Spectrum Brands and the DOJ Reach a Settlement Regarding the HHI Acquisition

May 05 2023 - 7:40PM

Business Wire

Spectrum Brands Holdings, Inc. (NYSE: SPB, “Spectrum Brands” or

the “Company”), a leading global branded consumer products and home

essentials company focused on driving innovation and providing

exceptional customer service, today announced that it has agreed to

a stipulation with the U.S. Department of Justice (the “DOJ”) to

settle the DOJ’s challenge of ASSA ABLOY’s acquisition of the

Company’s Hardware and Home Improvement segment (“HHI”).

As previously announced, on September 8, 2021, Spectrum Brands

announced an agreement to sell HHI to ASSA ABLOY for $4.3 billion

in cash, subject to customary adjustments. On September 15, 2022,

the DOJ filed a lawsuit to block the closing of the HHI sale. On

December 2, 2022, ASSA ABLOY announced an agreement to sell its

Emtek and the Smart Residential Business in the U.S. and Canada to

Fortune Brands, a strong and experienced player in the home

hardware and security markets.

David Maura, the Company’s Chief Executive Officer, said, “We

are very pleased to have reached agreement with the DOJ, which is a

critical milestone toward putting HHI in the hands of ASSA ABLOY,

who we believe will enhance HHI’s ability to bring consumers better

innovation and product choice.”

The closing of the transaction is subject to satisfaction of

customary closing conditions. Approval of the Mexican competition

authority is the only outstanding regulatory approval. The Company

continues to expect to close this transaction on or prior to June

30, 2023.

About Spectrum Brands

Spectrum Brands Holdings is a home-essentials company with a

mission to make living better at home. We focus on delivering

innovative products and solutions to consumers for use in and

around the home through our trusted brands. We are a leading

supplier of specialty pet supplies, lawn and garden and home pest

control products, personal insect repellents, shaving and grooming

products, personal care products, and small household appliances.

Helping to meet the needs of consumers worldwide, Spectrum Brands

offers a broad portfolio of market-leading, well-known and widely

trusted brands including Tetra®, DreamBone®, SmartBones®, Nature’s

Miracle®, 8-in-1®, FURminator®, Healthy-Hide®, Good Boy®, Meowee!®,

OmegaOne®, Spectracide®, Cutter®, Repel®, Hot Shot®, Rejuvenate®,

Black Flag®, Liquid Fence®, Remington®, George Foreman®, Russell

Hobbs®, Black+Decker®, PowerXL®, Emeril Lagasse®, and Copper Chef®.

For more information, please visit www.spectrumbrands.com. Spectrum

Brands – A Home Essentials Company™.

Forward Looking Statements

Certain matters discussed in this press release may be

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. We have tried, whenever

possible, to identify these statements by using words like

“future,” “anticipate”, “intend,” “plan,” “estimate,” “believe,”

“expect,” “project,” “forecast,” “could,” “would,” “should,”

“will,” “may,” and similar expressions of future intent or the

negative of such terms. These statements are based upon our current

expectations of future events and projections and are subject to a

number of risks and uncertainties, many of which are beyond our

control and some of which may change rapidly, actual results or

outcomes may differ materially from those expressed or implied

herein, and you should not place undue reliance on these

statements. Important factors and uncertainties that could cause

our actual results to differ materially from those expressed or

implied herein include, without limitation: (1) the risk that the

court fails to enter of the agreed stipulation, (2) the risk that

ASSA ABLOY and Fortune fail to satisfy the conditions to closing of

the divestiture transaction and / or otherwise fail to consummate

the divestiture transaction, (3) the ability to consummate the

announced transaction on the expected terms and within the

anticipated time period, or at all, which is dependent on the

parties’ ability to satisfy certain closing conditions and our

ability to realize the benefits of the transaction, including

reducing the leverage of the Company, invest in the organic growth

of the Company, fund any future acquisitions, returning capital to

shareholders, and/or maintain its quarterly dividends; (4) the risk

that regulatory approvals that are required to complete the

proposed transaction may not be received, may take longer than

expected or may impose adverse conditions; (5) our ability to

realize the expected benefits of such transaction and to

successfully separate the divested business; and (6) the other risk

factors set forth in the securities filings of Spectrum Brands

Holdings, Inc. and SB/RH Holdings, LLC, including our fiscal 2022

Annual Report and subsequent Quarterly Reports on Form 10-Q.

Some of the above-mentioned factors are described in further

detail in the sections entitled “Risk Factors” in our annual and

quarterly reports, as applicable. You should assume the information

appearing in this press release is accurate only as of the date

hereof, or as otherwise specified, as our business, financial

condition, results of operations and prospects may have changed

since such date. Except as required by applicable law, including he

securities laws of the United States and the rules and regulations

of the United States Securities and Exchange Commission, we

undertake no obligation to publicly update or revise any

forward-looking statement, whether as a result of new information,

future events or otherwise, to reflect actual results or changes in

factors or assumptions affecting such forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230505005508/en/

Faisal Qadir 608-278-6207

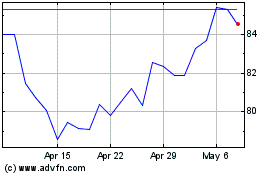

Spectrum Brands (NYSE:SPB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Spectrum Brands (NYSE:SPB)

Historical Stock Chart

From Nov 2023 to Nov 2024