As filed Pursuant to Rule 424(b)(5)

Registration No. 333-281556

PRELIMINARY PROSPECTUS SUPPLEMENT

(To Prospectus dated August 23, 2024)

3,135,136

SHARES OF CLASS A COMMON STOCK

We are offering 3,135,136 shares of our Class A common stock, par value $0.0001 per share (“common stock”). The purchase price for each share is $3.70.

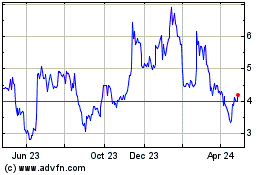

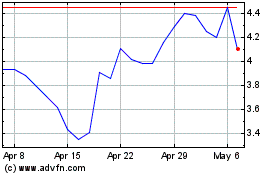

Our common stock is listed on the New York Stock Exchange under the symbol “OWLT.” On September 11, 2024, the last reported sale price of the common stock on the New York Stock Exchange was $4.35 per share.

| | | | | | | | | | | |

| Per

Share | | Total |

| Public offering price | $ | 3.70 | | | $ | 11,600,003.20 | |

Underwriting discounts and commissions(1) | $ | 0.259 | | | $ | 812,000.22 | |

Proceeds, before expenses, to us(2) | $ | 3.441 | | | $ | 10,788,002.98 | |

__________________

(1)Underwriting discounts and commissions do not include the reimbursement of certain expenses of the underwriter we have agreed to pay. We have also agreed to issue the underwriter or its designees at the closing of this offering a warrant to purchase the number of shares of common stock equal to 4% of the aggregate number of shares of common stock sold in this offering (the “Underwriter Warrant”). See “Underwriting” for additional disclosure regarding underwriting discounts, commissions and estimated offering expenses.

(2)The amount of the offering proceeds to us presented in this table does not give effect to the exercise, if any, of the Underwriter Warrant being issued concurrently with this offering.

The aggregate market value of our outstanding common stock held by non-affiliates is approximately $34.9 million, which was calculated based on 6,917,535 shares of outstanding common stock that were held by non-affiliates as of September 11, 2024 and a price per share of $5.04, the closing price of our common stock on August 13, 2024. Pursuant to General Instruction I.B.6. of Form S-3, in no event will we sell securities pursuant to the registration statement of which this prospectus supplement forms a part with a value more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our common stock held by non-affiliates is less than $75.0 million. During the prior 12-calendar-month period that ends on, and includes, the date of this prospectus supplement, we have not offered any securities pursuant to General Instruction I.B.6. of Form S-3.

Investing in our common stock involves significant risks. See “Risk Factors” on page S-15 of this prospectus supplement and in the documents incorporated by reference into this prospectus supplement before making your investment decision. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

The underwriter expects to deliver the shares of common stock to the investors on or about September 13, 2024.

Sole Bookrunner

Titan Partners Group

a division of American Capital Partners

The date of this prospectus supplement is September 11, 2024.

TABLE OF CONTENTS

PROSPECTUS SUPPLEMENT

PROSPECTUS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying prospectus relate to an offering of our common stock. Before buying any of the common stock that we are offering, we urge you to carefully read this prospectus supplement and the accompanying prospectus, together with the information incorporated by reference as described under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference” in this prospectus supplement. These documents contain important information that you should consider when making your investment decision.

This document is in two parts. The first part is this prospectus supplement, which describes the terms of this offering of common stock and also adds to, updates and changes information contained in the accompanying prospectus and the documents incorporated by reference. The second part is the accompanying prospectus, which provides more general information, some of which may not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts of this document combined, together with the documents incorporated by reference herein or therein. To the extent the information contained in this prospectus supplement differs from or conflicts with the information contained in the accompanying prospectus or any document incorporated by reference having an earlier date, the information in this prospectus supplement will control. If any statement in one of these documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference into this prospectus supplement and the accompanying prospectus—the statement in the document having the later date modifies or supersedes the earlier statement.

We have not, and the underwriter has not, authorized anyone to provide you with information different from that which is contained in or incorporated by reference in this prospectus supplement, the accompanying prospectus and in any free writing prospectus that we may authorize for use in connection with this offering. Neither we, nor the underwriter, take any responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you.

This prospectus supplement and the accompanying prospectus do not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this prospectus supplement and the accompanying prospectus in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer or solicitation of an offer in such jurisdiction. Persons into whose possession this prospectus supplement and the accompanying prospectus come are advised to inform themselves about and to observe any restrictions relating to the offering and the distribution of this prospectus supplement and the accompanying prospectus.

You should assume that the information contained in this prospectus supplement is accurate as of the date on the front cover of this prospectus supplement only and that any information we have incorporated by reference or included in the accompanying prospectus is accurate only as of the date given in the document incorporated by reference or as of the date of the accompanying prospectus, as applicable, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus, any related free writing prospectus, or any sale of our common stock. Our business, financial condition, results of operations and prospects may have changed since those dates.

We further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into this prospectus supplement or the accompanying prospectus were made solely for the benefit of the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This prospectus supplement and the accompanying prospectus contain summaries of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein have been or will be filed as exhibits to the registration statement of which this prospectus supplement is a part or as exhibits to documents incorporated by reference herein, and you may obtain

copies of those documents as described below under the headings “Where You Can Find More Information” and “Incorporation of Certain Information by Reference.”

This prospectus supplement and the accompanying prospectus incorporate by reference market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated by reference in this prospectus supplement or the accompanying prospectus may involve estimates, assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the heading “Risk Factors” contained in this prospectus supplement and the accompanying prospectus and under similar headings in other documents that are incorporated by reference herein and therein. Accordingly, investors should not place undue reliance on this information.

When we refer to “Owlet,” “we,” “our,” “us” and the “Company” in this prospectus supplement, we mean Owlet, Inc., a Delaware corporation, and its consolidated subsidiaries, unless otherwise specified. When we refer to “you,” we mean the potential holders of the applicable series of securities. When we refer to “common stock,” we mean our Class A common stock.

Owlet, Smart Sock, Dream Sock and Owlet Cam are some of our trademarks used in this prospectus supplement and the documents incorporated herein by reference. This prospectus supplement also includes trademarks, tradenames and service marks that are the property of other organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus supplement appear without the ® or ™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights, or the right of the applicable licensor to these trademarks and tradenames.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information about us and this offering and selected information contained elsewhere in or incorporated by reference into this prospectus supplement and the accompanying prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to invest in our common stock. For a more complete understanding of our company and this offering, we encourage you to read and consider carefully the more detailed information in this prospectus supplement and the accompanying prospectus, including the information incorporated by reference into this prospectus supplement and the accompanying prospectus, and the information included in any free writing prospectus that we authorize for use in connection with this offering, including the information contained in and incorporated by reference under the heading “Risk Factors” on page S-15 of this prospectus supplement, and under similar headings in the other documents that are filed after the date hereof and incorporated by reference into this prospectus supplement and the accompanying prospectus. Our Company

Our mission is to empower parents with the right information at the right time, to give them more peace of mind and to help them find more joy in the journey of parenting. Owlet’s digital health infant monitoring platform is transforming this journey. We offer FDA-authorized medical and consumer pediatric wearables and an integrated HD visual and audio camera that provide real-time data and insights to parents who safeguard health, optimize wellness, and ensure peaceful sleep for their children. We believe that our ecosystem of digital parenting solutions can help drive our mission by delivering real-time health insights with medical-grade accuracy and unprecedented advancements for at-home infant care.

We believe we have built a leading brand in infant health, with one of the top selling baby monitors in the United States. Since 2012, over 2 million parents worldwide have used Owlet’s platform, contributing to one of the largest collections of consumer infant health and sleep data. We continue to develop software and digital data solutions to bridge the current healthcare gap between hospital and home and bring new insights to parents and caregivers globally, and received numerous product and innovation awards in 2024. We have a strong net promoter score of 70 according to a survey we conducted in August 2024. Net promoter score is a rating metric used as a measure of customer advocacy and satisfaction as well as word of mouth referrals, expressed as a numerical value up to a maximum value of 100, based on responses from an August 2024 survey we conducted of approximately 1,900 respondents. We believe net promoter score is an important assessment to gauge customer satisfaction with our products and to measure the strength of our brand. We have also maintained strong engagement from our customers and community, with more than 500,000 monthly average users as of June 2024 and significant engagement across our social media sites.

We believe our market represents a significant and expanding opportunity. Researchers estimate that the global market for smart baby monitors was $1.4 billion in 2023 and is projected to reach $2.1 billion by 2030. We currently have market clearance to sell our products in the United States, Europe and United Kingdom, with the United States representing the largest of these markets at an estimated $384.2 million in 2023. We also sell our products in Canada and Australia and intend to explore expansion into additional international markets over time. There are an estimated 140 million births per year globally, with approximately nine million births per year in the United States, Europe, United Kingdom, Canada and Australia combined. Beyond the market for smart baby monitors, we believe there is also opportunity for us to expand within the healthcare industry and into other health data and services. For example, the deployment of our Dream Sock and Owlet Cam products within the healthcare industry, such as in hospitals, could expand our market opportunity, and we are actively working to establish reimbursement for our products. If each baby born this year in our current markets used a Dream Sock and Owlet Cam, it would represent an opportunity of approximately $4.1 billion based on the current retail prices for such products. If each such baby used our full ecosystem of products (Dream Sock, Owlet Cam, Owlet Accessory Sock, Sleeper and Travel Case), it would represent an opportunity of approximately $5.0 billion based on the current retail prices for such products. If each such baby had Owlet Insights, a $5.99 monthly subscription service for health and other data, for a period of five years from birth, it would represent an incremental opportunity of approximately $3.2 billion.

We continuously seek to drive market penetration in the market for smart baby monitors in the United States and internationally, and are focused on unlocking the opportunities presented within the healthcare industry and other health data and services. With respect to healthcare expansion, our new partnership with AdaptHealth is designed to facilitate caregiver access to insurance reimbursement and distribution through hospitals in the United States. Further, we are actively working with multiple insurance companies and Medicare in an effort to establish reimbursement for our products, and are exploring the potential for distribution of our products through hospitals at the time of post-birth patient discharge. In April 2024, we launched our first telehealth partnership with Wheel, with a goal to enhance caregiver access and facilitate improved care across the United States. We believe there is significant potential to improve infant health and safety by increasing the utilization of our products, and we estimate that there are approximately 570,000 medical condition cases annually in the United States that may benefit from monitoring with our products. With respect to health data and services, we recently launched Owlet Insights, a $5.99 monthly subscription service for health and other data, which we believe can leverage our existing devices sold, monthly users and extensive heartbeat, sleep and other data, and has the potential to double our lifetime value per customer. We aim to drive market penetration as efficiently as possible. As of June 30, 2024, we had an estimated lifetime value to customer acquisition cost ratio of approximately 4.2.

We believe that every child deserves to live a long, happy, and healthy life. In furtherance of this belief, we launched our Owlet Cares advocacy initiative and have established relationships with a robust network of more than 30 foundation partners across 21 U.S. states, as well as in Canada and Australia, to help drive parental engagement and education. In 2023, we donated $2 million in Owlet products and charitable support to like-minded organizations.

Recent Developments

Conversion of Series A Convertible Preferred Stock

On August 20, 2024, holders of our Series A convertible preferred stock (“Series A Preferred Stock”) elected to convert an aggregate of 15,721 shares of Series A Preferred Stock in exchange for an aggregate of 2,291,686 shares of our common stock (collectively referred to hereinafter as the “August Conversion”) as part of a coordinated effort by the Company to regain compliance with the global market capitalization requirement under the NYSE Listed Company Manual. Immediately following the August Conversion, 11,479 shares of Series A Preferred Stock were outstanding.

Debt Refinancing

On September 11, 2024, we entered into new debt arrangements and commenced the refinancing of our existing line of credit and term loan agreements with Silicon Valley Bank, a division of First-Citizens Bank & Trust Company (“SVB”), which we refer to herein as the “Debt Refinancing.” In connection with the Debt Refinancing, on September 11, 2024 we used existing cash to repay and extinguish all borrowings outstanding under the line of credit and term loan agreements with SVB and we initiated a draw down of $7.5 million under the WTI Loan Facility (as defined below), which amount is expected to be funded shortly subject to satisfaction of the applicable funding conditions. The new debt arrangements and related agreements are summarized below.

New Credit and Security Agreement

On September 11, 2024 (the “Effective Date”), the Company and Owlet Baby Care, Inc., a Delaware corporation and our wholly-owned subsidiary (the “Borrower”), entered into a Credit and Security Agreement (the “Credit Agreement”) with the financial institutions party thereto from time to time as lenders (collectively the “Lenders”) and ABL OPCO LLC, a Delaware limited liability company, in its capacity as administrative agent for the Lenders (in such capacity, the “Administrative Agent”).

The Credit Agreement provides for an asset-based revolving credit facility (the “Revolving Facility”) in a maximum principal amount of up to $15,000,000, which amount shall increase to $20,000,000 on the first anniversary of the Effective Date (the “Revolving Commitment”). Loans and other obligations of the Borrower bear interest at a rate per annum equal to the 1-month Secured Overnight Financing Rate (subject to a floor of 3.50%)

plus a margin, which varies between 7.50% and 8.50% depending on the Borrower’s EBITDA; provided that the interest rate shall not exceed the maximum rate permitted under applicable law.

The Revolving Facility matures on the third anniversary of the Effective Date (the “Maturity Date”). If for any reason the Credit Agreement is terminated or all outstanding loans and other obligations are paid in full and the Revolving Facility is terminated before the Maturity Date, the Borrower will be obligated to pay a prepayment fee equal to a percentage of the then-current Revolving Commitment, which percentage decreases on each anniversary of the Effective Date.

The Credit Agreement contains representations, warranties, covenants and events of default customary for agreements of this type, including customary covenants that, among other things, restrict or limit, subject to certain exceptions, the ability of us and our subsidiaries to: incur certain liens; incur or guarantee additional indebtedness; pay dividends and make other distributions on, or redeem or repurchase, capital stock; make certain investments, including loans to other parties; make certain capital expenditures; enter into certain transactions with affiliates; enter into certain leases and other material business agreements; merge, dissolve, liquidate or consolidate; make certain amendments to its organizational documents; change lines of business; and transfer or sell assets. Furthermore, the Credit Agreement requires the Borrower to also observe certain financial covenants, including (i) a covenant to maintain at least $4,000,000 of liquidity at all times, and (ii) during periods when a default or event of default has occurred and is continuing or when liquidity is less than $9,000,000, a covenant to achieve certain minimum EBITDA thresholds specified in the Credit Agreement.

The Credit Agreement also contains customary events of default, including cross-defaults to certain other material agreements of the Borrower and/or Owlet, Inc. If an event of default has occurred and is continuing, the Administrative Agent and the Lenders have the right to, among other remedies, accelerate repayment of all outstanding loans and other obligations of the Borrower, demand payment from Owlet, Inc. under its guaranty, foreclose on collateral security given to the Administrative Agent, and pursue all other remedies available to a secured creditor under applicable law.

The Borrower’s obligations under the Credit Agreement are: (i) fully and unconditionally guaranteed by the Owlet, Inc.; and (ii) secured by a security interest in substantially all personal property assets of Owlet, Inc. and the Borrower, including a pledge of the outstanding capital stock of the Borrower given by Owlet, Inc. In addition, pursuant to a letter agreement with the Administrative Agent (the “Letter Agreement”), we granted the parties to the Credit Agreement certain rights to participate in certain future offerings.

The foregoing summary of the Credit Agreement and the Letter Agreement does not purport to be complete and is subject to and qualified in its entirety by references to the terms of the Credit Agreement and the Letter Agreement, copies of which have been filed as exhibits to the Company’s Current Report on Form 8-K dated September 11, 2024, which is incorporated by reference herein.

WTI Loan Facility

On the Effective Date, the Company and Owlet Baby Care, Inc. (together, the “Loan Parties”), entered into the Loan and Security Agreement with WTI Fund X, Inc., a Maryland corporation (“WTI Fund X”), WTI Fund XI, Inc., a Maryland corporation (“WTI FUND XI”, and together with WTI Fund X, each, a “Term Lender” and collectively, the “Term Lenders”) for a term loan facility of up to $15 million (as supplemented by the Supplement to the Loan and Security Agreement, dated as of the Effective Date, the “WTI Loan Facility”). The WTI Loan Facility consists of two tranches: (i) a first tranche of $10 million, which is available at closing and through September 30, 2024, with $2.5 million of the first tranche availability extendable until December 31, 2024, and (ii) a second tranche of $5 million, which is available upon achievement of (a) at least $48.6 million in revenue for the period commencing October 1, 2024 and ending June 30, 2025 (the “Second Tranche Condition Period”), (b) total cash burn during the Second Tranche Condition Period not to exceed $600,000 for such period, (c) our receipt of at least $6 million of net proceeds from an equity financing during a period commencing on the Effective Date and ending on the second tranche borrowing date, and (d) Term Lenders shall have reviewed the Loan Parties’ then-current, board-approved operating and financing plan to their satisfaction. On the Effective Date, the Borrower initiated a draw down of $7.5

million under the WTI Loan Facility, which amount is expected to be funded shortly subject to satisfaction of the applicable funding conditions.

Interest on the outstanding principal amount of any borrowing under the WTI Loan Facility shall accrue at a per annum rate equal to the sum of Prime Rate (as defined under the WTI Loan Facility) plus 3.50%, with a floor of 12.00%, and such interest is payable (x) monthly in arrears, or (y) on any prepayment date. Commencing on November 1, 2025, and continuing on the first day of each month thereafter, Borrower shall pay each Term Lender the principal plus interest in arrears. Additionally, loans under the WTI Loan Facility shall accrue 2.5% in payment-in-kind interest (“PIK Interest”) compounded monthly, and PIK Interest payments will be due and payable during the amortization period.

For any prepayment of the outstanding loans under the WTI Loan Facility, which may be paid in whole but not in part, the Loan Parties shall pay an amount equal to (i) the accrued and unpaid interest on the outstanding loans (including any accrued PIK Interest), (ii) the outstanding principal balance, and (iii) an amount equal to the total amount of all scheduled but unpaid payments of interest (including any PIK Interest) that would have accrued and been payable from the date of prepayment through the latest repayment dates set forth in the loan payment schedules; provided, that if our fully diluted market capitalization of our Class A common stock is greater than or equal to $250 million for ten (10) consecutive Trading Days (as defined in the WTI Loan Facility), then so long as such prepayment is made within 60 days thereafter, we may apply a discount of 30% with respect to the total amount of all scheduled but unpaid interest (but excluding any PIK Interest, which will not be discounted).

The WTI Loan Facility contains representations, warranties, covenants and events of default customary for agreements of this type, including customary covenants that restrict the Loan Parties’ ability to, among other things, dispose of certain assets, entity control or business locations, undergo a merger, consolidation or certain other transactions, incur additional indebtedness, encumber certain Loan Party property and assets, declare dividends or make certain distributions, engage in any material transactions with any affiliate of any Loan Party, make or permit any payment on certain subordinated debt, and comply with governmental and regulatory authorities, laws and regulations. The WTI Loan Facility also contains certain customary events of default. Immediately upon and during the continuance of an event of default (as defined in the WTI Loan Facility) that is not cured or waived as provided in the WTI Loan Facility, in addition to other remedies that may be available to Term Lenders, outstanding obligations may be accelerated and shall bear interest at an annual default rate of five percent (5.0%) above the otherwise applicable rate.

The obligations under the WTI Loan Facility are secured by substantially all of the Loan Parties’ assets, with certain exceptions as set forth in the WTI Loan Facility.

The foregoing summary of the WTI Loan Facility does not purport to be complete and is subject to and qualified in its entirety by references to the terms of the WTI Loan Facility, a copy of which has been filed as an exhibit to the Company’s Current Report on Form 8-K dated September 11, 2024, which is incorporated by reference herein.

WTI Stock Issuance Agreement

As partial consideration for the availability and funding of the WTI Loan Facility, we and the Term Lenders under the WTI Loan Facility entered into a Stock Issuance Agreement (the “WTI Stock Issuance Agreement”), dated as of the Effective Date. Pursuant to the WTI Stock Issuance Agreement, we issued to the Term Lenders an aggregate of 750,000 shares of common stock on the Effective Date, of which 375,000 shares of common stock are subject to vesting upon the funding of a certain term loan facility pursuant to the WTI Loan Facility. In connection with the issuance of such shares, we agreed to use its commercially reasonable efforts to file, and have declared effective, a registration statement to register such shares, subject to certain conditions set forth in the WTI Stock Issuance Agreement.

Pursuant to the WTI Stock Issuance Agreement, we granted the Term Lenders an option (the “Put Option”) to sell all or any portion of the shares issued pursuant to the WTI Stock Issuance Agreement that are vested and held by the Term Lenders at the time of exercise of the Put Option to the Company for a price of $8.40 per share. The Put Option may be exercised, with respect to any amount that is equal to or less than the entire balance of such shares, at

any time during the period commencing on the first trading day following the fifth anniversary of the Effective Date and continuing through the date which is ten (10) years after the Effective Date, subject to certain acceleration provisions set forth in the WTI Stock Issuance Agreement. Any failure to pay the Put Option would constitute an event of default under the WTI Loan Facility. We also granted the Term Lenders an option (the “Exchange Option”) to exchange all or any portion of the shares issued pursuant to the WTI Stock Issuance Agreement that are vested and held by the Term Lenders at the time of exercise of the Exchange Option for shares of capital stock in any successor entity under certain circumstances, subject to certain conditions set forth in the WTI Stock Issuance Agreement, as well as certain rights to participate in certain future offerings.

The foregoing summary of the WTI Stock Issuance Agreement does not purport to be complete and is subject to and qualified in its entirety by references to the terms of the WTI Stock Issuance Agreement, a copy of which has been filed as an exhibit to the Company’s Current Report on Form 8-K dated September 11, 2024, which is incorporated by reference herein.

Corporate Information

We were initially incorporated in the State of Delaware on June 23, 2020 under the name Sandbridge Acquisition Corporation. Upon the closing of the business combination on July 15, 2021, we changed our name to Owlet, Inc. Our principal executive offices are located at 3300 North Ashton Boulevard, Suite 300, Lehi, Utah 84043 and our telephone number is (844) 334-5330.

Implications of Being an Emerging Growth Company

We are an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting and other burdens that are otherwise applicable generally to public companies. Some of these exemptions include:

•we are not required to engage an auditor to report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002, as amended, or the Sarbanes-Oxley Act;

•we are permitted to take advantage of extended transition periods for complying with new or revised accounting standards which allows an emerging growth company to delay the adoption of some accounting standards until those standards would otherwise apply to private companies;

•we are not required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency,” and “say-on-golden parachutes;” and

•we are not required to comply with certain disclosure requirements related to executive compensation, such as the requirement to disclose the correlation between executive compensation and performance and the requirement to present a comparison of our Chief Executive Officer’s compensation to our median employee compensation.

We will remain an emerging growth company until the earlier of (1) December 31, 2026, (2) the last day of the fiscal year in which we have total annual gross revenue of at least $1.235 billion, (3) the last day of the fiscal year in which the market value of our common stock that is held by non-affiliates exceeds $700 million as of the prior June 30th, and (4) the date on which we have issued more than $1.0 billion in non-convertible debt during the prior three-year period. We have chosen to take advantage of some but not all of these available exemptions. We also elected to take advantage of the extended transition periods for complying with certain new or revised accounting standards. As a result, the information that we provide to stockholders may be different than the information you may receive from other public companies in which you hold equity.

We are also a “smaller reporting company,” meaning that the market value of our shares held by non-affiliates plus the proposed aggregate amount of gross proceeds to us as a result of this offering is less than $700 million and our annual revenue was less than $100 million during the most recently completed fiscal year. We may continue to be a smaller reporting company after this offering if either (i) the market value of our shares held by non-affiliates is less than $250 million or (ii) our annual revenue was less than $100 million during the most recently completed

fiscal year and the market value of our shares held by non-affiliates is less than $700 million. If we are a smaller reporting company at the time we cease to be an emerging growth company, we may continue to rely on exemptions from certain disclosure requirements that are available to smaller reporting companies. Specifically, as a smaller reporting company, we may choose to present only the two most recent fiscal years of audited financial statements in our Annual Report on Form 10-K and, similar to emerging growth companies, smaller reporting companies have reduced disclosure obligations regarding executive compensation.

The Offering

| | | | | | | | |

Issuer | | Owlet, Inc. |

| | |

Common stock offered by us | | 3,135,136 shares of our common stock. |

| | |

Underwriter Warrant | | Upon the closing of this offering, we have agreed to issue to the underwriter, or its designees, a warrant (the “Underwriter Warrant”) to purchase a number of shares of common stock equal to an aggregate of 4% of the total number of shares sold in this public offering. The Underwriter Warrant will be exercisable at a per share exercise price equal to 125% of the offering price of the shares sold in this offering, or $4.63. The Underwriter Warrant will be exercisable commencing six months after the closing of this offering and will expire five years from the commencement of sales in this offering. The Underwriter Warrant will be issued in a private placement in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act. See “Underwriting—Underwriter Warrants” on page S-43 of this prospectus supplement. |

| | |

Common stock to be outstanding immediately following the offering | | 15,276,361 shares of common stock. |

| | |

Use of Proceeds | | We currently intend to use the net proceeds from this offering, excluding any proceeds that may be received upon the cash exercise of the Underwriter Warrants, for general corporate purposes, capital expenditures, working capital and general and administrative expenses. See “Use of Proceeds” on page S-22 of this prospectus supplement. |

| | |

Risk Factors | | Investing in our common stock involves a high degree of risk. See the information contained in or incorporated by reference under the heading “Risk Factors” on page S-15 of this prospectus supplement, in the accompanying prospectus and in the documents incorporated by reference into this prospectus supplement. |

| | |

Lock-up Agreements | | We, and our officers and directors have agreed with the underwriter, subject to certain exceptions, for a period of 90 days following the date of this prospectus supplement, not to sell, transfer or otherwise dispose of, directly or indirectly, any shares of our capital stock or any securities convertible into or exercisable or exchangeable for shares of capital stock for such applicable period. See “Underwriting” for more information. |

| | |

New York Stock Exchange symbol for our common stock | | “OWLT.” |

The above discussion and table are based on (i) 9,099,539 shares of our common stock outstanding as of June 30, 2024, (ii) 750,000 shares of common stock issued after June 30, 2024 pursuant to the WTI Stock Issuance Agreement, and (iii) 2,291,686 shares of our common stock issued upon the conversion of an aggregate of 15,721 shares of Series A Convertible Preferred Stock on August 20, 2024 (the “August Conversion”), and excludes:

•2,872,673 shares of common stock issuable upon the conversion of shares of convertible preferred stock outstanding as of June 30, 2024 (after giving effect to the August Conversion);

•463,168 shares of common stock issuable upon the exercise of options outstanding as of June 30, 2024, with a weighted-average exercise price of $16.03 per share;

•1,479,657 shares of common stock issuable upon vesting and settlement of restricted stock units outstanding as of June 30, 2024;

•71,428 shares of common stock issuable upon vesting and settlement of performance stock units outstanding as of June 30, 2024;

•1,285,490 shares of common stock that were reserved for future issuance as of June 30, 2024 under our 2021 Incentive Award Plan (the “2021 Plan”), after giving effect to an August 2024 amendment to the 2021 Plan, as well as any annual automatic increases in the number of shares of our common stock reserved for issuance under the 2021 Plan;

•259,711 shares of common stock that were reserved for future issuance as of June 30, 2024 under our 2021 Employee Stock Purchase Plan, or ESPP, as well as any automatic increases in the number of shares of our common stock reserved for future issuance under the ESPP;

•1,292,856 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2024, with an exercise price of $161 per share;

•9,681,447 shares of common stock issuable upon the exercise of warrants outstanding as of June 30, 2024, with a weighted-average exercise price of $5.23 per share; and

•shares of common stock to be issuable upon the exercise of the Underwriter Warrant.

Unless otherwise indicated, all information in this prospectus supplement reflects or assumes the following:

•no additional conversions of the convertible preferred stock described above;

•no exercise of outstanding stock options or warrants described above; and

•no settlement of unvested restricted stock units or performance stock units described above.

Summary Consolidated Financial and Other Data

The following table summarizes our consolidated financial and operating data for the periods and as of the dates indicated. We derived our summary consolidated statements of operations and comprehensive loss for the years ended December 31, 2023 and 2022 from our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Annual Report”), which is incorporated by reference in this prospectus supplement and the accompanying prospectus. We derived the summary consolidated statements of operations and comprehensive income (loss) for the six months ended June 30, 2024 and 2023 from our unaudited interim condensed consolidated financial statements included in our Quarterly Report on Form 10-Q for the quarter ended June 30, 2024 (the “Quarterly Report”), which is incorporated by reference in this prospectus supplement and the accompanying prospectus. In our opinion, the unaudited interim financial statements have been prepared on a basis consistent with our audited financial statements and contain all adjustments, consisting only of normal and recurring adjustments, necessary for a fair statement of such interim financial statements. Our historical results are not necessarily indicative of the results to be expected in the future and our operating results for the six months ended June 30, 2024 are not necessarily indicative of the results that may be expected for the year ending December 31, 2024 or any other interim periods or any future year or period. You should read the following information in conjunction with the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our 2023 Annual Report and Quarterly Report and our consolidated financial

statements, the accompanying notes and other financial information incorporated by reference in this prospectus supplement and the accompanying prospectus.

| | | | | | | | | | | | | | | | | | | | | | | |

| For the Year Ended December 31, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2024 | | 2023 |

| | | | | | | |

| (in thousands, except share and per share amounts) |

| Revenues | $ | 54,010 | | | $ | 69,202 | | | $ | 35,449 | | | $ | 23,824 | |

| Cost of revenues | 31,423 | | | 45,889 | | | 18,650 | | | 14,438 | |

| Gross profit | 22,587 | | | 23,313 | | | 16,799 | | | 9,386 | |

| Operating expenses: | | | | | | | |

| General and administrative | 27,343 | | | 41,547 | | | 12,340 | | | 14,990 | |

| Sales and marketing | 13,527 | | | 38,489 | | | 7,748 | | | 6,431 | |

| Research and development | 10,349 | | | 27,896 | | | 4,701 | | | 5,635 | |

| Total operating expenses | 51,219 | | | 107,932 | | | 24,789 | | | 27,056 | |

| Operating loss | (28,632) | | | (84,619) | | | (7,990) | | | (17,670) | |

| Other income (expense): | | | | | | | |

| Interest expense, net | (3,191) | | | (1,104) | | | (141) | | | (2,864) | |

| Common stock warrant liability adjustment | (924) | | | 6,337 | | | 10,207 | | | 283 | |

| Other income (expense), net | (144) | | | 79 | | | 73 | | | (78) | |

| Total other income (expense), net | (4,259) | | | 5,312 | | | 10,139 | | | (2,659) | |

| Loss before income tax provision | (32,891) | | | (79,307) | | | 2,149 | | | (20,329) | |

| Income tax provision | (10) | | | (29) | | | (22) | | | (5) | |

| Net loss and comprehensive loss | $ | (32,901) | | | $ | (79,336) | | | 2,127 | | | (20,334) | |

| Accretion on Series A convertible preferred stock | (4,591) | | | - | | | (2,863) | | | (1,979) | |

| Net loss attributable to common stockholders | $ | (37,492) | | | $ | (79,336) | | | $ | (736) | | | $ | (22,313) | |

| Net loss per share attributable to common stockholders, basic and diluted | $ | (4.53) | | | $ | (9.98) | | | $ | (0.08) | | | $ | (2.73) | |

| Weighted average number of shares outstanding used to compute net loss per share attributable to common stockholders, basic and diluted | 8,276,481 | | 7,950,757 | | 8,803,729 | | 8,162,102 |

Non-GAAP Financial Information

To supplement our consolidated financial statements presented in accordance with generally accepted accounting principles in the United States (“GAAP”), we provide investors with certain non-GAAP financial information. We use these non-GAAP financial measures internally in analyzing our financial results and believe that use of these non-GAAP financial measures is useful to investors as an additional tool to evaluate ongoing operating results and trends and in comparing our financial results with other companies in our industry, which may present similar non-GAAP financial measures.

Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures and should be read only in conjunction with our condensed consolidated financial statements prepared in accordance with GAAP, which are incorporated by reference in this prospectus supplement and the accompanying prospectus.

In addition to our results determined in accordance with GAAP, we believe that Adjusted EBITDA is useful in evaluating our financial performance and for internal planning and forecasting purposes. We calculate Adjusted

EBITDA, for a particular period, as net loss before interest, taxes, and depreciation and amortization, as further adjusted for restructuring costs, warrant liability adjustments, stock-based compensation and transaction costs.

We believe Adjusted EBITDA is helpful to investors, analysts and other interested parties because it can assist in providing a more consistent and comparable overview of our operations across our historical financial periods. In addition, this measure is frequently used by analysts, investors and other interested parties to evaluate and assess performance. Adjusted EBITDA is a non-GAAP measure and is presented for supplemental informational purposes only and should not be considered as an alternative or substitute to financial information presented in accordance with GAAP. This measure has certain limitations in that it does not include the impact of certain expenses that are reflected in our consolidated statement of operations that are necessary to run our business. Other companies, including other companies in our industry, may not use such measure or may calculate the measure differently than as presented in this prospectus supplement, limiting its usefulness as a comparative measure.

A reconciliation of net income to Adjusted EBITDA is set forth below for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| Sept. 30, 2022 | | Dec. 31, 2022 | | Mar. 31, 2023 | | June 30, 2023 | | Sept. 30, 2023 | | Dec. 31, 2023 | | Mar. 31, 2024 | | June 30, 2024 |

| | | | | | | | | | | | | | | |

| (dollars in thousands) |

Net income (loss) | (19,362) | | | (19,498) | | | (11,867) | | | (8,467) | | | (5,641) | | | (6,926) | | | 3,274 | | | (1,147) | |

Adjusted for: | | | | | | | | | | | | | | | |

Income tax provision | (5) | | | — | | | — | | | 5 | | | — | | | — | | | — | | | 22 | |

| Interest expense, net | 419 | | | 257 | | | 2,812 | | | 52 | | | 134 | | | 193 | | | 161 | | | (20) | |

| Depreciation and amortization | 359 | | | 356 | | | 293 | | | 237 | | | 237 | | | 136 | | | 109 | | | 104 | |

| Restructuring costs | 1,204 | | | 244 | | | — | | | — | | | — | | | — | | | — | | | — | |

| Common stock warrant liability adjustment | (2,867) | | | (1,535) | | | (1,912) | | | 1,629 | | | (2,395) | | | 3,603 | | | (9,179) | | | (1,028) | |

| Stock-based compensation | 1,840 | | | 4,441 | | | 2,789 | | | 2,644 | | | 2,210 | | | 2,290 | | | 2,227 | | | 2,104 | |

| Transaction costs | — | | | 563 | | | 2,102 | | | (392) | | | — | | | — | | | 292 | | | 83 | |

Adjusted EBITDA | (18,412) | | | (15,172) | | | (5,783) | | | (4,292) | | | (5,455) | | | (704) | | | (3,116) | | | 118 | |

We also believe that contribution margin, when taken collectively with our GAAP results, may be helpful to investors in understanding underlying trends that could otherwise be masked by certain expenses that we do not consider indicative of our ongoing performance. We calculate contribution margin, for a particular period, as gross profit minus sales and marketing expenses (excluding sales and marketing stock-based compensation) divided by revenue. Contribution margin is a non-GAAP measure and is presented for supplemental informational purposes only and should not be considered as an alternative or substitute to financial information presented in accordance with GAAP. This measure has certain limitations in that it does not include the impact of certain expenses that are reflected in our consolidated statement of operations that are necessary to run our business. Other companies, including other companies in our industry, may not use such measure or may calculate the measure differently than as presented in this prospectus supplement, limiting its usefulness as a comparative measure.

A reconciliation of gross profit to contribution margin is set forth below for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| Sept. 30, 2022 | | Dec. 31, 2022 | | Mar. 31, 2023 | | June 30, 2023 | | Sept. 30, 2023 | | Dec. 31, 2023 | | Mar. 31, 2024 | | June 30, 2024 |

| | | | | | | | | | | | | | | |

| (dollars in thousands) |

Gross profit | 4,613 | | | 3,321 | | | 4,153 | | | 5,233 | | | 3,329 | | | 9,872 | | | 6,547 | | | 10,252 | |

Gross Margin | 27 | % | | 28 | % | | 39 | % | | 40 | % | | 36 | % | | 47 | % | | 44 | % | | 50 | % |

Less: | | | | | | | | | | | | | | | |

| Sales and marketing expenses | (9,695) | | | (7,440) | | | (3,353) | | | (3,078) | | | (3,335) | | | (3,761) | | | (3,896) | | | (3,852) | |

| Sales and marketing stock-based compensation | 238 | | | 566 | | | 492 | | | 476 | | | 394 | | | 358 | | | 344 | | | 367 | |

Contribution | (4,844) | | | (3,553) | | | 1,292 | | | 2,631 | | | 388 | | | 6,469 | | | 2,995 | | | 6,767 | |

Revenue | 17,359 | | | 11,956 | | | 10,736 | | | 13,088 | | | 9,182 | | | 21,004 | | | 14,750 | | | 20,699 | |

Contribution Margin | (28) | % | | (30) | % | | 12 | % | | 20 | % | | 4 | % | | 31 | % | | 20 | % | | 33 | % |

RISK FACTORS

Investing in our common stock involves a high degree of risk. You should carefully review the risks and uncertainties described below and discussed under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as updated by our quarterly, annual and other reports and documents that are incorporated by reference into this prospectus supplement, before deciding whether to purchase any common stock in this offering. Each of the risk factors could adversely affect our business, operating results, financial condition and prospects, as well as adversely affect the value of an investment in our common stock, and the occurrence of any of these risks might cause you to lose all or part of your investment. Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations.

Risks Related to this Offering

We have broad discretion in how we use the net proceeds from this offering, and we may not use these proceeds effectively or in ways with which you agree.

We have not designated any portion of the net proceeds from this offering to be used for any particular purpose. Our management will have broad discretion as to the application of the net proceeds from this offering and could use them for purposes other than those contemplated at the time of this offering. Our stockholders may not agree with the manner in which our management chooses to allocate and spend the net proceeds. Moreover, our management may use the net proceeds for corporate purposes that may not increase the market price of our common stock. See “Use of Proceeds” in this prospectus supplement for a more detailed information.

You will experience immediate and substantial dilution in the book value of your shares.

Based on the public offering price and the as adjusted net tangible book deficit per share as of June 30, 2024, because the public offering price per share in this offering is substantially higher than the as adjusted net tangible book value per share, you will suffer immediate dilution of $4.55 per share in as adjusted net tangible book value of the common stock. The conversion of outstanding convertible preferred stock, exercise of outstanding stock options and warrants, including the Underwriter Warrant being issued concurrently with this offering, and settlement of outstanding unvested restricted stock units may result in significant further dilution of your investment. See “Dilution” in this prospectus supplement for a more detailed illustration of the dilution you would incur if you participate in this offering.

You may experience future dilution as a result of future equity offerings.

In order to raise additional capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our common stock at prices that may not be the same as the price per share in this offering. We may sell shares or other securities in any other offering at a price per share that is less than the price per share paid by any investors in this offering, and investors purchasing shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of our common stock, or securities convertible or exchangeable into common stock, in future transactions may be higher or lower than the price per share paid by any investors in this offering.

A substantial number of shares of common stock may be sold in the market following this offering, which may depress the market price for our common stock.

Sales of a substantial number of shares of our common stock in the public market following this offering could cause the market price of our common stock to decline. Third party sales of a substantial number of shares of our common stock in the public market could occur at any time. Our directors, executive officers and their related entities beneficially own substantial amounts of our common stock, including shares they may acquire by converting convertible preferred stock or exercising warrants they hold. If one or more of them were to sell a substantial portion of the shares they hold, it could cause our stock price to decline.

In connection with this offering, we and our directors and executive officers have agreed that for a period of 90 days following the date of this prospectus supplement, subject to certain exceptions, we or they will not sell, dispose of or hedge any shares of our common stock or securities convertible into or exchangeable or exercisable for any shares of our common stock without the prior written consent of the underwriter. See the section titled “Underwriting” for a more complete description of the lock-up agreements with the underwriter. Sales of a substantial number of such shares upon expiration of the lock-up agreements, the perception that such sales may occur, or early release of these agreements, could cause our market price to fall or make it more difficult for you to sell your common stock at a time and price that you deem appropriate.

We are involved, and may become involved in the future, in disputes and other legal or regulatory proceedings that, if adversely decided or settled, could materially and adversely affect our business, financial condition and results of operations.

We are, and may in the future become, party to litigation, regulatory proceedings or other disputes. In general, claims made by or against us in disputes and other legal or regulatory proceedings can be expensive and time-consuming to bring or defend against, requiring us to expend significant resources and divert the efforts and attention of our management and other personnel from our business operations. These potential claims may include but are not limited to personal injury and class action lawsuits, intellectual property claims and regulatory investigations relating to the advertising and promotional claims about our products and services and employee claims against us based on, among other things, discrimination, harassment or wrongful termination. Any one of these claims, even those without merit, may divert our financial and management resources that would otherwise be used to benefit the future performance of our operations. Any adverse determination against us in these proceedings, or even the allegations contained in the claims, regardless of whether they are ultimately found to be without merit, may also result in settlements, injunctions or damages that could have a material adverse effect on our business, financial condition and results of operations.

Additionally, in the past, securities class action litigation has often been brought against a company following a decline in the market price of its securities. In November 2021, two putative class action complaints were filed against us in the U.S. District Court for the Central District of California. Both complaints alleged violations of the Exchange Act against the Company and certain of our officers and directors on behalf of a putative class of investors who: (a) purchased our common stock between March 31, 2021 and October 4, 2021 (“Section 10(b) Claims”); or (b) held common stock in Sandbridge Acquisition Corporation as of June 1, 2021, and were eligible to vote at Sandbridge Acquisition Corporation’s special meeting held on July 14, 2021 (“Section 14(a) Claims”). Both complaints allege, among other things, that we and certain of our officers and directors made false and/or misleading statements and failed to disclose certain information regarding the FDA’s likely classification of the Owlet Smart Sock as a medical device requiring marketing authorization. On August 5, 2024, the Court denied Owlet’s and its officers’ motions to dismiss the Section 10(b) Claims and the Section 14(a) Claims. The Court has yet to enter a scheduling order for the case. Further, on August 26, 2024, an investor filed in the U.S. District Court for the Central District of California, derivatively on behalf of Owlet, Inc., a complaint against twelve of our current or former directors and officers six current or former directors and officers of Sandbridge Acquisition Corporation. The investor asserts derivative claims for violations of Section 14(a) of the Securities Exchange Act of 1934, as well as state law claims for breach of fiduciary duty, aiding and abetting breach of fiduciary duty, unjust enrichment, abuse of control, and waste of corporate assets. These claims leverage the allegations made in one of the securities class action complaints. The complaint does not specify the damages claimed in the action.

These lawsuits and any future lawsuits to which we may become a party are subject to inherent uncertainties and will likely be expensive and time-consuming to investigate, defend and resolve. Any litigation to which we are a party may result in an onerous or unfavorable judgment that may not be reversed upon appeal, or in payments of substantial monetary damages or fines, or we may decide to settle this or other lawsuits on similarly unfavorable terms, which could have a material adverse effect on our business, financial condition, results of operations or stock price.

The trading price of the shares of our common stock could be highly volatile, and purchasers of the common stock could incur substantial losses.

Our stock price has been, and will likely continue to be volatile. The stock market in general and the market for stock of medical device and technology companies in particular have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. As a result of this volatility, investors may not be able to sell their common stock at or above their purchase price. The market price for our common stock may be influenced by those factors discussed in this “Risk Factors” section and many others, including:

•actual or anticipated fluctuations in our operating results or future prospects;

•our announcements or our competitors’ announcements of new products and services;

•our ability to maintain listing of our common stock on a national stock exchange, including by coming back into compliance with Section 802.01B of the NYSE Listed Company Manual within the allotted cure period as described in our reports incorporated into this prospectus supplement;

•any developments in litigation in which we are involved;

•the public’s reaction to our press releases, our other public announcements and our filings with the Securities and Exchange Commission;

•strategic actions by us or our competitors, such as acquisitions or restructurings;

•new laws or regulations or new interpretations of existing laws or regulations applicable to our business;

•regulatory or other governmental actions, and actions taken in response to those actions;

•developments regarding our patents or proprietary rights or those of our competitors;

•our ability to raise additional capital as needed;

•changes in our capital structure, such as future issuances of securities or the incurrence of new or additional debt;

•the volume of shares of common stock available for public sale and the size of our public float;

•conversion of our outstanding convertible preferred stock and exercise of our outstanding warrants, and the resale of such shares into the market;

•additions and departures of key personnel;

•concerns or allegations as to the safety or efficacy of our products and services;

•sales of stock by us or members of our management team, our board of directors or certain significant stockholders;

•changes in stock market analyst recommendations or earnings estimates regarding our stock, other comparable companies or our industry generally; and

•changes in financial markets or general economic conditions.

In addition, in the past, stockholders have initiated class action lawsuits against technology companies following periods of volatility in the market prices of these companies’ stock. Such litigation, including the litigation instituted against us in our current class action lawsuit, including the derivative suits, could cause us to incur substantial costs and divert management's attention and resources, which could have a material adverse effect on our business, financial condition, and results of operations.

Risks Related to the Debt Refinancing

Our debt agreements contain certain covenants, restrictions and other terms that may limit our flexibility in operating our business and any failure to satisfy those covenants and restrictions could adversely affect our business and financial condition.

Our Credit Agreement contains various affirmative and negative covenants and restrictions that, among other things, restrict or limit, subject to certain exceptions, the ability of us and our subsidiaries to: incur certain liens; incur or guarantee additional indebtedness; pay dividends and make other distributions on, or redeem or repurchase, capital stock; make certain investments, including loans to other parties; make certain capital expenditures; enter into certain transactions with affiliates; enter into certain leases and other material business agreements; merge, dissolve, liquidate or consolidate; make certain amendments to its organizational documents; change lines of business; and transfer or sell assets. Furthermore, the Credit Agreement includes certain financial covenants, including (i) a covenant to maintain at least $4,000,000 of liquidity at all times, and (ii) during periods when a default or event of default has occurred and is continuing or when liquidity is less than $9,000,000, a covenant to achieve certain minimum EBITDA thresholds specified in the Credit Agreement. A breach of these covenants or restrictions could result in a default under the Credit Agreement. The Credit Agreement also contains other customary events of default, including cross-defaults to certain other material agreements. If an event of default has occurred and is continuing, the Administrative Agent and the Lenders have the right to, among other remedies, accelerate repayment of all outstanding loans and other obligations, demand guarantor payment, foreclose on collateral security given to the Administrative Agent, and pursue all other remedies available to a secured creditor under applicable law.

In addition, our WTI Loan Facility contains various customary representations, warranties, covenants and events of default, including customary covenants that restrict the our ability to, among other things, dispose of certain assets, entity control or business locations, undergo a merger, consolidation or certain other transactions, incur additional indebtedness, encumber certain of our property and assets, declare dividends or make certain distributions, engage in any material transactions with any affiliate, make or permit any payment on certain subordinated debt, and comply with governmental and regulatory authorities, laws and regulations. The WTI Loan Facility also contains certain customary events of default. Immediately upon and during the continuance of an event of default (as defined in the WTI Loan Facility) that is not cured or waived as provided in the WTI Loan Facility, in addition to other remedies that may be available, outstanding obligations may be accelerated by the lenders and shall bear interest at an annual default rate of five percent (5.0%) above the otherwise applicable rate.

In addition, we granted the lenders under the WTI Loan Facility a Put Option in respect of an aggregate of up to 750,000 shares issued to such lenders pursuant to the WTI Stock Issuance Agreement. The Put Option generally requires us to pay the lenders holding such shares a purchase price of $8.40 per share. The Put Option may be exercised, with respect to any amount that is equal to or less than the entire balance of such shares, at any time during the period commencing on the first trading day following the fifth anniversary of the Effective Date and continuing through the date which is ten (10) years after the Effective Date, subject to certain acceleration provisions set forth in the WTI Stock Issuance Agreement. Any failure to pay the Put Option would constitute an event of default under the WTI Loan Facility.

If the debt under our debt arrangements were accelerated due to an event of default or otherwise, or if the lenders under the WTI Loan Facility determine to exercise their Put Option or if the ability to exercise such Put Option is accelerated pursuant to the terms of the WTI Stock Issuance Agreement, we may not have sufficient cash or be able to sell sufficient assets to repay or honor these obligations, which would harm our business and financial condition. If we do not have or are unable to generate sufficient cash to repay or honor these obligations when they become due and payable, either upon maturity, in the event of a default or otherwise, our assets could be foreclosed upon and we may not be able to obtain additional debt or equity financing on favorable terms, if at all, which may negatively impact our ability to operate and continue our business as a going concern. Moreover, regardless of a potential event of default, the debt under our debt agreements matures pursuant to the terms of the respective agreements and the Put Option may be exercisable for up to ten (10) years after the date of the WTI Stock Issuance Agreement. As a result, we may need to refinance or secure separate financing in order to repay amounts outstanding when due or amounts due pursuant to the exercise of the Put Option. No assurance can be given that an

extension will be granted, that we will be able to renegotiate the terms of the agreement with the respective lenders, or that we will be able to secure separate debt or equity financing on favorable terms, if at all.

In order to service our indebtedness, we need to generate cash from our operating activities or additional equity or debt financings. Our ability to generate cash is subject, in part, to our ability to successfully execute our business strategy, as well as general economic, financial, competitive, regulatory and other factors beyond our control. We cannot assure you that our business will be able to generate sufficient cash flow from operations or that future borrowings or other financings will be available to us in an amount sufficient to enable us to service our indebtedness and fund our other liquidity needs. To the extent we are required to use cash from operations or the proceeds of any future financing to service our indebtedness instead of funding working capital, capital expenditures or other general corporate purposes, we will be less able to plan for, or react to, changes in our business, industry, and in the economy generally. This may place us at a competitive disadvantage compared to our competitors that have less indebtedness.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus supplement, the accompanying prospectus and the documents we have filed with the Securities and Exchange Commission, or SEC, that are incorporated by reference herein and therein contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act that involve a number of risks and uncertainties. All statements other than statements of historical facts contained in this prospectus supplement and the documents incorporated by reference herein, including statements concerning possible or assumed future actions, business strategies, events or results of operations, and any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this prospectus supplement and the documents incorporated by reference herein are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Some of the key factors that could cause actual results to differ from our expectations include, but are not limited to, the following:

•we have a limited operating history;

•we have not been profitable to date, and operating losses could continue, which could materially and adversely affect our business, financial condition and results of operations, including our ability to continue as a going concern;

•we have experienced fluctuations in the growth of our business and anticipate this will continue. If we fail to manage our growth effectively, our business could be materially and adversely affected;

•if any governmental authority or notified body were to require marketing authorization or similar certification for any product that we sell for which we have not obtained such marketing authorization or certification, we could be subject to regulatory enforcement action and/or required to cease selling or recall the product pending receipt of marketing authorization or similar certification from such other governmental authority or notified body, which can be a lengthy and time-consuming process, harm financial results and have long-term negative effects on our operations;

•our products rely on mobile applications to function and we rely on Apple’s App Store and the Google Play Store for distribution of our mobile applications;

•a substantial portion of our sales comes through a limited number of retailers;

•we are required to obtain and maintain marketing authorizations or certifications from the FDA, foreign regulatory authorities or notified bodies for medical device products in the U.S. or in foreign jurisdictions, which can be a lengthy and time-consuming process, and a failure to do so on a timely basis, or at all, could severely harm our business;

•we currently rely on a single manufacturer for the assembly of our Smart Sock and Dream Sock products and a single manufacturer for the assembly of our Owlet Cam;

•if we are unable to obtain key materials and components from sole or limited source suppliers, we will not be able to deliver our products to customers;

•our success depends in part on our proprietary technology, and if we are unable to obtain, maintain or successfully enforce our intellectual property rights, the commercial value of our products and services will be adversely affected, our competitive position may be harmed and we may be unable to operate our business profitably;

•our business and operations may suffer in the event of IT system failures, cyberattacks or deficiencies in our cybersecurity;

•we are involved, and may become involved in the future, in disputes and other legal or regulatory proceedings that, if adversely decided or settled, could materially and adversely affect our business, financial condition and results of operations;

•we face the risk of product liability claims and the amount of insurance coverage held now or in the future may not be adequate to cover all liabilities we might incur;

•operations in international markets will expose us to additional business, political, regulatory, operational, financial and economic risks;

•our success depends substantially on our reputation and brand;

•some of our products and services are in development or have been recently introduced into the market and may not achieve market acceptance, which could limit our growth and adversely affect our business, financial condition and results of operations;

•we have identified material weaknesses in our internal control over financial reporting and we may identify additional material weaknesses in the future or otherwise fail to maintain effective internal control over financial reporting, which may result in material misstatements of our consolidated financial statements, cause us to fail to meet our periodic reporting obligations or cause our access to the capital markets to be impaired;

•our failure to meet the New York Stock Exchange’s continued listing requirements could result in a delisting of our common stock;

•we may need to raise additional capital in the future in order to execute our strategic plan, which may not be available on terms acceptable to us, or at all; and

•the risks discussed in Part I, Item 1A, Risk Factors, included in our most recent Annual Report on Form 10-K and in any subsequent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and those discussed in other documents we file from time to time with the SEC.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above. Forward-looking statements speak only as of the date of this prospectus supplement. You should not put undue reliance on any forward-looking statements. We assume no obligation to publicly update or revise any forward-looking statements because of new information, future events, changes in assumptions or otherwise, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

USE OF PROCEEDS

We estimate that the net proceeds from this offering will be $10.1 million, after deducting the underwriting discounts and commissions and estimated offering expenses payable by us.

We intend to use the net proceeds from this offering for general corporate purposes, capital expenditures, working capital and general and administrative expenses. We may also use a portion of the net proceeds from this offering to acquire or invest in businesses, products and technologies that are complementary to our own, although we have no current plans, commitments or agreements with respect to any such acquisitions or investments as of the date of this prospectus supplement.

Our management will have broad discretion in the application of the net proceeds to us from this offering, including for any of the purposes described above. Pending the use of the net proceeds from this offering, we intend to invest the net proceeds in investment grade, interest bearing securities.

DIVIDEND POLICY

We have never declared or paid any cash dividends on our capital stock. We intend to retain future earnings, if any, to finance the operation and expansion of our business and do not anticipate paying any cash dividends in the foreseeable future. Any future determination related to our dividend policy will be made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions contained in our current or future financing instruments.

CAPITALIZATION

The following table sets forth our cash and cash equivalents and our capitalization as of June 30, 2024:

•on an actual basis;