UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-01731

SOURCE

CAPITAL, inc.

(Exact name of registrant as specified in charter)

235 West Galena Street

Milwaukee, Wisconsin 53212

(Address of principal executive offices)(Zip code)

| (Name and Address of Agent for Service) |

Copy to: |

| |

|

|

Maureen Quill

235 West Galena Street

Milwaukee, Wisconsin 53212 |

Laurie Anne Dee

Morgan, Lewis & Bockius LLP

600 Anton Boulevard, Suite 1800

Costa Mesa, California 92626 |

Registrant’s telephone number, including

area code: (626) 385-5777

Date of fiscal year end: December 31

Date of reporting period: June 30, 2023

Item 1: Report to Shareholders.

| (a) | The Report to Shareholders is attached herewith. |

SOURCE CAPITAL, INC.

2023

SEMIANNUAL REPORT

for the six months ended June 30, 2023

(This page has been left blank intentionally.)

SOURCE CAPITAL, INC.

LETTER TO SHAREHOLDERS

DEAR SHAREHOLDERS:

Performance Overview

Source Capital Inc.'s ("Source" or "Fund") net asset value (NAV) gained 4.74% in the second quarter and 12.53% for the trailing twelve months, which is favorable when compared to its two illustrative balanced indices shown below.

Performance Versus Indices1

|

|

|

Q2 2023 |

|

Trailing 12-month |

|

|

Source Capital (NAV) |

|

|

4.74 |

% |

|

|

12.53 |

% |

|

|

Balanced Indices |

|

|

|

|

|

|

60% MSCI ACWI/40% Bloomberg US Agg |

|

|

3.36 |

% |

|

|

9.44 |

% |

|

|

60% S&P 500/40% Bloomberg US Agg |

|

|

4.86 |

% |

|

|

11.24 |

% |

|

|

Equity Index |

|

|

|

|

|

|

MSCI ACWI |

|

|

6.18 |

% |

|

|

16.53 |

% |

|

The Fund's underlying exposure by asset class is captured in the following table:

Portfolio Exposure2

|

|

|

Q2 2023 |

|

|

Equity |

|

|

|

|

Common Stocks* |

|

|

44.1 |

% |

|

|

Common Stocks—SPACs |

|

|

0.0 |

% |

|

|

Total Equity |

|

|

44.1 |

% |

|

|

Credit |

|

|

|

|

Public |

|

|

26.8 |

% |

|

|

Private (Invested assets only) |

|

|

18.8 |

% |

|

|

Total Credit |

|

|

45.6 |

% |

|

|

Other |

|

|

0.2 |

% |

|

|

Cash |

|

|

10.1 |

% |

|

|

Total |

|

|

100.0 |

% |

|

1 Comparison to the indices is for illustrative purposes only. The Fund does not include outperformance of any index or benchmark in its investment objectives. An investor cannot invest directly in an index. No representation is being made that any account, product or strategy will or is likely to achieve profits, losses, or results similar to those shown. Fund shareholders may only invest or redeem their shares at market value (NYSE: SOR), which may be higher or lower than the Fund's net asset value (NAV).

2 Source: FPA, as of June 30, 2023. Portfolio composition will change due to ongoing management of the Fund. Cash includes the non-invested portion of private credit investments. Totals may not add up to 100% due to rounding.

* Includes a 0.1% allocation to the Altaba closed-end fund.

Past results are no guarantee, nor are they indicative, of future results.

1

Portfolio discussion

Equity

There wasn't a unifying theme that drove performance in the last year. In the previous twelve months, Source's top five equity performers contributed 4.32% to its return, while its bottom five detracted 1.24%.

The top equity contributors to and detractors from the Fund's trailing twelve-month returns are listed below.

Trailing Twelve-Month Contributors and Detractors as of June 30, 20233

|

Contributors |

|

Perf.

Cont. |

|

Avg. %

of Port. |

|

Detractors |

|

Perf.

Cont. |

|

Avg. %

of Port. |

|

|

Holcim |

|

|

1.42 |

% |

|

|

2.6 |

% |

|

Int'l Flavors and Fragrances |

|

|

-0.44 |

% |

|

|

1.5 |

% |

|

|

Broadcom |

|

|

0.95 |

% |

|

|

1.6 |

% |

|

EPIC Games |

|

|

-0.36 |

% |

|

|

0.5 |

% |

|

|

Analog Devices |

|

|

0.81 |

% |

|

|

2.4 |

% |

|

Charter Communications |

|

|

-0.19 |

% |

|

|

0.7 |

% |

|

|

Meta Platforms |

|

|

0.57 |

% |

|

|

0.7 |

% |

|

Open Text |

|

|

-0.14 |

% |

|

|

0.2 |

% |

|

|

TE Connectivity |

|

|

0.56 |

% |

|

|

2.1 |

% |

|

McDermott (multiple securities) |

|

|

-0.12 |

% |

|

|

0.1 |

% |

|

|

|

|

|

4.32 |

% |

|

|

9.4 |

% |

|

|

|

|

-1.24 |

% |

|

|

2.9 |

% |

|

Of the contributors and detractors listed, we haven't recently addressed Open Text and Broadcom. We have discussed most of the other positions in the last year, which you can find in our archived commentaries.

Open Text was a relatively short-lived holding in comparison to our typical time frame. We were attracted to this Canadian-based provider of enterprise software due to its stable revenue stream. More than 80% of Open Text's revenue was recurring, which helped deliver attractive mid-30s EBITDA margins. We considered the business to have a sticky customer base that included 97 of the 100 largest companies in the world. Purchased at a low double-digit multiple to after-tax free cash flow, we expected to own the company for years, with capital deployment going towards dividends, buybacks, and small bolt-on acquisitions, as it had in the past. Unfortunately, to our surprise, while we owned the stock, Open Text announced a relatively large acquisition in the form of UK-based Micro Focus. Familiar with the target, we were unenthused about both the asset and increased debt on the balance sheet from funding the purchase, so we chose to exit stage left rather than try to re-write our investment thesis.4

In contrast to our short-lived ownership of Open Text, Broadcom has been a holding for just short of five years. At the time of our original purchase, the company was primarily focused on driving organic growth in its existing semiconductor franchises and acquiring new ones when the opportunity presented itself. As potential acquisition candidates in the industry became scarce, management, led by highly regarded Hock Tan, pivoted to set their sights on the software industry, culminating in several acquisitions. Unlike Open Text, in this instance, after multiple discussions with senior management, we found ourselves comfortable with the company's new strategy after re-examining the investment implications. We are glad we did, as it would be an understatement to say that Broadcom has gone from strength to strength over the past five years, improving operating margins, aggressively repurchasing shares, and increasing the dividend, all the while continuing to execute its M&A strategy flawlessly.

"Risk on" in 2023 has replaced the fear that drove markets lower in 2022. How much of this rebound will ultimately be supported by corporate earnings has yet to be seen. While there is always something to fear, we prefer to focus on the future prospects of the businesses we own. Focusing on the destination makes the big potholes in the road feel more like small speed bumps and prevents us from executing panicked driving maneuvers.

Looking back at the past 18 months, there was certainly no shortage of opportunities to take down risk exposure as macro concerns, from interest rates to war, seemed to grow by the day. But as in prior market declines, we attempted to lean into the market and add to either new or existing names where our estimates of the risk/reward improved with each leg down. While we will never get it perfectly right, using the blended 60% MSCI ACWI / 40% Bloomberg US Agg as a proxy, in the downturn from January 5, 2022 through the market low of October 12, 2022, Source experienced a drop in value of 13.76%. While not ideal, this was more palatable than the blended index 21.62% decline in the same period. Including the decline, the Fund's recovery also puts us in the plus column (+0.63%), as compared to the blended index, which is still in the red (-8.33%).5

3 Reflects the top five contributors and detractors to the Fund's performance based on contribution to return for the trailing twelve months ("TTM"). Contribution is presented gross of investment management fees, transactions costs, and Fund operating expenses, which if included, would reduce the returns presented. The information provided does not reflect all positions purchased, sold or recommended by FPA during the quarter. A copy of the methodology used and a list of every holding's contribution to the overall Fund's performance during the TTM is available by contacting FPA Client Service at crm@fpa.com. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities listed.

4 Source: www.investors.opentext.com/press-releases; OpenText to Acquire Micro Focus International plc; August 25, 2022.

5 Source: Morningstar. The recovery performance noted is cumulative for the period January 5, 2022 through June 30, 2023.

Past results are no guarantee, nor are they indicative, of future results.

2

Looking forward, we do not offer a market forecast or make predictions about interest rates, the economy, or other significant macro issues because we don't know anyone who can do so consistently (ourselves included). We submit the following to show the futility of forecasting. In the last eighteen years, the consensus view only expected the market to increase, yet it declined 22% of the time. Further, the Wall Street consensus estimate of how the S&P 500 will perform (ex-dividends) in the next twelve months, from 2005 to 2022, usually missed the mark, often by quite a lot – 53.6% and 28.9% too high in 2008 and 2022; and 16.9% and 21.0% too low in 2013 and 2021. On average, the "experts" missed by 11.4%, quite a lot, particularly when compared to the S&P's 6.6% annualized return (before dividends) over the same period. We, therefore, direct our efforts from the bottom up rather than the top down.

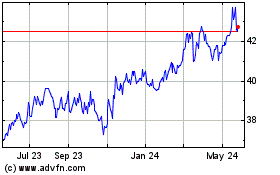

S&P 500 Actual vs Wall Street Analysts' Forecasted Returns Ex-Dividends6

Fixed Income

Traditional

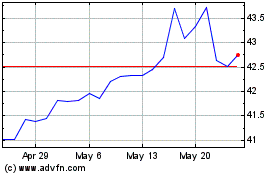

What we can see clearly, though, is that yields are still near decade-plus highs, as shown by the following charts which shows the BB component of the high-yield index, excluding energy, an index we believe is a better indicator of high-yield bond pricing because it excludes both "noise" related to the more volatile energy sector and changes in ratings composition in the overall high-yield index over time.

6 Source: Bloomberg; Chart shows actual S&P 500 price returns excluding dividends minus Wall Street analyst estimates. Chart period is 2005-2022.

Past performance is no guarantee, nor is it indicative, of future results.

3

Bloomberg US Corporate High-Yield BB excluding Energy7

While the market vacillates about the direction of the economy, yields remain higher than they have been in over a decade. Having said that, the market for high yield rated debt is generally not as attractive, particularly since spreads have recently decreased. We continue to search for attractive opportunities, but we often find that potential absolute returns are insufficient compared to the potential for permanent impairment of capital. We also often find that the extra return over highly rated debt that lower rated debt offers is insufficient in comparison to the incremental risk of permanent impairment of capital borne by lower rated debt.

Private Credit

Source's allocation to private credit remains high. If all commitments were drawn today, that exposure would be 27.1%. The Fund's investments in private partnerships and individual loans have a targeted net yield of at least 8% which should benefit Source's distributable yield.

Corporate and Other Matters

Distribution and Yield

On May 8, 2023, the Fund's Board approved increasing the Fund's regular monthly distribution to the current rate of 20.83 cents per share through August 2023.8 This equates to an annualized 6.52% unlevered distribution rate based on the Fund's closing market price on June 30, 2023.

Share Buyback

The Fund repurchased 31,638 shares during the quarter, representing 0.38% of the outstanding shares, at an average price of $37.27 per share and at an average discount to NAV of 11.02%.9

7 Source: Bloomberg. As of June 30, 2023. YTW is Yield-to-Worst. Spread reflects the quoted spread of a bond that is relative to the security off which it is priced, typically an on the-run treasury.

8 For more information related to the Fund's distribution rate, please see the press release dated May 8, 2023 https://fpa.com/docs/default-source/funds/source-capital/literature/2023-05-08_source-capital-press-release---may-2023-clean.pdf?sfvrsn=583f9f9d_8. Dividends and other distributions are not guaranteed.

9 For more information related to the Fund's share repurchase program, please see the press release dated January 4, 2022 (https://fpa.com/docs/default-source/fpa-news-documents/2022-01-04_source-capital-jan-2022-final.pdf?sfvrsn=4a01909d_6).

Past performance is no guarantee, nor is it indicative, of future results.

4

Closing

Co-portfolio manager, Steven Romick reflected on his last thirty-eight years in a recent speech at the Morningstar Conference titled "Evolution of a Value Investor," available on our website, www.fpa.com. He also wrote a chapter introduction for the new 7th Edition of Graham & Dodd's Security Analysis.

Respectfully submitted,

Source Capital Portfolio Management Team

August 16, 2023

5

Important Disclosures

This Commentary is for informational and discussion purposes only and does not constitute, and should not be construed as, an offer or solicitation for the purchase or sale with respect to any securities, products or services discussed, and neither does it provide investment advice. This Commentary does not constitute an investment management agreement or offering circular.

On December 1, 2015, a new portfolio management team assumed management of the Fund and the Fund transitioned to a balanced strategy. Performance prior to December 1, 2015 reflects the performance of the prior portfolio manager and investment strategy and is not indicative of performance for any subsequent periods.

Current performance information is updated monthly and is available by calling 1-800-982-4372 or by visiting www.fpa.com. Performance data quoted represents past performance, which is no guarantee of future results. Current performance may vary from the performance quoted. The returns shown for Source Capital are calculated at net asset value per share, including reinvestment of all distributions. Returns do not reflect the deduction of taxes that a shareholder would pay on Fund distributions, which would lower these figures. Since Source Capital is a closed-end investment company and its shares are bought and sold on the New York Stock Exchange, your performance may also vary based upon the market price of the common stock.

The Fund is managed according to its investment strategy which may differ significantly in terms of security holdings, industry weightings, and asset allocation from those of the comparative indices. Overall Fund performance, characteristics and volatility may differ from the comparative indices shown.

There is no guarantee the Fund's investment objectives will be achieved. You should consider the Fund's investment objectives, risks, and charges and expenses carefully before you invest. You can obtain additional information by visiting the website at www.fpa.com, by email at crm@fpa.com, toll free by calling 1-800-279-1241 (option 1), or by contacting the Fund in writing.

The views expressed herein and any forward-looking statements are as of the date of this publication and are those of the portfolio management team. Future events or results may vary significantly from those expressed and are subject to change at any time in response to changing circumstances and industry developments. This information and data has been prepared from sources believed reliable, but the accuracy and completeness of the information cannot be guaranteed and is not a complete summary or statement of all available data.

Portfolio composition will change due to ongoing management of the Fund. References to individual financial instruments or sectors are for informational purposes only and should not be construed as recommendations by the Fund or the portfolio managers. It should not be assumed that future investments will be profitable or will equal the performance of the financial instrument or sector examples discussed. The portfolio holdings as of the most recent quarter-end may be obtained at www.fpa.com.

Investing in closed-end funds involves risk, including loss of principal. Closed-end fund shares may frequently trade at a discount (less than) or premium (more than) to their net asset value. If the Fund's shares trade at a premium to net asset value, there is no assurance that any such premium will be sustained for any period of time and will not decrease, or that the shares will not trade at a discount to net asset value thereafter.

Capital markets are volatile and can decline significantly in response to adverse issuer, political, regulatory, market, or economic developments. It is important to remember that there are risks inherent in any investment and there is no assurance that any investment or asset class will provide positive performance over time.

The Fund may purchase foreign securities, including American Depository Receipts (ADRs) and other depository receipts, which are subject to interest rate, currency exchange rate, economic and political risks; these risks may be heightened when investing in emerging markets. Non-U.S. investing presents additional risks, such as the potential for adverse political, currency, economic, social or regulatory developments in a country, including lack of liquidity, excessive taxation, and differing legal and accounting standards. Non-U.S. securities, including American Depository Receipts (ADRs) and other depository receipts, are also subject to interest rate and currency exchange rate risks.

The return of principal in a fund that invests in fixed income instruments is not guaranteed. The Fund's investments in fixed income instruments have the same issuer, interest rate, inflation and credit risks that are associated with underlying fixed income instruments owned by the Fund. Such investments may be secured, partially secured or unsecured and may be unrated, and whether or not rated, may have speculative characteristics. The market price of the Fund's fixed income investments will change in response to changes in interest rates and other factors.

Generally, when interest rates go up, the value of fixed income instruments, such as bonds, typically go down (and vice versa) and investors may lose principal value. Credit risk is the risk of loss of principle due to the issuer's failure to repay a loan. Generally, the lower the quality rating of an instrument, the greater the risk that the issuer will fail to pay interest fully and return principal in a timely manner. If an issuer defaults, the security may lose some or all its value. Lower rated bonds, convertible securities and other types of debt obligations involve greater risks than higher rated bonds.

6

Mortgage securities and collateralized mortgage obligations (CMOs) are subject to prepayment risk and the risk of default on the underlying mortgages or other assets; such derivatives may increase volatility. Convertible securities are generally not investment grade and are subject to greater credit risk than higher-rated investments. High yield securities can be volatile and subject to much higher instances of default. The Fund may experience increased costs, losses and delays in liquidating underlying securities should the seller of a repurchase agreement declare bankruptcy or default.

The ratings agencies that provide ratings are Standard and Poor's, Moody's, and Fitch. Credit ratings range from AAA (highest) to D (lowest). Bonds rated BBB or above are considered investment grade. Credit ratings of BB and below are lower-rated securities (junk bonds). High-yielding, non-investment grade bonds (junk bonds) involve higher risks than investment grade bonds. Bonds with credit ratings of CCC or below have high default risk.

Private placement securities are securities that are not registered under the federal securities laws, and are generally eligible for sale only to certain eligible investors. Private placements may be illiquid, and thus more difficult to sell, because there may be relatively few potential purchasers for such investments, and the sale of such investments may also be restricted under securities laws.

The Fund may use leverage. While the use of leverage may help increase the distribution and return potential of the Fund, it also increases the volatility of the Fund's net asset value (NAV), and potentially increases volatility of its distributions and market price. There are costs associated with the use of leverage, including ongoing dividend and/or interest expenses. There also may be expenses for issuing or administering leverage. Leverage changes the Fund's capital structure through the issuance of preferred shares and/or debt, both of which are senior to the common shares in priority of claims. If short-term interest rates rise, the cost of leverage will increase and likely will reduce returns earned by the Fund's common stockholders.

Value style investing presents the risk that the holdings or securities may never reach their full market value because the market fails to recognize what the portfolio management team considers the true business value or because the portfolio management team has misjudged those values. In addition, value style investing may fall out of favor and underperform growth or other styles of investing during given periods.

Investing in Special Purpose Acquisition Companies ("SPACS") involves risks. Because SPACs and similar entities have no operating history or ongoing business other than seeking acquisitions, the value of their securities is particularly dependent on the ability of the entity's management to identify and complete a profitable acquisition. SPACs are not required to provide the depth of disclosures or undergo the rigorous due diligence of a traditional initial public offering (IPO). Investors in SPACs may become exposed to speculative investments, foreign or domestic, in higher risk sectors/industries. SPAC investors generally pay certain fees and give the sponsor certain incentives (e.g., discounted ownership stakes) not found in traditional IPOs. Due to this, an investment in a SPAC may include potential conflicts and the potential for misalignment of incentives in the structure of the SPAC. For more information relating to the risks of investing in SPACs please refer to the Fund's offering documents or FPA's Form ADV Part 2A.

Distribution Rate

Distributions may include ordinary income, net capital gains and/or returns of capital. Generally, a return of capital would occur when the amount distributed by the Fund includes a portion of (or is comprised entirely of) your investment in the Fund in addition to (or rather than) your pro-rata portion of the Fund's net income or capital gains. The Fund's distributions in any period may be more or less than the net return earned by the Fund on its investments, and therefore should not be used as a measure of performance or confused with "yield" or "income." A return of capital is not taxable; rather it reduces a shareholder's tax basis in his or her shares of the Fund. If the Fund estimates that a portion of its distribution may be comprised of amounts from sources other than net investment income, the Fund will notify shareholders of the estimated composition of such distribution through a separate written Section 19 notice. Such notices are provided for informational purposes only, and should not be used for tax reporting purposes. Final tax characteristics of all Fund distributions will be provided on Form 1099-DIV, which is mailed after the close of the calendar year.

The Fund's distribution rate may be affected by numerous factors, including changes in realized and projected market returns, Fund performance, and other factors. There can be no assurance that a change in market conditions or other factors will not result in a change in the Fund's distribution rate at a future time.

Index Definitions

Comparison to any index is for illustrative purposes only and should not be relied upon as a fully accurate measure of comparison. The Fund may be less diversified than the indices noted herein, and may hold non-index securities or securities that are not comparable to those contained in an index. Indices will hold positions that are not within the Fund's investment strategy. Indices are unmanaged and do not reflect any commissions, transaction costs, or fees and expenses which would be incurred by an investor purchasing the underlying securities and which would reduce the performance in an actual account. You cannot invest directly in an index. The Fund does not include outperformance of any index in its investment objectives.

S&P 500 Index includes a representative sample of 500 hundred companies in leading industries of the U.S. economy. The Index focuses on the large-cap segment of the market, with over 80% coverage of U.S. equities, but is also considered a proxy for the total market.

7

MSCI ACWI Index is a free float-adjusted market capitalization weighted index that is designed to represent performance of the full opportunity set of large- and mid-cap stocks across developed and emerging markets. Net Return indicates that this series approximates the minimum possible dividend reinvestment. The dividend is reinvested after deduction of withholding tax, applying the rate applicable to non-resident individuals who do not benefit from double taxation treaties.

60% S&P 500 / 40% Bloomberg US Aggregate Bond Index is a hypothetical combination of unmanaged indices and comprises 60% S&P 500 Index and 40% Bloomberg Barclays US Aggregate Bond Index.

60% MSCI ACWI / 40% Bloomberg US Aggregate Bond Index is a hypothetical combination of unmanaged indices and comprises 60% MSCI ACWI Index and 40% Bloomberg Barclays US Aggregate Bond Index.

Consumer Price Index (CPI) is an unmanaged index representing the rate of the inflation of U.S. consumer prices as determined by the U.S. Department of Labor Statistics. The CPI is presented to illustrate the Fund's purchasing power against changes in the prices of goods as opposed to a benchmark, which is used to compare the Fund's performance. There can be no guarantee that the CPI will reflect the exact level of inflation at any given time.

Bloomberg US Aggregate Bond Index provides a measure of the performance of the US investment grade bonds market, which includes investment grade US Government bonds, investment grade corporate bonds, mortgage pass-through securities and asset-backed securities that are publicly offered for sale in the United States. The securities in the Index must have at least 1-year remaining in maturity. In addition, the securities must be denominated in US dollars and must be fixed rate, nonconvertible, and taxable.

Bloomberg US High Yield Index ex. Energy measures the market of USD-denominated, non-investment grade, fixed-rate, taxable corporate bonds excluding Energy sector.

Other Definitions

After-tax free cash flow or Cash flow after taxes (CFAT) is a measure of financial performance that shows a company's ability to generate cash flow through its operations. It is calculated by adding back non-cash charges such as amortization, depreciation, restructuring costs, and impairment to net income.

EBITDA, or earnings before interest, taxes, depreciation, and amortization, is an alternate measure of profitability to net income.

EBITDA margin is a measure of a company's operating profit as a percentage of its revenue.

Credit Spread is the difference in yield between a U.S. Treasury bond and another debt security of the same maturity but different credit quality.

Discount to Net Asset Value (NAV) is a pricing situation when an exchange-trade fund (ETF) or mutual fund's market trading price is lower than its daily net asset value (NAV).

High Yield (HY) bond is a high paying bond with a lower credit rating (S&P and Fitch, BB+ and lower; Moody's, Ba1 or lower) than investment-grade corporate bonds, Treasury bonds and municipal bonds. Because of the higher risk of default, these bonds pay a higher yield than investment grade bonds.

Investment Grade (IG) is a rating (S&P and Fitch, BBB- and higher; Moody's Baa3 and higher) that indicates that a bond has a relatively low risk of default.

Inflation is the decline of purchasing power of a given currency over time. A quantitative estimate of the rate at which the decline in purchasing power occurs can be reflected in the increase of an average price level of a basket of selected goods and services in an economy over some period.

Net Asset Value (NAV) represents the net value of a mutual fund and is calculated as the total value of the fund's assets minus the total value of its liabilities, and is shown as a per share price.

Risk Assets is any asset that carries a degree of risk. Risk asset generally refers to assets that have a significant degree of price volatility, such as equities, commodities, high-yield bonds, real estate and currencies, but does not include cash and cash equivalents.

Standard Deviation is a measure of the dispersion of a set of data from its mean.

Yield is the discount rate that links the bond's cash flows to its current dollar price.

Yield to Maturity is the rate of return anticipated on a bond if held until the end of its lifetime. YTM is considered a long-term bond yield expressed as an annual rate. The YTM calculation takes into account the bond's current market price, par value, coupon interest rate and time to maturity. It is also assumed that all coupon payments are reinvested at the same rate as the bond's current yield.

Yield to Worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. It is a type of yield that is referenced when a bond has provisions that would allow the issuer to close it out before it matures.

8

Volatility is a statistical measure of the dispersion of returns for a given security or market index. In most cases, the higher the volatility, the riskier the security. Volatility is often measured as either the standard deviation or variance between returns from that same security or market index.

©2023 Morningstar, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted by Morningstar to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

You can obtain additional information by visiting the website at www.fpa.com, by email at crm@fpa.com, toll free by calling 1-800-279-1241, or by contacting the Fund in writing.

9

SOURCE CAPITAL, INC.

PORTFOLIO SUMMARY

June 30, 2023

(Unaudited)

|

Common Stocks |

|

|

|

|

44.0 |

% |

|

|

Semiconductor Devices |

|

|

4.9 |

% |

|

|

|

|

Internet Media |

|

|

4.0 |

% |

|

|

|

|

Industrial Distribution & Rental |

|

|

3.8 |

% |

|

|

|

|

Cable & Satellite |

|

|

3.2 |

% |

|

|

|

|

Cement & Aggregates |

|

|

3.1 |

% |

|

|

|

|

Electrical Components |

|

|

2.3 |

% |

|

|

|

|

Application Software |

|

|

2.2 |

% |

|

|

|

|

P&C Insurance |

|

|

2.1 |

% |

|

|

|

|

Insurance Brokers |

|

|

1.7 |

% |

|

|

|

|

Diversified Banks |

|

|

1.6 |

% |

|

|

|

|

Chemicals |

|

|

1.5 |

% |

|

|

|

|

Banks |

|

|

1.5 |

% |

|

|

|

|

Investment Companies |

|

|

1.3 |

% |

|

|

|

|

Base Metals |

|

|

1.3 |

% |

|

|

|

|

Beverages |

|

|

1.1 |

% |

|

|

|

|

Food Services |

|

|

1.1 |

% |

|

|

|

|

E-Commerce Discretionary |

|

|

0.9 |

% |

|

|

|

|

Apparel, Footwear & Accessory Design |

|

|

0.8 |

% |

|

|

|

|

Integrated Utilities |

|

|

0.8 |

% |

|

|

|

|

Midstream — Oil & Gas |

|

|

0.8 |

% |

|

|

|

|

Hotels, Restaurants & Leisure |

|

|

0.7 |

% |

|

|

|

|

Railroad Rolling Stock |

|

|

0.7 |

% |

|

|

|

|

Automotive Retailers |

|

|

0.5 |

% |

|

|

|

Commercial & Residential Building

Equipment & Systems |

|

|

0.5 |

% |

|

|

|

|

Entertainment Content |

|

|

0.3 |

% |

|

|

|

|

Industrials |

|

|

0.3 |

% |

|

|

|

|

Energy |

|

|

0.3 |

% |

|

|

|

|

Real Estate Owners & Developers |

|

|

0.3 |

% |

|

|

|

|

Health Care Services |

|

|

0.3 |

% |

|

|

|

|

Oil & Gas Services & Equipment |

|

|

0.1 |

% |

|

|

|

|

Retailing |

|

|

0.0 |

% |

|

|

|

|

Financials |

|

|

0.0 |

% |

|

|

|

|

Special Purpose Acquisition Companies |

|

|

|

|

0.0 |

% |

|

|

Limited Partnerships |

|

|

|

|

12.6 |

% |

|

|

Preferred Stocks |

|

|

|

|

0.1 |

% |

|

|

Closed End Fund |

|

|

|

|

0.1 |

% |

|

|

Warrants |

|

|

|

|

0.1 |

% |

|

|

Bonds & Debentures |

|

|

|

|

33.0 |

% |

|

|

Asset-Backed Securities |

|

|

14.1 |

% |

|

|

|

|

Corporate Bonds & Notes |

|

|

9.6 |

% |

|

|

|

|

Corporate Bank Debt |

|

|

6.2 |

% |

|

|

|

|

Convertible Bonds |

|

|

2.8 |

% |

|

|

|

|

Commercial Mortgage-Backed Securities |

|

|

0.3 |

% |

|

|

|

|

Short-term Investments |

|

|

|

|

10.4 |

% |

|

|

Other Assets And Liabilities, Net |

|

|

|

|

(0.3 |

)% |

|

|

Net Assets |

|

|

|

|

100.0 |

% |

|

10

SOURCE CAPITAL, INC.

PORTFOLIO OF INVESTMENTS

June 30, 2023

(Unaudited)

|

COMMON STOCKS |

|

Shares |

|

Fair Value |

|

|

SEMICONDUCTOR DEVICES — 4.9% |

|

|

Analog Devices, Inc. |

|

|

47,743 |

|

|

$ |

9,300,814 |

|

|

|

Broadcom, Inc. |

|

|

5,194 |

|

|

|

4,505,431 |

|

|

|

NXP Semiconductors NV (Netherlands) |

|

|

16,423 |

|

|

|

3,361,460 |

|

|

|

|

|

$ |

17,167,705 |

|

|

|

INTERNET MEDIA — 4.0% |

|

|

Alphabet, Inc. Class A(a) |

|

|

33,745 |

|

|

$ |

4,039,276 |

|

|

|

Alphabet, Inc. Class C(a) |

|

|

24,872 |

|

|

|

3,008,766 |

|

|

|

Meta Platforms, Inc. Class A(a) |

|

|

14,010 |

|

|

|

4,020,590 |

|

|

|

Naspers Ltd. N Shares (South Africa) |

|

|

17,364 |

|

|

|

3,135,830 |

|

|

|

|

|

$ |

14,204,462 |

|

|

|

INDUSTRIAL DISTRIBUTION & RENTAL — 3.8% |

|

|

Ferguson PLC (Britain) |

|

|

21,507 |

|

|

$ |

3,383,266 |

|

|

|

Howmet Aerospace, Inc. |

|

|

52,710 |

|

|

|

2,612,308 |

|

|

|

LG Corp. (South Korea) |

|

|

44,825 |

|

|

|

2,993,663 |

|

|

|

Safran SA (France) |

|

|

28,560 |

|

|

|

4,470,885 |

|

|

|

|

|

$ |

13,460,122 |

|

|

|

CABLE & SATELLITE — 3.2% |

|

|

Charter Communications, Inc. Class A(a) |

|

|

5,983 |

|

|

$ |

2,197,975 |

|

|

|

Comcast Corp. Class A |

|

|

215,600 |

|

|

|

8,958,180 |

|

|

|

|

|

$ |

11,156,155 |

|

|

|

CEMENT & AGGREGATES — 3.1% |

|

|

Heidelberg Materials AG (Germany) |

|

|

22,256 |

|

|

$ |

1,826,289 |

|

|

|

Holcim AG (Switzerland)(a) |

|

|

135,721 |

|

|

|

9,128,433 |

|

|

|

|

|

$ |

10,954,722 |

|

|

|

ELECTRICAL COMPONENTS — 2.3% |

|

|

TE Connectivity Ltd. (Switzerland) |

|

|

57,280 |

|

|

$ |

8,028,365 |

|

|

|

|

|

$ |

8,028,365 |

|

|

|

APPLICATION SOFTWARE — 2.2% |

|

|

Activision Blizzard, Inc.(a) |

|

|

28,324 |

|

|

$ |

2,387,713 |

|

|

|

Entain PLC (Isle of Man) |

|

|

48,095 |

|

|

|

776,945 |

|

|

|

Epic Games, Inc.(a)(b)(c)(d) |

|

|

4,347 |

|

|

|

1,278,018 |

|

|

|

Nexon Co. Ltd. (Japan) |

|

|

59,772 |

|

|

|

1,137,903 |

|

|

|

Nintendo Co. Ltd. (Japan) |

|

|

48,093 |

|

|

|

2,180,425 |

|

|

|

|

|

$ |

7,761,004 |

|

|

|

P&C INSURANCE — 2.1% |

|

|

American International Group, Inc. |

|

|

129,280 |

|

|

$ |

7,438,771 |

|

|

|

|

|

$ |

7,438,771 |

|

|

|

INSURANCE BROKERS — 1.7% |

|

|

Aon PLC Class A (Britain) |

|

|

17,019 |

|

|

$ |

5,874,959 |

|

|

|

|

|

$ |

5,874,959 |

|

|

|

DIVERSIFIED BANKS — 1.6% |

|

|

Citigroup, Inc. |

|

|

108,650 |

|

|

$ |

5,002,246 |

|

|

|

Gulfport Energy Corp.(a) |

|

|

8,000 |

|

|

|

840,560 |

|

|

|

|

|

$ |

5,842,806 |

|

|

See accompanying Notes to Financial Statements.

11

SOURCE CAPITAL, INC.

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2023

(Unaudited)

|

COMMON STOCKS (Continued) |

|

Shares |

|

Fair Value |

|

|

CHEMICALS — 1.5% |

|

|

International Flavors & Fragrances, Inc. |

|

|

67,193 |

|

|

$ |

5,347,891 |

|

|

|

|

|

$ |

5,347,891 |

|

|

|

BANKS — 1.5% |

|

|

Wells Fargo & Co. |

|

|

120,510 |

|

|

$ |

5,143,367 |

|

|

|

|

|

$ |

5,143,367 |

|

|

|

INVESTMENT COMPANIES — 1.3% |

|

|

Groupe Bruxelles Lambert NV (Belgium) |

|

|

60,010 |

|

|

$ |

4,725,248 |

|

|

|

|

|

$ |

4,725,248 |

|

|

|

BASE METALS — 1.3% |

|

|

Glencore PLC (Switzerland) |

|

|

788,595 |

|

|

$ |

4,451,735 |

|

|

|

|

|

$ |

4,451,735 |

|

|

|

BEVERAGES — 1.1% |

|

|

Heineken Holding NV (Netherlands) |

|

|

45,272 |

|

|

$ |

3,934,775 |

|

|

|

|

|

$ |

3,934,775 |

|

|

|

FOOD SERVICES — 1.1% |

|

|

JDE Peet's NV (Netherlands) |

|

|

122,940 |

|

|

$ |

3,656,988 |

|

|

|

Just Eat Takeaway.com NV (Netherlands)(a)(e) |

|

|

14,680 |

|

|

|

224,840 |

|

|

|

|

|

$ |

3,881,828 |

|

|

|

E-COMMERCE DISCRETIONARY — 0.9% |

|

|

Alibaba Group Holding Ltd. (China)(a) |

|

|

28,187 |

|

|

$ |

292,086 |

|

|

|

Amazon.com, Inc.(a) |

|

|

19,889 |

|

|

|

2,592,730 |

|

|

|

Delivery Hero SE (Germany)(a)(e) |

|

|

8,390 |

|

|

|

369,914 |

|

|

|

|

|

$ |

3,254,730 |

|

|

|

APPAREL, FOOTWEAR & ACCESSORY DESIGN — 0.8% |

|

|

Cie Financiere Richemont SA Class A (Switzerland)(a) |

|

|

17,577 |

|

|

$ |

2,978,104 |

|

|

|

|

|

$ |

2,978,104 |

|

|

|

INTEGRATED UTILITIES — 0.8% |

|

|

FirstEnergy Corp. |

|

|

68,180 |

|

|

$ |

2,650,839 |

|

|

|

PG&E Corp.(a) |

|

|

16,358 |

|

|

|

282,666 |

|

|

|

|

|

$ |

2,933,505 |

|

|

|

MIDSTREAM — OIL & GAS — 0.8% |

|

|

Kinder Morgan, Inc. |

|

|

160,090 |

|

|

$ |

2,756,750 |

|

|

|

|

|

$ |

2,756,750 |

|

|

|

HOTELS, RESTAURANTS & LEISURE — 0.7% |

|

|

Marriott International, Inc. Class A |

|

|

13,706 |

|

|

$ |

2,517,655 |

|

|

|

|

|

$ |

2,517,655 |

|

|

|

RAILROAD ROLLING STOCK — 0.7% |

|

|

Westinghouse Air Brake Technologies Corp. |

|

|

22,326 |

|

|

$ |

2,448,492 |

|

|

|

|

|

$ |

2,448,492 |

|

|

|

AUTOMOTIVE RETAILERS — 0.5% |

|

|

CarMax, Inc.(a) |

|

|

23,348 |

|

|

$ |

1,954,228 |

|

|

|

|

|

$ |

1,954,228 |

|

|

See accompanying Notes to Financial Statements.

12

SOURCE CAPITAL, INC.

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2023

(Unaudited)

|

COMMON STOCKS (Continued) |

|

Shares |

|

Fair Value |

|

|

COMMERCIAL & RESIDENTIAL BUILDING EQUIPMENT & SYSTEMS — 0.5% |

|

|

Samsung C&T Corp. (South Korea) |

|

|

21,370 |

|

|

$ |

1,714,271 |

|

|

|

|

|

$ |

1,714,271 |

|

|

|

ENTERTAINMENT CONTENT — 0.3% |

|

|

Netflix, Inc.(a) |

|

|

2,595 |

|

|

$ |

1,143,072 |

|

|

|

|

|

$ |

1,143,072 |

|

|

|

INDUSTRIALS — 0.3% |

|

|

Uber Technologies, Inc.(a) |

|

|

24,770 |

|

|

$ |

1,069,321 |

|

|

|

|

|

$ |

1,069,321 |

|

|

|

ENERGY — 0.3% |

|

|

PHI Group, Inc., Restricted(a)(b)(c)(d) |

|

|

84,452 |

|

|

$ |

1,013,424 |

|

|

|

|

|

$ |

1,013,424 |

|

|

|

REAL ESTATE OWNERS & DEVELOPERS — 0.3% |

|

|

Swire Pacific Ltd. Class A (Hong Kong) |

|

|

124,345 |

|

|

$ |

952,899 |

|

|

|

|

|

$ |

952,899 |

|

|

|

HEALTH CARE SERVICES — 0.3% |

|

|

ICON PLC (Ireland)(a) |

|

|

3,606 |

|

|

$ |

902,221 |

|

|

|

|

|

$ |

902,221 |

|

|

|

OIL & GAS SERVICES & EQUIPMENT — 0.1% |

|

|

McDermott International Ltd.(a) |

|

|

1,611,738 |

|

|

$ |

290,113 |

|

|

|

|

|

$ |

290,113 |

|

|

|

RETAILING — 0.0% |

|

|

Copper Earn Out Trust(a)(b)(c)(d) |

|

|

2,141 |

|

|

$ |

7,493 |

|

|

|

Copper Property CTL Pass Through Trust(b) |

|

|

16,058 |

|

|

|

168,609 |

|

|

|

|

|

$ |

176,102 |

|

|

|

FINANCIALS — 0.0% |

|

|

Pershing Square Tontine Holdings Ltd.(a)(c)(d) |

|

|

14,610 |

|

|

$ |

— |

|

|

|

|

|

$ |

— |

|

|

|

TOTAL COMMON STOCKS — 44.0% (Cost $113,825,350) |

|

|

|

$ |

155,478,802 |

|

|

|

SPECIAL PURPOSE ACQUISITION COMPANIES(a) |

|

|

African Gold Acquisition Corp. |

|

|

10,037 |

|

|

$ |

100 |

|

|

|

Alpha Partners Technology Merger Corp. |

|

|

3,087 |

|

|

|

32,012 |

|

|

|

Apollo Strategic Growth Capital II |

|

|

3,156 |

|

|

|

387 |

|

|

|

Ares Acquisition Corp. A Shares |

|

|

7,542 |

|

|

|

6,034 |

|

|

|

Atlantic Coastal Acquisition Corp. |

|

|

31,363 |

|

|

|

709 |

|

|

|

Atlantic Coastal Acquisition Corp. II |

|

|

11,954 |

|

|

|

181 |

|

|

|

BigBear.ai Holdings, Inc. |

|

|

20,278 |

|

|

|

4,461 |

|

|

|

Biote Corp. |

|

|

32 |

|

|

|

216 |

|

|

|

BurTech Acquisition Corp. |

|

|

94,574 |

|

|

|

1,655 |

|

|

|

C5 Acquisition Corp. |

|

|

9,146 |

|

|

|

452 |

|

|

|

Churchill Capital Corp. VII |

|

|

9,384 |

|

|

|

1,314 |

|

|

|

DHC Acquisition Corp. |

|

|

13,186 |

|

|

|

517 |

|

|

|

Digital Transformation Opportunities Corp. |

|

|

1,374 |

|

|

|

177 |

|

|

|

Disruptive Acquisition Corp. I A Shares |

|

|

26,146 |

|

|

|

2,092 |

|

|

|

ECARX Holdings, Inc. (Cayman Islands) |

|

|

12,721 |

|

|

|

944 |

|

|

|

Flame Acquisition Corp. |

|

|

39,217 |

|

|

|

12,251 |

|

|

|

Forest Road Acquisition Corp. II A Shares |

|

|

18,940 |

|

|

|

2,841 |

|

|

|

Fusion Acquisition Corp. II A Shares |

|

|

4,407 |

|

|

|

22 |

|

|

See accompanying Notes to Financial Statements.

13

SOURCE CAPITAL, INC.

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2023

(Unaudited)

|

SPECIAL PURPOSE ACQUISITION COMPANIES (Continued) |

|

Shares |

|

Fair Value |

|

|

Global Partner Acquisition Corp. II |

|

|

4,908 |

|

|

$ |

172 |

|

|

|

Golden Arrow Merger Corp. |

|

|

26,146 |

|

|

|

915 |

|

|

|

GSR II Meteora Acquisition Corp. |

|

|

34 |

|

|

|

10 |

|

|

|

Heliogen, Inc. |

|

|

7,538 |

|

|

|

302 |

|

|

|

Landcadia Holdings IV, Inc. |

|

|

23,622 |

|

|

|

3,874 |

|

|

|

MariaDB PLC (Ireland) |

|

|

24,015 |

|

|

|

3,122 |

|

|

|

Metals Acquisition Corp. (Cayman Islands) |

|

|

13,756 |

|

|

|

19,258 |

|

|

|

NioCorp Developments Ltd. (Canada) |

|

|

16,476 |

|

|

|

11,161 |

|

|

|

Northern Star Investment Corp. III |

|

|

6,999 |

|

|

|

84 |

|

|

|

Northern Star Investment Corp. IV |

|

|

5,407 |

|

|

|

270 |

|

|

|

Plum Acquisition Corp. I |

|

|

14,795 |

|

|

|

496 |

|

|

|

PowerUp Acquisition Corp. (Cayman Islands) |

|

|

3,497 |

|

|

|

36,544 |

|

|

|

Prenetics Global Ltd. (Cayman Islands) |

|

|

815 |

|

|

|

66 |

|

|

|

Ross Acquisition Corp. II |

|

|

5,878 |

|

|

|

995 |

|

|

|

Slam Corp. |

|

|

13,618 |

|

|

|

2,587 |

|

|

|

Stratim Cloud Acquisition Corp. |

|

|

17,072 |

|

|

|

34 |

|

|

|

Swvl Holdings Corp. |

|

|

2,126 |

|

|

|

35 |

|

|

|

TLG Acquisition One Corp. Class A |

|

|

31,567 |

|

|

|

1,263 |

|

|

|

Twelve Seas Investment Co. II |

|

|

25,079 |

|

|

|

1,455 |

|

|

|

Virgin Orbit Holdings, Inc. |

|

|

7,210 |

|

|

|

29 |

|

|

|

TOTAL SPECIAL PURPOSE ACQUISITION COMPANIES — 0.0% (Cost $235,266) |

|

|

|

$ |

149,037 |

|

|

|

LIMITED PARTNERSHIPS |

|

|

Blue Torch Credit Opportunities Fund II LP (Private Credit)(b)(c)(d)(j)(k) |

|

|

55,000 |

|

|

$ |

4,500,509 |

|

|

|

Clover Private Credit Opportunities LP (Private Credit)(b)(c)(d)(j)(k) |

|

|

60,000 |

|

|

|

4,361,677 |

|

|

|

HIG WhiteHorse Direct Lending Fund 2020 LP (Private Credit)(b)(c)(d)(j)(k) |

|

|

55,000 |

|

|

|

3,680,182 |

|

|

|

Metro Partners Fund V II LP (Private Credit)(b)(c)(d)(j)(k) |

|

|

80,000 |

|

|

|

8,380,322 |

|

|

|

MSD Private Credit Opportunity Fund II LP (Private Credit)(b)(c)(d)(j)(k) |

|

|

80,000 |

|

|

|

5,040,499 |

|

|

|

MSD Real Estate Credit Opportunities Fund (Private Credit)(b)(c)(d)(j)(k) |

|

|

30,000 |

|

|

|

1,806,821 |

|

|

|

Nebari Natural Resources Credit Fund I LP (Private Credit)(b)(c)(d)(j)(k) |

|

|

55,000 |

|

|

|

4,961,879 |

|

|

|

Piney Lake Opportunities Fund LP (Private Credit)(b)(c)(d)(j)(k) |

|

|

30,000 |

|

|

|

3,162,120 |

|

|

|

Post Road Special Opportunity Fund II LP (Private Credit)(b)(c)(d)(j)(k) |

|

|

18,000 |

|

|

|

1,670,228 |

|

|

|

Silverpeak Credit Opportunities LP (Private Credit)(b)(c)(d)(j)(k) |

|

|

34,745 |

|

|

|

1,993,575 |

|

|

|

Silverpeak Special Situations (Private Credit)(b)(c)(d)(j)(k) |

|

|

48,500 |

|

|

|

4,868,818 |

|

|

|

TOTAL LIMITED PARTNERSHIPS — 12.6% (Cost $40,452,826) |

|

|

|

$ |

44,426,630 |

|

|

|

PREFERRED STOCKS |

|

|

ENGINEERING SERVICES — 0.1% |

|

|

McDermott International, Inc.(b)(c)(d) |

|

|

711 |

|

|

$ |

243,902 |

|

|

|

|

|

$ |

243,902 |

|

|

|

ENERGY — 0.0% |

|

|

Gulfport Energy Corp.(c)(d) |

|

|

21 |

|

|

$ |

12,810 |

|

|

|

|

|

$ |

12,810 |

|

|

|

TOTAL PREFERRED STOCKS — 0.1% (Cost $19,277) |

|

|

|

$ |

256,712 |

|

|

|

CLOSED END FUND — 0.1% |

|

|

MEDICAL EQUIPMENT — 0.1% |

|

|

Altegrity, Escrow(b)(c)(d) (Cost $0) |

|

|

142,220 |

|

|

$ |

331,373 |

|

|

|

|

|

$ |

331,373 |

|

|

See accompanying Notes to Financial Statements.

14

SOURCE CAPITAL, INC.

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2023

(Unaudited)

|

WARRANTS |

|

Shares or

Principal

Amount |

|

Fair Value |

|

|

ENERGY — 0.1% |

|

|

Cie Financiere Richemont SA 11/22/2023 (Switzerland)(a) |

|

|

69,686 |

|

|

$ |

96,154 |

|

|

|

|

|

$ |

96,154 |

|

|

|

MIDSTREAM — OIL & GAS — 0.0% |

|

|

Windstream Holdings, Inc., 9/21/2055(a)(b)(c)(d) |

|

|

10,312 |

|

|

$ |

92,808 |

|

|

|

|

|

$ |

92,808 |

|

|

|

TOTAL WARRANTS — 0.1% (Cost $316,230) |

|

|

|

$ |

188,962 |

|

|

|

BONDS & DEBENTURES |

|

|

COMMERCIAL MORTGAGE-BACKED SECURITIES |

|

|

NON-AGENCY — 0.3% |

|

BX Commercial Mortgage Trust 2021-VOLT F, 1M USD LIBOR + 2.400% — 7.593%

9/15/2036(e)(f) |

|

$ |

1,311,000 |

|

|

$ |

1,222,567 |

|

|

|

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES — 0.3% (Cost $1,310,645) |

|

|

|

$ |

1,222,567 |

|

|

|

ASSET-BACKED SECURITIES — 14.1% |

|

|

COLLATERALIZED LOAN OBLIGATION — 7.6% |

|

ABPCI Direct Lending Fund CLO I LLC 2016-1A E2, 3M USD LIBOR + 8.730% — 13.980%

7/20/2033(e)(f) |

|

$ |

2,056,000 |

|

|

$ |

1,905,038 |

|

|

ABPCI Direct Lending Fund CLO II LLC 2017-1A ER, 3M USD LIBOR + 7.600% — 12.850%

4/20/2032(e)(f) |

|

|

2,942,000 |

|

|

|

2,651,430 |

|

|

Barings Middle Market CLO Ltd. 2021-IA D, 3M USD LIBOR + 8.650% — 13.900%

7/20/2033(e)(f) |

|

|

1,040,000 |

|

|

|

958,754 |

|

|

BlackRock Maroon Bells CLO XI LLC 2022-1A E, 3M TSFR + 9.500% — 14.486%

10/15/2034(e)(f) |

|

|

3,416,750 |

|

|

|

3,273,831 |

|

|

Fortress Credit Opportunities IX CLO Ltd. 2017-9A ER, 3M USD LIBOR + 8.060% — 13.320%

10/15/2033(e)(f) |

|

|

5,186,000 |

|

|

|

4,655,706 |

|

|

Ivy Hill Middle Market Credit Fund XII Ltd. 12A DR, 3M USD LIBOR + 8.170% — 13.420%

7/20/2033(e)(f) |

|

|

814,000 |

|

|

|

722,546 |

|

|

Ivy Hill Middle Market Credit Fund XVIII Ltd. 18A E, 3M USD LIBOR + 7.750% — 13.023%

4/22/2033(e)(f) |

|

|

3,464,000 |

|

|

|

3,056,360 |

|

|

Ivy Hill Middle Market Credit Fund XX Ltd. 20A E, 3M TSFR + 10.000% — 15.232%

4/15/2035(e)(f) |

|

|

2,380,000 |

|

|

|

2,285,466 |

|

|

|

Parliament CLO II Ltd. 2021-2A D, 3M USD LIBOR + 3.700% — 9.079% 8/20/2032(e)(f) |

|

|

1,854,000 |

|

|

|

1,692,281 |

|

|

TCP Waterman CLO LLC 2017-1A ER, 3M USD LIBOR + 8.160% — 13.539%

8/20/2033(e)(f) |

|

|

1,571,000 |

|

|

|

1,412,067 |

|

|

|

VCP CLO II Ltd. 2021-2A E, 3M USD LIBOR + 8.410% — 13.670% 4/15/2031(e)(f) |

|

|

4,421,000 |

|

|

|

4,201,325 |

|

|

|

|

|

$ |

26,814,804 |

|

|

|

EQUIPMENT — 0.8% |

|

|

Coinstar Funding LLC 2017-1A A2 — 5.216% 4/25/2047(e) |

|

$ |

2,880,160 |

|

|

$ |

2,444,456 |

|

|

|

Prosper Marketplace Issuance Trust 2017-1A — 5.300% 3/15/2042(d) |

|

|

447,155 |

|

|

|

391,260 |

|

|

|

|

|

$ |

2,835,716 |

|

|

|

OTHER — 5.7% |

|

|

ABPCI Direct Lending Fund ABS I Ltd. 2020-1A A — 3.199% 12/20/2030(e) |

|

$ |

350,000 |

|

|

$ |

325,985 |

|

|

|

ABPCI Direct Lending Fund ABS I Ltd. 2020-1A B — 4.935% 12/20/2030(e) |

|

|

3,536,000 |

|

|

|

3,277,787 |

|

|

|

ABPCI Direct Lending Fund ABS II LLC 2022-2A C — 8.237% 3/1/2032(e) |

|

|

3,387,000 |

|

|

|

2,844,789 |

|

|

|

Cologix Data Centers US Issuer LLC 2021-1A C — 5.990% 12/26/2051(e) |

|

|

1,765,000 |

|

|

|

1,445,339 |

|

|

|

Diamond Infrastructure Funding LLC 2021-1A C — 3.475% 4/15/2049(e) |

|

|

384,000 |

|

|

|

333,941 |

|

|

|

Diamond Issuer 2021-1A C — 3.787% 11/20/2051(e) |

|

|

1,000,000 |

|

|

|

797,304 |

|

|

|

Elm Trust 2020-3A A2 — 2.954% 8/20/2029(e) |

|

|

88,463 |

|

|

|

82,109 |

|

|

See accompanying Notes to Financial Statements.

15

SOURCE CAPITAL, INC.

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2023

(Unaudited)

|

BONDS & DEBENTURES (Continued) |

|

Principal

Amount |

|

Fair Value |

|

|

Elm Trust 2020-4A B — 3.866% 10/20/2029(e) |

|

$ |

1,123,287 |

|

|

$ |

962,020 |

|

|

|

Elm Trust 2020-3A B — 4.481% 8/20/2029(e) |

|

|

220,262 |

|

|

|

192,590 |

|

|

|

Golub Capital Partners ABS Funding Ltd. 2021-1A B — 3.816% 4/20/2029(e) |

|

|

1,444,000 |

|

|

|

1,310,284 |

|

|

|

Golub Capital Partners ABS Funding Ltd. 2021-2A B — 3.994% 10/19/2029(e) |

|

|

3,377,000 |

|

|

|

2,897,963 |

|

|

|

Golub Capital Partners ABS Funding Ltd. 2020-1A B — 4.496% 1/22/2029(e) |

|

|

1,620,000 |

|

|

|

1,471,472 |

|

|

|

Hotwire Funding LLC 2021-1 C — 4.459% 11/20/2051(e) |

|

|

750,000 |

|

|

|

623,817 |

|

|

|

Legal Fee Funding LLC 2006-1A A — 8.000% 7/20/2036(d)(e) |

|

|

20,259 |

|

|

|

20,259 |

|

|

|

Monroe Capital ABS Funding Ltd. 2021-1A B — 3.908% 4/22/2031(e) |

|

|

872,000 |

|

|

|

816,310 |

|

|

|

TVEST LLC 2020-A A — 4.500% 7/15/2032(e) |

|

|

30,835 |

|

|

|

30,554 |

|

|

|

VCP RRL ABS I Ltd. 2021-1A B — 2.848% 10/20/2031(e) |

|

|

1,041,232 |

|

|

|

938,470 |

|

|

|

VCP RRL ABS I Ltd. 2021-1A C — 5.425% 10/20/2031(e) |

|

|

2,193,312 |

|

|

|

1,956,994 |

|

|

|

|

|

$ |

20,327,987 |

|

|

|

TOTAL ASSET-BACKED SECURITIES — 14.1% (Cost $54,959,811) |

|

|

|

$ |

49,978,507 |

|

|

|

CORPORATE BONDS & NOTES |

|

|

COMMUNICATIONS — 1.0% |

|

|

Consolidated Communications, Inc. — 6.500% 10/1/2028(e) |

|

$ |

1,272,000 |

|

|

$ |

1,001,700 |

|

|

|

Frontier Communications Holdings LLC — 5.875% 10/15/2027(e) |

|

|

453,000 |

|

|

|

413,363 |

|

|

|

Upwork, Inc. — 0.250% 8/15/2026 |

|

|

2,500,000 |

|

|

|

2,024,716 |

|

|

|

|

|

$ |

3,439,779 |

|

|

|

CONSUMER, CYCLICAL — 0.8% |

|

|

Air Canada Pass-Through Trust 2020-1 C — 10.500% 7/15/2026(e) |

|

$ |

2,643,000 |

|

|

$ |

2,834,618 |

|

|

|

CONSUMER, NON-CYCLICAL — 0.7% |

|

|

Cimpress PLC — 7.000% 6/15/2026 |

|

$ |

381,000 |

|

|

$ |

344,805 |

|

|

|

Heartland Dental LLC/Heartland Dental Finance Corp. — 10.500% 4/30/2028(e) |

|

|

1,392,000 |

|

|

|

1,383,300 |

|

|

|

Herbalife Nutrition Ltd./HLF Financing, Inc. — 7.875% 9/1/2025(e) |

|

|

869,000 |

|

|

|

782,100 |

|

|

|

|

|

$ |

2,510,205 |

|

|

|

ENERGY — 3.6% |

|

|

Gulfport Energy Corp. — 6.000% 10/15/2024 |

|

$ |

337,000 |

|

|

$ |

212 |

|

|

|

Gulfport Energy Corp. — 6.625% 5/1/2023 |

|

|

171,000 |

|

|

|

108 |

|

|

|

Gulfport Energy Corp. — 6.375% 5/15/2025 |

|

|

162,000 |

|

|

|

102 |

|

|

|

Gulfport Energy Corp. — 6.375% 1/15/2026 |

|

|

169,000 |

|

|

|

106 |

|

|

|

Gulfport Energy Corp. — 8.000% 5/17/2026 |

|

|

10,975 |

|

|

|

11,027 |

|

|

|

Tidewater, Inc. — 8.500% 11/16/2026 |

|

|

9,600,000 |

|

|

|

9,852,000 |

|

|

|

Tidewater, Inc. — 10.375% 7/3/2028(e) |

|

|

3,000,000 |

|

|

|

2,992,500 |

|

|

|

|

|

$ |

12,856,055 |

|

|

|

FINANCIAL — 2.5% |

|

|

Charles Schwab Corp., 5 year CMT + 3.168% — 4.000% 6/1/2026(f) |

|

$ |

549,000 |

|

|

$ |

444,690 |

|

|

|

Charles Schwab Corp., 3M USD LIBOR + 2.575% — 5.000% 12/1/2027(f) |

|

|

75,000 |

|

|

|

56,906 |

|

|

|

Midcap Financial Issuer Trust — 6.500% 5/1/2028(e) |

|

|

3,466,000 |

|

|

|

3,083,700 |

|

|

|

OWL Rock Core Income Corp. — 4.700% 2/8/2027 |

|

|

1,970,000 |

|

|

|

1,781,671 |

|

|

|

OWL Rock Core Income Corp. — 7.750% 9/16/2027(e) |

|

|

2,243,000 |

|

|

|

2,229,124 |

|

|

|

Vornado Realty LP (Private Credit) — 3.500% 1/15/2025 |

|

|

1,000,000 |

|

|

|

941,530 |

|

|

|

Vornado Realty LP (Private Credit) — 2.150% 6/1/2026 |

|

|

250,000 |

|

|

|

211,750 |

|

|

|

|

|

$ |

8,749,371 |

|

|

|

TECHNOLOGY — 1.0% |

|

|

Hlend Senior Notes — 8.170% 3/15/2028(b)(c)(d) |

|

$ |

3,500,000 |

|

|

$ |

3,500,000 |

|

|

|

TOTAL CORPORATE BONDS & NOTES — 9.6% (Cost $34,265,959) |

|

|

|

$ |

33,890,028 |

|

|

See accompanying Notes to Financial Statements.

16

SOURCE CAPITAL, INC.

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2023

(Unaudited)

|

BONDS & DEBENTURES (Continued) |

|

Principal

Amount |

|

Fair Value |

|

|

CORPORATE BANK DEBT |

|

|

ABG Intermediate Holdings 2 LLC, 1M SOFR + 0.100% — 11.202% 12/20/2029(b)(f)(g) |

|

$ |

1,226,000 |

|

|

$ |

1,134,050 |

|

|

|

Asurion LLC, 3M USD LIBOR + 3.000% — 8.538% 11/3/2024(b)(f)(g) |

|

|

1,567,247 |

|

|

|

1,563,329 |

|

|

|

Axiom Global, Inc., 1M SOFR + 4.750% — 9.941% 10/1/2026(b)(f)(g) |

|

|

1,731,160 |

|

|

|

1,657,586 |

|

|

Capstone Acquisition Holdings, Inc. 2020 Delayed Draw Term Loan,

1M SOFR + 4.750% — 9.953% 11/12/2027(b)(f)(g)(h) |

|

|

150,205 |

|

|

|

144,196 |

|

|

Capstone Acquisition Holdings, Inc. 2020 Term Loan, 1M SOFR + 4.750% — 9.953%

11/12/2027(b)(f)(g) |

|

|

2,170,350 |

|

|

|

2,083,536 |

|

|

Centric Commercial Finance Ltd., 3M SOFR + 6.000% — 11.277%

9/30/26(b)(c)(d)(f)(g)(h) |

|

|

43,000 |

|

|

|

1,791,667 |

|

|

|

Cimpress Public Ltd., 1M USD LIBOR + 3.500% — 8.693% 5/17/2028(b)(f)(g) |

|

|

988,820 |

|

|

|

961,627 |

|

|

|

Cornerstone OnDemand, Inc., 3M SOFR + 3.750% — 9.254% 10/16/2028(b)(f)(g) |

|

|

73,442 |

|

|

|

67,598 |

|

|

Element Commercial Funding LP (Private Credit), 1M SOFR + 5.750% — 10.731%

9/15/24(b)(c)(d)(f)(h) |

|

|

23,600 |

|

|

|

2,094,500 |

|

|

|

Emerald Topco, Inc., 1M SOFR + 3.500% — 8.717% 7/24/2026(b)(f)(g) |

|

|

1,150,102 |

|

|

|

1,115,955 |

|

|

|

Farfetch U.S. Holdings, Inc., 3M SOFR + 6.250% — 11.299% 10/20/2027(b)(f)(g) |

|

|

2,411,880 |

|

|

|

2,267,167 |

|

|

|

Frontier Communications Corp., 1M USD LIBOR + 3.750% — 9.000% 5/1/2028(b)(f)(g) |

|

|

1,240,448 |

|

|

|

1,197,962 |

|

|

|

Heartland Dental LLC, 1M SOFR + 5.000% — 10.102% 4/30/2028(b)(f)(g) |

|

|

400,000 |

|

|

|

385,752 |

|

|

|

JC Penney Corp., Inc., 1M USD LIBOR + 9.500% — 9.500% 6/23/2023(b)(f)(g) |

|

|

471,317 |

|

|

|

47 |

|

|

|

Lealand Finance Company B.V. Super Senior Exit LC — 5.250% 6/30/2024(b)(c)(f)(g)(h) |

|

|

7,365,000 |

|

|

|

(1,546,650 |

) |

|

Light Commercial Funding LP (Private Credit), 1M SOFR + 6.000% — 11.153%

10/31/26(b)(c)(d)(f)(g)(h) |

|

|

14,800 |

|

|

|

1,286,778 |

|

|

|

McDermott International, Inc. — 4.000% 12/31/2025(b)(c)(d)(f)(g)(h) |

|

|

302,560 |

|

|

|

342,354 |

|

|

|

McDermott Senior Exit LC — 3.000% 6/30/2024(b)(f)(g)(h) |

|

|

655,670 |

|

|

|

(295,051 |

) |

|

McDermott Technology Americas, Inc., 1M USD LIBOR + 1.000% — 6.154%

6/30/2025(b)(f)(g) |

|

|

1,237,250 |

|

|

|

618,625 |

|

|

|

McDermott Technology Americas, Inc., 1M SOFR + 3.000% — 8.217% 6/28/2024(b)(f)(g) |

|

|

141,927 |

|

|

|

99,349 |

|

|

|

Polaris Newco, LLC Term Loan B, 3M USD LIBOR + 4.000% — 9.538% 6/2/2028(b)(f)(g) |

|

|

1,145,595 |

|

|

|

1,046,501 |

|

|

|

Project Myrtle, 1M SOFR + 3.179% — 7.500% 6/15/2025(b)(c)(d)(f)(g)(h) |

|

|

3,000,000 |

|

|

|

793,334 |

|

|

|

QBS Parent, Inc., 3M USD LIBOR + 4.250% — 9.642% 9/22/2025(b)(f)(g) |

|

|

1,934,177 |

|

|

|

1,619,873 |

|

|

|

Vision Solutions, Inc., 3M USD LIBOR + 4.000% — 9.255% 4/24/2028(b)(f)(g) |

|

|

73,439 |

|

|

|

69,446 |

|

|

|

WH Borrower LLC, Term Loan B, 3M SOFR + 5.500% — 10.486% 2/15/2027(b)(f)(g) |

|

|

1,155,330 |

|

|

|

1,132,223 |

|

|

|

Windstream Services LLC, 1M SOFR + 0.100% — 11.452% 9/21/2027(b)(f)(g) |

|

|

253,078 |

|

|

|

234,729 |

|

|

|

TOTAL CORPORATE BANK DEBT — 6.2% (Cost $25,865,494) |

|

|

|

$ |

21,866,483 |

|

|

|

CONVERTIBLE BONDS |

|

|

COMMUNICATIONS — 2.8% |

|

|

Delivery Hero SE (Germany) — 1.000% 4/30/2026 |

|

$ |

3,500,000 |

|

|

$ |

3,067,644 |

|

|

|

Delivery Hero SE (Germany) — 1.000% 1/23/2027 |

|

|

500,000 |

|

|

|

421,410 |

|

|

|

RealReal, Inc. — 3.000% 6/15/2025 |

|

|

2,000,000 |

|

|

|

1,360,000 |

|

|

|

Wayfair, Inc. — 0.625% 10/1/2025 |

|

|

5,078,000 |

|

|

|

4,321,851 |

|

|

|

Wayfair, Inc. — 1.000% 8/15/2026 |

|

|

122,000 |

|

|

|

100,353 |

|

|

|

Zillow Group, Inc. — 1.375% 9/1/2026 |

|

|

350,000 |

|

|

|

440,125 |

|

|

|

Zillow Group, Inc. — 2.750% 5/15/2025 |

|

|

48,000 |

|

|

|

50,352 |

|

|

|

TOTAL CONVERTIBLE BONDS — 2.8% (Cost $9,798,039) |

|

|

|

$ |

9,761,735 |

|

|

|

TOTAL BONDS & DEBENTURES — 33.0% (Cost $126,199,948) |

|

|

|

$ |

116,719,320 |

|

|

|

TOTAL INVESTMENT SECURITIES — 89.9% (Cost $281,048,897) |

|

|

|

$ |

317,550,836 |

|

|

See accompanying Notes to Financial Statements.

17

SOURCE CAPITAL, INC.

PORTFOLIO OF INVESTMENTS (Continued)

June 30, 2023

(Unaudited)

|

SHORT-TERM INVESTMENTS — 10.4% |

|