Assa Abloy Proposes Divestments To Settle Competition Concerns Around HHI Acquisition

December 02 2022 - 3:23AM

Dow Jones News

By Dominic Chopping

STOCKHOLM--Swedish lock maker Assa Abloy AB said Friday that it

has agreed to sell certain U.S. and Canadian businesses to settle

competition concerns and clear the way for its acquisition of the

hardware and home-improvement division of Spectrum Brands Holdings

Inc.

Assa Abloy's $4.3 billion acquisition of the HHI division was

announced in September last year but was blocked by the U.S.

Justice Department earlier this year on competition concerns.

Under Friday's deal, Assa Abloy's Emtek and Smart Residential

business in the U.S. and Canada would be sold to Fortune Brands

Home & Security Inc. for $800 million, with the Swedish company

hoping the deal will fully resolve all the competitive concerns

surrounding its proposed HHI acquisition. These businesses

represented sales of about $350 million in 2021, the company

said.

"With Fortune Brands our excellent U.S. and Canadian residential

businesses will get a good and strong home with an experienced

owner," Assa Abloy Chief Executive Nico Delvaux said. "While

keeping these residential businesses in the U.S. and Canada would

have been preferred, we are confident that we have now fully

eliminated all competitive concerns alleged by the DOJ and that the

acquisition of HHI is in the long-term interest of our

shareholders."

The U.S. and Canadian divestments depend on the successful

defense against the DOJ's complaint concerning Assa Abloy's HHI

acquisition, and if successful, the company said it expects both

deals to close during the second quarter of 2023.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

December 02, 2022 03:08 ET (08:08 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

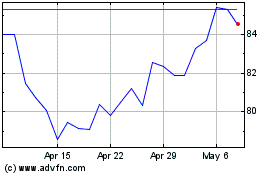

Spectrum Brands (NYSE:SPB)

Historical Stock Chart

From Oct 2024 to Nov 2024

Spectrum Brands (NYSE:SPB)

Historical Stock Chart

From Nov 2023 to Nov 2024