Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

May 26 2020 - 5:19PM

Edgar (US Regulatory)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Filed Pursuant to Rule 433

|

|

|

|

|

|

|

|

Registration Statement No. 333-229539

|

|

|

|

|

|

|

|

May 26, 2020

|

Final Term Sheet

$650,000,000 1.150% Notes due 2025

$1,000,000,000 1.950% Notes due 2030

$650,000,000 2.900% Notes due 2050

|

|

|

|

|

|

|

|

|

Issuer:

|

|

Stryker Corporation

|

|

|

|

|

|

|

|

|

2025 Notes

|

|

2030 Notes

|

|

2050 Notes

|

|

|

|

|

|

|

Security Type:

|

|

1.150% Notes due 2025

|

|

1.950% Notes due 2030

|

|

2.900% Notes due 2050

|

|

|

|

|

|

|

Principal Amount:

|

|

$650,000,000

|

|

$1,000,000,000

|

|

$650,000,000

|

|

|

|

|

|

|

Maturity Date:

|

|

June 15, 2025

|

|

June 15, 2030

|

|

June 15, 2050

|

|

|

|

|

|

|

Interest Payment Dates:

|

|

Each June 15 and December 15, commencing December 15, 2020

|

|

Each June 15 and December 15, commencing December 15, 2020

|

|

Each June 15 and December 15, commencing December 15, 2020

|

|

|

|

|

|

|

Coupon (Interest Rate):

|

|

1.150% per year

|

|

1.950% per year

|

|

2.900% per year

|

|

|

|

|

|

|

Price to Public:

|

|

99.766% of the Principal Amount

|

|

99.611% of the Principal Amount

|

|

99.701% of the Principal Amount

|

|

|

|

|

|

|

Benchmark Treasury:

|

|

0.375% due April 30, 2025

|

|

0.625% due May 15, 2030

|

|

2.000% due February 15, 2050

|

|

|

|

|

|

|

Spread to Benchmark Treasury:

|

|

T + 85 bps

|

|

T + 130 bps

|

|

T + 150 bps

|

|

|

|

|

|

|

Benchmark Treasury Yield:

|

|

0.348%

|

|

0.693%

|

|

1.415%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Yield to Maturity:

|

|

1.198%

|

|

1.993%

|

|

2.915%

|

|

|

|

|

|

|

Optional Redemption Provisions:

|

|

|

|

|

|

|

|

|

|

|

|

|

Make-Whole Call:

|

|

Prior to May 15, 2025, T+ 15 bps

|

|

Prior to March 15, 2030, T+ 20 bps

|

|

Prior to December 15, 2049, T+ 25 bps

|

|

|

|

|

|

|

Par Call:

|

|

On or after May 15, 2025, at par

|

|

On or after March 15, 2030, at par

|

|

On or after December 15, 2049, at par

|

|

|

|

|

|

|

CUSIP/ISIN:

|

|

863667 BA8 / US863667BA85

|

|

863667 AY7 / US863667AY70

|

|

863667 AZ4 / US863667AZ46

|

|

|

|

|

Special Mandatory Redemption:

|

|

In the event that the Issuer does not satisfy the minimum tender and other conditions in the Purchase Agreement and consummate the Wright Tender Offer on or prior to February 4, 2021, or if, prior to such date, the

Issuer notifies the trustee in writing that the Purchase Agreement has been terminated, the Issuer will be required to redeem each series of notes (other than the 2050 Notes) in whole and not in part for cash at a special mandatory redemption price

equal to 101% of the aggregate principal amount of such series, plus accrued and unpaid interest, if any, to, but excluding, the special mandatory redemption date. The 2050 Notes will not be subject to the special mandatory redemption and will

remain outstanding (unless otherwise redeemed) even if the Wright Tender Offer is not consummated on or prior to February 4, 2021.

|

|

|

|

|

Expected Ratings*:

|

|

Baa1 (negative) (Moody’s) / A- (negative) (Standard & Poor’s)

|

|

|

|

|

Trade Date:

|

|

May 26, 2020

|

|

|

|

|

Settlement Date**:

|

|

June 4, 2020 (T+7)

|

|

|

|

|

Joint Book-Running Managers:

|

|

BofA Securities, Inc.

Citigroup

Global Markets Inc.

Wells Fargo Securities, LLC

Barclays

Capital Inc.

BNP Paribas Securities Corp.

Goldman

Sachs & Co. LLC

Morgan Stanley & Co. LLC

|

|

|

|

|

|

|

|

|

|

|

|

|

Co-Managers:

|

|

HSBC Securities (USA) Inc.

Mizuho

Securities USA LLC

MUFG Securities Americas Inc.

U.S. Bancorp

Investments, Inc.

PNC Capital Markets LLC

Siebert Williams

Shank & Co., LLC

|

*Ratings may be changed, suspended or withdrawn at any time and are not a recommendation to buy, hold or sell any security. No

report of any rating agency is being incorporated by reference herein.

** Pursuant to Rule 15c6-1 under the

Securities Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers of the notes who wish to trade

the notes on any date prior to the second business day before delivery thereof will be required, by virtue of the fact that the notes initially will settle in T+7, to specify an alternative settlement cycle at the time of any such trade to prevent

failed settlement.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication

relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by

visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling BofA Securities, Inc. toll-free at 1-800-294-1322, Citigroup Global Markets Inc. toll-free at 1-800-831-9146 and Wells Fargo Securities, LLC toll-free at 1-800-645-3751 or

wfscustomerservice@wellsfargo.com.

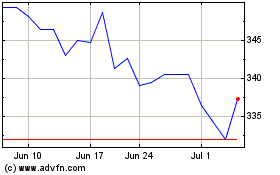

Stryker (NYSE:SYK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Stryker (NYSE:SYK)

Historical Stock Chart

From Nov 2023 to Nov 2024