SelectQuote, Inc. (NYSE: SLQT) (the “Company”), a leading

distributor of Medicare insurance policies and owner of a

rapidly-growing healthcare services platform, today announced that

the Company signed a $350 million strategic investment from funds

managed by Bain Capital, Morgan Stanley Private Credit, and

Newlight Partners.

The transaction positions the Company to continue growing its

healthcare services business, deepening its relationship with

carrier partners and providing choice and value for consumers. This

investment will allow the Company to recapitalize its balance

sheet, to lower its annual cash debt service, and to provide

liquidity and increase operating flexibility to fund growth

initiatives. The Company’s successful renegotiation of its Senior

Secured Credit Facility provides a lower interest rate on the

remaining balance.

This investment will accelerate the Company’s effort to optimize

its capital structure as it continues to explore accretive,

strategic solutions with its insurance carrier partners and to grow

its rapidly expanding healthcare services business.

Additionally, SelectQuote is appointing Chris Wolfe of Bain

Capital and Srdjan Vukovic of Newlight Partners to the Board of

Directors, each bringing over 20 years of investing and healthcare

sector experience to the Company. SelectQuote anticipates Mr. Wolfe

and Mr. Vukovic will join the Board upon the closing of the

transaction, expected to be on February 28, 2025.

SelectQuote CEO Tim Danker commented, “This strategic investment

provides the financing we need to capitalize on the robust growth

opportunities we foresee in both the senior health insurance and

healthcare services marketplaces. While we have more work to do,

this deal, on the heels of our 2024 receivables securitization,

marks the second meaningful milestone toward our ultimate goal of

refinancing the business and significantly deleveraging the balance

sheet.”

Mr. Danker continued, “We look forward to benefitting from

Chris’s and Srdjan’s valuable growth-oriented healthcare expertise

to help augment the Company’s mission to drive long-term value

creation.”

Mr. Wolfe is a Managing Director at Bain Capital Insurance, the

dedicated insurance investing unit of Bain Capital. Previously, he

was a partner at Capital Z Partners and a principal in a series of

special purpose acquisition vehicles focused on health insurance

and services. Mr. Wolfe has more than 20 years of experience in

healthcare and insurance private equity investing.

“SelectQuote pioneered the way consumers approach shopping for

insurance by removing barriers and introducing transparency and

choice,” added Mr. Wolfe. “I am excited to partner with my fellow

board members and the Company’s management team to drive continued

growth of its robust insurance sales and healthcare services

solutions, which play a crucial role in safeguarding and enhancing

the financial well-being and health of its customers."

Mr. Vukovic is a Partner at Newlight Partners, where he focuses

on investments in the healthcare industry. Representative

investments include Oak Street Health (acquired by CVS Health) and

Zing Health. He has over 20 years of private equity investing

experience.

Ashwin Krishnan, Managing Director and Co-Head of North America

Private Credit at Morgan Stanley Investment Management stated, “We

are pleased to partner with SelectQuote and lead this financing

alongside our partners Bain Capital and Newlight. We believe this

investment, along with the Company’s recent operating momentum,

sets the business up for continued long-term success.”

Jefferies served as Exclusive Financial Advisor to SelectQuote

in the transaction. Wachtell, Lipton, Rosen & Katz served as

legal advisor to SelectQuote.

Forward Looking Statements

This release contains forward-looking statements. These

forward-looking statements reflect our current views with respect

to, among other things, future events and our financial

performance. These statements are often, but not always, made

through the use of words or phrases such as “may,” “should,”

“could,” “predict,” “potential,” “believe,” “will likely result,”

“expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,”

“intend,” “plan,” “projection,” “would” and “outlook,” or the

negative version of those words or other comparable words or

phrases of a future or forward-looking nature. These

forward-looking statements are not historical facts, and are based

on current expectations, estimates and projections about our

industry, management’s beliefs and certain assumptions made by

management, many of which, by their nature, are inherently

uncertain and beyond our control. Accordingly, we caution you that

any such forward-looking statements are not guarantees of future

performance and are subject to risks, assumptions and uncertainties

that are difficult to predict. Although we believe that the

expectations reflected in these forward-looking statements are

reasonable as of the date made, actual results may prove to be

materially different from the results expressed or implied by the

forward-looking statements.

There are or will be important factors that could cause our

actual results to differ materially from those indicated in these

forward-looking statements, including, but not limited to, the

following: our reliance on a limited number of insurance carrier

partners and any potential termination of those relationships or

failure to develop new relationships; existing and future laws and

regulations affecting the health insurance market; changes in

health insurance products offered by our insurance carrier partners

and the health insurance market generally; insurance carriers

offering products and services directly to consumers; changes to

commissions paid by insurance carriers and underwriting practices;

competition with brokers, exclusively online brokers and carriers

who opt to sell policies directly to consumers; competition from

government-run health insurance exchanges; developments in the U.S.

health insurance system; our dependence on revenue from carriers in

our senior segment and downturns in the senior health as well as

life, automotive and home insurance industries; our ability to

develop new offerings and penetrate new vertical markets; risks

from third-party products; failure to enroll individuals during the

Medicare annual enrollment period; our ability to attract,

integrate and retain qualified personnel; our dependence on lead

providers and ability to compete for leads; failure to obtain

and/or convert sales leads to actual sales of insurance policies;

access to data from consumers and insurance carriers; accuracy of

information provided from and to consumers during the insurance

shopping process; cost-effective advertisement through internet

search engines; ability to contact consumers and market products by

telephone; global economic conditions, including inflation;

disruption to operations as a result of future acquisitions;

significant estimates and assumptions in the preparation of our

financial statements; impairment of goodwill; potential litigation

and other legal proceedings or inquiries; our existing and future

indebtedness; our ability to maintain compliance with our debt

covenants; access to additional capital; failure to protect our

intellectual property and our brand; fluctuations in our financial

results caused by seasonality; accuracy and timeliness of

commissions reports from insurance carriers; timing of insurance

carriers’ approval and payment practices; factors that impact our

estimate of the constrained lifetime value of commissions per

policyholder; changes in accounting rules, tax legislation and

other legislation; disruptions or failures of our technological

infrastructure and platform; failure to maintain relationships with

third-party service providers; cybersecurity breaches or other

attacks involving our systems or those of our insurance carrier

partners or third-party service providers; our ability to protect

consumer information and other data; failure to market and sell

Medicare plans effectively or in compliance with laws; and other

factors related to our pharmacy business, including manufacturing

or supply chain disruptions, access to and demand for prescription

drugs, and regulatory changes or other industry developments that

may affect our pharmacy operations. For a further discussion of

these and other risk factors that could impact our future results

and performance, see the section entitled “Risk Factors” in the

most recent Annual Report on Form 10-K (the “Annual Report”) and

subsequent periodic reports filed by us with the Securities and

Exchange Commission. Accordingly, you should not place undue

reliance on any such forward-looking statements. Any

forward-looking statement speaks only as of the date on which it is

made, and, except as otherwise required by law, we do not undertake

any obligation to publicly update or review any forward-looking

statement, whether as a result of new information, future

developments or otherwise.

About SelectQuote:

Founded in 1985, SelectQuote (NYSE: SLQT) pioneered the model of

providing unbiased comparisons from multiple, highly-rated

insurance companies, allowing consumers to choose the policy and

terms that best meet their unique needs. Two foundational pillars

underpin SelectQuote’s success: a strong force of highly-trained

and skilled agents who provide a consultative needs analysis for

every consumer, and proprietary technology that sources and routes

high-quality leads. Today, the Company operates an ecosystem

offering high touchpoints for consumers across insurance, pharmacy,

and virtual care.

With an ecosystem offering engagement points for consumers

across insurance, Medicare, pharmacy, and value-based care, the

company now has three core business lines: SelectQuote Senior,

SelectQuote Healthcare Services, and SelectQuote Life. SelectQuote

Senior serves the needs of a demographic that sees around 10,000

people turn 65 each day with a range of Medicare Advantage and

Medicare Supplement plans. SelectQuote Healthcare Services is

comprised of the SelectRx Pharmacy, a Patient-Centered Pharmacy

Home™ (PCPH) accredited pharmacy, SelectPatient Management, a

provider of chronic care management services, and Healthcare Select

which proactively connects consumers with a wide breadth of

healthcare services supporting their needs.

About Bain Capital:

Founded in 1984, Bain Capital is one of the world’s leading

private investment firms. We are committed to creating lasting

impact for our investors, teams, businesses, and the communities in

which we live. As a private partnership, we lead with conviction

and a culture of collaboration, advantages that enable us to

innovate investment approaches, unlock opportunities, and create

exceptional outcomes. Our global platform invests across five focus

areas: Private Equity, Growth & Venture, Capital Solutions,

Credit & Capital Markets, and Real Assets. In these focus

areas, we bring deep sector expertise and wide-ranging

capabilities. We have 24 offices on four continents, more than

1,850 employees, and approximately $185 billion in assets under

management. To learn more, visit www.baincapital.com. Follow

@BainCapital on LinkedIn and X (Twitter).

About Newlight Partners:

Newlight Partners LP is a growth-focused private equity firm

that builds businesses in partnership with exceptional founders and

management teams. Newlight’s thematic investment approach focuses

on identifying and addressing marketplace opportunities in rapidly

growing subsectors. Areas of focus include digital transformation,

decarbonization, financial services, and healthcare.

About Morgan Stanley Private Credit:

Morgan Stanley Private Credit, part of Morgan Stanley Investment

Management, is a private credit platform focused on direct lending

and opportunistic private credit investment in North America and

Western Europe. The Morgan Stanley Private Credit team invests

across the capital structure, including senior secured term loans,

unitranche loans, junior debt, structured equity and common equity

co-investments. For further information, please visit the website:

morganstanley.com/im/private-credit

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250210433873/en/

Investor Relations: Sloan Bohlen 877-678-4083

investorrelations@selectquote.com Media: Matt Gunter 913-286-4931

matt.gunter@selectquote.com

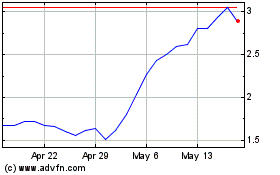

SelectQuote (NYSE:SLQT)

Historical Stock Chart

From Jan 2025 to Feb 2025

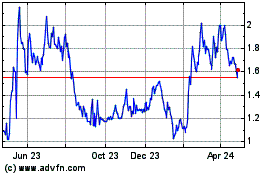

SelectQuote (NYSE:SLQT)

Historical Stock Chart

From Feb 2024 to Feb 2025