0001794783false00017947832024-09-132024-09-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________

FORM 8-K

_______________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 13, 2024

_____________________________________

SELECTQUOTE, INC.

(Exact name of registrant as specified in its charter)

_____________________________________

| | | | | | | | |

| Delaware | 001-39295 | 94-3339273 |

(State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

|

6800 West 115th Street, Suite 2511 |

Overland Park, Kansas 66211 |

(Address of principal executive offices) (Zip code) |

| | |

(913) 599-9225 |

(Registrant’s telephone number, including area code) |

|

No change since last report |

(Former Name or Address, If Changed Since Last Report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, $0.01 par value | | SLQT | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On September 13, 2024, the Company reported its financial results for the fourth quarter and year ended June 30, 2024. Copies of the related press release and investor presentation are attached hereto as Exhibits 99.1 and 99.2, respectively, and are incorporated herein by reference.

These exhibits are being furnished pursuant to Item 2.02, and the information contained therein shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall either of them be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit No. | Description of Exhibit |

| Press Release |

| Investor Presentation |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

SELECTQUOTE, INC.

| | | | | |

Date: September 13, 2024 | By: /s/ Ryan M. Clement |

| Name: Ryan M. Clement |

| Title: Chief Financial Officer

|

SelectQuote, Inc. Reports Fourth Quarter of Fiscal Year 2024 Results

Fourth Quarter of Fiscal Year 2024 – Consolidated Earnings Highlights

•Revenue of $307.2 million

•Net loss of $31.0 million

•Adjusted EBITDA* of $14.4 million

Fiscal Year 2025 Guidance Ranges:

•Revenue expected in a range of $1.4 billion to $1.5 billion

•Net loss expected in a range of $42 million to $6 million

•Adjusted EBITDA* expected in a range of $90 million to $120 million

Fourth Quarter Fiscal Year 2024 – Segment Highlights

Senior

•Revenue of $114.1 million

•Adjusted EBITDA* of $27.9 million

•Approved Medicare Advantage policies of 107,272

Healthcare Services

•Revenue of $145.2 million

•Adjusted EBITDA* of $0.9 million

•Approximately 82,000 SelectRx members

Life

•Revenue of $42.1 million

•Adjusted EBITDA* of $7.2 million

Auto & Home

•Revenue of $7.6 million

•Adjusted EBITDA* of $2.5 million

OVERLAND PARK, Kan., September 13, 2024--(BUSINESS WIRE)--SelectQuote, Inc. (NYSE: SLQT) reported consolidated revenue for the fourth quarter of fiscal year 2024 of $307.2 million compared to consolidated revenue for the fourth quarter of fiscal year 2023 of $221.8 million. Consolidated net loss for the fourth quarter of fiscal year 2024 was $31.0 million compared to consolidated net loss for the fourth quarter of fiscal year 2023 of $47.8 million. Finally, consolidated Adjusted EBITDA* for the fourth quarter of fiscal year 2024 was $14.4 million compared to consolidated Adjusted EBITDA* for the fourth quarter of fiscal year 2023 of $(5.8) million.

Consolidated revenue for the fiscal year ended June 30, 2024, was $1.3 billion compared to consolidated revenue for the fiscal year ended June 30, 2023, of $1.0 billion. Consolidated net loss for the fiscal year ended June 30, 2024, was $34.1 million compared to consolidated net loss for the fiscal year ended June 30, 2023, of $58.5 million. Finally, consolidated Adjusted EBITDA* for the fiscal year ended June 30, 2024, was $117.0 million compared to consolidated Adjusted EBITDA* of $74.3 million for the fiscal year ended June 30, 2023.

SelectQuote Chief Executive Officer, Tim Danker, commented, “2024 was another successful and strong year for SelectQuote across both Senior Medicare Advantage distribution and our Healthcare Services business, driven by SelectRx. On a consolidated basis our fiscal year revenue and Adjusted EBITDA outperformed the midpoint of our original forecast by 17% and 26%, respectively. This marks the 10th consecutive quarter of outperformance versus our internal expectations, reaffirming our strategy to prioritize profitability and cash efficiency over volume growth. Revenue growth was driven primarily by 68% growth in SelectRx members and increasing utilization. Our profitability was driven by another strong year of execution in Senior, which achieved a 25% Adjusted EBITDA margin, similar to a very strong fiscal 2023. Additionally, our Healthcare Services segment achieved its 5th straight quarter of profitability ending the year with Adjusted EBITDA of $7.8 million, which compares to an Adjusted EBITDA loss of $22.8 million in fiscal 2023. Lastly, SelectQuote has signed a non-binding letter of intent to

* See “Non-GAAP Financial Measures” below.

complete an initial commissions receivable securitization of approximately $100 million with certain of our term lenders. Provided this deal closes in the coming weeks, we believe this will be an important first step in our strategic imperative to optimizing our balance sheet capacity, lowering our funding costs, and extending our debt maturities.”

Mr. Danker continued, “SelectQuote’s unique healthcare information platform remains best positioned as a value creation conduit, efficiently connecting a large and growing population of Americans in need of coverage and care with the best providers, based on each of their distinct personal needs.”

Segment Results

We currently report on four segments: 1) Senior, 2) Healthcare Services, 3) Life, and 4) Auto & Home. The performance measures of the segments include total revenue and Adjusted EBITDA.* Costs of commissions and other services revenue, cost of goods sold-pharmacy revenue, marketing and advertising, selling, general, and administrative, and technical development operating expenses that are directly attributable to a segment are reported within the applicable segment. Indirect costs of revenue, marketing and advertising, selling, general, and administrative, and technical development operating expenses are allocated to each segment based on varying metrics such as headcount. Adjusted EBITDA is our segment profit measure to evaluate the operating performance of our business. We define Adjusted EBITDA as net loss plus: (i) interest expense, net; (ii) benefit for income taxes; (iii) depreciation and amortization; (iv) share-based compensation; (v) goodwill, long-lived asset, and intangible assets impairments; (vi) transaction costs; (vii) loss on disposal of property, equipment and software, net; and (viii) other non-recurring expenses and income. Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided by revenue.

Senior

Financial Results

The following table provides the financial results for the Senior segment for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| (in thousands) | 4Q 2024 | | 4Q 2023 | | % Change | | FY 2024 | | FY 2023 | | % Change |

| Revenue | $ | 114,143 | | | $ | 103,592 | | | 10 | % | | $ | 655,849 | | | $ | 590,131 | | | 11 | % |

| Adjusted EBITDA* | 27,872 | | | 16,147 | | | 73 | % | | 166,744 | | | 155,077 | | | 8 | % |

| Adjusted EBITDA Margin* | 24 | % | | 16 | % | | | | 25% | | 26% | | |

Operating Metrics

Submitted Policies

Submitted policies are counted when an individual completes an application with our licensed agent and provides authorization to the agent to submit the application to the insurance carrier partner. The applicant may have additional actions to take before the application will be reviewed by the insurance carrier.

The following table shows the number of submitted policies for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

| 4Q 2024 | | 4Q 2023 | | % Change | | FY 2024 | | FY 2023 | | % Change |

| Medicare Advantage | 117,091 | | 114,383 | | 2 | % | | 720,027 | | 652,630 | | 10 | % |

| Medicare Supplement | 456 | | 539 | | (15) | % | | 2,790 | | 3,444 | | (19) | % |

| Dental, Vision and Hearing | 12,821 | | 14,668 | | (13) | % | | 61,713 | | 74,181 | | (17) | % |

| Prescription Drug Plan | 404 | | 351 | | 15 | % | | 3,100 | | 2,433 | | 27 | % |

| Other | 1,579 | | 2,099 | | (25) | % | | 5,303 | | 7,501 | | (29) | % |

| Total | 132,351 | | 132,040 | | — | % | | 792,933 | | 740,189 | | 7 | % |

*See “Non-GAAP Financial Measures” below.

Approved Policies

Approved policies represents the number of submitted policies that were approved by our insurance carrier partners for the identified product during the indicated period. Not all approved policies will go in force.

The following table shows the number of approved policies for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| 4Q 2024 | | 4Q 2023 | | % Change | | FY 2024 | | FY 2023 | | % Change |

| Medicare Advantage | 107,272 | | 110,027 | | (3) | % | | 625,245 | | 577,567 | | 8 | % |

| Medicare Supplement | 307 | | 435 | | (29) | % | | 1,885 | | 2,619 | | (28) | % |

| Dental, Vision and Hearing | 10,995 | | 12,884 | | (15) | % | | 52,469 | | 60,824 | | (14) | % |

| Prescription Drug Plan | 545 | | 350 | | 56 | % | | 3,229 | | 2,144 | | 51 | % |

| Other | 2,002 | | 1,356 | | 48 | % | | 4,836 | | 5,288 | | (9) | % |

| Total | 121,121 | | 125,052 | | (3) | % | | 687,664 | | 648,442 | | 6 | % |

Lifetime Value of Commissions per Approved Policy

Lifetime value of commissions per approved policy represents commissions estimated to be collected over the estimated life of an approved policy based on multiple factors, including but not limited to, contracted commission rates, carrier mix and expected policy persistency with applied constraints. The lifetime value of commissions per approved policy is equal to the sum of the commission revenue due upon the initial sale of a policy, and when applicable, an estimate of future renewal commissions.

The following table shows the lifetime value of commissions per approved policy for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (dollars per policy): | 4Q 2024 | | 4Q 2023 | | % Change | | FY 2024 | | FY 2023 | | % Change |

| Medicare Advantage | $ | 847 | | | $ | 830 | | | 2 | % | | $ | 910 | | | $ | 877 | | | 4 | % |

| Medicare Supplement | 245 | | 1,207 | | (80) | % | | 967 | | 1,030 | | (6) | % |

| Dental, Vision and Hearing | 168 | | 121 | | 39 | % | | 114 | | 100 | | 14 | % |

| Prescription Drug Plan | 181 | | 185 | | (2) | % | | 228 | | 207 | | 10 | % |

| Other | 282 | | 105 | | 169 | % | | 115 | | 101 | | 14 | % |

| | | | | | | | | | | |

Healthcare Services

Financial Results

The following table provides the financial results for the Healthcare Services segment for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (in thousands) | 4Q 2024 | | 4Q 2023 | | % Change | | FY 2024 | | FY 2023 | | % Change |

| Revenue | $ | 145,223 | | | $ | 82,803 | | | 75 | % | | $ | 478,508 | | | $ | 252,075 | | | 90 | % |

| Adjusted EBITDA* | 909 | | | 1,685 | | | (46) | % | | 7,821 | | | (22,769) | | | NM |

| Adjusted EBITDA Margin* | 1 | % | | 2 | % | | | | 2% | | (9)% | | |

Operating Metrics

Members

The total number of SelectRx members represents the amount of active customers to which an order has been shipped and the prescriptions per day represents the total average prescriptions shipped per business day. These two metrics are the primary drivers of revenue for Healthcare Services.

*See “Non-GAAP Financial Measures” below.

The following table shows the total number of SelectRx members as of the periods presented:

| | | | | | | | | | | | | | | | | | |

| | June 30, 2024 | | June 30, 2023 | | | | |

| Total SelectRx Members | | 82,385 | | 49,044 | | | | |

The total number of SelectRx members increased by 68% as of June 30, 2024, compared to June 30, 2023, due to our operating strategy to grow SelectRx.

The following table shows the average prescriptions shipped per day for the periods presented:

| | | | | | | | | | | | | | |

| | FY 2024 | | FY 2023 |

Prescriptions Per Day | | 18,935 | | 10,657 |

Combined Senior and Healthcare Services - Consumer Per Unit Economics

The opportunity to leverage our existing database and distribution model to improve access to healthcare services for our consumers has created a need for us to review our key metrics related to our per unit economics. As we think about the revenue and expenses for Healthcare Services, we note that they are derived from the marketing acquisition costs associated with the sale of an MA or MS policy, some of which costs are allocated directly to Healthcare Services, and therefore determined that our per unit economics measure should include components from both Senior and Healthcare Services. See details of revenue and expense items included in the calculation below.

Combined Senior and Healthcare Services consumer per unit economics represents total MA and MS commissions; other product commissions; other revenues, including revenues from Healthcare Services; and operating expenses associated with Senior and Healthcare Services, each shown per number of approved MA and MS policies over a given time period. Management assesses the business on a per-unit basis to help ensure that the revenue opportunity associated with a successful policy sale is attractive relative to the marketing acquisition cost. Because not all acquired leads result in a successful policy sale, all per-policy metrics are based on approved policies, which is the measure that triggers revenue recognition.

The MA and MS commission per MA/MS policy represents the LTV for policies sold in the period. Other commission per MA/MS policy represents the LTV for other products sold in the period, including DVH prescription drug plan, and other products, which management views as additional commission revenue on our agents’ core function of MA/MS policy sales. Pharmacy revenue per MA/MS policy represents revenue from SelectRx, and other revenue per MA/MS policy represents revenue from Population Health, production bonuses, marketing development funds, lead generation revenue, and adjustments from the Company’s reassessment of its cohorts’ transaction prices. Total operating expenses per MA/MS policy represents all of the operating expenses within Senior and Healthcare Services. The revenue to customer acquisition cost (“CAC”) multiple represents total revenue as a multiple of total marketing acquisition cost, which represents the direct costs of acquiring leads. These costs are included in marketing and advertising expense within the total operating expenses per MA/MS policy.

The following table shows combined Senior and Healthcare Services consumer per unit economics for the periods presented. Based on the seasonality of Senior and the fluctuations between quarters, we believe that the most relevant view of per unit economics is on a rolling 12-month basis. All per MA/MS policy metrics below are based on the sum of approved MA/MS policies, as both products have similar commission profiles.

| | | | | | | | | | | | | |

| Twelve Months Ended June 30, |

| (dollars per approved policy): | 2024 | | 2023 | | |

| MA and MS approved policies | 627,130 | | | 580,186 | | | |

| MA and MS commission per MA / MS policy | $ | 910 | | | $ | 877 | | | |

| Other commission per MA/MS policy | 12 | | | 12 | | | |

| Pharmacy revenue per MA/MS policy | 741 | | | 412 | | | |

| Other revenue per MA/MS policy | 146 | | | 150 | | | |

| Total revenue per MA / MS policy | 1,809 | | | 1,451 | | | |

| Total operating expenses per MA / MS policy | (1,530) | | | (1,224) | | | |

| Adjusted EBITDA per MA/MS policy * | $ | 279 | | | $ | 227 | | | |

| Adjusted EBITDA Margin per MA/MS policy * | 15 | % | | 16 | % | | |

| Revenue / CAC multiple | 4.5X | | 4.1X | | |

Total revenue per MA/MS policy increased 25% for the twelve months ended June 30, 2024, compared to the twelve months ended June 30, 2023, primarily due to the increase in pharmacy revenue. Total operating expenses per MA/MS policy increased 25% for the twelve months ended June 30, 2024, compared to the twelve months ended June 30, 2023, driven by an increase in cost of goods sold-pharmacy revenue for Healthcare Services due to the growth of the business, offset by a decrease in our marketing and advertising costs.

Life

Financial Results

The following table provides the financial results for the Life segment for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (in thousands) | 4Q 2024 | | 4Q 2023 | | % Change | | FY 2024 | | FY 2023 | | % Change |

| Revenue | $ | 42,074 | | | $ | 38,052 | | | 11 | % | | $ | 157,930 | | | $ | 145,832 | | | 8 | % |

| Adjusted EBITDA* | 7,217 | | | 6,702 | | | 8 | % | | 20,164 | | | 23,073 | | | (13) | % |

| Adjusted EBITDA Margin* | 17 | % | | 18 | % | | | | 13% | | 16% | | |

Operating Metrics

Life premium represents the total premium value for all policies that were approved by the relevant insurance carrier partner and for which the policy document was sent to the policyholder and payment information was received by the relevant insurance carrier partner during the indicated period. Because our commissions are earned based on a percentage of total premium, total premium volume for a given period is the key driver of revenue for our Life segment.

The following table shows term and final expense premiums for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (in thousands) | 4Q 2024 | | 4Q 2023 | | % Change | | FY 2024 | | FY 2023 | | % Change |

| Term Premiums | $ | 18,074 | | | $ | 20,507 | | | (12) | % | | $ | 70,450 | | | $ | 68,941 | | | 2 | % |

| Final Expense Premiums | 23,789 | | | 18,960 | | | 25 | % | | 86,600 | | | 77,725 | | | 11 | % |

| Total | $ | 41,863 | | | $ | 39,467 | | | 6 | % | | $ | 157,050 | | | $ | 146,666 | | | 7 | % |

*See “Non-GAAP Financial Measures” below.

Auto & Home

Financial Results

The following table provides the financial results for the Auto & Home segment for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (in thousands) | 4Q 2024 | | 4Q 2023 | | % Change | | FY 2024 | | FY 2023 | | % Change |

| Revenue | $ | 7,580 | | | $ | (1,266) | | (1) | 699 | % | | $ | 36,228 | | | $ | 21,862 | | (1) | 66 | % |

| Adjusted EBITDA* | 2,474 | | | (7,235) | | (1) | NM | | 14,127 | | | 81 | | (1) | NM |

| Adjusted EBITDA Margin* | 33 | % | | NM | | | | 39 | % | | — | % | | |

(1) Decrease is due to the impact of the $10.4 million change in estimate related to the mutual termination of a contract with a certain Auto & Home carrier to provide for the ability to migrate the book of business to other carriers.

Operating Metrics

Auto & Home premium represents the total premium value of all new policies that were approved by our insurance carrier partners during the indicated period. Because our commissions are earned based on a percentage of total premium, total premium volume for a given period is the key driver of revenue for our Auto & Home segment.

The following table shows premiums for the periods presented:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| (in thousands): | 4Q 2024 | | 4Q 2023 | | % Change | | FY 2024 | | FY 2023 | | % Change |

| Premiums | $ | 13,891 | | | $ | 14,460 | | | (4) | % | | $ | 56,637 | | | $ | 50,917 | | | 11 | % |

*See “Non-GAAP Financial Measures” below.

Earnings Conference Call

SelectQuote, Inc. will host a conference call with the investment community on September 13, 2024, beginning at 8:30 a.m. ET. To register for this conference call, please use this link: https://www.netroadshow.com/events/login?show=7297aa9f&confId=70516. After registering, a confirmation will be sent via email, including dial-in details and unique conference call codes for entry. Registration is open through the live call, but to ensure you are connected for the full call we suggest registering at least 10 minutes before the start of the call. The event will also be webcasted live via our investor relations website https://ir.selectquote.com/investor-home/default.aspx.

Non-GAAP Financial Measures

This release includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. To supplement our financial statements presented in accordance with GAAP and to provide investors with additional information regarding our GAAP financial results, we have presented in this release Adjusted EBITDA and Adjusted EBITDA Margin, which are non-GAAP financial measures. These non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP and are not necessarily comparable to similarly titled measures presented by other companies. We define Adjusted EBITDA as net income (loss) before interest expense, income tax expense (benefit), depreciation and amortization, and certain add-backs for non-cash or non-recurring expenses, including restructuring and share-based compensation expenses. The most directly comparable GAAP measure is net income (loss). We define Adjusted EBITDA Margin as Adjusted EBITDA divided by revenue. The most directly comparable GAAP measure is net income margin. We monitor and have presented in this release Adjusted EBITDA and Adjusted EBITDA Margin because they are key measures used by our management and Board of Directors to understand and evaluate our operating performance, to establish budgets, and to develop operational goals for managing our business. In particular, we believe that excluding the impact of these expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core operating performance. We believe that these non-GAAP financial measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses that we exclude in the calculations of these non-GAAP financial measures. Accordingly, we believe that these financial measures provide useful information to investors and others in understanding and evaluating our operating results, enhancing the overall understanding of our past performance and future prospects. Reconciliations of net income (loss) to Adjusted EBITDA are presented below beginning on page 13.

Forward Looking Statements

This release contains forward-looking statements. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts, and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: impacts of the COVID-19 pandemic and any other significant public health events; our reliance on a limited number of insurance carrier partners and any potential termination of those relationships or failure to develop new relationships; existing and future laws and regulations affecting the health insurance market; changes in health insurance products offered by our insurance carrier partners and the health insurance market generally; insurance carriers offering products and services directly to consumers; changes to commissions paid by insurance carriers and underwriting practices; competition with brokers, exclusively online brokers and carriers who opt to sell policies directly to consumers; competition from government-run health insurance exchanges; developments in the U.S. health insurance system; our dependence on revenue from carriers in our senior segment and downturns in the senior health as well as life, automotive and home insurance industries; our ability to develop new offerings and penetrate new vertical markets;

risks from third-party products; failure to enroll individuals during the Medicare annual enrollment period; our ability to attract, integrate and retain qualified personnel; our dependence on lead providers and ability to compete for leads; failure to obtain and/or convert sales leads to actual sales of insurance policies; access to data from consumers and insurance carriers; accuracy of information provided from and to consumers during the insurance shopping process; cost-effective advertisement through internet search engines; ability to contact consumers and market products by telephone; global economic conditions, including inflation; disruption to operations as a result of future acquisitions; significant estimates and assumptions in the preparation of our financial statements; impairment of goodwill; our ability to regain and maintain compliance with NYSE listing standards; potential litigation and other legal proceedings or inquiries; our existing and future indebtedness; our ability to maintain compliance with our debt covenants; access to additional capital; failure to protect our intellectual property and our brand; fluctuations in our financial results caused by seasonality; accuracy and timeliness of commissions reports from insurance carriers; timing of insurance carriers’ approval and payment practices; factors that impact our estimate of the constrained lifetime value of commissions per policyholder; changes in accounting rules, tax legislation and other legislation; disruptions or failures of our technological infrastructure and platform; failure to maintain relationships with third-party service providers; cybersecurity breaches or other attacks involving our systems or those of our insurance carrier partners or third-party service providers; our ability to protect consumer information and other data; failure to market and sell Medicare plans effectively or in compliance with laws; and and other factors related to our pharmacy business, including manufacturing or supply chain disruptions, access to and demand for prescription drugs, and regulatory changes or other industry developments that may affect our pharmacy operations. For a further discussion of these and other risk factors that could impact our future results and performance, see the section entitled “Risk Factors” in the most recent Annual Report on Form 10-K (the “Annual Report”) and subsequent periodic reports filed by us with the Securities and Exchange Commission. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

About SelectQuote:

Founded in 1985, SelectQuote (NYSE: SLQT) provides solutions that help consumers protect their most valuable assets: their families, health, and property. The company pioneered the model of providing unbiased comparisons from multiple, highly-rated insurance companies allowing consumers to choose the policy and terms that best meet their unique needs. Two foundational pillars underpin SelectQuote’s success: a strong force of highly-trained and skilled agents who provide a consultative needs analysis for every consumer, and proprietary technology that sources and routes high-quality leads.

With an ecosystem offering high touchpoints for consumers across Insurance, Medicare, Pharmacy, and Value-Based Care, the company now has four core business lines: SelectQuote Senior, SelectQuote Healthcare Services, SelectQuote Life, and SelectQuote Auto and Home. SelectQuote Senior serves the needs of a demographic that sees around 10,000 people turn 65 each day with a range of Medicare Advantage and Medicare Supplement plans. SelectQuote Healthcare Services is comprised of the SelectRx Pharmacy, a specialized medication management pharmacy, and Population Health which proactively connects its members with best-in-class healthcare services that fit each member's unique healthcare needs. The platform improves health outcomes and lowers healthcare costs through proactive engagement and access to high-value healthcare solutions.

Investor Relations:

Sloan Bohlen

877-678-4083

investorrelations@selectquote.com

Media:

Matt Gunter

913-286-4931

matt.gunter@selectquote.com

Source: SelectQuote, Inc.

SELECTQUOTE, INC. AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands)

| | | | | | | | | | | | |

| June 30, 2024 | | June 30, 2023 | |

| ASSETS | | | | |

| CURRENT ASSETS: | | | | |

| Cash and cash equivalents | $ | 42,690 | | | $ | 83,156 | | |

| | | | |

| Accounts receivable, net of allowances of $8.2 million and $2.7 million, respectively | 150,035 | | | 154,565 | | |

| Commissions receivable-current | 119,871 | | | 111,148 | | |

| Other current assets | 20,327 | | | 14,355 | | |

| Total current assets | 332,923 | | | 363,224 | | |

| COMMISSIONS RECEIVABLE—Net | 761,446 | | | 729,350 | | |

| PROPERTY AND EQUIPMENT—Net | 18,973 | | | 27,452 | | |

| SOFTWARE—Net | 13,978 | | | 14,740 | | |

| OPERATING LEASE RIGHT-OF-USE ASSETS | 23,437 | | | 23,563 | | |

| INTANGIBLE ASSETS—Net | 10,194 | | | 10,200 | | |

| GOODWILL | 29,438 | | | 29,136 | | |

| OTHER ASSETS | 3,519 | | | 21,586 | | |

| TOTAL ASSETS | $ | 1,193,908 | | | $ | 1,219,251 | | |

| | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | |

| CURRENT LIABILITIES: | | | | |

| Accounts payable | $ | 36,587 | | | $ | 27,577 | | |

| Accrued expenses | 16,904 | | | 16,993 | | |

| Accrued compensation and benefits | 57,594 | | | 49,966 | | |

| | | | |

| | | | |

| Operating lease liabilities—current | 4,709 | | | 5,175 | | |

| Current portion of long-term debt | 45,854 | | | 33,883 | | |

| Contract liabilities | 8,066 | | | 1,691 | | |

| Other current liabilities | 4,873 | | | 1,972 | | |

| Total current liabilities | 174,587 | | | 137,257 | | |

| LONG-TERM DEBT, NET—less current portion | 637,480 | | | 664,625 | | |

| | | | |

| DEFERRED INCOME TAXES | 37,478 | | | 39,581 | | |

| OPERATING LEASE LIABILITIES | 25,685 | | | 27,892 | | |

| OTHER LIABILITIES | 1,877 | | | 2,926 | | |

| Total liabilities | 877,107 | | | 872,281 | | |

| | | | |

| COMMITMENTS AND CONTINGENCIES | | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| SHAREHOLDERS’ EQUITY: | | | | |

| Common stock, $0.01 par value | 1,694 | | | 1,669 | | |

| Additional paid-in capital | 580,764 | | | 567,266 | | |

| | | | |

| Accumulated deficit | (269,769) | | | (235,644) | | |

| Accumulated other comprehensive income | 4,112 | | | 13,679 | | |

| Total shareholders’ equity | 316,801 | | | 346,970 | | |

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY | $ | 1,193,908 | | | $ | 1,219,251 | | |

SELECTQUOTE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Year Ended June 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| REVENUE: | | | | | | | |

Commissions and other services | $ | 165,656 | | | $ | 141,873 | | | $ | 856,923 | | | $ | 763,301 | |

| | | | | | | |

| Pharmacy | 141,552 | | | 79,905 | | | 464,853 | | | 239,547 | |

| | | | | | | |

| Total revenue | 307,208 | | | 221,778 | | | 1,321,776 | | | 1,002,848 | |

| | | | | | | |

| OPERATING COSTS AND EXPENSES: | | | | | | | |

Cost of commissions and other services revenue | 64,548 | | | 65,697 | | | 318,798 | | | 301,524 | |

| Cost of goods sold—pharmacy revenue | 120,644 | | | 71,211 | | | 405,004 | | | 225,963 | |

| Marketing and advertising | 70,181 | | | 63,521 | | | 358,858 | | | 301,245 | |

| Selling, general, and administrative | 43,993 | | | 49,856 | | | 141,042 | | | 136,518 | |

| Technical development | 9,233 | | | 7,154 | | | 33,524 | | | 26,015 | |

| | | | | | | |

| Total operating costs and expenses | 308,599 | | | 257,439 | | | 1,257,226 | | | 991,265 | |

| | | | | | | |

| INCOME (LOSS) FROM OPERATIONS | (1,391) | | | (35,661) | | | 64,550 | | | 11,583 | |

| | | | | | | |

| INTEREST EXPENSE, NET | (23,409) | | | (21,721) | | | (93,551) | | | (80,606) | |

| | | | | | | |

| OTHER EXPENSE, NET | (15) | | | (3) | | | (65) | | | (121) | |

LOSS BEFORE INCOME TAX EXPENSE (BENEFIT) | (24,815) | | | (57,385) | | | (29,066) | | | (69,144) | |

INCOME TAX EXPENSE (BENEFIT) | 6,202 | | | (9,547) | | | 5,059 | | | (10,600) | |

| | | | | | | |

| NET LOSS | $ | (31,017) | | | $ | (47,838) | | | $ | (34,125) | | | $ | (58,544) | |

| | | | | | | |

| NET LOSS PER SHARE: | | | | | | | |

| Basic | $ | (0.18) | | | $ | (0.29) | | | $ | (0.20) | | | $ | (0.35) | |

| Diluted | $ | (0.18) | | | $ | (0.29) | | | $ | (0.20) | | | $ | (0.35) | |

| | | | | | | |

| WEIGHTED-AVERAGE COMMON STOCK OUTSTANDING USED IN PER SHARE AMOUNTS: | | | | | | | |

| Basic | 169,204 | | | 166,709 | | | 168,519 | | | 166,140 | |

| Diluted | 169,204 | | | 166,709 | | | 168,519 | | | 166,140 | |

| | | | | | | |

OTHER COMPREHENSIVE INCOME (LOSS) NET OF TAX: | | | | | | | |

Change in cash flow hedge | (2,364) | | | 605 | | | (9,567) | | | 1,963 | |

OTHER COMPREHENSIVE INCOME (LOSS) | (2,364) | | | 605 | | | (9,567) | | | 1,963 | |

| COMPREHENSIVE LOSS | $ | (33,381) | | | $ | (47,233) | | | $ | (43,692) | | | $ | (56,581) | |

SELECTQUOTE, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended June 30, | | Year Ended June 30, |

| | | | | 2024 | | 2023 | | 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | | | | | | | | |

| Net loss | | | | | $ | (31,017) | | | $ | (47,838) | | | $ | (34,125) | | | $ | (58,544) | |

| Adjustments to reconcile net loss to net cash and cash equivalents used in operating activities: | | | | | | | | | | | |

| Depreciation and amortization | | | | | 6,407 | | | 6,794 | | | 24,998 | | | 27,881 | |

| | | | | | | | | | | |

| Loss on disposal of property, equipment, and software | | | | | 523 | | | 364 | | | 536 | | | 754 | |

| Impairment of long-lived assets | | | | | — | | | 17,332 | | | — | | | 17,332 | |

| Share-based compensation expense | | | | | 3,304 | | | 2,785 | | | 13,816 | | | 11,310 | |

| Deferred income taxes | | | | | 3,314 | | | (9,760) | | | 1,163 | | | (11,176) | |

| Amortization of debt issuance costs and debt discount | | | | | 1,279 | | | 2,426 | | | 6,142 | | | 8,676 | |

| Write-off of debt issuance costs | | | | | — | | | — | | | 293 | | | 710 | |

| | | | | | | | | | | |

| Accrued interest payable in kind | | | | | 5,254 | | | 3,565 | | | 19,577 | | | 12,015 | |

| Non-cash lease expense | | | | | 404 | | | 1,070 | | | 2,349 | | | 4,185 | |

| Changes in operating assets and liabilities: | | | | | | | | | | | |

| Accounts receivable, net | | | | | 103,722 | | | 37,921 | | | 5,203 | | | (24,817) | |

| Commissions receivable | | | | | (48,194) | | | (18,964) | | | (40,819) | | | (1,872) | |

| Other assets | | | | | 653 | | | (2,997) | | | (1,967) | | | 169 | |

| Accounts payable and accrued expenses | | | | | (28,726) | | | (10,089) | | | 7,347 | | | (3,649) | |

| Operating lease liabilities | | | | | (1,095) | | | (1,312) | | | (4,897) | | | (5,643) | |

| Other liabilities | | | | | 4,167 | | | 12,161 | | | 15,620 | | | 3,292 | |

Net cash provided by (used in) operating activities | | | | | 19,995 | | | (6,542) | | | 15,236 | | | (19,377) | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | | | | | | | | |

| Purchases of property and equipment | | | | | (268) | | | (391) | | | (3,382) | | | (1,447) | |

| Proceeds from sales of property and equipment | | | | | — | | | — | | | 253 | | | — | |

| Purchases of software and capitalized software development costs | | | | | (2,219) | | | (1,874) | | | (8,284) | | | (7,678) | |

| Acquisition of business | | | | | (3,433) | | | — | | | (3,433) | | | — | |

| | | | | | | | | | | |

| Net cash used in investing activities | | | | | (5,920) | | | (2,265) | | | (14,846) | | | (9,125) | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Payments on Term Loans | | | | | (8,471) | | | — | | | (38,883) | | | (17,833) | |

| | | | | | | | | | | |

| Payments on other debt | | | | | (37) | | | (35) | | | (149) | | | (158) | |

| Proceeds from common stock options exercised and employee stock purchase plan | | | | | 74 | | | — | | | 81 | | | 1,187 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Payments of tax withholdings related to net share settlement of equity awards | | | | | (1) | | | — | | | (374) | | | (40) | |

| Payments of debt issuance costs | | | | | (758) | | | — | | | (1,531) | | | (10,110) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Payment of acquisition holdback | | | | | — | | | (50) | | | — | | | (2,385) | |

Net cash used in financing activities | | | | | (9,193) | | | (85) | | | (40,856) | | | (29,339) | |

NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | | | | | 4,882 | | | (8,892) | | | (40,466) | | | (57,841) | |

| CASH AND CASH EQUIVALENTS—Beginning of period | | | | | 37,808 | | | 92,048 | | | 83,156 | | | 140,997 | |

| CASH AND CASH EQUIVALENTS—End of period | | | | | $ | 42,690 | | | $ | 83,156 | | | $ | 42,690 | | | $ | 83,156 | |

SELECTQUOTE, INC. AND SUBSIDIARIES

Adjusted EBITDA to Loss before income tax expense (benefit) Reconciliation

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2024 |

| (in thousands) | Senior | | Healthcare Services | | Life | | Auto & Home | | | | Total |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Adjusted Segment EBITDA | $ | 27,872 | | | $ | 909 | | | $ | 7,217 | | | $ | 2,474 | | | | | $ | 38,472 | |

Corporate & elimination of intersegment profits | | | | | | | | | | | (24,115) | |

Adjusted EBITDA | | | | | | | | | | | 14,357 | |

| | | | | | | | | | | |

| Share-based compensation expense | | | | | | | | | | | (3,304) | |

Transaction costs | | | | | | | | | | | (5,529) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Depreciation and amortization | | | | | | | | | | | (6,407) | |

| Loss on disposal of property, equipment, and software | | | | | | | | | | | (523) | |

| | | | | | | | | | | |

| Interest expense, net | | | | | | | | | | | (23,409) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Loss before income tax expense (benefit) | | | | | | | | | | | $ | (24,815) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2023 |

| (in thousands) | Senior | | Healthcare Services | | Life | | Auto & Home | | | | Total |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Adjusted Segment EBITDA | $ | 16,147 | | | $ | 1,685 | | | $ | 6,702 | | | $ | (7,235) | | | | | $ | 17,299 | |

| Corporate & elimination of intersegment profits | | | | | | | | | | | (23,122) | |

Adjusted EBITDA | | | | | | | | | | | (5,823) | |

| | | | | | | | | | | |

| Share-based compensation expense | | | | | | | | | | | (2,785) | |

Transaction costs | | | | | | | | | | | (2,568) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Depreciation and amortization | | | | | | | | | | | (6,793) | |

| Loss on disposal of property, equipment, and software | | | | | | | | | | | (363) | |

| Impairment of long-lived assets | | | | | | | | | | | (17,332) | |

| Interest expense, net | | | | | | | | | | | (21,721) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Loss before income tax expense (benefit) | | | | | | | | | | | $ | (57,385) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended June 30, 2024 |

| (in thousands) | Senior | | Healthcare Services | | Life | | Auto & Home | | | | Total |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Adjusted Segment EBITDA | $ | 166,744 | | | $ | 7,821 | | | $ | 20,164 | | | $ | 14,127 | | | | | $ | 208,856 | |

| Corporate & elimination of intersegment profits | | | | | | | | | | | (91,863) | |

| Adjusted EBITDA | | | | | | | | | | | 116,993 | |

| | | | | | | | | | | |

| Share-based compensation expense | | | | | | | | | | | (13,816) | |

| Transaction costs | | | | | | | | | | | (13,158) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Depreciation and amortization | | | | | | | | | | | (24,998) | |

| Loss on disposal of property, equipment, and software | | | | | | | | | | | (536) | |

| | | | | | | | | | | |

| Interest expense, net | | | | | | | | | | | (93,551) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Loss before income tax expense (benefit) | | | | | | | | | | | $ | (29,066) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended June 30, 2023 |

| (in thousands) | Senior | | Healthcare Services | | Life | | Auto & Home | | | | Total |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Adjusted Segment EBITDA | $ | 155,077 | | | $ | (22,769) | | | $ | 23,073 | | | $ | 81 | | | | | $ | 155,462 | |

| Corporate & elimination of intersegment profits | | | | | | | | | | | (81,159) | |

| Adjusted EBITDA | | | | | | | | | | | 74,303 | |

| | | | | | | | | | | |

| Share-based compensation expense | | | | | | | | | | | (11,310) | |

Transaction costs | | | | | | | | | | | (5,569) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Depreciation and amortization | | | | | | | | | | | (27,881) | |

| Loss on disposal of property, equipment, and software | | | | | | | | | | | (749) | |

| | | | | | | | | | | |

| Impairment of long-lived assets | | | | | | | | | | | (17,332) | |

| Interest expense, net | | | | | | | | | | | (80,606) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Loss before income tax expense (benefit) | | | | | | | | | | | $ | (69,144) | |

SELECTQUOTE, INC. AND SUBSIDIARIES

Net Loss to Adjusted EBITDA Reconciliation

(Unaudited)

Guidance net loss to Adjusted EBITDA reconciliation, year ending June 30, 2025:

| | | | | | | | | | | |

| (in thousands) | Range |

| Net loss | $ | (42,000) | | | $ | (6,000) | |

| Income tax benefit | (16,000) | | | (2,000) | |

| Interest expense, net | 102,000 | | | 92,000 | |

| Depreciation and amortization | 24,000 | | | 20,000 | |

| Share-based compensation expense | 16,000 | | | 13,000 | |

| Transaction costs | 6,000 | | | 3,000 | |

| Adjusted EBITDA | $ | 90,000 | | | $ | 120,000 | |

| We shop. You save. 4th Quarter Fiscal 2024 Earnings Conference Call Presentation September 13, 2024 Exhibit 99.2

| We shop. You save. Forward-Looking Statements This presentation contains forward-looking statements. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: impacts of the COVID-19 pandemic and any other significant public health events; our reliance on a limited number of insurance carrier partners and any potential termination of those relationships or failure to develop new relationships; existing and future laws and regulations affecting the health insurance market; changes in health insurance products offered by our insurance carrier partners and the health insurance market generally; insurance carriers offering products and services directly to consumers; changes to commissions paid by insurance carriers and underwriting practices; competition with brokers, exclusively online brokers and carriers who opt to sell policies directly to consumers; competition from government-run health insurance exchanges; developments in the U.S. health insurance system; our dependence on revenue from carriers in our senior segment and downturns in the senior health as well as life, automotive and home insurance industries; our ability to develop new offerings and penetrate new vertical markets; risks from third-party products; failure to enroll individuals during the Medicare annual enrollment period; our ability to attract, integrate and retain qualified personnel; our dependence on lead providers and ability to compete for leads; failure to obtain and/or convert sales leads to actual sales of insurance policies; access to data from consumers and insurance carriers; accuracy of information provided from and to consumers during the insurance shopping process; cost-effective advertisement through internet search engines; ability to contact consumers and market products by telephone; global economic conditions, including inflation; disruption to operations as a result of future acquisitions; significant estimates and assumptions in the preparation of our financial statements; impairment of goodwill; our ability to regain and maintain compliance with NYSE listing standards; potential litigation and other legal proceedings or inquiries; our existing and future indebtedness; our ability to maintain compliance with our debt covenants; access to additional capital; failure to protect our intellectual property and our brand; fluctuations in our financial results caused by seasonality; accuracy and timeliness of commissions reports from insurance carriers; timing of insurance carriers’ approval and payment practices; factors that impact our estimate of the constrained lifetime value of commissions per policyholder; changes in accounting rules, tax legislation and other legislation; disruptions or failures of our technological infrastructure and platform; failure to maintain relationships with third-party service providers; cybersecurity breaches or other attacks involving our systems or those of our insurance carrier partners or third-party service providers; our ability to protect consumer information and other data; failure to market and sell Medicare plans effectively or in compliance with laws; and and other factors related to our pharmacy business, including manufacturing or supply chain disruptions, access to and demand for prescription drugs, and regulatory changes or other industry developments that may affect our pharmacy operations. For a further discussion of these and other risk factors that could impact our future results and performance, see the section entitled “Risk Factors” in the most recent Annual Report on Form 10-K (the “Annual Report”) and subsequent periodic reports filed by us with the Securities and Exchange Commission. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward- looking statement, whether as a result of new information, future developments or otherwise. Certain information contained in this presentation and statements made orally during this presentation relate to or are based on publications and other data obtained from third-party sources. While we believe these third-party sources to be reliable as of the date of this presentation, we have not independently verified, and make no representation as to the adequacy, fairness, accuracy or completeness of, any information obtained from such third-party sources. No Offer or Solicitation; Further Information This presentation is for informational purposes only and is not an offer to sell with respect to any securities. This presentation should be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and the consolidated financial statements and the related notes thereto included in the Annual Report and subsequent quarterly reports. Non-GAAP Financial Measures This presentation includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. To supplement our financial statements presented in accordance with GAAP and to provide investors with additional information regarding our GAAP financial results, we have presented in this presentation Adjusted EBITDA, which is a non-GAAP financial measure. This non-GAAP financial measure is not based on any standardized methodology prescribed by GAAP and is not necessarily comparable to any similarly titled measure presented by other companies. We define Adjusted EBITDA as income (loss) before interest expense, income tax expense (benefit), depreciation and amortization, and certain add-backs for non-cash or non-recurring expenses, including restructuring and share-based compensation expenses. The most directly comparable GAAP measure is net income (loss). We monitor and have presented in this presentation Adjusted EBITDA because it is a key measure used by our management and Board of Directors to understand and evaluate our operating performance, establish budgets, and develop operational goals for managing our business. In particular, we believe that excluding the impact of these expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core operating performance. For further discussion regarding these non-GAAP measures, please see today’s press release. See below beginning on slide 17 for reconciliations of these non-GAAP financial measures to their most directly comparable GAAP measures. Disclaimer 2

| We shop. You save. Key Highlights $MM SelectQuote Year-in-Review Revenue $1,125 $1,322 FY24 Actual Results vs. Original Guidance 8% Increase in year-over-year Approved MA policies 25% Senior division full year Adjusted EBITDA* margin 82k SelectRx members as of fiscal year end Adjusted EBITDA* $93 $117 Original Guidance** FY 2024 Actual Results **Midpoint of guidance range provided September 13, 2023 *See "Non-GAAP Financial Measures" section on slide 2 3

| We shop. You save. Revenue/CAC*** 1.7 4.1 4.5 FY22 FY23 FY24 Operating Expense Per Policy* $1,034 $750 $780 FY22 FY23 FY24 *Represents Senior operating costs divided by approved MA/MS policies. **Represents Senior marketing costs divided by approved MA/MS policies. Senior Efficiency Metrics Marketing Expense Per Policy** $578 $382 $430 FY22 FY23 FY24 ***The revenue to customer acquisition cost (“CAC”) multiple represents total revenue as a multiple of total marketing acquisition costs for the Senior and Healthcare Services divisions, which represents the direct costs of acquiring leads. 4

| We shop. You save. $70 $252 $479 FY22 FY23 FY24 Healthcare Services Growth & Profitability Revenue $MM SelectRx Members 000s FY25 CommentaryAdjusted EBITDA* $MM *See "Non-GAAP Financial Measures" section on slide 2 $(32) $(23) $8 FY22 FY23 FY24 26 49 82 FY22 FY23 FY24 5 • Continued strong SelectRx revenue growth • Scaled profitability and incremental margin improvement • Expansion into large and attractive markets

| We shop. You save. Extension of term debt maturity until Fall 2027 with staggered paydowns Cash generative business model presents opportunity to materially de-lever in future quarters Executing on Recapitalization Plan SelectQuote recently entered into a non-binding letter of intent with certain of its term debt lenders for a ~$100M securitization related to a portion of the company's commission receivables. Provided the deal closes, we expect immediate balance sheet benefits. Most importantly, we expect the proposed deal to represent a critical first step in a phased approach to improving our capital structure. Lays foundational work for future warehouse financing and securitization deals on newly sold policies First critical step in improving our capital structure and reducing overall debt load in future years Extended Maturities Lower Cost of Capital Future Optionality 6 Cost of capital well inside existing term loan Material interest expense savings after paydown

| We shop. You save. • Medicare Advantage policy persistency trends are stable and broad demand from aging Americans remains strong • SelectQuote's growing Healthcare Services business helps diversify revenues and mitigate the high seasonality of the Senior Medicare Advantage business • Attractive and stable unit economics within Senior and confidence in achieving target margins of 20%+ • A large insurance carrier partner will shift back to a ratable commission structure vs. the previous front- loaded structure • While this new commission structure remains economically attractive, the change limits SLQT's typical capital availability during the compressed Medicare Advantage selling season • Approved policy volume for 2025 compared to 2024 expected to be ~10-15% lower What Stays the Same? 2025 Outlook in Context What Changed? 7

| We shop. You save. Healthcare Select’s ‘right-to-win’ lies in our proven track record of engaging members, capturing critical self-reported information in real-time, and then taking action on that information to offer each member personalized solutions Healthcare Select Flywheel Unbiased shopping platform helping Seniors locate best Medicare plan for their unique needs Simplifying the healthcare journey through personalized solutions for each patient’s unique needs High-touch Patient-Centered Pharmacy At Home provides convenient approach to improved medication adherence Highly-synergistic, needs-based care market opportunities that serve a vast and growing population of U.S. Seniors >4.0x Rev/CAC Future Opportunities 8

| We shop. You save. 4Q and FY2024 Earnings Highlights *See "Non-GAAP Financial Measures" section on slide 2 $ in millions 4Q24 4Q23 FY2024 FY2023 Revenue $307.2 $221.8 $1,321.8 $1,002.8 Adjusted EBITDA* $14.4 $(5.8) $117.0 $74.3 Financial Results• Consolidated Company Highlights ◦ Operating cash flow and free cash flow positive during FY2024 ◦ Exceeded the top ends of both revenue and Adjusted EBITDA guides for full fiscal year 2024 • Senior ◦ Delivered full year Adjusted EBITDA margins of 25%, well above our stated 20%+ target ◦ Strong close rates fueled production ahead of internal forecasts ◦ Indicators point to continued stability in customer retention metrics • Healthcare Services ◦ Positive Adjusted EBITDA* for a fifth consecutive quarter despite continued growth investment ◦ SelectRx ended FY2024 with over 82,000 members representing growth of 68% year-over-year 9

| We shop. You save. Revenue $MM Adjusted EBITDA* $MM $1,003 $1,322 FY23 FY24 $(6) $14 4Q23 4Q24 2024 Consolidated Financial Summary Margin % 9% $222 $307 4Q23 4Q24 $74 $117 FY23 FY24 YOY Growth 32%39% *See "Non-GAAP Financial Measures" section on slide 2 5% 10

| We shop. You save. Total Approved Policies 000s MA LTV SelectQuote Senior KPIs 648 688 578 625 71 62 MA Other FY23 FY24 $830 $847 4Q23 4Q24 125 121 110 107 15 14 MA Other 4Q23 4Q24 11 $877 $910 FY23 FY24

| We shop. You save. Revenue $MM Adjusted EBITDA* $MM $590 $656 FY23 FY24 $155 $167 FY23 FY24 Senior Financial Summary 25%24% $104 $114 4Q23 4Q24 $16 $28 4Q23 4Q24 *See "Non-GAAP Financial Measures" section on slide 2 12 Margin %

| We shop. You save. $38 $42 $(1) $8 4Q23 4Q24 $7 $7 $(7) $2 4Q23 4Q24 Life and Auto & Home Financial Summary $146 $158 $22 $36 FY23 FY24 $23 $20 $— $14 FY23 FY24 13 (1) Includes the impact of a one-time $10.4 million change in estimated revenue related to the mutual termination of a contract with one of our Auto & Home carriers. (1) (1)(1)(1) *See "Non-GAAP Financial Measures" section on slide 2 Life Auto & Home Revenue $MM Adjusted EBITDA* $MM

| We shop. You save. REVENUE +10% YoY At the Midpoint$1.4B ADJUSTED EBITDA** NET INCOME (LOSS) to $1.5B $90M to $120M $(42)M to $(6)M (10%) YoY At the Midpoint +30% YoY At the Midpoint **See "Non-GAAP Financial Measures" above on slide 2. 14 FY25 Financial Guidance

| We shop. You save. $103 $14 FY24 FY25 Guidance Midpoint Adjusted EBITDA* $MM FY2025 Guidance Drivers *See "Non-GAAP Financial Measures" section on slide 2 **Excludes $14 million contribution from Auto & Home business ***Includes an immaterial contribution from Auto & Home business • Forecasting approximately 10-15% decline in Senior MA volume due to current capital constraints • Expect MA unit economics to remain strong and plan to deliver on 20%+ Adjusted EBITDA margin target within Senior business • MA volume headwinds partially offset by strong growth and continued profitability in Healthcare Services • Strategic rationalization of Auto & Home headwind to 2025E Adjusted EBITDA but tailwind to operating cashflow Drivers 15 $117 $105 ** ***

| We shop. You save. Supplemental Information 16

| We shop. You save. Adjusted EBITDA to Loss before income tax expense (benefit) Reconciliation 4Q FY 2024 (in thousands) Senior Healthcare Services Life Auto & Home Total Adjusted Segment EBITDA $ 27,872 $ 909 $ 7,217 $ 2,474 $ 38,472 Corporate & elimination of intersegment profits (24,115) Adjusted EBITDA 14,357 Share-based compensation expense (3,304) Transaction costs (5,529) Depreciation and amortization (6,407) Loss on disposal of property, equipment, and software (523) Interest expense, net (23,409) Loss before income tax expense (benefit) $ (24,815) 4Q FY 2023 (in thousands) Senior Healthcare Services Life Auto & Home Total Adjusted Segment EBITDA $ 16,147 $ 1,685 $ 6,702 $ (7,235) $ 17,299 Corporate & elimination of intersegment profits (23,122) Adjusted EBITDA (5,823) Share-based compensation expense (2,785) Transaction costs (2,568) Depreciation and amortization (6,793) Loss on disposal of property, equipment, and software (363) Impairment of long-lived assets (17,332) Interest expense, net (21,721) Loss before income tax expense (benefit) $ (57,385) 17

| We shop. You save. Adjusted EBITDA to Loss before income tax expense (benefit) Reconciliation FY 2024 (in thousands) Senior Healthcare Services Life Auto & Home Total Adjusted Segment EBITDA $ 166,744 $ 7,821 $ 20,164 $ 14,127 $ 208,856 Corporate & elimination of intersegment profits (91,863) Adjusted EBITDA 116,993 Share-based compensation expense (13,816) Transaction costs (13,158) Depreciation and amortization (24,998) Loss on disposal of property, equipment, and software (536) Interest expense, net (93,551) Loss before income tax expense (benefit) $ (29,066) FY 2023 (in thousands) Senior Healthcare Services Life Auto & Home Total Adjusted Segment EBITDA $ 155,077 $ (22,769) $ 23,073 $ 81 $ 155,462 Corporate & elimination of intersegment profits (81,159) Adjusted EBITDA 74,303 Share-based compensation expense (11,310) Transaction costs (5,569) Depreciation and amortization (27,881) Loss on disposal of property, equipment, and software (749) Impairment of long-lived assets (17,332) Interest expense, net (80,606) Loss before income tax expense (benefit) $ (69,144) 18

| We shop. You save. (in thousands) Range Net loss $ (42,000) $ (6,000) Income tax benefit $ (16,000) $ (2,000) Interest expense, net $ 102,000 $ 92,000 Depreciation and amortization $ 24,000 $ 20,000 Share-based compensation expense $ 16,000 $ 13,000 Transaction costs $ 6,000 $ 3,000 Adjusted EBITDA $ 90,000 $ 120,000 Net Loss to Adjusted EBITDA Reconciliation FY25 Guidance 19

| We shop. You save. SelectQuote Inc. 6800 West 115th Street Suite 2511 Overland Park, Kansas 66211 Phone: (913) 599-9225 Investor Relations investorrelations@selectquote.com 20

v3.24.2.u1

Cover

|

Sep. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 13, 2024

|

| Entity Registrant Name |

SELECTQUOTE, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39295

|

| Entity Tax Identification Number |

94-3339273

|

| Entity Address, Address Line One |

6800 West 115th Street

|

| Entity Address, Address Line Two |

Suite 2511

|

| Entity Address, City or Town |

Overland Park

|

| Entity Address, State or Province |

KS

|

| Entity Address, Postal Zip Code |

66211

|

| City Area Code |

913

|

| Local Phone Number |

599-9225

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

SLQT

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001794783

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

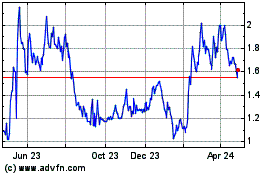

SelectQuote (NYSE:SLQT)

Historical Stock Chart

From Oct 2024 to Nov 2024

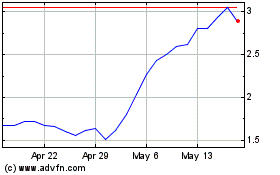

SelectQuote (NYSE:SLQT)

Historical Stock Chart

From Nov 2023 to Nov 2024