UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

FORM 6-K

Report of Foreign Private Issuer Pursuant to Rule 13a-16

or

15d-16 of the Securities Exchange Act of 1934

For the month of February 2024

Commission File Number: 001-39928

_____________________

Sendas Distribuidora S.A.

(Exact Name as Specified in its Charter)

Sendas Distributor S.A.

(Translation of registrant’s name into

English)

Avenida Ayrton Senna, No. 6,000, Lote 2, Pal 48959,

Anexo A

Jacarepaguá

22775-005 Rio de Janeiro, RJ, Brazil

(Address of principal executive offices)

(Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.)

Form 20-F: ý

Form 40-F: o

(FREE TRANSLATION INTO ENGLISH FROM THE ORIGINAL

PREVIOUSLY ISSUED IN PORTUGUESE)

Standard Financial Statement – December

31,2023 – SENDAS DISTRIBUIDORA S.A.

| Independent Auditor's Report on Financial Statements |

2 |

Financial Statements

| Balance Sheet |

8 |

| Statements of Operations |

10 |

| Statements of Comprehensive Income |

11 |

| Statements of Changes in Shareholders’ Equity |

12 |

| Statements of Cash Flows |

13 |

| Notes to the financial statements |

14 |

| Opinion of Auditing Board or an Equivalent Body |

50 |

| Summary Report of Audit Committee (statutory, prescribed in a specific provision of CVM) |

51 |

| Management Statement on the Financial Statements and Independent Auditor's Report |

52 |

|

Sendas Distribuidora S.A.

Financial Statements

for the Year Ended

December 31, 2023 and

Independent Auditor’s Report

Deloitte Touche Tohmatsu Auditores Independentes Ltda. |

|

(Convenience Translation into English from the

Original Previously Issued in Portuguese) |

|

Deloitte Touche Tohmatsu

Dr. Chucri Zaidan Avenue, 1.240 -

4th to 12th floors - Golden Tower

04711-130 - São Paulo - SP

Brazil

Tel.: + 55 (11) 5186-1000

Fax: + 55 (11) 5181-2911

www.deloitte.com.br |

| |

|

(Convenience Translation into English from the Original Previously

Issued in Portuguese)

INDEPENDENT AUDITOR’S REPORT ON THE FINANCIAL STATEMENTS

To the Shareholders and Board of Directors of

Sendas Distribuidora S.A.

Opinion

We have audited the accompanying financial statements of Sendas

Distribuidora S.A. (“Company”), which comprise the balance sheet as at December 31, 2023, and the related statements of operations,

of comprehensive income, of changes in shareholders’ equity and of cash flows for the year then ended, and notes to the financial

statements, including material accounting policies.

In our opinion, the financial statements referred to above present

fairly, in all material respects, the financial position of Sendas Distribuidora S.A. as at December 31, 2023, and the results of its

operations and of its cash flows for the year then ended, in accordance with accounting practices adopted in Brazil and International

Financial Reporting Standards - IFRS, as issued by the International Accounting Standards Board - IASB.

Basis for opinion

We conducted our audit in accordance with Brazilian and International

Standards on Auditing.

Our responsibilities under those standards are further described in the “Auditor’s responsibilities for the audit of the financial

statements” section of our report. We are independent of the Company in accordance with the relevant ethical requirements set out

in the Code of Ethics for Professional Accountants and the professional standards issued by the Brazilian Federal Accounting Council (CFC),

and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we

have obtained is sufficient and appropriate to provide a basis for our audit opinion.

Key audit matters

Key audit matters - KAM are those matters that, in our professional

judgment, were of most significance in our audit of the current year. These matters were addressed in the context of our audit of the

financial statements as a whole and in forming our opinion thereon, and, therefore, we do not provide a separate opinion on these matters.

Recoverability of ICMS tax credits

Why it is a KAM

As described in note 9.1 to the financial statements, as at December

31, 2023, the Company had recoverable ICMS tax credits amounting to R$1,085 million, whose recoverability depends on the generation of

sufficient amounts of ICMS tax payable in the future. In assessing the recoverability of these tax credits, Management uses projections

of revenues, costs and expenses, as well as other information used in estimating the timing and nature of the future amounts of ICMS tax

payable, which are based on estimates and assumptions of future business performance and market conditions, as well as expectations as

to applicable tax regulations and adoption of special tax regime obtained by the Company and used in the ICMS computation for certain

States.

|

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”),

its global network of member firms, and their related entities (collectively, the “Deloitte organization”). DTTL (also referred

to as “Deloitte Global”) and each of its member firms and related entities are legally separate and independent entities,

which cannot obligate or bind each other in respect of third parties. DTTL and each DTTL member firm and related entity is liable only

for its own acts and omissions, and not those of each other. DTTL does not provide services to clients. Please see www.deloitte.com/about

to learn more.

Deloitte provides industry-leading audit and assurance, tax and legal,

consulting, financial advisory, and risk advisory services to nearly 90% of the Fortune Global 500® and thousands of private companies.

Our people deliver measurable and lasting results that help reinforce public trust in capital markets, enable clients to transform and

thrive, and lead the way toward a stronger economy, a more equitable society, and a sustainable world. Building on its 175-plus year history,

Deloitte spans more than 150 countries and territories. Learn how Deloitte’s approximately 457,000 people worldwide make an impact

that matters at www.deloitte.com.

|

© 2024. For information, contact Deloitte Global.

Auditing the recoverability of ICMS tax credits was considered

especially challenging due to:

(i) the magnitude of amounts involved; and (ii) the high degree of complexity involved in the Brazilian indirect State tax legislation

and in Management’s assessment process, which requires significant judgment by Management and includes significant assumptions in

the estimation of the timing and amounts of future ICMS tax payable that could be affected by future market or economic conditions and

events and by matters related to the special tax regime and potential changes in State tax legislation.

How the matter was addressed in our audit

Our audit procedures included, among others:

| · | We obtained an understanding of relevant internal controls

over Management’s assessment of the recoverability of ICMS tax credits, including relevant internal controls over projections prepared

by Management and approved by those charged with governance, used in the recoverability assessment. |

| · | We evaluated the significant assumptions used by Management

in its recoverability assessment and tested the completeness and accuracy of the underlying data supporting the significant assumptions. |

| · | With the assistance of our tax specialists, we evaluated

the application of tax laws and special tax regimes used in the recoverability assessment. |

| · | We tested the data used by Management in determining the

recorded amounts for recoverable tax credits, comparing inputs to internal data and testing the accuracy and completeness of calculations. |

| · | We evaluated the related

disclosures in the financial statements. |

Based on the evidence obtained through our audit procedures

described above, we consider that the recoverability of these tax credits and related disclosures in the notes to the financial statements

are acceptable in the context of the financial statements taken as a whole.

Provisions and Tax contingencies

Why it is a KAM

As described in notes 17.1 and 17.4 to the financial statements,

the Company is party to a significant number of administrative and legal proceedings arising from various tax claims and assessments.

Based on the opinions and with the support of its internal and external legal counsel, Management assesses the likelihood of loss related

to these tax claims and assessments, and records provisions when the likelihood of loss is assessed as probable and the amounts can be

estimated. As of December 31, 2023, Management has recorded provisions in the amount of R$62 million. Additional claims and assessments

of

R$2,173 million were outstanding as of December 31, 2023, for which no provision was recorded. Out of this amount, R$1,494 million is

subject of reimbursement from its former controlling shareholders, under the separation agreement signed by the parties. Management uses

significant judgment in evaluating the merits of each claim and assessment and in evaluating the likelihood and potential amounts of loss,

considering the complexity of the Brazilian tax environment and legislation, including existence and interpretation of applicable jurisprudence

and case law. Management evaluation also involves assistance from internal and external legal counsels of the Company.

Auditing Management’s assessment of the likelihood

of loss on tax claims was considered especially challenging due to: (i) the complexity involved in the evaluation and interpretation

of applicable tax legislation, case law, and applicable jurisprudence, which requires a high degree of judgment applied by Management

and the assistance of the Company’s internal and external counsels; (ii) the amounts involved and the significant estimate

uncertainty related to the ultimate outcome and timing of court decisions; and (iii) the additional audit efforts, which include

the involvement of our tax specialists.

How the matter was addressed in our audit

Our audit procedures included, among others:

| · | We obtained an understanding of relevant internal controls

over the identification and evaluation of tax claims and assessments, including the assumptions and technical merits of tax positions

used in the evaluation of the likelihood of loss, as well as the processes to measure, record and disclose the amounts related to tax

contingencies. |

| · | We read and obtained an understanding on indemnification

agreements entered by the Company and former controlling entity. |

| · | We tested the completeness of the tax contingencies subject

to evaluation by the Company. |

| · | With the assistance of our tax specialists,

we evaluated Management’s assessment of the likelihood and estimate of

loss for a sample of material tax contingencies, which included: |

| - | Obtaining an understanding and evaluating Management’s

judgments, the technical merits and documentation supporting Management’s assessment, including reading and evaluating tax opinions

or other third-party tax advice obtained from the Company’s external tax and legal counsel. |

| - | Inspecting and evaluating the responses to external confirmations

sent to key external tax and legal advisers of the Company. |

| - | Challenging Management’s assessment using our knowledge

of, and experience with, the application of tax laws and developments in the applicable regulatory and tax environments. |

| - | Testing the assumptions, underlying data and accuracy of

the calculation of the amounts related to recorded tax provisions and disclosed tax contingencies. |

| · | We also evaluated the

related disclosures in the financial statements. |

Based on the evidence obtained through our audit procedures described

above, we consider that Management’s assessment of the likelihood of loss on tax claims and related disclosures in the notes to

the financial statements is acceptable in the context of the financial statements taken as a whole.

Other matters

Statements of value added

The statement of value added (DVA) for the year ended December

31, 2023, prepared under the responsibility of the Company’s Management and presented as supplemental information for purposes of

the IFRSs, were subject to audit procedures performed together with the audit of the Company’s financial statements. In forming

our opinion, we assess whether these statements are reconciled with the other financial statements and accounting records, as applicable,

and whether their form and content are in accordance with the criteria set out in technical pronouncement CPC 09 - Statement of Value

Added. In our opinion, these statements of value added were appropriately prepared, in all material respects, in accordance with the criteria

set out in such technical pronouncement and are consistent in relation to the financial statements taken as a whole.

Other information accompanying the financial statements and

the independent auditor’s report.

Management is responsible for the other information. Such other

information comprises the Management Report.

Our opinion on the financial statements does not cover the Management

Report, and we do not express any form of audit conclusion thereon.

In connection with our audit of the financial statements, our responsibility

is to read the Management Report and, in doing so, consider whether this report is materially inconsistent with the financial statements,

or our knowledge obtained in the audit or otherwise appears to be materially misstated. If, based on the work we have performed, we conclude

that there is a material misstatement in the Management Report, we are required to report that fact. We have nothing to report in this

regard.

Responsibilities of Management and those charged with governance

for the financial statements

Management is responsible for the preparation and fair presentation

of the financial statements in accordance with accounting practices adopted in Brazil and the IFRSs, issued by the IASB, and for such

internal control as Management determines is necessary to enable the preparation of financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the financial statements, Management is responsible

for assessing the Company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern

and using the going concern basis of accounting unless Management either intends to liquidate the Company or to cease operations, or has

no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the

Company’s financial reporting process.

Auditor’s responsibilities for the audit of the financial

statements

Our objectives are to obtain reasonable assurance about whether

the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s

report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in

accordance with Brazilian and International Standards on Auditing will always detect a material misstatement when it exists. Misstatements

can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence

the economic decisions of users taken on the basis of these financial statements.

As part of an audit in accordance with Brazilian and International

Standards on Auditing, we exercise professional judgment and maintain professional skepticism throughout the audit. We also:

| · | Identify and assess the risks of material misstatement

of the financial statements, whether due to fraud or error, design and perform audit procedures responsive to those risks, and obtain

audit evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not detecting a material misstatement

resulting from fraud is higher than for one resulting from error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations,

or the override of internal control. |

| · | Obtain an understanding of internal control relevant to

the audit in order to design audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion

on the effectiveness of the Company’s internal control. |

| · | Evaluate the appropriateness of accounting

policies used and the reasonableness of accounting estimates

and related disclosures made by Management. |

| · | Conclude on the appropriateness of Management’s use

of the going concern basis of accounting and, based on the audit evidence obtained, whether a material uncertainty

exists related to events or conditions that may cast significant doubt on the ability of the Company to continue as a going concern. If

we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s report to the related disclosures

in the financial statements or, if such disclosures are inadequate, to modify our opinion. Our conclusions are based on the audit evidence

obtained up to the date of our auditor’s report. However, future events or conditions may cause the Company to cease to continue

as a going concern. |

| · | Evaluate the overall presentation, structure

and content of the financial statements, including the disclosures, and whether the financial statements represent the underlying transactions

and events in a manner that achieves fair presentation. |

We communicate with those charged with governance regarding, among

other matters, the planned scope and timing of the audit and significant audit findings, including any significant deficiencies in internal

control that we identify during our audit.

We also provide to those charged with governance a statement that

we have complied with the relevant ethical requirements, including independence requirements, and communicate all relationships or matters

that could considerably affect our independence, including, when applicable, the related safeguards.

From the matters communicated with those charged with governance,

we determine those matters that were of most significance in the audit of the financial statements of the current year and are therefore

the key audit matters. We describe these matters in our auditor’s report unless law or regulation precludes public disclosure about

the matter or when, in extremely rare circumstances, we determine that a matter should not be communicated in our report because the adverse

consequences of doing so would reasonably be expected to outweigh the public interest benefits of such communication.

The accompanying financial statements have been translated into

English for the convenience of readers outside Brazil.

São Paulo, February 21, 2024

| DELOITTE TOUCHE TOHMATSU |

Eduardo Franco Tenório |

| Auditores Independentes Ltda. |

Engagement Partner |

SENDAS DISTRIBUIDORA S.A.

|

| BALANCE SHEET |

| AS OF DECEMBER 31, 2023 |

| (In millions of Brazilian Reais) |

| |

|

|

|

|

|

| |

|

|

31, 2022 |

|

December 31, 2021 |

| ASSETS |

Note |

|

12/31/2023 |

|

12/31/2022 |

| Current assets |

|

|

|

|

|

| Cash and cash equivalents |

6 |

|

5,459 |

|

5,842 |

| Trade receivables |

7 |

|

1,199 |

|

570 |

| Inventories |

8 |

|

6,664 |

|

6,467 |

| Recoverable taxes |

9 |

|

1,100 |

|

1,055 |

| Derivative financial instruments |

16.9 |

|

48 |

|

27 |

| Other accounts receivable |

. |

. |

146 |

|

123 |

| . |

. |

. |

14,616 |

|

14,084 |

| . |

. |

. |

|

|

|

| Assets held for sale |

27 |

. |

- |

|

95 |

| . |

. |

. |

|

|

|

| Total current assets |

|

. |

14,616 |

|

14,179 |

| |

|

. |

|

|

|

| Non-current assets |

|

. |

|

|

|

| Recoverable taxes |

9 |

. |

573 |

|

927 |

| Deferred income tax and social contribution |

19.2 |

|

171 |

|

6 |

| Derivative financial instruments |

16.9 |

|

226 |

|

155 |

| Related parties |

10.1 |

|

23 |

|

252 |

| Restricted deposits for legal proceedings |

17.6 |

|

44 |

|

56 |

| Other accounts receivable |

|

|

118 |

|

9 |

| . |

. |

. |

1,155 |

|

1,405 |

| . |

. |

. |

|

|

|

| Investments |

11 |

|

864 |

|

833 |

| Property, plant and equipment |

12.2 |

|

13,148 |

|

11,582 |

| Intangible assets |

13.1 |

|

5,172 |

|

5,000 |

| Right-of-use assets |

14.1 |

|

8,222 |

|

7,619 |

| |

|

|

27,406 |

|

25,034 |

| |

|

|

|

|

|

| Total non-current assets |

|

|

28,561 |

|

26,439 |

| |

|

|

|

|

|

| TOTAL ASSETS |

|

|

43,177 |

|

40,618 |

| |

|

|

|

|

|

| The accompanying notes are an integral part of these financial statements. |

| SENDAS DISTRIBUIDORA S.A. |

| BALANCE SHEET |

| AS OF DECEMBER 31, 2023 |

| (In millions of Brazilian Reais) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| LIABILITIES |

Note |

|

12/31/2023 |

|

12/31/2022 |

| Current liabilities |

|

|

|

|

|

| Trade payables, net |

15 |

|

9,759 |

|

8,538 |

| Trade payables - Agreements |

15.2 |

|

1,459 |

|

2,039 |

| Trade payables - Agreements - Acquisition of hypermarkets |

15.3 |

|

892 |

|

2,422 |

| Borrowings |

16.9 |

|

36 |

|

829 |

| Debentures and promissory notes |

16.9 |

|

2,079 |

|

431 |

| Payroll and related taxes |

|

|

624 |

|

584 |

| Lease liabilities |

14.2 |

|

532 |

|

435 |

| Related parties |

10.1 |

|

- |

|

201 |

| Taxes payable |

|

|

298 |

|

265 |

| Deferred revenues |

18 |

|

418 |

|

328 |

| Dividends and interest on own capital |

20.2 |

|

- |

|

111 |

| Other accounts payable |

|

|

328 |

|

233 |

| Total current liabilities |

|

|

16,425 |

|

16,416 |

| |

|

|

|

|

|

| Non-current liabilities |

|

|

|

|

|

| Trade payables, net |

15 |

|

38 |

|

- |

| Trade payables - Agreements - Acquisition of hypermarkets |

15.3 |

|

- |

|

780 |

| Borrowings |

16.9 |

|

1,947 |

|

737 |

| Debentures and promissory notes |

16.9 |

|

11,122 |

|

10,594 |

| Provision for legal proceedings |

17 |

|

263 |

|

165 |

| Related parties |

10.1 |

|

- |

|

60 |

| Lease liabilities |

14.2 |

|

8,652 |

|

7,925 |

| Deferred revenues |

18 |

|

37 |

|

31 |

| Other accounts payable |

|

|

63 |

|

14 |

| Total non-current liabilities |

. |

|

22,122 |

|

20,306 |

| |

. |

|

|

|

|

| SHAREHOLDERS´ EQUITY |

. |

|

|

|

|

| Share capital |

20.1 |

|

1,272 |

|

1,263 |

| Capital reserves |

|

|

56 |

|

36 |

| Earnings reserves |

|

|

3,309 |

|

2,599 |

| Other comprehensive income |

|

|

(7) |

|

(2) |

| Total shareholders' equity |

|

|

4,630 |

|

3,896 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

43,177 |

|

40,618 |

| |

|

|

|

|

|

| The accompanying notes are an integral part of these financial statements. |

| SENDAS DISTRIBUIDORA S.A.s |

| STATEMENTS OF OPERATIONS |

| FOR THE YEAR ENDED DECEMBER 31, 2023 |

|

|

|

|

|

| (In millions of Brazilian Reais, unless otherwise stated) |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

Note |

|

12/31/2023 |

|

12/31/2022 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Net operating revenue |

21 |

|

66,503 |

|

54,520 |

| Cost of sales |

22 |

|

(55,682) |

|

(45,557) |

| Gross profit |

|

|

10,821 |

|

8,963 |

| Operating expenses, net |

|

|

|

|

|

| Selling expenses |

22 |

|

(5,411) |

|

(4,379) |

| General and administrative expenses |

22 |

|

(831) |

|

(787) |

| Depreciation and amortization |

|

|

(1,394) |

|

(919) |

| Share of profit of associates |

11 |

|

51 |

|

44 |

| Other operating revenues (expenses), net |

23 |

|

49 |

|

(72) |

| |

|

|

(7,536) |

|

(6,113) |

| Operating profit before financial result |

|

|

3,285 |

|

2,850 |

| |

|

|

|

|

|

| Financial revenues |

24 |

|

281 |

|

394 |

| Financial expenses |

24 |

|

(3,012) |

|

(1,909) |

| Net financial result |

|

|

(2,731) |

|

(1,515) |

| |

|

|

|

|

|

| Income before income tax and social contribution |

|

|

554 |

|

1,335 |

| |

|

|

|

|

|

| Income tax and social contribution |

19.1 |

|

156 |

|

(115) |

| |

|

|

|

|

|

| Net income for the year |

|

|

710 |

|

1,220 |

| |

|

|

|

|

|

| Basic earnings per millions shares in Brazilian reais |

|

|

|

|

|

| (weighted average for the year - R$) |

|

|

|

|

|

| Common shares |

25 |

|

0.525574 |

|

0.905322 |

| |

|

|

|

|

|

| Diluted earnings per millions shares in Brazilian reais |

|

|

|

|

|

| (weighted average for the year - R$) |

|

|

|

|

|

| Common shares |

25 |

|

0.524174 |

|

0.901589 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| The accompanying notes are an integral part of these financial statements. |

| SENDAS DISTRIBUIDORA S.A. |

|

|

|

| STATEMENTS OF COMPREHENSIVE

INCOME |

|

|

|

| For the year ended december

31, 2023 |

|

|

|

|

|

| (In millions of Brazilian Reais) |

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

12/31/2023 |

|

12/31/2022 |

| |

|

|

|

|

|

| Net income for the year |

|

|

710 |

|

1,220 |

| |

|

|

|

|

|

| Items that may be subsequently reclassified into the statement of operations |

|

|

|

|

| Fair value of receivables |

|

|

(7) |

|

(2) |

| Income tax effect |

|

|

2 |

|

1 |

| Total comprehensive income for the year |

|

|

705 |

|

1,219 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| The accompanying notes are an integral part of these financial statements. |

| SENDAS DISTRIBUIDORA S.A. |

|

| Statements

of changes in shareholder's equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| For the year

ended december 31, 2023 |

| (In millions of Brazilian Reais) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

Earnings reserves |

|

|

|

|

|

|

| |

|

Note |

|

Share capital |

|

Capital reserves |

|

Legal reserve |

|

Expansion reserve |

|

Tax incentive reserve |

|

Profit Reserve |

|

Retained earnings |

|

Other comprehensive income |

|

Total |

| As of January 1, 2022 |

|

|

|

788 |

|

18 |

|

157 |

|

- |

|

709 |

|

1,095 |

|

- |

|

(1) |

|

2,766 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income for the year |

|

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

1,220 |

|

- |

|

1,220 |

| Fair value of receivables |

|

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(2) |

|

(2) |

| Income tax effect |

|

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

1 |

|

1 |

| Comprehensive income for the year |

|

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

1,220 |

|

(1) |

|

1,219 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital contribution |

|

|

|

11 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

11 |

| Capital contribution - capitalization of reserves |

|

|

|

464 |

|

- |

|

- |

|

- |

|

- |

|

(464) |

|

- |

|

- |

|

- |

| Stock options granted |

|

|

|

- |

|

18 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

18 |

| Interest on own capital |

|

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(50) |

|

- |

|

(50) |

| Dividends |

|

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(68) |

|

- |

|

(68) |

| Tax incentive reserve |

|

|

|

- |

|

- |

|

- |

|

- |

|

753 |

|

- |

|

(753) |

|

- |

|

- |

| Expansion reserve |

|

|

|

- |

|

- |

|

- |

|

632 |

|

- |

|

(632) |

|

- |

|

- |

|

- |

| Legal reserve |

|

|

|

- |

|

- |

|

23 |

|

- |

|

- |

|

- |

|

(23) |

|

- |

|

- |

| Profit reserve |

|

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

326 |

|

(326) |

|

- |

|

- |

| As of December 31, 2022 |

|

|

|

1,263 |

|

36 |

|

180 |

|

632 |

|

1,462 |

|

325 |

|

- |

|

(2) |

|

3,896 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other comprehensive income |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income for the year |

|

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

710 |

|

- |

|

710 |

| Fair value of receivables |

|

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

(7) |

|

(7) |

| Income tax effect |

|

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

2 |

|

2 |

| Comprehensive income for the year |

|

|

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

710 |

|

(5) |

|

705 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital contribution |

|

20.1 |

|

9 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

9 |

| Stock options granted |

|

|

|

- |

|

20 |

|

- |

|

- |

|

- |

|

- |

|

- |

|

- |

|

20 |

| Tax incentive reserve |

|

20.5 |

|

- |

|

- |

|

- |

|

- |

|

710 |

|

- |

|

(710) |

|

- |

|

- |

| Expansion reserve |

|

20.4 |

|

- |

|

- |

|

- |

|

325 |

|

- |

|

(325) |

|

- |

|

- |

|

- |

| As of December 31, 2023 |

|

|

|

1,272 |

|

56 |

|

180 |

|

957 |

|

2,172 |

|

- |

|

- |

|

(7) |

|

4,630 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| The accompanying notes are an integral part of these financial statements. |

| SENDAS DISTRIBUIDORA S.A. |

| Statements of cash

flows |

| For the year ended

december 31, 2023 |

| (In millions of Brazilian Reais) |

| |

|

|

|

|

| |

|

12/31/2023 |

|

12/31/2022 |

| Cash flow from operating activities |

|

|

|

|

| Net income for the year |

|

710 |

|

1,220 |

| Adjustments to reconcile net income for the year |

|

|

|

|

| Deferred income tax and social contribution |

|

(162) |

|

40 |

| (Gain) loss of disposal of property, plant and equipment and leasing |

|

(55) |

|

34 |

| Depreciation and amortization |

|

1,476 |

|

990 |

| Financial charges |

|

2,853 |

|

1,827 |

| Share of profit of associate |

|

(51) |

|

(44) |

| Provision (reversal) for legal proceedings |

|

151 |

|

(7) |

| Provision for stock option |

|

20 |

|

18 |

| Allowance for inventory losses and damages |

|

538 |

|

418 |

| Expected credit loss for doubtful accounts |

|

4 |

|

7 |

| |

|

5,484 |

|

4,503 |

| Variations in operating assets and liabilities |

|

|

|

|

| Trade receivables |

|

(640) |

|

(313) |

| Inventories |

|

(735) |

|

(2,505) |

| Recoverable taxes |

|

352 |

|

(336) |

| Restricted deposits for legal proceedings |

|

12 |

|

63 |

| Other assets |

|

(14) |

|

9 |

| Trade payables |

|

1,498 |

|

3,175 |

| Payroll and related taxes |

|

40 |

|

159 |

| Related parties |

|

(5) |

|

196 |

| Payment for legal proceedings |

|

(71) |

|

(49) |

| Taxes and social contributions payable |

|

40 |

|

101 |

| Deferred revenue |

|

96 |

|

68 |

| Dividends received |

|

20 |

|

16 |

| Other liabilities |

|

(114) |

|

57 |

| |

|

479 |

|

641 |

| |

|

|

|

|

| Net cash generated by operating activities |

|

5,963 |

|

5,144 |

| |

|

|

|

|

| Cash flow from investment activities |

|

|

|

|

| Purchase of property, plant and equipment |

|

(3,116) |

|

(3,524) |

| Purchase of intangible assets |

|

(169) |

|

(636) |

| Purchase of assets held for sale |

|

- |

|

(250) |

| Proceeds from property, plant and equipment |

|

19 |

|

- |

| Proceeds from assets held for sale |

|

211 |

|

620 |

| Net cash used in investment activities |

|

(3,055) |

|

(3,790) |

| |

|

|

|

|

| Cash flow from financing activities |

|

|

|

|

| Capital contribution |

|

9 |

|

11 |

| Proceeds from borrowings |

|

3,392 |

|

4,001 |

| Borrowing costs |

|

(142) |

|

(42) |

| Payment of borrowings |

|

(1,499) |

|

(183) |

| Payment of interest on borrowings |

|

(1,085) |

|

(783) |

| Dividends and interest on own capital paid |

|

(118) |

|

(168) |

| Payment of lease liabilities |

|

(262) |

|

(126) |

| Payment of interest on lease liabilities |

|

(977) |

|

(772) |

| Payment of acquisition of hypermarkets |

|

(2,609) |

|

- |

| Net cash (used in) generated by financing activities |

|

(3,291) |

|

1,938 |

| |

|

|

|

|

| Net (decrease) increase in cash and cash equivalents |

|

(383) |

|

3,292 |

| |

|

|

|

|

| Cash and cash equivalents at the beginning of the year |

|

5,842 |

|

2,550 |

| Cash and cash equivalents at the end of the year |

|

5,459 |

|

5,842 |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| The accompanying notes are an integral part of these financial statements. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 |

CORPORATE

INFORMATION |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

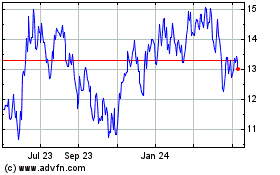

Sendas Distribuidora S.A.

(“Company” or “Sendas”) is a publicly held company listed in the Novo Mercado segment of B3 S.A. - Brasil,

Bolsa, Balcão (B3), under ticker symbol "ASAI3" and on the New York Stock Exchange (NYSE), under ticker symbol "ASAI".

The Company is primarily engaged in the retail and wholesale of food products, bazaar items and other products through its chain

of stores, operated under “ASSAÍ” brand, since this is the only disclosed segment. The Company's registered office

is at Avenida Ayrton Senna, 6.000, Lote 2 - Anexo A, Jacarepaguá, in the State of Rio de Janeiro. As of December 31, 2023,

the Company operated 288 stores (263 stores as of December 31, 2022) and 11 distribution centers (12 distribution centers as of December

31, 2022) in the five regions of the country, with operations in 24 states and in the Federal District. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.1 |

Key

matters |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Disposal of ownership interest of the Casino Group, see note 10.1. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Acquisition of hypermarkets by Assaí, see notes 13.1, 15.3 and 27. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1.2 |

Going concern analysis |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Management

has assessed the Company’s ability to continue operating in a foreseeable future and concluded that Company has ability to

maintain its operations and systems working regularly. Therefore, Management is not aware of any material uncertainty that could

indicate significant doubts about its ability to continue operating and the financial statements have been prepared based on the

assumption of business continuity. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 2 |

BASIS

OF PREPARATION AND DISCLOSURE OF THE FINANCIAL STATEMENTS |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The

financial statements have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued

by the International Accounting Standards Board ("IASB"), and accounting practices adopted in Brazil law 6,404/76 and technical

pronouncements and interpretations issued by the Brazilian Accounting Pronouncements Committee ("CPC") and approved by

the Brazilian Securities and Exchange Commission ("CVM"). |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The

financial statements have been prepared based on the historical cost basis, except for: (i) certain financial instruments; and (ii)

assets and liabilities arising from business combinations measured at their fair values, when applicable. In accordance with OCPC

07 - Presentation and Disclosures in General Purpose - Financial Statements, all significant information related to the financial

statements, and only them, is being disclosed and is consistent with the information used by Management in managing of the Company's

activities. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The

financial statements are presented in millions of Brazilian Reais (R$), which is the Company's functional currency. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The financial statements

for the year ended December 31, 2023 were approved by the Board of Directors on February 21, 2024. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3 |

MATERIAL

ACCOUNTING POLICIES INFORMATION |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The

material accounting policies and practices are described in each corresponding explanatory note, except for those below that are

related to more than one explanatory note. Accounting policies and practices have been consistently applied to the years presented. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.1 |

Foreign

currency transactions |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Assets

and liabilities denominated in foreign currencies are translated into Brazilian Reais, using the spot exchange rate at the end of

each reporting period. Gains or losses on changes in exchange rate variations are recognized as financial revenues or expense. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.2 |

Classification

of assets and liabilities as current and non-current |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Assets

(with the exception of deferred income tax and social contribution) that are expected to be realized or that are intended to be sold

or consumed within twelve months, as of the balance sheet dates, are classified as current assets. Liabilities (with the exception

of deferred income tax and social contribution) expected to be settled within twelve months from the balance sheet dates are classified

as current. All other assets and liabilities (including deferred tax taxes) are classified as "non-current". |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Long-term

assets and liabilities are not adjusted to present value at initial recognition as their effects are immaterial. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Deferred

tax assets and liabilities are classified as “non-current”, net by legal entity, as provided for in accounting pronouncement

CPC 32/IAS 12 - Income Taxes. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.3 |

Joint

Venture |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

A

joint venture is a joint arrangement whereby the parties that have joint control of the arrangement have rights to the assets of

the arrangement and have obligations for the liabilities related to the business. These parties are called joint venturers. Joint

control is the contractually agreed sharing of business control, which exists only when decisions about the relevant activities require

the unanimous consent of the parties who share control. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Jointly-controlled

subsidiary is accounted in the equity method, see note 11. |

| 3.4 |

Investment

grants |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Investment grants are

recognized when there is reasonable assurance that the entity will comply with all conditions established and related to the grant

and that the grant will be received. When the benefit relates to an expense item, it is recognized as revenue over the period of

the benefit systematically in relation to the respective expenses for whose benefit it is intended to offset. When the benefit relates

to an asset, it is recognized as deferred revenue in liabilities and on a systematic and rational basis over the useful life of the

asset. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.5 |

Dividends |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The

distribution of dividends to the Company's shareholders is recognized as a liability at the end of the year, based on the minimum

mandatory dividends defined in the bylaws. Any amounts exceeding this minimum are recorded only on the date on which such additional

dividends are approved by the Company's shareholders, see note 20.2. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.6 |

Statement

of cash flows interest payments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The

interest payments on borrowings and lease settled by the Company are being disclosed in the financing activities in conjunction with

payments of related borrowings and lease, in accordance with CPC 03 (R2)/IAS7 – Statement of Cash Flows. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3.7 |

Statement

of value added |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The

statement of value added intends to evidence the wealth created by the Company and its distribution in a given year and is presented

as required by Brazilian Corporation Law as part of its financial statements, as it is neither mandatory nor established by IFRS. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

This

statement was prepared based on information obtained from accounting records which provide the basis for the preparation of the financial

statements, additional records, and in accordance with technical pronouncement CPC 09 – Statement of Value Added. The first

part presents the wealth created by the Company, represented by revenue (gross sale revenue, including taxes, other revenue and the

effects of the allowance for doubtful accounts), inputs acquired from third parties (cost of sales and acquisition of materials,

energy and outsourced services, including taxes at the time of acquisition, the effects of losses and the recovery of assets, and

depreciation and amortization) and value added received from third parties (equity in the earnings of subsidiaries, financial revenues

and other revenues). The second part of the statement presents the distribution of wealth among personnel, taxes, fees and contributions;

and value distributed to third party creditors and shareholders. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4 |

ADOPTION

OF NEW PROCEDURES, AMENDMENTS TO AND INTERPRETATIONS OF EXISTING STANDARDS ISSUED BY THE IASB AND CPC AND PUBLISHED STANDARDS EFFECTIVE

FROM 2023 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 4.1 |

Amendments

to IFRSs and new interpretations of mandatory application starting at the current year |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

In

2023, the Company evaluated the amendments and new interpretations to the CPCs and IFRSs issued by the CPC and IASB, respectively,

which are effective for accounting periods beginning on or after January 1, 2023. The main changes applicable to the Company

are: |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Pronouncement |

|

Description |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Amendments

to IAS 1 Presentation of Financial Statements and IFRS Statement of Practice 2 - Making Materiality Judgments |

|

It

changes the requirements in IAS 1 with regard to disclosure of accounting policies. Only the policies that, together with other information

in the financial statements, can reasonably influence decisions. Policies related to immaterial transactions do not need to be disclosed,

but policies may be significant due to their nature even if the amounts are immaterial. However, not all significant policy information

is in itself material. |

| |

Amendments

to IAS 12/CPC 32 - Deferred Tax Related to Assets and Liabilities Resulting from a Single Transaction |

|

The

amendments introduce a further exception from the initial recognition exemption. Under the amendments, an entity does not apply the

initial recognition exemption to transactions that give rise to equal taxable and deductible temporary differences.

Depending on the applicable tax law, equal taxable and deductible differences may arise on initial recognition of an asset and liability

in a transaction that is not a business combination and affects neither accounting nor taxable profit. For example, this may arise

upon recognition of a lease liability and the corresponding right-of-use asset applying IFRS 16 at the commencement date of a lease. |

| |

Amendments

to IAS 8 - Accounting Policies, Changes in Accounting Estimates and Rectification of Errors — Definition of Accounting Estimates |

|

The

amendments to IAS 8 refer to situations that requiring changes in accounting policies and reinforce that they should only occur if

required by standard or implementation of IASB or if they result in financial statements that are more reliable and material. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The

adoption of these standards did not result in a material impact on the Company's financial statements. |

| 4.2 |

New

and revised standards and interpretations issued but not yet adopted |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The

Company evaluated all new and revised CPCs and IFRSs, already issued and not yet effective, however did not adopt them in advance,

of which the most significant are: |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Pronouncement |

|

Description |

|

Applicable

to annual periods beginning on or after |

| |

Amendments

to IFRS 10/CPC 36 (R3) and IAS 28/CPC 18 (R2) - Sale or Contribution of Assets between an Investor and its Associate or Joint Venture |

|

The

amendments to IFRS 10 (CPC 36 (R3)) and IAS 28 (CPC 18 (R2)) deal with situations that involve the sale or contribution of assets

between an investor and its associate or joint venture. Specifically the amendments state that gains or losses resulting from the

loss of control of a subsidiary that does not contain a business in a transaction with an associate or joint venture that is accounted

for using the equity method, are recognized in the parent company's statement of operations only in proportion to the interests of

the unrelated investor in this affiliate or joint venture. Similarly, gains and losses resulting from the remeasurement of investments

retained in a former controlled company (that has become an associate or joint venture that is accounted for using the equity method)

to fair value are recognized in the statement of operations of the former controlling company in proportion to the investor's shares

not related to the new associate or joint venture. |

|

1/1/2024 |

| |

|

|

|

| |

Amendments

to IAS 1/CPC 26 (R1):

- Classification of liabilities as current and non-current |

|

The

amendments to IAS 1 published in January 2020 affect only the presentation of liabilities as current or non-current in the balance

sheet and not the amount or timing of recognition of any asset, liability, income or expenses, or the information disclosed about

those items.

The amendments clarify that the classification of liabilities as current or non-current is based on rights that are in existence

at the end of the reporting period, specify that classification is unaffected by expectations about whether an entity will exercise

its right to defer settlement of a liability, explain that rights are in existence if covenants are complied with at the end of the

reporting period, and introduce a definition of ‘settlement’ to make clear that settlement refers to the transfer to

the counterparty of cash, equity instruments, other assets or services. |

|

1/1/2024 |

| |

|

|

|

| |

Amendments

to IAS 1 – Presentation of Financial Statements – Non-Current Liabilities with Covenants |

|

IAS

1 requires debt to be classified as non-current only if the company can defer the settlement of the debt in the 12 months after the

reporting date. The purpose of this initiative is regarding to improve the information disclosed by companies regarding long-term

debt with covenants, and allow investors to understand the risk that a certain debt would become payable in advance. |

|

1/1/2024 |

| |

|

|

|

| |

Amendments

to IFRS 7/IAS 7 - Statement of Cash Flows and IFRS 7 - Financial Instruments: Disclosures - Supplier Financing Agreements |

|

The

amendments include a disclosure objective in IAS 7 stating that an entity must disclose information on its supplier financing arrangements

that allows users of financial statements to assess the effects of these arrangements on the entity's liabilities and cash flows.

Additionally, IFRS 7 was amended to include supplier financing agreements within the requirements to disclosure of information on

the entity's exposure to liquidity risk concetration. |

|

1/1/2024 |

| |

|

|

|

| |

Amendments

to IFRS 16 - Lease liabilities in a “Sale and Leaseback” transaction |

|

Under

the amendments, the seller-lessee must not recognize a gain or loss related to the right of use retained by the seller-lessee. |

|

1/1/2024 |

| |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The

amendments are not expected to have a significant impact on the Company's financial statements. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5 |

SIGNIFICANT

ACCOUNTING JUDGMENTS, ESTIMATES AND ASSUMPTIONS |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The preparation of

the financial statements requires Management to makes judgments and estimates and adopt assumptions that affect the reported amounts

of revenues, expenses, assets and liabilities, and the disclosure of contingent liabilities at the end of the reporting period, however,

the uncertainties about these assumptions and estimates may generate results that require substantial adjustments to the carrying

amount of the asset or liability in future periods. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

In the process of

applying the Company's accounting policies, Management has made the following judgments, which have the most significant impact on

the amounts recognized in the financial statements, as disclosed in the following explanatory notes: |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Accounting

Policy |

|

|

|

Note |

| |

Impairment |

|

7.3,12.1,

13.2 and 13.3 |

| |

Inventories:

allowance for inventory losses |

|

8.2 |

| |

Recoverable

taxes: expected realization of tax credits |

|

9 |

| |

Leasing

operations: determination of the lease term, and incremental interest rate |

|

14.2 |

| |

Measurement

of the fair value of derivatives and other financial instruments |

|

16.8 |

| |

Provision

for legal proceedings: Record of provision for claims with likelihood assessed as probable loss estimated with a certain degree of

reasonability |

|

17 |

| |

Income

tax: provisions based on reasonable estimates, including uncertain tax treatments |

|

17.4.1

and 19 |

| |

Share-based

payments: estimate of fair value of operations based on a valuation model |

|

20.6 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 6 |

CASH AND CASH EQUIVALENTS |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Cash and equivalents

comprise the bank accounts and short-term, highly liquid investments, immediately convertible into known cash amounts, and subject

to an insignificant risk of change in value, with intention and possibility to be redeemed in the short term, within 90 days as of

the date of investment, without losing income. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

12/31/2023 |

|

12/31/2022 |

|

|

|

|

|

|

|

|

| |

Cash

and bank accounts |

|

|

|

352 |

|

213 |

|

|

|

|

|

|

|

|

| |

Cash

and bank accounts - Abroad (i) |

|

22 |

|

24 |

|

|

|

|

|

|

|

|

| |

Financial

investments (ii) |

|

|

|

5,085 |

|

5,605 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

5,459 |

|

5,842 |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(i) As of December

31, 2023, the Company had funds held abroad, of which R$22 in US dollars (R$24 in US dollars as of December 31, 2022). |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

(ii) As of December 31, 2023, the financial

investments refer to the repurchase and resale agreements and Bank Deposit Certificates - CDB, with a weighted average interest rate

of 95.92% of the CDI - Interbank Deposit Certificate (92.80% of the CDI as of December 31, 2022). |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

The Company's exposure

to interest rate indexes and the sensitivity analysis for these financial assets are disclosed in note 16.7. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 7 |

TRADE RECEIVABLES |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Trade receivables are initially recorded

at the transaction amount, which corresponds to the sale value, and are subsequently measured according to the portfolio: (i) fair

value through other comprehensive income, in the case of receivables from credit card companies and (ii) amortized cost, for other

customer portfolio. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Note |

|

12/31/2023 |

|

12/31/2022 |

| |

From

sales with: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Credit

card |

|

|

|

|

|

|

|

|

|

7.1 |

|

589 |

|

241 |

| |

Credit

card - related parties |

|

|

|

|

|

|

|

10.1 |

|

211 |

|

49 |

| |

Ticket

and slips |

|

|

|

|

|

|

|

|

|

7.1

and 7.2 |

|

333 |

|

249 |

| |

Related

parties |

|

|

|

|

|

|

|

|

|

10.1 |

|

- |