Notice of Full Redemption to the Holders of the EUR 700,000,000 0.625 Per Cent. Notes Due 11 June 2025 Issued by Vivendi SE on 11 June 2019

November 14 2024 - 2:36AM

Business Wire

ISIN: FR0013424868

Regulatory News:

Reference is made to the terms and conditions included in the

base prospectus dated 22 March 2019 which was approved by the

Autorité des marchés financiers under n°19-112 on 22 March 2019, as

completed by the Final Terms dated 7 June 2019 (the "Terms and

Conditions"), of the EUR 700,000,000 aggregate principal amount

of 0.625 per cent. Notes due 11 June 2025 (the "Notes")

issued by Vivendi SE (the "Issuer") (Paris:VIV).

All capitalized terms used herein and not otherwise defined in

this notice shall have the meanings assigned to them in the Terms

and Conditions.

The Issuer hereby gives irrevocable notice to all Noteholders

that the Issuer has elected to exercise its make-whole redemption

option of the outstanding Notes, in whole, in accordance with

Condition 7.2.2 (Make-whole redemption) and Condition 15 (Notices)

of the Terms and Conditions (the “Redemption”). The

Make-Whole Redemption Date is set to 13 December 2024 (the

"Make-Whole Redemption Date").

This notice, together with the Redemption, are conditional on

the adoption, by the Issuer’s Combined General Shareholders’

Meeting to be held on 9 December 2024, of any of the resolutions

(and such resolutions becoming effective) regarding the proposed

spin-off of the Issuer’s group submitted to its vote, as such

resolutions are set forth in the notice of meeting (avis de

réunion) published in the Bulletin des Annonces Légales

Obligatoires (BALO) on 30 October 2024 and available on the

Issuer’s website

(https://www.vivendi.com/en/shareholders-investors/shareholders-meeting/)

and may subsequently be amended or completed by the Issuer’s

Management Board (Directoire) at its own initiative, as the case

may be. For the avoidance of doubt, should the Issuer’s Combined

General Shareholders’ Meeting be cancelled or not held, no

Redemption should occur.

As set out in the Terms and Conditions, all Notes will be

redeemed at their Make-Whole Redemption Amount (the

"Make-Whole Redemption Amount"), as calculated by the

Calculation Agent in accordance with Condition 7.2.2 (Make-whole

redemption) of the Terms and Conditions. The Make-Whole Redemption

Amount, along with the Make-Whole Redemption Rate (which will be

determined as per Condition 7.2.2 (Make-whole redemption) of the

Terms and Conditions), will be published in accordance with the

Terms and Conditions.

In accordance with Condition 8 (Payments and Talons) of the

Terms and Conditions, the Make-Whole Redemption Amount will be paid

in euros by the Paying Agent (Société Générale Securities

Services - 32 rue du Champ de Tir, 44308 Nantes Cedex 3) on the

Make-Whole Redemption Date to the Account Holders for the benefit

of the Noteholders.

Pursuant to Condition 7.9 (Cancellation) of the Terms and

Conditions, all Notes so redeemed will be cancelled and an

application for their delisting will be made to Euronext.

The results of the Issuer’s Combined General Shareholders’

Meeting to be held on 9 December 2024 will be published by the

Issuer in a press release and made available on its website, and

will also be communicated by the Issuer to the Paying Agent.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114361614/en/

Vivendi SE

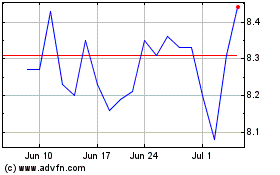

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Oct 2024 to Nov 2024

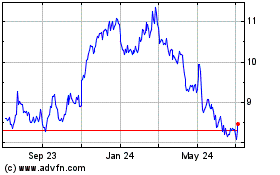

Telefonica Brasil (NYSE:VIV)

Historical Stock Chart

From Nov 2023 to Nov 2024