Stryker announces pricing of €2.4 billion senior notes offering

November 25 2019 - 3:16PM

Stryker (NYSE:SYK) announced today that it has priced the following

senior notes: (i) €850 million aggregate principal amount of the

Company’s 0.25% Notes due 2024 (the “2024 Notes”), (ii) €800

million aggregate principal amount of the Company’s 0.75% Notes due

2029 (the “2029 Notes”) and (iii) €750 million aggregate principal

amount of the Company’s 1.00% Notes due 2031 (the “2031 Notes” and,

collectively with the 2024 Notes and 2029 Notes, the

“Notes”). Unless previously redeemed pursuant to their terms,

if applicable, the 2024 Notes will mature on December 3, 2024, the

2029 Notes will mature on March 1, 2029 and the 2031 Notes will

mature on December 3, 2031. The Notes are expected to settle

on December 3, 2019, subject to the satisfaction of customary

closing conditions.

The Company intends to use the net proceeds from the offering,

together with other financing and/or cash on hand, to consummate

the Company’s recently announced acquisition of Wright Medical

Group N.V. (“Wright”) and pay related fees and expenses, with any

remainder to be used for general corporate purposes.

Barclays Bank PLC, BNP Paribas, Goldman Sachs & Co. LLC and

Morgan Stanley & Co. International plc are acting as active

joint book-running managers for the offering. This offering was

made pursuant to a prospectus supplement, filed today, to the

Company’s prospectus, dated February 7, 2019, filed as part of the

Company’s effective shelf registration statement. Copies of the

preliminary prospectus supplement and accompanying prospectus

relating to the notes may be obtained by contacting: (i) Barclays

Bank PLC, 5 The North Colonnade, Canary Wharf, London E14 4BB,

United Kingdom, or by calling 1-888-603-5847 or emailing

barclaysprospectus@broadridge.com, (ii) BNP Paribas, 10 Harewood

Avenue, London NW1 6AA, United Kingdom, or by calling

1-800-854-5674, (iii) Goldman Sachs & Co. LLC, Prospectus

Department, 200 West Street, New York, NY 10282, or by calling

(866) 471-2526, by faxing (212) 902-9316 or emailing

prospectus-ny@ny.email.gs.com or (iv) Morgan Stanley & Co.

International plc, Prospectus Department, 2nd Floor, 180 Varick

Street, New York, NY, 10014, United States of America, or by

calling 1-866-718-1649, or by email at

prospectus@morganstanley.com.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy any securities nor will there be

any sale of these securities in any state or other jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or other jurisdiction.

Forward-looking statements

This press release contains information that includes or is

based on forward-looking statements within the meaning of the

federal securities laws that are subject to various risks and

uncertainties that could cause our actual results to differ

materially from those expressed or implied in such statements. Such

factors include, but are not limited to: the failure to satisfy any

of the closing conditions to the tender offer in connection with

the acquisition of Wright, including the receipt of any required

regulatory clearances (and the risk that such clearances may result

in the imposition of conditions that could adversely affect the

expected benefits of the transaction); delays in consummating the

acquisition of Wright; unexpected liabilities, costs, charges or

expenses in connection with the acquisition of Wright; the effects

of the proposed Wright transaction (or the announcement thereof) on

the parties’ relationships with employees, customers, other

business partners or governmental entities; weakening of economic

conditions that could adversely affect the level of demand for our

products; pricing pressures generally, including cost-containment

measures that could adversely affect the price of or demand for our

products; our ability to maintain adequate working relationships

with healthcare professionals; changes in foreign exchange markets;

legislative and regulatory actions; the possibility of incurring

goodwill impairment charges to one or more of our business units;

federal, state and foreign anti-bribery and anti-corruption laws;

unanticipated issues arising in connection with clinical studies

and otherwise that affect U.S. Food and Drug Administration

approval of new products, including Wright products; potential

supply disruptions; changes in reimbursement levels from

third-party payors; a significant increase in product liability

claims; the ultimate total cost with respect to recall-related

matters; the impact of investigative and legal proceedings and

compliance risks; resolution of tax audits; the impact of the

federal legislation to reform the United States healthcare system;

costs to comply with medical device regulations; the impact of

federal legislation that reformed the United States tax system and

further changes in the tax laws of foreign jurisdictions; the

possibility of our being negatively impacted by future changes in

the allocation of income to each of the income tax jurisdictions in

which we operate; the possibility of an interruption of

manufacturing operations; significant shortages or price increases

associated with raw materials; changes in financial markets;

changes in the competitive environment; cost of intellectual

property litigation; additional capital that we may require in the

future may not be available to us, or only available to us on

unfavorable terms; our extensive international operations; our

ability to attract and retain key employees; failure of a key

information technology system, process or site and a breach of

information security; our ability to manage the implementation of a

new global enterprise resource planning system; our ability to

integrate and realize the anticipated benefits of acquisitions in

full or at all or within the expected timeframes, including the

acquisition of Wright; and our ability to realize anticipated cost

savings. Additional information concerning these and other factors

is contained in our filings with the U.S. Securities and Exchange

Commission, including our Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q.

About Stryker

Stryker is one of the world’s leading medical technology

companies and, together with its customers, is driven to make

healthcare better. The company offers innovative products and

services in Orthopaedics, Medical and Surgical, and Neurotechnology

and Spine that help improve patient and hospital outcomes.

For investor inquiries please contact:

Katherine Owen, Vice President, Strategy & Investor Relations at 269-385-2600 or katherine.owen@stryker.com

For media inquiries please contact:

Yin Becker, Vice President, Communications, Public Affairs and Corporate Marketing at 269-385-2600 or yin.becker@stryker.com

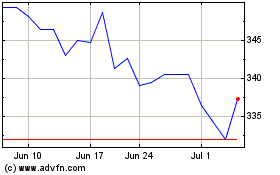

Stryker (NYSE:SYK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Stryker (NYSE:SYK)

Historical Stock Chart

From Nov 2023 to Nov 2024