false

0001712463

0001712463

2024-10-31

2024-10-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

October 31, 2024

(Date of Report, Date of earliest event reported)

RANPAK HOLDINGS CORP.

(Exact name of registrant as specified in its charter)

| Delaware |

001-38348 |

98-1377160 |

|

(State or other jurisdiction of

incorporation) |

(Commission File Number) |

(I.R.S. Employer

Identification No.) |

7990 Auburn Road

Concord Township, Ohio 44077

(Address of principal executive offices) (Zip Code)

(440) 354-4445

(Registrant’s telephone number, including

area code)

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.

below):

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share |

PACK |

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

| Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD.

Today, Ranpak Holdings Corp. (the “Company”) announced

its results for the three- and nine-months periods ended September 30, 2024 and held its quarterly earnings call. Due to a technical error,

the first few minutes of the broadcast may have been inaudible to certain listeners who joined the call remotely. The Company has reproduced

below the statements from the Company’s Chairman and Chief Executive Officer from that portion of the call, which should be read

together with the earnings release to which they relate and with the Company’s other SEC filings, including the Company’s

Form 10-Q for period ended September 30, 2024:

“We are pleased to share that our third quarter delivered double

digit top-line growth and Adj EBITDA hence driving our fifth quarter in a row of higher volumes. Our financial results reflect that many

of our key strategic initiatives are beginning to come to fruition and are accelerating the momentum we have been building over the past

year. The continued improved performance in the quarter was driven by North American strategic account activity and solid performance

in our Europe/APAC reporting unit. Overall we believe our strategy is playing out and we continue to make further progress in a number

of key areas. While we are pleased with the performance of our strategic initiatives in North America, the general environment remains

somewhat timid globally with an uneven environment in Europe and APAC.

North American sales increased 15.3% in the quarter on a constant currency

basis vs last year driven by strategic account led void-fill activity as well as growth in Automation. We are seeing many of the larger

e-Commerce companies doing better while other smaller businesses are still struggling to get back on track. Housing related activity remains

weak given high mortgage rates, suppressing a lot of the discretionary goods purchases that typically go along with moving and new home

builds. Industrial activity remains slower as well will which has impacted cushioning.”

Note Regarding Forward-Looking Statements

This filing contains “forward-looking statements” within

the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Statements that are not

historical facts are forward-looking statements. Our forward-looking statements include, but are not limited to, statements regarding

our or our management team’s expectations, hopes, beliefs, intentions or strategies regarding the future. In addition, any statements

that refer to estimates, projections, forecasts or other characterizations of future events or circumstances, including any underlying

assumptions, are forward-looking statements. The words “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “intend,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “should,” “would”

and similar expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not

forward-looking. Forward-looking statements in this filing include, for example, statements about our expectations around the future performance

of the business, including our forward-looking guidance.

The forward-looking statements contained in this filing are based on

our current expectations and beliefs concerning future developments and their potential effects on us taking into account information

currently available to us. There can be no assurance that future developments affecting us will be those that we have anticipated. These

forward-looking statements involve a number of risks, uncertainties (some of which are beyond our control) or other assumptions that may

cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements. These

risks include, but are not limited to: (i) our inability to secure a sufficient supply of paper to meet our production requirements; (ii)

the impact of rising prices on production inputs,

including labor, energy, and freight on our results of operations; (iii) the impact

of the price of kraft paper on our results of operations; (iv) our reliance on third party suppliers; (v) geopolitical conflicts and other

social and political unrest or change; (vi) the high degree of competition and continued consolidation in the markets in which we operate;

(vii) consumer sensitivity to increases in the prices of our products, changes in consumer preferences with respect to paper products

generally or customer inventory rebalancing; (viii) economic, competitive and market conditions generally, including macroeconomic uncertainty,

the impact of inflation, and variability in energy, freight, labor and other input costs; (ix) the loss of certain customers; (x) our

failure to develop new products that meet our sales or margin expectations or the failure of those products to achieve market acceptance;

(xi) our ability to achieve our environmental, social and governance (“ESG”) goals and maintain the sustainable nature of

our product portfolio and fulfill our obligations under evolving ESG standards; (xii) our ability to fulfill our obligations under new

disclosure regimes relating to ESG matters, such as the European Sustainability Disclosure Standards recently adopted by the European

Union (“EU”) under the EU’s Corporate Sustainability Reporting Directive (“CSRD”); (xiii) our future operating

results fluctuating, failing to match performance or to meet expectations; (xiv) our ability to fulfill our public company obligations;

and (xv) other risks and uncertainties indicated from time to time in filings made with the SEC.

Should one or more of these risks or uncertainties materialize, they

could cause our actual results to differ materially from the forward-looking statements. We are not undertaking any obligation to update

or revise any forward-looking statements whether as a result of new information, future events or otherwise. You should not take any statement

regarding past trends or activities as a representation that the trends or activities will continue in the future. Accordingly, you should

not put undue reliance on these statements.

Adjusted EBITDA is a non-GAAP financial measure. For additional information

with respect to the Company’s use of Adjusted EBITDA, please refer to the Company’s earnings release filed on Form 8-K on

October 31, 2024. Constant currency net revenue growth is a non-GAAP financial measure. As noted in the Company’s earnings release,

net revenue for North America increased 15.5% year over year during the quarter on a GAAP basis. For additional information with respect

to the Company’s use of constant currency net revenue growth, please refer to the Company’s earnings release filed on Form 8-K on October 31, 2024.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| Exhibit No. |

|

Description |

| |

|

|

| 104(*) |

|

Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document |

(*) Furnished herewith

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

RANPAK HOLDINGS CORP. |

| |

|

|

|

| Date: |

October 31, 2024 |

By: |

/s/ William Drew |

| |

|

|

William Drew |

| |

|

|

|

| |

|

|

Executive Vice President and Chief Financial Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

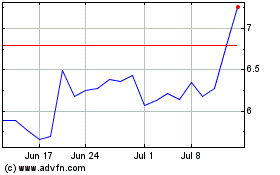

Ranpak (NYSE:PACK)

Historical Stock Chart

From Feb 2025 to Mar 2025

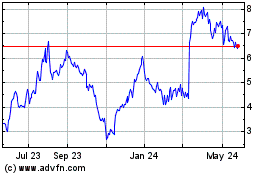

Ranpak (NYSE:PACK)

Historical Stock Chart

From Mar 2024 to Mar 2025