Highlights*

•As compared to the nine months ended September 30, 2022:

•Net revenue decreased 1.0%, and 0.3% excluding political

•Net income decreased $51.6 million

•Adjusted EBITDA decreased 11.8%

•Total Digital net revenue increased 3.2%

•Subscription Digital Marketing Solutions net revenue decreased 7.3%

•Digital Advertising net revenue increased 10.1%

•Total Digital Adjusted Operating Income increased 7.5%

•Subscription Digital Marketing Solutions Adjusted Operating Income decreased 10.9%

•Digital Advertising Adjusted Operating Income increased 19.3%

•Broadcast Advertising net revenue decreased 6.5%, and 5.3% excluding political

•Repurchased an aggregate $27.1 million of our 2026 Secured Senior Notes below par

•Repurchased 1.7 million shares of the Company’s common stock

*See below for discussion of non-GAAP measures.

Guidance

For the fourth quarter of 2023, net revenue is expected to be between $110.6 million and $112.6 million, and Adjusted EBITDA is expected to be between $24.8 million and $25.8 million.

For the full year 2023, net revenue guidance is expected to be between $450 million and $452 million, and Adjusted EBITDA guidance is expected to be between $100 million and $101 million.

Quarter Ended September 30, 2023 Compared to the Quarter Ended September 30, 2022

Net Revenue

Net revenue for the three months ended September 30, 2023 decreased $5.5 million, or 4.6%, to $115.1 million as compared to $120.6 million in the same period in 2022. Broadcast Advertising net revenue decreased $5.1 million, or 8.6%, and Subscription Digital Marketing Solutions net revenue decreased $2.9 million, or 12.6%, as compared to the same period in 2022. These revenue declines were partially offset by Digital Advertising net revenue which increased $2.0 million, or 5.5%, and Other net revenue which increased $0.5 million, or 42.4%, as compared to the same period in 2022. Excluding political revenue of $0.6 million and $1.6 million for the three months ended September 30, 2023 and 2022, respectively, net revenue decreased $4.6 million, or 3.8%, to $114.5 million, Digital Advertising net revenue increased $2.1 million, or 5.6%, to $38.9 million, and Broadcast Advertising net revenue decreased $4.2 million, or 7.2%, to $53.6 million.

Net (Loss) Income

For the quarter ended September 30, 2023, we reported a net loss of $36.5 million, as compared to net income of $2.8 million in the same period last year, primarily due to a $20.7 million increase in non-cash impairment charges, a $15.2 million increase in the provision for income taxes and a $5.5 million decrease in net revenue, partially offset by a $2.7 million decrease in direct operating expenses, due in part to lower compensation. Adjusted Net Income was approximately flat as compared to the prior year.

Adjusted EBITDA

Adjusted EBITDA for the three months ended September 30, 2023 decreased $3.7 million, or 12.1%, to $27.2 million, as compared to $30.9 million in the same period last year. Adjusted EBITDA (Excluding Political) decreased $2.9 million, or 9.9%, to $26.6 million, as compared to $29.6 million in the same period last year.

Nine Months Ended September 30, 2023 Compared to the Nine Months Ended September 30, 2022

Net Revenue

Net revenue for the nine months ended September 30, 2023, decreased $3.4 million, or 1.0%, to $339.4 million as compared to $342.8 million in the same period in 2022. Broadcast Advertising net revenue decreased $10.7 million, or 6.5%, and Subscription Digital Marketing Solutions net revenue decreased $4.9 million, or 7.3%. These declines were partially offset by Digital Advertising net revenue which increased $10.5 million, or 10.1%, and Other net revenue which increased $1.8 million, or 26.4%, as compared to the same period in 2022. Excluding political revenue of $1.2 million and $3.5 million for the nine months ended September 30, 2023 and 2022, respectively, net revenue decreased $1.1 million, or 0.3% to $338.2 million, Digital Advertising net revenue increased $10.6 million, or 10.3%, to $113.7 million, and Broadcast Advertising net revenue decreased $8.6 million, or 5.3%, to $152.7 million.

Net (Loss) Income

Net income for the nine months ended September 30, 2023 decreased $51.6 million, or 493.4%, to a net loss of $41.1 million, as compared to net income of $10.5 million in the same period last year, primarily driven by a $45.5 million increase in non-cash impairment charges, a $4.4 million increase in the provision for income taxes, a $3.7 million increase in direct operating expenses and a decrease in net revenue of $3.4 million. Adjusted Net Income decreased $6.7 million, primarily driven by higher direct operating expenses and the decrease in net revenue, partially offset by a lower provision for income taxes.

Adjusted EBITDA

Adjusted EBITDA for the nine months ended September 30, 2023 decreased $10.1 million, or 11.8% to $75.2 million, as compared to $85.3 million in the same period last year. Adjusted EBITDA (Excluding Political) decreased $8.1 million, or 9.9%, to $74.2 million, as compared to $82.3 million in the same period last year.

Liquidity and Capital Resources

As of September 30, 2023, we had a total of $38.0 million of cash and cash equivalents and $503.6 million of outstanding indebtedness, representing 4.86x and 4.49x gross and net leverage, respectively, based on Adjusted EBITDA for the twelve months ended September 30, 2023, of $103.6 million.

The table below presents a summary, as of November 3, 2023, of our outstanding common stock.

| | | | | | | | | | | | | | |

Security | | Number Outstanding | | Description |

| Class A common stock | | 13,680,703 | | | One vote per share. |

| Class B common stock | | 815,296 | | | 10 votes per share.1 |

| Class C common stock | | 1,961,341 | | | No votes.1 |

| | | | |

| Total | | 16,457,340 | | | |

1 Each share converts into one share of Class A common stock upon transfer or at the option of the holder, subject to certain conditions, including compliance with FCC rules. |

|

Conference Call

Townsquare Media, Inc. will host a conference call to discuss certain third quarter 2023 financial results and 2023 guidance on Thursday, November 9, 2023 at 8:00 a.m. Eastern Time. The conference call dial-in number is 1-888-999-5318 (U.S. & Canada) or 1-848-280-6460 (International) and the confirmation code is 11153822. A live webcast of the conference call will also be available on the investor relations page of the Company’s website at www.townsquaremedia.com.

A replay of the conference call will be available through November 16, 2023. To access the replay, please dial 1-844-512-2921 (U.S. and Canada) or 1-412-317-6671 (International) and enter confirmation code 11153822. A web-based archive of the conference call will also be available at the above website.

About Townsquare Media, Inc.

Townsquare is a community-focused digital media and digital marketing solutions company with market leading local radio stations, principally focused outside the top 50 markets in the U.S. Our assets include a subscription digital marketing services business, Townsquare Interactive, providing website design, creation and hosting, search engine optimization, social media and online reputation management as well as other digital monthly services for approximately 25,750 SMBs; a robust digital advertising division, Townsquare Ignite, a powerful combination of a) an owned and operated portfolio of more than 400 local news and entertainment websites and mobile apps along with a network of leading national music and entertainment brands, collecting valuable first party data and b) a proprietary digital programmatic advertising technology stack with an in-house demand and data management platform; and a portfolio of 354 local terrestrial radio stations in 74 U.S. markets strategically situated outside the Top 50 markets in the United States. Our portfolio includes local media brands such as WYRK.com, WJON.com and NJ101.5.com, and premier national music brands such as XXLmag.com, TasteofCountry.com, UltimateClassicRock.com, and Loudwire.com. For more information, please visit www.townsquaremedia.com, www.townsquareinteractive.com and www.townsquareignite.com.

Forward-Looking Statements

Except for the historical information contained in this press release, the matters addressed are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements often discuss our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “aim,” “anticipate,” “estimate,” “expect,” “forecast,” “outlook,” “potential,” “project,” “projection,” “plan,” “intend,” “seek,” “believe,” “may,” “could,” “would,” “will,” “should,” “can,” “can have,” “likely,” the negatives thereof and other words and terms. Actual events or results may differ materially from the results anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors that could cause actual results to differ materially from those estimated by us include the impact of general economic conditions in the United States, or in the specific markets in which we currently do business including supply chain disruptions, inflation, labor shortages and the effect on advertising activity, industry conditions, including existing competition and future competitive technologies, the popularity of radio as a broadcasting and advertising medium, cancellations, disruptions or postponements of advertising schedules in response to national or world events, our ability to develop and maintain digital technologies and hire and retain technical and sales talent, our dependence on key personnel, our capital expenditure requirements, our continued ability to identify suitable acquisition targets, and consummate and integrate any future acquisitions, legislative or regulatory requirements, risks and uncertainties relating to our leverage and changes in interest rates, our ability to obtain financing at times, in amounts and at rates considered appropriate by us, our ability to access the capital markets as and when needed and on terms that we consider favorable to us and other factors discussed in this section entitled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in this report and under “Risk Factors” in our 2022 Annual Report on Form 10-K, for the year ended December 31, 2022, filed with the SEC on March 16, 2023, as well as other risks discussed from time to time in our filings with the SEC. Many of these factors are beyond our ability to predict or control. In addition, as a result of these and other factors, our past financial performance should not be relied on as an indication of future performance. The cautionary statements referred to in this section also should be considered in connection with any subsequent written or oral forward-looking statements that may be issued by us or persons acting on our behalf. The forward-looking statements included in this report are made only as of the date hereof or as of the date specified herein. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Non-GAAP Financial Measures and Definitions

In this press release, we refer to Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA (Excluding Political), Adjusted Net (Loss) Income and Adjusted Net Income Per Share which are financial measures that have not been prepared in accordance with generally accepted accounting principles in the United States (“GAAP”).

We define Adjusted Operating Income as operating income before the deduction of depreciation and amortization, stock-based compensation, corporate expenses, transaction costs, business realignment costs, impairments and net (gain) loss on sale and retirement of assets. We define Adjusted EBITDA as net income before the deduction of income taxes, interest expense, net, gain on repurchases of debt, transaction and business realignment costs, depreciation and amortization, stock-based compensation, impairments, net loss (gain) on sale and retirement of assets and other expense (income) net. We define Adjusted EBITDA (Excluding Political) as Adjusted EBITDA less political net revenue, net of a fifteen percent deduction to account for estimated national representative firm fees, music licensing fees and sales commissions expense. Adjusted Net Income is defined as net income before the deduction of transaction and business realignment costs, impairments, change in fair value of investment, net (gain) loss on sale and retirement of assets, gain on repurchases of debt, gain on sale of digital assets, gain on insurance recoveries and net income attributable to non-controlling interest, net of income taxes. Adjusted Net Income Per

Share is defined as Adjusted Net Income divided by the weighted average shares outstanding. We define Net Leverage as our total outstanding indebtedness, net of our total cash balance as of September 30, 2023, divided by our Adjusted EBITDA for the twelve months ended September 30, 2023. These measures do not represent, and should not be considered as alternatives to or superior to, financial results and measures determined or calculated in accordance with GAAP. In addition, these non-GAAP measures are not based on any comprehensive set of accounting rules or principles. You should be aware that in the future we may incur expenses or charges that are the same as or similar to some of the adjustments in the presentation, and we do not infer that our future results will be unaffected by unusual or non-recurring items. In addition, these non-GAAP measures may not be comparable to similarly-named measures reported by other companies.

We use Adjusted Operating Income to evaluate the operating performance of our business segments. We use Adjusted EBITDA and Adjusted EBITDA (Excluding Political) to facilitate company-to-company operating performance comparisons by backing out potential differences caused by variations in capital structures (affecting interest expense), taxation and the age and book depreciation of facilities and equipment (affecting relative depreciation expense), which may vary for different companies for reasons unrelated to operating performance, and to facilitate year over year comparisons, by backing out the impact of political revenue which varies depending on the election cycle and may be unrelated to operating performance. We use Adjusted Net Income and Adjusted Net Income Per Share to assess total company operating performance on a consistent basis. We use Net Leverage to measure the Company’s ability to handle its debt burden. We believe that these measures, when considered together with our GAAP financial results, provide management and investors with a more complete understanding of our business operating results, including underlying trends, by excluding the effects of transaction costs, net (gain) loss on sale and retirement of assets, business realignment costs and certain impairments. Further, while discretionary bonuses for members of management are not determined with reference to specific targets, our board of directors may consider Adjusted Operating Income, Adjusted EBITDA, Adjusted EBITDA (Excluding Political), Adjusted Net Income, Adjusted Net Income Per Share, and Net Leverage when determining discretionary bonuses.

Investor Relations

Claire Yenicay

(203) 900-5555

investors@townsquaremedia.com

TOWNSQUARE MEDIA, INC.

CONSOLIDATED BALANCE SHEETS

(in Thousands, Except Share and Per Share Data)

(unaudited)

| | | | | | | | | | | |

| September 30,

2023 | | December 31,

2022 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 37,955 | | | $ | 43,417 | |

Accounts receivable, net of allowance for credit losses of $4,544 and $5,946, respectively | 63,527 | | | 61,234 | |

| Prepaid expenses and other current assets | 11,860 | | | 16,037 | |

| | | |

Total current assets | 113,342 | | | 120,688 | |

| Property and equipment, net | 111,301 | | | 113,846 | |

| Intangible assets, net | 220,755 | | | 276,838 | |

| Goodwill | 158,670 | | | 161,385 | |

| Investments | 4,209 | | | 19,106 | |

| Operating lease right-of-use assets | 47,719 | | | 50,962 | |

| Other assets | 828 | | | 1,197 | |

| Restricted cash | 501 | | | 496 | |

Total assets | $ | 657,325 | | | $ | 744,518 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 4,844 | | | $ | 4,127 | |

| | | |

| Deferred revenue | 8,845 | | | 10,669 | |

| Accrued compensation and benefits | 11,227 | | | 14,831 | |

| Accrued expenses and other current liabilities | 24,326 | | | 17,876 | |

| Operating lease liabilities, current | 9,039 | | | 9,008 | |

| | | |

| Accrued interest | 5,760 | | | 15,203 | |

| | | |

| Total current liabilities | 64,041 | | | 71,714 | |

Long-term debt, net of deferred finance costs of $4,480 and $6,324, respectively | 499,138 | | | 524,442 | |

| Deferred tax liability | 27,565 | | | 18,748 | |

| Operating lease liability, net of current portion | 42,281 | | | 45,107 | |

| Other long-term liabilities | 11,866 | | | 15,428 | |

Total liabilities | 644,891 | | | 675,439 | |

| Stockholders’ equity: | | | |

Class A common stock, par value $0.01 per share; 300,000,000 shares authorized; 13,864,471 and 12,964,312 shares issued and outstanding, respectively | 139 | | | 130 | |

Class B common stock, par value $0.01 per share; 50,000,000 shares authorized; 815,296 and 815,296 shares issued and outstanding, respectively | 8 | | | 8 | |

Class C common stock, par value $0.01 per share; 50,000,000 shares authorized; 1,961,341 and 3,461,341 shares issued and outstanding, respectively | 20 | | | 35 | |

| Total common stock | 167 | | | 173 | |

Treasury stock, at cost; 183,768 and 0 shares of Class A common stock, respectively | (2,194) | | | — | |

| Additional paid-in capital | 307,498 | | | 309,645 | |

| Accumulated deficit | (296,573) | | | (244,298) | |

| Non-controlling interest | 3,536 | | | 3,559 | |

Total stockholders’ equity | 12,434 | | | 69,079 | |

Total liabilities and stockholders’ equity | $ | 657,325 | | | $ | 744,518 | |

TOWNSQUARE MEDIA, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in Thousands, Except Per Share Data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net revenue | $ | 115,104 | | | $ | 120,635 | | | $ | 339,445 | | | $ | 342,801 | |

| Operating costs and expenses: | | | | | | | |

| Direct operating expenses, excluding depreciation, amortization, and stock-based compensation | 81,323 | | | 83,985 | | | 245,301 | | | 241,581 | |

| Depreciation and amortization | 4,717 | | | 4,467 | | | 14,496 | | | 13,546 | |

| Corporate expenses | 6,604 | | | 5,744 | | | 18,911 | | | 15,892 | |

| Stock-based compensation | 2,350 | | | 722 | | | 6,228 | | | 2,430 | |

| Transaction and business realignment costs | 161 | | | 1,004 | | | 764 | | | 2,280 | |

| | | | | | | |

| | | | | | | |

Impairment of intangible assets, investments, goodwill and long-lived assets | 30,970 | | | 10,300 | | | 65,697 | | | 20,197 | |

| | | | | | | |

| Net gain on sale and retirement of assets | (362) | | | (119) | | | (703) | | | (338) | |

| Total operating costs and expenses | 125,763 | | | 106,103 | | | 350,694 | | | 295,588 | |

| Operating (loss) income | (10,659) | | | 14,532 | | | (11,249) | | | 47,213 | |

| Other expense (income): | | | | | | | |

| Interest expense, net | 9,343 | | | 9,967 | | | 28,215 | | | 30,038 | |

| Gain on repurchases of debt | (430) | | | — | | | (1,249) | | | (108) | |

| Other (income) expense, net | (547) | | | (508) | | | (6,451) | | | 1,886 | |

| (Loss) income from operations before tax | (19,025) | | | 5,073 | | | (31,764) | | | 15,397 | |

| Income tax provision | 17,478 | | | 2,275 | | | 9,380 | | | 4,939 | |

| | | | | | | |

| | | | | | | |

| Net (loss) income | $ | (36,503) | | | $ | 2,798 | | | $ | (41,144) | | | $ | 10,458 | |

| | | | | | | |

| Net (loss) income attributable to: | | | | | | | |

| Controlling interests | $ | (36,999) | | | $ | 2,260 | | | $ | (42,620) | | | $ | 8,878 | |

| Non-controlling interests | $ | 496 | | | $ | 538 | | | $ | 1,476 | | | $ | 1,580 | |

| | | | | | | |

| Basic (loss) income per share | $ | (2.27) | | | $ | 0.13 | | | $ | (2.52) | | | $ | 0.52 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted (loss) income per share | $ | (2.27) | | | $ | 0.13 | | | $ | (2.52) | | | $ | 0.48 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 16,277 | | | 17,037 | | | 16,897 | | | 16,941 | |

| | | | | | | |

| Diluted | 16,277 | | | 17,482 | | | 16,897 | | | 18,645 | |

| | | | | | | |

| Cash dividend declared per share | $ | 0.1875 | | | $ | — | | | $ | 0.563 | | | $ | — | |

TOWNSQUARE MEDIA, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in Thousands)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net (loss) income | $ | (41,144) | | | $ | 10,458 | |

| | | |

| | | |

| Adjustments to reconcile net (loss) income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 14,496 | | | 13,546 | |

| Amortization of deferred financing costs | 1,567 | | | 1,359 | |

| Non-cash lease expense (income) | 69 | | | (298) | |

| Net deferred taxes and other | 8,817 | | | 4,413 | |

| Provision for doubtful accounts | 2,817 | | | 1,429 | |

| Stock-based compensation expense | 6,228 | | | 2,430 | |

| Gain on repurchases of debt | (1,249) | | | (108) | |

| | | |

| Trade activity, net | (1,352) | | | (3,496) | |

| Impairment of intangible assets, investments, goodwill and long-lived assets | 65,697 | | | 20,197 | |

| Realized gain on sale of digital assets | (839) | | | — | |

| | | |

| | | |

| | | |

| Gain on sale of investment | (5,210) | | | — | |

| | | |

| Unrealized loss on investment | 493 | | | 1,934 | |

| | | |

Content rights acquired | — | | | (19,320) | |

Amortization of content rights | 3,645 | | | 3,124 | |

Change in content rights liabilities | (1,819) | | | 17,397 | |

| Reimbursement of equipment modification costs | (1,487) | | | — | |

| Other | (1,276) | | | (815) | |

| Changes in assets and liabilities, net of acquisitions: | | | |

| Accounts receivable | (3,037) | | | (4,900) | |

| Prepaid expenses and other assets | 5,130 | | | (1,253) | |

| | | |

| Accounts payable | 646 | | | (123) | |

| Accrued expenses | (3,845) | | | (3,916) | |

| Accrued interest | (9,443) | | | (9,674) | |

| Other long-term liabilities | 60 | | | (278) | |

| | | |

| | | |

| Net cash provided by operating activities | 38,964 | | | 32,106 | |

| Cash flows from investing activities: | | | |

| Payment for acquisition | — | | | (18,419) | |

| Purchase of property and equipment | (11,373) | | | (13,100) | |

| Purchase of investments | — | | | (100) | |

| Purchase of digital assets | — | | | (4,997) | |

| Proceeds from sale of digital assets | 2,975 | | | — | |

| Proceeds from insurance recoveries | 721 | | | 452 | |

| Proceeds from sale of assets and investment related transactions | 7,277 | | | 810 | |

| | | |

| | | |

| | | |

| Net cash used in investing activities | (400) | | | (35,354) | |

| Cash flows from financing activities: | | | |

| | | |

| Repurchases of 2026 Notes | (25,621) | | | (18,850) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Dividend payments | (6,285) | | | — | |

| Proceeds from stock options exercised | 5,440 | | | 790 | |

| Withholdings for shares issued under the ESPP | 729 | | | — | |

| Repurchases of stock | (16,645) | | | (225) | |

| Cash distribution to non-controlling interests | (1,499) | | | (1,820) | |

| | | |

| Repayments of capitalized obligations | (140) | | | (105) | |

| Net cash used in financing activities | (44,021) | | | (20,210) | |

| Cash and cash equivalents and restricted cash: | | | |

| Net decrease in cash, cash equivalents and restricted cash | (5,457) | | | (23,458) | |

| Beginning of period | 43,913 | | | 50,999 | |

| End of period | $ | 38,456 | | | $ | 27,541 | |

TOWNSQUARE MEDIA, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (continued)

(in Thousands)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended

September 30, |

| 2023 | | 2022 |

| Supplemental Disclosure of Cash Flow Information: | | | |

Cash payments: | | | |

Interest | $ | 37,273 | | | $ | 38,284 | |

Income taxes | 1,122 | | | 1,049 | |

| | | |

| Supplemental Disclosure of Non-cash Activities: | | | |

| | | |

| Dividends declared, but not paid during the period | $ | 3,164 | | | $ | — | |

Investments acquired in exchange for advertising(1) | — | | | 2,750 | |

Property and equipment acquired in exchange for advertising(1) | 550 | | | 726 | |

| | | |

| Accrued capital expenditures | 229 | | | 45 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Supplemental Disclosure of Cash Flow Information relating to Leases: | | | |

Cash paid for amounts included in the measurement of operating lease liabilities, included in operating cash flows | $ | 8,850 | | | $ | 7,982 | |

Right-of-use assets obtained in exchange for operating lease obligations | 4,035 | | | 8,923 | |

| | | |

| Reconciliation of cash, cash equivalents and restricted cash | | | |

| Cash and cash equivalents | $ | 37,955 | | | $ | 27,046 | |

| Restricted cash | 501 | | | 495 | |

| $ | 38,456 | | | $ | 27,541 | |

(1) Represents total advertising services provided by the Company in exchange for property and equipment and equity interests acquired during each of the nine months ended September 30, 2023 and 2022, respectively.

TOWNSQUARE MEDIA, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS BY SEGMENT

(in Thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | | | Nine Months Ended

September 30, | | |

| 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Subscription Digital Marketing Solutions | $ | 20,257 | | | $ | 23,188 | | | (12.6) | % | | $ | 63,086 | | | $ | 68,021 | | | (7.3) | % |

| Digital Advertising | 39,009 | | | 36,989 | | | 5.5 | % | | 113,842 | | | 103,379 | | | 10.1 | % |

| Broadcast Advertising | 54,179 | | | 59,293 | | | (8.6) | % | | 153,822 | | | 164,520 | | | (6.5) | % |

| Other | 1,659 | | | 1,165 | | | 42.4 | % | | 8,695 | | | 6,881 | | | 26.4 | % |

| Net revenue | 115,104 | | | 120,635 | | | (4.6) | % | | 339,445 | | | 342,801 | | | (1.0) | % |

| Subscription Digital Marketing Solutions Expenses | 14,498 | | | 16,744 | | | (13.4) | % | | 45,703 | | | 48,513 | | | (5.8) | % |

| Digital Advertising expenses | 27,271 | | | 25,949 | | | 5.1 | % | | 77,666 | | | 73,058 | | | 6.3 | % |

| Broadcast Advertising expenses | 37,510 | | | 39,889 | | | (6.0) | % | | 113,858 | | | 113,875 | | | — | % |

| Other expenses | 2,044 | | | 1,403 | | | 45.7 | % | | 8,074 | | | 6,135 | | | 31.6 | % |

| Direct operating expenses | 81,323 | | | 83,985 | | | (3.2) | % | | 245,301 | | | 241,581 | | | 1.5 | % |

| Depreciation and amortization | 4,717 | | | 4,467 | | | 5.6 | % | | 14,496 | | | 13,546 | | | 7.0 | % |

| Corporate expenses | 6,604 | | | 5,744 | | | 15.0 | % | | 18,911 | | | 15,892 | | | 19.0 | % |

| Stock-based compensation | 2,350 | | | 722 | | | 225.5 | % | | 6,228 | | | 2,430 | | | 156.3 | % |

| Transaction and business realignment costs | 161 | | | 1,004 | | | (84.0) | % | | 764 | | | 2,280 | | | (66.5) | % |

| | | | | | | | | | | |

| Impairment of intangible assets, investments, goodwill and long-lived assets | 30,970 | | | 10,300 | | | 200.7 | % | | 65,697 | | | 20,197 | | | 225.3 | % |

| | | | | | | | | | | |

| Net gain on sale and retirement of assets | (362) | | | (119) | | | 204.2 | % | | (703) | | | (338) | | | 108.0 | % |

| Total operating costs and expenses | 125,763 | | | 106,103 | | | 18.5 | % | | 350,694 | | | 295,588 | | | 18.6 | % |

| Operating (loss) income | (10,659) | | | 14,532 | | | (173.3) | % | | (11,249) | | | 47,213 | | | (123.8) | % |

| Other expense (income): | | | | | | | | | | | |

| Interest expense, net | 9,343 | | | 9,967 | | | (6.3) | % | | 28,215 | | | 30,038 | | | (6.1) | % |

| Gain on repurchases of debt | (430) | | | — | | | ** | | (1,249) | | | (108) | | | ** |

| Other (income) expense, net | (547) | | | (508) | | | 7.7 | % | | (6,451) | | | 1,886 | | | ** |

| (Loss) income from operations before tax | (19,025) | | | 5,073 | | | (475.0) | % | | (31,764) | | | 15,397 | | | (306.3) | % |

| Income tax provision | 17,478 | | | 2,275 | | | 668.3 | % | | 9,380 | | | 4,939 | | | 89.9 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net (loss) income | $ | (36,503) | | | $ | 2,798 | | | ** | | $ | (41,144) | | | $ | 10,458 | | | (493.4) | % |

** not meaningful

The following table presents Net revenue and Adjusted Operating Income by segment, for the three and nine months ended September 30, 2023, and 2022, respectively (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Three Months Ended

September 30, | | | | Nine Months Ended

September 30, | | |

| (Unaudited) | | | | (Unaudited) | | |

| 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Subscription Digital Marketing Solutions | $ | 20,257 | | | $ | 23,188 | | | (12.6) | % | | $ | 63,086 | | | $ | 68,021 | | | (7.3) | % |

| Digital Advertising | 39,009 | | | 36,989 | | | 5.5 | % | | 113,842 | | | 103,379 | | | 10.1 | % |

| Digital | 59,266 | | | 60,177 | | | (1.5) | % | | 176,928 | | | 171,400 | | | 3.2 | % |

| Broadcast Advertising | 54,179 | | | 59,293 | | | (8.6) | % | | 153,822 | | | 164,520 | | | (6.5) | % |

| Other | 1,659 | | | 1,165 | | | 42.4 | % | | 8,695 | | | 6,881 | | | 26.4 | % |

| Net revenue | $ | 115,104 | | | $ | 120,635 | | | (4.6) | % | | $ | 339,445 | | | $ | 342,801 | | | (1.0) | % |

| Subscription Digital Marketing Solutions | $ | 5,759 | | | $ | 6,444 | | | (10.6) | % | | $ | 17,383 | | | $ | 19,508 | | | (10.9) | % |

| Digital Advertising | 11,738 | | | 11,040 | | | 6.3 | % | | 36,176 | | | 30,321 | | | 19.3 | % |

| Digital | 17,497 | | | 17,484 | | | 0.1 | % | | 53,559 | | | 49,829 | | | 7.5 | % |

| Broadcast Advertising | 16,669 | | | 19,404 | | | (14.1) | % | | 39,964 | | | 50,645 | | | (21.1) | % |

| Other | (385) | | | (238) | | | 61.8 | % | | 621 | | | 746 | | | (16.8) | % |

| Adjusted Operating Income | $ | 33,781 | | | $ | 36,650 | | | (7.8) | % | | $ | 94,144 | | | $ | 101,220 | | | (7.0) | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

The following table reconciles Net revenue to Net revenue, excluding political revenue on a GAAP basis by segment for the three and nine months ended September 30, 2023, and 2022, respectively (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| Three Months Ended

September 30, | | | | Nine Months Ended

September 30, | | |

| (Unaudited) | | | | (Unaudited) | | |

| 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Subscription Digital Marketing Solutions | $ | 20,257 | | | $ | 23,188 | | | (12.6) | % | | $ | 63,086 | | | $ | 68,021 | | | (7.3) | % |

| Digital Advertising | 39,009 | | | 36,989 | | | 5.5 | % | | 113,842 | | | 103,379 | | | 10.1 | % |

| Digital | 59,266 | | | 60,177 | | | (1.5) | % | | 176,928 | | | 171,400 | | | 3.2 | % |

| Broadcast Advertising | 54,179 | | | 59,293 | | | (8.6) | % | | 153,822 | | | 164,520 | | | (6.5) | % |

| Other | 1,659 | | | 1,165 | | | 42.4 | % | | 8,695 | | | 6,881 | | | 26.4 | % |

| Net revenue | $ | 115,104 | | | $ | 120,635 | | | (4.6) | % | | $ | 339,445 | | | $ | 342,801 | | | (1.0) | % |

| Subscription Digital Marketing Solutions political revenue | — | | | — | | | — | | | — | | | — | | | — | |

| Digital Advertising political revenue | 66 | | | 100 | | | (34.0) | % | | 127 | | | 297 | | | (57.2) | % |

| Broadcast Advertising political revenue | 561 | | | 1,487 | | | (62.3) | % | | 1,118 | | | 3,238 | | | (65.5) | % |

| Other political revenue | — | | | — | | | — | | | — | | | — | | | — | |

| Political revenue | $ | 627 | | | $ | 1,587 | | | (60.5) | % | | $ | 1,245 | | | $ | 3,535 | | | (64.8) | % |

| Subscription Digital Marketing Solutions net revenue (ex. political) | $ | 20,257 | | | $ | 23,188 | | | (12.6) | % | | $ | 63,086 | | | $ | 68,021 | | | (7.3) | % |

| Digital Advertising net revenue (ex. political) | 38,943 | | | 36,889 | | | 5.6 | % | | 113,715 | | | 103,082 | | | 10.3 | % |

| Digital net revenue (ex. political) | 59,200 | | | 60,077 | | | (1.5) | % | | 176,801 | | | 171,103 | | | 3.3 | % |

| Broadcast Advertising political net revenue (ex. political) | 53,618 | | | 57,806 | | | (7.2) | % | | 152,704 | | | 161,282 | | | (5.3) | % |

| Other net revenue (ex. political) | 1,659 | | | 1,165 | | | 42.4 | % | | 8,695 | | | 6,881 | | | 26.4 | % |

| Net revenue (ex. political) | $ | 114,477 | | | $ | 119,048 | | | (3.8) | % | | $ | 338,200 | | | $ | 339,266 | | | (0.3) | % |

| | | | | | | | | | | |

** not meaningful

The following table reconciles on a GAAP basis net (loss) income, the most directly comparable financial measure calculated and presented in accordance with GAAP, to Adjusted Net Income for the three and nine months ended September 30, 2023, and 2022, respectively (in thousands, except per share data):

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (Unaudited) |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net (loss) income | $ | (36,503) | | | $ | 2,798 | | | $ | (41,144) | | | $ | 10,458 | |

| | | | | | | |

| | | | | | | |

| Income tax provision | 17,478 | | | 2,275 | | | 9,380 | | | 4,939 | |

| (Loss) Income from operations before taxes | (19,025) | | | 5,073 | | | (31,764) | | | 15,397 | |

| Transaction and business realignment costs | 161 | | | 1,004 | | | 764 | | | 2,280 | |

| | | | | | | |

| | | | | | | |

| Impairment of intangible assets, investments, goodwill and long-lived assets | 30,970 | | | 10,300 | | | 65,697 | | | 20,197 | |

| | | | | | | |

| Net gain on sale and retirement of assets | (362) | | | (119) | | | (703) | | | (338) | |

| Gain on repurchases of debt | (430) | | | — | | | (1,249) | | | (108) | |

| Gain on sale of digital assets | — | | | — | | | (839) | | | — | |

| Gain on sale of investments | — | | | — | | | (5,210) | | | — | |

| Change in fair value of investment | 605 | | | (239) | | | 493 | | | 1,934 | |

| Gain on insurance recoveries | (349) | | | (441) | | | (721) | | | (452) | |

| Net income attributable to non-controlling interest, net of income taxes | (496) | | | (538) | | | (1,476) | | | (1,580) | |

| Adjusted net income before income taxes | 11,074 | | | 15,040 | | | 24,992 | | | 37,330 | |

Income tax provision (1) | 2,824 | | | 6,745 | | | 6,373 | | | 11,975 | |

| Adjusted Net Income | $ | 8,250 | | | $ | 8,295 | | | $ | 18,619 | | | $ | 25,355 | |

| | | | | | | |

| | | | | | | |

| Adjusted Net Income Per Share: | | | | | | | |

| Basic | $ | 0.51 | | | $ | 0.49 | | | $ | 1.10 | | | $ | 1.50 | |

| Diluted | $ | 0.46 | | | $ | 0.47 | | | $ | 1.05 | | | $ | 1.36 | |

| | | | | | | |

| Weighted average shares outstanding: | | | | | | | |

| Basic | 16,277 | | | 17,037 | | | 16,897 | | | 16,941 | |

| Diluted | 18,073 | | | 17,482 | | | 17,726 | | | 18,645 | |

(1) Income tax provision for the three and nine months ended September 30, 2023 was calculated using the Company's statutory effective tax rate.

The following table reconciles on a GAAP basis net (loss) income, the most directly comparable financial measure calculated and presented in accordance with GAAP, to Adjusted EBITDA, Adjusted EBITDA (Excluding Political), and Adjusted EBITDA Less Interest, Capex and Taxes for the three and nine months ended September 30, 2023, and 2022, respectively (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | |

| |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| (Unaudited) |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | | | | | | |

| Net (loss) income | $ | (36,503) | | | $ | 2,798 | | | $ | (41,144) | | | $ | 10,458 | |

| Income tax provision | 17,478 | | | 2,275 | | | 9,380 | | | 4,939 | |

| Interest expense, net | 9,343 | | | 9,967 | | | 28,215 | | | 30,038 | |

| Gain on repurchases of debt | (430) | | | — | | | (1,249) | | | (108) | |

| Depreciation and amortization | 4,717 | | | 4,467 | | | 14,496 | | | 13,546 | |

| Stock-based compensation | 2,350 | | | 722 | | | 6,228 | | | 2,430 | |

| Transaction and business realignment costs | 161 | | | 1,004 | | | 764 | | | 2,280 | |

| | | | | | | |

| | | | | | | |

| Impairment of intangible assets, investments, goodwill and long-lived assets | 30,970 | | | 10,300 | | | 65,697 | | | 20,197 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Other (a) | (909) | | | (627) | | | (7,154) | | | 1,548 | |

| Adjusted EBITDA | $ | 27,177 | | | $ | 30,906 | | | $ | 75,233 | | | $ | 85,328 | |

| Political Adjusted EBITDA | (533) | | | (1,349) | | | (1,058) | | | (3,005) | |

| Adjusted EBITDA (Excluding Political) | $ | 26,644 | | | $ | 29,557 | | | $ | 74,175 | | | $ | 82,323 | |

| Political Adjusted EBITDA | 533 | | | 1,349 | | | 1,058 | | | 3,005 | |

| Net cash paid for interest | (18,219) | | | (18,776) | | | (37,273) | | | (38,284) | |

| Capital expenditures | (4,237) | | | (5,473) | | | (11,373) | | | (13,100) | |

| Cash paid for taxes | (305) | | | (190) | | | (1,122) | | | (1,049) | |

| Adjusted EBITDA Less Interest, Capex and Taxes | $ | 4,416 | | | $ | 6,467 | | | $ | 25,465 | | | $ | 32,895 | |

(a) Other includes net gain on sale and retirement of assets and other (income) expense, net.

The following table reconciles net income (loss), the most directly comparable financial measure calculated and presented in accordance with GAAP, to Adjusted EBITDA on a quarterly basis for the twelve months ended September 30, 2023 (dollars in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Twelve Months Ended |

| (Unaudited) |

| December 31, 2022 | | March 31, 2023 | | June 30, 2023 | | September 30,

2023 | | September 30,

2023 |

| Net income (loss) | $ | 3,932 | | | $ | (1,941) | | | $ | (2,700) | | | $ | (36,503) | | | $ | (37,212) | |

| Income tax benefit | (5,503) | | | (1,578) | | | (6,520) | | | 17,478 | | | 3,877 | |

| Interest expense, net | 9,790 | | | 9,558 | | | 9,314 | | | 9,343 | | | 38,005 | |

| | | | | | | | | |

| Gain on repurchases of debt | — | | | (775) | | | (44) | | | (430) | | | (1,249) | |

| Depreciation and amortization | 5,498 | | | 4,944 | | | 4,835 | | | 4,717 | | | 19,994 | |

| Stock-based compensation | 1,367 | | | 1,772 | | | 2,106 | | | 2,350 | | | 7,595 | |

| Transaction and business realignment costs | 2,168 | | | 292 | | | 311 | | | 161 | | | 2,932 | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Impairment of intangible assets, investments, goodwill and long-lived assets | 10,917 | | | 8,487 | | | 26,240 | | | 30,970 | | | 76,614 | |

| | | | | | | | | |

| | | | | | | | | |

Other (a) | 221 | | | (1,318) | | | (4,927) | | | (909) | | | (6,933) | |

| Adjusted EBITDA | $ | 28,390 | | | $ | 19,441 | | | $ | 28,615 | | | $ | 27,177 | | | $ | 103,623 | |

(a) Other includes net gain on sale and retirement of assets and other (income) expense, net.

The following tables reconcile Operating income (loss), the most directly comparable financial measure calculated and presented in accordance with GAAP, to Adjusted Operating Income (loss) by segment for the three months ended September 30, 2023, and 2022 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2023 |

| (Unaudited) |

| Subscription Digital Marketing Solutions | | Digital Advertising | | Broadcast Advertising | | Other | | Corporate and Other Reconciling Items | | Total |

| Operating income (loss) | $ | 5,282 | | | $ | 11,448 | | | $ | (13,081) | | | $ | (427) | | | $ | (13,881) | | | $ | (10,659) | |

| Depreciation and amortization | 325 | | | 147 | | | 3,263 | | | 35 | | | 947 | | | 4,717 | |

| Corporate expenses | — | | | — | | | — | | | — | | | 6,604 | | | 6,604 | |

| Stock-based compensation | 152 | | | 143 | | | 240 | | | 4 | | | 1,811 | | | 2,350 | |

| Transaction and business realignment costs | — | | | — | | | 6 | | | 3 | | | 152 | | | 161 | |

| Impairment of intangible assets, investments, goodwill and long-lived assets | — | | | — | | | 26,603 | | | — | | | 4,367 | | | 30,970 | |

| Net gain on sale and retirement of assets | — | | | — | | | (362) | | | — | | | — | | | (362) | |

| Adjusted Operating Income (loss) | $ | 5,759 | | | $ | 11,738 | | | $ | 16,669 | | | $ | (385) | | | $ | — | | | $ | 33,781 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2022 |

| (Unaudited) |

| Subscription Digital Marketing Solutions | | Digital Advertising | | Broadcast Advertising | | Other | | Corporate and Other Reconciling Items | | Total |

| Operating income (loss) | $ | 5,986 | | | $ | 10,870 | | | $ | 5,793 | | | $ | (272) | | | $ | (7,845) | | | $ | 14,532 | |

| Depreciation and amortization | 321 | | | 150 | | | 3,301 | | | 26 | | | 669 | | | 4,467 | |

| Corporate expenses | — | | | — | | | — | | | — | | | 5,744 | | | 5,744 | |

| Stock-based compensation | 137 | | | 20 | | | 109 | | | 2 | | | 454 | | | 722 | |

| Transaction and business realignment costs | — | | | — | | | — | | | 6 | | | 998 | | | 1,004 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Impairment of long-lived assets, intangible assets and investments | — | | | — | | | 10,300 | | | — | | | — | | | 10,300 | |

| Net gain on sale and retirement of assets | — | | | — | | | (99) | | | — | | | (20) | | | (119) | |

| Adjusted Operating Income (loss) | $ | 6,444 | | | $ | 11,040 | | | $ | 19,404 | | | $ | (238) | | | $ | — | | | $ | 36,650 | |

The following tables reconcile Operating income (loss), the most directly comparable financial measure calculated and presented in accordance with GAAP, to Adjusted Operating Income by segment for the nine months ended September 30, 2023, and 2022 (in thousands):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| (Unaudited) |

| Subscription Digital Marketing Solutions | | Digital Advertising | | Broadcast Advertising | | Other | | Corporate and Other Reconciling Items | | Total |

| Operating income (loss) | $ | 15,972 | | | $ | 35,439 | | | $ | (22,399) | | | $ | 493 | | | $ | (40,754) | | | $ | (11,249) | |

| Depreciation and amortization | 980 | | | 479 | | | 10,245 | | | 104 | | | 2,688 | | | 14,496 | |

| Corporate expenses | — | | | — | | | — | | | — | | | 18,911 | | | 18,911 | |

| Stock-based compensation | 431 | | | 258 | | | 622 | | | 10 | | | 4,907 | | | 6,228 | |

| Transaction and business realignment costs | — | | | — | | | 366 | | | 14 | | | 384 | | | 764 | |

| | | | | | | | | | | |

| Impairment of intangible assets, investments, goodwill and long-lived assets | — | | | — | | | 51,833 | | | — | | | 13,864 | | | 65,697 | |

| Net gain on sale and retirement of assets | — | | | — | | | (703) | | | — | | | — | | | (703) | |

| Adjusted Operating Income | $ | 17,383 | | | $ | 36,176 | | | $ | 39,964 | | | $ | 621 | | | $ | — | | | $ | 94,144 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2022 |

| (Unaudited) |

| Subscription Digital Marketing Solutions | | Digital Advertising | | Broadcast Advertising | | Other | | Corporate and Other Reconciling Items | | Total |

| Operating income (loss) | $ | 18,195 | | | $ | 29,911 | | | $ | 24,786 | | | $ | 487 | | | $ | (26,166) | | | $ | 47,213 | |

| Depreciation and amortization | 911 | | | 360 | | | 9,603 | | | 113 | | | 2,559 | | | 13,546 | |

| Corporate expenses | — | | | — | | | — | | | — | | | 15,892 | | | 15,892 | |

| Stock-based compensation | 402 | | | 50 | | | 280 | | | 8 | | | 1,690 | | | 2,430 | |

| Transaction and business realignment costs | — | | | — | | | — | | | 18 | | | 2,262 | | | 2,280 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Impairment of long-lived assets, intangible assets and investments | — | | | — | | | 16,258 | | | 120 | | | 3,819 | | | 20,197 | |

| Net gain on sale and retirement of assets | — | | | — | | | (282) | | | — | | | (56) | | | (338) | |

| Adjusted Operating Income | $ | 19,508 | | | $ | 30,321 | | | $ | 50,645 | | | $ | 746 | | | $ | — | | | $ | 101,220 | |

Cover Page Cover Page

|

Nov. 09, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 09, 2023

|

| Entity Registrant Name |

Townsquare Media, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-36558

|

| Entity Tax Identification Number |

27-1996555

|

| Entity Address, Address Line One |

One Manhattanville Road,

|

| Entity Address, Address Line Two |

Suite 202

|

| Entity Address, City or Town |

Purchase,

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10577

|

| City Area Code |

203

|

| Local Phone Number |

861-0900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.01 par value per share

|

| Trading Symbol |

TSQ

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001499832

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

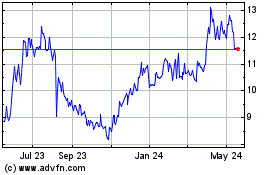

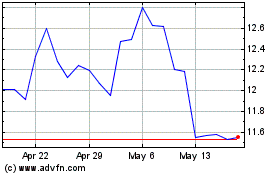

Townsquare Media (NYSE:TSQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

Townsquare Media (NYSE:TSQ)

Historical Stock Chart

From Dec 2023 to Dec 2024