Form 8-K - Current report

December 01 2023 - 4:55PM

Edgar (US Regulatory)

0000716643FALSE6/3000007166432023-11-272023-11-2700007166432023-07-012024-06-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 27, 2023

REGIS CORPORATION

(Exact name of registrant as specified in charter)

| | | | | | | | | | | | | | |

| Minnesota | | 1-12725 | | 41-0749934 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

3701 Wayzata Boulevard

Minneapolis, MN 55416

(Address of principal executive offices and zip code)

(952) 947-7777

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.05 per share | | RGS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Regis Corporation

Current Report on Form 8-K

ITEM 3.03 MATERIAL MODIFICATION TO RIGHTS OF SECURITY HOLDERS.

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 herein is incorporated by reference into this Item 3.03.

ITEM 5.03 AMENDMENTS TO ARTICLES OF INCORPORATION OR BYLAWS; CHANGE IN FISCAL YEAR.

Effective November 29, 2023, Regis Corporation (the “Company”) amended its Restated Articles of Incorporation to implement a twenty-for-one reverse stock split. The Company’s common stock began trading on a split-adjusted basis when the market opened on November 29, 2023.

As a result of the reverse stock split, at 12:01 a.m. Central Time on the effective date, every 20 shares of common stock then issued and outstanding automatically were combined into one share of common stock, with no change in par value per share. No fractional shares were outstanding following the reverse stock split and any fractional shares that would have resulted from the reverse stock split will be settled in cash. The total number of shares authorized for issuance was reduced to 5,000,000 in proportion to the reverse stock split. The text of the Articles of Amendment of Restated Articles of Incorporation of the Company that effected the foregoing actions is attached hereto as Exhibit 3.1 and incorporated herein by reference.

Effective as of the same time as the reverse stock split, the Compensation Committee of the Company’s Board of Directors reduced the number of shares of common stock available for issuance under the Company’s equity compensation plans in proportion to the reverse stock split. Upon effectiveness, the reverse stock split also resulted in reductions in the number of shares of common stock issuable upon exercise or vesting of equity awards in proportion to the reverse stock split and caused a proportionate increase in exercise price or share-based performance criteria, if any, applicable to such awards.

Effective later in the day on November 29, 2023, the Company restated its Restated Articles of Incorporation to reflect all amendments through that date, including the amendment describe above. The text of the Restated Articles of Incorporation is set forth in Exhibit 3.2 and incorporated herein by reference.

ITEM 8.01 OTHER EVENTS

A total of 2,279,417 shares of common stock were issued and outstanding immediately after the reverse stock split became effective on November 29, 2023. The CUSIP identifier for the Company’s common stock following the reverse stock split is 758932206.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits.

Exhibit

Number

| | | | | | | | |

| 3.1 | | |

| 3.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

|

| | | |

| | | REGIS CORPORATION |

| | | |

| | | |

| Dated: December 1, 2023 | | By: | /s/ Kersten D. Zupfer |

| | | | Kersten D. Zupfer |

| | | Executive Vice President and Chief Financial Officer |

1 Exhibit 3.1 ARTICLES OF AMENDMENT OF RESTATED ARTICLES OF INCORPORATION OF REGIS CORPORATION The undersigned, Kersten D. Zupfer, in her capacity as Executive Vice President, Chief Financial Officer of Regis Corporation, a Minnesota corporation (the “Corporation”), hereby certifies that: 1. Article III of the Corporation’s Restated Articles of Incorporation has been amended to read in its entirety as follows: “The aggregate number of shares that the corporation has authority to issue is 5,000,000 shares of the par value of $.05 each.” 2. that such amendment has been adopted by the Corporation’s Board of Directors in accordance with the requirements of, and pursuant to, Chapter 302A of the Minnesota Statutes; 3. that such amendment was adopted pursuant to Section 302A.402 of the Minnesota Statutes in connection with a combination of the Corporation’s capital stock; and 4. that such amendment will not adversely affect the rights or preferences of the holders of outstanding shares of any class or series of the Corporation and will not result in the percentage of authorized shares of any class or series that remains unissued after such combination exceeding the percentage of authorized shares of the same class or series remaining unissued before the division. The division giving rise to the amendment set forth above concerns a 1-for-20 combination of the capital stock of the Corporation. Such combination is being effected as follows: A. at 12:01 a.m. Central Time on November 29, 2023 (the “Effective Time”), every 20 shares of capital stock then outstanding will be combined and converted into one share of capital stock of the Corporation; and B. at the Effective Time, each certificate representing shares of the authorized but unissued capital stock of the Corporation or book entries for the same recorded by the Corporation’s transfer agent and registrar will be deemed to represent 1/20th of the number of shares held of record by such shareholder of record as of the Effective Time; and C. in settlement of fractional interests which may arise as a result of common shareholders of record at the Effective Time holding a number of shares less than 20 immediately prior to effecting the combination described herein, such capital shareholders of record will be entitled to receive cash, without interest, in lieu of fractional shares of capital stock, in an amount equal to the product obtained by multiplying (i) the closing price per share of the capital stock on the date immediately preceding the date of the Effective Time as reported on New York Stock Exchange, after giving effect to the combination described above, by (ii) the fraction of the share owned by the shareholder; provided, however, that to accommodate the needs of common shareholders of record who may be acting as nominees for a number of beneficial holders, the Corporation may settle for cash fractional interests which may result from the allocation by capital shareholders of record of the stock split shares to beneficial holders of the common stock, although the aggregate amount of cash necessary to effect such settlement may exceed the amount otherwise indicated by the number of shares held of record by such shareholder.

2 IN WITNESS WHEREOF, I have subscribed my name this 27th day of November, 2023. /s/ Kersten D. Zupfer Kersten D. Zupfer Executive Vice President and Chief Financial Officer

Exhibit 3.2 REGIS CORPORATION RESTATED ARTICLES OF INCORPORATION The undersigned, Kersten D. Zupfer, in her capacity as Executive Vice President and Chief Financial Officer of Regis Corporation, a Minnesota corporation (the “Corporation”), hereby certifies that: 1. The Corporation’s Restated Articles of Incorporation, as amended to date, is hereby amended and restated in its entirety as set forth in Attachment I. 2. This amendment restating the Restated Articles of Incorporation correctly sets forth without change the corresponding provisions of the articles of incorporation as previously amended. 3. This amendment was adopted pursuant to Chapter 302A of the Minnesota Statutes. 4. Pursuant to Section 302A.135, Subd.5, of the Minnesota Statutes, approval of this amendment by the shareholders of the Corporation is not required. IN WITNESS WHEREOF, I have subscribed my name this 29th day of November, 2023. /s/ Kersten D. Zupfer Kersten D. Zupfer Executive Vice President and Chief Financial Officer

Page 2 Attachment I 2023 RESTATED ARTICLES OF INCORPORATION OF REGIS CORPORATION (as restated November 29, 2023) ARTICLE I Name The name of the corporation is Regis Corporation. ARTICLE II Registered Office The address of the registered office of the corporation is 3701 Wayzata Boulevard, Suite 500, Minneapolis, Minnesota, 55416. ARTICLE III Aggregate Number of Shares The aggregate number of shares that the corporation has authority to issue is 5,000,000 shares of the par value of $.05 each. ARTICLE IV Written Action Without Meeting Any action required or permitted to be taken at any meeting of the Board of Directors may be taken without a meeting by written action signed by a majority of the Board of Directors then in office, except as to those matters which require shareholder approval, in which case the written action shall be signed by all members of the Board of Directors then in office. ARTICLE V Cumulative Voting Denied No shareholder of the corporation shall have any cumulative voting rights. ARTICLE VI Preemptive Rights Denied No shareholder of the corporation shall have any preferential, preemptive, or other rights of subscription to any shares of the corporation allotted or sold or to be allotted or sold and now or hereafter authorized, or to any obligations or securities convertible into any class or series of shares of this corporation, nor any right of subscription to any part thereof.

Page 3 ARTICLE VII Classes and Series In addition to, and not by way of limitation of, the powers granted to the Board of Directors by Minnesota Statutes Chapter 302A, the Board of Directors of the corporation shall have the power and authority to fix by resolution any designation, class, series, voting power, preference, right, qualification, limitation, restriction, dividend, time and price of redemption, and conversion right with respect to any shares of the corporation. ARTICLE VIII Certain Corporate Action A. In addition to any affirmative vote required by law under any other provision of these Articles of Incorporation, and except as otherwise expressly provided in subparagraph B: i. any merger of the corporation with or into any 10% Shareholder or any exchange, lease, transfer, or other disposition of all or substantially all of its property and assets, with or to any 10% Shareholder, or ii. the adoption of any plan or proposal for the liquidation of the corporation, shall require the affirmative vote of the holders of at least 80 percent of the outstanding shares of the corporation entitled to vote. B. The provisions of subparagraph A of this Article shall not be applicable to any of the actions listed therein, and such action shall require the affirmative vote of the holders of a majority of all shares entitled to vote, if such action has been unanimously approved by the continuing directors of the corporation. C. “10% Shareholder” shall mean any person who or which is the beneficial owner, directly or indirectly, of 10% or more of the outstanding shares of the corporation, except for persons owning such number of shares on the effective date of the 1983 Restated Articles of Incorporation. “Continuing Directors” shall be persons who were either (i) members of the Board of Directors of the corporation prior to the date when any shareholder became a 10% Shareholder or (ii) persons who are designated as continuing directors (before initial election as a director) by a majority of the then continuing directors. “Person” shall mean any individual, firm, corporation or other entity. A person shall be the “beneficial owner” of any shares of the corporation: i. which such person or any affiliate or associate of such person beneficially owns, directly or indirectly, or ii. which such person or an affiliate or associate of such person has the right to acquire or vote under any agreement, arrangement of understanding, or upon the exercise of any rights or options, or

Page 4 iii. which are beneficially owned, directly or indirectly, by any person with which such first mentioned person or any of its affiliates or associates has any agreement, arrangement or understanding for the purpose of acquiring, holding, voting or disposing of any shares of the corporation. “Affiliate” or “associate” shall have the meanings given those terms in Rule 12b-2 of the General Rules and Regulations under the Securities Exchange Act of 1934, as in effect on January 1, 1983. D. Any amendment, alteration, change or repeal of this Article VIII shall require the affirmative vote of at least 80 percent of the shares entitled to vote. ARTICLE IX Restated Articles These Restated Articles of Incorporation supersede the original articles, as amended, and all prior amendments thereto or restatements thereof. ARTICLE X Liability of Directors A director of the corporation shall not be personally liable to the corporation or its stockholders for monetary damages for any breach of fiduciary duty as a director, except for liability (i) for a breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 302A.559 and 80A.76 of the Minnesota Statutes, (iv) for any act or omission occurring prior to the effective date of this section. No amendment to or repeal of this Article shall apply to or have any effect on the liability or alleged liability of any director of the corporation for or with respect to any acts or omissions of such director occurring prior to such amendment or repeal. ARTICLE XI Election of Directors Subject to the rights, if any, of the holders of one or more classes or series of preferred or preference stock issued by the corporation, voting separately by class or series to elect directors in accordance with the terms of such preferred or preference stock, each director shall be elected at a meeting of shareholders by the vote of the majority of the votes cast with respect to the director, provided that directors shall be elected by a plurality of the votes present and entitled to vote on the election of directors at any such meeting for which the number of nominees (other than nominees withdrawn on or prior to the day preceding the date the corporation first mails its notice for such meeting to the shareholders) exceeds the number of directors to be elected. For purposes of this Article XI, action at a meeting shall mean action at a meeting which satisfies the notice and quorum requirements imposed by the bylaws of this corporation, except as otherwise provided by law, and a majority of the votes cast means that the votes entitled to be cast by the holders of all then outstanding shares of voting stock of the corporation that are voted “for” a director must exceed the votes entitled to be cast by the holders of all then outstanding shares of voting stock of the corporation that are voted “against” that director.

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

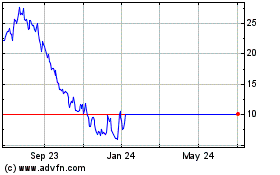

Regis (NYSE:RGS)

Historical Stock Chart

From Oct 2024 to Nov 2024

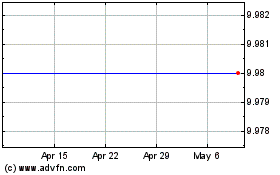

Regis (NYSE:RGS)

Historical Stock Chart

From Nov 2023 to Nov 2024