As filed with the Securities and Exchange Commission

on September 28, 2022

Registration No. 333-251390

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 4

TO

FORM S-1 ON FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

Rush Street Interactive, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

7999 |

84-3626708 |

(State or other jurisdiction of

incorporation or organization) |

(Primary Standard Industrial

Classification Code Number) |

(I.R.S. Employer

Identification No.) |

900 N. Michigan Avenue, Suite 950

Chicago, Illinois 60611

(773) 893-5855

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Richard

Schwartz

Rush Street Interactive, Inc.

900 N. Michigan Avenue, Suite 950

Chicago, Illinois 60611

(312) 915-2815

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Robert E. Goedert, P.C.

Brian Wolfe

Ana Sempertegui

Kirkland & Ellis LLP

300 North LaSalle

Chicago, Illinois 60654

Tel: (312) 862-2000

Approximate

date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933 check the following box: x

If

this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check

the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ¨

If

this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If

this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

x |

| |

|

|

|

| Non-accelerated filer |

¨ |

Smaller reporting company |

¨ |

| |

|

|

|

| |

|

Emerging growth company |

x |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ¨

The registrant hereby amends

this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further

amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933, as amended, or until this registration statement shall become effective on such date as the Securities and

Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

On December 16, 2020,

the registrant filed a Registration Statement on Form S-1 (Registration No. 333-251390), which was subsequently declared effective

by the U.S. Securities and Exchange Commission (the “SEC”) on December 29, 2020 (as amended and supplemented, the “Registration

Statement”).

This Post-Effective Amendment

No. 4 to Form S-1 on Form S-3 (“Post-Effective Amendment No. 4”) is being filed by the Company to: (i)

convert the Registration Statement on Form S-1 into a registration statement on Form S-3, and (ii) maintain the registration

of an aggregate of 16,043,002 shares of Class A common stock that may, from time to time, be offered or sold by the selling stockholders

identified in the prospectus. No additional securities are being registered under this Post-Effective Amendment No. 4. All applicable

registration fees were paid at the time of the original filing of the Registration Statement.

The information in this preliminary

prospectus is not complete and may be changed. Neither we nor the Selling Stockholders may sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities

and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER

28, 2022

PRELIMINARY PROSPECTUS

Rush Street Interactive, Inc.

16,043,002 Shares of Class A Common Stock

This prospectus relates to the

offer and sale, from time to time, by the selling stockholders identified in this prospectus (the “Selling Stockholders”)

of up to 16,043,002 shares of our Class A common stock, par value $0.0001 per share (“Class A Common Stock”), which

were issued in a private placement pursuant to the terms of the Subscription Agreements (as defined below) in connection with the Business

Combination (as defined below).

In connection with entering

into the Business Combination Agreement, the Company and RSILP (each as defined below) entered into subscription agreements, each dated

as of July 27, 2020 (the “Subscription Agreements”), with the Selling Stockholders, pursuant to which the Company agreed

to issue and sell to the Selling Stockholders, in a private placement that closed immediately prior to the Business Combination Closing

(the “PIPE”), an aggregate of 16,043,002 shares of Class A Common Stock at a purchase price of $10.00 per share (the

“PIPE Shares”), for an aggregate purchase price of $160,430,020.

This prospectus provides you

with a general description of such securities and the general manner in which the Selling Stockholders may offer or sell the securities.

More specific terms of any securities that the Selling Stockholders may offer or sell may be provided in a prospectus supplement that

describes, among other things, the specific amounts and prices of the securities being offered and the terms of the offering. The prospectus

supplement may also add, update or change information contained in this prospectus.

We will not receive any proceeds

from the sale of shares of Class A Common Stock by the Selling Stockholders pursuant to this prospectus. However, we will pay the

expenses, other than underwriting discounts and commissions, associated with the sale of securities pursuant to this prospectus.

Our registration of the securities

covered by this prospectus does not mean that the Selling Stockholders will offer or sell, as applicable, any of the securities. The Selling

Stockholders may offer and sell the securities covered by this prospectus in a number of different ways and at varying prices. We provide

more information in the section entitled “Plan of Distribution.”

You should read this prospectus

and any prospectus supplement or amendment carefully before you invest in our securities.

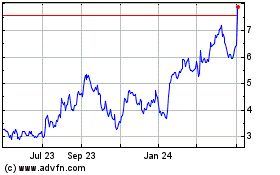

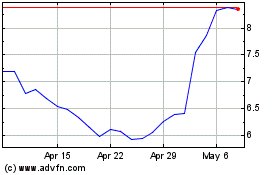

Our Class A Common Stock

is traded on the New York Stock Exchange (“NYSE”) under the symbol “RSI”. On September 27, 2022, the closing

price of our Class A Common Stock was $3.95 per share.

We are an “emerging

growth company” as that term is defined under the federal securities laws and, as such, are subject to certain reduced public company

reporting requirements.

INVESTING

IN OUR SECURITIES INVOLVES RISKS THAT ARE DESCRIBED IN THE “RISK FACTORS”

SECTION BEGINNING ON PAGE 3 OF THIS PROSPECTUS AND IN THE DOCUMENTS INCORPORATED BY REFERENCE HEREIN.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of the securities offered under this prospectus or determined if this

prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is ,

2022

Table

of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of

a registration statement that we filed with the SEC using a “shelf” registration process. Under this shelf registration process,

the Selling Stockholders may, from time to time, offer and sell any combination of the securities described in this prospectus in one

or more offerings. The Selling Stockholders may use the shelf registration statement to sell up to an aggregate of 16,043,002 shares of

Class A Common Stock from time to time through any means described in the section entitled “Plan of Distribution.”

More specific terms of any securities that the Selling Stockholders offer and sell may be provided in a prospectus supplement that describes,

among other things, the specific amounts and prices of the Class A Common Stock being offered and the terms of the offering.

A prospectus supplement may

also add, update or change information included in this prospectus. Any statement contained in this prospectus will be deemed to be modified

or superseded for purposes of this prospectus to the extent that a statement contained in such prospectus supplement modifies or supersedes

such statement. Any statement so modified will be deemed to constitute a part of this prospectus only as so modified, and any statement

so superseded will be deemed not to constitute a part of this prospectus. You should rely only on the information contained in this prospectus,

any applicable prospectus supplement or any related free writing prospectus. See “Where You Can Find More Information.”

Neither we nor the Selling

Stockholders have authorized anyone to provide any information or to make any representations other than those contained in this prospectus,

any accompanying prospectus supplement, any free writing prospectus we have prepared or the documents incorporated by reference herein.

We and the Selling Stockholders take no responsibility for, and can provide no assurance as to the reliability of, any other information

that others may give you. This prospectus is an offer to sell only the securities offered hereby and only under circumstances and in jurisdictions

where it is lawful to do so. No dealer, salesperson or other person is authorized to give any information or to represent anything not

contained in this prospectus, any applicable prospectus supplement or any related free writing prospectus. This prospectus is not an offer

to sell securities, and it is not soliciting an offer to buy securities, in any jurisdiction where the offer or sale is not permitted.

You should assume that the information appearing in this prospectus, any prospectus supplement or in the documents incorporated by reference

herein is accurate only as of the date on the front of those documents, regardless of the time of delivery of this prospectus or any applicable

prospectus supplement, or any sale of a security. Our business, financial condition, results of operations and prospects may have changed

since those dates.

This prospectus contains summaries

of certain provisions contained in some of the documents described herein, but reference is made to the actual documents for complete

information. All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to

herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus

is a part, and you may obtain copies of those documents as described below under “Where You Can Find More Information.”

On December 29, 2020

(the “Business Combination Closing Date”), Rush Street Interactive, Inc. (formerly known as dMY Technology Group, Inc.)

consummated its previously announced business combination pursuant to that certain Business Combination Agreement, dated as of July 27,

2020 (as amended, amended and restated, or otherwise modified from time to time, the “Business Combination Agreement”), among

dMY (as defined below), Rush Street Interactive, LP (“RSILP”), the Business Combination Sellers (as defined below), dMY Sponsor,

LLC (the “Sponsor”), and Rush Street Interactive GP, LLC, in its capacity as the Business Combination Sellers’ Representative

(the transactions contemplated by the Business Combination Agreement, collectively, the “Business Combination”). As contemplated

by the Business Combination Agreement, on the Business Combination Closing Date, dMY Technology Group, Inc. changed its name to Rush

Street Interactive, Inc. and RSILP became an indirect subsidiary of Rush Street Interactive, Inc.

Unless the context indicates

otherwise, references to “the Company,” “we,” “us” and “our”

refer to Rush Street Interactive, Inc., a Delaware corporation, and its consolidated subsidiaries following the Business Combination.

CERTAIN DEFINED TERMS

Unless otherwise stated in

this prospectus or the context otherwise requires, references to:

“Board”

means the members of the board of directors of the post-combination company.

“Business Combination”

means the acquisitions and transactions contemplated by the Business Combination Agreement.

“Business Combination

Agreement” means the Business Combination Agreement, dated as of July 27, 2020, by and among dMY, RSILP, the Business Combination

Sellers, the Sponsor and the Business Combination Sellers’ Representative, as amended and restated by the parties on October 9,

2020 and further amended on December 4, 2020.

“Business Combination

Closing” means the closing of the Business Combination.

“Business Combination

Closing Date” means December 29, 2020.

“Business Combination

Seller” means each of Rush Street Interactive GP, LLC, Greg and Marcy Carlin Family Trust, Gregory Carlin, Rush Street Investors,

LLC, Neil Bluhm, NGB 2013 Dynasty Trust, Einar Roosileht, Richard Schwartz and Mattias Stetz.

“Business Combination

Sellers’ Representative” means Rush Street Interactive GP, LLC, in its capacity as the Business Combination Sellers’

representative.

“Charter”

means the second amended and restated certificate of incorporation of the Company.

“Class A Common

Stock” means the Class A Common Stock of the Company, par value $0.0001 per share.

“Class B Common

Stock” means the Class B Common Stock of the Company, par value $0.0001 per share.

“Class V Voting

Stock” means the Class V Voting Stock of the Company, par value $0.0001 per share.

“Company”

refers (i) before the Business Combination, to dMY and (ii) immediately following the Business Combination, to Rush Street Interactive, Inc.,

as the context requires.

“DGCL”

means the General Corporation Law of the State of Delaware.

“dMY” means,

before the Business Combination, dMY Technology Group, Inc.

“Exchange Act”

means the Securities Exchange Act of 1934, as amended.

“Founder Holders”

means the independent directors of dMY (consisting of Darla Anderson, Francesca Luthi and Charles E. Wert) together with the Sponsor.

“Investor Rights

Agreement” means the agreement, dated as of the Business Combination Closing Date, pursuant to which, among other things, the

Sponsor has the right to nominate two directors to the Board and the Business Combination Sellers have the right (i) to nominate

the remaining directors of the Board, and (ii) to appoint up to three non-voting board observers to the Board, in each case subject

to certain conditions.

“IPO” means

the Company’s initial public offering of equity units consummated on February 25, 2020.

“NYSE”

means the New York Stock Exchange.

“PIPE”

means the private placement that closed immediately prior to the Business Combination Closing, pursuant to which dMY issued and sold to

the subscribers in that private placement an aggregate of 16,043,002 shares of Class A Common Stock at $10.00 per share, for an aggregate

purchase price of $160,430,020, with such shares being registered for resale by the Selling Stockholders.

“PIPE Shares”

means the 16,043,002 shares of Class A Common Stock previously sold to the subscribers in the PIPE.

“Public Warrants”

means the warrants issued by dMY to third-party investors in the IPO (whether they were purchased in the IPO or thereafter in the open

market). Each Public Warrant was exercisable for one share of Class A Common Stock of the Company at a price of $11.50 per share.

All the Public Warrants were exercised or redeemed as of March 25, 2021.

“Retained RSILP Units”

means the 160,000,000 RSILP Units that were retained by the Business Combination Sellers pursuant to the Business Combination Agreement.

“RSILP”

refers to Rush Street Interactive, L.P., a Delaware limited partnership.

“RSILP A&R LPA”

means the Amended and Restated Agreement of Limited Partnership of RSILP.

“RSI GP”

means RSI GP, LLC, a Delaware limited liability company and wholly-owned subsidiary of the Company.

“RSILP Units”

means the equity interests of RSILP, following the transactions contemplated by the Business Combination.

“RSG” means

Rush Street Gaming, LLC, a current affiliate of RSILP.

“SEC” means

the Securities and Exchange Commission.

“Securities Act”

means the Securities Act of 1933, as amended.

“Special Limited

Partner” means RSI ASLP, Inc., a wholly owned subsidiary of the Company that was formed in connection with the Business

Combination.

“Sponsor”

means the Company’s sponsor, dMY Sponsor, LLC.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

The statements contained in

this prospectus and any accompanying prospectus supplement and the documents incorporated by reference herein that are not purely historical

are forward-looking statements within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform

Act of 1995. The forward-looking statements depend upon events, risks and uncertainties that may be outside of our control. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,”

“intends,” “may,” “might,” “plan,” “possible,” “potential,” “predict,”

“project,” “should,” “would” and similar expressions may identify forward-looking statements, but

the absence of these words does not mean that a statement is not forward-looking. You are cautioned that our business and operations are

subject to a variety of risks and uncertainties, many of which are beyond our control, and, consequently, our actual results may differ

materially from those projected.

Factors that could cause or

contribute to such differences include, but are not limited to, those identified below and those discussed in the section entitled “Risk

Factors” included elsewhere in this prospectus and incorporated by reference. Any statements contained herein that are not statements

of historical fact may be forward-looking statements.

| · |

the ability to maintain the listing of our Class A Common Stock on the NYSE; |

| |

|

| · |

our ability to raise financing in the future; |

| |

|

| · |

our success in retaining or recruiting, or changes required in, our officers, key employees or directors; |

| |

|

| · |

our officers and directors allocating their time to other businesses and potentially having conflicts of interest with our business; |

| |

|

| · |

our public securities’ potential liquidity and trading; |

| |

|

| · |

the lack of a market for our securities; |

| |

|

| · |

competition in the online casino, online sports betting and retail sports betting (i.e., such as within a bricks-and-mortar casino) industries is intense and, as a result, we may fail to attract and retain customers, which may negatively impact our operations and growth prospects; |

| |

|

| · |

economic downturns and political and market conditions beyond our control,

including a reduction in consumer discretionary spending, inflation and sports leagues shortening, delaying or cancelling their seasons

due to COVID-19, could adversely affect our business, financial condition, results of operations and prospects; |

| |

|

| · |

our growth prospects may suffer if we are unable to develop successful offerings, if we fail to pursue additional offerings or if we lose any of our key executives or other key employees; |

| |

|

| · |

our business is subject to a variety of U.S. and foreign laws (including

Colombia, Canada and Mexico, where we have business operations), many of which are unsettled and still developing, and our growth prospects

depend on the legal status of real-money gaming in various jurisdictions; |

| |

|

| · |

failure to comply with regulatory requirements or to successfully obtain a license or permit applied for could adversely impact our ability to comply with licensing and regulatory requirements or to obtain or maintain licenses in other jurisdictions, or could cause financial institutions, online platforms and distributors to stop providing services to us; |

| |

|

| · |

we rely on information technology and other systems and platforms (including reliance on third-party providers to validate the identity and location of our customers and to process deposits and withdrawals made by our customers), and any breach or disruption of such information technology could compromise our networks and the information stored there could be accessed, publicly disclosed, lost, corrupted or stolen; |

| |

|

| · |

our projections, including for revenues, market share, expenses and profitability, are subject to significant risks, assumptions, estimates and uncertainties; |

| |

|

| · |

the requirements of being a public company, including compliance with

the SEC’s requirements regarding internal controls over financial reporting, may strain our resources and divert our attention; |

| · |

we license certain trademarks and domain names to RSG and its affiliates, and RSG’s and its affiliates’ use of such trademarks and domain names, or failure to protect or enforce our intellectual property rights, could harm our business, financial condition, results of operations and prospects; |

| |

|

| · |

we currently and will likely continue to rely on licenses and service agreements to use the intellectual property rights of third parties that are incorporated into or used in our products and services; and |

| |

|

| · |

other factors detailed under the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 and from time to time in our Quarterly Reports on Form 10-Q or Current Reports on Form 8-K. |

Due to the uncertain nature

of these factors, management cannot assess the impact of each factor on the business or the extent to which any factor, or combination

of factors, may cause actual results to differ materially from those contained in any forward-looking statements. Any forward-looking

statement speaks only as of the date on which such statement is made, and we undertake no obligation to update any of these statements

to reflect events or circumstances occurring after the date of this prospectus. New factors may emerge, and it is not possible to predict

all factors that may affect our business and prospects.

SUMMARY OF THE PROSPECTUS

This summary highlights

selected information from this prospectus and the documents incorporated by reference herein and does not contain all of the information

that is important to you in making an investment decision. This summary is qualified in its entirety by the more detailed information

included or incorporated by reference in this prospectus. Before making your investment decision with respect to our securities, you should

carefully read this entire prospectus, including the information under “Risk Factors,” and any applicable prospectus supplement,

as well as the documents incorporated by reference herein or therein, before you make your investment decision.

The Company

We are a leading online gaming

and entertainment company that focuses primarily on online casino and online sports betting in the U.S., Canadian and Latin American markets.

Our mission is to engage and delight players by delivering friendly, fun and fair betting experiences. In furtherance of this mission,

we strive to create an online community for our customers where we are transparent and honest, treat our customers fairly, show them that

we value their time and loyalty, and listen to feedback. We also endeavor to implement industry leading responsible gaming practices and

provide our customers with a cutting-edge online gaming platform and exciting, personalized offerings that will enhance their user experience.

We provide our customers an

array of leading gaming offerings such as real-money online casino, online sports betting, and retail sports betting (i.e., sports betting

services provided at bricks-and-mortar casinos), as well as social gaming, which involves free-to-play games that use virtual credits

that customers can earn or purchase. We launched our first social gaming website in 2015 and began accepting real-money bets in the United

States in 2016. Currently, we offer real-money online casino, online sports betting and/or retail sports betting in fourteen U.S. states

as well as online casino and online sports betting in Colombia, Ontario, Canada and Mexico.

Background, the Business Combination and Corporate

Information

Rush Street Interactive, Inc.,

a Delaware corporation, was initially a blank check company called dMY Technology Group, Inc., which was incorporated as a Delaware

corporation on September 27, 2019. dMY was formed for the purpose of effecting a merger, share exchange, asset acquisition, stock

purchase, reorganization, recapitalization or other similar business combination with one or more businesses. dMY completed its initial

public offering in February 2020 and prior to the Business Combination, the Company was a “shell company” as defined

under the Exchange Act because it had no operations and nominal assets consisting almost entirely of cash.

On July 27, 2020, dMY

entered into the Business Combination Agreement with RSILP, the Business Combination Sellers, the Sponsor, and the Business Combination

Sellers’ Representative. The parties amended and restated the Business Combination Agreement on October 9, 2020 and further

amended the business combination agreement on December 4, 2020. On December 29, 2020, the Business Combination was completed,

and the Company became organized in an umbrella partnership–C corporation (“Up-C”) structure, in which substantially

all of the assets of the Company are held by RSILP, and the Company’s only assets is its equity interests in RSILP (which is held

indirectly through the Special Limited Partner and RSI GP, which is a wholly-owned subsidiaries of the Company). For more information

on the Business Combination, see the section entitled “Business Combination.” At the Business Combination Closing, dMY changed

its name to “Rush Street Interactive, Inc.”

The mailing address of our

principal executive office is 900 N. Michigan Avenue, Suite 950, Chicago, Illinois 60611. Our telephone number is (773) 893-5855.

Our website is www.rushstreetinteractive.com. The information found on, or that can be accessed from or that is hyperlinked to, our website

is not part of or incorporated by reference into this prospectus.

THE

OFFERING

This prospectus relates to

the resale from time to time by the Selling Stockholders of up to 16,043,002 shares of Class A Common Stock. We are not offering

any shares for sale under the registration statement of which this prospectus is a part.

| Class A Common Stock offered by the Selling Stockholders |

|

Up to 16,043,002 shares of Class A Common Stock, which were issued pursuant to the terms of the Subscription Agreements in a private placement in connection with, and as part of the consideration for, the Business Combination. |

| |

|

|

| Use of Proceeds |

|

We will not receive any proceeds from the sale of the Class A Common Stock to be offered by the Selling Stockholders. See “Use of Proceeds.” |

| |

|

|

| NYSE Ticker Symbol |

|

Class A Common Stock: “RSI” |

| |

|

|

| Risk Factors |

|

See “Risk Factors” and other information incorporated by reference in this prospectus for a discussion of factors you should consider before investing our securities. |

RISK FACTORS

An investment in our securities

involves a high degree of risk. Before you make a decision to buy our securities, in addition to the risks and uncertainties discussed

above under “Cautionary Note Regarding Forward-Looking Statements,” you should carefully consider the specific risks incorporated

by reference in this prospectus and our most recent Annual Report on Form 10-K and any subsequent Quarterly Reports on Form 10-Q

or Current Reports on Form 8-K, and all other information contained or incorporated by reference into this prospectus, as updated

by our subsequent filings under the Exchange Act, and the risk factors and other information contained in any applicable prospectus supplement

and any applicable free writing prospectus before acquiring any such securities. See “Where You Can Find More Information”

and “Incorporation of Certain Information by Reference.” If any of these risks actually occur, it may materially harm our

business, financial condition, liquidity and results of operations. As a result, the market price of our securities could decline, and

you could lose all or part of your investment. Additionally, the risks and uncertainties incorporated by reference in this prospectus

or any prospectus supplement are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known

to us or that we currently believe to be immaterial may become material and adversely affect our business.

USE

OF PROCEEDS

All of the securities offered

by the Selling Stockholders pursuant to this prospectus will be sold by the Selling Stockholders for their respective accounts. We will

not receive any of the proceeds from these sales.

The Selling Stockholders will

pay any underwriting discounts and commissions and expenses incurred by the Selling Stockholders for brokerage, accounting, tax or legal

services or any other expenses incurred by the Selling Stockholders in disposing of the securities. We will bear the costs, fees and expenses

incurred in effecting the registration of the securities covered by this prospectus, including all registration and filing fees, NYSE

listing fees and fees and expenses of our counsel and our independent registered public accounting firm.

SELLING

STOCKHOLDERS

This prospectus relates to

the possible offer and resale by the Selling Stockholders of up to 16,043,002 shares of Class A Common Stock. The Selling Stockholders

may from time to time offer and sell any or all of the shares of Class A Common Stock set forth below pursuant to this prospectus.

When we refer to the “Selling Stockholders” in this prospectus, we mean the persons listed in the table below, and the pledgees,

donees, transferees, assignees, successors and others who later come to hold any of the Selling Stockholders’ interest in the shares

of Class A Common Stock after the date of this prospectus such that registration rights shall apply to those securities.

The following table is prepared

based on information provided to us by the Selling Stockholders on or prior to May 19, 2021 and may not reflect subsequent sales

by the Selling Stockholders. It sets forth the name and address of the Selling Stockholders, the aggregate number of shares of Class A

Common Stock that the Selling Stockholders may offer pursuant to this prospectus, and the beneficial ownership of the Selling Stockholders

both before and after the offering. We have based the percentage ownership prior to this offering on 64,056,803 shares of Class A

Common Stock, 156,373,584 shares of Class V Voting Stock, in each case outstanding as of September 27, 2022.

For purposes of the table

below, we have assumed that none of the Selling Stockholders has acquired beneficial ownership of any additional securities during this

offering. In addition, we assume that the Selling Stockholders have not sold, transferred or otherwise disposed of, our securities in

any transactions exempt from the registration requirements of the Securities Act.

We cannot advise you as to

whether the Selling Stockholders will in fact sell any or all of such Class A Common Stock. In addition, the Selling Stockholders

may sell, transfer or otherwise dispose of, at any time and from time to time, the Class A Common Stock in transactions exempt from

the registration requirements of the Securities Act after the date of this prospectus. For purposes of this table, we have assumed that

the Selling Stockholders will have sold all of the securities covered by this prospectus upon the completion of the offering.

Selling Stockholder information

for each additional Selling Stockholder, if any, will be set forth by prospectus supplement to the extent required prior to the time of

any offer or sale of such Selling Stockholder’s securities pursuant to this prospectus. Any prospectus supplement may add, update,

substitute, or change the information contained in this prospectus, including the identity of each Selling Stockholder and the number

of securities registered on its behalf. See “Plan of Distribution” for additional information.

| Name and Address of Beneficial Owner | |

Number of Shares

Beneficially Owned

Before Sale of All Shares

of Class A Common

Stock Offered Hereby | | |

Number of

Shares to be

Sold in the

Offering | | |

Number of Shares

Beneficially Owned After

Sale of All Shares of

Class A Common Stock

Offered Hereby | |

| | |

Number | | |

%(1) | | |

Number | | |

Number | | |

%(1) | |

| Adam Gerchen | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| Alan K. Warms | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| Alfred E. D’Ancona III Trust(2) | |

| 50,000 | | |

| * | | |

| 50,000 | | |

| — | | |

| — | |

| Anthony B. Davis(3) | |

| 35,000 | | |

| * | | |

| 35,000 | | |

| — | | |

| — | |

| Atreides Foundation Master Fund LP(4) | |

| 1,000,000 | | |

| * | | |

| 1,000,000 | | |

| — | | |

| — | |

| Funds and accounts managed by Balyasny Asset Management, L.P.(5) | |

| 900,000 | | |

| * | | |

| 900,000 | | |

| — | | |

| — | |

| Blackstone Global Master Fund ICAV(6) | |

| 569,876 | | |

| * | | |

| 300,000 | | |

| 619,876 | | |

| * | |

| Brian Black | |

| 20,000 | | |

| * | | |

| 20,000 | | |

| — | | |

| — | |

| Bruce Block | |

| 20,000 | | |

| * | | |

| 20,000 | | |

| — | | |

| — | |

| Canyon Capital Advisors LLC(7) | |

| 900,000 | | |

| * | | |

| 900,000 | | |

| — | | |

| — | |

| Caryn Skurnick | |

| 100,000 | | |

| * | | |

| 100,000 | | |

| — | | |

| — | |

| Colby Lamberson | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| Accounts managed by Michael R. Friedberg(8) | |

| 400,002 | | |

| * | | |

| 400,002 | | |

| — | | |

| — | |

| Dennis Carlin | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Funds associated with Davidson Kempner Capital Management LP(9) | |

| 500,000 | | |

| * | | |

| 500,000 | | |

| — | | |

| — | |

| Fern Carlin | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Funds and accounts managed by FMR LLC(10) | |

| 3,000,000 | | |

| 1.4 | | |

| 3,000,000 | | |

| — | | |

| — | |

| Name and Address of Beneficial Owner | |

Number of Shares

Beneficially Owned

Before Sale of All Shares

of Class A Common

Stock Offered Hereby | | |

Number of

Shares to be

Sold in the

Offering | | |

Number of Shares

Beneficially Owned After

Sale of All Shares of

Class A Common Stock

Offered Hereby | |

| | |

Number | | |

%(1) | | |

Number | | |

Number | | |

%(1) | |

| Alfredo Unikel | |

| 3,000 | | |

| * | | |

| 3,000 | | |

| — | | |

| — | |

| Governors Lane Master Fund LP(11) | |

| 500,000 | | |

| * | | |

| 500,000 | | |

| 150,000 | | |

| * | |

| Ilan J. Shalit(12) | |

| 125,000 | | |

| * | | |

| 125,000 | | |

| — | | |

| — | |

| Accounts associated with Jaime Peisach(13) | |

| 150,000 | | |

| * | | |

| 150,000 | | |

| — | | |

| — | |

| Jason M. Finkelstein | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Jeffrey Friedstein | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Joel Westle | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| H Rigel Barber(14) | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Terry E Newman | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Katherine L Malkin | |

| 150,000 | | |

| * | | |

| 150,000 | | |

| — | | |

| — | |

| Lambert Security Trust(15) | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| SAM INVESTMENT PARTNERS LP II(16) | |

| 20,000 | | |

| * | | |

| 20,000 | | |

| — | | |

| — | |

| Kimberly Paige Fleming | |

| 50,000 | | |

| * | | |

| 50,000 | | |

| — | | |

| — | |

| M. Kingdon Offshore Master Fund, L.P.(17) | |

| 600,000 | | |

| * | | |

| 600,000 | | |

| — | | |

| — | |

| CM-NP LLC(18) | |

| 120,000 | | |

| * | | |

| 120,000 | | |

| — | | |

| — | |

| NP1 LLC(19) | |

| 960,000 | | |

| * | | |

| 960,000 | | |

| — | | |

| — | |

| RRSJ Associates(20) | |

| 50,000 | | |

| * | | |

| 50,000 | | |

| — | | |

| — | |

| Wellwater LLC(21) | |

| 120,000 | | |

| * | | |

| 120,000 | | |

| — | | |

| — | |

| Accounts managed by John Levin(22) | |

| 200,000 | | |

| * | | |

| 200,000 | | |

| — | | |

| — | |

| Luis Pinedo | |

| 15,000 | | |

| * | | |

| 15,000 | | |

| — | | |

| — | |

| Mark A. Levy | |

| 35,000 | | |

| * | | |

| 35,000 | | |

| — | | |

| — | |

| Moore Global Investments, LLC(23) | |

| 500,000 | | |

| * | | |

| 500,000 | | |

| — | | |

| — | |

| Neil Book | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| Anna-Maria and Stephen Kellen Foundation, Inc(24) | |

| 100,000 | | |

| * | | |

| 100,000 | | |

| — | | |

| — | |

| Accounts associated with BC Advisors, LLC(25) | |

| 400,000 | | |

| * | | |

| 400,000 | | |

| — | | |

| — | |

| Funds associated with Polar Asset Management Partners Inc.(26) | |

| 800,000 | | |

| * | | |

| 800,000 | | |

| — | | |

| — | |

| Owl Creek Investments III, LLC(27) | |

| 800,000 | | |

| * | | |

| 800,000 | | |

| — | | |

| — | |

| Robert Pascal and Lynne Pascal | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| Ron Rappaport | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Ryan Shpritz | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| Scopus Asset Management, L.P.(28) | |

| 500,000 | | |

| * | | |

| 500,000 | | |

| — | | |

| — | |

| Skybox Capital LLC(29) | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| SLAB Holdings LLC(30) | |

| 25,000 | | |

| * | | |

| 25,000 | | |

| — | | |

| — | |

| Star Investment Series LLC – Series 78(31) | |

| 200,000 | | |

| * | | |

| 200,000 | | |

| — | | |

| — | |

| Stephen A. Lovelette | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Suzanne Shanker Schwartz | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| Funds and accounts managed by TimesSquare Capital Management, LLC(32) | |

| 500,000 | | |

| * | | |

| 500,000 | | |

| — | | |

| — | |

| Tuft GS Investment Partners, LP(33) | |

| 200,000 | | |

| * | | |

| 200,000 | | |

| — | | |

| — | |

| Accounts managed by UBS O’Connor LLC(34) | |

| 500,000 | | |

| * | | |

| 500,000 | | |

| 204,413 | | |

| * | |

| Veralda Investment Limited(35) | |

| 500,000 | | |

| * | | |

| 500,000 | | |

| — | | |

| — | |

| Accounts managed by Weiss Asset Management LP(36) | |

| 400,000 | | |

| * | | |

| 400,000 | | |

| — | | |

| — | |

| Larry and Suzanne Schwartz Trust(37) | |

| 10,000 | | |

| * | | |

| 10,000 | | |

| — | | |

| — | |

| * |

Represents beneficial ownership of less than 1%. |

| (1) |

The percentage of beneficial ownership before this offering is calculated based on 64,056,803 shares of Class A Common Stock outstanding and 156,373,584 shares of Class V Voting Stock outstanding, each as of September 27, 2022. Unless otherwise indicated, we believe that all persons named in the table have sole voting and investment power with respect to all shares beneficially owned by them. |

| (2) |

Alfred E. D’Ancona III is the trustee for Alfred E. D’Ancona III Trust, and may be deemed to be the beneficial owner of the shares held by such entity. |

| (3) |

The address of this stockholder is 150 N. Riverside Plz, Suite 5100, Chicago, IL 60606. |

| (4) |

Gavin Baker is the Managing Partner & CIO of Atreides Management, LP, the investment manager for Atreides Foundation Master Fund LP and has voting and dispositive power with respect to the securities of this stockholder. The address of the foregoing individual and entities is One International Place, Suite 4410, Boston, MA 02110. |

| (5) |

Includes (i) 787,846 PIPE Shares held by Atlas Enhanced Master Fund, Ltd. and (ii) 112,154 PIPE Shares held by Atlas Master Fund, Ltd. These funds are managed by Balyasny Asset Management, L.P., an investment adviser registered with the SEC. The address of Atlas Enhanced Master Fund, Ltd. and Atlas Master Fund, Ltd. is 444 West Lake Street 50th Floor, Chicago, IL 60606. |

| (6) |

The number of shares beneficially owned before this offering includes (i) 300,000 PIPE Shares and (ii) 269,876 shares of Class A Common Stock. The number of shares beneficially owned after the sale of the shares registered in this offering includes (i) 269,876 shares of Class A Common Stock and (ii) 350,000 shares of Class A Common Stock underlying Public Warrants, which, for purposes of this table, are assumed to have been exercised in full. The securities are held directly by Blackstone Global Master Fund ICAV acting solely on behalf of its sub fund Blackstone Aqua Master Sub-Fund (the “Aqua Fund”). Blackstone Alternative Solutions L.L.C. is the investment manager of the Aqua Fund. Blackstone Holdings I L.P. is the sole member of Blackstone Alternative Solutions L.L.C. Blackstone Holdings I/II GP L.L.C. is the general partner of Blackstone Holdings I L.P. The Blackstone Group Inc. is the sole member of Blackstone Holdings I/II GP L.L.C. Blackstone Group Management L.L.C. is the sole holder of the Class C common stock of The Blackstone Group Inc. Blackstone Group Management L.L.C. is wholly owned by its senior managing directors and controlled by its founder, Stephen A. Schwarzman. Each of such Blackstone entities and Mr. Schwarzman may be deemed to beneficially own the securities beneficially owned by the Aqua Fund directly or indirectly controlled by it or him, but each (other than the Aqua Fund to the extent of its direct holdings) disclaims beneficial ownership of such securities. The address of each of the entities listed in this footnote is c/o The Blackstone Group Inc., 345 Park Avenue, New York, New York 10154. |

| (7) |

Includes (i) 833,476 PIPE Shares held by Canyon Balanced Master Fund, Ltd. and (ii) 66,524 PIPE Shares held by EP Canyon Ltd. Canyon Capital Advisors LLC, as the investment advisor to both entities, has sole voting and sole investment power. Canyon Capital Advisors LLC is ultimately owned by family limited liability companies and/or trusts that are ultimately controlled by Joshua S. Friedman and Mitchell R. Julis, each of whom disclaims beneficial ownership over any securities directly or indirectly held by them other than to the extent of any voting and investment power. The address of the foregoing individuals and entities is 2000 Avenue of the Stars, 11th Floor, Los Angeles, CA 90067. |

| (8) |

Includes (i) 133,334 PIPE Shares held by Daniel 95 Investments, LLC, (ii) 133,334 PIPE Shares held by Elaine 95 Investments, LLC and, (iii) 133,334 PIPE Shares held by Laura 95 Investments, LLC. Michael R. Friedberg is the Manager of such shares and has voting and dispositive power. The address of the foregoing individual is 333 W. Wacker Dr., Suite 1700, Chicago, IL 60606. |

| (9) |

Includes (i) 183,500 PIPE Shares held by Davidson Kempner Institutional Partners, L.P., (ii) 14,350 PIPE Shares held by M.H. Davidson & Co., (iii) 86,650 PIPE Shares held by Davidson Kempner Partners and (iv) 215,500 PIPE Shares held by Davidson Kempner International, Ltd. Voting and dispositive authority over the securities is held by Davidson Kempner Capital Management LP (“DKCM”), and Anthony A. Yoseloff, Eric P. Epstein, Avram Z. Friedman, Conor Bastable, Shulamit Leviant, Morgan P. Blackwell, Patrick W. Dennis, Gabriel T. Schwartz, Zachary Z. Altschuler, Joshua D. Morris and Suzanne K. Gibbons, through DKCM, are responsible for the voting and investment decisions relating to such securities. Each of the aforementioned entities and individuals disclaims beneficial ownership of the securities held by any other entity or individual referencing this footnote except to the extent of such entity or individual’s pecuniary interest therein, if any. The address of each of the entities and individuals in this footnote is c/o Davidson Kempner Capital Management LP, 520 Madison Avenue, 30th Floor, New York, New York 10022. |

| (10) |

Includes (i) 1,057,600 PIPE Shares held by Fidelity Securities Fund: Fidelity Blue Chip Growth Fund, (ii) 39,100 PIPE Shares held by Fidelity Blue Chip Growth Commingled Pool, (iii) 1,700 PIPE Shares held by Fidelity Securities Fund: Fidelity Flex Large Cap Growth Fund, (iv) 108,600 PIPE Shares held by Fidelity Securities Fund: Fidelity Blue Chip Growth K6 Fund, (v) 3,500 PIPE Shares held by Fidelity Blue Chip Growth Institutional Trust, (vi) 170,600 PIPE Shares held by Fidelity Securities Fund: Fidelity Series Blue Chip Growth Fund, (vii) 99,335 PIPE Shares held by FIAM Target Date Blue Chip Growth Commingled Pool, (viii) 398,700 PIPE Shares held by Fidelity Advisor Series I: Fidelity Advisor Growth Opportunities Fund, (ix) 60,600 PIPE Shares held by Variable Insurance Products Fund III: Growth Opportunities Portfolio, (x) 19,900 PIPE Shares held by Fidelity Advisor Series I: Fidelity Advisor Series Growth Opportunities Fund, (xi) 2,900 PIPE Shares held by Fidelity U.S. Growth Opportunities Investment Trust, (xii) 37,465 PIPE Shares held by Fidelity NorthStar Fund, (xiii) 102,555 PIPE Shares held by Fidelity Mt. Vernon Street Trust: Fidelity Series Growth Company Fund, (xiv) 447,095 PIPE Shares held by Fidelity Mt. Vernon Street Trust: Fidelity Growth Company Fund, (xv) 405,476 PIPE Shares held by Fidelity Growth Company Commingled Pool and (xvi) 44,874 PIPE Shares held by Fidelity Mt. Vernon Street Trust: Fidelity Growth Company K6 Fund. These accounts are managed by direct or indirect subsidiaries of FMR LLC. Abigail P. Johnson is a Director, the Chairman, the Chief Executive Officer and the President of FMR LLC. Neither FMR LLC nor Abigail P. Johnson has the sole power to vote or direct the voting of the shares owned directly by the various investment companies registered under the Investment Company Act advised by Fidelity Management & Research Company, LLC, a wholly owned subsidiary of FMR LLC, which power resides with the Fidelity Funds’ Boards of Trustees. Fidelity Management & Research Company, LLC carries out the voting of the shares under written guidelines established by the Fidelity Funds’ Boards of Trustees. The address of the foregoing individual and entities is 88 Black Falcon Ave, Suite 167, V12F, Boston, MA 02210. |

| (11) |

The number of shares beneficially owned before this offering is 500,000 PIPE Shares. The number of shares beneficially owned after the sale of the shares registered in this offering is 150,000 shares of Class A Common Stock underlying Public Warrants, which, for purposes of this table, are assumed to have been exercised in full. Governors Lane LP serves as the investment advisor to Governors Lane Master Fund LP. Governors Lane Fund General Partner LLC serves as the general partner of Governors Lane Master Fund LP. Mr. Isaac Corre is the managing member of both Governors Lane Fund General Partner LLC and Governors Lane GP LLC, the general partner of Governors Lane LP. Each of Governors Lane LP, Governors Lane GP LLC, Governors Lane Fund General Partner LLC and Isaac Corre disclaims beneficial ownership over any securities directly or indirectly held by them other than to the extent of any pecuniary interest they may have therein, directly or indirectly. The address for each entity and person described in this paragraph is c/o Governors Lane LP, 510 Madison Avenue, 11th Floor, New York, NY 10022. |

| (12) |

The address of this stockholder is 71 S. Wacker Dr., Ste. 2300, Chicago, IL 60606. |

| (13) |

Includes (i) 120,000 PIPE Shares held by The JP Vida Trust and (ii) 30,000 PIPE Shares held by The MP Vida Trust. Jaime Peisach is the trustee and holds voting and investment power over the shares held by such entities and may be deemed to be the beneficial owner of the shares held by such entities. |

| (14) |

The address of this stockholder is 900 N. Michigan Ave., Suite 1400, Chicago, IL 60611. |

| (15) |

Ronald M Lambert, the trustee of the stockholder, holds voting and dispositive power of the shares and may be deemed to be the beneficial owner of the shares. |

| (16) |

Miles Berger, the Managing Partner of the stockholder, holds voting and dispositive power of the shares and may be deemed to be the beneficial owner of the shares. |

| (17) |

Mark Kingdon is the managing member of Kingdon Capital Management, LLC, the investment adviser for M. Kingdon Offshore Master Fund, L.P., and has voting and dispositive power with respect to the securities of this stockholder. The address of the foregoing individual and entities is 152 W. 57th Street, 50th Floor, New York, NY 10019. |

| (18) |

Ralph Finerman has voting and dispositive power over the securities held by this stockholder and wishes to disclaim beneficial ownership of the shares. The address of the foregoing individual and entity is 1250 Fourth Street 5th Floor, Santa Monica, CA 90401. |

| (19) |

Ralph Finerman has voting and dispositive power over the securities held by this stockholder and wishes to disclaim beneficial ownership of the shares. The address of the foregoing individual and entity is 1250 Fourth Street 5th Floor, Santa Monica, CA 90401. |

| (20) |

Ralph Finerman, Jeffrey Green, Stanley Maron, Richard Sandler are the Partners of RRSJ Associates and have voting and dispositive power over the securities held by this stockholder. The address of the foregoing individuals and entity is 1250 Fourth Street 5th Floor, Santa Monica, CA 90401. |

| (21) |

Ralph Finerman has voting and dispositive power over the securities held by this stockholder and wishes to disclaim beneficial ownership of the shares. The address of the foregoing individual and entity is 1250 Fourth Street 5th Floor, Santa Monica, CA 90401. |

| (22) |

Includes (i) 75,000 PIPE Shares held by Trust U/W Carl M. Loeb FBO Elisabeth Levin, (ii) 40,000 PIPE Shares held by Trust U/W Carl M. Loeb FBO Arthur L. Loeb, (iii) 35,000 PIPE Shares held by Trust U/W Frances L. Loeb FBO Arthur L. Loeb, (iv) 35,000 PIPE Shares held by HAL 63 Partnership and (v) 15,000 PIPE Shares held by Trust U/W Carl. M Loeb FBO Jean Troubh. Voting and investment power over the shares held by such entities resides with their trustee, John Levin, who may be deemed to be the beneficial owner of the shares. The address of the foregoing individual and entities is c/o River Partners 595 Madison Ave, 16 Floor, New York, NY 10022. |

| (23) |

Moore Capital Management, LP, the investment manager of Moore Global Investments, LLC (“MGI LLC”), has voting and investment control of the shares held by MGI LLC. Mr. Louis M. Bacon controls the general partner of Moore Capital Management, LP and may be deemed the beneficial owner of the shares of the Company held by MGI LLC. Mr. Bacon also is the indirect majority owner of MGI LLC. The address of MGI LLC, Moore Capital Management, LP and Mr. Bacon is 11 Times Square, New York, New York 10036. |

| (24) |

The shares are held by Anna-Maria and Stephen Kellen Foundation, Inc. The designated investment manager is Northern Right Capital Management, LP, and Matthew Drapkin is managing member of the general partner. Mr. Drapkin wishes to disclaim beneficial ownership of the shares except to the extent of his pecuniary interest therein. The address of the foregoing individual and entities is 9 Old Kings Hwy. S., 4th Flr., Darien, CT 06820. |

| (25) |

Includes (i) 100,000 PIPE Shares held by NRC Partners I, LP and (ii) 300,000 PIPE Shares held by Northern Right Capital (QP), LP. Voting and investment power over the shares held by such entities resides with BC Advisors, LLC, which is the General Partner of Northern Right Capital Management, LP, which is the General Partner of Northern Right Capital (QP), LP. Matthew Drapkin is the Managing Member of BC Advisors, LLC, and wishes to disclaim beneficial ownership of the shares. The address of the foregoing individual and entities is 9 Old Kings Hwy. S., 4th Flr., Darien, CT 06820. |

| (26) |

Includes (i) 467,161 PIPE Shares held by POLAR LONG/SHORT MASTER FUND and (ii) 332,839 PIPE Shares held by POLAR MULTI-STRATEGY MASTER FUND. Voting and investment power over the shares held by such entities resides with Polar Asset Management Partners Inc. Paul Sabourin is Chief Investment Officer of Polar Asset Management Partners Inc. The address of the foregoing individual and entities is 401 Bay Street St. Suite 1900, Toronto, Ontario, M5H 2Y4. |

| (27) |

Jeffrey A. Altman, the Managing Partner of Owl Creek Asset Management, L.P., which is the manager of Owl Creek Investments III, LLC, holds voting and dispositive power over the shares, and wishes to disclaim beneficial ownership of such shares. The address of the foregoing individual and entities is 640 Fifth Ave, Floor 20, New York, NY 10019. |

| (28) |

The address of this stockholder is 717 Fifth Ave, Fl 21, New York, NY 10022. |

| (29) |

Cromwell Holdings LLC is the Manager of Skybox Capital LLC and may be deemed to be the beneficial owner of the shares held by Skybox Capital LLC. Each of Eric Vassilatos, Jerry Bednyak, Kea Molnar and Matt Bahr as officers of Cromwell Holdings LLC has voting and dispositive power over the shares, and each wishes to disclaim beneficial ownership of the shares. The address of Cromwell Holdings LLC and each of the foregoing individuals is 255 Buffalo Way, P.O. Box 1905, Jackson, WY 83001. |

| (30) |

Matt Aven is the Manager of SLAB Holdings LLC and has voting and dispositive power over the shares. The address of SLAB Holdings LLC is 450 Skokie Blvd. #600, Northbrook, IL 60062. |

| (31) |

James A. Star has voting and investment power over the shares held by Star Investment Series LLC – Series 78 and may be deemed to be the beneficial owner of the shares held by such entity. The address of the foregoing individual and entity is 222 N. LaSalle St. Suite 700, Chicago, IL 60601. |

| (32) |

Includes (i) 126,700 PIPE Shares held by Cox Enterprises, Inc. Master Fund, (ii) 24,700 PIPE Shares held by Hallmark Cards, Incorporated Master Trust (Small Cap), (iii) 15,400 PIPE Shares held by The Kemper & Ethel Marley Foundation, (iv) 4,300 PIPE Shares held by Pacific Gas and Electric Company Postretirement Medical Plan Trust Non-Management Employees and Retirees, (v) 93,300 PIPE Shares held by PG&E Corporation Retirement Master Trust, (vi) 100,700 PIPE Shares held by Savings Banks Employees Retirement Association, (vii) 104,600 PIPE Shares held by TimesSquare Capital Management Collective Investment Trust, (viii) 13,900 PIPE Shares held by SUPERVALU INC. MASTER INVESTMENT TRUST, (ix) 1,000 PIPE Shares held by Trudy Trust and (x) 15,400 PIPE Shares held by Truth Initiative Foundation. Voting and investment power over the shares held by such entities resides with their investment manager, TimesSquare Capital Management, LLC. Kenneth Duca is the Director, Portfolio Manager of TimesSquare Capital Management, LLC and may be deemed to be the beneficial owner of the shares held by such entities. The address of the foregoing individual and entities is 7 Times Square, 42nd Floor, New York, NY 10036. |

| (33) |

Thomas E. Tuft has voting and investment power over the shares held by Tuft GS Investment Partners, LP and may be deemed to be the beneficial owner of the shares held by such entity. The address of the foregoing entity and individual is 101 Central Park West 17B, New York, NY 10023. |

| (34) |

The number of shares beneficially owned before this offering includes (i) 250,000 PIPE Shares held by Nineteen77 Global Multi-Strategy Alpha Master Limited and (ii) 250,000 PIPE Shares held by Nineteen77 Global Merger Arbitrage Master Limited. The number of shares beneficially owned after the sale of the shares registered in this offering includes (i) 85,998 shares of Class A Common Stock underlying Public Warrants held by Nineteen77 Global Multi-Strategy Alpha Master Limited, which, for purposes of this table, are assumed to have been exercised in full, and (ii) 118,415 shares of Class A Common Stock underlying Public Warrants held by Nineteen77 Global Merger Arbitrage Master Limited, which, for purposes of this table, are assumed to have been exercised in full. UBS O’Connor LLC is the investment manager of the entities, and Kevin Russell, the Chief Investment Officer of UBS O’Connor LLC has voting and dispositive power over the shares. The address of the foregoing entities and individual is One North Wacker Drive, 31st Floor, Chicago, IL 60606. |

| (35) |

Bengt Anders Stefan Strom is the ultimate beneficial owner of Verada Investment Limited. The address of the foregoing entity and individual is 18 Gropius Street, 3095, Limassol, Cyprus. |

| (36) |

Includes (i) 132,000 PIPE Shares held by Brookdale Global Opportunity Fund and (ii) 268,000 PIPE Shares held by Brookdale International Partners, L.P. Andrew Weiss is Manager of WAM GP LLC, which is the general partner of Weiss Asset Management LP, the investment manager of the entities. Andrew Weiss has voting and dispositive power with respect to the securities of this stockholder, and wishes to disclaim beneficial ownership of the shares. The address of the foregoing individual and entities is c/o Weiss Asset Management LP, 222 Berkeley St. 16th Floor, Boston, MA 02116. |

| (37) |

Lawrence Schwartz and Suzanne Schwartz are the trustees of the stockholder. Each individual holds voting and dispositive power with respect to such securities, and each may be deemed to be the beneficial owner. |

We have determined beneficial

ownership in accordance with the rules of the SEC and the information is not necessarily indicative of beneficial ownership for any

other purpose. Unless otherwise indicated, to our knowledge, the persons and entities named in the tables have sole voting and sole investment

power with respect to all securities that they beneficially own, subject to community property laws where applicable.

PLAN OF DISTRIBUTION

We are registering the resale

by the Selling Stockholders of up to 16,043,002 shares of Class A Common Stock, which were issued in a private placement in connection

with, and as part of the consideration for, the Business Combination.

We will not receive any of

the proceeds from the sale of the securities by the Selling Stockholders.

The securities beneficially

owned by the Selling Stockholders covered by this prospectus may be offered and sold from time to time by the Selling Stockholders. The

term “Selling Stockholders” includes donees, pledgees, transferees or other successors in interest selling securities received

after the date of this prospectus from a Selling Stockholder as a gift, pledge, partnership distribution or other transfer. The Selling

Stockholders will act independently of us in making decisions with respect to the timing, manner and size of each sale. Such sales may

be made on one or more exchanges or in the over-the-counter market or otherwise, at prices and under terms then prevailing or at prices

related to the then current market price or in negotiated transactions. Each Selling Stockholder reserves the right to accept and, together

with its respective agents, to reject, any proposed purchase of securities to be made directly or through agents. The Selling Stockholders

and any of their permitted transferees may sell their securities offered by this prospectus on any stock exchange, market or trading facility

on which the securities are traded or in private transactions.

Subject to the limitations

set forth in any applicable registration rights agreement, the Selling Stockholders may use any one or more of the following methods when

selling the securities offered by this prospectus:

| |

• |

purchases by a broker-dealer as principal and resale by such broker-dealer for its own account pursuant to this prospectus; |

| |

• |

ordinary brokerage transactions and transactions in which the broker solicits purchasers; |

| |

• |

block trades in which the broker-dealer so engaged will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

• |

an over-the-counter distribution in accordance with the rules of the applicable exchange; |

| |

• |

settlement of short sales entered into after the date of this prospectus; |

| |

• |

agreements with broker-dealers to sell a specified number of the securities at a stipulated price per share; |

| |

• |

in “at the market” offerings, as defined in Rule 415 under the Securities Act, at negotiated prices, at prices prevailing at the time of sale or at prices related to such prevailing market prices, including sales made directly on a national securities exchange or sales made through a market maker other than on an exchange or other similar offerings through sales agents; |

| |

• |

directly to purchasers, including through a specific bidding, auction or other process or in privately negotiated transactions; |

| |

• |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

• |

through a combination of any of the above methods of sale; or |

| |

• |

any other method permitted pursuant to applicable law. |

In addition, a Selling Stockholder

that is an entity may elect to make a pro rata in-kind distribution of securities to its members, partners or stockholders pursuant

to the registration statement of which this prospectus is a part by delivering a prospectus with a plan of distribution. Such members,

partners or stockholders would thereby receive freely tradeable securities pursuant to the distribution through a registration statement.

To the extent a distributee is an affiliate of ours (or to the extent otherwise required by law), we may file a prospectus supplement

in order to permit the distributees to use the prospectus to resell the securities acquired in the distribution.

The Selling Stockholders also

may transfer the securities in other circumstances, in which case the transferees, pledgees or other successors-in-interest will be the

selling beneficial owners for purposes of this prospectus. Upon being notified by a Selling Stockholder that a donee, pledgee, transferee

or other successor-in-interest intends to sell our securities, we will, to the extent required, promptly file a supplement to this prospectus

to name specifically such person as a Selling Stockholder.

To the extent required, the

shares of our Class A Common Stock to be sold, the names of the Selling Stockholders, the respective purchase prices and public offering

prices, the names of any agents, dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will

be set forth in an accompanying prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that

includes this prospectus.

In connection with the sale

of shares of our Class A Common Stock, the Selling Stockholders may enter into hedging transactions with broker-dealers or other

financial institutions, which may in turn engage in short sales of the shares of our Class A Common Stock in the course of hedging

the positions they assume. The Selling Stockholders may also sell shares of our Class A Common Stock short and deliver these securities

to close out their short positions, or loan or pledge the Class A Common Stock to broker-dealers that in turn may sell these shares.

The Selling Stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation

of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered

by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented

or amended to reflect such transaction).

In offering the securities

covered by this prospectus, the Selling Stockholders and any underwriters, broker-dealers or agents who execute sales for the Selling

Stockholders may be deemed to be “underwriters” within the meaning of the Securities Act in connection with such sales. Any

discounts, commissions, concessions or profit they earn on any resale of those securities may be underwriting discounts and commissions

under the Securities Act.

In order to comply with the

securities laws of certain states, if applicable, the securities must be sold in such jurisdictions only through registered or licensed

brokers or dealers. In addition, in certain states the securities may not be sold unless they have been registered or qualified for sale

in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

We have advised the Selling

Stockholders that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares in the market and

to the activities of the Selling Stockholders and their affiliates. In addition, to the extent applicable we will make copies of this

prospectus (as it may be supplemented or amended from time to time) available to the Selling Stockholders for the purpose of satisfying

the prospectus delivery requirements of the Securities Act. The Selling Stockholders may indemnify any broker-dealer that participates

in transactions involving the sale of the shares against certain liabilities, including liabilities arising under the Securities Act.

U.S.

FEDERAL INCOME TAX CONSIDERATIONS to non-u.s. STOCKholders

The following is a discussion

of certain material U.S. federal income tax consequences of the acquisition, ownership and disposition of shares of our Class A Common

Stock, which we refer to as our securities, to Non-U.S. Holders (as defined below). This discussion is limited to certain U.S. federal

income tax considerations to beneficial owners of our securities that will hold our securities as a capital asset within the meaning of

Section 1221 of the U.S. Internal Revenue Code of 1986, as amended (the “Code”). This discussion assumes that any distributions

made by us on our securities and any consideration received by a holder in consideration for the sale or other disposition of our securities

will be in U.S. dollars.

This summary is based upon

U.S. federal income tax laws as of the date of this prospectus, which is subject to change or differing interpretations, possibly with

retroactive effect. This discussion is a summary only and does not describe all of the tax consequences that may be relevant to you in

light of your particular circumstances, including but not limited to the alternative minimum tax, the Medicare tax on certain net investment

income and the different consequences that may apply if you are subject to special rules that apply to certain types of investors,

including but not limited to:

| |

• |

financial institutions or financial services entities; |

| |

• |

governments or agencies or instrumentalities thereof; |

| |

• |

expatriates or former long-term residents of the United States; |

| |

• |

persons that actually or constructively own five percent or more (by vote or value) of our shares; |

| |

• |

persons that acquired our Class A Common Stock pursuant to an exercise of employee share options, in connection with employee share incentive plans or otherwise as compensation; |

| |

• |

dealers or traders subject to a mark-to-market method of accounting with respect to our Class A Common Stock; |

| |

• |

persons holding our Class A Common Stock as part of a “straddle,” constructive sale, hedge, conversion or other integrated or similar transaction; |

| |

• |

partnerships (or entities or arrangements classified as partnerships or other pass-through entities for U.S. federal income tax purposes) and any beneficial owners of such partnerships; |

| |

• |

controlled foreign corporations; and |

| |

• |

passive foreign investment companies. |

If a partnership (including

an entity or arrangement treated as a partnership or other pass-thru entity for U.S. federal income tax purposes) holds our securities,

the tax treatment of a partner, member or other beneficial owner in such partnership will generally depend upon the status of the partner,

member or other beneficial owner, the activities of the partnership and certain determinations made at the partner, member or other beneficial

owner level. If you are a partner, member or other beneficial owner of a partnership holding our securities, you are urged to consult

your tax advisor regarding the tax consequences of the acquisition, ownership and disposition of our securities.

This discussion is based on

the Code, and administrative pronouncements, judicial decisions and final, temporary and proposed Treasury regulations as of the date

hereof, which are subject to change, possibly on a retroactive basis, and changes to any of which subsequent to the date of this prospectus

may affect the tax consequences described herein. This discussion does not address any aspect of state, local or non-U.S. taxation, or

any U.S. federal taxes other than income taxes (such as gift and estate taxes).

We have not sought, and do

not expect to seek, a ruling from the U.S. Internal Revenue Service (the “IRS”) as to any U.S. federal income tax consequence

described herein. The IRS may disagree with the discussion herein, and its determination may be upheld by a court. Moreover, there can

be no assurance that future legislation, regulations, administrative rulings or court decisions will not adversely affect the accuracy

of the statements in this discussion. You are urged to consult your tax advisor with respect to the application of U.S. federal tax laws

to your particular situation, as well as any tax consequences arising under the laws of any state, local or foreign jurisdiction.

As used herein, the term “Non-U.S.

holder” means a beneficial owner of our Class A Common Stock who or that is for U.S. federal income tax purposes:

| |

• |

a non-resident alien individual (other than certain former citizens and residents of the United States subject to U.S. tax as expatriates); |

| |

• |

a foreign corporation; or |

| |

• |

an estate or trust that is not a U.S. holder; |

but generally does not include

an individual who is present in the United States for 183 days or more in the taxable year of the disposition of our Class A

Common Stock. If you are such an individual, you should consult your tax advisor regarding the U.S. federal income tax consequences of

the acquisition, ownership or sale or other disposition of our securities.

THIS DISCUSSION IS ONLY A

SUMMARY OF CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS ASSOCIATED WITH THE ACQUISITION, OWNERSHIP AND DISPOSITION OF OUR SECURITIES

TO NON-U.S. HOLDERS. EACH PROSPECTIVE INVESTOR IN OUR CLASS A COMMON STOCK IS URGED TO CONSULT ITS OWN TAX ADVISOR WITH RESPECT TO

THE PARTICULAR TAX CONSEQUENCES TO SUCH INVESTOR OF THE ACQUISITION, OWNERSHIP AND DISPOSITION OF OUR SECURITIES, INCLUDING THE APPLICABILITY

AND EFFECT OF ANY U.S. FEDERAL NON-INCOME, STATE, LOCAL, AND NON-U.S. TAX LAWS.

Taxation

of Distributions.

In general, any distributions

we make to a Non-U.S. holder of shares of our Class A Common Stock, to the extent paid out of our current or accumulated earnings

and profits (as determined under U.S. federal income tax principles), will constitute dividends for U.S. federal income tax purposes and,

provided such dividends are not effectively connected with the Non-U.S. holder’s conduct of a trade or business within the United

States, we will be required to withhold tax from the gross amount of the dividend at a rate of 30%, unless such Non-U.S. holder is eligible

for a reduced rate of withholding tax under an applicable income tax treaty and provides proper certification of its eligibility for such

reduced rate (usually on an IRS Form W-8BEN or W-8BEN-E). Any distribution not constituting a dividend will be treated first as reducing

(but not below zero) the Non-U.S. holder’s adjusted tax basis in its shares of our Class A Common Stock and, to the extent