CONSHOHOCKEN, Pa., Oct. 31 /PRNewswire-FirstCall/ -- Quaker

Chemical Corporation (NYSE:KWR) today announced record third

quarter sales of $116.4 million and a 42% net income improvement to

$3.1 million, compared to third quarter 2005 sales of $105.8

million and net income of $2.2 million. Diluted earnings per share

increased to $0.32 for the third quarter of 2006 versus $0.23 in

the third quarter of last year. Third Quarter 2006 Summary Net

sales for the third quarter of 2006 were $116.4 million, up 10.1%

from the third quarter of 2005 due to higher selling prices across

all regions and volume growth in the U.S. and China. Gross margin

as a percentage of sales was 31.6% for the third quarter of 2006,

as compared to 32.0% for the third quarter of 2005. Higher selling

prices and stronger performance from the Company's CMS channel

helped restore margins to prior year third quarter levels despite

continued significant escalations in raw material costs. The third

quarter 2006 gross margin percentage of 31.6% shows sequential

improvement over the first two quarters of the year in which the

Company reported gross margins of 29.6% and 30.4%, respectively.

Selling, general and administrative expenses for the quarter

increased $1.5 million, but decreased as a percentage of sales to

27% from 28.3% in the prior year third quarter. Planned new

spending in higher growth areas was funded by savings from the

Company's restructuring program in the fourth quarter of 2005.

Higher variable compensation in the third quarter of 2006 as

compared to the prior year third quarter was the result of

increased earnings. The increase in net interest expense is

attributable to higher average borrowings and higher interest

rates. The decrease in minority interest expense is due to lower

financial performance from the Company's minority affiliates.

Year-to-Date Summary Net sales for the first nine months of 2006

were $344.9 million, up 8.8% from $317.0 million for the first nine

months of 2005. The increase in net sales was attributable to

higher sales prices and volume growth. Volume growth was mainly

attributable to market share growth and increased demand in the

U.S. and China. Selling price increases continue to be broadly

implemented across all regions and market segments to offset

significantly higher raw material costs. Net income for the first

nine months of 2006 was $8.7 million compared to $7.1 million for

the first nine months of 2005, which included a $4.2 million

pre-tax gain from the Company's real estate joint venture,

partially offset by a $1.2 million pre-tax restructuring charge.

Gross margin as a percentage of sales was 30.5% for the first nine

months of 2006, as compared to 30.8% for the first nine months of

2005. Higher selling prices and a stronger performance from the

Company's CMS channel helped maintain margins notwithstanding

continued increases in raw material prices, particularly crude oil

derivatives. Selling, general and administrative expenses for the

first nine months of 2006 increased $1.4 million compared to the

first nine months of 2005. As was the case in the third quarter,

cost savings from the Company's restructuring efforts in 2005

enabled increased spending in higher growth areas, restoration of

variable compensation and higher professional fees with only minor

cost increases. In addition, due to a legislative change, effective

January 1, 2006, the Company recorded a pension gain in the first

quarter of 2006 for $0.9 million relating to one of its European

pension plans. As a percentage of sales, selling, general and

administrative expenses were 25.7% for the first nine months of

2006, as compared to 27.5% in the first nine months of 2005. The

decrease in other income is largely due to $4.2 million of pre-tax

gain relating to the Company's real estate joint venture recorded

in 2005. The remainder of the decrease was the result of foreign

exchange losses in the first nine months of 2006, compared to gains

in the first nine months of 2005. The increase in net interest

expense is attributable to higher average borrowings and higher

interest rates. The decrease in minority interest expense for the

year is due to the acquisition of the remaining 40% interest in the

Company's Brazilian affiliate in March of 2005 and lower financial

performance from the Company's minority affiliates. Balance Sheet

and Cash Flow Items The Company's net debt has increased from

December 2005, primarily to fund working capital needs, as well as

the restructuring actions taken in the fourth quarter of 2005. The

Company's net debt-to-total capital ratio was 38% at September 30,

2006, compared to 39% at June 30, 2006, 40% at March 31, 2006 and

35% at December 31, 2005. Ronald J. Naples, Chairman and Chief

Executive Officer, commented, "We had a great third quarter that

flowed from increasing contributions from strategic initiatives

such as Asia/Pacific growth and CMS, persistent pricing attention,

and the fourth quarter 2005 repositioning of our cost base. We have

also benefited from strong global steel demand in 2006. We're

pleased with our continued earnings progress and to have been able

to generate sequential quarter-over-quarter improvement in gross

margin percentage in the face of continued increases in raw

material costs. The recent easing of crude oil prices may help

mineral oil in the long term, but this year so far we're still

facing increases in mineral oil prices. Further, we have observed

that global steel and automotive production has been outpacing

demand in some markets over the past few months. We've had a fine

profit rebound this year, and this is one of the challenges we'll

be dealing with in keeping up our sequential quarterly progress as

the year comes to a close. Still, we're performing significantly

better than prior year, and longer term, we have a number of

initiatives underway in both new markets and new products that

provide new promise for the future." Quaker Chemical Corporation,

headquartered in Conshohocken, Pennsylvania, is a worldwide

developer, producer, and marketer of custom-formulated chemical

specialty products and a provider of chemical management services

for manufacturers around the globe, primarily in the steel and

automotive industries. This release contains forward-looking

statements that are subject to certain risks and uncertainties that

could cause actual results to differ materially from those

projected in such statements. A major risk is that the Company's

demand is largely derived from the demand for its customers'

products, which subjects the Company to downturns in a customer's

business and unanticipated customer production shutdowns. Other

major risks and uncertainties include, but are not limited to,

significant increases in raw material costs, customer financial

stability, worldwide economic and political conditions, foreign

currency fluctuations, and future terrorist attacks such as those

that occurred on September 11, 2001. Other factors could also

adversely affect us. Therefore, we caution you not to place undue

reliance on our forward-looking statements. This discussion is

provided by the Private Securities Litigation Reform Act of 1995.

As previously announced, Quaker Chemical's investor conference call

to discuss third quarter results is scheduled for November 1, 2006

at 2:30 p.m. (ET). Access the conference by calling 877-269-7756 or

visit Quaker's Web site at http://www.quakerchem.com/ for a live

webcast. Quaker Chemical Corporation Condensed Consolidated

Statement of Income (Dollars in thousands, except per share data

and share amounts) (Unaudited) (Unaudited) Three Months Ended Nine

Months Ended September 30, September 30, 2006 2005 2006 2005 Net

sales $116,425 $105,751 $344,924 $316,954 Cost of goods sold 79,650

71,874 239,599 219,441 Gross margin 36,775 33,877 105,325 97,513 %

31.6% 32.0% 30.5% 30.8% Selling, general and administrative 31,485

29,937 88,636 87,274 Restructuring and related activities, net - -

- 1,232 Operating income 5,290 3,940 16,689 9,007 % 4.5% 3.7% 4.8%

2.8% Other income, net 539 353 1,054 5,869 Interest expense, net

(1,218) (670) (3,435) (1,844) Income before taxes 4,611 3,623

14,308 13,032 Taxes on income 1,378 1,178 5,058 4,235 3,233 2,445

9,250 8,797 Equity in net income of associated companies 218 208

456 414 Minority interest in net income of subsidiaries (312) (441)

(1,033) (2,078) Net income $3,139 $2,212 $8,673 $7,133 % 2.7% 2.1%

2.5% 2.3% Per share data: Net income - basic $0.32 $0.23 $0.89

$0.74 Net income - diluted $0.32 $0.23 $0.88 $0.73 Shares

Outstanding: Basic 9,792,187 9,693,851 9,762,019 9,671,516 Diluted

9,854,625 9,801,893 9,833,903 9,816,006 Quaker Chemical Corporation

Condensed Consolidated Balance Sheet (Dollars in thousands, except

par value and share amounts) (Unaudited) September 30, December 31,

2006 2005* ASSETS Current assets Cash and cash equivalents $15,785

$16,121 Accounts receivable, net 106,657 93,943 Inventories, net

51,533 45,818 Prepaid expenses and other current assets 13,324

10,111 Total current assets 187,299 165,993 Property, plant and

equipment 153,591 140,903 Less accumulated depreciation 93,773

84,006 Net property, plant and equipment 59,818 56,897 Goodwill

37,966 35,418 Other intangible assets, net 7,839 8,703 Investments

in associated companies 6,780 6,624 Deferred income taxes 24,031

24,385 Other assets 34,294 33,975 Total assets $358,027 $331,995

LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Short-term

borrowings and current portion of long-term debt $2,862 $5,094

Accounts and other payables 58,314 52,923 Accrued compensation

12,642 9,818 Other current liabilities 17,481 19,053 Total current

liabilities 91,299 86,888 Long-term debt 83,550 67,410 Deferred

income taxes 5,035 4,608 Other non-current liabilities 57,889

60,573 Total liabilities 237,773 219,479 Minority interest in

equity of subsidiaries 6,452 6,609 Shareholders' equity Common

stock, $1 par value; authorized 30,000,000 shares; issued 2006 -

9,873,744, 2005 - 9,726,385 shares 9,874 9,726 Capital in excess of

par value 4,456 3,574 Retained earnings 113,640 111,317 Accumulated

other comprehensive loss (14,168) (18,710) Total shareholders'

equity 113,802 105,907 Total liabilities and shareholders' equity

$358,027 $331,995 * Condensed from audited financial statements.

Quaker Chemical Corporation Condensed Consolidated Statement of

Cash Flows For the nine months ended September 30, (Dollars in

thousands) (Unaudited) 2006 2005* Cash flows from operating

activities Net income $8,673 $7,133 Adjustments to reconcile net

income to net cash (used in) provided by operating activities:

Depreciation 7,406 6,731 Amortization 1,058 1,014 Equity in

undistributed earnings of associated companies, net of dividends

(251) (180) Minority interest in earnings of subsidiaries 1,033

2,078 Deferred income taxes 834 419 Deferred compensation and

other, net 387 145 Stock-based compensation 601 563 Restructuring

and related activities, net - 1,232 Gain on sale of partnership

assets - (2,989) (Gain) Loss on disposal of property, plant and

equipment 19 - Insurance settlement realized (252) - Pension and

other postretirement benefits (3,108) (3,905) Increase (decrease)

in cash from changes in current assets and current liabilities, net

of acquisitions: Accounts receivable (10,077) (8,635) Inventories

(4,561) (2,920) Prepaid expenses and other current assets (3,022)

(2,063) Accounts payable and accrued liabilities 8,351 5,349 Change

in restructuring liabilities (3,731) (1,636) Net cash provided by

operating activities 3,360 2,336 Cash flows from investing

activities Capital expenditures (8,513) (5,142) Payments related to

acquisitions (1,069) (6,700) Proceeds from partnership disposition

of assets - 2,989 Proceeds from disposition of assets 64 1,894

Interest received on insurance settlement 240 - Change in

restricted cash, net 12 - Net cash used in investing activities

(9,266) (6,959) Cash flows from financing activities Short-term

debt borrowings 1,873 7,815 Repayments of short-term debt (4,519) -

Long-term debt borrowings 15,680 - Repayments of long-term debt

(704) (9,328) Dividends paid (6,320) (6,251) Issuance of common

stock 429 256 Distributions to minority shareholders (1,464)

(3,163) Net cash provided by (used in) financing activities 4,975

(10,671) Effect of exchange rate changes on cash 595 (675) Net

decrease in cash and cash equivalents (336) (15,969) Cash and cash

equivalents at the beginning of the period 16,121 29,078 Cash and

cash equivalents at the end of the period $15,785 $13,109 * Certain

reclassifications of prior year data have been made to improve

comparability. DATASOURCE: Quaker Chemical Corporation CONTACT:

Neal E. Murphy, Vice President and Chief Financial Officer, Quaker

Chemical Corporation, +1-610-832-4189 Web site:

http://www.quakerchem.com/

Copyright

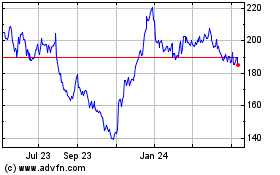

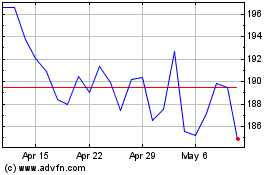

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Oct 2024 to Nov 2024

Quaker Houghton (NYSE:KWR)

Historical Stock Chart

From Nov 2023 to Nov 2024