Stryker extends cash tender offer for all outstanding shares of Wright Medical

April 27 2020 - 7:45AM

Stryker (NYSE: SYK) announced today that Stryker B.V., an indirect,

wholly owned subsidiary of Stryker, has extended the offering

period of its previously announced cash tender offer for all

outstanding ordinary shares of Wright Medical Group N.V. (NASDAQ:

WMGI). The tender offer is being made pursuant to the purchase

agreement, dated November 4, 2019, among Stryker, Stryker B.V. and

Wright Medical.

The tender offer is now scheduled to expire at 5:00 p.m.,

Eastern Time, on June 30, 2020, unless the tender offer is further

extended or earlier terminated in accordance with the purchase

agreement.

American Stock Transfer & Trust Company, LLC, the depositary

for the tender offer, has advised Stryker B.V. that as of 5:00

p.m., Eastern Time, on April 24, 2020, the last business day prior

to the announcement of the extension of the offer, 5,343,007 Wright

Medical ordinary shares (excluding Wright Medical ordinary shares

tendered pursuant to guaranteed delivery procedures), representing

approximately 4.2% of the outstanding Wright Medical ordinary

shares, have been validly tendered pursuant to the tender offer and

not properly withdrawn and an additional 534,244 Wright Medical

ordinary shares, representing approximately 0.4% of the outstanding

Wright Medical ordinary shares, had been tendered pursuant to

guaranteed delivery procedures. Shareholders who have already

tendered their Wright Medical ordinary shares do not have to

re-tender their shares or take any other action as a result of the

extension of the expiration date of the tender offer.

Completion of the tender offer remains subject to the conditions

described in the tender offer statement on Schedule TO filed by

Stryker B.V. with the U.S. Securities and Exchange Commission on

December 13, 2019, as amended. The tender offer will continue to be

extended until all conditions are satisfied or waived, or until the

tender offer is terminated, in either case pursuant to the terms of

the purchase agreement and as described in the Schedule TO.

Innisfree M&A Incorporated is acting as information agent

for the tender offer. Requests for documents and questions

regarding the tender offer may be directed to Innisfree M&A

Incorporated by telephone, toll-free at (888) 750-5834 for

shareholders, or collect at (212) 750-5833 for banks and

brokers.

About Stryker

Stryker is one of the world’s leading medical technology

companies and, together with its customers, is driven to make

healthcare better. The company offers innovative products and

services in Orthopaedics, Medical and Surgical, and Neurotechnology

and Spine that help improve patient and hospital outcomes. More

information is available at www.stryker.com.

Forward-looking statements

This press release contains information that includes or is

based on forward-looking statements within the meaning of the

federal securities law that are subject to various risks and

uncertainties that could cause our actual results to differ

materially from those expressed or implied in such statements. Such

factors include, but are not limited to: the impact of the COVID-19

pandemic and related policies and actions by governments or third

parties; the failure to satisfy any of the closing conditions to

the acquisition of Wright, including the receipt of any required

regulatory clearances (and the risk that such clearances may result

in the imposition of conditions that could adversely affect the

expected benefits of the transaction); delays in consummating the

acquisition of Wright; unexpected liabilities, costs, charges or

expenses in connection with the acquisition of Wright; the effects

of the proposed Wright transaction (or the announcement thereof) on

the parties relationships with employees, customers, other business

partners or governmental entities; weakening of economic conditions

that could adversely affect the level of demand for our products;

pricing pressures generally, including cost-containment measures

that could adversely affect the price of or demand for our

products; changes in foreign exchange markets; legislative and

regulatory actions; unanticipated issues arising in connection with

clinical studies and otherwise that affect U.S. Food and Drug

Administration approval of new products, including Wright products;

potential supply disruptions; changes in reimbursement levels from

third-party payors; a significant increase in product liability

claims; the ultimate total cost with respect to recall-related

matters; the impact of investigative and legal proceedings and

compliance risks; resolution of tax audits; the impact of the

federal legislation to reform the United States healthcare system;

costs to comply with medical device regulations; changes in

financial markets; changes in the competitive environment; our

ability to integrate and realize the anticipated benefits of

acquisitions in full or at all or within the expected timeframes,

including the acquisition of Wright; and our ability to realize

anticipated cost savings. Additional information concerning these

and other factors is contained in our filings with the U.S.

Securities and Exchange Commission, including our Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q. We disclaim any

intention or obligation to publicly update or revise any

forward-looking statement to reflect any change in our expectations

or in events, conditions or circumstances on which those

expectations may be based, or that affect the likelihood that

actual results will differ from those contained in the

forward-looking statements.

Additional Information and Where to Find It

The tender offer for Wright’s outstanding ordinary shares

referenced herein commenced on December 13, 2019. This

communication is not a recommendation, an offer to purchase or a

solicitation of an offer to sell ordinary shares of Wright or any

other securities. On December 13, 2019, Stryker filed with the

Securities and Exchange Commission (the “SEC”) a Tender Offer

Statement on Schedule TO, and Wright filed with the SEC a

Solicitation/Recommendation Statement on Schedule 14D-9.

SHAREHOLDERS ARE URGED TO READ THE TENDER OFFER STATEMENT

(INCLUDING THE OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL

AND OTHER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION

STATEMENT ON SCHEDULE 14D-9 (INCLUDING ANY AMENDMENTS OR

SUPPLEMENTS TO ANY OF THE FOREGOING), AS THEY WILL CONTAIN

IMPORTANT INFORMATION THAT PERSONS SHOULD CONSIDER BEFORE MAKING

ANY DECISION REGARDING TENDERING THEIR ORDINARY SHARES.

Shareholders can obtain these documents when they are filed and

become available free of charge from the SEC’s website at

www.sec.gov. Copies of the documents filed with the SEC by Stryker

will be available free of charge on Stryker’s website,

www.stryker.com, or by contacting Stryker’s investor relations

department at katherine.owen@stryker.com. Copies of the documents

filed with the SEC by Wright will be available free of charge on

Wright’s website, www.wright.com, or by contacting Wright’s

investor relations department at julie.dewey@wright.com. In

addition, Wright shareholders may obtain free copies of the tender

offer materials by contacting Innisfree M&A Incorporated, the

information agent for the tender offer, toll free at (888)

750-5834.

Contacts

For investor inquiries please contact:

Katherine Owen, Vice President, Strategy & Investor

Relations at 269-385-2600 or katherine.owen@stryker.com

For media inquiries please contact:

Yin Becker, Vice President, Communications, Public Affairs and

Corporate Marketing at 269-385- 2600 or yin.becker@stryker.com

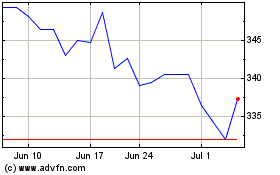

Stryker (NYSE:SYK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Stryker (NYSE:SYK)

Historical Stock Chart

From Nov 2023 to Nov 2024