Reliance, Inc. (NYSE: RS) today reported its financial results for

the second quarter ended June 30, 2024.

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in

millions, except tons which are in thousands and per share

amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

SequentialQuarter |

|

Six Months Ended June 30, |

|

Year-Over-Year |

|

|

|

|

Year-Over-Year |

| |

Q2 2024 |

|

Q1 2024 |

|

% Change |

|

2024* |

|

2023 |

|

|

% Change |

|

Q2 2023 |

|

% Change |

| Income Statement

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

$ |

3,643.3 |

|

|

$ |

3,644.8 |

|

|

0.0 |

% |

|

$ |

7,288.1 |

|

|

$ |

7,845.6 |

|

|

(7.1 |

%) |

|

$ |

3,880.3 |

|

|

(6.1 |

%) |

| Gross profit1 |

$ |

1,086.0 |

|

|

$ |

1,128.2 |

|

|

(3.7 |

%) |

|

$ |

2,214.2 |

|

|

$ |

2,448.7 |

|

|

(9.6 |

%) |

|

$ |

1,222.7 |

|

|

(11.2 |

%) |

| Gross profit margin1 |

|

29.8% |

|

|

|

31.0% |

|

|

(1.2 |

%) |

|

|

30.4% |

|

|

|

31.2% |

|

|

(0.8 |

%) |

|

|

31.5% |

|

|

(1.7 |

%) |

| Non-GAAP gross profit

margin1,2 |

|

29.8% |

|

|

|

31.0% |

|

|

(1.2 |

%) |

|

|

30.4% |

|

|

|

31.2% |

|

|

(0.8 |

%) |

|

|

31.5% |

|

|

(1.7 |

%) |

| LIFO income |

$ |

(50.0 |

) |

|

$ |

(50.0 |

) |

|

|

|

$ |

(100.0 |

) |

|

$ |

(60.0 |

) |

|

|

|

$ |

(45.0 |

) |

|

|

| LIFO income as a % of net

sales |

|

(1.4% |

) |

|

|

(1.4% |

) |

|

0.0 |

% |

|

|

(1.4% |

) |

|

|

(0.8% |

) |

|

(0.6 |

%) |

|

|

(1.2% |

) |

|

(0.2 |

%) |

| LIFO income per diluted share,

net of tax |

$ |

(0.66 |

) |

|

$ |

(0.64 |

) |

|

|

|

$ |

(1.30 |

) |

|

$ |

(0.75 |

) |

|

|

|

$ |

(0.57 |

) |

|

|

| Non-GAAP pretax (income)

expense adjustments² |

$ |

(1.6 |

) |

|

$ |

4.9 |

|

|

|

|

$ |

3.3 |

|

|

$ |

(4.8 |

) |

|

|

|

$ |

— |

|

|

|

| Pretax income |

$ |

349.7 |

|

|

$ |

396.2 |

|

|

(11.7 |

%) |

|

$ |

745.9 |

|

|

$ |

1,019.4 |

|

|

(26.8 |

%) |

|

$ |

510.9 |

|

|

(31.6 |

%) |

| Non-GAAP pretax income2 |

$ |

348.1 |

|

|

$ |

401.1 |

|

|

(13.2 |

%) |

|

$ |

749.2 |

|

|

$ |

1,014.6 |

|

|

(26.2 |

%) |

|

$ |

510.9 |

|

|

(31.9 |

%) |

| Pretax income margin |

|

9.6% |

|

|

|

10.9% |

|

|

(1.3 |

%) |

|

|

10.2% |

|

|

|

13.0% |

|

|

(2.8 |

%) |

|

|

13.2% |

|

|

(3.6 |

%) |

| Net income attributable to

Reliance |

$ |

267.8 |

|

|

$ |

302.9 |

|

|

(11.6 |

%) |

|

$ |

570.7 |

|

|

$ |

768.2 |

|

|

(25.7 |

%) |

|

$ |

385.1 |

|

|

(30.5 |

%) |

| Diluted EPS |

$ |

4.67 |

|

|

$ |

5.23 |

|

|

(10.7 |

%) |

|

$ |

9.90 |

|

|

$ |

12.92 |

|

|

(23.4 |

%) |

|

$ |

6.49 |

|

|

(28.0 |

%) |

| Non-GAAP diluted EPS2 |

$ |

4.65 |

|

|

$ |

5.30 |

|

|

(12.3 |

%) |

|

$ |

9.94 |

|

|

$ |

12.86 |

|

|

(22.7 |

%) |

|

$ |

6.49 |

|

|

(28.4 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance Sheet and Cash

Flow Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash provided by

operations |

$ |

366.3 |

|

|

$ |

126.3 |

|

|

190.0 |

% |

|

$ |

492.6 |

|

|

$ |

679.7 |

|

|

(27.5 |

%) |

|

$ |

295.1 |

|

|

24.1 |

% |

| Free cash flow3 |

$ |

268.1 |

|

|

$ |

17.6 |

|

|

nm |

|

|

$ |

285.7 |

|

|

$ |

446.6 |

|

|

(36.0 |

%) |

|

$ |

164.9 |

|

|

62.6 |

% |

| Net debt-to-total

capital4 |

|

9.4% |

|

|

|

2.6% |

|

|

|

|

|

9.4% |

|

|

|

4.1% |

|

|

|

|

|

4.1% |

|

|

|

| Net debt-to-EBITDA2,5 |

|

0.5x |

|

|

|

0.1x |

|

|

|

|

|

|

0.5x |

|

|

|

0.1x |

|

|

|

|

|

|

0.1x |

|

|

|

| Total debt-to-EBITDA2,5 |

|

0.7x |

|

|

|

0.6x |

|

|

|

|

|

|

0.7x |

|

|

|

0.5x |

|

|

|

|

|

|

0.5x |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Allocation

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Acquisitions, net |

$ |

292.8 |

|

|

$ |

53.7 |

|

|

|

|

$ |

346.5 |

|

|

$ |

24.1 |

|

|

|

|

$ |

24.1 |

|

|

|

| Capital expenditures |

$ |

98.2 |

|

|

$ |

108.7 |

|

|

|

|

$ |

206.9 |

|

|

$ |

233.1 |

|

|

|

|

$ |

130.2 |

|

|

|

| Dividends |

$ |

62.6 |

|

|

$ |

65.3 |

|

|

|

|

$ |

127.9 |

|

|

$ |

120.6 |

|

|

|

|

$ |

58.6 |

|

|

|

| Share repurchases |

$ |

519.3 |

|

|

$ |

— |

|

|

|

|

$ |

519.3 |

|

|

$ |

112.8 |

|

|

|

|

$ |

73.9 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key Business

Metrics: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Tons sold |

|

1,553.5 |

|

|

|

1,494.0 |

|

|

4.0 |

% |

|

|

3,047.5 |

|

|

|

3,004.2 |

|

|

1.4 |

% |

|

|

1,484.1 |

|

|

4.7 |

% |

| Tons sold (same-store) |

|

1,489.6 |

|

|

|

1,476.4 |

|

|

0.9 |

% |

|

|

2,966.0 |

|

|

|

2,999.0 |

|

|

(1.1 |

%) |

|

|

1,478.9 |

|

|

0.7 |

% |

| Average selling price per ton

sold |

$ |

2,348 |

|

|

$ |

2,442 |

|

|

(3.8 |

%) |

|

$ |

2,394 |

|

|

$ |

2,625 |

|

|

(8.8 |

%) |

|

$ |

2,626 |

|

|

(10.6 |

%) |

| Average selling price per ton

sold (same-store) |

$ |

2,376 |

|

|

$ |

2,453 |

|

|

(3.1 |

%) |

|

$ |

2,414 |

|

|

$ |

2,626 |

|

|

(8.1 |

%) |

|

$ |

2,630 |

|

|

(9.7 |

%) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| * Six months

ended June 30, 2024 includes one less shipping day compared to the

same 2023

period. |

|

|

| nm= Not meaningful. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Please refer to

the footnotes at the end of this press release for additional

information. |

|

|

Management Commentary

“Our second quarter performance once again highlighted the

attractiveness of our business model through various market cycles,

delivering solid results in a challenging pricing environment,”

said Karla Lewis, President and Chief Executive Officer of

Reliance. “Reliance’s growth and diversification strategies,

coupled with our focus on customer service and relationships,

increased our shipments well ahead of industry levels. Our new

acquisitions and focus on smart, profitable growth increased our

tons shipped. However, carbon steel product pricing during the

second quarter declined further than anticipated, offsetting the

benefits of our increased tonnage. Declining metal pricing was the

primary driver of our gross profit margin decrease and sequential

reduction in earnings per diluted share to $4.67. Despite these

challenges, our teams across the company maintained a strong gross

profit margin of 29.8%, within our long-term sustainable range of

29-31%, driven in part by the significant investments we have made

in value-added processing capabilities in recent years.”

Mrs. Lewis continued, “Our cash flow from operations helped fund

two acquisitions in the second quarter and three year-to-date. We

also invested $98.2 million in capital expenditures during the

quarter, the majority of which was directed towards growth

activities to improve our value-added processing capabilities and

increase capacity to support future growth. We repurchased $519.3

million of our common stock during the second quarter and $165.4

million in July, underscoring the confidence our Board and

management team have in our future, and paid $62.6 million in

dividends to our stockholders. While we are continuing to execute

through near-term headwinds in demand and pricing affecting certain

of our markets, we remain excited about the opportunities that lie

ahead and confident in our talented team’s ability to successfully

continue executing our robust and resilient business model.”

End Market CommentaryReliance provides a

diverse range of metal products and value-added processing services

to a wide range of end markets, generally in small quantities on an

as-needed basis. The Company’s tons sold in the second quarter of

2024 increased 4.0% compared to the prior quarter, in line with

management’s expectations of up 2.5% to 4.5%. On a same-store

basis, the Company’s tons sold increased 0.9% compared to the prior

quarter and 0.7% compared to the prior year period.

Demand in non-residential construction (including

infrastructure), Reliance’s largest end market, improved from the

second quarter of 2023. Reliance continues to service new

construction projects in diverse sectors, including public

infrastructure, manufacturing, data centers and energy

infrastructure. The Company expects non-residential construction

demand to remain relatively steady in the third quarter with

continued pricing pressure on carbon steel tubing, plate and

structural products, which are predominantly sold into the

non-residential construction market.

Demand in commercial aerospace improved from the second quarter

of 2023. Reliance anticipates commercial aerospace demand will

remain relatively stable in the third quarter of 2024, subject to

further changes in build rates that impact the supply chain, along

with potential pricing pressure. The military and space related

portion of Reliance’s aerospace business is also expected to remain

at strong levels in the third quarter of 2024.

Demand for the toll processing services Reliance provides to the

automotive market improved compared to the second quarter of 2023.

The Company expects demand for automotive toll processing to remain

stable in the third quarter of 2024, subject to normal

seasonality.

Demand across the broader manufacturing sectors Reliance serves

was relatively consistent on the whole compared to the second

quarter of 2023 primarily due to increased activity in industrial

machinery and military spending which offset declines in demand for

consumer products and heavy equipment, especially agricultural.

Reliance anticipates that demand for its products across the

broader manufacturing sector will experience a customary seasonal

slowdown in the third quarter of 2024.

Demand in the semiconductor market declined compared to the

second quarter of 2023. The Company anticipates demand will remain

under pressure in the third quarter of 2024 due to excess inventory

in the supply chain. Reliance’s long-term outlook for the

semiconductor market remains positive, supported by the CHIPS Act

and significant semiconductor fabrication expansion underway in the

United States.

Balance Sheet & Cash FlowAt June 30, 2024,

Reliance’s cash and cash equivalents totaled $350.8 million with

total debt outstanding of $1.15 billion and no outstanding

borrowings under its $1.5 billion revolving credit facility.

Reliance generated cash flow from operations of $366.3 million in

the second quarter of 2024. The acquisitions of American Alloy

Steel, Inc. and Mid-West Materials, Inc. were completed in April

2024 with cash on hand.

Stockholder Return ActivityOn July 23, 2024,

the Company’s Board of Directors declared a quarterly cash dividend

of $1.10 per share of common stock, payable on August 30, 2024 to

stockholders of record as of August 16, 2024. Reliance has paid

regular quarterly cash dividends for 65 consecutive years without

reduction or suspension.

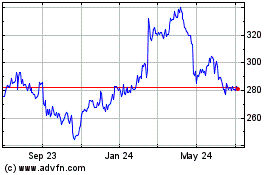

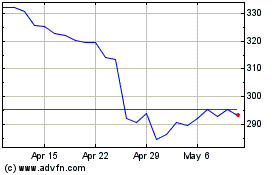

In the second quarter of 2024, Reliance repurchased

approximately 1.8 million shares of its common stock at an average

cost of $287.81 per share, for a total of $519.3 million.

Subsequent to the end of the quarter, as of July 23, 2024, Reliance

repurchased 582,311 shares of its common stock at an average cost

of $284.12 per share, for a total of $165.4 million. As of July 23,

2024, $755.0 million remained available under the Company’s $1.5

billion share repurchase program. Since 2019, Reliance has

repurchased approximately 14.2 million shares of its common stock

at an average cost of $176.88 per share, for a total of $2.51

billion.

AcquisitionsEffective April 1, 2024, Reliance

completed its acquisition of all of the outstanding equity

interests and related real estate assets of American Alloy Steel,

Inc. (“American Alloy”), a leading distributor of specialty carbon

and alloy steel plate and round bar, including pressure vessel

quality (PVQ) material. The acquisition of American Alloy increases

Reliance’s value-added processing and fabrication capabilities and

expands the Company’s specialty carbon steel plate product

portfolio. American Alloy's net sales for the year ended December

31, 2023 were approximately $310 million.

Effective April 1, 2024, Reliance acquired all of the

outstanding equity interests of Mid-West Materials, Inc. (“MidWest

Materials”), a premier flat-rolled steel service center primarily

serving North American original equipment manufacturers (“OEMs”).

The addition of MidWest Materials expands Reliance’s flat-rolled

presence in the key markets in and around Ohio. MidWest Materials’

net sales for the year ended December 31, 2023 were approximately

$87 million.

On July 15, 2024, Reliance reached an agreement to acquire

certain toll processing assets of the FerrouSouth division of

Ferragon Corporation (“FerrouSouth”), a premier toll processing

operation headquartered in Iuka, Mississippi. The transaction is

expected to close within the next 30 days, subject to customary

closing conditions. Net sales for the FerrouSouth toll processing

operations to be acquired by Reliance for the year ended December

31, 2023 were approximately $15 million.

All three of these transactions were previously announced.

Business Outlook Reliance anticipates

underlying demand will remain relatively stable across the majority

of the end markets it serves in the third quarter of 2024 subject

to shipment levels to be impacted by normal seasonal patterns,

which include a decline in shipping volumes due to planned customer

shutdowns and vacation schedules. As a result, the Company

estimates its tons sold will be down 2.5% to 4.5% in the third

quarter of 2024 compared to the second quarter of 2024 and up 4.5%

to 6.5% from the third quarter of 2023. Reliance expects its

average selling price per ton sold for the third quarter of 2024 to

be down 2% to 4% compared to the second quarter of 2024, primarily

driven by lower prices for carbon steel products. Therefore,

Reliance anticipates gross profit margin to remain under some

pressure in the third quarter of 2024. Based on these expectations,

the Company anticipates non-GAAP earnings per diluted share in the

range of $3.60 to $3.80 for the third quarter of 2024.

Conference Call DetailsA conference call and

simultaneous webcast to discuss Reliance’s second quarter 2024

financial results and business outlook will be held on Thursday,

July 25, 2024 at 11:00 a.m. Eastern Time / 8:00 a.m. Pacific Time.

To listen to the live call by telephone, please dial (877) 407-0792

(U.S. and Canada) or (201) 689-8263 (International) approximately

10 minutes prior to the start time and use conference ID: 13747336.

The call will also be broadcast live over the Internet hosted on

the Investors section of the Company's website at

investor.reliance.com.

For those unable to participate during the live broadcast, a

replay of the call will also be available beginning that same day

at 2:00 p.m. Eastern Time until 11:59 p.m. Eastern Time on August

8, 2024, by dialing (844) 512-2921 (U.S. and Canada) or (412)

317-6671 (International) and entering the conference ID: 13747336.

The webcast will remain posted on the Investors section of

Reliance’s website at reliance.com for 90 days.

About Reliance, Inc.Founded in 1939, Reliance,

Inc. (NYSE: RS) is a leading global diversified metal solutions

provider and the largest metals service center company in North

America. Through a network of more than 320 locations in 40 states

and 12 countries outside of the United States, Reliance provides

value-added metals processing services and distributes a full-line

of over 100,000 metal products to more than 125,000 customers in a

broad range of industries. Reliance focuses on small orders with

quick turnaround and value-added processing services. In 2023,

Reliance’s average order size was $3,210, approximately 51% of

orders included value-added processing and approximately 40% of

orders were delivered within 24 hours. Reliance, Inc.’s press

releases and additional information are available on the Company’s

website at reliance.com.

Forward-Looking StatementsThis press release

contains certain statements that are, or may be deemed to be,

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements may include, but are not limited to, discussions of

Reliance’s industry and end markets, business strategies,

acquisitions, and expectations concerning the Company’s future

growth and profitability and its ability to generate industry

leading returns for its stockholders, as well as future demand and

metals pricing and the Company’s results of operations, margins,

profitability, taxes, liquidity, macroeconomic conditions,

including inflation and the possibility of an economic recession or

slowdown, litigation matters and capital resources. In some cases,

you can identify forward-looking statements by terminology such as

“may,” “will,” “should,” “could,” “would,” “expect,” “plan,”

“anticipate,” “believe,” “estimate,” “predict,” “potential,”

“preliminary,” “range,” “intend” and “continue,” the negative of

these terms, and similar expressions.

These forward-looking statements are based on management's

estimates, projections and assumptions as of today’s date that may

not prove to be accurate. Forward-looking statements involve known

and unknown risks and uncertainties and are not guarantees of

future performance. Actual outcomes and results may differ

materially from what is expressed or forecasted in these

forward-looking statements as a result of various important

factors, including, but not limited to, actions taken by Reliance,

as well as developments beyond its control, including, but not

limited to, the possibility that the expected benefits of

acquisitions may not materialize as expected, the impacts of labor

constraints and supply chain disruptions, changes in domestic and

worldwide political and economic conditions such as inflation and

the possibility of an economic recession that could materially

impact the Company, its customers and suppliers, and demand for the

Company’s products and services. Deteriorations in economic

conditions as a result of inflation, economic recession, slowing

growth, outbreaks of infectious disease, conflicts such as the war

in Ukraine and the evolving events in Israel and Gaza or otherwise,

could lead to a decline in demand for the Company’s products and

services and negatively impact its business, and may also impact

financial markets and corporate credit markets which could

adversely impact the Company’s access to financing, or the terms of

any financing. The Company cannot at this time predict all of the

impacts of inflation, product price fluctuations, economic

recession, outbreaks of infectious disease or the war in Ukraine

and the Israel-Gaza conflict and related economic effects, but

these factors, individually or in any combination, could have a

material adverse effect on the Company’s business, financial

position, results of operations and cash flows.

The statements contained in this press release speak only as of

the date hereof, and Reliance disclaims any and all obligations to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or for any other

reason, except as may be required by law. Important risks and

uncertainties about Reliance’s business can be found in “Item 1A.

Risk Factors” of the Company’s Annual Report on Form 10-K for the

year ended December 31, 2023 and in other documents Reliance files

or furnishes with the United States Securities and Exchange

Commission.

CONTACT:(213) 576-2428investor@reliance.com

or Addo Investor Relations(310) 829-5400

(Tables to follow)

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Second

Quarter 2024 Major Commodity Metrics |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons Sold (tons in thousands; % change) |

|

Average Selling Price per Ton Sold (% change) |

|

|

|

|

Q2 2024 |

|

Q1 2024 |

|

Sequential Quarter Change |

|

Q2 2023 |

|

Year-Over-Year Change |

|

Sequential Quarter Change |

|

Year-Over-Year Change |

|

Carbon steel |

|

1,274.3 |

|

|

|

1,214.8 |

|

|

|

4.9 |

% |

|

|

1,205.7 |

|

|

|

5.7 |

% |

|

|

(4.0 |

%) |

|

|

|

(10.5 |

%) |

|

| Aluminum |

|

81.3 |

|

|

|

81.8 |

|

|

|

(0.6 |

%) |

|

|

83.1 |

|

|

|

(2.2 |

%) |

|

|

(0.9 |

%) |

|

|

|

(6.2 |

%) |

|

| Stainless steel |

|

73.6 |

|

|

|

75.5 |

|

|

|

(2.5 |

%) |

|

|

71.7 |

|

|

|

2.6 |

% |

|

|

(4.4 |

%) |

|

|

|

(16.0 |

%) |

|

| Alloy |

|

32.5 |

|

|

|

33.0 |

|

|

|

(1.5 |

%) |

|

|

34.5 |

|

|

|

(5.8 |

%) |

|

|

(1.4 |

%) |

|

|

|

(5.2 |

%) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Sales ($'s in millions; % change) |

|

|

|

|

|

|

|

| |

Q2 2024 |

|

Q1 2024 |

|

Sequential Quarter Change |

|

Q2 2023 |

|

Year-Over-Year Change |

|

|

|

|

|

|

|

| Carbon steel |

$ |

2,025.7 |

|

|

$ |

2,012.9 |

|

|

|

0.6 |

% |

|

$ |

2,141.2 |

|

|

|

(5.4 |

%) |

|

|

|

|

|

|

|

| Aluminum |

$ |

587.8 |

|

|

$ |

596.1 |

|

|

|

(1.4 |

%) |

|

$ |

639.7 |

|

|

|

(8.1 |

%) |

|

|

|

|

|

|

|

| Stainless steel |

$ |

521.8 |

|

|

$ |

559.9 |

|

|

|

(6.8 |

%) |

|

$ |

604.0 |

|

|

|

(13.6 |

%) |

|

|

|

|

|

|

|

| Alloy |

$ |

166.8 |

|

|

$ |

171.9 |

|

|

|

(3.0 |

%) |

|

$ |

186.8 |

|

|

|

(10.7 |

%) |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-to-Date (6 Months) 2024 Major Commodity

Metrics |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Tons Sold (tons in thousands; % change) |

|

Average Selling Price per Ton Sold (% change) |

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

Year-Over-Year Change |

|

Year-Over-Year Change |

|

|

|

|

|

|

|

|

|

|

| Carbon steel |

|

2,489.1 |

|

|

|

2,437.7 |

|

|

|

2.1 |

% |

|

|

(7.4 |

%) |

|

|

|

|

|

|

|

|

|

|

| Aluminum |

|

163.1 |

|

|

|

169.2 |

|

|

|

(3.6 |

%) |

|

|

(6.3 |

%) |

|

|

|

|

|

|

|

|

|

|

| Stainless steel |

|

149.1 |

|

|

|

148.5 |

|

|

|

0.4 |

% |

|

|

(14.6 |

%) |

|

|

|

|

|

|

|

|

|

|

| Alloy |

|

65.5 |

|

|

|

70.8 |

|

|

|

(7.5 |

%) |

|

|

(3.2 |

%) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Sales ($'s in millions; % change) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

2024 |

|

|

2023 |

|

|

Year-Over-Year Change |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Carbon steel |

$ |

4,038.6 |

|

|

$ |

4,269.7 |

|

|

|

(5.4 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aluminum |

$ |

1,183.9 |

|

|

$ |

1,309.9 |

|

|

|

(9.6 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stainless steel |

$ |

1,081.7 |

|

|

$ |

1,261.3 |

|

|

|

(14.2 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Alloy |

$ |

338.7 |

|

|

$ |

378.2 |

|

|

|

(10.4 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Sales by Product ($'s as a % of total sales) |

|

|

|

|

|

|

|

| |

|

|

Six Months Ended |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

June 30, |

|

|

|

|

|

|

|

|

|

Q2 2024 |

|

Q1 2024 |

|

Q2 2023 |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

| Carbon steel plate |

|

12 |

% |

|

|

11 |

% |

|

|

12 |

% |

|

|

12 |

% |

|

|

12 |

% |

|

|

|

|

|

|

|

| Carbon steel structurals |

|

11 |

% |

|

|

11 |

% |

|

|

10 |

% |

|

|

11 |

% |

|

|

10 |

% |

|

|

|

|

|

|

|

| Carbon steel tubing |

|

10 |

% |

|

|

10 |

% |

|

|

10 |

% |

|

|

10 |

% |

|

|

10 |

% |

|

|

|

|

|

|

|

| Hot-rolled steel sheet &

coil |

|

9 |

% |

|

|

9 |

% |

|

|

9 |

% |

|

|

9 |

% |

|

|

9 |

% |

|

|

|

|

|

|

|

| Carbon steel bar |

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

|

|

|

|

|

| Galvanized steel sheet &

coil |

|

5 |

% |

|

|

5 |

% |

|

|

4 |

% |

|

|

5 |

% |

|

|

4 |

% |

|

|

|

|

|

|

|

| Cold-rolled steel sheet &

coil |

|

2 |

% |

|

|

2 |

% |

|

|

3 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

|

|

|

|

|

|

Carbon steel |

|

54 |

% |

|

|

53 |

% |

|

|

53 |

% |

|

|

54 |

% |

|

|

52 |

% |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Aluminum bar & tube |

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

|

|

|

|

|

| Heat-treated aluminum

plate |

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

|

|

|

|

|

| Common alloy aluminum sheet

& coil |

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

|

|

|

|

|

| Common alloy aluminum

plate |

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

|

|

|

|

|

| Heat-treated aluminum sheet

& coil |

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

|

|

|

|

|

|

Aluminum |

|

16 |

% |

|

|

16 |

% |

|

|

16 |

% |

|

|

16 |

% |

|

|

16 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stainless steel bar &

tube |

|

7 |

% |

|

|

8 |

% |

|

|

7 |

% |

|

|

7 |

% |

|

|

8 |

% |

|

|

|

|

|

|

|

| Stainless steel sheet &

coil |

|

5 |

% |

|

|

5 |

% |

|

|

6 |

% |

|

|

5 |

% |

|

|

6 |

% |

|

|

|

|

|

|

|

| Stainless steel plate |

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

|

|

|

|

|

|

Stainless steel |

|

14 |

% |

|

|

15 |

% |

|

|

15 |

% |

|

|

14 |

% |

|

|

16 |

% |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Alloy bar & rod |

|

3 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

|

|

|

|

|

| Alloy tube |

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

|

|

|

|

|

|

Alloy |

|

4 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Miscellaneous |

|

6 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

5 |

% |

|

|

|

|

|

|

|

| Toll processing &

logistics |

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

4 |

% |

|

|

|

|

|

|

|

| Copper & brass |

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

2 |

% |

|

|

|

|

|

|

|

|

Other |

|

12 |

% |

|

|

11 |

% |

|

|

11 |

% |

|

|

11 |

% |

|

|

11 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total |

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

100 |

% |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

RELIANCE, INC. |

|

UNAUDITED CONSOLIDATED STATEMENTS OF INCOME |

|

(in millions, except number of shares which are reflected

in thousands and per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

| |

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

Net sales |

$ |

3,643.3 |

|

|

$ |

3,880.3 |

|

|

$ |

7,288.1 |

|

|

$ |

7,845.6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Cost of sales (exclusive of depreciation and amortization shown

below) |

|

2,557.3 |

|

|

|

2,657.6 |

|

|

|

5,073.9 |

|

|

|

5,396.9 |

|

|

Warehouse, delivery, selling, general and administrative

(“SG&A”) |

|

667.7 |

|

|

|

650.6 |

|

|

|

1,339.2 |

|

|

|

1,301.9 |

|

|

Depreciation and amortization |

|

66.6 |

|

|

|

60.8 |

|

|

|

130.2 |

|

|

|

121.9 |

|

| |

|

3,291.6 |

|

|

|

3,369.0 |

|

|

|

6,543.3 |

|

|

|

6,820.7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

351.7 |

|

|

|

511.3 |

|

|

|

744.8 |

|

|

|

1,024.9 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Other (income) expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

9.7 |

|

|

|

9.7 |

|

|

|

19.4 |

|

|

|

20.6 |

|

|

Other income, net |

|

(7.7 |

) |

|

|

(9.3 |

) |

|

|

(20.5 |

) |

|

|

(15.1 |

) |

| Income before income

taxes |

|

349.7 |

|

|

|

510.9 |

|

|

|

745.9 |

|

|

|

1,019.4 |

|

| Income tax provision |

|

81.4 |

|

|

|

124.6 |

|

|

|

173.8 |

|

|

|

248.7 |

|

| Net income |

|

268.3 |

|

|

|

386.3 |

|

|

|

572.1 |

|

|

|

770.7 |

|

|

Less: net income attributable to noncontrolling interests |

|

0.5 |

|

|

|

1.2 |

|

|

|

1.4 |

|

|

|

2.5 |

|

| Net income attributable to

Reliance |

$ |

267.8 |

|

|

$ |

385.1 |

|

|

$ |

570.7 |

|

|

$ |

768.2 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share

attributable to Reliance stockholders: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

4.71 |

|

|

$ |

6.56 |

|

|

$ |

9.99 |

|

|

$ |

13.07 |

|

|

Diluted |

$ |

4.67 |

|

|

$ |

6.49 |

|

|

$ |

9.90 |

|

|

$ |

12.92 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Shares used in computing

earnings per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

56,878 |

|

|

|

58,688 |

|

|

|

57,109 |

|

|

|

58,760 |

|

|

Diluted |

|

57,394 |

|

|

|

59,346 |

|

|

|

57,638 |

|

|

|

59,440 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash dividends per share |

$ |

1.10 |

|

|

$ |

1.00 |

|

|

$ |

2.20 |

|

|

$ |

2.00 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

RELIANCE, INC. |

|

UNAUDITED CONSOLIDATED BALANCE SHEETS |

|

(in millions, except number of shares

which are reflected in thousands and par

value) |

|

|

|

|

|

|

|

|

|

| |

June 30, |

|

December 31, |

| |

2024 |

|

|

2023* |

|

ASSETS |

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

350.8 |

|

|

$ |

1,080.2 |

|

|

Accounts receivable, less allowance for credit losses of $27.6 at

June 30, 2024 and $24.9 at December 31, 2023 |

|

1,650.9 |

|

|

|

1,472.4 |

|

|

Inventories |

|

2,288.7 |

|

|

|

2,043.2 |

|

|

Prepaid expenses and other current assets |

|

132.3 |

|

|

|

140.4 |

|

|

Income taxes receivable |

|

9.8 |

|

|

|

35.6 |

|

|

Total current assets |

|

4,432.5 |

|

|

|

4,771.8 |

|

| Property, plant and

equipment: |

|

|

|

|

|

|

Land |

|

292.8 |

|

|

|

281.7 |

|

|

Buildings |

|

1,627.1 |

|

|

|

1,510.9 |

|

|

Machinery and equipment |

|

2,813.6 |

|

|

|

2,700.4 |

|

|

Accumulated depreciation |

|

(2,295.9 |

) |

|

|

(2,244.6 |

) |

|

Property, plant and equipment, net |

|

2,437.6 |

|

|

|

2,248.4 |

|

| Operating lease right-of-use

assets |

|

241.7 |

|

|

|

231.6 |

|

| Goodwill |

|

2,167.0 |

|

|

|

2,111.1 |

|

| Intangible assets, net |

|

1,036.2 |

|

|

|

981.1 |

|

| Cash surrender value of life

insurance policies, net |

|

34.4 |

|

|

|

43.8 |

|

| Other long-term assets |

|

98.7 |

|

|

|

92.5 |

|

|

Total assets |

$ |

10,448.1 |

|

|

$ |

10,480.3 |

|

| |

|

|

|

|

|

|

LIABILITIES AND EQUITY |

| |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

458.4 |

|

|

$ |

410.3 |

|

|

Accrued expenses |

|

146.6 |

|

|

|

118.5 |

|

|

Accrued compensation and retirement benefits |

|

173.8 |

|

|

|

213.9 |

|

|

Accrued insurance costs |

|

47.0 |

|

|

|

44.4 |

|

|

Current maturities of long-term debt |

|

0.3 |

|

|

|

0.3 |

|

|

Current maturities of operating lease liabilities |

|

57.4 |

|

|

|

56.2 |

|

|

Total current liabilities |

|

883.5 |

|

|

|

843.6 |

|

| Long-term debt |

|

1,143.3 |

|

|

|

1,141.9 |

|

| Operating lease

liabilities |

|

187.6 |

|

|

|

178.9 |

|

| Long-term retirement

benefits |

|

27.7 |

|

|

|

25.1 |

|

| Other long-term

liabilities |

|

71.3 |

|

|

|

64.0 |

|

| Deferred income taxes |

|

501.7 |

|

|

|

494.0 |

|

|

Total liabilities |

|

2,815.1 |

|

|

|

2,747.5 |

|

| Commitments and

contingencies |

|

|

|

|

|

| Equity: |

|

|

|

|

|

|

Preferred stock, $0.001 par value: 5,000 shares authorized; none

issued or outstanding |

|

— |

|

|

|

— |

|

|

Common stock and additional paid-in capital, $0.001 par value and

200,000 shares authorized |

|

|

|

|

|

|

Issued and outstanding shares—55,627 at June 30, 2024 and 57,271 at

December 31, 2023 |

|

0.1 |

|

|

|

0.1 |

|

|

Retained earnings |

|

7,724.4 |

|

|

|

7,798.9 |

|

|

Accumulated other comprehensive loss |

|

(101.5 |

) |

|

|

(76.7 |

) |

|

Total Reliance stockholders’ equity |

|

7,623.0 |

|

|

|

7,722.3 |

|

|

Noncontrolling interests |

|

10.0 |

|

|

|

10.5 |

|

|

Total equity |

|

7,633.0 |

|

|

|

7,732.8 |

|

|

Total liabilities and equity |

$ |

10,448.1 |

|

|

$ |

10,480.3 |

|

| |

|

|

|

|

|

| * Derived from audited

financial statements. |

|

|

|

|

|

| |

|

|

|

|

|

|

RELIANCE, INC. |

|

UNAUDITED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(in millions) |

|

|

|

|

|

|

|

|

|

| |

Six Months Ended |

| |

June 30, |

| |

2024 |

|

|

2023 |

|

| Operating

activities: |

|

|

|

|

|

|

Net income |

$ |

572.1 |

|

|

$ |

770.7 |

|

| Adjustments to reconcile net

income to net cash provided by operating activities: |

|

|

|

|

|

|

Depreciation and amortization expense |

|

130.2 |

|

|

|

121.9 |

|

|

Stock-based compensation expense |

|

26.9 |

|

|

|

31.6 |

|

|

Other |

|

3.7 |

|

|

|

2.2 |

|

| Changes in operating assets

and liabilities (excluding effect of businesses acquired): |

|

|

|

|

|

|

Accounts receivable |

|

(142.2 |

) |

|

|

(163.3 |

) |

|

Inventories |

|

(141.0 |

) |

|

|

(202.1 |

) |

|

Prepaid expenses and other assets |

|

84.5 |

|

|

|

71.1 |

|

|

Accounts payable and other liabilities |

|

(41.6 |

) |

|

|

47.6 |

|

|

Net cash provided by operating activities |

|

492.6 |

|

|

|

679.7 |

|

|

|

|

|

|

|

|

| Investing

activities: |

|

|

|

|

|

|

Acquisitions, net of cash acquired |

|

(346.5 |

) |

|

|

(24.1 |

) |

|

Purchases of property, plant and equipment |

|

(206.9 |

) |

|

|

(233.1 |

) |

|

Other |

|

(8.6 |

) |

|

|

2.2 |

|

|

Net cash used in investing activities |

|

(562.0 |

) |

|

|

(255.0 |

) |

|

|

|

|

|

|

|

| Financing

activities: |

|

|

|

|

|

|

Net short-term debt repayments |

|

— |

|

|

|

(2.2 |

) |

|

Principal payment on long-term debt |

|

— |

|

|

|

(505.7 |

) |

|

Cash dividends and dividend equivalents |

|

(127.9 |

) |

|

|

(120.6 |

) |

|

Share repurchases |

|

(519.3 |

) |

|

|

(112.8 |

) |

|

Taxes paid related to net share settlement of restricted stock

units |

|

(24.1 |

) |

|

|

(37.3 |

) |

|

Other |

|

17.2 |

|

|

|

(1.8 |

) |

|

Net cash used in financing activities |

|

(654.1 |

) |

|

|

(780.4 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

(5.9 |

) |

|

|

(1.4 |

) |

| Decrease in cash and cash

equivalents |

|

(729.4 |

) |

|

|

(357.1 |

) |

| Cash and cash equivalents at

beginning of year |

|

1,080.2 |

|

|

|

1,173.4 |

|

| Cash and cash equivalents at

end of the period |

$ |

350.8 |

|

|

$ |

816.3 |

|

| |

|

|

|

|

|

| Supplemental cash flow

information: |

|

|

|

|

|

| Interest paid during the

period |

$ |

18.0 |

|

|

$ |

23.7 |

|

| Income taxes paid during the

period, net |

$ |

147.7 |

|

|

$ |

191.0 |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

RELIANCE, INC. |

|

NON-GAAP RECONCILIATION |

|

(in millions, except per share amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Net Income |

|

Diluted EPS |

| |

Three Months Ended |

|

Three Months Ended |

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

March 31, |

|

June 30, |

| |

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2024 |

|

|

2023 |

|

Net income attributable to Reliance |

$ |

267.8 |

|

|

$ |

302.9 |

|

|

$ |

385.1 |

|

|

$ |

4.67 |

|

|

$ |

5.23 |

|

|

$ |

6.49 |

| Restructuring charges |

|

0.4 |

|

|

|

0.3 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

— |

| Non-recurring income of

acquisitions |

|

(2.0 |

) |

|

|

— |

|

|

|

— |

|

|

|

(0.03 |

) |

|

|

— |

|

|

|

— |

| Non-recurring settlement

charges |

|

— |

|

|

|

4.6 |

|

|

|

— |

|

|

|

— |

|

|

|

0.08 |

|

|

|

— |

| Income tax expense (benefit)

related to above items |

|

0.4 |

|

|

|

(1.2 |

) |

|

|

— |

|

|

|

— |

|

|

|

(0.02 |

) |

|

|

— |

| Non-GAAP net income

attributable to Reliance |

$ |

266.6 |

|

|

$ |

306.6 |

|

|

$ |

385.1 |

|

|

$ |

4.65 |

|

|

$ |

5.30 |

|

|

$ |

6.49 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Net Income |

|

Diluted EPS |

|

|

|

| |

|

|

|

Six Months Ended |

|

Six Months Ended |

|

|

|

| |

|

|

|

June 30, |

|

June 30, |

|

June 30, |

|

June 30, |

|

|

|

| |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

| Net income attributable to

Reliance |

|

|

|

$ |

570.7 |

|

|

$ |

768.2 |

|

|

$ |

9.90 |

|

|

$ |

12.92 |

|

|

|

|

| Restructuring charges |

|

|

|

|

0.7 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

|

|

|

| Non-recurring income of

acquisitions |

|

|

|

|

(2.0 |

) |

|

|

— |

|

|

|

(0.03 |

) |

|

|

— |

|

|

|

|

| Non-recurring settlement

charges |

|

|

|

|

4.6 |

|

|

|

— |

|

|

|

0.08 |

|

|

|

— |

|

|

|

|

| Gains related to sales of

non-core assets |

|

|

|

|

— |

|

|

|

(4.8 |

) |

|

|

— |

|

|

|

(0.08 |

) |

|

|

|

| Income tax (benefit) expense

related to above items |

|

|

|

|

(0.8 |

) |

|

|

1.2 |

|

|

|

(0.02 |

) |

|

|

0.02 |

|

|

|

|

| Non-GAAP net income

attributable to Reliance |

|

|

|

$ |

573.2 |

|

|

$ |

764.6 |

|

|

$ |

9.94 |

|

|

$ |

12.86 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

|

|

|

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

|

|

|

| |

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

| Pretax income |

$ |

349.7 |

|

|

$ |

396.2 |

|

|

$ |

510.9 |

|

|

$ |

745.9 |

|

|

$ |

1,019.4 |

|

|

|

|

| Restructuring charges |

|

0.4 |

|

|

|

0.3 |

|

|

|

— |

|

|

|

0.7 |

|

|

|

— |

|

|

|

|

| Non-recurring income of

acquisitions |

|

(2.0 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2.0 |

) |

|

|

— |

|

|

|

|

| Non-recurring settlement

charges |

|

— |

|

|

|

4.6 |

|

|

|

— |

|

|

|

4.6 |

|

|

|

— |

|

|

|

|

| Gains related to sales of

non-core assets |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(4.8 |

) |

|

|

|

| Non-GAAP pretax income |

$ |

348.1 |

|

|

$ |

401.1 |

|

|

$ |

510.9 |

|

|

$ |

749.2 |

|

|

$ |

1,014.6 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Six Months Ended |

|

|

|

| |

June 30, |

|

March 31, |

|

June 30, |

|

June 30, |

|

June 30, |

|

|

|

| |

2024 |

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

| Gross profit - LIFO |

$ |

1,086.0 |

|

|

$ |

1,128.2 |

|

|

$ |

1,222.7 |

|

|

$ |

2,214.2 |

|

|

$ |

2,448.7 |

|

|

|

|

| Amortization of inventory

step-down |

|

(2.0 |

) |

|

|

— |

|

|

|

— |

|

|

|

(2.0 |

) |

|

|

— |

|

|

|

|

| Non-GAAP gross profit |

|

1,084.0 |

|

|

|

1,128.2 |

|

|

|

1,222.7 |

|

|

|

2,212.2 |

|

|

|

2,448.7 |

|

|

|

|

| LIFO income |

|

(50.0 |

) |

|

|

(50.0 |

) |

|

|

(45.0 |

) |

|

|

(100.0 |

) |

|

|

(60.0 |

) |

|

|

|

| Non-GAAP gross profit -

FIFO |

$ |

1,034.0 |

|

|

$ |

1,078.2 |

|

|

$ |

1,177.7 |

|

|

$ |

2,112.2 |

|

|

$ |

2,388.7 |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gross profit margin -

LIFO |

|

29.8% |

|

|

|

31.0% |

|

|

|

31.5% |

|

|

|

30.4% |

|

|

|

31.2% |

|

|

|

|

| Amortization of inventory

step-down as a % of sales |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

| Non-GAAP gross profit

margin |

|

29.8% |

|

|

|

31.0% |

|

|

|

31.5% |

|

|

|

30.4% |

|

|

|

31.2% |

|

|

|

|

| LIFO income as a % of

sales |

|

(1.4% |

) |

|

|

(1.4% |

) |

|

|

(1.2% |

) |

|

|

(1.4% |

) |

|

|

(0.8% |

) |

|

|

|

| Non-GAAP gross profit margin -

FIFO |

|

28.4% |

|

|

|

29.6% |

|

|

|

30.3% |

|

|

|

29.0% |

|

|

|

30.4% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

June 30, |

|

March 31, |

|

June 30, |

|

|

|

|

|

|

|

| |

2024 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

| Total debt |

$ |

1,151.4 |

|

|

$ |

1,151.4 |

|

|

$ |

1,151.7 |

|

|

|

|

|

|

|

|

|

|

| Less: unamortized debt

discount and debt issuance costs |

|

(7.8 |

) |

|

|

(8.5 |

) |

|

|

(10.5 |

) |

|

|

|

|

|

|

|

|

|

| Carrying amount of debt |

|

1,143.6 |

|

|

|

1,142.9 |

|

|

|

1,141.2 |

|

|

|

|

|

|

|

|

|

|

| Less: cash and cash

equivalents |

|

(350.8 |

) |

|

|

(934.9 |

) |

|

|

(816.3 |

) |

|

|

|

|

|

|

|

|

|

| Net debt |

$ |

792.8 |

|

|

$ |

208.0 |

|

|

$ |

324.9 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Twelve Months Ended |

|

|

|

|

|

|

|

|

|

| |

June 30, |

|

March 31, |

|

June 30, |

|

|

|

|

|

|

|

|

|

| |

2024 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

1,141.5 |

|

|

$ |

1,259.5 |

|

|

$ |

1,516.4 |

|

|

|

|

|

|

|

|

|

|

| Depreciation and

amortization |

|

253.7 |

|

|

|

247.9 |

|

|

|

243.7 |

|

|

|

|

|

|

|

|

|

|

| Interest expense |

|

38.9 |

|

|

|

38.9 |

|

|

|

51.7 |

|

|

|

|

|

|

|

|

|

|

| Income taxes |

|

325.7 |

|

|

|

368.9 |

|

|

|

473.6 |

|

|

|

|

|

|

|

|

|

|

| EBITDA |

$ |

1,759.8 |

|

|

$ |

1,915.2 |

|

|

$ |

2,285.4 |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net debt-to-EBITDA |

|

0.5x |

|

|

0.1x |

|

|

0.1x |

|

|

|

|

|

|

|

|

|

| Total debt-to-EBITDA |

|

0.7x |

|

|

0.6x |

|

|

0.5x |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reliance, Inc.’s presentation of non-GAAP pretax income, net income

and EPS over certain time periods is an attempt to provide

meaningful comparisons to the Company's historical performance for

its existing and future stockholders. Adjustments include

restructuring charges, non-recurring income of its acquisitions,

non-recurring settlement charges, and gains on sales of non-core

property, plant, and equipment, which make comparisons of the

Company’s operating results between periods difficult using GAAP

measures. Reliance, Inc.’s presentation of gross profit margin -

FIFO, which is calculated as gross profit plus LIFO expense (or

minus LIFO income) divided by net sales, is presented in order to

provide a means of comparison amongst its competitors who may not

use the same inventory valuation method. Please see footnote 1

below for additional information on the Company’s gross profit and

gross profit margin. Reliance, Inc. presents net debt- and total

debt-to-EBITDA as a measurement of leverage utilized by management

to monitor its debt levels in relation to its operating cash flow

for which it utilizes EBITDA as a proxy. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Footnotes |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Gross profit, calculated as net sales less cost of sales, and

gross profit margin, calculated as gross profit divided by net

sales, are non-GAAP financial measures as they exclude depreciation

and amortization expense associated with the corresponding sales.

About half of Reliance's orders are basic distribution with no

processing services performed. For the remainder of its sales

orders, Reliance performs “first-stage” processing, which is

generally not labor intensive as it is simply cutting the metal to

size. Because of this, the amount of related labor and overhead,

including depreciation and amortization, is not significant and is

excluded from cost of sales. Therefore, Reliance’s cost of sales is

substantially comprised of the cost of the material it sells.

Reliance uses gross profit and gross profit margin, as shown, as

measures of operating performance. Gross profit and gross profit

margin are important operating and financial measures, as their

fluctuations can have a significant impact on Reliance's earnings.

Gross profit and gross profit margin, as presented, are not

necessarily comparable with similarly titled measures for other

companies. |

|

2 See accompanying Non-GAAP Reconciliation. Certain percentages may

not calculate due to rounding. |

|

3 Free cash flow is calculated as cash provided by operations

reduced by capital expenditures. |

|

4 Net debt-to-total capital is calculated as carrying amount of

debt (net of cash) divided by total Reliance stockholders’ equity

plus carrying amount of debt (net of cash). |

|

5 Net debt- and total debt-to-EBITDA are calculated as carrying

amount of debt (net of cash) or total debt divided by earnings

before interest, income taxes, depreciation, amortization and

impairment of long-lived assets (“EBITDA”) for the most recent

twelve months. |

Reliance (NYSE:RS)