- Generated Q2 Cash Flow from Operations of $37 Million

- Executed $20 Million in Share Repurchases

- Completed the Refinancing of the $680 Million Senior Unsecured

Note Due 2025

- Updates Fiscal 2024 Guidance

Sally Beauty Holdings, Inc. (NYSE: SBH) (“the Company”), the

leader in professional hair color, today announced financial

results for its second quarter ended March 31, 2024. The Company

will hold a conference call today at 7:30 a.m. Central Time to

discuss these results and its business.

Fiscal 2024 Second Quarter Summary

- Consolidated net sales of $908 million, a decrease of 1.1%

compared to the prior year;

- Consolidated comparable sales decline of 1.5%;

- Global e-commerce sales of $90 million, representing 9.9% of

net sales;

- GAAP gross margin 51.0%;

- GAAP operating earnings of $60 million and GAAP operating

margin of 6.6%; Adjusted Operating Earnings of $69 million and

Adjusted Operating Margin of 7.6%;

- GAAP diluted net earnings per share of $0.27 and Adjusted

Diluted Net Earnings Per Share of $0.35; and

- Cash flow from operations of $37 million and Operating Free

Cash Flow of $23 million.

“Our second quarter performance reflects the benefits of

expanded distribution, product innovation and the strengthening of

salon demand trends in our Beauty Systems Group segment, offset by

moderating traffic and customer purchasing patterns in our Sally

Beauty segment resulting from the inflationary environment,” said

Denise Paulonis, president and chief executive officer. “Amidst

these cross-currents, our teams continued to advance our strategic

initiatives and deliver engaging experiences for our customers as

we focus on driving long-term growth and profitability.”

Paulonis added, “We further optimized our balance sheet by

refinancing our $680 million senior unsecured note due 2025, which

extended the maturity to 2032. We also generated solid cash flow

from operations of $37 million in the quarter, allowing us to

return value to shareholders through our share repurchase

program.”

Fiscal 2024 Second Quarter Operating Results

Second quarter consolidated net sales were $908.4 million, a

decrease of 1.1% compared to the prior year. Foreign currency

translation had a favorable impact of 50 basis points on

consolidated net sales for the quarter. At constant currency,

global e-commerce sales were $90 million or 9.9% of consolidated

net sales for the quarter.

Consolidated comparable sales declined 1.5%, primarily

reflecting soft traffic and consumer purchasing trends at Sally

Beauty driven by the inflationary environment, partially offset by

expanded distribution, product innovation and improving salon

demand trends at Beauty Systems Group.

Consolidated gross profit for the second quarter was $463.1

million compared to $468.3 million in the prior year, a decrease of

1.1%. Consolidated GAAP gross margin was 51.0%, which was flat to

the prior year of 51.0%. Excluding the prior year’s true-up of the

non-cash inventory write-down as part of the Company’s previously

announced distribution center consolidation and store optimization

plan, Adjusted Gross Margin was 51.0%, an increase of 30 basis

points compared to 50.7% in the prior year. The increase was driven

primarily by lower distribution and freight costs from supply chain

efficiencies, partially offset by an unfavorable sales mix shift

between Sally Beauty (higher margin) and Beauty Systems Group

(lower margin).

Selling, general and administrative (SG&A) expenses totaled

$403.4 million, an increase of $13.8 million compared to the prior

year. Adjusted Selling, General and Administrative Expenses,

excluding costs related to the Company’s fuel for growth initiative

and other expenses, totaled $394.5 million, an increase of $4.8

million compared to the prior year. The increase was driven

primarily by higher labor costs and rent expense, partially offset

by lower accrued bonus expense. As a percentage of sales, Adjusted

SG&A expenses were 43.4% compared to 42.4% in the prior

year.

GAAP operating earnings and operating margin in the second

quarter were $59.6 million and 6.6%, compared to $71.4 million and

7.8%, in the prior year. Adjusted Operating Earnings and Operating

Margin, excluding the costs related to the Company’s fuel for

growth initiative, restructuring efforts, and other expenses, were

$68.6 million and 7.6%, compared to $76.3 million and 8.3%, in the

prior year.

GAAP net earnings in the second quarter were $29.2 million, or

$0.27 per diluted share, compared to GAAP net earnings of $40.9

million, or $0.37 per diluted share in the prior year. Adjusted Net

Earnings, excluding the costs related to the Company’s fuel for

growth initiative, loss on debt extinguishment, restructuring

efforts, and other expenses, were $37.8 million, or $0.35 per

diluted share, compared to Adjusted Net Earnings of $44.6 million,

or $0.41 per diluted share in the prior year. Adjusted EBITDA in

the second quarter was $99.5 million, a decrease of 5.4% compared

to the prior year, and Adjusted EBITDA Margin was 11.0%, a decrease

of 50 basis points compared to the prior year.

Balance Sheet and Cash Flow

As of March 31, 2024, the Company had cash and cash equivalents

of $97 million and a $62 million balance outstanding under its

asset-based revolving line of credit. At the end of the quarter,

inventory was $1.04 billion, up 1.6% versus a year ago. The Company

ended the quarter with a net debt leverage ratio of 2.2x.

During the second quarter, the Company issued a new $600 million

8-year senior unsecured note due 2032. The net proceeds from the

transaction, in combination with existing cash and a modest draw

under the Company’s asset-based revolving line of credit, were used

to refinance the Company’s $680 million 5.625% senior unsecured

note due 2025. The new senior unsecured note was issued with a

coupon rate of 6.75%.

Second quarter cash flow from operations was $36.9 million.

Capital expenditures in the quarter totaled $14.1 million. During

the quarter, the Company repurchased 1.5 million shares under its

share repurchase program at an aggregate cost of $20 million.

Fiscal 2024 Second Quarter Segment Results

Sally Beauty Supply

- Segment net sales were $513.2 million in the quarter, a

decrease of 3.2% compared to the prior year. The segment had a

favorable impact of 90 basis points from foreign currency

translation on reported sales. At constant currency, segment

e-commerce sales were $34 million or 6.6% of segment net sales for

the quarter.

- Segment comparable sales decreased 4.0% in the second quarter,

primarily reflecting soft traffic and customer purchasing trends

driven by the inflationary environment.

- At the end of the quarter, segment store count was 3,134

compared to 3,143 in the prior year.

- GAAP gross margin increased by 10 basis points to 59.9%

compared to the prior year. The increase was driven primarily by

lower distribution and freight costs from supply chain

efficiencies, partially offset by the prior year’s true-up of the

non-cash inventory write-down as part of the Company’s previously

announced distribution center consolidation and store optimization

plan.

- GAAP operating earnings were $76.8 million compared to $92.1

million in the prior year. GAAP operating margin decreased to 15.0%

compared to 17.4% in the prior year.

Beauty Systems Group

- Segment net sales were $395.1 million in the quarter, an

increase of 1.7% compared to the prior year. At constant currency,

segment e-commerce sales were $56 million or 14.1% of segment net

sales for the quarter.

- Segment comparable sales increased 2.0% in the second quarter,

primarily reflecting expanded distribution, product innovation and

improving salon demand trends.

- At the end of the quarter, net store count was 1,334 compared

to 1,341 in the prior year.

- GAAP gross margin increased 50 basis points to 39.4% in the

quarter compared to the prior year. The increase was driven

primarily by lower distribution and freight costs from supply chain

efficiencies, partially offset by lower product margin due to a

higher take rate on promotions and brand mix.

- GAAP operating earnings were $43.0 million in the quarter

compared to $37.3 million in the prior year. GAAP operating margin

in the quarter was 10.9% compared to 9.6% in the prior year.

- At the end of the quarter, there were 654 distributor sales

consultants compared to 675 in the prior year.

Fiscal Year 2024 Guidance

The Company is updating its full year guidance by adjusting its

full year operating margin outlook to reflect the Company’s second

quarter results, as follows:

- The Company continues to expect net sales and comparable sales

to be approximately flat compared to the prior year;

- Gross Margin is now expected to be in the range of 50.5% to

51.0%;

- Adjusted Operating Margin is now expected to be approximately

8.5%;

- Operating Cash Flow is now expected to be approximately $240

million; and

- Capital expenditures are expected to be approximately $100

million.

*

The Company does not provide a

reconciliation for forward-looking non-GAAP financial measures

where it is unable to provide a meaningful or accurate calculation

or estimation of reconciling items and the information is not

available without unreasonable effort. This is due to the inherent

difficulty of forecasting the occurrence and the financial impact

of various items that have not yet occurred, are out of the

Company’s control or cannot be reasonably predicted. For the same

reasons, the Company is unable to address the probable significance

of the unavailable information. Forward-looking non-GAAP financial

measures provided without the most directly comparable GAAP

financial measures may vary materially from the corresponding GAAP

financial measures.

Conference Call and Where You Can Find Additional

Information

The Company will hold a conference call and audio webcast today

to discuss its financial results and its business at approximately

7:30 a.m. Central Time today, May 9, 2024. During the conference

call, the Company may discuss and answer one or more questions

concerning business and financial matters and trends affecting the

Company. The Company’s responses to these questions, as well as

other matters discussed during the conference call, may contain or

constitute material information that has not been previously

disclosed. Simultaneous to the conference call, an audio webcast of

the call will be available via a link on the Company’s website,

sallybeautyholdings.com/investor-relations. The conference call can

be accessed by dialing (877) 336-4440 (International: (409)

207-6984) and referencing the access code 2198500#. The

teleconference will be held in a “listen-only” mode for all

participants other than the Company’s current sell-side and

buy-side investment professionals. A replay of the earnings

conference call will be available starting at 11:30 a.m. Central

Time, May 9, 2024, through May 23, 2024, by dialing (866) 207-1041

(International: (402) 970-0847) and referencing access code

3810288#. Also, a website replay will be available on

sallybeautyholdings.com/investor-relations.

About Sally Beauty Holdings, Inc.

Sally Beauty Holdings, Inc. (NYSE: SBH), as the leader in

professional hair color, sells and distributes professional beauty

supplies globally through its Sally Beauty Supply and Beauty

Systems Group businesses. Sally Beauty Supply stores offer up to

7,000 products for hair color, hair care, nails, and skin care

through proprietary brands such as Ion®, Bondbar®, Strawberry

Leopard®, Generic Value Products®, Inspired by Nature® and Silk

Elements® as well as professional lines such as Wella®, Clairol®,

OPI®, L’Oreal®, Wahl® and Babyliss Pro®. Beauty Systems Group

stores, branded as CosmoProf® or Armstrong McCall® stores, along

with its outside sales consultants, sell up to 8,000 professionally

branded products including Paul Mitchell®, Wella®, Matrix®,

Schwarzkopf®, Kenra®, Goldwell®, Joico®, Amika® and Moroccannoil®,

intended for use in salons and for resale by salons to retail

consumers. For more information about Sally Beauty Holdings, Inc.,

please visit https://www.sallybeautyholdings.com/.

Cautionary Notice Regarding Forward-Looking

Statements

Statements in this news release and the schedules hereto which

are not purely historical facts or which depend upon future events

may be forward-looking statements within the meaning of Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. Forward-looking

statements, as that term is defined in the Private Securities

Litigation Reform Act of 1995, can be identified by the use of

forward-looking terminology such as “believes,” “projects,”

“expects,” “can,” “may,” “estimates,” “should,” “plans,” “targets,”

“intends,” “could,” “will,” “would,” “anticipates,” “potential,”

“confident,” “optimistic,” or the negative thereof, or other

variations thereon, or comparable terminology, or by discussions of

strategy, objectives, estimates, guidance, expectations and future

plans. Forward-looking statements can also be identified by the

fact that these statements do not relate strictly to historical or

current matters.

Readers are cautioned not to place undue reliance on

forward-looking statements as such statements speak only as of the

date they were made. Any forward-looking statements involve risks

and uncertainties that could cause actual events or results to

differ materially from the events or results described in the

forward-looking statements, including, those described in our

filings with the Securities and Exchange Commission, including our

Annual Report on Form 10-K for the year ended September 30, 2023.

Consequently, all forward-looking statements in this release are

qualified by the factors, risks and uncertainties contained

therein. We assume no obligation to publicly update or revise any

forward-looking statements.

Use of Non-GAAP Financial Measures

This news release and the schedules hereto include the following

financial measures that have not been calculated in accordance with

accounting principles generally accepted in the United States, or

GAAP, and are therefore referred to as non-GAAP financial measures:

(1) Adjusted Gross Margin; (2) Adjusted Selling, General and

Administrative Expenses; (3) Adjusted EBITDA and EBITDA Margin; (4)

Adjusted Operating Earnings and Operating Margin; (5) Adjusted Net

Earnings; (6) Adjusted Diluted Net Earnings Per Share; and (7)

Operating Free Cash Flow. We have provided definitions below for

these non-GAAP financial measures and have provided tables in the

schedules hereto to reconcile these non-GAAP financial measures to

the comparable GAAP financial measures.

Adjusted Gross Margin – We define the measure Adjusted Gross

Margin as GAAP gross margin excluding the true-up of the inventory

write-down related to the Company’s distribution center

consolidation and store optimization plan for the relevant time

periods as indicated in the accompanying non-GAAP reconciliations

to the comparable GAAP financial measures.

Adjusted Selling, General and Administrative Expenses – We

define the measure Adjusted Selling, General and Administrative

Expenses as GAAP selling, general and administrative expenses

excluding costs related to the Company’s fuel for growth initiative

and other expenses for the relevant time periods as indicated in

the accompanying non-GAAP reconciliations to the comparable GAAP

financial measures.

Adjusted EBITDA and EBITDA Margin – We define the measure

Adjusted EBITDA as GAAP net earnings before depreciation and

amortization, interest expense, income taxes, share-based

compensation, costs related to the Company’s restructuring plans,

costs related to the Company’s fuel for growth initiative and other

expenses for the relevant time periods as indicated in the

accompanying non-GAAP reconciliations to the comparable GAAP

financial measures. Adjusted EBITDA Margin is Adjusted EBITDA as a

percentage of net sales.

Adjusted Operating Earnings and Operating Margin – Adjusted

operating earnings are GAAP operating earnings that exclude costs

related to the Company’s restructuring plans, costs related to the

Company’s fuel for growth initiative and other expenses for the

relevant time periods as indicated in the accompanying non-GAAP

reconciliations to the comparable GAAP financial measures. Adjusted

Operating Margin is Adjusted Operating Earnings as a percentage of

net sales.

Adjusted Net Earnings – Adjusted net earnings is GAAP net

earnings that exclude tax-effected costs related to the Company’s

restructuring plans, tax-effected expenses related to the Company’s

fuel for growth initiative and other costs, and tax-effected

expenses related to loss on debt extinguishment for the relevant

time periods as indicated in the accompanying non-GAAP

reconciliations to the comparable GAAP financial measures.

Adjusted Diluted Net Earnings Per Share – Adjusted diluted net

earnings per share is GAAP diluted earnings per share that exclude

tax-effected costs related to the Company’s restructuring plans,

tax-effected expenses related to the Company’s fuel for growth

initiative and other costs, and tax-effected expenses related to

loss on debt extinguishment for the relevant time periods as

indicated in the accompanying non-GAAP reconciliations to the

comparable GAAP financial measures.

Operating Free Cash Flow – We define the measure Operating Free

Cash Flow as GAAP net cash provided by operating activities less

payments for capital expenditures (net). We believe Operating Free

Cash Flow is an important liquidity measure that provides useful

information to investors about the amount of cash generated from

operations after taking into account payments for capital

expenditures (net).

We believe that these non-GAAP financial measures provide

valuable information regarding our earnings and business trends by

excluding specific items that we believe are not indicative of the

ongoing operating results of our businesses; providing a useful way

for investors to make a comparison of our performance over time and

against other companies in our industry.

We have provided these non-GAAP financial measures as

supplemental information to our GAAP financial measures and believe

these non-GAAP measures provide investors with additional

meaningful financial information regarding our operating

performance and cash flows. Our management and Board of Directors

also use these non-GAAP measures as supplemental measures to

evaluate our businesses and the performance of management,

including the determination of performance-based compensation, to

make operating and strategic decisions, and to allocate financial

resources. We believe that these non-GAAP measures also provide

meaningful information for investors and securities analysts to

evaluate our historical and prospective financial performance.

These non-GAAP measures should not be considered a substitute for

or superior to GAAP results. Furthermore, the non-GAAP measures

presented by us may not be comparable to similarly titled measures

of other companies.

Supplemental Schedules

Segment Information

1

Non-GAAP Financial Measures

Reconciliations

2-3

Non-GAAP Financial Measures

Reconciliations; Adjusted EBITDA and

Operating Free Cash Flow

4

Store Count and Comparable

Sales

5

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Condensed

Consolidated Statements of Earnings (In thousands, except per share

data) (Unaudited)

Three Months Ended March 31, Six

Months Ended March 31,

2024

2023

PercentageChange

2024

2023

PercentageChange Net sales

$

908,361

$

918,712

(1.1

)%

$

1,839,663

$

1,875,767

(1.9

)%

Cost of products sold

445,289

450,373

(1.1

)%

909,415

918,854

(1.0

)%

Gross profit

463,072

468,339

(1.1

)%

930,248

956,913

(2.8

)%

Selling, general and administrative expenses

403,435

389,657

3.5

%

801,573

781,237

2.6

%

Restructuring

63

7,274

(99.1

)%

(22

)

17,680

(100.1

)%

Operating earnings

59,574

71,408

(16.6

)%

128,697

157,996

(18.5

)%

Interest expense

20,523

16,685

23.0

%

37,837

34,608

9.3

%

Earnings before provision for income taxes

39,051

54,723

(28.6

)%

90,860

123,388

(26.4

)%

Provision for income taxes

9,807

13,862

(29.3

)%

23,226

32,190

(27.8

)%

Net earnings

$

29,244

$

40,861

(28.4

)%

$

67,634

$

91,198

(25.8

)%

Earnings per share: Basic

$

0.28

$

0.38

(26.3

)%

$

0.64

$

0.85

(24.7

)%

Diluted

$

0.27

$

0.37

(27.0

)%

$

0.63

$

0.83

(24.1

)%

Weighted average shares: Basic

104,276

107,453

105,117

107,294

Diluted

107,080

109,706

107,881

109,499

Basis PointChange Basis PointChange

Comparison as a percentage of net

sales Consolidated gross margin

51.0

%

51.0

%

—

50.6

%

51.0

%

(40

)

Selling, general and administrative expenses

44.4

%

42.4

%

200

43.6

%

41.6

%

200

Consolidated operating margin

6.6

%

7.8

%

(120

)

7.0

%

8.4

%

(140

)

Effective tax rate

25.1

%

25.3

%

(20

)

25.6

%

26.1

%

(50

)

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Condensed

Consolidated Balance Sheets (In thousands) (Unaudited)

March 31,2024 September 30,2023 Cash and cash

equivalents

$

97,174

$

123,001

Trade and other accounts receivable

87,561

75,875

Inventory

1,039,752

975,218

Other current assets

55,836

53,903

Total current assets

1,280,323

1,227,997

Property and equipment, net

273,175

297,779

Operating lease assets

562,770

570,657

Goodwill and other intangible assets

588,582

588,252

Other assets

41,692

40,565

Total assets

$

2,746,542

$

2,725,250

Current maturities of long-term debt

$

66,164

$

4,173

Accounts payable

289,606

258,884

Accrued liabilities

150,002

163,366

Current operating lease liabilities

137,631

150,479

Income taxes payable

366

2,355

Total current liabilities

643,769

579,257

Long-term debt, including capital leases

978,360

1,065,811

Long-term operating lease liabilities

458,030

455,071

Other liabilities

21,626

23,139

Deferred income tax liabilities, net

93,907

93,224

Total liabilities

2,195,692

2,216,502

Total stockholders’ equity

550,850

508,748

Total liabilities and stockholders’ equity

$

2,746,542

$

2,725,250

Supplemental Schedule 1

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Segment

Information (In thousands) (Unaudited)

Three

Months Ended March 31, Six Months Ended March 31,

2024

2023

PercentageChange

2024

2023

PercentageChange Net sales: Sally Beauty Supply ("SBS")

$

513,241

$

530,246

(3.2

)%

$

1,036,479

$

1,079,718

(4.0

)%

Beauty Systems Group ("BSG")

395,120

388,466

1.7

%

803,184

796,049

0.9

%

Total net sales

$

908,361

$

918,712

(1.1

)%

$

1,839,663

$

1,875,767

(1.9

)%

Operating earnings: SBS

$

76,820

$

92,134

(16.6

)%

$

154,449

$

191,308

(19.3

)%

BSG

43,015

37,260

15.4

%

87,642

86,907

0.8

%

Segment operating earnings

119,835

129,394

(7.4

)%

242,091

278,215

(13.0

)%

Unallocated expenses (1)

60,198

50,712

18.7

%

113,416

102,539

10.6

%

Restructuring

63

7,274

(99.1

)%

(22

)

17,680

(100.1

)%

Interest expense

20,523

16,685

23.0

%

37,837

34,608

9.3

%

Earnings before provision for income taxes

$

39,051

$

54,723

(28.6

)%

$

90,860

$

123,388

(26.4

)%

Segment gross margin:

2024

2023

Basis PointChange

2024

2023

Basis PointChange SBS

59.9

%

59.8

%

10

59.3

%

59.3

%

—

BSG

39.4

%

38.9

%

50

39.4

%

39.7

%

(30

)

Segment operating margin: SBS

15.0

%

17.4

%

(240

)

14.9

%

17.7

%

(280

)

BSG

10.9

%

9.6

%

130

10.9

%

10.9

%

—

Consolidated operating margin

6.6

%

7.8

%

(120

)

7.0

%

8.4

%

(140

)

(1) Unallocated expenses, including share-based compensation

expense, consist of corporate and shared costs and are included in

selling, general and administrative expenses. Additionally,

unallocated expenses include costs associated with our Fuel for

Growth initiative. Supplemental Schedule 2

SALLY BEAUTY

HOLDINGS, INC. AND SUBSIDIARIES Non-GAAP Financial Measures

Reconciliations (In thousands, except per share data) (Unaudited)

Three Months Ended March 31, 2024 As

Reported(GAAP) Restructuring (1) Fuel for Growthand Other (2) Loss

on DebtExtinguishment (3) As Adjusted(Non-GAAP) Cost of

products sold

$

445,289

$

—

$

—

$

—

$

445,289

Consolidated gross margin

51.0

%

51.0

%

Selling, general and administrative expenses

403,435

—

(8,945

)

—

394,490

SG&A expenses, as a percentage of sales

44.4

%

43.4

%

Operating earnings

59,574

63

8,945

—

68,582

Operating margin

6.6

%

7.6

%

Interest expense

20,523

—

—

(2,565

)

17,958

Earnings before provision for income taxes

39,051

63

8,945

2,565

50,624

Provision for income taxes (4)

9,807

16

2,297

659

12,779

Net earnings

$

29,244

$

47

$

6,648

$

1,906

$

37,845

Earnings per share: Basic

$

0.28

$

0.00

$

0.06

$

0.02

$

0.36

Diluted

$

0.27

$

0.00

$

0.07

$

0.02

$

0.35

Three Months Ended March 31, 2023 As Reported(GAAP)

Restructuring (1) As Adjusted(Non-GAAP) Cost of products

sold

$

450,373

$

2,362

$

452,735

Consolidated gross margin

51.0

%

50.7

%

Selling, general and administrative expenses

389,657

—

389,657

SG&A expenses, as a percentage of sales

42.4

%

42.4

%

Operating earnings

71,408

4,912

76,320

Operating margin

7.8

%

8.3

%

Interest expense

16,685

—

16,685

Earnings before provision for income taxes

54,723

4,912

59,635

Provision for income taxes (4)

13,862

1,222

15,084

Net earnings

$

40,861

$

3,690

$

44,551

Earnings per share: Basic

$

0.38

$

0.03

$

0.41

Diluted

$

0.37

$

0.03

$

0.41

(1) For the three months ended March 31, 2024 and 2023,

restructuring represents expenses and adjustments incurred

primarily in connection with our Distribution Center Consolidation

and Store Optimization Plan, including $2.4 million in cost of

products sold related to adjustments to our expected obsolescence

reserve in the three months ended March 31, 2023. (2) Fuel

for Growth and other represents expenses related to consulting

services and severance expenses. (3) Loss on debt

extinguishment relates to the repayment of our 5.625% Senior Notes

due 2025, which included a the write-off of unamortized deferred

financing costs of $2.0 million, and overlapping interest, net of

interest earned on short-term cash equivalents, in the amount of

$0.5 million on such senior notes after February 27, 2024 and until

their redemption. These pro-forma adjustments assume the redeemed

senior notes were repaid on February 27, 2024 at the time of

closing on our 6.75% Senior Notes due 2032. (4) The

provision for income taxes was calculated using the applicable tax

rates for each country, while excluding the tax benefits for

countries where the tax benefit is not currently deemed probable of

being realized. Supplemental Schedule 3

SALLY BEAUTY HOLDINGS,

INC. AND SUBSIDIARIES Non-GAAP Financial Measures

Reconciliations, Continued (In thousands, except per share data)

(Unaudited)

Six Months Ended March 31, 2024 As

Reported(GAAP) Restructuring (1) Fuel for Growthand Other (2) Loss

on DebtExtinguishment (3) As Adjusted(Non-GAAP) Cost of

products sold

$

909,415

$

—

$

—

$

—

$

909,415

Consolidated gross margin

50.6

%

50.6

%

Selling, general and administrative expenses

801,573

—

(13,826

)

—

787,747

SG&A expenses, as a percentage of sales

43.6

%

42.8

%

Operating earnings

128,697

(22

)

13,826

—

142,501

Operating margin

7.0

%

7.7

%

Interest expense

37,837

—

—

(2,565

)

35,272

Earnings before provision for income taxes

90,860

(22

)

13,826

2,565

107,229

Provision for income taxes (5)

23,226

(5

)

3,552

659

27,432

Net earnings

$

67,634

$

(17

)

$

10,274

$

1,906

$

79,797

Earnings per share: Basic

$

0.64

$

(0.00

)

$

0.10

$

0.02

$

0.76

Diluted

$

0.63

$

(0.00

)

$

0.10

$

0.02

$

0.74

Six Months Ended March 31, 2023 As Reported(GAAP)

Restructuring andOther (1) COVID-19 (4) As Adjusted(Non-GAAP)

Cost of products sold

$

918,854

$

5,043

$

—

$

923,897

Consolidated gross margin

51.0

%

50.7

%

Selling, general and administrative expenses

781,237

—

(1,052

)

780,185

SG&A expenses, as a percentage of sales

41.6

%

41.6

%

Operating earnings

157,996

12,637

1,052

171,685

Operating margin

8.4

%

9.2

%

Interest expense

34,608

—

—

34,608

Earnings before provision for income taxes

123,388

12,637

1,052

137,077

Provision for income taxes (5)

32,190

3,198

270

35,658

Net earnings

$

91,198

$

9,439

$

782

$

101,419

Earnings per share: Basic

$

0.85

$

0.09

$

0.01

$

0.95

Diluted

$

0.83

$

0.09

$

0.01

$

0.93

(1) For the six months ended March 31, 2024 and 2023,

restructuring represents expenses and adjustments incurred

primarily in connection with our Distribution Center Consolidation

and Store Optimization Plan, including $5.0 million in cost of

products sold related to adjustments to our expected obsolescence

reserve in the three months ended March 31, 2023. (2) Fuel

for Growth and other represents expenses related to consulting

services and severance expenses. (3) Loss on debt

extinguishment relates to the repayment of our 5.625% Senior Notes

due 2025, which included a the write-off of unamortized deferred

financing costs of $2.0 million, and overlapping interest, net of

interest earned on short-term cash equivalents, in the amount of

$0.5 million on such senior notes after February 27, 2024 and until

their redemption. These pro-forma adjustments assume the redeemed

senior notes were repaid on February 27, 2024 at the time of

closing on our 6.75% Senior Notes due 2032. (4) For the six

months ended March 31, 2023, COVID-19 expenses related to use taxes

around the donation of personal protection merchandise. (5)

The provision for income taxes was calculated using the applicable

tax rates for each country, while excluding the tax benefits for

countries where the tax benefit is not currently deemed probable of

being realized.

Supplemental Schedule 4

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Non-GAAP

Financial Measures Reconciliations, Continued (In thousands)

(Unaudited)

Three Months Ended March 31,

Six Months Ended March 31, Adjusted EBITDA:

2024

2023

PercentageChange

2024

2023

PercentageChange Net earnings

$

29,244

$

40,861

(28.4

)%

$

67,634

$

91,198

(25.8

)%

Add: Depreciation and amortization

26,954

25,062

7.5

%

55,017

50,347

9.3

%

Interest expense

20,523

16,685

23.0

%

37,837

34,608

9.3

%

Provision for income taxes

9,807

13,862

(29.3

)%

23,226

32,190

(27.8

)%

EBITDA (non-GAAP)

86,528

96,470

(10.3

)%

183,714

208,343

(11.8

)%

Share-based compensation

3,964

3,838

3.3

%

9,082

8,973

1.2

%

Restructuring

63

4,912

(98.7

)%

(22

)

12,637

(100.2

)%

Fuel for Growth and Other

8,945

—

100.0

%

13,826

—

100.0

%

COVID-19

—

—

—

%

—

1,052

(100.0

)%

Adjusted EBITDA (non-GAAP)

$

99,500

$

105,220

(5.4

)%

$

206,600

$

231,005

(10.6

)%

Basis PointChange Basis PointChange

Adjusted EBITDA as a percentage of net

sales Adjusted EBITDA margin

11.0

%

11.5

%

(50

)

11.2

%

12.3

%

(110

)

Operating Free Cash Flow:

2024

2023

PercentageChange

2024

2023

PercentageChange Net cash provided by operating activities

$

36,940

$

24,697

49.6

%

$

87,960

$

79,648

10.4

%

Less: Payments for property and equipment, net

14,108

17,174

(17.9

)%

44,659

42,181

5.9

%

Operating free cash flow (non-GAAP)

$

22,832

$

7,523

203.5

%

$

43,301

$

37,467

15.6

%

Supplemental Schedule 5

SALLY BEAUTY HOLDINGS, INC. AND SUBSIDIARIES Store

Count and Comparable Sales (Unaudited)

As of March

31,

2024

2023

Change Number of stores: SBS stores

3,134

3,143

(9

)

BSG: Company-operated stores

1,202

1,209

(7

)

Franchise stores

132

132

—

Total BSG

1,334

1,341

(7

)

Total consolidated

4,468

4,484

(16

)

Number of BSG distributor sales consultants (1)

654

675

(21

)

(1) BSG distributor sales consultants (DSC) include 191 and

189 sales consultants employed by our franchisees at March 31, 2024

and 2023, respectively.

Three Months Ended March 31,

Six Months Ended March 31,

2024

2023

Basis PointChange

2024

2023

Basis PointChange Comparable sales growth (decline): SBS

(4.0

)%

9.1

%

(1,310

)

(3.0

)%

5.9

%

(890

)

BSG

2.0

%

1.3

%

70

1.3

%

(0.2

)%

150

Consolidated

(1.5

)%

5.7

%

(720

)

(1.1

)%

3.3

%

(440

)

Our comparable sales include sales from stores that have

been operating for 14 months or longer as of the last day of a

month and e-commerce revenue. Additionally, our comparable sales

include sales to franchisees and full service sales. Our comparable

sales excludes the effect of changes in foreign exchange rates and

sales from stores relocated until 14 months after the relocation.

Revenue from acquisitions are excluded from our comparable sales

calculation until 14 months after the acquisition.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509744268/en/

Jeff Harkins Investor Relations 940-297-3877

jharkins@sallybeauty.com

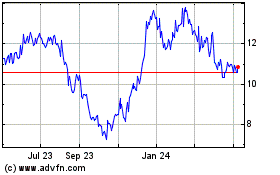

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Oct 2024 to Nov 2024

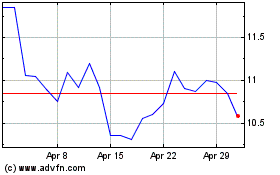

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Nov 2023 to Nov 2024