CONSHOHOCKEN, Pa., April 29 /PRNewswire-FirstCall/ -- Quaker

Chemical Corporation (NYSE:KWR) today announced sales for the first

quarter 2008 of $147.7 million, a quarterly record, and net income

of $5.1 million, increases of 18.3% and 44.0%, respectively,

compared to the first quarter of 2007. Earnings per share increased

to $0.50 per diluted share from $0.35 per diluted share for the

first quarter of 2007. "We're very pleased with our start in 2008,

particularly given today's world," commented Ronald J. Naples,

Chairman and Chief Executive Officer. "We achieved improvement in

operating income as a percentage of sales to over 6%, despite the

headwinds of rapidly escalating raw material costs. We did see a

decrease in our sequential gross margin percentage from the fourth

quarter of 2007, but were able to maintain our margins in dollar

terms, and continue to work with our customers to recognize the

value we deliver and our cost realities. With our future in mind,

we remain committed to invest in key growth initiatives, while at

the same time being mindful of today's challenges and limited

visibility of the current economic environment and commodity price

trends. As suggested by our recent dividend increase, we have

confidence about our long-term future and the prospects of earnings

improvement for 2008." First Quarter 2008 Summary Net sales for the

first quarter were $147.7 million, up 18.3% from $124.9 million for

the first quarter 2007. The increase in net sales was attributable

to volume growth, higher sales prices and foreign exchange rate

translation. Volume growth was realized in virtually all the

Company's regions, including higher revenue related to the

Company's Chemical Management Services ("CMS") channel. Foreign

exchange rate translation increased revenues by approximately 8%

for the first quarter of 2008, compared to the same period in 2007.

Selling price increases were realized, in part, as a result of an

ongoing effort to offset higher raw material costs. CMS revenues

were higher due to the full year impact of additional CMS accounts

gained in 2007, as well as the renewal and restructuring of several

of the Company's CMS contracts. Gross margin dollars were up more

than $5.0 million, or 13.2% for the first quarter of 2008, compared

to the same period in 2007. However, the gross margin percentage

was 29.5% for the first quarter of 2008, compared to 30.9% for the

first quarter of 2007. The Company's larger mix of CMS contracts

reported on a gross versus pass-through basis decreased gross

margin as a percentage of sales by approximately 0.5 percentage

points. The remaining decline in gross margin as a percentage of

sales is due to increased raw material costs in excess of price

increases, as well as product and regional sales mix. The Company

has announced and implemented a number of further price increases

to aid in offsetting unprecedented levels in the Company's key raw

material costs. Selling, general and administrative expenses for

the quarter increased $2.6 million, compared to the first quarter

of 2007. Foreign exchange rate translation accounted for the

majority of the increase over the prior year period. Inflationary

increases were largely offset by lower legal and environmental

costs and lower incentive compensation expense. The decrease in

other income was primarily due to foreign exchange rate losses in

2008 compared to gains in 2007. Net interest expense was lower due

to lower average borrowings as well as lower interest rates.

Balance Sheet and Cash Flow Items The Company's net debt increased

from December 31, 2007, primarily to fund working capital needs

driven by higher quarterly sales and scheduled first quarter

payments, including the payment of incentive compensation. The

Company's net debt-to-total-capital ratio was 34% at March 31,

2008, compared to 43% at March 31, 2007 and 32% at December 31,

2007. Quaker Chemical Corporation is a leading global provider of

process chemicals, chemical specialties, services, and technical

expertise to a wide range of industries -- including steel,

automotive, mining, aerospace, tube and pipe, coatings and

construction materials. Our products, technical solutions, and

chemical management services enhance our customers' processes,

improve their product quality, and lower their costs. Quaker's

headquarters is located near Philadelphia in Conshohocken,

Pennsylvania. This release contains forward-looking statements that

are subject to certain risks and uncertainties that could cause

actual results to differ materially from those projected in such

statements. A major risk is that the Company's demand is largely

derived from the demand for its customers' products, which subjects

the Company to downturns in a customer's business and unanticipated

customer production shutdowns. Other major risks and uncertainties

include, but are not limited to, significant increases in raw

material costs, customer financial stability, worldwide economic

and political conditions, foreign currency fluctuations, and future

terrorist attacks such as those that occurred on September 11,

2001. Other factors could also adversely affect us. Therefore, we

caution you not to place undue reliance on our forward-looking

statements. This discussion is provided as permitted by the Private

Securities Litigation Reform Act of 1995. As previously announced,

Quaker Chemical's investor conference call to discuss first quarter

results is scheduled for April 30, 2008 at 2:30 p.m. (ET). Access

the conference by calling 877-269-7756 or visit Quaker's Web site

at http://www.quakerchem.com/ for a live webcast. Quaker Chemical

Corporation Condensed Consolidated Statement of Income (Dollars in

thousands, except per share data and share amounts) (Unaudited)

Three Months Ended March 31, 2008 2007 Net sales $147,718 124,891

Cost of goods sold 104,083 86,345 Gross margin 43,635 38,546 %

29.5% 30.9% Selling, general and administrative expenses 34,504

31,919 Operating income 9,131 6,627 % 6.2% 5.3% Other income, net

161 327 Interest expense, net (1,182) (1,350) Income before taxes

8,110 5,604 Taxes on income 2,765 1,844 5,345 3,760 Equity in net

income of associated companies 112 125 Minority interest in net

income of subsidiaries (364) (348) Net income $5,093 $3,537 % 3.4%

2.8% Per share data: Net income - basic $0.50 $0.36 Net income -

diluted $0.50 $0.35 Shares Outstanding: Basic 10,085,859 9,907,683

Diluted 10,179,539 10,024,905 Quaker Chemical Corporation Condensed

Consolidated Balance Sheet (Dollars in thousands, except par value

and share amounts) (Unaudited) March 31, December 31, 2008 2007

ASSETS Current assets Cash and cash equivalents $20,527 $20,195

Accounts receivable, net 120,273 118,135 Inventories, net 64,559

60,738 Prepaid expenses and other current assets 16,057 14,433

Total current assets 221,416 213,501 Property, plant and equipment,

net 63,707 62,287 Goodwill 45,799 43,789 Other intangible assets,

net 7,668 7,873 Investments in associated companies 7,959 7,323

Deferred income taxes 32,018 30,257 Other assets 40,476 34,019

Total assets $419,043 $399,049 LIABILITIES AND SHAREHOLDERS' EQUITY

Current liabilities Short-term borrowings and current portion of

long-term debt $3,875 $4,288 Accounts and other payables 68,519

67,380 Accrued compensation 9,730 17,287 Other current liabilities

17,701 17,396 Total current liabilities 99,825 106,351 Long-term

debt 89,235 78,487 Deferred income taxes 8,209 7,583 Other

non-current liabilities 77,557 71,722 Total liabilities 274,826

264,143 Minority interest in equity of subsidiaries 4,750 4,513

Shareholders' equity Common stock, $1 par value; authorized

30,000,000 shares; issued 10,268,988 shares 10,269 10,147 Capital

in excess of par value 11,844 10,104 Retained earnings 118,506

115,767 Accumulated other comprehensive loss (1,152) (5,625) Total

shareholders' equity 139,467 130,393 Total liabilities and

shareholders' equity 419,043 $399,049 Quaker Chemical Corporation

Condensed Consolidated Statement of Cash Flows For the Three months

ended March 31, (Dollars in thousands) (Unaudited) 2008 2007 Cash

flows from operating activities Net income $5,093 $3,537

Adjustments to reconcile net income to net cash used in operating

activities: Depreciation 2,680 2,719 Amortization 300 339 Equity in

net income of associated companies, net of dividends (112) 44

Minority interest in earnings of subsidiaries 364 348 Deferred

income tax 1,246 361 Deferred compensation and other, net 22 267

Stock-based compensation 376 262 (Gain) Loss on disposal of

property, plant and equipment (35) 5 Insurance settlement realized

(136) (265) Pension and other postretirement benefits (2,458) (869)

Increase (decrease) in cash from changes in current assets and

current liabilities, net of acquisitions: Accounts receivable 1,159

(10,633) Inventories (2,374) (3,019) Prepaid expenses and other

current assets (3,037) (873) Accounts payable and accrued

liabilities (9,280) 2,749 Net cash used in operating activities

(6,192) (5,028) Cash flows from investing activities Capital

expenditures (1,949) (2,721) Payments related to acquisitions

(1,000) (1,000) Proceeds from disposition of assets 65 - Insurance

settlement received and interest earned 5,112 143 Change in

restricted cash, net (4,976) 122 Net cash used in investing

activities (2,748) (3,456) Cash flows from financing activities Net

decrease in short-term borrowings (378) (1,262) Proceeds from

long-term debt 9,844 5,277 Repayments of long-term debt (251) (225)

Dividends paid (2,181) (2,137) Stock options exercised, other 1,486

1,809 Distributions to minority shareholders - (270) Net cash

provided by financing activities 8,520 3,192 Effect of exchange

rate changes on cash 752 17 Net increase (decrease) in cash and

cash equivalents 332 (5,275) Cash and cash equivalents at the

beginning of the period 20,195 16,062 Cash and cash equivalents at

the end of the period $20,527 $10,787 DATASOURCE: Quaker Chemical

Corporation CONTACT: Mark A. Featherstone, Vice President and Chief

Financial Officer of Quaker Chemical Corporation, +1-610-832-4160

Web site: http://www.quakerchem.com/

Copyright

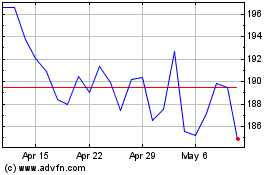

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Jun 2024 to Jul 2024

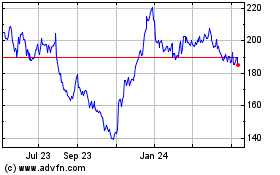

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Jul 2023 to Jul 2024