FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of 08/01/2023

Ternium S.A.

(Translation of Registrant's name into English)

Ternium S.A.

26 Boulevard Royal – 4th floor

L-2449 Luxembourg

(352) 2668-3152

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F a Form 40-F __

Indicate by check mark whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12G3-2(b) under the Securities Exchange Act of 1934.

Yes __ No a

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

Not applicable

The attached material is being furnished to the Securities and Exchange Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended.

This report contains Ternium S.A.’s consolidated financial statements as of June 30, 2023.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TERNIUM S.A.

| | | | | | | | |

By: /s/ Guillermo Etchepareborda | | By:/s/ Sebastián Martí |

| Name: Guillermo Etchepareborda | | Name: Sebastián Martí |

| Title: Attorney in Fact | | Title: Attorney in Fact |

Dated: August 1, 2023

| | | | | |

| |

| |

| TERNIUM S.A. | |

| Consolidated Condensed Interim Financial Statements | |

as of June 30, 2023 | |

| and for the six-month periods | |

ended on June 30, 2023 and 2022

| |

| |

| |

| |

26 Boulevard Royal, 4th floor

| |

L – 2449 Luxembourg

| |

R.C.S. Luxembourg: B 98 668

| |

INDEX

| | | | | | | | |

| Page |

| |

| |

| |

Consolidated Condensed Interim Statements of Financial Position | |

Consolidated Condensed Interim Statements of Changes in Equity | |

Consolidated Condensed Interim Statements of Cash Flows | |

Notes to the Consolidated Condensed Interim Financial Statements | |

| 1 | General information and basis of presentation | |

| 2 | Accounting policies | |

| 3 | Segment information | |

| 4 | Cost of sales | |

| 5 | Selling, general and administrative expenses | |

| 6 | Finance expense, Finance income and Other financial income (expenses), net | |

| 7 | Property, plant and equipment, net | |

| 8 | Intangible assets, net | |

| 9 | Investments in non-consolidated companies | |

| 10 | Distribution of dividends | |

| 11 | Contingencies, commitments and restrictions on the distribution of profits | |

| 12 | Related party transactions | |

| 13 | Financial instruments by category and fair value measurement | |

| 14 | Foreign exchange restrictions in Argentina | |

| 15 | The Russia-Ukraine armed conflict | |

| 16 | Ternium to integrate operations in the USMCA | |

| 17 | Ternium to Increase its Participation in Usiminas Control Group - New Governance Structure of Usiminas | |

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

| (All amounts in $ thousands) | | |

Consolidated Condensed Interim Income Statements

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | Three-month period ended

June 30, | | Six-month period ended

June 30, |

| | Notes | | 2023 | | 2022 | | 2023 | | 2022 |

| | | | (Unaudited) | | (Unaudited) |

| Net sales | | 3 | | 3,871,272 | | | 4,437,676 | | | 7,494,643 | | | 8,742,505 | |

| Cost of sales | | 4 | | (2,839,419) | | | (3,058,908) | | | (5,820,170) | | | (6,043,093) | |

| | | | | | | | | | |

| Gross profit | | | | 1,031,853 | | | 1,378,768 | | | 1,674,473 | | | 2,699,412 | |

| | | | | | | | | | |

| Selling, general and administrative expenses | | 5 | | (304,271) | | | (310,444) | | | (597,195) | | | (591,747) | |

| Other operating income, net | | | | 4,159 | | | 2,828 | | | 11,853 | | | 22,502 | |

| | | | | | | | | | |

| Operating income | | 3 | | 731,741 | | | 1,071,152 | | | 1,089,131 | | | 2,130,167 | |

| | | | | | | | | | |

| Finance expense | | 6 | | (17,542) | | | (7,313) | | | (33,742) | | | (13,935) | |

| Finance income | | 6 | | 42,033 | | | 15,636 | | | 83,479 | | | 39,953 | |

| Other financial (expense) income, net | | 6 | | (42,481) | | | 28,856 | | | (59,900) | | | (49,711) | |

| | | | | | | | | | |

| Equity in earnings of non-consolidated companies | | 9 | | 27,301 | | | 49,273 | | | 62,176 | | | 108,022 | |

| | | | | | | | | | |

| Profit before income tax credit (expense) | | | | 741,052 | | | 1,157,604 | | | 1,141,144 | | | 2,214,496 | |

| | | | | | | | | | |

| Income tax credit (expense) | | | | (5,169) | | | (221,419) | | | 74,259 | | | (400,793) | |

| | | | | | | | | | |

| Profit for the period | | | | 735,883 | | | 936,185 | | | 1,215,403 | | | 1,813,703 | |

| | | | | | | | | | |

| Attributable to: | | | | | | | | | | |

| Owners of the parent | | | | 626,930 | | | 799,270 | | | 1,001,304 | | | 1,574,891 | |

| Non-controlling interest | | | | 108,953 | | | 136,915 | | | 214,099 | | | 238,812 | |

| | | | | | | | | | |

| Profit for the period | | | | 735,883 | | | 936,185 | | | 1,215,403 | | | 1,813,703 | |

| | | | | | | | | | |

| Weighted average number of shares outstanding | | | | 1,963,076,776 | | 1,963,076,776 | | | 1,963,076,776 | | | 1,963,076,776 | |

| | | | | | | | | | |

| Basic and diluted earnings per share for profit attributable to the equity holders of the company (expressed in $ per share) | | | | 0.32 | | 0.41 | | 0.51 | | 0.80 |

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the year ended December 31, 2022.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

| (All amounts in $ thousands) | | |

Consolidated Condensed Interim Statements of Comprehensive Income

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Three-month period ended

June 30, | | Six-month period ended

June 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | (Unaudited) | | (Unaudited) |

| Profit for the period | | 735,883 | | 936,185 | | | 1,215,403 | | | 1,813,703 | |

| | | | | | | | |

| Items that may be reclassified subsequently to profit or loss: | | | | | | | | |

| Currency translation adjustment | | 1,591 | | | 10 | | | 3,240 | | | 562 | |

| Currency translation adjustment from participation in non-consolidated companies | | 42,305 | | | (84,417) | | | 62,610 | | | 42,311 | |

| Changes in the fair value of financial instruments at fair value through other comprehensive income | | (95,706) | | | (11,595) | | | (123,732) | | | (39,588) | |

| Income tax related to financial instruments at fair value | | (31,779) | | | 3,913 | | | (21,758) | | | 13,496 | |

| Changes in the fair value of derivatives classified as cash flow hedges | | — | | | 23 | | | — | | | 55 | |

| Income tax related to cash flow hedges | | — | | | (7) | | | — | | | (17) | |

| | | | | | | | |

| | | | | | | | |

| Other comprehensive income items from participation in non-consolidated companies | | (37) | | | 106 | | | 415 | | | 205 | |

| Items that will not be reclassified subsequently to profit or loss: | | | | | | | | |

| Remeasurement of post employment benefit obligations | | (879) | | | (656) | | | (879) | | | (3,042) | |

| Income tax relating to remeasurement of post employment benefit obligations | | 328 | | | 314 | | | 328 | | | 1,025 | |

| Remeasurement of post employment benefit obligations from participation in non-consolidated companies | | (7,745) | | | (1,559) | | | (7,561) | | | (1,930) | |

| | | | | | | | |

| Other comprehensive income (loss) for the period, net of tax | | (91,922) | | | (93,868) | | | (87,337) | | | 13,077 | |

| | | | | | | | |

| Total comprehensive income for the period | | 643,961 | | | 842,317 | | | 1,128,066 | | | 1,826,780 | |

| | | | | | | | |

| Attributable to: | | | | | | | | |

| Owners of the parent | | 510,092 | | | 714,115 | | | 894,029 | | | 1,594,843 | |

| Non-controlling interest | | 133,869 | | | 128,202 | | | 234,037 | | | 231,937 | |

| | | | | | | | |

| Total comprehensive income for the period | | 643,961 | | | 842,317 | | | 1,128,066 | | | 1,826,780 | |

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the year ended December 31, 2022.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

| (All amounts in $ thousands) | | |

Consolidated Condensed Interim Statements of Financial Position

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Balances as of |

| | Notes | | June 30, 2023 | | December 31, 2022 |

| | | | (Unaudited) | | | | |

| ASSETS | | | | | | | | | | |

| | | | | | | | | | |

| Non-current assets | | | | | | | | | | |

| Property, plant and equipment, net | | 7 | | 6,324,307 | | | | | 6,261,887 | | | |

| Intangible assets, net | | 8 | | 968,124 | | | | | 944,409 | | | |

| Investments in non-consolidated companies | | 9 | | 938,998 | | | | | 821,571 | | | |

| Other investments | | | | 102,931 | | | | | 100,716 | | | |

| | | | | | | | | | |

| Deferred tax assets | | | | 348,858 | | | | | 200,237 | | | |

| Receivables, net | | | | 409,351 | | | 9,092,569 | | | 318,690 | | | 8,647,510 | |

| | | | | | | | | | |

| | | | | | | | | | |

| Current assets | | | | | | | | | | |

| Receivables, net | | | | 719,446 | | | | | 662,762 | | | |

| Derivative financial instruments | | | | — | | | | | 227 | | | |

| Inventories, net | | | | 3,758,603 | | | | | 3,470,215 | | | |

| Trade receivables, net | | | | 1,412,260 | | | | | 1,180,689 | | | |

| Other investments | | | | 2,031,761 | | | | | 1,875,026 | | | |

| Cash and cash equivalents | | | | 920,404 | | | 8,842,474 | | | 1,653,355 | | | 8,842,274 | |

| | | | | | | | | | |

| Non-current assets classified as held for sale | | | | | | 1,764 | | | | | 1,764 | |

| | | | | | | | | | |

| | | | | | 8,844,238 | | | | | 8,844,038 | |

| | | | | | | | | | |

| Total Assets | | | | | | 17,936,807 | | | | | 17,491,548 | |

| | | | | | | | | | |

| EQUITY | | | | | | | | | | |

| Capital and reserves attributable to the owners of the parent | | | | | | 12,386,634 | | | | | 11,845,959 | |

| | | | | | | | | | |

| Non-controlling interest | | | | | | 1,922,933 | | | | | 1,922,434 | |

| | | | | | | | | | |

| Total Equity | | | | | | 14,309,567 | | | | | 13,768,393 | |

| | | | | | | | | | |

| LIABILITIES | | | | | | | | | | |

| | | | | | | | | | |

| Non-current liabilities | | | | | | | | | | |

| Provisions | | | | 84,891 | | | | | 81,422 | | | |

| Deferred tax liabilities | | | | 25,271 | | | | | 162,742 | | | |

| Other liabilities | | | | 603,186 | | | | | 538,214 | | | |

| Trade payables | | | | 1,314 | | | | | 1,112 | | | |

| | | | | | | | | | |

| Lease liabilities | | | | 179,428 | | | | | 190,134 | | | |

| Borrowings | | | | 514,521 | | | 1,408,611 | | | 532,701 | | | 1,506,325 | |

| | | | | | | | | | |

| Current liabilities | | | | | | | | | | |

| Current income tax liabilities | | | | 108,480 | | | | | 135,703 | | | |

| Other liabilities | | | | 350,226 | | | | | 344,843 | | | |

| Trade payables | | | | 1,321,932 | | | | | 1,187,600 | | | |

| Derivative financial instruments | | | | 14,044 | | | | | 505 | | | |

| Lease liabilities | | | | 46,114 | | | | | 49,015 | | | |

| Borrowings | | | | 377,833 | | | 2,218,629 | | | 499,164 | | | 2,216,830 | |

| | | | | | | | | | |

| Total Liabilities | | | | | | 3,627,240 | | | | | 3,723,155 | |

| | | | | | | | | | |

| Total Equity and Liabilities | | | | | | 17,936,807 | | | | | 17,491,548 | |

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the year ended December 31, 2022.

| | | | | | | | |

| TERNIUM S.A. |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

| (All amounts in $ thousands) |

Consolidated Condensed Interim Statements of Changes in Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Attributable to the owners of the parent (1) | | | | |

| | Capital stock

(2) | Treasury shares

(2) | Initial public offering expenses | Reserves

(3) | Capital stock issue discount

(4) | Currency translation adjustment | Retained earnings | Total | | Non-controlling interest | | Total Equity |

| |

| | | | | | | | | | | | | |

| Balance as of January 1, 2023 | | 2,004,743 | | (150,000) | | (23,295) | | 1,394,567 | | (2,324,866) | | (2,859,068) | | 13,803,878 | | 11,845,959 | | | 1,922,434 | | | 13,768,393 | |

| | | | | | | | | | | | | |

| Profit for the period | | | | | | | | 1,001,304 | | 1,001,304 | | | 214,099 | | | 1,215,403 | |

| Other comprehensive income (loss) for the period | | | | | | | | | | | | | |

| Currency translation adjustment | | | | | | | 60,495 | | | 60,495 | | | 5,355 | | | 65,850 | |

| Remeasurement of post employment benefit obligations | | | | | (7,544) | | | | | (7,544) | | | (568) | | | (8,112) | |

| | | | | | | | | | | | | |

| Others (5) | | | | | (160,226) | | | | | (160,226) | | | 15,151 | | | (145,075) | |

| | | | | | | | | | | | | |

| Total comprehensive income (loss) for the period | | — | | — | | — | | (167,770) | | — | | 60,495 | | 1,001,304 | | 894,029 | | | 234,037 | | | 1,128,066 | |

| | | | | | | | | | | | | |

| Dividends paid in cash (6) | | | | | | | | (353,354) | | (353,354) | | | — | | | (353,354) | |

| Dividends paid in kind to non-controlling interest | | | | | | | | | — | | | (233,538) | | | (233,538) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Balance as of June 30, 2023 (unaudited) | | 2,004,743 | | (150,000) | | (23,295) | | 1,226,797 | | (2,324,866) | | (2,798,573) | | 14,451,828 | | 12,386,634 | | | 1,922,933 | | | 14,309,567 | |

(1) Shareholders’ equity is determined in accordance with accounting principles generally accepted in Luxembourg.

(2) The Company has an authorized share capital of a single class of 3.5 billion shares having a nominal value of $ 1.00 per share. As of June 30, 2023, there were 2,004,743,442 shares issued. All issued shares are fully paid. Also, as of June 30, 2023, the Company held 41,666,666 shares as treasury shares.

(3) Includes legal reserve under Luxembourg law for $ 200.5 million, undistributable reserves under Luxembourg law for $ 1.4 billion and reserves related to the acquisition of non-controlling interest in subsidiaries for $ (72.4) million.

(4) Represents the difference between book value of non-monetary contributions received from shareholders under Luxembourg GAAP and IFRS.

(5) Includes mainly the changes of the fair value of financial instruments at fair value through other comprehensive income, net of tax.

(6) See note 10.

Dividends may be paid by Ternium to the extent distributable retained earnings calculated in accordance with Luxembourg law and regulations exist. Therefore, retained earnings included in these consolidated condensed interim financial statements may not be wholly distributable.

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the year ended December 31, 2022.

| | | | | | | | |

| TERNIUM S.A. |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for six-month periods ended June 30, 2023 and 2022 |

| (All amounts in $ thousands) |

Consolidated Condensed Interim Statements of Changes in Equity

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Attributable to the owners of the parent (1) | | | | |

| | Capital stock

(2) | Treasury shares

(2) | Initial public offering expenses | Reserves

(3) | Capital stock issue discount

(4) | Currency translation adjustment | Retained earnings | Total | | Non-controlling interest | | Total Equity |

| |

| | | | | | | | | | | | | |

| Balance as of January 1, 2022 | | 2,004,743 | | (150,000) | | (23,295) | | 1,360,637 | | (2,324,866) | | (2,898,593) | | 12,566,393 | | 10,535,019 | | | 1,700,019 | | | 12,235,038 | |

| | | | | | | | | | | | | |

| Profit for the period | | | | | | | | 1,574,891 | | 1,574,891 | | | 238,812 | | | 1,813,703 | |

| Other comprehensive income (loss) for the period | | | | | | | | | | | | | |

| Currency translation adjustment | | | | | | | 39,807 | | | 39,807 | | | 3,066 | | | 42,873 | |

| Remeasurement of post employment benefit obligations | | | | | (3,370) | | | | | (3,370) | | | (577) | | | (3,947) | |

| Cash flow hedges, net of tax | | | | | 19 | | | | | 19 | | | 19 | | | 38 | |

| Others (5) | | | | | (16,504) | | | | | (16,504) | | | (9,383) | | | (25,887) | |

| | | | | | | | | | | | | |

| Total comprehensive income (loss) for the period | | — | | — | | — | | (19,855) | | — | | 39,807 | | 1,574,891 | | 1,594,843 | | | 231,937 | | | 1,826,780 | |

| | | | | | | | | | | | | |

| Dividends paid in cash | | | | | | | | (353,354) | | (353,354) | | | — | | | (353,354) | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| Acquisition of non-controlling interest (6) | | | | | (223) | | | | | (223) | | | (3,993) | | | (4,216) | |

| | | | | | | | | | | | | |

| Balance as of June 30, 2022 (unaudited) | | 2,004,743 | | (150,000) | | (23,295) | | 1,340,559 | | (2,324,866) | | (2,858,786) | | 13,787,930 | | 11,776,285 | | | 1,927,963 | | | 13,704,248 | |

(1) Shareholders’ equity is determined in accordance with accounting principles generally accepted in Luxembourg.

(2) The Company has an authorized share capital of a single class of 3.5 billion shares having a nominal value of $ 1.00 per share. As of June 30, 2022, there were 2,004,743,442 shares issued. All issued shares are fully paid. Also, as of June 30, 2022, the Company held 41,666,666 shares as treasury shares.

(3) Include legal reserve under Luxembourg law for $ 200.5 million, undistributable reserves under Luxembourg law for $ 1.4 billion and reserves related to the acquisition of non-controlling interest in subsidiaries for $ (72.4) million.

(4) Represents the difference between book value of non-monetary contributions received from shareholders under Luxembourg GAAP and IFRS.

(5) Includes mainly the changes of the fair value of financial instruments at fair value through other comprehensive income, net of tax.

(6) Corresponds to the acquisition of non-controlling interest participation of Ternium Argentina S.A..

Dividends may be paid by Ternium to the extent distributable retained earnings calculated in accordance with Luxembourg law and regulations exist. Therefore, retained earnings included in these consolidated condensed interim financial statements may not be wholly distributable.

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the year ended December 31, 2022.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

| (All amounts in $ thousands) |

Consolidated Condensed Interim Statements of Cash Flows

| | | | | | | | | | | | | | | | | | | | | | |

| | | | Six-month period ended

June 30, | | |

| | Notes | | 2023 | | 2022 | | |

| | | | (Unaudited) | | |

| Cash flows from operating activities | | | | | | | | |

| Profit for the period | | | | 1,215,403 | | | 1,813,703 | | | |

| Adjustments for: | | | | | | | | |

| Depreciation and amortization | | 7 & 8 | | 301,499 | | | 302,894 | | | |

| Income tax accruals less payments | | | | (273,426) | | | (1,084,086) | | | |

| Equity in earnings of non-consolidated companies | | 9 | | (62,176) | | | (108,022) | | | |

| Interest accruals less payments/receipts, net | | | | (76,103) | | | 3,989 | | | |

| | | | | | | | |

| Changes in provisions | | | | 40 | | | (1,732) | | | |

| Changes in working capital (1) | | | | (386,874) | | | (349,988) | | | |

| | | | | | | | |

| Net foreign exchange results and others | | | | (58,135) | | | 110,265 | | | |

| | | | | | | | |

| Net cash provided by operating activities | | | | 660,228 | | | 687,023 | | | |

| | | | | | | | |

| Cash flows from investing activities | | | | | | | | |

| Capital expenditures | | 7 & 8 | | (395,440) | | | (285,633) | | | |

| | | | | | | | |

| Increase in other investments | | | | (448,881) | | | (195,251) | | | |

| Proceeds from the sale of property, plant and equipment | | | | 878 | | | 794 | | | |

| Dividends received from non-consolidated companies | | | | 15,162 | | | 28,884 | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Acquisition of non-controlling interest | | | | — | | | (4,216) | | | |

| | | | | | | | |

| Net cash used in investing activities | | | | (828,281) | | | (455,422) | | | |

| | | | | | | | |

| Cash flows from financing activities | | | | | | | | |

| Dividends paid in cash to company’s shareholders | | | | (353,354) | | | (353,354) | | | |

| | | | | | | | |

| Finance lease payments | | | | (26,966) | | | (24,892) | | | |

| | | | | | | | |

| | | | | | | | |

| Proceeds from borrowings | | | | 72,616 | | | 153,590 | | | |

| Repayments of borrowings | | | | (227,191) | | | (541,498) | | | |

| | | | | | | | |

| Net cash used in financing activities | | | | (534,895) | | | (766,154) | | | |

| | | | | | | | |

| Decrease in cash and cash equivalents | | | | (702,948) | | | (534,553) | | | |

| | | | | | | | |

| Movement in cash and cash equivalents | | | | | | | | |

| At January 1, | | | | 1,653,355 | | | 1,276,605 | | | |

| Effect of exchange rate changes | | | | (30,003) | | | (22,903) | | | |

| Decrease in cash and cash equivalents | | | | (702,948) | | | (534,553) | | | |

| | | | | | | | |

| Cash and cash equivalents as of June 30, (2) | | | | 920,404 | | | 719,149 | | | |

| | | | | | | | |

| Non-cash transactions: | | | | | | | | |

| Dividends paid in kind to non-controlling interest | | | | (233,538) | | | — | | | |

| Acquisition of PP&E under lease contract agreements | | | | 1,939 | | | 5,769 | | | |

(1) The working capital is impacted by non-cash movements of $ 41.5 million as of June 30, 2023 ($ 10.8 million as of June 30, 2022) due to the variations in the exchange rates used by subsidiaries.

(2) It includes restricted cash of $ 98 and $ 55 as of June 30, 2023 and 2022, respectively. In addition, the Company had other investments with a maturity of more than three months for $ 2,134,536 and $ 1,410,314 as of June 30, 2023 and 2022, respectively.

The accompanying notes are an integral part of these consolidated condensed interim financial statements. These consolidated condensed interim financial statements should be read in conjunction with our audited Consolidated Financial Statements and notes for the year ended December 31, 2022.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

Notes to the Consolidated Condensed Interim Financial Statements

1.GENERAL INFORMATION AND BASIS OF PRESENTATION

Ternium S.A. (the “Company” or “Ternium”), was incorporated on December 22, 2003 to hold investments in flat and long steel manufacturing and distributing companies. The Company has an authorized share capital of a single class of 3.5 billion shares having a nominal value of $ 1.00 per share. As of June 30, 2023, there were 2,004,743,442 shares issued. All issued shares are fully paid.

Ternium’s American Depositary Shares (“ADS”) trade on the New York Stock Exchange under the symbol “TX”.

The name and percentage of ownership of subsidiaries that have been included in consolidation in these Consolidated Condensed Interim Financial Statements are disclosed in Note 2 to the audited Consolidated Financial Statements for the year ended December 31, 2022.

The preparation of Consolidated Condensed Interim Financial Statements requires management to make estimates and assumptions that might affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities as of the date of the statement of financial position, and also the reported amounts of revenues and expenses for the reported periods. Actual results may differ from these estimates. The main assumptions and estimates were disclosed in the Consolidated Financial Statements for the year ended December 31, 2022, without significant changes since its publication.

2. ACCOUNTING POLICIES

These Consolidated Condensed Interim Financial Statements have been prepared in accordance with IAS 34, “Interim Financial Reporting” and are unaudited. These Consolidated Condensed Interim Financial Statements should be read in conjunction with the audited Consolidated Financial Statements for the year ended December 31, 2022, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board (“IASB”) and in conformity with International Financial Reporting Standards as adopted by the European Union (“EU”). Recently issued accounting pronouncements were applied by the Company as from their respective dates.

These Consolidated Condensed Interim Financial Statements have been prepared following the same accounting policies used in the preparation of the audited Consolidated Financial Statements for the year ended December 31, 2022.

None of the accounting pronouncements issued after December 31, 2022, and as of the date of these Consolidated Condensed Interim Financial Statements have a material effect on the Company’s financial condition or result or operations.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

3. SEGMENT INFORMATION

OPERATING SEGMENTS

The Company is organized in two operating segments: Steel and Mining.

The Steel segment includes the sales of steel products, which comprises mainly slabs, hot and cold rolled products, coated products, roll-formed and tubular products, billets, bars and other products.

The Mining segment includes the sales of mining products, mainly iron ore and pellets, and comprises the mining activities of Las Encinas, an iron ore mining company in which Ternium holds a 100% equity interest and the 50% of the operations and results performed by Peña Colorada, another iron ore mining company in which Ternium maintains that same percentage over its equity interest.

Ternium’s Chief Executive Officer (“CEO”) functions as the Company’s Chief Operating Decision Maker (“CODM”). The various geographic regions operate as an integrated steel producer. The CEO allocates resources and assesses performance of the Steel Segment as an integrated business and of the Mining Segment. The CEO uses “Operating income – Management view” as per the below table as the performance measure which differs from operating income determined in accordance with IFRS principally as follows:

• The use of direct cost methodology to calculate the inventories, while under IFRS is at full cost, including absorption of production overheads and depreciation.

• The use of costs based on previously internally defined cost estimates, while, under IFRS, costs are calculated at historical cost (with the FIFO method).

• Other non-significant differences.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six-month period ended June 30, 2023 (Unaudited) |

| | Steel | | Mining | | Inter-segment eliminations | | Total |

| | | | | | | | |

| Operating income - Management view | | 1,117,369 | | | (30,944) | | | (8,880) | | | 1,077,545 | |

| Reconciliation: | | | | | | | | |

| Differences in Cost of sales | | | | | | | | 11,586 | |

| | | | | | | | |

| Operating income - Under IFRS | | | | | | | | 1,089,131 | |

| | | | | | | | |

| Financial income (expense), net | | | | | | | | (10,163) | |

| Equity in earnings (losses) of non-consolidated companies | | | | | | | | 62,176 | |

| | | | | | | | |

| Income before income tax expense - IFRS | | | | | | | | 1,141,144 | |

| | | | | | | | |

| Net sales from external customers | | 7,494,547 | | | 96 | | | — | | | 7,494,643 | |

| Net sales from transactions with other operating segments of the same entity | | — | | | 194,770 | | | (194,770) | | | — | |

| | | | | | | | |

| Depreciation and amortization | | (252,500) | | | (48,999) | | | — | | | (301,499) | |

| | | | | | | | |

| | Six-month period ended June 30, 2022 (Unaudited) |

| | Steel | | Mining | | Inter-segment eliminations | | Total |

| | | | | | | | |

| Operating income - Management view | | 1,474,243 | | | 21,311 | | | 6,061 | | | 1,501,615 | |

| Reconciliation: | | | | | | | | |

| Differences in Cost of sales | | | | | | | | 628,552 | |

| | | | | | | | |

| Operating income - Under IFRS | | | | | | | | 2,130,167 | |

| | | | | | | | |

| Financial income (expense), net | | | | | | | | (23,693) | |

| Equity in earnings (losses) of non-consolidated companies | | | | | | | | 108,022 | |

| | | | | | | | |

| Income before income tax expense - IFRS | | | | | | | | 2,214,496 | |

| | | | | | | | |

| Net sales from external customers | | 8,742,442 | | | 63 | | | — | | | 8,742,505 | |

| Net sales from transactions with other operating segments of the same entity | | — | | | 213,490 | | | (213,490) | | | — | |

| | | | | | | | |

| Depreciation and amortization | | (260,608) | | | (42,286) | | | — | | | (302,894) | |

Information on segment assets is not disclosed as it is not reviewed by the CEO.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

3. SEGMENT INFORMATION (continued)

GEOGRAPHICAL INFORMATION

The Company had no revenues attributable to the Company’s country of incorporation (Luxembourg) in 2023.

For purposes of reporting geographical information, net sales are allocated based on the customer’s location. Allocation of depreciation and amortization is based on the geographical location of the underlying assets.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Six-month period ended June 30, 2023 (Unaudited) |

| | Mexico | | Southern region | | | | Brazil and other markets | | Total |

| | | | | | | | | | |

| Net sales | | 4,713,028 | | | 1,738,048 | | | | | 1,043,567 | | | 7,494,643 | |

| | | | | | | | | | |

| Non-current assets (1) | | 4,859,342 | | | 870,248 | | | | | 1,562,841 | | | 7,292,431 | |

| | | | | | | | | | |

| | Six-month period ended June 30, 2022 (Unaudited) |

| | Mexico | | Southern region | | | | Brazil and other markets | | Total |

| | | | | | | | | | |

| Net sales | | 4,779,293 | | | 1,892,019 | | | | | 2,071,193 | | | 8,742,505 | |

| | | | | | | | | | |

| Non-current assets (1) | | 4,767,553 | | | 860,474 | | | | | 1,695,154 | | | 7,323,181 | |

| | | | | | | | | | |

| (1) Includes Property, plant and equipment and Intangible assets. | | | | | | |

4.COST OF SALES

| | | | | | | | | | | | | | |

| | Six-month period ended

June 30, |

| | 2023 | | 2022 |

| | (Unaudited) |

| | | | |

| Inventories at the beginning of the year | | 3,470,214 | | | 3,908,305 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Plus: Charges for the period | | | | |

Raw materials and consumables used and

other movements | | 5,002,579 | | | 5,504,178 | |

| Services and fees | | 99,133 | | | 86,242 | |

| Labor cost | | 397,802 | | | 477,049 | |

| Depreciation of property, plant and equipment | | 260,729 | | | 263,829 | |

| Amortization of intangible assets | | 18,923 | | | 19,591 | |

| Maintenance expenses | | 341,107 | | | 310,841 | |

| Office expenses | | 6,180 | | | 4,503 | |

| Valuation allowance | | (15,333) | | | — | |

| Insurance | | 7,762 | | | 7,692 | |

| Change of obsolescence allowance | | (478) | | | 12,140 | |

| Recovery from sales of scrap and by-products | | (21,102) | | | (21,213) | |

| Others | | 11,257 | | | 10,367 | |

| | | | |

| Less: Inventories at the end of the period | | (3,758,603) | | | (4,540,431) | |

| | | | |

| Cost of Sales | | 5,820,170 | | | 6,043,093 | |

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

5.SELLING, GENERAL AND ADMINISTRATIVE EXPENSES

| | | | | | | | | | | | | | |

| | Six-month period ended

June 30, |

| | 2023 | | 2022 |

| | (Unaudited) |

| Services and fees | | 40,224 | | 37,091 |

| Labor cost | | 156,460 | | 160,898 |

| Depreciation of property, plant and equipment | | 7,484 | | 6,783 |

| Amortization of intangible assets | | 14,363 | | 12,691 |

| Maintenance and expenses | | 4,095 | | 4,634 |

| Taxes | | 79,436 | | 85,183 |

| Office expenses | | 25,854 | | 20,485 |

| Freight and transportation | | 244,211 | | 260,347 |

| Increase of allowance for doubtful accounts | | 12,294 | | | 486 | |

| Others | | 12,774 | | 3,149 |

| | | | |

| Selling, general and administrative expenses | | 597,195 | | | 591,747 | |

6.FINANCE EXPENSE, FINANCE INCOME AND OTHER FINANCIAL INCOME (EXPENSES), NET

| | | | | | | | | | | | | | |

| | Six-month period ended

June 30, |

| | 2023 | | 2022 |

| | (Unaudited) |

| Interest expense | | (33,742) | | | (13,935) | |

| | | | |

| Finance expense | | (33,742) | | | (13,935) | |

| | | | |

| Interest income | | 83,479 | | | 39,953 | |

| | | | |

| Finance income | | 83,479 | | | 39,953 | |

| | | | |

| Net foreign exchange loss (1) | | (40,439) | | | (118,359) | |

| | | | |

| Change in fair value of financial assets | | 26,307 | | | 80,663 | |

| Derivative contract results | | (36,104) | | | (1,801) | |

| Others | | (9,664) | | | (10,214) | |

| | | | |

| Other financial (expenses) income, net | | (59,900) | | | (49,711) | |

(1) Mainly related to the devaluation of the Argentine peso.

7. PROPERTY, PLANT AND EQUIPMENT, NET

| | | | | | | | | | | | | | |

| | Six-month period ended

June 30, |

| | 2023 | | 2022 |

| | (Unaudited) |

| At the beginning of the year | | 6,261,887 | | | 6,431,578 | |

| | | | |

| | | | |

| Currency translation differences | | 1,501 | | | 282 | |

| Additions | | 340,326 | | | 245,665 | |

| Value adjustments of lease contracts | | 5,926 | | | 15,919 | |

| Disposals | | (17,180) | | | (13,446) | |

| Depreciation charge | | (268,213) | | | (270,612) | |

| Capitalized borrowing costs | | — | | | 403 | |

| Transfers and reclassifications | | 60 | | | (2,193) | |

| | | | |

| | | | |

| At the end of the period | | 6,324,307 | | | 6,407,596 | |

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

8. INTANGIBLE ASSETS, NET

| | | | | | | | | | | | | | |

| | | Six-month period ended

June 30, |

| | 2023 | | 2022 |

| | (Unaudited) |

| At the beginning of the year | | 944,409 | | | 902,256 | |

| | | | |

| | | | |

| Currency translation differences | | 8 | | | — | |

| Additions | | 57,053 | | | 43,418 | |

| Amortization charge | | (33,286) | | | (32,282) | |

| | | | |

| | | | |

| Transfers/Disposals | | (60) | | | 2,193 | |

| | | | |

| At the end of the period | | 968,124 | | | 915,585 | |

9.INVESTMENTS IN NON-CONSOLIDATED COMPANIES

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Company | | Country of incorporation | | Main activity | | Voting rights as of | | Value as of |

| | | June 30, 2023 | | December 31, 2022 | | June 30, 2023 | | December 31, 2022 |

| | | | | | | | | |

| | | | | | | | | | | | |

| Usinas Siderurgicas de Minas Gerais S.A. - USIMINAS | | Brazil | | Manufacturing and selling of steel products | | 34.39% | | 34.39% | | 827,141 | | 725,705 |

| Techgen S.A. de C.V. | | Mexico | | Provision of electric power | | 48.00% | | 48.00% | | 106,803 | | 90,559 |

| Other non-consolidated companies (1) | | | | | | | | | | 5,054 | | 5,307 |

| | | | | | | | | | 938,998 | | 821,571 |

(1) It includes the investments held in Finma S.A.I.F., Recrotek S.R.L. de C.V. and Gas Industrial de Monterrey S.A. de C.V.

Usinas Siderurgicas de Minas Gerais S.A. - USIMINAS

As of June 30, 2023, Ternium, through its subsidiaries, owns a total of 242.6 million ordinary shares and 8.5 million preferred shares, representing 20.4% of the issued and outstanding share capital of Usinas Siderurgicas de Minas Gerais S.A. – USIMINAS (“Usiminas”), one of the main producers of flat steel products in Brazil for the energy, automotive and other industries.

Ternium, through its subsidiaries, together with Tenaris S.A.’s Brazilian subsidiary Confab Industrial S.A. (“TenarisConfab”), are part of Usiminas’ control group, comprising the so-called T/T Group. As of June 30, 2023, the Usiminas control group holds, in the aggregate, 483.6 million ordinary shares bound to the Usiminas shareholders’ agreement, representing approximately 68.6% of Usiminas’ voting capital. The Usiminas control group, which is bound by a long-term shareholders’ agreement that governs the rights and obligations of Usiminas’ control group members, is currently composed of three sub-groups: the T/T Group; the NSC Group, comprising Nippon Steel Corporation (“NSC”), Metal One Corporation and Mitsubishi Corporation; and Usiminas’ pension fund Previdência Usiminas. The T/T Group holds approximately 47.1% of the total shares held by the control group (39.5% corresponding to the Ternium entities and the other 7.6% corresponding to TenarisConfab); the NSC Group holds approximately 45.9% of the total shares held by the control group; and Previdência Usiminas holds the remaining 7%.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

9.INVESTMENTS IN NON-CONSOLIDATED COMPANIES (continued)

The corporate governance rules reflected in the Usiminas shareholders agreement provide, among other things, that Usiminas’ executive board will be composed of six members, including the chief executive officer and five vice-presidents, with Ternium and NSC nominating three members each. The right to nominate Usiminas’ chief executive officer alternates between Ternium and NSC at every 4-year interval, with the party that does not nominate the chief executive officer having the right to nominate the chairman of Usiminas’ board of directors for the same 4-year period. The Usiminas shareholders agreement also provides for an exit mechanism consisting of a buy-and-sell procedure—exercisable at any time after November 16, 2022, and applicable with respect to shares held by NSC and the T/T Group—, which would allow either Ternium or NSC to purchase all or a majority of the Usiminas shares held by the other shareholder.

As of June 30, 2023, the closing price of the Usiminas ordinary and preferred shares, as quoted on the BM&F Bovespa Stock Exchange, was BRL7.29 (approximately $1.51; December 31, 2022: BRL7.41 – $1.42) per ordinary share and BRL7.07 (approximately $1.47; December 31, 2022: BRL7.16 – $1.37) per preferred share, respectively. Accordingly, as of June 30, 2023, Ternium’s ownership stake had a market value of approximately $379.4 million ($356.2 million as of December 31, 2022) and a carrying value of $827.1 million ($725.7 million as of December 31, 2022).

Although as of June 30, 2023, the market value continued to be below the book value, considering the financial results of Usiminas for the quarter and market expectations, there was no other objective evidence of impairment and, consequently, Management concluded that there was no need to recognize any impairment charges and that it would continue to review periodically the recoverability of this investment.

As of June 30, 2023, the value of the investment in Usiminas is comprised as follows:

| | | | | | | | |

| Value of investment | | USIMINAS |

| | |

| As of January 1, 2023 | | 725,705 | |

| Share of results (1) | | 46,158 | |

| Other comprehensive income (2) | | 55,278 | |

| | |

| | |

| | |

| | |

| As of June 30, 2023 | | 827,141 | |

| | |

| (1) It includes the adjustment of the values associated to the purchase price allocation. |

| (2) It includes mainly the effect of the currency translation adjustment. | | |

The investment in Usiminas is based on the following calculation:

| | | | | | | | |

| Usiminas' shareholders' equity | | 4,919,866 | |

| Percentage of interest of the Company over shareholders' equity | | 20.40 | % |

| | |

| Interest of the Company over shareholders' equity | | 1,003,324 | |

| | |

| Purchase price allocation | | 61,345 | |

| Goodwill | | 215,686 | |

| Impairment | | (453,214) | |

| | |

| | |

| Total Investment in Usiminas | | 827,141 | |

On July 28, 2023, Usiminas issued its consolidated interim accounts as of and for the six-month period ended June 30, 2023.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

9. INVESTMENTS IN NON-CONSOLIDATED COMPANIES (continued)

| | | | | | | | |

| | USIMINAS |

| Summarized balance sheet (in million $) | | As of June 30, 2023 |

| Assets | | |

| Non-current | | 4,312 | |

| Current | | 2,908 | |

| Other current investments | | 247 | |

| Cash and cash equivalents | | 778 | |

| | |

| Total Assets | | 8,245 | |

| Liabilities | | |

| Non-current | | 600 | |

| Non-current borrowings | | 1,198 | |

| Current | | 964 | |

| Current borrowings | | 27 | |

| | |

| Total Liabilities | | 2,789 | |

| | |

| Non-controlling interest | | 536 | |

| | |

| Shareholders' equity | | 4,920 | |

| | | | | | | | |

| | |

| Summarized income statement (in million $) | | Six-month period ended

June 30, 2023 |

| | |

| Net sales | | 2,788 | |

| Cost of sales | | (2,500) | |

| Gross Profit | | 288 | |

| Selling, general and administrative expenses | | (109) | |

| Other operating income (loss), net | | (70) | |

| Operating income | | 109 | |

| Financial income (expenses), net | | 79 | |

| Equity in earnings of associated companies | | 21 | |

| Profit before income tax | | 209 | |

| Income tax expense | | (46) | |

| Net profit before non-controlling interest | | 163 | |

| Non-controlling interest in other subsidiaries | | (20) | |

| Net profit for the period | | 143 | |

Techgen S.A. de C.V.

Techgen stated as of and for the six-month period ended June 30, 2023, that revenues amounted to $221 million ($275 million for the six-month period ended June 30, 2022), net profit from continuing operations to $34 million ($28 million for the six-month period ended June 30, 2022), non-current assets to $778 million ($766 million as of December 31, 2022), current assets to $143 million ($131 million as of December 31, 2022), non-current liabilities to $494 million ($527 million as of December 31, 2022), current liabilities to $205 million ($181 million as of December 31, 2022) and shareholders’ equity to $222 million ($189 million as of December 31, 2022).

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

10. DISTRIBUTION OF DIVIDENDS

During the annual shareholders’ meeting held on May 2, 2023, the shareholders approved a distribution of dividends of USD 0.27 per share (USD 2.70 per ADS). The annual dividend included the interim dividend of $0.09 per share ($0.90 per ADS) paid in November 2022. A net dividend of $0.18 per share ($1.80 per ADS) was paid on May 10, 2023, of approximately USD 360.9 million in the aggregate.

11. CONTINGENCIES, COMMITMENTS AND RESTRICTIONS ON THE DISTRIBUTION OF PROFITS

Contingencies, commitments and restrictions on the distributions of profits should be read in Note 24 to the Company’s audited Consolidated Financial Statements for the year ended December 31, 2022.

(i) Tax claims and other contingencies

Companhia Siderúrgica Nacional (CSN) - Tender offer litigation

In 2013, the Company was notified of a lawsuit filed in Brazil by Companhia Siderúrgica Nacional, or CSN, and various entities affiliated with CSN against Ternium Investments, its subsidiary Ternium Argentina, and TenarisConfab. The entities named in the CSN lawsuit had acquired a participation in Usiminas in January 2012. The CSN lawsuit alleges that, under applicable Brazilian laws and rules, the acquirers were required to launch a tag-along tender offer to all non-controlling holders of Usiminas ordinary shares for a price per share equal to 80% of the price per share paid in such acquisition, or BRL 28.8, and seeks an order to compel the acquirers to launch an offer at that price plus interest. If so ordered, the offer would need to be made to 182,609,851 ordinary shares of Usiminas not belonging to Usiminas’ control group; Ternium Investments and Ternium Argentina’s respective shares in the offer would be 60.6% and 21.5%.

On September 23, 2013, the first instance court dismissed the CSN lawsuit, and on February 8, 2017, the court of appeals of São Paulo maintained the understanding of the first instance court. On March 6, 2017, CSN filed a motion for clarification against the decision of the court of appeals, which was rejected on July 19, 2017. On August 18, 2017, CSN filed with the court of appeals an appeal seeking the review and reversal of the decision issued by the court of appeals by the Superior Court of Justice. On March 5, 2018, the court of appeals ruled that CSN’s appeal did not meet the requirements for review by the Superior Court of Justice and rejected such appeal. On May 8, 2018, CSN appealed against such ruling and on January 22, 2019, the court of appeals rejected such appeal and ordered that the case be submitted to the Superior Court of Justice. On September 10, 2019, the Superior Court of Justice declared CSN’s appeal admissible. On March 7, 2023, the Superior Court of Justice, by majority vote, rejected CSN’s appeal. CSN has made several submissions in connection with the Supreme Court of Justice decision, including a motion for clarification. In addition, plaintiffs may appeal against the Superior Court of Justice’s decision. At this time, the Company cannot predict whether CSN will appeal against the decision and, if appealed, the ultimate resolution of the matter.

Ternium continues to believe that all of CSN’s claims and allegations are groundless and without merit, as confirmed by several opinions of Brazilian legal counsel, two decisions issued by the Brazilian securities regulator (CVM) in February 2012 and December 2016, the first and second instance court decisions and the March 2023 Superior Court of Justice decision referred to above.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

11. CONTINGENCIES, COMMITMENTS AND RESTRICTIONS ON THE DISTRIBUTION OF PROFITS (continued)

(ii) Commitments

(a) Ternium Argentina also signed various contracts for the provision of natural gas, including Tecpetrol and Energy Consulting Services S.A., both related companies of Ternium, assuming firm commitments for a total of $ 74.4 million payable until April 2025. Additionally, Ternium Argentina signed contracts for gas transportation with Transportadora de Gas del Norte S.A., a related company of Ternium, assuming firm commitments for a total of $ 14.6 million payable until April 2028.

(b) Ternium Argentina signed an agreement with Air Liquide Argentina S.A. for the supply of oxygen, nitrogen and argon until 2021, for an aggregate amount of $ 107.6 million, which is due to terminate in 2037.

(c) Ternium Argentina signed various contracts within its investment plan for the future acquisition of Property, plant and equipment for a total of $ 172.2 million. Also, Vientos de Olavarría, a subsidiary controlled by Ternium Argentina, subscribed various contracts for the maintenance and the operation of the wind farm for a total of $ 44.0 million payable until the year 2054.

(d) Ternium México issued a guarantee letter covering up to approximately $28.8 million of the obligations of Gas Industrial de Monterrey, S.A. de C.V. (“GIMSA”), under the natural gas trading agreement between GIMSA and NEG Natural S.A. de C.V. (“NEG”) The credit line granted by NEG in connection with this natural gas trading agreement amounted to approximately $ 19.8 million. As of June 30, 2023, the outstanding amount under the natural gas trading agreement was $7.0 million, which is below the amount included in the guarantee letter issued by Ternium México. The contract with NEG was renewed in June 28, 2022, and the guarantee letter covering up to the above-mentioned amount was issued in January 2023.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

12. RELATED PARTY TRANSACTIONS

As of June 30, 2023, Techint Holdings S.à r.l. (“Techint”) indirectly owned 65.03% of the Company’s share capital and Tenaris Investments S.à r.l. (“Tenaris”) held 11.46% of the Company’s share capital. Each of Techint and Tenaris were controlled by San Faustin S.A., a Luxembourg company (“San Faustin”). Rocca & Partners Stichting Administratiekantoor Aandelen San Faustin (“RP STAK”), a private foundation (Stichting) located in the Netherlands, held voting shares in San Faustin sufficient in number to control San Faustin. No person or group of persons controls RP STAK.

The following transactions were carried out with related parties:

| | | | | | | | | | | | | | |

| | Six-month period ended

June 30, |

| | 2023 | | 2022 |

| | (Unaudited) |

| (i) Transactions | | | | |

| (a) Sales of goods and services | | | | |

| Sales of goods to non-consolidated parties | | 119,256 | | | 374,962 | |

| Sales of goods to other related parties | | 64,221 | | | 110,500 | |

| Sales of services and others to non-consolidated parties | | 84 | | | 89 | |

| Sales of services and others to other related parties | | 1,935 | | | 2,136 | |

| | | | |

| | 185,496 | | | 487,687 | |

| (b) Purchases of goods and services | | | | |

| Purchases of goods from non-consolidated parties | | 208,018 | | | 314,071 | |

| Purchases of goods from other related parties | | 35,709 | | | 36,560 | |

| Purchases of services and others from non-consolidated parties | | 5,784 | | | 6,477 | |

| Purchases of services and others from other related parties | | 40,902 | | | 39,594 | |

| | | | |

| | | | |

| | 290,413 | | | 396,702 | |

| (c) Financial results | | | | |

| Income with non-consolidated parties | | 6,204 | | | 3,383 | |

| | | | |

| | | | |

| | | | |

| Expenses in connection with lease contracts from other related parties | | (396) | | | (527) | |

| | | | |

| | 5,808 | | | 2,856 | |

| (d) Dividends | | | | |

| Dividends from non-consolidated parties | | 214 | | | 1,007 | |

| | | | |

| | 214 | | | 1,007 | |

| (e) Other income and expenses | | | | |

| Income (expenses), net with non-consolidated parties | | 1,539 | | | 943 | |

| Income (expenses), net with other related parties | | 757 | | | 422 | |

| | | | |

| | 2,296 | | | 1,365 | |

| | | | | | | | | | | | | | |

| | June 30, 2023 | | December 31, 2022 |

| | (Unaudited) | | |

| (ii) Period-end balances | | | | |

| (a) Arising from sales/purchases of goods/services | | | | |

| Receivables from non-consolidated parties | | 144,312 | | | 180,476 | |

| Receivables from other related parties | | 13,601 | | | 43,765 | |

| Advances to non-consolidated parties | | 3,475 | | | 4,851 | |

| Advances to suppliers with other related parties | | 3,341 | | | 3,683 | |

| Payables to non-consolidated parties | | (96,537) | | | (91,172) | |

| Payables to other related parties | | (23,848) | | | (20,163) | |

| Lease Liabilities with other related parties | | (1,869) | | | (2,287) | |

| | | | |

| | 42,475 | | | 119,153 | |

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

13. FINANCIAL INSTRUMENTS BY CATEGORY AND FAIR VALUE MEASUREMENT

1)Financial instruments by category

The accounting policies for financial instruments have been applied to the line items below. According to the scope and definitions set out in IFRS 7 and IAS 32, employers’ rights and obligations under employee benefit plans, and non-financial assets and liabilities such as advanced payments and income tax payables, are not included.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| As of June 30, 2023 (in $ thousands) | | Amortized

cost | | Assets at fair value through profit or loss | | Assets at fair value through OCI | | Total |

| | | | | | | | |

| (i) Assets as per statement of financial position | | | | | | | | |

| Receivables | | 191,008 | | | — | | | — | | | 191,008 | |

| | | | | | | | |

| Trade receivables | | 1,412,260 | | | — | | | — | | | 1,412,260 | |

| Other investments | | 788,414 | | | 65,769 | | | 1,280,353 | | | 2,134,536 | |

| Cash and cash equivalents | | 527,961 | | | 330,550 | | | 61,893 | | | 920,404 | |

| | | | | | | | |

| Total | | 2,919,643 | | | 396,319 | | | 1,342,246 | | | 4,658,208 | |

| | | | | | | | |

| As of June 30, 2023 (in $ thousands) | | Amortized

cost | | Liabilities at fair value through profit or loss | | | | Total |

| | | | | | | | |

| (ii) Liabilities as per statement of financial position | | | | | | | | |

| Other liabilities | | 71,997 | | | — | | | | | 71,997 | |

| Trade payables | | 1,262,511 | | | — | | | | | 1,262,511 | |

| Derivative financial instruments | | — | | | 14,044 | | | | | 14,044 | |

| Lease liabilities | | 225,542 | | | — | | | | | 225,542 | |

| Borrowings | | 892,354 | | | — | | | | | 892,354 | |

| | | | | | | | |

| Total | | 2,452,404 | | | 14,044 | | | | | 2,466,448 | |

2)Fair Value by Hierarchy

IFRS 13 requires for financial instruments that are measured at fair value, a disclosure of fair value measurements by level. See note 28 of the Consolidated Financial Statements as of December 31, 2022 for definitions of levels of fair values and figures at that date.

The following table presents the assets and liabilities that are measured at fair value:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair value measurement as of June 30, 2023

(in $ thousands): |

| Description | | Total | | Level 1 | | Level 2 | | Level 3 |

| | | | | | | | |

| Financial assets at fair value through profit or loss / OCI | | | | | | | | |

| Cash and cash equivalents | | 392,443 | | | 392,443 | | | — | | | — | |

| Other investments | | 1,346,122 | | | 1,233,877 | | | 87,397 | | | 24,848 | |

| | | | | | | | |

| | | | | | | | |

| Total assets | | 1,738,565 | | | 1,626,320 | | | 87,397 | | | 24,848 | |

| | | | | | | | |

| Financial liabilities at fair value through profit or loss / OCI | | | | | | | | |

| Derivative financial instruments | | 14,044 | | | — | | | 14,044 | | | — | |

| | | | | | | | |

| Total liabilities | | 14,044 | | | — | | | 14,044 | | | — | |

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

13. FINANCIAL INSTRUMENTS BY CATEGORY AND FAIR VALUE MEASUREMENT (continued)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Fair value measurement as of December 31, 2022

(in $ thousands): |

| Description | | Total | | Level 1 | | Level 2 | | Level 3 (*) |

| | | | | | | | |

| Financial assets at fair value through profit or loss / OCI | | | | | | | | |

| Cash and cash equivalents | | 772,953 | | | 772,953 | | | — | | | — | |

| Other investments | | 1,492,281 | | | 1,283,284 | | | 164,980 | | | 44,017 | |

| Derivative financial instruments | | 227 | | | — | | | 227 | | | — | |

| | | | | | | | |

| Total assets | | 2,265,461 | | | 2,056,237 | | | 165,207 | | | 44,017 | |

| | | | | | | | |

| Financial liabilities at fair value through profit or loss / OCI | | | | | | | | |

| Derivative financial instruments | | 505 | | | — | | | 505 | | | — | |

| | | | | | | | |

| Total liabilities | | 505 | | | — | | | 505 | | | — | |

(*) The fair value of financial instruments classified as level 3 is not obtained from observable market information, but from measurements of the asset portfolio at market value provided by the fund manager. The evolution of such instruments during the six-month period ended June 30, 2023, and the year ended December 31 2022, corresponds to the initial investment and to the changes in its fair value.

14. FOREIGN EXCHANGE RESTRICTIONS IN ARGENTINA

Ternium’s Argentine subsidiary, Ternium Argentina S.A., is currently operating in a complex and volatile economic environment. Beginning in September 2019, the Argentine government has imposed and continues to impose significant restrictions on foreign exchange transactions. Restrictions have tightened significantly over time.

Effective November 1, 2022, the Argentine Central Bank put in place a new regulation on import of services rendered by non-related parties, pursuant to which the Argentine Central Bank may clear or not the payment of import of services and, if cleared, may determine a payment term equal or different to that being requested. There are no rules on the conditions upon which the Argentine Central Bank may clear or determine alternative payment terms.

Also effective November 1, 2022, the Argentine government implemented a new system, known as the SIRA system, pursuant to which the Argentine government may clear or not the payment of imports and, if cleared, may determine a payment term equal or different to that being requested. There are no objective conditions upon which the Argentine government may clear the payment of imports or determine alternative payment terms under the SIRA system.

This context of volatility and uncertainty remains in place as of the issue date of these Consolidated Financial Statements. Although as of the date of these financial statements these measures did not have a significant effect on Ternium Argentina’s ability to purchase U.S. dollars at the prevailing official exchange rate for most of its imports of goods and for the acquisition of services from unrelated parties, if such restrictions continue to be maintained, or are further tightened, Ternium Argentina could be restricted from making payment of imports for key steelmaking inputs (which would adversely affect its operations), or would need to resort to alternative, more expensive arrangements (which would adversely affect its results of operations). In addition, access to the Argentine foreign exchange market to distribute dividends or to pay royalties to related parties at the prevailing official exchange rate generally requires prior Argentine Central Bank approval, which is rarely, if ever, granted, thus limiting Ternium’s ability to collect dividends from Ternium Argentina at the prevailing official exchange rate.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

14. FOREIGN EXCHANGE RESTRICTIONS IN ARGENTINA (continued)

Ternium Argentina stated in its interim accounts as of June 30, 2023, and for the six-month period then ended, that revenues amounted to $1,727 million (six-month period ended June 30, 2022: $1,885 million), net profit from continuing operations to $523 million (six-month period ended June 30, 2022: $650 million), total assets to $5,208 million (December 31, 2022: $5,258 million), total liabilities to $512 million (December 31, 2022: $511 million) and shareholders’ equity to $4,696 million (December 31, 2022: $4,747 million). Ternium Argentina’s cash and cash equivalents and other investments amounted to $1,068 million as of June 30, 2023, broken down as follows:

–$945 million in U.S. dollars-denominated instruments, mainly sovereign bonds issued by the Argentine Government and payable in U.S. dollars, Argentine Treasury bonds related to the official exchange rate and negotiable obligations and promissory notes issued by Argentine export driven companies in U.S. dollars and payable in Argentine pesos.

–$63 million in Argentine pesos-denominated instruments with underlying assets linked to the U.S. dollar.

–$60 million in Argentine pesos-denominated instruments, mainly mutual funds.

Ternium Argentina’s financial position in ARS as of June 30, 2023, amounted to $168 million in monetary assets and $188 million in monetary liabilities. All of Ternium Argentina’s ARS-denominated assets and liabilities are valued at the prevailing official exchange rate.

On April 24, 2023, Ternium Argentina’s board of directors approved the payment of a dividend in kind in US dollar-denominated Argentine bonds for a total amount of up to $624 million. On May 4, 2023, Ternium received its share of the dividend in kind. Considering the impact of foreign exchange restrictions in Argentina and based on the value of the bonds in the international market, Ternium recorded in its equity a negative reserve of approximately $183 million as of the collection date. If and when Ternium disposes of these instruments, the reserve will be cancelled and Ternium will recogize the financial result arising fron the disposition of the bonds.

On July 23, 2023, a national Decree has extended the list of goods and services under the scope of a new tax in Argentina, which will affect imports of its main raw materials and international freight of Ternium Argentina at a rate of 7.5%.

15. THE RUSSIA-UKRAINE ARMED CONFLICT

On February 24, 2022, Russia launched a military attack on Ukraine. In response, the United States, the United Kingdom, and the European Union, among other countries, have imposed a wave of sanctions against certain Russian institutions, companies and citizens. As a result of the armed conflict and related sanctions, foreign trade transactions involving Russian and Ukrainian counterparties have been severely affected.

Russia has a significant participation in the international trade of steel slabs, iron ore pellets, metallurgical coal, pulverized coal for injection, which are relevant inputs for Ternium’s operations. In addition, Ukraine traditionally had a relevant participation in the international trade of steel slabs and iron ore pellets. As a result of the armed conflict and the economic sanctions imposed on Russia, Ternium or its contractors (including shipping companies) may not be able to continue purchasing or transporting products from, or making payments to, Ukrainian or Russian suppliers or counterparties; and the Company may be required to purchase raw materials from other sources at increased prices, resulting in limitations to Ternium’s production levels and higher costs, affecting the Company’s profitability and results of operations.

| | | | | | | | |

| TERNIUM S.A. | | |

Consolidated Condensed Interim Financial Statements as of June 30, 2023 |

and for the six-month periods ended June 30, 2023 and 2022 |

16. TERNIUM TO INTEGRATE OPERATIONS IN THE USMCA

On February 14, 2023, Ternium's Board of Directors approved the construction of a new upstream production capacity project to integrate its operations in the USMCA region. The increased slab production capacity will complement and support the company’s new state-of-the-art hot rolling mill, which began operations in mid-2021, as well as the previously announced downstream project in Mexico. Ternium expects to invest approximately $2.2 billion toward the construction of an electric arc furnace (EAF)-based steel shop with annual capacity of 2.6 million tons, as well as a direct reduced iron (DRI) module with annual capacity of 2.1 million tons. The slab production capacity program will also include the construction of a port facility for raw material handling.

On June 20, 2023, the Company announced that this new steel slab mill will be built at and integrated into the company’s existing downstream facility in Pesquería, Nuevo León, Mexico following an extensive review of location candidates. Construction is expected to begin in December 2023, with the start of operations anticipated to occur during the first half of 2026.

17. TERNIUM TO INCREASE ITS PARTICIPATION IN USIMINAS CONTROL GROUP - NEW GOVERNANCE STRUCTURE OF USIMINAS

On March 30, 2023, Ternium S.A. announced that its subsidiaries Ternium Investments and Ternium Argentina, together with Confab, a subsidiary of its affiliate Tenaris S.A., all of which compose the T/T group within Usiminas control group, entered into a share purchase agreement to acquire from Nippon Steel Corporation, Mitsubishi and MetalOne (the “NSC group”), pro rata to their current participations in the T/T group, 68.7 million ordinary shares of Usinas Siderúrgicas de Minas Gerais S.A. – USIMINAS (“Usiminas”) at a price of BRL10 per ordinary share. On July 3, 2023, the Company announced the completion of the acquisition of this additional participation. Pursuant to the transaction, Ternium paid $118.7 million in cash for 57.7 million ordinary shares, increasing its participation in the Usiminas control group to 51.5%.

The Usiminas control group holds the majority of Usiminas’ voting rights. Following the completion of the transaction, the T/T group holds an aggregate participation of 61.3% in the control group, with the NSC group and Previdência Usiminas (Usiminas employees’ pension fund) holding 31.7% and 7.0%, respectively. The Usiminas control group members also agreed a new governance structure, as a result of which the T/T group nominated a majority of the Usiminas board of directors, the CEO and four other members of Usiminas board of officers, and ordinary decisions are approved with a 55% majority of the control group shares. Pursuant to the Usiminas shareholders agreement, as supplemented by the T/T Group shareholders’ agreement, Ternium will fully consolidate Usiminas balance sheet and results of operations in its consolidated financial statements beginning in July 2023.

At any time after the second anniversary of the closing of the transaction, the T/T group will have the right to buy the NSC group’s remaining interest in the Usiminas control group (153.1 million ordinary shares) at the higher of BRL10 per share and the 40-trading day average price per share immediately prior to the date of exercising the option. In addition, the NSC group will have the right, at any time after the closing of the transaction, to withdraw its remaining shares from the control group and sell them in the open market after giving the T/T group the opportunity to buy them at the 40-trading day average price per share immediately prior to the NSC group’s notice of withdrawal, as well as the right, at any time after the second anniversary of the closing, to sell such shares to the T/T group at BRL10 per share.

| | | | | | | | | | | | | | |

| | Pablo Brizzio | | |

| | Chief Financial Officer | | |

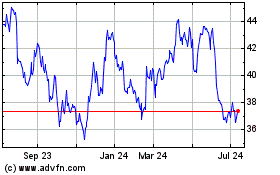

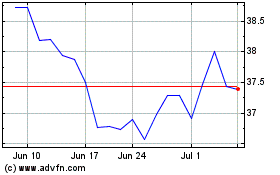

Ternium (NYSE:TX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ternium (NYSE:TX)

Historical Stock Chart

From Nov 2023 to Nov 2024