Achieves first quarter key guidance metrics and reaffirms

full-year guidance

Returns more than $100 million of capital to shareholders

during the quarter, on track to meet commitment to return

approximately $350 million of capital in 2024

Increases regular quarterly dividend by 10%

Expects previously announced business transformation

initiatives to generate $90-$100 million of annualized cost savings

exiting 2025

Integration of Octillion Media’s cutting-edge technology into

Premion is underway, will drive enhanced revenue growth and

performance in local CTV/OTT

TEGNA Inc. (NYSE: TGNA) today announced financial results for

the first quarter ended March 31, 2024.

FIRST QUARTER FINANCIAL HIGHLIGHTS:

- Total company revenue was $714 million in the first quarter,

down four percent year-over-year and at the midpoint of our

guidance range, primarily due to lower subscription revenue, which

was adversely impacted by a temporary disruption of service with a

distribution partner, partially offset by higher political

advertising dollars.

- Subscription revenue was $375 million in the first quarter,

down nine percent year-over-year, primarily due to subscriber

declines, the temporary disruption of service with a distribution

partner in January, and a year-end adjustment that benefited first

quarter 2023 results, partially offset by contractual rate

increases. The underlying subscription revenue trend is down

mid-single digits percent year-over-year.

- Advertising and Marketing Services (“AMS”) revenue was $299

million in the first quarter, down three percent year-over-year.

While national advertising showed softness, local advertising

trends in the first quarter showed positive growth reflected in

strong performance in automotive, services, entertainment,

restaurants, banking and finance categories.

- GAAP operating expenses were $577 million, up two percent

year-over-year. Non-GAAP operating expenses1 of $568 million

finished, up one percent year-over-year due to increases in

compensation expenses, partially offset by reduction in programming

expenses.

- GAAP and non-GAAP operating income totaled $138 million and

$146 million, respectively.

- Interest expense was slightly lower year-over-year at $42

million due to our reduced fees on undrawn balances as a result of

downsizing of the revolving credit facility during the

quarter.

1 A non-GAAP measure detailed in Table

2

- TEGNA achieved net income of $190 million on a GAAP basis, or

$80 million on a non-GAAP basis. Net income on a GAAP basis

included a $116 million after-tax gain from the sale of TEGNA’s

interest in Broadcast Music, Inc. during the quarter.

- GAAP and non-GAAP earnings per diluted share were $1.06 and

$0.45, respectively.

- Total company Adjusted EBITDA2 was $174 million, representing a

decrease of 15 percent compared to the first quarter of 2023

primarily due to lower subscription profits.

- Adjusted free cash flow3 was $113 million for the quarter.

- For the trailing two-year period ending March 31, 2024,

Adjusted free cash flow as a percentage of revenue was 19.4

percent.

- The Company is on track and reaffirming its expectation of

2024-2025 two-year Adjusted free cash flow guidance range of $900

million-$1.1 billion.

- Cash and cash equivalents totaled $431 million at the end of

the quarter. Net leverage finished the quarter at 2.8x.

CAPITAL ALLOCATION

TEGNA’s comprehensive capital allocation framework supports

shareholder value creation through predictable and sustained return

of capital. The Company continues to expect to return 40-60 percent

of Adjusted free cash flow generated in 2024-2025 to shareholders

through share repurchases and dividends, with the remaining free

cash flow expected to be used for organic investments and/or

bolt-on acquisitions and to prepare for future debt retirement.

TEGNA will continue to analyze all uses of capital, including

regular evaluation of the dividend, with a goal of maximizing

long-term shareholder value creation.

Consistent with this framework, TEGNA is on track to return

approximately $350 million of capital to shareholders in 2024

through dividends and opportunistic share repurchases from time to

time on the open market at prevailing prices or in negotiated

transactions.

During the first quarter, TEGNA returned more than $100 million

of capital to shareholders with $82 million of share repurchases,

representing 5.7 million shares, and paid $20 million in dividends.

In February, the Company also received a final settlement of

approximately four million shares related to the completion of our

previously announced accelerated share repurchase (“ASR”) program

launched in November 2023.

Additionally, the TEGNA Board approved a 10 percent increase to

the Company’s regular quarterly dividend, from 11.375 to 12.5 cents

per share, which reflects confidence in the durability of TEGNA’s

free cash flow and strength of our balance sheet. This increase

builds on a 20 percent increase to TEGNA’s dividend last year. The

increased dividend announced today will be in effect for quarterly

dividend payments, beginning with the July 1, 2024 payment, to

stockholders of record as of the close of business on June 7,

2024.

2 A non-GAAP measure detailed in Table

3

3 A non-GAAP measure detailed in Table

5

CEO COMMENT

“TEGNA remains focused on maximizing long-term value for our

shareholders and delivering on our key priorities. We returned more

than $100 million of capital to shareholders during the quarter and

announced today that we are increasing our quarterly dividend by

10%,” said Dave Lougee, president and chief executive officer.

“We met our quarterly guidance metrics, with local advertising

trends continuing to improve with positive performance in

automotive and services, our two largest advertising categories as

well as entertainment and restaurants. Our capabilities in local

advertising are bolstered by Premion and deliver results for our

clients in the converged linear and streaming television

marketplace. The addition of Octillion further enhances Premion’s

growth and margin potential by creating an even more attractive

platform for advertisers, and we are already seeing early signs of

success with our customers.

“In this new era of sports distribution, we are the first

broadcast group with local television deals with teams across the

NBA, WNBA, NHL and National Women’s Soccer League, including newly

announced deals with the WNBA’s Indiana Fever, featuring first

round pick Caitlin Clark, the NHL’s Seattle Kraken and National

Women Soccer League’s Seattle Reign. These are win-win

opportunities to marry local sports teams and their passionate fans

with our strong station brands and our unparalleled

distribution.

“We expect our previously announced business transformation

initiatives to drive increased efficiency and generate annualized

cost savings of $90-$100 million as we exit 2025. Several

initiatives are already underway. In the quarter, we deployed a

new, regional go-to-market strategy for digital advertising sales

that reduces costs while better positioning TEGNA to capture and

fulfill digital campaigns. Our business transformation initiatives

and industry-leading balance sheet position us well to take

advantage of accretive opportunities to expand and diversify our

business while keeping net leverage under 3.0x.

“Looking ahead, 2024 is shaping up to be another robust

political cycle and we’re in a good position to take our fair share

driven by our favorable portfolio of stations in key competitive

markets.”

FULL-YEAR AND SECOND QUARTER 2024 OUTLOOK

Full-Year 2024 Key Guidance

Metrics

TEGNA is reaffirming its guidance metrics

for the full year of 2024, except for amortization, which is

updated to include Octillion Media.

2024/2025 Two-Year Adjusted FCF

$900 million – 1.1 billion

Net Leverage Ratio

Below 3x at year end

Corporate Expenses

$40 – 45 million

Depreciation

$56 – 60 million

Amortization

$51 – 55 million

Interest Expense

$170 – 173 million

Capital Expenditures

$62 – 67 million

Effective Tax Rate

23.5 – 24.5%

Second Quarter 2024 Key Guidance

Metrics

Reflects expectations relative to second

quarter 2023 results

Total Company GAAP Revenue

Down Low-to-Mid Single Digit

Percent

Total Non-GAAP Operating Expenses

Flat

KEY STRATEGIC UPDATES

- Premion Continues to Drive Growth with Local Advertisers –

Premion continues to gain momentum with local advertisers by

selling CTV advertising in a converged linear + streaming TV

marketplace. The integration of Octillion Media with Premion is

underway and will further drive innovation and streamline media

buying processes. For the 2024 election cycle, Premion has expanded

its programmatic selling capabilities, enabling advertisers and

agencies to leverage a multi-faceted programmatic and managed

service approach to executing CTV campaigns and driving measurable

outcomes.

- Caitlin Clark’s Indiana Fever Games to be Distributed in 12

Markets – TEGNA’s partnership with the Indiana Fever creates an

unprecedented 12-market footprint to air 17 Indiana Fever games for

free over the air in 2024. 4.6 million homes will have the

opportunity to watch #1 overall draft pick Caitlin Clark, 2023 #1

overall pick and WNBA Rookie of the Year Aliyah Boston, and the

exciting Fever roster as they make a push to return to the

playoffs.

- TEGNA Completes Multi-year Deal with NHL’s Seattle Kraken –

Beginning next season, TEGNA stations KING 5 and KONG in Seattle

will broadcast Seattle Kraken games for free over the air. The

games will also be broadcast on KGW in Portland and KREM in

Spokane. TEGNA will work with additional broadcast companies to

expand free over the air broadcast access to all available

television markets in Washington, Oregon and Alaska. (Press

release)

- KING 5 and National Women’s Soccer League’s Seattle Reign

Partner for Broadcast and Streaming – 11 regular season Seattle

Reign games will air on KONG and on the free KING 5+ app during the

2024 season. As the official local broadcast partner of the Seattle

Reign, KING will also provide fans with special access to post-game

coverage, interviews and digital and social content.

- “Cult Justice” Debuts on Hulu – Investigative series “Cult

Justice,” which leverages TEGNA’s vast archival library of

investigative content, debuted on Hulu on March 28. The series

comes from TEGNA’s multi-year development partnership with top

legal and true crime network Law&Crime and Cineflix Rights, the

UK’s largest independent TV content distributor.

- Disinformation Training for Journalists – Recognizing the

continued threat of disinformation and misinformation, TEGNA

continued ongoing training to assist our journalists and newsrooms

in navigating the intricate web of misinformation and uphold the

integrity of reporting, safeguarding trust with our viewers and

communities.

- TEGNA’s ‘BB+’ Issuer Credit Rating Affirmed and Outlook Stable

– In March, S&P Global affirmed TEGNA’s issuer credit rating at

‘BB+’ and ‘outlook stable’ underscoring our industry-leading

balance sheet.

FORWARD-LOOKING STATEMENTS

This communication includes forward-looking statements within

the meaning of the “safe harbor” provisions of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. When used in this

communication, the words “believes,” “estimates,” “plans,”

“expects,” “should,” “could,” “outlook,” and “anticipates” and

similar expressions as they relate to the Company or its financial

results are intended to identify forward-looking statements.

Forward-looking statements in this communication may include,

without limitation, statements regarding anticipated growth rates,

the Company’s capital allocation framework, the Company’s business

transformation initiatives, and the Company's other plans,

objectives and expectations. Forward-looking statements are based

on a number of assumptions about future events and are subject to

various risks, uncertainties and other factors that may cause

actual results to differ materially from the views, beliefs,

projections and estimates expressed in such statements, many of

which are outside the Company’s control. These risks, uncertainties

and other factors include, but are not limited to, risks and

uncertainties related to: changes in the market price of the

Company's shares, general market conditions, constraints,

volatility, or disruptions in the capital markets; the possibility

that the Company's share repurchases, including through ASR

programs, and the execution of the capital allocation framework may

not enhance long-term stockholder value; the Company’s ability to

realize cost savings and execute its business transformation

initiatives; the possibility that share repurchases could increase

the volatility of the price of the Company's common stock; legal

proceedings, judgments or settlements; the Company's ability to

re-price or renew subscribers; potential regulatory actions;

changes in consumer behaviors and impacts on and modifications to

TEGNA's operations and business relating thereto; and economic,

competitive, governmental, technological and other factors and

risks that may affect the Company's operations or financial

results, which are discussed in our Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. Any forward-looking statements in

this communication should be evaluated in light of these important

risk factors. The Company is not responsible for updating the

information contained in this communication beyond the published

date, or for changes made to this press release by wire services,

Internet service providers or other media.

Readers are cautioned not to place undue reliance on

forward-looking statements made by or on behalf of the Company.

Each such statement speaks only as of the day it was made. The

Company undertakes no obligation to update or to revise any

forward-looking statements.

ADDITIONAL INFORMATION

TEGNA Inc. (NYSE: TGNA) is an innovative media company that

serves the greater good of our communities. Across platforms, TEGNA

tells empowering stories, conducts impactful investigations and

delivers innovative marketing solutions. With 64 television

stations in 51 U.S. markets, TEGNA is the largest owner of top 4

network affiliates in the top 25 markets among independent station

groups, reaching approximately 39 percent of all television

households nationwide. TEGNA also owns leading multicast networks

True Crime Network and Quest. TEGNA offers innovative solutions to

help businesses reach consumers across television, digital and

over-the-top (OTT) platforms, including Premion, TEGNA’s OTT

advertising service. For more information, visit www.TEGNA.com.

CONSOLIDATED STATEMENTS OF

INCOME

TEGNA Inc.

Unaudited, in thousands of dollars (except

per share amounts)

Table No. 1

Quarter ended Mar. 31,

2024

2023

Change

Revenues

$

714,252

$

740,327

(4

%)

Operating expenses:

Cost of revenues

430,567

426,932

1

%

Business units - Selling, general and

administrative expenses

102,260

99,109

3

%

Corporate - General and administrative

expenses

14,798

12,100

22

%

Depreciation

14,310

15,049

(5

%)

Amortization of intangible assets

13,660

13,582

1

%

Asset impairment and other

1,097

—

***

Total

576,692

566,772

2

%

Operating income

137,560

173,555

(21

%)

Non-operating (expense) income:

Interest expense

(42,368

)

(42,906

)

(1

%)

Interest income

5,573

7,573

(26

%)

Other non-operating items, net

149,758

(2,399

)

***

Total

112,963

(37,732

)

***

Income before income taxes

250,523

135,823

84

%

Provision for income taxes

61,261

31,819

93

%

Net income

189,262

104,004

82

%

Net loss attributable to redeemable

noncontrolling interest

298

299

(0

%)

Net income attributable to TEGNA

Inc.

$

189,560

$

104,303

82

%

Earnings per share:

Basic

$

1.06

$

0.46

***

Diluted

$

1.06

$

0.46

***

Weighted average number of common

shares outstanding:

Basic shares

177,823

224,544

(21

%)

Diluted shares

178,437

224,839

(21

%)

*** Not meaningful

USE OF NON-GAAP

INFORMATION

The company uses non-GAAP financial performance measures to

supplement the financial information presented on a GAAP basis.

These non-GAAP financial measures should not be considered in

isolation from, or as a substitute for, the related GAAP measures,

nor should they be considered superior to the related GAAP measures

and should be read together with financial information presented on

a GAAP basis. Also, our non-GAAP measures may not be comparable to

similarly titled measures of other companies.

Management and the company’s Board of Directors regularly use

Corporate–General and administrative expenses, Operating expenses,

Operating income and Income before income taxes, Provision for

income taxes, Net income attributable to TEGNA Inc., and Diluted

earnings per share, each presented on a non-GAAP basis, for

purposes of evaluating company performance. Management and our

Board of Directors also use Adjusted EBITDA and Adjusted free cash

flow to evaluate performance. Furthermore, the Leadership

Development and Compensation Committee of our Board of Directors

uses non-GAAP measures such as Adjusted EBITDA, non-GAAP net

income, non-GAAP EPS, and Adjusted free cash flow to evaluate

management’s performance. The company, therefore, believes that

each of the non-GAAP measures presented provides useful information

to investors and other stakeholders by allowing them to view our

business through the eyes of management and our Board of Directors,

facilitating comparisons of results across historical periods and

focus on the underlying ongoing operating performance of our

business. The company also believes these non-GAAP measures are

frequently used by investors, securities analysts and other

interested parties in their evaluation of our business and other

companies in the broadcast industry.

The company discusses in this release non-GAAP financial

performance measures that exclude from its reported GAAP results

the impact of “special items” consisting of asset impairment and

other, M&A-related costs, retention costs, workforce

restructuring, and a gain on an investment.

The company believes that such expenses and gains are not

indicative of normal, ongoing operations. While these items should

not be disregarded in evaluation of our earnings performance, it is

useful to exclude such items when analyzing current results and

trends compared to other periods as these items can vary

significantly from period to period depending on specific

underlying transactions or events that may occur. Therefore, while

we may incur or recognize these types of expenses, charges and

gains in the future, the company believes that removing these items

for purposes of calculating the non-GAAP financial measures

provides investors with a more focused presentation of our ongoing

operating performance.

The company also discusses Adjusted EBITDA (with and without

stock-based compensation expense), a non-GAAP financial performance

measure that it believes offers a useful view of the overall

operation of its businesses. The company defines Adjusted EBITDA as

net income attributable to TEGNA before (1) net (loss) income

attributable to redeemable noncontrolling interest, (2) income

taxes, (3) interest expense, (4) interest income, (5) other

non-operating items, net, (6) M&A-related costs, (7) asset

impairment and other, (8) workforce restructuring, (9) employee

retention costs, (10) depreciation and (11) amortization of

intangible assets. The company believes these adjustments

facilitate company-to-company operating performance comparisons by

removing potential differences caused by variations unrelated to

operating performance, such as capital structures (interest

expense), income taxes, and the age and book appreciation of

property and equipment (and related depreciation expense). The most

directly comparable GAAP financial measure to Adjusted EBITDA is

Net income attributable to TEGNA. Users should consider the

limitations of using Adjusted EBITDA, including the fact that this

measure does not provide a complete measure of our operating

performance. Adjusted EBITDA is not intended to purport to be an

alternate to net income as a measure of operating performance or to

cash flows from operating activities as a measure of liquidity. In

particular, Adjusted EBITDA is not intended to be a measure of cash

flow available for management’s discretionary expenditures, as this

measure does not consider certain cash requirements, such as

working capital needs, capital expenditures, contractual

commitments, interest payments, tax payments and other debt service

requirements.

This earnings release also discusses Adjusted free cash flow and

Adjusted free cash flow as a percentage of revenues, non-GAAP

performance measures that the Board of Directors uses to review the

performance of the business and compensate senior management.

Adjusted free cash flow is reviewed by the Board of Directors as a

percentage of revenue over a trailing two-year period (reflecting

both an even and odd year reporting period given the political

cyclicality of the business). The most directly comparable GAAP

financial measure to Adjusted free cash flow is Net income

attributable to TEGNA. Adjusted free cash flow is calculated as

Adjusted EBITDA (as defined above), further adjusted by adding back

(1) employee stock-based compensation awards, (2) Company stock

401(k) match contributions, (3) syndicated programming

amortization, (4) dividends received from equity method

investments, (5) reimbursements from spectrum repacking, (6)

proceeds from company-owned life insurance policies and (7)

interest income. This is further adjusted by deducting payments

made for (1) syndicated programming, (2) pension, (3) interest, (4)

taxes (net of refunds) and (5) purchases of property and equipment.

Adjusted free cash flow is not intended to be a measure of residual

cash available for management's discretionary use since it omits

significant sources and uses of cash flow including mandatory debt

repayments and changes in working capital.

This earnings release also presents our net leverage ratio which

includes Adjusted EBITDA (without stock-based compensation) as a

component of the computation. Our net leverage ratio is a financial

measure that is used by management to assess the borrowing capacity

of the company and management believes it is useful to investors

for the same reason. The company defines its Net Leverage Ratio as

(a) net debt (total debt less cash and cash equivalents) as of the

balance sheet date divided by (b) Average Annual Adjusted EBITDA

for the trailing two-year period.

The company is furnishing forward-looking guidance with respect

to free cash flow for the combined 2024-25 years, net leverage and

corporate expenses for fiscal year 2024 and non-GAAP operating

expenses for the second quarter of 2024. Our future GAAP financial

results will include the impact of special items such as retention

costs including stock-based compensation and cash payments. The

company believes that such expenses are not indicative of normal,

ongoing operations. While these items should not be disregarded in

evaluation of our earnings performance, it is useful to exclude

such items when analyzing current results and trends compared to

other periods. Therefore, while we may incur or recognize these

types of expenses in the future, the company believes that removing

these items for purposes of calculating the non-GAAP financial

measures provides investors with a more focused presentation of our

ongoing operating performance.

The Company is not able to reconcile these amounts to their

comparable GAAP financial measures without unreasonable efforts

because certain information necessary to calculate such measures on

a GAAP basis is unavailable, dependent on future events outside of

our control and cannot be predicted. An example of such information

is share-based compensation, which is impacted by future share

price movement in the Company’s stock price and also dependent on

future hiring and attrition. In addition, the Company believes such

reconciliations could imply a degree of precision that might be

confusing or misleading to investors. The actual effect of the

reconciling items that the Company may exclude from these non-GAAP

expense numbers, when determined, may be significant to the

calculation of the comparable GAAP measures.

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc.

Unaudited, in thousands of dollars (except

per share amounts)

Table No. 2

Reconciliations of certain line items

impacted by special items to the most directly comparable financial

measure calculated and presented in accordance with GAAP on the

company's Consolidated Statements of Income follow:

Special Items

Quarter ended Mar. 31, 2024

GAAP measure

Retention costs - SBC

Retention costs - Cash

M&A-related costs

Workforce

restructuring

Asset impairment and

other

Other non-operating

item

Non-GAAP measure

Corporate - General and administrative

expenses

$

14,798

$

(752

)

$

(221

)

$

(2,290

)

$

(111

)

$

—

$

—

$

11,424

Operating expenses

576,692

(2,893

)

(570

)

(2,290

)

(1,807

)

(1,097

)

—

568,035

Operating income

137,560

2,893

570

2,290

1,807

1,097

—

146,217

Income before income taxes

250,523

2,893

570

2,290

1,807

1,097

(152,867

)

106,313

Provision for income taxes

61,261

431

77

593

445

284

(36,621

)

26,470

Net income attributable to TEGNA Inc.

189,560

2,462

493

1,697

1,362

813

(116,246

)

80,141

Earnings per share - diluted (a)

$

1.06

$

0.01

$

—

$

0.01

$

0.01

$

—

$

(0.65

)

$

0.45

(a) Per share amounts do not sum due to

rounding.

Special Items

Quarter ended Mar. 31, 2023

GAAP measure

M&A-related costs

Non-GAAP measure

Corporate - General and administrative

expenses

$

12,100

$

(2,766

)

$

9,334

Operating expenses

566,772

(2,766

)

564,006

Operating income

173,555

2,766

176,321

Income before income taxes

135,823

2,766

138,589

Provision for income taxes

31,819

181

32,000

Net income attributable to TEGNA Inc.

104,303

2,585

106,888

Earnings per share - diluted

$

0.46

$

0.01

$

0.47

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc.

Unaudited, in thousands of dollars

Table No. 3

Reconciliations of Adjusted EBITDA to net

income presented in accordance with GAAP on the company's

Consolidated Statements of Income are presented below:

Quarter ended Mar. 31,

2024

2023

Net income attributable to TEGNA Inc.

(GAAP basis)

$

189,560

$

104,303

Less: Net loss attributable to redeemable

noncontrolling interest

(298

)

(299

)

Plus: Provision for income taxes

61,261

31,819

Plus: Interest expense

42,368

42,906

Less: Interest income

(5,573

)

(7,573

)

(Less) Plus: Other non-operating items,

net

(149,758

)

2,399

Operating income (GAAP basis)

137,560

173,555

Plus: M&A-related costs

2,290

2,766

Plus: Asset impairment and other

1,097

—

Plus: Workforce restructuring

1,807

—

Plus: Retention costs - Employee

stock-based compensation awards

2,893

—

Plus: Retention costs - Cash

570

—

Adjusted operating income (non-GAAP

basis)

146,217

176,321

Plus: Depreciation

14,310

15,049

Plus: Amortization of intangible

assets

13,660

13,582

Adjusted EBITDA

$

174,187

$

204,952

Stock-based compensation:

Employee awards

8,240

3,688

Company stock 401(k) match

contributions

5,429

5,564

Adjusted EBITDA before stock-based

compensation costs

$

187,856

$

214,204

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc.

Unaudited, in thousands of dollars

Table No. 4

Below is a detail of our primary sources

of revenue presented in accordance with GAAP on company’s

Consolidated Statements of Income. In addition, we show Adjusted

EBITDA and Adjusted EBITDA margins (see non-GAAP reconciliations at

Table No. 3).

Quarter ended Mar. 31,

2024

2023

Change

Subscription

$

375,324

$

414,280

(9%)

Advertising & Marketing Services

298,692

307,845

(3%)

Political

27,828

5,291

***

Other

12,408

12,911

(4%)

Total revenues

$

714,252

$

740,327

(4%)

Adjusted EBITDA

$

174,187

$

204,952

(15%)

Adjusted EBITDA Margin

24

%

28

%

*** Not meaningful

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc.

Unaudited, in thousands of dollars

Table No. 5

Quarter ended Mar. 31,

2024

2023

Change

Net income attributable to TEGNA Inc.

(GAAP basis)

$

189,560

$

104,303

82

%

Plus: Provision for income taxes

61,261

31,819

93

%

Plus: Interest expense

42,368

42,906

(1

%)

Plus: M&A-related costs

2,290

2,766

(17

%)

Plus: Depreciation

14,310

15,049

(5

%)

Plus: Amortization of intangible

assets

13,660

13,582

1

%

Plus: Employee stock-based compensation

awards

11,132

3,688

***

Plus: Company stock 401(k) match

contribution

5,429

5,564

(2

%)

Plus: Syndicated programming

amortization

10,983

14,459

(24

%)

Plus: Workforce restructuring expense

1,807

—

***

Plus: Retention costs, cash portion

570

—

***

Plus: Asset impairment and other

1,097

—

***

(Less) Plus: Other non-operating items,

net

(149,758

)

2,399

***

Less: Net loss attributable to redeemable

noncontrolling interest

(298

)

(299

)

(0

%)

Less: Syndicated programming payments

(10,159

)

(17,119

)

(41

%)

Less: Income tax payments, net of

refunds

(1,044

)

(914

)

14

%

Less: Pension contributions

(952

)

(959

)

(1

%)

Less: Interest payments

(74,240

)

(73,862

)

1

%

Less: Purchases of property and

equipment

(4,911

)

(2,845

)

73

%

Adjusted free cash flow (non-GAAP

basis)

$

113,105

$

140,537

(20

%)

*** Not meaningful

Our share of net earnings and losses from investments that we

have significant influence over, but do not have control, were

previously included in “Equity loss in unconsolidated investments,

net” in the Consolidated Statements of Income. However, beginning

in the first quarter of 2024 such amounts are now included in

"Other non-operating items, net". Prior year amounts have been

reclassified to conform to the new presentation.

Starting in the fourth quarter of 2023, TEGNA began presenting

interest income as a separate line item on its Statements of Income

as a result of its increasing size. Prior to this, interest income

was included in Other non-operating items, net. Prior year amounts

have been reclassified to conform to the new presentation. Interest

income is included in free cash flow while Other non-operating

items, net is not, consistent with past presentations.

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc.

Unaudited, in thousands of dollars

Table No. 5 (continued)

Two-year period ended Mar.

31,

2024

2023

Net income attributable to TEGNA Inc.

(GAAP basis)

$

1,162,519

$

1,099,110

Plus: Provision for income taxes

349,092

334,056

Plus: Interest expense

345,674

356,093

Plus: M&A-related costs

32,421

27,021

Plus: Depreciation

119,969

125,189

Plus: Amortization of intangible

assets

112,009

120,715

Plus: Employee stock-based compensation

awards

55,615

56,923

Plus: Company stock 401(k) match

contribution

37,381

36,063

Plus: Syndicated programming

amortization

114,427

136,964

Plus: Workforce restructuring expense

1,807

—

Plus: Advisory fees related to activism

defense

—

12,012

Plus: Cash dividend from equity

investments for return on capital

500

4,276

Plus: Cash reimbursements from spectrum

repacking

265

3,842

Plus: Net income attributable to

redeemable noncontrolling interest

1

1,457

Plus: Reimbursement from Company-owned

life insurance policies

1,879

1,929

Plus: Retention costs, cash portion

5,018

—

Plus (Less): Asset impairment and

other

4,191

(1,207

)

Less: Other non-operating items, net

(162,922

)

(5,746

)

Less: Merger termination fee

(136,000

)

—

Less: Syndicated programming payments

(110,970

)

(140,650

)

Less: Income tax payments, net of

refunds

(298,525

)

(351,206

)

Less: Pension contributions

(9,613

)

(12,149

)

Less: Interest payments

(332,842

)

(345,153

)

Less: Purchases of property and

equipment

(105,400

)

(104,069

)

Adjusted free cash flow (non-GAAP

basis)

$

1,186,496

$

1,355,470

Revenue

$

6,130,304

$

6,286,614

Adjusted free cash flow as a % of

Revenue

19.4

%

21.6

%

Our share of net earnings and losses from investments that we

have significant influence over, but do not have control, were

previously included in “Equity loss in unconsolidated investments,

net” in the Consolidated Statements of Income. However, beginning

in the first quarter of 2024 such amounts are now included in

"Other non-operating items, net". Prior year amounts have been

reclassified to conform to the new presentation.

Starting in the fourth quarter of 2023, TEGNA began presenting

interest income as a separate line item on its Statements of Income

as a result of its increasing size. Prior to this, interest income

was included in Other non-operating items, net. Prior year amounts

have been reclassified to conform to the new presentation. Interest

income is included in free cash flow while Other non-operating

items, net is not, consistent with past presentations.

NON-GAAP FINANCIAL INFORMATION

TEGNA Inc.

Unaudited, in thousands of dollars

Table No. 6

The following table reconciles long-term

debt, net of current portion to Net debt.

Mar. 31, 2024

Long-term debt, net of current portion

$

3,090,000

Plus: Current portion of long-term

debt

—

Less: Cash and cash equivalents

(430,764

)

Net debt (numerator)

$

2,659,236

The following table shows the calculation

of the average annual Adjusted EBITDA before stock-based

compensation over the trailing two-year period ("T2Y").

Adjusted EBITDA before stock-based

compensation:

First quarter of 20241

$

187,856

Plus: Year ended December 31, 20232

781,562

Plus: Year ended December 31, 20222

1,181,045

Less: First quarter of 20223

(265,451

)

Combined T2Y

$

1,885,012

Divided by

2

T2Y Adjusted EBITDA (denominator)

$

942,506

The following table shows the calculation

of the Net Leverage Ratio.

Mar. 31, 2024

Net debt (numerator)

$

2,659,236

T2Y Adjusted EBITDA (denominator)

$

942,506

Net Leverage Ratio

2.8

x

1 A non-GAAP measure detailed in Table

3.

2 Refer to page 39 of the 2023 Form 10-K

for reconciliations of 2023 and 2022 Adjusted EBITDA before

stock-based compensation costs to net income attributable to TEGNA

Inc.

3 Refer to page 23 in our Q1 2022 Form

10-Q for a reconciliation of our Q1 2022 Adjusted EBITDA. Note that

we did not present Adjusted EBITDA before stock-based compensation

in our Q1 2022 10-Q. Our Adjusted EBITDA was $249,618 thousand

while our stock-based compensation and Company stock 401(k)

contribution expenses were $10,495 thousand and $5,338 thousand,

respectively, which sums to the amount shown above.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240507210248/en/

For media inquiries, contact: Anne Bentley Vice President, Chief

Communications Officer 703-873-6366 abentley@TEGNA.com

For investor inquiries, contact: Julie Heskett Senior Vice

President, Chief Financial Officer 703-873-6747

investorrelations@TEGNA.com

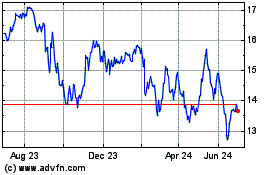

TEGNA (NYSE:TGNA)

Historical Stock Chart

From Dec 2024 to Jan 2025

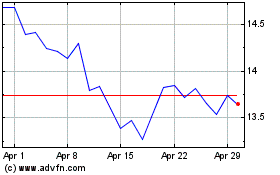

TEGNA (NYSE:TGNA)

Historical Stock Chart

From Jan 2024 to Jan 2025