Spruce Power Announces $130 Million Debt Financing

July 01 2024 - 7:30AM

Business Wire

Spruce Power Holding Corporation (NYSE: SPRU) (“Spruce” or the

“Company”), a leading owner and operator of distributed solar

energy assets across the United States, today announced that

certain of its subsidiaries have closed on a $130 million

non-recourse debt facility (the “New Debt Facility”) provided by

Barings LLC (“Barings”). The New Debt Facility refinances the

Company’s term loan of $125 million (the “SP4 Facility”) and

provides for a net injection of incremental capital.

“Spruce is proud to announce the execution and closing of the

refinance of its SP4 Facility. This transaction achieves a

favorable balance of capitalizing on the Company’s strong asset

performance and retention of asset level cash flows for our

shareholders,” said Joe Pettit, Spruce’s VP of Corporate

Development. “Additionally, I’m pleased to announce a new

relationship with Barings, who brings deep industry expertise that

is supportive of Spruce’s mission to power our customers’ clean and

efficient energy use.”

“We are pleased to start a great partnership with Spruce to

support the Company’s innovative business model and growth

trajectory, as we seek to deliver attractive risk-adjusted returns

to our clients,” said Burak Cetin, Barings’ Managing Director and

Head of Private Residential and Consumer Asset Finance.

The $130 million New Debt Facility was rated A+ by Kroll and

priced at a fixed loan rate of 6.889%. The initial balance of the

New Debt Facility represents a 69% advance rate of ADSAB

(contracted cash flows available for debt service discounted at

6%).

The New Debt Facility’s collateral pool consists of cash flows

from over 22,000 solar contracts (the “Spruce Power 4 Portfolio”),

the majority of which are variable rate PPAs indexed to retail

electric rates of California investor-owned utilities. Since its

acquisition in March 2023, rapidly rising retail electric pricing

in California and other geographies across the Spruce Power 4

Portfolio has resulted in ADSAB accretion, and looking ahead, the

Company expects continued strong performance of variable rate PPAs

underlying the Spruce Power 4 Portfolio.

The refinancing transaction provides for an injection of

incremental capital into the Company of over $6 million, net of

fees and inclusive of positive value realized in the simultaneous

termination of interest rate swaps underlying the SP4 Facility.

Santander US Capital Markets LLC served as the sole structuring

agent.

About Spruce Power

Spruce Power Holding Corporation (NYSE: SPRU) is a leading owner

and operator of distributed solar energy assets across the United

States. We provide subscription-based services that make it easy

for homeowners to benefit from rooftop solar power and battery

storage. Our power as-a-service model allows consumers to access

new technology without making a significant upfront investment or

incurring maintenance costs. Our company owns the cash flows from

over 75,000 home solar assets and contracts across the United

States. For additional information, please visit

www.sprucepower.com.

About Barings LLC

Barings is a $406+ billion* global investment manager sourcing

differentiated opportunities and building long-term portfolios

across public and private fixed income, real estate, and specialist

equity markets. With investment professionals based in North

America, Europe and Asia Pacific, the firm, a subsidiary of

MassMutual, aims to serve its clients, communities and employees,

and is committed to sustainable practices and responsible

investment. Learn more at www.barings.com.

*Assets under management as of March 31, 2024

Forward Looking Statements

Certain statements in this press release may constitute

“forward-looking statements” within the meaning of the federal

securities laws. Forward-looking statements can be identified by

the use of forward-looking words or phrases such as “anticipate,”

“believe,” “could,” “expect,” “intends,” “may,” “opportunity,”

“plans,” “goals,” “target” “predict,” “potential,” “estimate,”

“should,” “will,” “would,” “continue,” “likely” or the negative of

these terms or other words of similar meaning. These statements are

based upon our current plans and strategies and reflect our current

assessment of the risks and uncertainties. Forward-looking

statements in this release include statements regarding the future

direction of the Company and growth opportunities. These statements

are based on various assumptions, whether or not identified in this

press release and on the current expectations of management, and

are not predictions of actual performance. Forward-looking

statements are subject to a number of risks and uncertainties that

could cause actual results to differ materially from the

forward-looking statements, including but not limited to:

expectations regarding the growth of the solar industry, home

electrification, electric vehicles and distributed energy

resources; the ability to successfully integrate XL Fleet and

Spruce; the ability to identify and complete future acquisitions;

the ability to develop and market new products and services; the

effects of pending and future legislation; the highly competitive

nature of the Company’s business and markets; the ability to

execute on and consummate business plans in anticipated time

frames; litigation, complaints, product liability claims,

government investigations and/or adverse publicity; cost increases

or shortages in the components or chassis necessary to support the

Company’s products and services; the introduction of new

technologies; the impact of natural disasters and other events

beyond our control, such as hurricanes, wildfires or pandemics, on

the Company’s business, results of operations, financial condition,

regulatory compliance and customer experience; privacy and data

protection laws, privacy or data breaches, or the loss of data;

general economic, financial, legal, political and business

conditions and changes in domestic and foreign markets; risks

related to the rollout of the Company’s business and the timing of

expected business milestones; the effects of competition on the

Company’s future business; the availability of capital; and the

other risks discussed under the heading “Risk Factors” in the

Company’s Annual Report on Form 10 K for the year ended December

31, 2023 filed with the SEC on April 9, 2024, subsequent Quarterly

and Annual Reports on Form 10-Q and Form 10-K, respectively, and

other documents that the Company files with the SEC in the future.

If any of these risks materialize or our assumptions prove

incorrect, actual results could differ materially from the results

implied by these forward-looking statements. These forward-looking

statements speak only as of the date hereof and the Company

specifically disclaims any obligation to update these

forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240701266202/en/

For More Information Investor Contact:

investors@sprucepower.com Head of Investor Relations: Bronson

Fleig

Media Contact: publicrelations@sprucepower.com

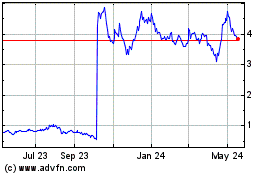

Spruce Power (NYSE:SPRU)

Historical Stock Chart

From Oct 2024 to Nov 2024

Spruce Power (NYSE:SPRU)

Historical Stock Chart

From Nov 2023 to Nov 2024