Target, TJX Sales Surge as Shoppers Return -- Update

May 19 2021 - 12:50PM

Dow Jones News

By Sarah Nassauer and Suzanne Kapner

Target Corp., Lowe's Cos. and the owner of T.J. Maxx reported

robust sales and a jump in store visits during the spring, as

Covid-related restrictions eased and people returned to shopping at

physical stores.

The strong results posted Wednesday followed similar reports

earlier this week from other national chains, including Home Depot

Inc. and Macy's Inc. Many of these retailers benefited during the

pandemic from being able to stay open and the shift to online

orders, or they are now capturing pent-up demand as they

reopen.

"The first quarter felt like a first step towards a

post-pandemic world, " said Target Chief Executive Brian Cornell on

a call with analysts Wednesday. "With vaccinations rolling out

across the country and consumers increasingly comfortable venturing

out, we've seen an enthusiastic return to in-store shopping," he

said.

At Target, comparable sales -- those from stores and digital

channels operating for at least 12 months -- rose 23% from a year

earlier in the quarter ended May 1. The growth rate was twice that

of the same quarter last year when people rushed to buy food and

household staples early in the pandemic.

Larger rival Walmart Inc. reported comparable sales rose 6% in

its latest quarter, a slightly smaller gain than in the

year-earlier period. Walmart executives said sales benefited from

government stimulus checks and pent-up consumer demand.

TJX Cos., which owns T.J. Maxx, Marshalls and HomeGoods,

reported on Wednesday first-quarter sales that were up 16% from the

same period last year and up 8.7% from 2019.

Strong sales, particularly of apparel, signaled that consumers

are "beginning to resume more normal activities," said TJX Chief

Executive Ernie Herrman. He said sales trends for the start of the

second quarter remained strong.

TJX suffered during the pandemic because only a small portion of

its sales are digital. Sales at the division that houses T.J. Maxx

and Marshalls, which mainly sell apparel, increased 12% in the

latest quarter, while its HomeGoods division posted 40% growth from

a year earlier.

Lowe's said its comparable sales rose 26% in the quarter ended

April 30, as people continued to buy home-improvement items, one of

the biggest product category winners during the pandemic. Home

Depot's most recent quarterly comparable sales were up 31%.

Target booked gains across categories, while its results also

suggested changes in buying behavior as more people ventured out or

hosted social events. Apparel sales rose more than 60%, Target

said, and sales of home goods and hardlines, such as small

appliances, rose more than 30%. Sales of food and home essentials,

big winners last year, increased by a few percentage points.

The company's overall sales through digital channels increased

50% in the most recent quarter, a slowdown from the same period

last year when sales grew 141%. Store visits rose 17%, year over

year.

Target reported quarterly earnings of $2.1 billion, up from $284

million a year earlier, lifted by strong sales of higher margin

items such as apparel and store brands. Total revenue rose 23% to

$24.2 billion.

For the current quarter, Target expects comparable-sales

percentage growth in the mid-to-high single digits.

Worker shortages affecting many retailers and restaurants aren't

being felt at Target, Mr. Cornell said, because of wage investments

and other worker benefits. Target raised pay for hourly workers to

at least $15 an hour last year.

Write to Sarah Nassauer at sarah.nassauer@wsj.com and Suzanne

Kapner at Suzanne.Kapner@wsj.com

(END) Dow Jones Newswires

May 19, 2021 12:35 ET (16:35 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

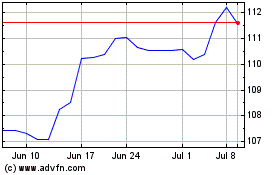

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Aug 2024 to Sep 2024

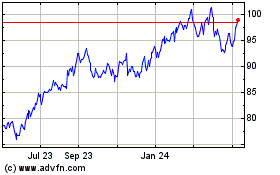

TJX Companies (NYSE:TJX)

Historical Stock Chart

From Sep 2023 to Sep 2024